0001837686FALSE00018376862025-02-192025-02-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 19, 2025

VIMEO, INC.

(Exact name of registrant as specified in charter)

| | | | | | | | |

| Delaware | 001-40420 | 85-4334195 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | | | | |

330 West 34th Street, 5th Floor New York, NY 10001 | 10001 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (212) 524-8791

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Common Stock, par value $0.01 | | VMEO | | The Nasdaq Stock Market LLC |

| | | | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 Results of Operations and Financial Condition

On February 19, 2025, Vimeo, Inc. (the “Company”) issued a shareholder letter (the "Letter") announcing the Company's results for the fiscal quarter and year ended December 31, 2024. The full text of the Letter, which is posted on the Company’s website at https://vimeo.com/investors/ and appears in Exhibit 99.1 hereto, is incorporated herein by reference. In the Letter, the Company also announced that it would be livestreaming a video conference on February 19, 2025, at 5:00 p.m. Eastern Time to answer questions regarding its fourth quarter and fiscal year results.

The Letter includes certain non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to the comparable GAAP financial measures are contained in the Letter and the financial tables attached thereto.

The information furnished under this Item 2.02 and in the accompanying Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

ITEM 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | Shareholder Letter of Vimeo, Inc. dated February 19, 2025 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| VIMEO, INC. |

| |

| By: | | /s/ Gillian Munson |

| Name: | | Gillian Munson |

| Title: | | Chief Financial Officer (Principal Financial Officer) |

Date: February 19, 2025

| | | | | | | | |

Dear

Shareholders, | | Philip Moyer, CEO . |

I want to begin by expressing my sincere gratitude to our shareholders for your support and belief in Vimeo’s vision.

Vimeo is entering 2025 in its strongest position since going public. The market opportunities for video are expansive, and that’s why we’re investing in innovations that capitalize on these, including: vertical solutions such as video-powered learning and development, security features to protect video content, new video formats like spatial video, and AI-powered innovations across our platform that make it easier for creators to produce better videos, drive viewership, and scale the reach of their video projects globally.

2024 Highlights:

In 2024, we demonstrated our financial strength and resiliency, built a new leadership team, defined our long-term mission, and attracted world-class customers. Q4 results were emblematic of the instrumental changes to our strategy that had a positive impact throughout 2024 as we ended the year with our highest dollar level of quarterly bookings in 10 quarters. 2024 highlights include:

–Customer Traction. We solidified our position as one of the largest and most trusted private video platforms in the world, serving millions of creators, thousands of streamers, and the largest global brands, including at least 8 of the top 10: grocery stores, big-box retailers, healthcare and life sciences companies, insurance, and media companies. Vimeo now serves video in over 190 countries, including China, and over 45% of our revenue comes from outside the U.S.

–Bookings Growth. We grew our Vimeo Enterprise bookings from $100,000+ ARR customers by over 50%. Our OTT/Streaming business returned to growth in bookings and customers grew. We rearchitected our Self-Serve pricing and began raising our prices, driving positive results entering 2025. Most encouraging, we ended the year with Q4 bookings growth of 3%.

–Financial Strength & Efficiency. Our business demonstrated its resiliency and financial strength, delivering 78% gross margin, net earnings of $27 million, and an all-time high $55 million in Adjusted EBITDA*, over 3x the total Adjusted EBITDA* generated in all three years from 2021-2023 combined. We achieved this on essentially flat revenue as compared to 2023 while having taken over $100 million run rate out of expenses since early 2022. We are pairing our increased investment in technology with a healthier and more productive marketing & sales engine.

–AI Innovations. We launched AI features to bring productivity and value to our creators, including automated video transcription, video captioning, social media clip generation, and, most recently, video translation into over 28 languages.

–Industry engagement and recognition. Our creator community won Oscars, Cannes and Sundance Film Festival awards. Vimeo received Webby awards and was recognized by Gartner, Aragon Research, and Frost & Sullivan as an Enterprise Video platform leader. We held our inaugural customer event, Vimeo REFRAME ‘24, attracting thousands of creators, and we collaborated with Apple on the launch of an all-new spatial video-sharing app for the Apple Vision Pro.

