Virco Mfg. Corporation (NASDAQ: VIRC), the leading manufacturer and

supplier of moveable furniture and equipment for educational

environments in the United States, today reported financial results

for the fourth quarter and full fiscal year ended January 31, 2024.

Net revenue for the full year ended January 31, 2024 increased

16.5% to $269.1 million from $231.1 million in the prior year. For

the seasonally light fourth quarter, revenue increased 9.8% to

$42.6 million from $38.8 million.

For the full year, the Company’s domestically-based vertical

business model continued to support timely delivery of highly

seasonal school furniture, approximately 50% of which is installed

during the summer months of June through August, when schools are

out of session. This seasonality creates operational, logistical,

and financing challenges for the school furniture market. Virco’s

74-year history of serving public and private schools, along with

its experienced workforce—40% of whom have over twenty years’

service with the Company—has resulted in an integrated strategy

that combines reliable customer service with good control of the

order-to-cash cycle. At fiscal year-end, other than a small

mortgage on one of its Conway, Arkansas facilities, the Company was

effectively debt-free, having emerged from the pandemic financially

stronger than in 2019.

Gross margin for the full year improved to 43.1% compared to

36.9% in the prior year. For the seasonally light fourth quarter,

gross margin improved to 37.7% vs. 33.5% in the prior year. The

improved gross margin was due to stabilizing raw material costs and

operating efficiencies generated by higher overall volume.

Selling, General, and Administrative expenses for the full year

declined to 31.3% of revenue compared to 32.3% in the prior year.

Demand for the Company’s PlanSCAPE project-management services

continued to grow, along with more traditional full service

delivery and installation—all of which are part of Virco’s

vertically integrated sales, manufacturing, and service model. The

Company estimates that over two-thirds of its revenue now includes

some degree of enhanced services, continuing a trajectory that

began over twenty years ago. The control offered by this vertical

model, which provides better visibility than more fragmented

models, allowed the Company to modulate its inventories and

borrowings despite the uncertainties and disruptions in the supply

chain over the past few years.

Operating Income for the full year ended January 31, 2024 was

$31.9 million compared to $10.6 million the prior year. Interest

expense as a percent of revenue was 1.0% compared to 0.9% the prior

year, due to higher interest rates. Overall borrowing under the

Company’s seasonal working capital revolver was substantially lower

despite the growth in shipments, allowing the Company to completely

pay down its credit facility at year end. Other than a small

mortgage on one of its Arkansas facilities, Virco was effectively

debt-free as of this press release. Management fully expects to

utilize its revolving credit facility during the peak summer

season, but it also views the Company’s strong financial position

as essential to providing continuity of service to schools as well

as a balanced portfolio of returns to investors.

Total Net Income after taxes for the full year was $21.9 million

compared to $16.5 million the prior year. This comparison includes

the reversal last year of an $8.5 million valuation allowance for

potentially un-recoverable net operating loss (NOL) tax credits.

Because of this, Management believes the most accurate comparison

of year-over-year operating performance is Net Income before Taxes,

which reached $29.2 million in FYE 1.31.24. This compares to $8.0

million in the prior year, a more than three-fold improvement.

Looking forward, Management notes that its preferred

early-season measure of business velocity: “Shipments + Backlog”

exceeded $317.6 million at year end, compared to $289.6 million FYE

1.31.23. Management uses this non-GAAP metric to plan production,

staffing, and borrowings ahead of the busy summer delivery season,

when the metric, which is heavily weighted toward backlog in the

offseason, converts to shipments and receivables. This seasonal

transition is of sufficient magnitude to represent an obvious

burden on financing, but also on the systems and people who manage

it. The Company has developed these systems, many of which are

proprietary and not available “off the shelf,” over its continuous

74-year history of serving America’s public and private

schools.

Commenting on the year’s results, Virco Chairman and CEO Robert

Virtue said: “While we are extremely pleased with last year’s

results, we’ve been at this long enough to know that markets and

competition are always evolving. We have meaningful opportunities

and challenges ahead of us, but I feel confident in our ability to

address these with the same discipline and optimism that we’ve

exhibited over our 74-year history. I also want to thank our loyal

investors, whose support made it possible to realize the vision of

our long-term strategy. A visit to our factories, or to one the

thousands of schools that we furnished last year, will validate the

qualitative elements of our strategy. Good jobs and good schools:

two things we’re honored to support.”

About Virco Mfg. Corporation

Founded in 1950, Virco Mfg. Corporation is the largest

manufacturer and supplier of moveable educational furniture and

equipment for the preschool through 12th grade market in the United

States. The Company manufactures a wide assortment of products,

including mobile tables, mobile storage equipment, desks, computer

furniture, chairs, activity tables, folding chairs and folding

tables. Along with serving customers in the education market -

which in addition to preschool through 12th grade public and

private schools includes: junior and community colleges; four-year

colleges and universities; trade, technical and vocational schools

- Virco is a furniture and equipment supplier for convention

centers and arenas; the hospitality industry with respect to

banquet and meeting facilities; government facilities at the

federal, state, county and municipal levels; and places of worship.

