false

0000101594

US ENERGY CORP

0000101594

2025-01-29

2025-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 29, 2025

U.S. ENERGY CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-06814

|

|

83-0205516

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

1616 S. Voss, Suite 725, Houston, Texas

|

|

77057

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (303) 993-3200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

USEG

|

|

The NASDAQ Stock Market LLC

(Nasdaq Capital Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry Into a Material Definitive Agreement.

|

On January 27, 2025, U.S. Energy Corp. (the “Company”, “we” and “us”), entered into a Share Repurchase Agreement with Banner Oil & Gas, LLC (“Banner”), Woodford Petroleum, LLC (“Woodford”), and Sage Road Energy II, LP, (“Sage Road”, and together with Banner and Woodford, the “Selling Stockholders”). In his capacity as co-Managing Partner of Sage Road Capital, LLC, which indirectly controls and manages certain funds which own a majority interest in Banner, Woodford and Sage Road, Joshua L. Batchelor, a member of the Board of Directors of the Company, may be deemed to beneficially own the shares of common stock, par value $0.01 per share (the “Common Stock”) held by the Selling Stockholders.

Pursuant to the Share Repurchase Agreement, the Company, in a private transaction, outside of, and separate from the Company’s previously disclosed share repurchase program, on January 27, 2025, repurchased (a) 534,020 shares of Common Stock held by Banner, (b) 41,229 shares of Common Stock held by Woodford, and (c) 60,151 shares of Common Stock held by Sage Road, for an aggregate of $1,574,362 or $2.47775 per share, which is the price per share of the 4,871,400 shares of Common Stock which we sold in our underwritten public offering which closed on January 23, 2025, less underwriting discounts and commissions, and which represents an 8.2% premium to the closing sales price of the Issuer’s Common Stock on January 27, 2025.

The Share Repurchase Agreement contains customary representations, warranties and covenants of the parties. The share repurchase was approved by the disinterested members of the Board of Directors of the Company, as well as the Company’s Audit Committee, comprised solely of independent directors not affiliated with Mr. Batchelor or the Selling Stockholders.

A copy of the Share Repurchase Agreement is attached to this Current Report on Form 8-K as Exhibit10.1 and is incorporated by reference as though it were fully set forth herein. The foregoing description of the Share Repurchase Agreement does not purport to be complete and is qualified in its entirety by reference to Exhibit 10.1 to this Current Report on Form 8-K.

As of January 29, 2025, and after taking into account the cancellation of the Repurchase Shares, we have a total of 35,163,070 shares of Common Stock outstanding.

On January 28, 2025, the Board of Directors of the Company authorized and approved an extension of the ongoing share repurchase program for up to $5.0 million of the currently outstanding shares of the Company’s common stock originally approved by the Board of Directors on April 26, 2023 and extended on March 19, 2024, and set to expire on June 30, 2025. Subject to any future extension in the discretion of the Board of Directors of the Company, the repurchase program is now scheduled to expire on June 30, 2026, when a maximum of $5.0 million of the Company’s common stock has been repurchased, or when such program is discontinued by the Board of Directors. As of the date of this Report, a total of up to approximately $3.8 million remains available under the repurchase program for future repurchases.

Under the stock repurchase program, shares may be repurchased from time to time in the open market or through negotiated transactions at prevailing market rates, or by other means in accordance with federal securities laws. Repurchases will be made at management’s discretion at prices management considers to be attractive and in the best interests of both the Company and its stockholders, subject to the availability of stock, general market conditions, the trading price of the stock, alternative uses for capital, and the Company’s financial performance. Open market purchases are expected to be conducted in accordance with the limitations set forth in Rule 10b-18 of the Securities Exchange Act of 1934 (the “Exchange Act”) and other applicable laws and regulations. Repurchases may also be made under a Rule 10b5-1 plan, which would permit shares to be repurchased when the Company might otherwise be precluded from doing so under insider trading laws.

The repurchase program may be suspended, terminated or modified at any time for any reason, including market conditions, the cost of repurchasing shares, the availability of alternative investment opportunities, liquidity, and other factors deemed appropriate. These factors may also affect the timing and amount of share repurchases. The repurchase program does not obligate the Company to purchase any particular number of shares. There is no guarantee as to the exact number or value of shares that will be repurchased by the Company, if any.