*Please refer to the reconciliations of GAAP to non-GAAP measures starting on page 17.

2

Q4 Highlights

In Q4, we delivered bookings growth. While revenue fell 2%, bookings grew 3%. We started executing investment plans while delivering net earnings of $2 million, operating income of $1 million, and Adjusted EBITDA* of $11 million. Vimeo Enterprise revenue grew 37% and reached a $100 million-plus run rate in annualized bookings for the second quarter in a row, placing Vimeo as one of the most successful enterprise video SaaS platforms in the world. Q4 ended with a cash balance of $325 million, up $24 million in 2024, after using over $30 million to buy back almost 6 million shares and satisfy tax obligations related to the vesting of equity.

2025 Outlook

Demand for video is at an all-time high, and customers want more choices in how it is discovered, delivered, and monetized. Vimeo hosts over 8 billion video minutes and serves over 100 billion views annually. We are now in a strong position to increase investment and pursue accelerating growth profitably.

In 2025, we will increase innovation investment in the key areas I mentioned above, utilizing shareholders’ resources wisely to accelerate profitable growth in bookings and revenue. We believe that as a result of these investments our growth rates will accelerate as we move through 2025, first in bookings and followed by revenue due to the subscription nature of our business. Vimeo Enterprise and OTT/streaming are delivering meaningful growth and in Q4, together, are now 38% of our bookings and 34% of our revenue. We are seeing positive early impacts of Self-Serve price increases. We have set goals to expand and delight our customer base across even more video use cases and believe if we achieve our goals, we can leave 2025 with double-digit growth in sight.

On behalf of the entire Vimeo team, I extend our heartfelt thanks to you, our shareholders, for your belief in our vision for Vimeo’s future. Customers need Vimeo’s trust and innovation now more than ever, and we are committed to delivering just that. We are excited about the year ahead and look forward to sharing our progress with you.

Thank you!

Philip Moyer

Chief Executive Officer

*Please refer to the reconciliations of GAAP to non-GAAP measures starting on page 17.

3

Q4 Financial

Overview

Bookings

& Revenue

*Please refer to the reconciliations of GAAP to non-GAAP measures starting on page 17.

4

Vimeo

Enterprise

Vimeo Enterprise continues its strong momentum and Q4 annualized bookings topped $100 million for the second consecutive quarter. We secured new enterprise deals with Q4 wins at Adidas, Clarins, Orange, Datadog, and Sandisk while expanding our relationships with Sanofi, Cole Haan, Warby Parker, Pegasystems and Bang & Olufsen. Year-over-year Q4 bookings grew 39%, with revenue increasing by 37%. Vimeo Enterprise represented 29% of Vimeo’s total Q4 bookings, up 7 points year-over-year and 22% of revenue, making it a meaningful driver of our growth.

Key factors in our success include our platform’s ease of use, high-quality video, and robust features in hosting, player, security, and AI. We’re seeing particular demand within the Retail, eLearning, Healthcare, and Financial Services sectors. We believe we are gaining market share against both peer video companies and internal development.

Subscribers reached approximately 4,000 with subscriber growth of 19%, and a 12% ARPU increase to over $23,000. Notably, over 40% of our Vimeo Enterprise customers expanded their annual spend beyond our standard annual price increase of up to 7%, demonstrating our ability to land and expand.

The Vimeo Enterprise product significantly progressed in 2024 across enterprise requirements such as security and compliance, customization and integration, and AI-powered tools. Enhancements included SSO, local data residency, enterprise custom domains, expanded integrations, and advanced analytics, ensuring a secure, flexible, and insightful platform tailored to enterprise needs. These features were key selling points for 30% of our new business in 2024.

For 2025, as we ramp innovation investment, our product pipeline includes workspaces for seamless collaboration, governance and control for enhanced oversight, improved network compatibility and usability, OTT-centric streaming features, and AI-driven platform advancements such as best-in-class video translation capabilities and knowledge extraction through video intelligence. AI is a particularly exciting opportunity, as evidenced by customer interest. It was a factor in nearly 40% of our Vimeo Enterprise wins since August 2024.