The Company also sells to wholesalers, distributors, traditional

retailers and catalog retailers that serve these same markets. With

operations entirely based in the United States, Virco designs,

manufactures, and ships its furniture and equipment from one

facility in Torrance, CA and three facilities in Conway, AR. More

information on the Company can be found at www.virco.com.

Contact:Virco Mfg. Corporation (310)

533-0474Robert A. Virtue, Chairman and Chief Executive OfficerDoug

Virtue, PresidentRobert Dose, Chief Financial Officer

Non-GAAP Financial Information

This press release includes a statement of shipments plus

unshipped backlog as of January 31, 2024 compared to the same date

in the prior fiscal year. Shipments represent the dollar amount of

net sales actually shipped during the period presented. Unshipped

backlog represents the dollar amount of net sales that we expect to

recognize in the future from sales orders that have been received

from customers in the ordinary course of business. The Company

considers shipments plus unshipped backlog a relevant and preferred

supplemental measure for production and delivery planning. However,

such measure has inherent limitations, is not required to be

uniformly applied or audited and other companies may use

methodologies to calculate similar measures that are not

comparable. Readers should be aware of these limitations and should

be cautious as to their use of such measure.

Statement Concerning Forward-Looking

Information

This news release contains “forward-looking statements” as

defined by the Private Securities Litigation Reform Act of 1995.

These statements include, but are not limited to, statements

regarding: our future financial results and growth in our business;

business strategies; market demand and product development;

estimates of unshipped backlog; order rates and trends in

seasonality; product relevance; economic conditions and patterns;

the educational furniture industry generally, including the

domestic market for classroom furniture; cost control initiatives;

absorption rates; and supply chain challenges. Forward-looking

statements are based on current expectations and beliefs about

future events or circumstances, and you should not place undue

reliance on these statements. Such statements involve known and

unknown risks, uncertainties, assumptions and other factors, many

of which are out of our control and difficult to forecast. These

factors may cause actual results to differ materially from those

that are anticipated. Such factors include, but are not limited to:

uncertainties surrounding the ongoing and long-term effects of the

COVID-19 pandemic; changes in general economic conditions including

raw material, energy and freight costs; state and municipal bond

funding; state, local, and municipal tax receipts; order rates; the

seasonality of our markets; the markets for school and office

furniture generally, the specific markets and customers with which

we conduct our principal business; the impact of cost-saving

initiatives on our business; the competitive landscape, including

responses of our competitors and customers to changes in our

prices; demographics; and the terms and conditions of available

funding sources. See our Annual Report on Form 10-K for the year

ended January 31, 2024, our Quarterly Reports on Form 10-Q, and

other reports and material that we file with the Securities and

Exchange Commission for a further description of these and other

risks and uncertainties applicable to our business. We assume no,

and hereby disclaim any, obligation to update any of our

forward-looking statements. We nonetheless reserve the right to

make such updates from time to time by press release, periodic

reports, or other methods of public disclosure without the need for

specific reference to this press release. No such update shall be

deemed to indicate that other statements which are not addressed by

such an update remain correct or create an obligation to provide

any other updates.

