UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2024

Commission File Number: 001-40805

VersaBank

(Exact name of registrant as specified in its

charter)

140 Fullarton Street, Suite 2002

London, Ontario N6A 5P2

Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

On December 16, 2024, VersaBank issued a press

release regarding the launch of its offering of common shares. A copy of the press release is attached hereto as Exhibit 99.1.

The information in this Form 6-K (including the

exhibit) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange

Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the Securities Act of 1933 or the Exchange Act.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

VERSABANK |

| |

|

|

| Date: December 16, 2024 |

By: |

/s/ Brent T. Hodge |

| |

|

Name: |

|

Brent T. Hodge |

| |

|

Title: |

|

SVP, General Counsel & Corporate Secretary |

EXHIBIT INDEX

Exhibit 99.1

For Immediate Release: December 16,

2024

Attention: Business Editors

VERSABANK LAUNCHES

OFFERING OF COMMON SHARES

The Base Shelf Prospectus and the Preliminary

Supplement are accessible on SEDAR+ and on EDGAR

LONDON, ON/CNW – VersaBank (Nasdaq:VBNK;

TSX:VBNK) (the “Bank”) today announced that it has filed a preliminary prospectus supplement (the “Preliminary Supplement”)

to its short form base shelf prospectus dated November 22, 2024 (the “Base Shelf Prospectus”). The Preliminary Supplement

was filed in connection with a public offering of the Bank’s common shares (the “Offering”). The Preliminary Supplement

has been filed with the securities regulatory authorities in each of the provinces and territories of Canada except Quebec. The Preliminary

Supplement has also been filed with the U.S. Securities and Exchange Commission (the “SEC”) as part of a registration statement

on Form F-10 (the “Registration Statement”) under the U.S./Canada Multijurisdictional Disclosure System.

Raymond James & Associates, Inc. is acting

as the sole bookrunning manager, and Keefe, Bruyette & Woods, Inc., A Stifel Company, and Roth Canada, Inc. are acting as co-managers

for the Offering (collectively, the “Underwriters”).

The Bank will also grant the Underwriters an over-allotment

option to purchase up to an additional 15% of the common shares to be sold pursuant to the Offering (the “Over-Allotment Option”).

The Over-Allotment Option will be exercisable for a period of 30 days from the date of the final prospectus supplement relating to the

Offering.

The Bank expects that the net proceeds from the

Offering will be used for general banking purposes and will qualify as Common Equity Tier 1 capital for the Bank.

The closing of the Offering will be subject to

a number of customary closing conditions, including the listing of the common shares on the Nasdaq and TSX, and any required approvals

of each exchange.

No securities regulatory authority has either approved

or disapproved the contents of this news release. This news release shall not constitute an offer to sell or the solicitation of an offer

to buy, nor shall there be any sale of these securities in any province, state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to the registration or qualification under the securities laws of any such province, state or jurisdiction. The

Preliminary Supplement, the Base Shelf Prospectus and the Registration Statement contain important detailed information about the Offering.

Access to the Base Shelf Prospectus and the

Preliminary Supplement, and any amendments to the documents, will be provided in accordance with securities legislation relating to

procedures for providing access to a shelf prospectus supplement, a base shelf prospectus and any amendment. The Base Shelf

Prospectus and the Preliminary Supplement are accessible on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. An electronic or

paper copy of the Base Shelf Prospectus, the Registration Statement, the Preliminary Supplement, and any amendment to the documents

may be obtained without charge, from Raymond James & Associates, Inc., Attention: Equity Syndicate – 880 Carillon Parkway,

St. Petersburg, Florida. Telephone: (800) 248-8863 or e-mail: prospectus@raymondjames.com by providing the contact with an email

address or address, as applicable. Prospective investors should read the Base Shelf Prospectus, the Registration Statement and the

Preliminary Supplement (and any final prospectus supplement, when filed) before making an investment decision.

