false000157082700015708272024-10-092024-10-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

October 9, 2024

Date of Report (date of earliest event reported)

Victory Capital Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware |

001-38388 |

32-0402956 |

(State or other jurisdiction |

(Commission |

(IRS Employer |

of incorporation) |

File Number) |

Identification No.) |

|

|

|

|

|

|

|

|

15935 La Cantera Parkway; San Antonio, TX |

|

78256 |

(Address of principal executive offices) |

|

(Zip Code) |

(216) 898-2400

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8‑K filing is intended to simultaneously satisfy the filing obligation of the registrants under any of the following provisions (see General Instruction A.2. below):

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

Soliciting material pursuant to Rule 14a‑12 under the Exchange Act (17 CFR 240.14a‑12)

Pre-commencement communications pursuant to Rule 14d‑2(b) under the Exchange Act (17 CFR 240.14d‑2(b))

Pre-commencement communications pursuant to Rule 13e‑4(c) under the Exchange Act (17 CFR 240.13e‑4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, Par Value $0.01 |

VCTR |

NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b‑2 of the Securities Exchange Act of 1934 (§240.12b‑2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 8.01. Other Events.

On October 9, 2024, Victory Capital Holdings, Inc., (the “Company”) issued a press release reporting certain information about the Company’s assets under management (“AUM”) as of September 30, 2024. A copy of that press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE(S)

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

VICTORY CAPITAL HOLDINGS, INC. |

|

|

|

|

|

|

Date: October 9, 2024 |

|

By: |

/s/ MICHAEL D. POLICARPO |

|

|

|

Name: Michael D. Policarpo |

|

|

|

Title: President, Chief Financial Officer and Chief Administrative Officer |

|

|

|

News Release |

Victory Capital Reports September 2024 Total Client Assets

Schedules Third-Quarter Financial Results Conference Call for November 8

San Antonio, Texas, October 9, 2024 ― Victory Capital Holdings, Inc. (NASDAQ: VCTR) (“Victory Capital” or the “Company”) today reported Total Assets Under Management (AUM) of $176.1 billion, Other Assets of $5.0 billion, and Total Client Assets of $181.1 billion, as of September 30, 2024.

For the month of September, average Total AUM was $173.8 billion, average Other Assets was $5.0 billion, and average Total Client Assets was $178.7 billion.

For the third quarter, the Company reported long-term AUM net flows of -$2.6 billion.

|

Victory Capital Holdings, Inc. |

Total Client Assets (unaudited; in millions) 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of: |