Financial Tables Follow

|

Virco Mfg. CorporationConsolidated Balance

Sheets |

| |

January 31, |

|

|

2024 |

|

|

|

2023 |

|

|

(In thousands, except share and par value

data) |

| |

|

|

|

| Assets |

|

|

|

| Current assets |

|

|

|

|

Cash |

$ |

5,286 |

|

|

$ |

1,057 |

|

| Trade accounts receivables (net

of allowance of $200 at January 31, 2024 and 2023) |

|

23,161 |

|

|

|

18,435 |

|

| Other receivables |

|

20 |

|

|

|

68 |

|

| Income tax receivable |

|

— |

|

|

|

19 |

|

| Inventories |

|

58,371 |

|

|

|

67,406 |

|

| Prepaid expenses and other

current assets |

|

2,188 |

|

|

|

2,083 |

|

| Total current assets |

|

89,026 |

|

|

|

89,068 |

|

| Property, plant, and

equipment |

|

|

|

| Land |

|

3,731 |

|

|

|

3,731 |

|

| Land improvements |

|

694 |

|

|

|

686 |

|

| Buildings and building

improvements |

|

51,576 |

|

|

|

51,310 |

|

| Machinery and equipment |

|

114,400 |

|

|

|

113,662 |

|

| Leasehold improvements |

|

523 |

|

|

|

983 |

|

| Total property, plant, and

equipment |

|

170,924 |

|

|

|

170,372 |

|

| Less accumulated depreciation and

amortization |

|

136,356 |

|

|

|

135,810 |

|

| Net property, plant, and

equipment |

|

34,568 |

|

|

|

34,562 |

|

| Operating lease right-of-use

assets |

|

6,508 |

|

|

|

10,120 |

|

| Deferred income tax assets,

net |

|

6,634 |

|

|

|

7,800 |

|

| Other assets |

|

9,709 |

|

|

|

8,576 |

|

| Total assets |

$ |

146,445 |

|

|

$ |

150,126 |

|

|

Virco Mfg. CorporationConsolidated Balance

Sheets |

| |

January 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| |

(In thousands, except share and par value

data) |

| |

|

|

|

| Liabilities |

|

|

|

| Current liabilities |

|

|

|

| Accounts payable |

$ |

12,945 |

|

|

$ |

19,448 |

|

| Accrued compensation and employee

benefits |

|

10,880 |

|

|

|

9,554 |

|

| Income tax payable |

|

145 |

|

|

|

— |

|

| Current portion of long-term

debt |

|

248 |

|

|

|

7,360 |

|

| Current portion of operating

lease liability |

|

5,744 |

|

|

|

5,082 |

|

| Other accrued liabilities |

|

8,570 |

|

|

|

7,081 |

|

| Total current liabilities |

|

38,532 |

|

|

|

48,525 |

|

| Non-current liabilities |

|

|

|

| Accrued self-insurance |

|

650 |

|

|

|

1,050 |

|

| Accrued retirement benefits |

|

9,429 |

|

|

|

10,676 |

|

| Income tax payable |

|

128 |

|

|

|

79 |

|

| Long-term debt, less current

portion |

|

4,136 |

|

|

|

14,384 |

|

| Operating lease liability, less

current portion |

|

1,829 |

|

|

|

6,796 |

|

| Other long-term liabilities |

|

562 |

|

|

|

555 |

|

| Total non-current

liabilities |

|

16,734 |

|

|

|

33,540 |

|

| Commitments and contingencies

(Note 8) |

|

|

|

| Stockholders’ equity |

|

|

|

| Preferred stock: |

|

|

|

| Authorized 3,000,000 shares,

$0.01 par value; none issued or outstanding |

|

— |

|

|

|

— |

|

| Common stock: |

|

|

|

| Authorized 25,000,000 shares,

$0.01 par value; issued and outstanding 16,348,314 shares in 2024

and 16,210,985 shares in 2023 |

|

164 |

|

|

|

162 |

|

| Additional paid-in capital |

|

121,373 |

|

|

|

120,890 |

|

| Accumulated deficit |

|

(29,048 |

) |

|

|

(50,631 |

) |

| Accumulated other comprehensive

loss |

|

(1,310 |

) |

|

|

(2,360 |

) |

| Total stockholders’ equity |

|

91,179 |

|

|

|

68,061 |

|

| Total liabilities and

stockholders’ equity |

$ |

146,445 |

|

|

$ |

150,126 |

|

|

Virco Mfg. CorporationConsolidated

Statements of Income |

| |

Year ended January 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| |

(In thousands, except per share data) |

| |

|

|

|

| Net sales |

$ |

269,117 |

|

|

$ |

231,064 |

|

| Costs of goods sold |

|

153,059 |

|

|

|

145,723 |

|

| Gross profit |

|

116,058 |

|

|

|

85,341 |

|

| Selling, general, and

administrative expenses |

|

84,181 |

|

|

|

74,697 |

|

| Operating income |

|

31,877 |

|

|

|

10,644 |

|

| Unrealized gain on investment in

trust account |

|

(1,050 |

) |

|

|

(194 |

) |

| Pension expense |

|

1,008 |

|

|

|

816 |

|

| Interest expense, net |

|

2,679 |

|

|

|

1,979 |

|

| Income before income taxes |

|

29,240 |

|

|

|

8,043 |

|

| Income tax expense (benefit) |

|

7,330 |

|

|

|

(8,504 |

) |

| Net income |

$ |

21,910 |

|

|

$ |

16,547 |

|

| |

|

|

|

| Cash dividends declared per

common share: |

$ |

0.02 |

|

|

$ |

— |

|

| |

|

|

|

| Net income per common share: |

|

|

|

| Basic |

$ |

1.34 |

|

|

$ |

1.03 |

|

| Diluted |

$ |

1.34 |

|

|

$ |

1.02 |

|

| Weighted average shares

outstanding: |

|

|

|

| Basic |

|

16,295 |

|

|

|

16,142 |

|

| Diluted |

|

16,388 |

|

|

|

16,192 |

|

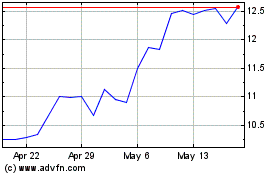

Virco Manufacturing (NASDAQ:VIRC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Virco Manufacturing (NASDAQ:VIRC)

Historical Stock Chart

From Nov 2023 to Nov 2024