The repurchase program will be funded using the Company’s working capital.

Information regarding share repurchases will be available in the Company’s periodic reports on Form 10-Q and 10-K filed with the Securities and Exchange Commission as required by the applicable rules of the Exchange Act.

On January 29, 2025, the Company filed a press release disclosing the entry into, and the closing of the transactions contemplated by, the Share Repurchase Agreement and the extension of the repurchase program. A copy of the press release is included herewith as Exhibit 99.1 and the information in the press release is incorporated by reference into this Item8.01 in its entirety.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit

No.

|

|

Description

|

|

10.1*

|

|

|

|

99.1*

|

|

|

|

104

|

|

Inline XBRL for the cover page of this Current Report on Form 8-K

|

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

U.S. ENERGY CORP.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Ryan Smith

|

|

|

|

|

Ryan Smith

|

|

|

|

|

Chief Executive Officer

|

|

| |

|

|

|

| |

Dated: |

January 29, 2025 |

|

Exhibit 10.1

SHARE REPURCHASE AGREEMENT

This Share Repurchase Agreement (this “Agreement”) is entered into as of January 27, 2025, by and between (a) U.S. Energy Corp., a Delaware corporation (the “Company”), and (b) Banner Oil & Gas, LLC, a Delaware limited liability company and a stockholder of the Company (“Banner”), Woodford Petroleum, LLC, a Delaware limited liability company and a stockholder of the Company (“Woodford”), and Sage Road Energy II, LP, a Delaware limited partnership and a stockholder of the Company (“Sage Road”, and together with Banner and Woodford, the “Selling Stockholders”).

BACKGROUND

A. In his capacity as co-Managing Partner of Sage Road Capital, LLC (“Sage Road Capital”), which indirectly controls and manages certain funds which own a majority interest in Banner, Woodford and Sage Road, Joshua L. Batchelor, a member of the Board of Directors of the Company (the “Board”), may be deemed to beneficially own the shares of common stock, par value $0.01 per share (the “Common Stock”) held by the Selling Stockholders.

B. As a result of Mr. Batchelor’s ownership and control of the Selling Stockholders (as discussed in A., above), the transactions contemplated by this Agreement are related party transactions.

C. The Company’s January 22, 2025 underwriting agreement (the “Underwriting Agreement”) entered into with Roth Capital Partners, LLC (the “Representative”), as representative of the several underwriters named in the Underwriting Agreement, allows the Company to use up to the entire amount of proceeds from the Underwriters’ over-allotment option (635,400 shares of Common Stock sold at $2.65 per share to the public or $2.47775 per share after underwriting discounts), to purchase shares of Common Stock from Sage Road Capital or its affiliates, at up to $2.47775 per share (the “Per Share Purchase Price”).

D. Banner desires to sell 534,020 shares of Common Stock of the Company (the “Banner Shares”), Woodford desires to sell 41,229 shares of Common Stock (the “Woodford Shares”), and Sage Road desires to sell 60,151 shares of Common Stock (the “Sage Road Shares”, and together with the Banner Shares and Woodford Shares, collectively, the “Repurchase Shares”), and the Company desires to repurchase such Repurchase Shares from the Selling Stockholders at the Per Share Purchase Price and upon the terms and conditions provided in this Agreement (the “Repurchase”).

E. The Company intends to use cash on its balance sheet to complete the Repurchase.

F. After due consideration, the Board of the Company, with Mr. Batchelor abstaining, and the Company’s Audit Committee, has approved the Repurchase contemplated hereby.

Share Repurchase Agreement

NOW, THEREFORE, in consideration of the mutual covenants herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the undersigned hereby agrees as follows:

AGREEMENT

1. Repurchase.

(a) Subject to the terms and conditions of this Agreement, at the Closing (as defined below), (i) Banner shall sell to the Company the Banner Shares; (ii) Woodford shall sell to the Company the Woodford Shares; and (iii) Sage Road shall sell to the Company the Sage Road Shares, and the Company shall purchase, acquire and accept from the Selling Stockholders, all of the Repurchase Shares.