|

By Asset Class |

|

|

September 30, 2024 |

|

|

|

August 31, 2024 |

|

Solutions |

|

$ |

|

62,544 |

|

|

$ |

|

61,315 |

|

Fixed Income |

|

|

|

25,081 |

|

|

|

|

24,887 |

|

U.S. Mid Cap Equity |

|

|

|

32,333 |

|

|

|

|

32,136 |

|

U.S. Small Cap Equity |

|

|

|

15,591 |

|

|

|

|

15,688 |

|

U.S. Large Cap Equity |

|

|

|

14,239 |

|

|

|

|

14,103 |

|

Global / Non-U.S. Equity |

|

|

|

19,752 |

|

|

|

|

19,143 |

|

Alternative Investments |

|

|

|

3,178 |

|

|

|

|

3,190 |

|

Total Long-Term Assets |

|

$ |

|

172,720 |

|

|

$ |

|

170,462 |

|

Money Market / Short Term Assets |

|

|

|

3,393 |

|

|

|

|

3,368 |

|

Total Assets Under Management2 |

|

$ |

|

176,113 |

|

|

$ |

|

173,830 |

|

|

|

|

|

|

|

|

|

|

By Vehicle |

|

|

|

|

|

|

|

|

Mutual Funds3 |

|

$ |

|

117,044 |

|

|

$ |

|

115,877 |

|

Separate Accounts and Other Pooled Vehicles4 |

|

|

|

52,375 |

|

|

|

|

51,562 |

|

ETFs5 |

|

|

|

6,694 |

|

|

|

|

6,391 |

|

Total Assets Under Management |

|

$ |

|

176,113 |

|

|

$ |

|

173,830 |

|

|

|

|

|

|

|

|

|

|

Other Assets6 |

|

|

|

|

|

|

|

|

Institutional |

|

$ |

|

4,981 |

|

|

$ |

|

4,942 |

|

Total Other Assets |

|

$ |

|

4,981 |

|

|

$ |

|

4,942 |

|

|

|

|

|

|

|

|

|

|

Total Client Assets |

|

|

|

|

|

|

|

|

Total Assets Under Management |

|

$ |

|

176,113 |

|

|

$ |

|

173,830 |

|

Total Other Assets |

|

|

|

4,981 |

|

|

|

|

4,942 |

|

Total Client Assets |

|

$ |

|

181,094 |

|

|

$ |

|

178,772 |

|

1Due to rounding, numbers presented in these tables may not add up precisely to the totals provided.

2Total AUM includes both discretionary assets under management and non-discretionary assets under advisement and excludes Other Assets.

3Includes institutional and retail share classes, money market and VIP funds.

4Includes wrap program accounts, CITs, UMAs, UCITS, private funds, and non-U.S. domiciled pooled vehicles.

5Represents only ETF assets held by third parties and excludes ETF assets held by other Victory Capital products.

6Includes low-fee (2 to 4 bps) institutional assets, previously reported in the Solutions asset class within the by asset class table and in Separate Accounts and Other Pooled Vehicles within the by vehicle table. These assets are included as part of Victory’s Regulatory Assets Under Management reported in Form ADV Part 1.

Third-Quarter Conference Call and Webcast Details

Victory Capital will report third-quarter 2024 financial results after the market closes on Thursday, November 7, 2024. The Company will host a conference call the following morning, Friday, November 8, at 8:00 a.m. ET to discuss the results. Victory Capital’s earnings release and supplemental materials will be available on the investor relations section of the Company’s website at https://ir.vcm.com before the conference call begins.

To participate in the conference call, please call 1-888-330-3571 (domestic) or 1-646-960-0657 (international), shortly before 8:00 a.m. ET and reference the Victory Capital Conference Call. A live, listen-only webcast will also be available via the investor relations section of the Company’s website at https://ir.vcm.com. For anyone who is unable to join the live event, an archive of the webcast will be available for replay, at the same location, shortly after the call concludes.

About Victory Capital

Victory Capital is a diversified global asset management firm with total assets under management of $176.1 billion, and $181.1 billion in total client assets, as of September 30, 2024. The Company employs a next-generation business strategy that combines boutique investment qualities with the benefits of a fully integrated, centralized operating and distribution platform.

Victory Capital provides specialized investment strategies to institutions, intermediaries, retirement platforms and individual investors. With 11 autonomous Investment Franchises and a Solutions Business, Victory Capital offers a wide array of investment products and services, including mutual funds, ETFs, separately managed accounts, alternative investments, third-party ETF model strategies, collective investment trusts, private funds, a 529 Education Savings Plan, and brokerage services.

Victory Capital is headquartered in San Antonio, Texas, with offices and investment professionals in the U.S. and around the world. To learn more please visit www.vcm.com or follow Victory Capital on Facebook, Twitter, and LinkedIn.

Contacts

Investors: Media:

Matthew Dennis, CFA Jessica Davila

Chief of Staff Director of Global Communications

Director, Investor Relations 210-694-9693

216-898-2412 Jessica_davila@vcm.com

mdennis@vcm.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

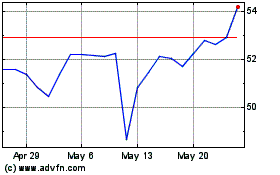

Victory Capital (NASDAQ:VCTR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Victory Capital (NASDAQ:VCTR)

Historical Stock Chart

From Dec 2023 to Dec 2024