VBI Vaccines Initiates Restructuring Proceedings Under CCAA to Implement a Review of its Strategic Alternatives

30 July 2024 - 11:55PM

Business Wire

VBI Vaccines Inc. (Nasdaq: VBIV) (VBI), a biopharmaceutical

company driven by immunology in the pursuit of powerful prevention

and treatment of disease, today announced that the Ontario Superior

Court of Justice (Commercial List) (“Court”) has issued an initial

order (“Initial Order”) granting the company protection under the

Companies’ Creditors Arrangement Act, R.S.C. 1985, c. C-36, as

amended (“CCAA”). The Initial Order provides for, among other

things: (i) a stay of proceeding in favour of VBI, (ii) approval of

the DIP Loan (as described below), and (iii) the appointment of

Ernst & Young Inc. (“EY”) to serve as monitor (“Monitor”) in

the Court during the restructuring (“Restructuring Process”).

The decision to seek creditor protection was made in the best

interest of its stakeholders after careful evaluation of VBI’s

financial situation and all available alternatives following

consultation with its legal and financial advisors. The board of

directors of VBI will remain in place and VBI will remain

responsible for the sale process under the supervision of the CCAA

Court and the general oversight of the Monitor. VBI intends to fund

the CCAA process from cash on hand as well as through the

authorized interim debtor-in-possession financing (“DIP Loan”)

entered into with K2 HealthVentures LLC (“K2HV”), as the secured

creditor and DIP lender.

VBI intends to seek approval of a sale and investment

solicitation process (“SISP”), which, if approved, would allow

interested parties to participate in the process in accordance with

the SISP procedure. VBI intends to use this process to build on the

work it undertook prior to the filing to identify one or multiple

purchasers of its assets on an efficient basis. The SISP, if

approved by the CCAA Court, will be administered by VBI, with the

assistance of its financial advisor and the Monitor, EY. Additional

detail relating to the SISP will be disclosed in due course.

VBI intends to commence a case under Chapter 15 of the United

States Bankruptcy Code to seek recognition and enforcement in the

United States of the CCAA Court’s orders, and to commence a case

under the relevant provisions of the Israeli Insolvency and

Economic Rehabilitation Law, 2018 (“Israeli Insolvency Law”), to

protect VBI’s subsidiaries and assets located in the United States

and Israel, respectively.

The Company has notified Nasdaq of the foregoing and expects its

common shares will cease trading on the Nasdaq Capital Market upon

such date that Nasdaq determines. The Company expects to cease

reporting as a public reporting company.

Stikeman Elliott LLP, Haynes and Boone, LLP, Morris, Nicols,

Arsht & Tunnell LLP, and Pearl Cohen Zedek Latzer Baratz are

acting as legal advisors to VBI. EY is acting as financial advisor

to VBI in connection with the CCAA process and the proposed

SISP.

Additional information regarding the CCAA proceeding can be

found on the Monitor’s website here, or by contacting the Monitor

at vbi.monitor@ca.ey.com or 1-888-338-1764.

About VBI Vaccines Inc.

VBI Vaccines Inc. (“VBI”) is a biopharmaceutical company driven

by immunology in the pursuit of powerful prevention and treatment

of disease. Through its innovative approach to virus-like particles

(“VLPs”), including a proprietary enveloped VLP (“eVLP”) platform

technology and a proprietary mRNA-launched eVLP (“MLE”) platform

technology, VBI develops vaccine candidates that mimic the natural

presentation of viruses, designed to elicit the innate power of the

human immune system. VBI is committed to targeting and overcoming

significant infectious diseases, including hepatitis B,

coronaviruses, and cytomegalovirus (CMV), as well as aggressive

cancers including glioblastoma (GBM). VBI is headquartered in

Cambridge, Massachusetts, with research operations in Ottawa,

Canada, and a research and manufacturing site in Rehovot,

Israel.