(b) The closing of the sale of the Repurchase Shares (the “Closing”) shall take place on January 27, 2025, or at such other time and place as may be agreed upon by the Company and the Selling Stockholders. At the Closing, the Selling Stockholders shall deliver to the Company the Repurchase Shares by delivery of one or more certificates evidencing the Repurchase Shares being repurchased, endorsed to the Company and/or accompanied by duly executed stock powers or other instrument of assignment, and such other information and documents as the Company’s Transfer Agent may reasonably request to affect the Repurchase, and the Company shall deliver to the Selling Stockholders by wire transfer of immediately available funds that the Selling Stockholders shall designate in writing at least one business days prior to the Closing, an amount equal to (i) the Per Share Purchase Price multiplied by (ii) the number of Repurchase Shares being sold by the applicable Selling Stockholders to the Company hereunder (the “Aggregate Purchase Price”).

2. Company Representations. In connection with the transactions contemplated hereby, the Company represents and warrants to the Selling Stockholders that:

(a) The Company is a corporation duly incorporated and validly existing under the laws of the State of Delaware. The Company has the requisite corporate power and authority to execute, deliver and perform its obligations under this Agreement and to consummate the transactions contemplated hereby.

(b) This Agreement has been duly authorized, executed and delivered by the Company and constitutes a valid and binding agreement of the Company enforceable in accordance with its terms, except to the extent that enforcement thereof may be limited by bankruptcy, insolvency, reorganization or other laws affecting enforcement of creditors’ rights or by general equitable principles.

Share Repurchase Agreement

(c) The compliance by the Company with this Agreement and the consummation of the transactions herein contemplated will not conflict with, result in a breach or violation or imposition of any lien, charge or encumbrance upon any property or assets of the Company or its subsidiaries or constitute a default under (i) the terms of any indenture, contract, lease, mortgage, deed of trust, note agreement, loan agreement or other agreement, obligation, condition, covenant or instrument to which the Company or any of its subsidiaries is a party or by which the Company or any of its subsidiaries is bound or to which any of the property or assets of the Company or any of its subsidiaries is subject, (ii) any provision of the Certificate of Incorporation, as amended, or Amended and Restated Bylaws of the Company or (iii) any statute, law, order, rule, regulation, judgment or decree of any court, regulatory body, administrative agency or governmental agency or body, arbitrator or other authority having jurisdiction over the Company or any of its subsidiaries or any of their properties; except, in the case of clauses (i) and (iii), as would not impair in any material respect the consummation of the Company’s obligations hereunder or reasonably be expected to have a material adverse effect on the financial position, stockholders’ equity or results of operations of the Company and its subsidiaries, taken as a whole, in the case of each such clause, after giving effect to any consents, approvals, authorizations, orders, registrations, qualifications, waivers and amendments as will have been obtained or made as of the date of this Agreement; and no consent, approval, authorization, order, registration or qualification of or with any such court or governmental agency or body is required for the execution, delivery and performance by the Company of its obligations under this Agreement, including the consummation by the Company of the transactions contemplated by this Agreement.

(d) The Company will have as of the Closing, sufficient cash available to pay the Aggregate Purchase Price to the Selling Stockholders on the terms and conditions contained herein.

(e) Prior to the date hereof, the Board has approved the Repurchase in accordance with Rule 16b-3 of the Securities Exchange Act of 1934, as amended.

(f) Prior to the date hereof, the disinterested members of the Board have approved this Agreement and the transactions contemplated hereby, including the purchase of the Repurchase Shares contemplated hereby.

3. Representations of the Selling Stockholders. In connection with the transactions contemplated hereby, each of the Selling Stockholders, individually, and not jointly or severally, represents and warrants to the Company that:

(a) The Selling Stockholder is duly organized or formed and validly existing under the laws of its state of organization or formation.

(b) All consents, approvals, authorizations and orders necessary for the execution and delivery by the Selling Stockholder of this Agreement and for the sale and delivery of the Repurchase Shares (each reference to Repurchase Shares set forth in this Section 3 shall refer to the applicable Selling Stockholder’s portion of the Repurchase Shares) to be sold by the Selling Stockholder hereunder, have been obtained, except for such consents, approvals, authorizations and orders as would not impair in any material respect the consummation of the Selling Stockholder’s obligations hereunder; and the Selling Stockholder has full right, power and authority to enter into this Agreement and to sell, assign, transfer and deliver the Repurchase Shares to be sold by the Selling Stockholder hereunder.

