UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. )*

| Vinci

Partners Investments Ltd. |

| (Name

of Issuer) |

| |

| Class

A Common Shares, par value $0.00005 per share |

| (Title

of Class of Securities) |

| |

| G9451V109 |

| (CUSIP

Number) |

| |

Costanera

Management LLC

Attention:

Compass Group LLC

590

Madison Avenue, 33rd Floor

New

York, New York, 10022

212-355-7630

|

| |

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications) |

| |

| October

29, 2024 |

| (Date

of Event which Requires Filing of this Statement) |

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240. 13d-1(e), 240. 13d-1(f) or 240. 13d-1(g), check the following box: ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule

240. 13d-7 for other parties to whom copies are to be sent.

*The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| CUSIP

No. G9451V109 |

|

Page

2 of 8 Pages |

| 1 |

NAME

OF REPORTING PERSON

COSTANERA

MANAGEMENT LLC |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐

(b) ☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

SC |

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

6,969,513 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

6,969,513 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,969,513 |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

10.7% |

| 14 |

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS)

OO |

| CUSIP

No. G9451V109 |

|

Page

3 of 8 Pages |

| 1 |

NAME

OF REPORTING PERSON

MANUEL

JOSE BALBONTIN FERNANDEZ |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐

(b) ☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

SC |

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

CITIZENSHIP

OR PINLACE OF ORGANIZATION

U.S.A. |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

6,969,513 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

6,969,513 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,969,513 |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

10.7% |

| 14 |

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS)

IN |

| CUSIP

No. G9451V109 |

|

Page

4 of 8 Pages |

| 1 |

NAME

OF REPORTING PERSON

CORINA

BEATRIZ ULIVI |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐

(b) ☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

SC |

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

U.S.A. |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

6,969,513 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

6,969,513 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,969,513 |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

10.7% |

| 14 |

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS)

IN |

| CUSIP

No. G9451V109 |

|

Page

5 of 6 Pages |

| Item

1. |

Security

and Issuer |

The

securities to which this Schedule 13D (the “Schedule”) relates are shares of Class A common shares, par value $0.00005 per

share (the “Common Stock”), of Vinci Partners Investments Ltd. (the “Issuer”). The principal executive offices

of the Issuer are located at Av. Bartolomeu Mitre, 336, Leblon – Rio de Janeiro, Brazil, 22431-002.

| Item

2. | Identity

and Background |

(a),

(f) This Schedule is being filed by Costanera Management LLC, a Delaware limited liability company (the “Company”), Manuel

Jose Balbontin Fernandez, a citizen of the United States of America, and Corina Beatriz Ulivi, a citizen of the United States of America

(each of the foregoing, a “Reporting Person” and, collectively, the “Reporting Persons”).

The

Company is ultimately controlled by Mr. Manuel Jose Balbontin Fernandez and Mrs. Corina Beatriz Ulivi. By virtue of these relationships,

Mr. Manuel Jose Balbontin Fernandez and Mrs. Corina Beatriz Ulivi may be deemed to beneficially own the Common Stock owned directly by

the Company. This report shall not be deemed an admission that the Reporting Persons are beneficial owners of Common Stock for purposes

of Section 13 of the Exchange Act 1934, as amended, or for any other purpose. Each of the Reporting Persons disclaims beneficial ownership

of the shares of Common Stock reported herein except to the extent of the Reporting Person’s pecuniary interest therein.

(b)

The principal business address for the Reporting Persons is 590 Madison Avenue 33rd Floor, New York, NY 10022.

(c)

The Company is a holding company without day-to-day business operations. Corina Beatriz Ulivi serves as the manager of the Company.

The principal business of Manuel Jose Balbontin Fernandez is working as a senior investment strategist at Compass Group Holdings, Inc

and its affiliates.

(d)

During the last five years, none of the Reporting Persons, or, to the Reporting Persons’ best knowledge, any of their respective

directors, executive officers, or controlling persons, as the case may be, has been convicted in a criminal proceeding (excluding traffic

violations and other similar misdemeanors).

(e)

During the last five years, none of the Reporting Persons, or, to the Reporting Persons’ best knowledge, any of their respective

directors, executive officers, or controlling persons, as the case may be, is or has been a party to a civil proceeding of a judicial

or administrative body of competent jurisdiction and as a result of such proceeding, was or is subject to a judgment, decree, or final

order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities law or finding any

violation with respect to such laws.

| Item

3. |

Source

and Amount of Funds or Other Consideration. |

The

Company received the 6,969,513 shares of Common Stock reported herein as part of the consideration with respect to the business combination

of the Issuer and MNC Holdings Limited (the “Merger”) in accordance with the agreement(s) for the Merger. The Company was

one of the beneficial owners of MNC Holdings Limited. On October 29, 2024, the Issuer announced that it completed its business combination.

No

funds were/are being borrowed by the Reporting Persons to fund the acquisition of the shares of the Issuer’s Common Stock, although

the Reporting Persons may borrow funds in the future and may pledge any or all of such shares as collateral against such borrowings.

| Item

4. |

Purpose

of Transaction. |

As

noted in Item 3, the Reporting Persons acquired the 6,969,513 shares of Common Stock over which they exercise beneficial ownership as

part of its consideration of the Merger. Mr. Manuel Jose Balbontin Fernandez has also been appointed to serve as a director to the Issuer’s

board of directors.

