U.S. Energy Corp. (NASDAQ: USEG, “

U.S. Energy” or

the “

Company”) today announced that its Board of

Directors has authorized the extension of the previously announced

share repurchase program under which the Company may purchase up to

$5.0 million of its outstanding shares of common stock in the open

market, in accordance with all applicable securities laws and

regulations, including Rule 10b-18 of the Securities Exchange Act

of 1934, as amended. The repurchase program was originally approved

in April 2023 and extended in March 2024, and was to expire on June

30, 2025. The expiration date has now been extended until June 30,

2026. A total of up to approximately $3.8 million remains available

under the repurchase program for future repurchases.

The Company’s decision to repurchase its shares,

as well as the timing of such repurchases, will depend on a variety

of factors, including the ongoing assessment of the Company’s

capital needs, the market price of the Company’s common stock,

general market conditions and other corporate considerations, as

determined by management. The repurchase program may be suspended

or discontinued at any time.

MANAGEMENT COMMENTARY

“U.S. Energy is committed to a focused and

disciplined capital allocation strategy that emphasizes creating

value in our shares by advancing our industrial gas project,

maintaining a clean balance sheet, and ensuring ample liquidity,"

said Ryan Smith, U.S. Energy’s Chief Executive Officer, who

continued, "The continuation of our share repurchase program

reflects our belief that this represents a highly attractive use of

capital. We expect this program to continue delivering multiple

benefits to the Company and its stockholders, including supporting

the market value of our common stock, providing a tax-efficient

method of returning capital to shareholders, and driving accretion

to key per-share metrics.”

REPURCHASE PROGRAM TO DATE

Since initiating the repurchase program in April

2023, we have repurchased 985,000 shares, representing 2.8% of our

total shares outstanding, at an average price of $1.24 per

share.

AFFILIATE SHARE REPURCHASE

Immediately following the closing of U.S.

Energy’s recently completed underwritten offering, and separate

from the ongoing repurchase program, discussed above, the Company

repurchased from certain affiliates of Sage Road Capital, which is

controlled by Joshua L. Batchelor, a member of the Board of

Directors of the Company, an aggregate of 635,400 common shares at

a price per share equal to $2.47775, the net price per share

received by U.S. Energy as part of the recently completed

underwritten offering, with cash on hand. Affiliates of Sage

Road Capital own shares across multiple managed funds, and as of

January 29, 2025, continue to own 6,304,037 Company shares.

More information regarding the stock repurchase

can be found in the Current Report on Form 8-K filed by the Company

today with the Securities and Exchange Commission.

ABOUT U.S. ENERGY CORP.

We are a growth company focused on consolidating

high-quality assets in the United States with the potential to

optimize production and generate free cash flow through low-risk

development while maintaining an attractive shareholder returns

program. We are committed to being a leader in reducing our

carbon footprint in the areas in which we operate. More information

about U.S. Energy Corp. can be found at www.usnrg.com.

ACCOMPANYING FINANCIAL

DISCLOSURES

Under the stock repurchase program, shares may

be repurchased from time to time in the open market or through

negotiated transactions at prevailing market rates, or by other

means in accordance with federal securities laws. Repurchases will

be made at management’s discretion at prices management considers

to be attractive and in the best interests of both the Company and

its stockholders, subject to the availability of shares, general

market conditions, the trading price of the common stock,

alternative uses for capital, and the Company’s financial

performance. Open market purchases are expected to be conducted in

accordance with the limitations set forth in Rule 10b-18 of the

Securities Exchange Act of 1934 (the “Exchange Act”) and other

applicable laws and regulations. Repurchases may also be made under

a Rule 10b5-1 plan, which would permit shares to be repurchased

when the Company might otherwise be precluded from doing so under

insider trading laws.

The repurchase program may be suspended,

terminated or modified at any time for any reason, including market

conditions, the cost of repurchasing shares, the availability of

alternative investment opportunities, liquidity, and other factors

deemed appropriate. These factors may also affect the timing and

amount of share repurchases. The repurchase program does not

obligate the Company to purchase any particular number of shares.

There is no guarantee as to the exact number or value of shares

that will be repurchased by the Company, if any.

All shares purchased by the Company under the

stock repurchase program will be retired and returned to

treasury.