Website Home: http://www.vbivaccines.com/

News and Resources:

http://www.vbivaccines.com/news-and-resources/

Investors: http://www.vbivaccines.com/investors/

Cautionary Statement on Forward-looking Information

Certain statements in this press release that are

forward-looking and not statements of historical fact are

forward-looking statements within the meaning of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995

and are forward-looking information within the meaning of Canadian

securities laws (collectively, “forward-looking statements”). The

Company cautions that such forward-looking statements involve risks

and uncertainties that may materially affect the Company’s results

of operations. Such forward-looking statements are based on the

beliefs of management as well as assumptions made by and

information currently available to management. Actual results could

differ materially from those contemplated by the forward-looking

statements as a result of certain factors, including but not

limited to, risks and uncertainties regarding the Company’s ability

to successfully complete a sale process under Chapter 15 and/or the

CCAA and/or Israeli Insolvency Law; potential adverse effects of

the Restructuring Proceedings on the Company’s liquidity and

results of operations; the Company’s ability to obtain timely

approval by the applicable courts in Canada, US, and Israel, with

respect to the motions filed in or in connection with the

Restructuring Proceedings; objections to the Company’s sale

process, the DIP Loan, or other pleadings filed that could protract

the restructuring proceedings; employee attrition and the Company’s

ability to retain senior management and other key personnel due to

the distractions and uncertainties, including the Company’s ability

to provide adequate compensation and benefits during the

Restructuring Proceedings; the Company’s ability to comply with the

restrictions imposed by the DIP Loan and other financing

arrangements; the Company’s ability to maintain relationships with

suppliers, customers, employees and other third parties and

regulatory authorities as a result of the Chapter 15, CCAA filings,

and proceedings under the Israeli Insolvency Law; the applicable

rulings in the Restructuring Proceedings, including the approval of

the DIP Loan, and the outcome of the Restructuring Proceedings

generally; the length of time that the Company will operate under

Chapter 15, CCAA protection, and protection under the Israeli

Insolvency Law, and the continued availability of operating capital

during the pendency of the proceedings; risks associated with third

party motions in the Restructuring Proceedings and/or under Israeli

Insolvency Law, which may interfere with the Company’s ability to

consummate a sale; and increased administrative and legal costs

related to the Chapter 15, the CCAA proceedings, and proceedings

under Israeli Insolvency Law, and other litigation and inherent

risks involved in a bankruptcy process, the Company’s ability to

regain and maintain compliance with the listing standards of the

Nasdaq Capital Market, the Company’s ability to satisfy all of the

conditions to the consummation of the transactions with Brii

Biosciences, the Company’s ability to comply with its obligations

under its loan agreement with K2 HealthVentures, the impact of

general economic, industry or political conditions in the United

States or internationally; the impact and continuing effects of the

COVID-19 epidemic on our clinical studies, manufacturing, business

plan, and the global economy; the ability to successfully

manufacture and commercialize PreHevbrio/PreHevbri; the ability to

establish that potential products are efficacious or safe in

preclinical or clinical trials; the ability to establish or

maintain collaborations on the development of pipeline candidates

and the commercialization of PreHevbrio/PreHevbri; the ability to

obtain appropriate or necessary regulatory approvals to market

potential products; the ability to obtain future funding for

developmental products and working capital and to obtain such

funding on commercially reasonable terms; the Company’s ability to

manufacture product candidates on a commercial scale or in

collaborations with third parties; changes in the size and nature

of competitors; the ability to retain key executives and

scientists; and the ability to secure and enforce legal rights

related to the Company’s products. A discussion of these and other

factors, including risks and uncertainties with respect to the

Company, is set forth in the Company’s filings with the SEC and the

Canadian securities authorities, including its Annual Report on

Form 10-K filed with the SEC on March 13, 2023, and filed with the

Canadian security authorities at sedarplus.ca on March 13, 2023, as

may be supplemented or amended by the Company’s Quarterly Reports

on Form 10-Q. Given these risks, uncertainties and factors, you are

cautioned not to place undue reliance on such forward-looking

statements, which are qualified in their entirety by this

cautionary statement. All such forward-looking statements made

herein are based on our current expectations and we undertake no

duty or obligation to update or revise any forward-looking

statements for any reason, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730295745/en/

VBI Email: IR@vbivaccines.com

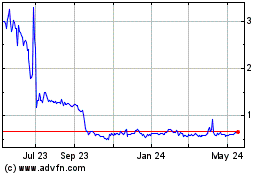

VBI Vaccines (NASDAQ:VBIV)

Historical Stock Chart

From Jan 2025 to Feb 2025

VBI Vaccines (NASDAQ:VBIV)

Historical Stock Chart

From Feb 2024 to Feb 2025