Share Repurchase Agreement

(c) This Agreement has been duly authorized, executed and delivered by the Selling Stockholder and constitutes a valid and binding agreement of the Selling Stockholder, enforceable in accordance with its terms, except to the extent that enforcement thereof may be limited by bankruptcy, insolvency, reorganization or other laws affecting enforcement of creditors’ rights or by general equitable principles.

(d) The sale of the Repurchase Shares by the Selling Stockholder hereunder and the compliance by the Selling Stockholder with all of the provisions of this Agreement and the consummation of the transactions contemplated herein (i) will not conflict with or result in a breach or violation of any of the terms or provisions of, or constitute a default under, any indenture, mortgage, deed of trust, loan agreement or other agreement or instrument to which the Selling Stockholder is a party or by which the Selling Stockholder is bound or to which any of the property or assets of the Selling Stockholder is subject, (ii) nor will such action result in any violation of the provisions of (x) the certificate of formation and limited liability company agreement or limited partnership of the Selling Stockholder or (y) any statute or any order, rule or regulation of any court or governmental agency or body having jurisdiction over the Selling Stockholder or any of its properties or assets; except in the case of clause (i) or clause (ii)(y), for such conflicts, breaches or violations which would not, individually or in the aggregate, reasonably be expected to have a material adverse effect on the Selling Stockholder’s ability to perform its obligations hereunder.

(e) The Selling Stockholder is the record and beneficial owner of the Repurchase Shares to be sold by the Selling Stockholder hereunder, and shall sell such Repurchase Shares free and clear of all liens, encumbrances, equities and claims and upon sale and delivery of, and payment for, such securities, as provided herein, the Company will own the Repurchase Shares, free and clear of all liens, encumbrances, equities and claims whatsoever. The Selling Stockholder has not, in whole or in part, (a) assigned, transferred, hypothecated, pledged or otherwise disposed of the Repurchase Shares or its ownership rights in such Repurchase Shares or (b) given any person or entity any transfer order, power of attorney or other authority of any nature whatsoever with respect to such Repurchase Shares.

(f) The Selling Stockholder (either alone or together with its advisors) has such knowledge and experience in financial or business matters that it is capable of evaluating the merits and risks of the transaction contemplated by this Agreement. The Selling Stockholder has received all information it considers necessary or appropriate for deciding whether to consummate the Repurchase. The Selling Stockholder has had an opportunity to ask questions and receive answers from the Company regarding the terms and conditions of the Company’s purchase of the Repurchase Shares and the business and financial condition of the Company, and to obtain additional information (to the extent the Company possessed such information or could acquire it without unreasonable effort or expense) necessary to verify the accuracy of any information furnished to them or to which it had access. The Selling Stockholder has had the opportunity to discuss with its tax advisors the consequences of the Repurchase. The Selling Stockholder has not received, nor is it relying on, any representations or warranties from the Company other than as a provided herein, and the Company hereby disclaims any other express or implied representations or warranties with respect to itself.

Share Repurchase Agreement

(g) Selling Stockholder acknowledges that it is a sophisticated investor capable of assessing and assuming investment risks with respect to securities, including securities such as the Repurchase Shares, and further acknowledges that the Company is entering into this Agreement with Selling Stockholder in reliance on this acknowledgment and with Selling Stockholder’s understanding, acknowledgment and agreement that each of the Selling Stockholders, as a result of Mr. Batchelor’s ownership and control thereof, has access to, and knowledge of, any and all material non-public information regarding the Company that the Company has knowledge of and access to. The Selling Stockholder understands and acknowledges that the Company would not enter into this Agreement in the absence of the representations and warranties set forth in this paragraph, and that these representations and warranties are a fundamental inducement to the Company in entering into this Agreement.

(h) Selling Stock is not subject to the “backup withholding” provisions of U.S. Federal tax law, and shall, at the request of the Company or its Transfer Agent, deliver the Company and its Transfer Agent a Form W-9, and such other information as they may reasonably request, confirming the same.

4. Termination. This Agreement may be terminated by mutual written consent of the Company and each of the Selling Stockholders prior to the Closing.