INVESTOR RELATIONS CONTACT

Mason McGuire IR@usnrg.com(303) 993-3200www.usnrg.com

FORWARD-LOOKING STATEMENTS

Certain of the matters discussed in this

communication which are not statements of historical fact

constitute forward-looking statements within the meaning of the

federal securities laws, including the Private Securities

Litigation Reform Act of 1995, that involve a number of risks and

uncertainties. Words such as “strategy,” “expects,” “continues,”

“plans,” “anticipates,” “believes,” “would,” “will,” “estimates,”

“intends,” “projects,” “goals,” “targets” and other words of

similar meaning are intended to identify forward-looking statements

but are not the exclusive means of identifying these

statements.

Important factors that may cause actual results

and outcomes to differ materially from those contained in such

forward-looking statements include, without limitation: (1) risks

associated with the stock buyback, including, but not limited to,

the purchase price of shares acquired, the availability of funding

for such buyback, the effect of such buyback on the Company’s cash

on hand, and the effect of such buyback, if any, on the value of

the Company’s securities; (2) the ability of the Company to grow

and manage growth profitably and retain its key employees; (3)

risks associated with the integration of recently acquired assets;

(4) the Company’s ability to comply with the terms of its senior

credit facilities; (5) the ability of the Company to retain and

hire key personnel; (6) the business, economic and political

conditions in the markets in which the Company operates; (7) the

volatility of oil and natural gas prices; (8) the Company’s success

in discovering, estimating, developing and replacing oil, natural

gas and helium reserves; (9) risks of the Company’s operations not

being profitable or generating sufficient cash flow to meet its

obligations; (10) risks relating to the future price of oil,

natural gas, NGLs and helium; (11) risks related to the status and

availability of oil, natural gas and helium gathering,

transportation, and storage facilities; (12) risks related to

changes in the legal and regulatory environment governing the oil,

gas and helium industry, and new or amended environmental

legislation and regulatory initiatives; (13) risks relating to

crude oil production quotas or other actions that might be imposed

by the Organization of Petroleum Exporting Countries and other

producing countries; (14) technological advancements; (15) changing

economic, regulatory and political environments in the markets in

which the Company operates; (16) general domestic and international

economic, market and political conditions, including the military

conflict between Russia and Ukraine and the global response to such

conflict; (17) actions of competitors or regulators; (18) the

potential disruption or interruption of the Company’s operations

due to war, accidents, political events, severe weather, cyber

threats, terrorist acts, or other natural or human causes beyond

the Company’s control; (19) pandemics, governmental responses

thereto, economic downturns and possible recessions caused thereby;

(20) inflationary risks and recent changes in inflation and

interest rates, and the risks of recessions and economic downturns

caused thereby or by efforts to reduce inflation; (21) risks

related to military conflicts in oil producing countries; (22)

changes in economic conditions; limitations in the availability of,

and costs of, supplies, materials, contractors and services that

may delay the drilling or completion of wells or make such wells

more expensive; (23) the amount and timing of future development

costs; (24) the availability and demand for alternative energy

sources; (25) regulatory changes, including those related to carbon

dioxide and greenhouse gas emissions; (26) uncertainties inherent

in estimating quantities of oil, natural gas and helium reserves

and projecting future rates of production and timing of development

activities; (27) risks relating to the lack of capital available on

acceptable terms to finance the Company’s continued growth,

potential future sales of debt or equity and dilution caused

thereby; (28) the review and evaluation of potential strategic

transactions and their impact on stockholder value and the process

by which the Company engages in evaluation of strategic

transactions; and (29) other risk factors included from time to

time in documents U.S. Energy files with the Securities and

Exchange Commission, including, but not limited to, its Form 10-Ks,

Form 10-Qs and Form 8-Ks. Other important factors that may cause

actual results and outcomes to differ materially from those

contained in the forward-looking statements included in this

communication are described in the Company’s publicly filed

reports, including, but not limited to, the Company’s Annual Report

on Form 10-K for the year ended December 31, 2023 and Quarterly

Report on Form 10-Q for the quarter ended September 30, 2024, and

future annual reports and quarterly reports. These reports and

filings are available at www.sec.gov. Unknown or unpredictable

factors also could have material adverse effects on the Company’s

future results.

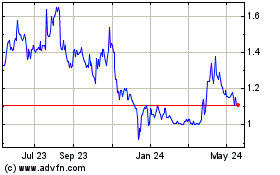

US Energy (NASDAQ:USEG)

Historical Stock Chart

From Dec 2024 to Jan 2025

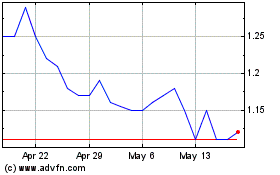

US Energy (NASDAQ:USEG)

Historical Stock Chart

From Jan 2024 to Jan 2025