In 2025, we will go to market with two approaches: one tailored to smaller commercial clients and another targeting large corporate customers. We think this updated approach will more closely align with how customers want to buy Vimeo, enabling us to scale up and better utilize sales resources. As part of this transition we have brought our Vimeo Enterprise and OTT sales teams closer together, which we believe will have cross-sell and expansion benefits.

We believe that our momentum and innovation investments will enable us to maintain strong double-digit growth in Vimeo Enterprise.

*Please refer to the reconciliations of GAAP to non-GAAP measures starting on page 17.

5

*Please refer to the reconciliations of GAAP to non-GAAP measures starting on page 17.

6

Self-Serve

& Add-Ons

In Self-Serve & Add-Ons, the work continues to move back to growth. While revenue and bookings were down 8% and 6% year-over-year in Q4, respectively, we saw positive signs of potential growth. Average Order Values increased by double-digits due to new pricing, in some cases approximately 30% higher than previous rates. Q4 new bookings rose 2% quarter-over-quarter, countering the typical season decline. These signals indicate to us that customers recognize the value of our enhanced plan designs, such as removing selected upload limits, which contribute to a significantly improved customer experience.

Beyond pricing, we’re confident that innovation and refined global marketing spend will drive further growth in 2025. Our top-of-funnel growth strategy involves expanding into new channels, optimizing web & user journeys, and accelerating and building strategic partnerships with like-minded brands to grow awareness. Product-wise, we have compelling improvements for customers, including more flexible content distribution and monetization options and improved video review and collaboration capabilities. Finally, we continue to see Self-Serve customers engaged in uploading and distributing content, actions at the center of our value proposition.

Add-On bookings (roughly 15% of our 2024 Self-Serve & Add-Ons category) declined due to fewer subscribers and lower usage per average subscriber vs. the accelerated pandemic years. Some of those subscribers upgraded to Vimeo Enterprise, a good sign of our ability to continue expanding our value with customers. While Add-Ons presents a near-term headwind, we believe there is an opportunity to expand beyond bandwidth and return to growth over time. As part of our 2025 innovation investment, we are focused on delivering AI Add-Ons in the near term, which we believe will be highly valued by our customer base, though it may take patience to fully see the results.

*Please refer to the reconciliations of GAAP to non-GAAP measures starting on page 17.

7

*Please refer to the reconciliations of GAAP to non-GAAP measures starting on page 17.

8

Other

In Q4, Other bookings and revenue declined year-over-year largely due to the deprecation of certain products. OTT, our product serving streaming customers, delivered bookings growth in the mid-single digits, bringing its full-year growth to the low single digits. We believe OTT has solid growth potential as we know our customers derive measurable value from our feature-rich, easy-to-use comprehensive solution to run streaming businesses. In the quarter, we won four $100,000+ OTT deals. As we look to 2025, we are focusing incremental investment dollars on OTT to draw streaming customers closer to our Vimeo Enterprise offerings. As mentioned above, we have adjusted our go-to-market strategy for OTT and enabled our sales force to sell both Vimeo Enterprise and OTT.

Expenses & Profitability

In Q4, we emerged from a two-year period of cost reductions, ready to invest responsibly for growth. From Q1 2022 to Q4 2024, GAAP and non-GAAP expenses* fell over $100M run rate, including a 31% reduction in non-GAAP Sales & Marketing*, an approximate 20% reduction in non-GAAP General & Administrative*, and a 36% decline in Stock-Based Compensation. The result has been a significant swing in profitability to the positive, putting Vimeo on solid financial footing for our future investments.

Q4 GAAP and non-GAAP cost of revenue* were $23 million, both essentially flat year-over-year, primarily due to a decrease in credit card processing fees, partially offset by an increase in hosting costs. GAAP and non-GAAP gross profit margin* were both 78% in Q4. Optimizations in cost of revenue have enabled us to maintain quarterly gross profit dollar levels near $80 million a quarter despite the revenue decline experienced since early 2022.

*Please refer to the reconciliations of GAAP to non-GAAP measures starting on page 17.