5. Notices. All notices, demands or other communications to be given or delivered under or by reason of the provisions of this Agreement will be in writing and will be deemed to have been given when delivered personally, mailed by certified or registered mail, return receipt requested and postage prepaid, or sent via a nationally recognized overnight courier, or sent via email (receipt of which is confirmed) to the recipient. Such notices, demands and other communications will be sent to the addresses indicated below:

To the Company:

U.S. Energy Corp.

1616 S. Voss, Suite 725

Houston, Texas 77057

Attention: Ryan Smith

E-mail Address: ryan@usnrg.com

Share Repurchase Agreement

With a copy to (which shall not constitute notice):

The Loev Law Firm, PC

6300 West Loop South, Suite 280

Bellaire, Texas 77401

Attention: David M. Loev and John S. Gillies

Email Address: dloev@loevlaw.com; and john@loevlaw.com

To the Selling Stockholders:

Sage Road Capital, LLC

2121 Sage Road, Suite 325

Houston, Texas 77056

Attention: Benjamin A. Staments

E-mail Address: ben@sagerc.com

With a copy to (which shall not constitute notice):

Porter Hedges LLC

1000 Main Street, 36th Floor

Houston, Texas 7702

Attention: Jeremy Mouton

Email Address: jmouton@porterhedges.com

or such other address or to the attention of such other person as the recipient party shall have specified by prior written notice to the sending party.

6. Miscellaneous.

(a) Survival of Representations and Warranties. All representations and warranties contained herein or made in writing by any party in connection herewith shall survive the execution and delivery of this Agreement and the consummation of the transactions contemplated hereby for a period of six (6) months.

(b) Severability. Whenever possible, each provision of this Agreement will be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Agreement is held to be invalid, illegal or unenforceable in any respect under any applicable law or rule in any jurisdiction, such invalidity, illegality or unenforceability will not affect any other provision or any other jurisdiction, but this Agreement will be reformed, construed and enforced in such jurisdiction as if such invalid, illegal or unenforceable provision had never been contained herein.

Share Repurchase Agreement

(c) Complete Agreement. This Agreement and any other agreements ancillary hereto and executed and delivered on the date hereof embody the complete agreement and understanding between the parties and supersede and preempt any prior understandings, agreements, or representations by or among the parties, written or oral, which may have related to the subject matter hereof in any way.

(d) Counterparts. This Agreement may be executed in separate counterparts, each of which is deemed to be an original and all of which taken together constitute one and the same agreement.

(e) Assignment; Successors and Assigns. Neither this Agreement nor any of the rights, interests or obligations hereunder shall be assigned, in whole or in part, by any of the parties without the prior written consent of the other parties. Subject to the preceding sentence, this Agreement shall bind and inure to the benefit of and be enforceable by the Selling Stockholders and the Company and their respective successors and permitted assigns. Any purported assignment not permitted under this paragraph shall be null and void.

(f) No Third Party Beneficiaries or Other Rights. This Agreement is for the sole benefit of the parties and their successors and permitted assigns and nothing herein express or implied shall give or shall be construed to confer any legal or equitable rights or remedies to any person other than the parties to this Agreement and such successors and permitted assigns.

(g) Governing Law; Jurisdiction. EACH OF THE PARTIES TO THIS AGREEMENT IRREVOCABLY WAIVES ANY AND ALL RIGHTS TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATED TO THIS AGREEMENT. This Agreement is to be construed in accordance with and governed by the laws of the State of Texas, without giving effect to any choice or conflict of law, rule or regulation (whether of the State of Texas or other jurisdiction) which would cause the application of any law, rule or regulation other than of the State of Texas. Any dispute, claim, controversy, or legal proceeding arising out of or relating to this Agreement in any way (any “Dispute”) shall be exclusively brought before a business court in the Eleventh Business Court Division of the State of Texas (the “Business Court”), if the Dispute meets the jurisdictional requirements of such Business Court; and, if the Dispute does not meet the jurisdictional requirements of such Business Court, or the Business Court is not then accepting new case filings, then the Dispute shall be exclusively brought in the Circuit Court in and for Harris County, Texas. The Parties also hereby consent to supplemental jurisdiction by the Business Court over any claims that are part of the same case or controversy as that which meets the primary jurisdictional requirements of such Business Court. Each of the parties waives any defense of inconvenient forum to the maintenance of any action or proceeding brought in accordance with this paragraph. Each of the parties agrees that service of any process, summons, notice or document by U.S. registered mail to its address set forth herein shall be effective service of process for any action, suit or proceeding brought against it in accordance with this paragraph, provided that nothing in the foregoing sentence shall affect the right of any party to serve legal process in any other manner permitted by law.