Except

as stated in response to this Item 4, the Reporting Persons have no current plans or proposals with respect to the Issuer or its securities

enumerated in paragraphs (a) through (j) of this Item 4 to the form Schedule 13D promulgated under the Act. Notwithstanding the foregoing,

the Reporting Persons may determine, from time to time in the future, based on market and general economic conditions, the business affairs

and financial conditions of the Issuer, the capital requirements of the Company (or other Reporting Persons), the availability

of securities at favorable prices and other alternative investment opportunities available to the Reporting Persons, and other factors

that the Reporting Persons may deem relevant, to acquire additional securities of the Issuer in the open market, in privately negotiated

transactions, or otherwise, or to sell some or all of the securities it now holds or hereafter acquires as set forth above or otherwise.

| Item

5. |

Interest

in Securities of the Issuer. |

As

of October 29, 2024, the Reporting Persons beneficially own the number of Common Stock set forth below. Percentage ownership is based

on 64,865,964 shares of Common Stock of the Issuer that were outstanding as of October 29, 2024.

(a),

(b) The applicable Reporting Persons may be deemed to beneficially own an aggregate of 6,969,513 shares of Common Stock. These shares

of Common Stock represent approximately 10.7% of the outstanding shares of Common Stock of the Issuer. By virtue of relationships between

the Reporting Persons (i.e., Mr. Manuel Jose Balbontin Fernandez’s and Mrs. Corina Beatriz Ulivi’s authority to direct the

affairs of the Company, including the voting and disposition of shares of Common Stock held by all Reporting Persons), the Reporting

Persons may be deemed to have sole voting and dispositive power with respect to the shares owned directly by the Company. Each Reporting

Person disclaims beneficial ownership of such shares except to the extent of their pecuniary interest therein.

The

Company may be deemed to have:

Sole

power to vote or direct 6,969,513 shares

of Common Stock;

Shared

power to vote or direct the vote of 0 shares of

Common Stock;

Sole

power to dispose or direct the disposition of 6,969,513

shares of Common Stock; and

Shared power to dispose or direct the disposition

of 0 shares of Common Stock.

Each

Mr. Manuel Jose Balbontin Fernandez and Mrs. Corina Beatriz Ulivi, may be deemed to have:

Sole

power to vote or direct 6,969,513 shares of Common

Stock;

Shared

power to vote or direct the vote of 0 shares of

Common Stock;

Sole

power to dispose or direct the disposition of 6,969,513

shares of Common Stock; and

Shared

power to dispose or direct the disposition of 0

shares of Common Stock.

(c)

The Reporting Persons have not transacted in the issuer in the past 60 days.

(d)

The Reporting Persons have the right to receive dividends from, and the proceeds from the sale of, the shares of Common Stock covered

by this Schedule and held for their account. Except as disclosed in this Item 5, no other person is known to the Reporting Persons to

have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the shares of Common

Stock covered by this Schedule.

(e)

Not applicable.

| Item

6. | Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

Other

than the joint filing agreement filed as Exhibit A to this Schedule 13D, the Reporting Persons have no knowledge of any contracts, arrangements,

understandings or relationships (legal or otherwise) among the persons named in response to Item 2 or between such persons and any person

with respect to any securities of the Issuer.

| Item

7. | Material

to be Filed as Exhibits |

| CUSIP

No. G9451V109 |

|

Page

6 of 6 Pages |

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| Dated:

November 5, 2024 |

Costanera

Management LLC

|

| |

|

|

| |

By: |

/s/

Manuel Jose Balbontin Fernandez |

| |

Name: |

Manuel

Jose Balbontin Fernandez |

| |

Title:

|

Manager |

| |

|

|

| |

Manuel

Jose Balbontin Fernandez |

| |

|

|

| |

By: |

/s/

Manuel Jose Balbontin Fernandez |

| |

Name: |

Manuel

Jose Balbontin Fernandez |

| |

Title: |

Individually |

| |

|

|

| |

Corina

Beatriz Ulivi |

| |

|

|

| |

By: |

/s/

Corina Beatriz Ulivi |

| |

Name: |

Corina

Beatriz Ulivi |

| |

Title: |

Individually |

EXHIBIT

A

Joint

Filing Statement

Statement

Pursuant to Rule 13d-1(k)(1)

The

undersigned hereby consent and agree to file a joint statement on Schedule 13D under the Act with respect to the Common Stock, $0.00005

per share, of Vinci Partners Investments Ltd., beneficially owned by them, together with any or all amendments thereto, when and if appropriate.

The parties hereto further consent and agree to file this Statement pursuant to Rule 13d-1(k)(1)(iii) as an exhibit to Schedule 13D,

thereby incorporating the same into such Schedule 13D.

| Dated:

November 5, 2024 |

Costanera

Management LLC

|

| |

|

|

| |

By: |

/s/

Manuel Jose Balbontin Fernandez |

| |

Name: |

Manuel

Jose Balbontin Fernandez |

| |

Title:

|

Manager |

| |

|

|

| |

Manuel

Jose Balbontin Fernandez |

| |

|

|

| |

By: |

/s/

Manuel Jose Balbontin Fernandez |

| |

Name: |

Manuel

Jose Balbontin Fernandez |

| |

Title: |

Individually |

| |

|

|

| |

Corina

Beatriz Ulivi |

| |

|

|

| |

By: |

/s/

Corina Beatriz Ulivi |

| |

Name: |

Corina

Beatriz Ulivi |

| |

Title: |

Individually |

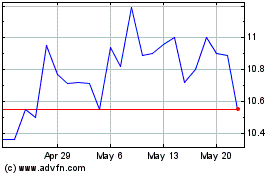

Vinci Partners Investments (NASDAQ:VINP)

Historical Stock Chart

From Dec 2024 to Jan 2025

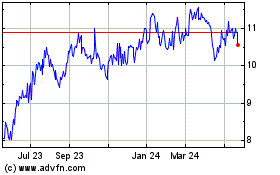

Vinci Partners Investments (NASDAQ:VINP)

Historical Stock Chart

From Jan 2024 to Jan 2025