About VersaBank

VersaBank is a North American bank (federally chartered

in Canada and the United States) with a difference. VersaBank has a branchless, digital, business-to-business model based on its proprietary

state-of-the-art technology that enables it to profitably address underserved segments of the banking industry in a significantly risk

mitigated manner. Because VersaBank obtains substantially all of its deposits and undertakes the majority of its lending electronically

through financial intermediary partners, it benefits from significant operating leverage that drives efficiency and return on common equity.

In March 2022, VersaBank launched its unique Receivable Purchase Program (“RPP”) funding solution for point-of-sale finance

companies, which has been highly successful in Canada for nearly 15 years, to the underserved multi-trillion-dollar U.S. market. VersaBank

also owns Washington, DC-based DRT Cyber Inc., a North America leader in the provision of cyber security services to address the rapidly

growing volume of cyber threats challenging financial institutions, multi-national corporations and government entities.

Forward-looking Statements

This press release contains forward-looking information

and forward-looking statements within the meaning of applicable securities laws (“forward-looking statements”) including statements

regarding the proposed Offering, the terms of the Offering and the proposed use of proceeds. Words such as “expects”, “is

expected”, “anticipates”, “plans”, “budget”, “scheduled”, “forecasts”,

“estimates”, “believes”, “aims”, “endeavours”, “projects”, “continue”,

“predicts”, “potential”, “intends”, or the negative of these terms or variations of such words and

phrases, or statements that certain actions, events or results “may”, “could”, “would”, “might”,

“will” or “should” are intended to identify forward-looking statements.

These forward-looking statements by their

nature require the Bank to make assumptions and are subject to inherent risks and uncertainties that may be general or specific,

including without limitation with respect to: the strength of the Canadian and U.S. economies in general and the strength of the

local economies within Canada and the U.S. in which the Bank conducts operations; the effects of changes in monetary and fiscal

policy, including changes in interest rate policies of the Bank of Canada and the U.S. Federal Reserve; global commodity prices; the

effects of competition in the markets in which the Bank operates; inflation; capital market fluctuations; the timely development and

introduction of new products in receptive markets; the impact of changes in the laws and regulations pertaining to financial

services; changes in tax laws; technological changes; unexpected judicial or regulatory proceedings; unexpected changes in consumer

spending and savings habits; the impact of wars or conflicts on global supply chains and markets; the impact of outbreaks of disease

or illness that affect local, national or international economies; the possible effects on our business of terrorist activities;

natural disasters and disruptions to public infrastructure, such as transportation, communications, power or water supply; and the

Bank’s anticipation of and success in managing the risks implicated by the foregoing. The foregoing list of important factors

is not exhaustive. Although the Bank believes that the assumptions underlying these forward-looking statements are reasonable, they

may prove to be incorrect, and readers cannot be assured that the Offering discussed above will be completed on the terms described

above. Completion of the proposed Offering is subject to numerous factors, many of which are beyond the Bank’s control,

including but not limited to, the failure of customary closing conditions and other important factors disclosed previously and from

time to time in the Bank’s filings with the SEC and the securities commissions or similar securities regulatory authorities in

each of the provinces or territories of Canada. The forward-looking statements contained in this news release represent the

Bank’s expectations as of the date of this news release, or as of the date they are otherwise stated to be made, and

subsequent events may cause these expectations to change. The Bank undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by

law.

FOR FURTHER INFORMATION, PLEASE CONTACT:

LodeRock Advisors

Lawrence Chamberlain

(416) 519-4196

lawrence.chamberlain@loderockadvisors.com

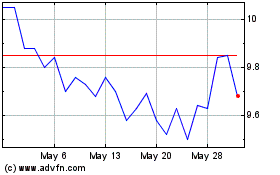

VersaBank (NASDAQ:VBNK)

Historical Stock Chart

From Nov 2024 to Dec 2024

VersaBank (NASDAQ:VBNK)

Historical Stock Chart

From Dec 2023 to Dec 2024