Share Repurchase Agreement

(h) Mutuality of Drafting. The parties have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as jointly drafted by the parties, and no presumption or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship of any provision of the Agreement.

(i) Remedies. The parties hereto agree and acknowledge that money damages will not be an adequate remedy for any breach of the provisions of this Agreement, that any breach of the provisions of this Agreement shall cause the other parties irreparable harm, and that any party may in its sole discretion apply to any court of law or equity of competent jurisdiction (without posting any bond or deposit) for specific performance or other injunctive relief in order to enforce, or prevent any violations of, the provisions of this Agreement.

(j) Amendment and Waiver. The provisions of this Agreement may be amended, modified or waived only with the prior written consent of each of the Selling Stockholders and the Company. No waiver of any of the provisions of this Agreement shall be deemed or shall constitute a waiver of any other provisions of this Agreement, nor shall any waiver constitute a continuing waiver. No failure by any party to insist upon strict performance of any of the provisions of this Agreement or to exercise any right or remedy arising out of a breach thereof shall constitute a waiver of any other provisions or any other breaches of this Agreement.

(k) Further Assurances. Each of the Company and the Selling Stockholders shall execute and deliver such additional documents and instruments and shall take such further action as may be necessary or appropriate to effectuate fully the provisions of this Agreement.

(l) Expenses. Each of the Company and the Selling Stockholders shall bear their own respective expenses in connection with the drafting, negotiation, execution and delivery of this Agreement and the consummation of the transactions contemplated hereby.

(m) Interpretation. The definitions in this Agreement are applicable to the singular as well as the plural forms of such terms.

(n) No Broker. No party has engaged any third party as broker or finder or incurred or become obligated to pay any broker’s commission or finder’s fee in connection with the transactions contemplated by this Agreement.

(o) Public Announcements. Prior to disclosure of this Agreement and the transactions contemplated herein by the Company, which disclosure the Company agrees to make on or prior to the end of the second (2nd) business day after the date of this Agreement, the Selling Stockholders shall not publicly disclose the existence or the terms of this Agreement, whether by the filing of a Form 4, Schedule 13D/A or otherwise.

Share Repurchase Agreement

(p) Voluntary Execution of Agreement. This Agreement is executed voluntarily, without any duress or undue influence on the part of any party or on behalf of any party. Each party acknowledges that (a) they have read and understand the terms and consequences of this Agreement; (b) they have been represented in the preparation, negotiation and execution of this Agreement by legal counsel of their own choice or that they have voluntarily declined to seek such counsel; and (c) they are fully aware of the legal and binding effect of this Agreement.

[Signatures appear on following page.]

Share Repurchase Agreement

IN WITNESS WHEREOF, the parties hereto have executed this Share Repurchase Agreement as of the date first written above.

| |

“Company”

|

|

| |

|

|

| |

U.S. Energy Corp.

|

|

| |

|

|

| |

By:

|

|

|

| |

Name:

|

Ryan Smith

|

|

| |

Title:

|

Chief Executive Officer

|

|

“Selling Stockholders”

“Banner”

Banner Oil & Gas, LLC

By:______________________

Its:_______________________________

Printed Name:______________________

“Woodford”

Woodford Petroleum, LLC

By:______________________

Its:_______________________________

Printed Name:______________________

“Sage Road”

Sage Road Energy II, LP

By:______________________

Its:_______________________________

Printed Name:______________________

Share Repurchase Agreement

Exhibit 99.1

U.S. Energy Corp. Announces Extension of $5.0 Million Share

Repurchase Program and Separate Affiliate Share Repurchase

HOUSTON, Texas, January 29, 2025 — U.S. Energy Corp. (NASDAQ: USEG, “U.S. Energy” or the “Company”) today announced that its Board of Directors has authorized the extension of the previously announced share repurchase program under which the Company may purchase up to $5.0 million of its outstanding shares of common stock in the open market, in accordance with all applicable securities laws and regulations, including Rule 10b-18 of the Securities Exchange Act of 1934, as amended. The repurchase program was originally approved in April 2023 and extended in March 2024, and was to expire on June 30, 2025. The expiration date has now been extended until June 30, 2026. A total of up to approximately $3.8 million remains available under the repurchase program for future repurchases.

The Company’s decision to repurchase its shares, as well as the timing of such repurchases, will depend on a variety of factors, including the ongoing assessment of the Company’s capital needs, the market price of the Company’s common stock, general market conditions and other corporate considerations, as determined by management. The repurchase program may be suspended or discontinued at any time.

MANAGEMENT COMMENTARY

“U.S. Energy is committed to a focused and disciplined capital allocation strategy that emphasizes creating value in our shares by advancing our industrial gas project, maintaining a clean balance sheet, and ensuring ample liquidity," said Ryan Smith, U.S. Energy’s Chief Executive Officer, who continued, "The continuation of our share repurchase program reflects our belief that this represents a highly attractive use of capital. We expect this program to continue delivering multiple benefits to the Company and its stockholders, including supporting the market value of our common stock, providing a tax-efficient method of returning capital to shareholders, and driving accretion to key per-share metrics.”

REPURCHASE PROGRAM TO DATE

Since initiating the repurchase program in April 2023, we have repurchased 985,000 shares, representing 2.8% of our total shares outstanding, at an average price of $1.24 per share.

AFFILIATE SHARE REPURCHASE

Immediately following the closing of U.S. Energy’s recently completed underwritten offering, and separate from the ongoing repurchase program, discussed above, the Company repurchased from certain affiliates of Sage Road Capital, which is controlled by Joshua L. Batchelor, a member of the Board of Directors of the Company, an aggregate of 635,400 common shares at a price per share equal to $2.47775, the net price per share received by U.S. Energy as part of the recently completed underwritten offering, with cash on hand. Affiliates of Sage Road Capital own shares across multiple managed funds, and as of January 29, 2025, continue to own 6,304,037 Company shares.

More information regarding the stock repurchase can be found in the Current Report on Form 8-K filed by the Company today with the Securities and Exchange Commission.

ABOUT U.S. ENERGY CORP.

We are a growth company focused on consolidating high-quality assets in the United States with the potential to optimize production and generate free cash flow through low-risk development while maintaining an attractive shareholder returns program. We are committed to being a leader in reducing our carbon footprint in the areas in which we operate. More information about U.S. Energy Corp. can be found at www.usnrg.com.

ACCOMPANYING FINANCIAL DISCLOSURES

Under the stock repurchase program, shares may be repurchased from time to time in the open market or through negotiated transactions at prevailing market rates, or by other means in accordance with federal securities laws. Repurchases will be made at management’s discretion at prices management considers to be attractive and in the best interests of both the Company and its stockholders, subject to the availability of shares, general market conditions, the trading price of the common stock, alternative uses for capital, and the Company’s financial performance. Open market purchases are expected to be conducted in accordance with the limitations set forth in Rule 10b-18 of the Securities Exchange Act of 1934 (the “Exchange Act”) and other applicable laws and regulations. Repurchases may also be made under a Rule 10b5-1 plan, which would permit shares to be repurchased when the Company might otherwise be precluded from doing so under insider trading laws.

The repurchase program may be suspended, terminated or modified at any time for any reason, including market conditions, the cost of repurchasing shares, the availability of alternative investment opportunities, liquidity, and other factors deemed appropriate. These factors may also affect the timing and amount of share repurchases. The repurchase program does not obligate the Company to purchase any particular number of shares. There is no guarantee as to the exact number or value of shares that will be repurchased by the Company, if any.

All shares purchased by the Company under the stock repurchase program will be retired and returned to treasury.

INVESTOR RELATIONS CONTACT

Mason McGuire

IR@usnrg.com

(303) 993-3200

www.usnrg.com

FORWARD-LOOKING STATEMENTS

Certain of the matters discussed in this communication which are not statements of historical fact constitute forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995, that involve a number of risks and uncertainties. Words such as “strategy,” “expects,” “continues,” “plans,” “anticipates,” “believes,” “would,” “will,” “estimates,” “intends,” “projects,” “goals,” “targets” and other words of similar meaning are intended to identify forward-looking statements but are not the exclusive means of identifying these statements.

Important factors that may cause actual results and outcomes to differ materially from those contained in such forward-looking statements include, without limitation: (1) risks associated with the stock buyback, including, but not limited to, the purchase price of shares acquired, the availability of funding for such buyback, the effect of such buyback on the Company’s cash on hand, and the effect of such buyback, if any, on the value of the Company’s securities; (2) the ability of the Company to grow and manage growth profitably and retain its key employees; (3) risks associated with the integration of recently acquired assets; (4) the Company’s ability to comply with the terms of its senior credit facilities; (5) the ability of the Company to retain and hire key personnel; (6) the business, economic and political conditions in the markets in which the Company operates; (7) the volatility of oil and natural gas prices; (8) the Company’s success in discovering, estimating, developing and replacing oil, natural gas and helium reserves; (9) risks of the Company’s operations not being profitable or generating sufficient cash flow to meet its obligations; (10) risks relating to the future price of oil, natural gas, NGLs and helium; (11) risks related to the status and availability of oil, natural gas and helium gathering, transportation, and storage facilities; (12) risks related to changes in the legal and regulatory environment governing the oil, gas and helium industry, and new or amended environmental legislation and regulatory initiatives; (13) risks relating to crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries and other producing countries; (14) technological advancements; (15) changing economic, regulatory and political environments in the markets in which the Company operates; (16) general domestic and international economic, market and political conditions, including the military conflict between Russia and Ukraine and the global response to such conflict; (17) actions of competitors or regulators; (18) the potential disruption or interruption of the Company’s operations due to war, accidents, political events, severe weather, cyber threats, terrorist acts, or other natural or human causes beyond the Company’s control; (19) pandemics, governmental responses thereto, economic downturns and possible recessions caused thereby; (20) inflationary risks and recent changes in inflation and interest rates, and the risks of recessions and economic downturns caused thereby or by efforts to reduce inflation; (21) risks related to military conflicts in oil producing countries; (22) changes in economic conditions; limitations in the availability of, and costs of, supplies, materials, contractors and services that may delay the drilling or completion of wells or make such wells more expensive; (23) the amount and timing of future development costs; (24) the availability and demand for alternative energy sources; (25) regulatory changes, including those related to carbon dioxide and greenhouse gas emissions; (26) uncertainties inherent in estimating quantities of oil, natural gas and helium reserves and projecting future rates of production and timing of development activities; (27) risks relating to the lack of capital available on acceptable terms to finance the Company’s continued growth, potential future sales of debt or equity and dilution caused thereby; (28) the review and evaluation of potential strategic transactions and their impact on stockholder value and the process by which the Company engages in evaluation of strategic transactions; and (29) other risk factors included from time to time in documents U.S. Energy files with the Securities and Exchange Commission, including, but not limited to, its Form 10-Ks, Form 10-Qs and Form 8-Ks. Other important factors that may cause actual results and outcomes to differ materially from those contained in the forward-looking statements included in this communication are described in the Company’s publicly filed reports, including, but not limited to, the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, and future annual reports and quarterly reports. These reports and filings are available at www.sec.gov. Unknown or unpredictable factors also could have material adverse effects on the Company’s future results.

v3.24.4

Document And Entity Information

|

Jan. 29, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

US ENERGY CORP

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 29, 2025

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-06814

|

| Entity, Tax Identification Number |

83-0205516

|

| Entity, Address, Address Line One |

1616 S. Voss, Suite 725

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77057

|

| City Area Code |

303

|

| Local Phone Number |

993-3200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

USEG

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000101594

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

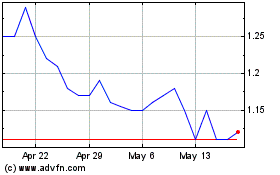

US Energy (NASDAQ:USEG)

Historical Stock Chart

From Jan 2025 to Feb 2025

US Energy (NASDAQ:USEG)

Historical Stock Chart

From Feb 2024 to Feb 2025