9

| | | | | | | | |

| YoY Change |

| 2% | 2% | (2)% |

| Gross Margin |

| 77% | 78% | 78% |

| | | | | | | | |

| YoY Change |

| 2% | 2% | (3)% |

| Non-GAAP Gross Margin* |

| 77% | 78% | 78% |

In Q4, we began executing on our plan to strategically invest, particularly in R&D. GAAP and non-GAAP operating expenses* were up slightly both year-over-year and versus Q3 due to beginning to make our strategic investments and seasonal Sales and Marketing spend fluctuations. We ended the year with headcount at 1,102, up 3% year-over-year.

| | | | | | | | |

| YoY Change in Total Operating Expenses |

| (15)% | (12)% | 3% |

| | | | | | | | |

| YoY Change in Total Non-GAAP Operating Expenses* |

| (14)% | (7)% | 1% |

*Please refer to the reconciliations of GAAP to non-GAAP measures starting on page 17.

10

Net earnings was $2 million or 1% of revenue in Q4. Adjusted EBITDA* was $11 million or 10% of revenue in Q4.

| | | | | | | | |

| YoY Change |

| 79% | NM | (82)% |

| Net Earnings (Loss) as a % of Revenue |

| (5)% | 8% | 1% |

| | | | | | | | |

| YoY Change |

| NM | 105% | (19)% |

| Adjusted EBITDA Margin* |

| 6% | 13% | 10% |

*Please refer to the reconciliations of GAAP to non-GAAP measures starting on page 17.

11

Balance Sheet &

Cash Flow Highlights

We ended Q4 with $325 million in cash and cash equivalents, in line with the prior quarter, despite using $10 million to repurchase shares. Cash from operations was up 8% year-over-year to $11 million, and Free Cash Flow* was up 8% year-over-year to $11 million.

In Q4, we repurchased 1.6 million shares of Vimeo's common stock at a weighted average per share cost of $6.25, and an additional 1.5 million shares of common stock through February 13, 2025 at a per share cost of $6.55. As of February 13, 2025, we had $14 million remaining in our share repurchase authorization. We plan to continue to act on our existing repurchase authorization at a minimum to reduce dilution from current and future share issuance.

Guidance

•Q1 2025 revenue near $100 million, Operating loss to be approximately $9 million, and Adjusted EBITDA* slightly greater than breakeven

•Full year 2025 revenue to grow in the low single digits with growth accelerating through the year

•Full year 2025 Operating loss to be approximately $5 million and Adjusted EBITDA* of $25 million - $30 million, reflecting our desire to invest up to $30 million incrementally in our business

•Expect to end the year with line of sight to double-digit growth

*Please refer to the reconciliations of GAAP to non-GAAP measures starting on page 17.

12

| | | | | | | | | | | | | | | | | | | | | | | |

| GAAP FINANCIAL STATEMENTS |

| VIMEO, INC. CONSOLIDATED STATEMENT OF OPERATIONS |

| ($ in thousands except per share data) |

| | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 103,156 | | | $ | 105,544 | | | $ | 417,006 | | | $ | 417,214 | |

| Cost of revenue (exclusive of depreciation shown separately below) | 22,902 | | | 23,257 | | | 90,731 | | | 91,576 | |

| Gross profit | 80,254 | | | 82,287 | | | 326,275 | | | 325,638 | |

| Operating expenses: | | | | | | | |

| Research and development expense | 27,678 | | | 25,985 | | | 109,373 | | | 107,074 | |

| Sales and marketing expense | 31,089 | | | 35,032 | | | 119,869 | | | 151,487 | |

| General and administrative expense | 19,828 | | | 14,549 | | | 76,604 | | | 49,194 | |

| Depreciation | 43 | | | 799 | | | 356 | | | 1,997 | |

| Amortization of intangibles | 348 | | | 348 | | | 1,390 | | | 2,839 | |

| Total operating expenses | 78,986 | | | 76,713 | | | 307,592 | | | 312,591 | |

| Operating income | 1,268 | | | 5,574 | | | 18,683 | | | 13,047 | |

| Interest expense | — | | | — | | | — | | | (998) | |

| | | | | | | |

| Other income, net | 3,721 | | | 3,627 | | | 15,033 | | | 12,862 | |

| Earnings before income taxes | 4,989 | | | 9,201 | | | 33,716 | | | 24,911 | |

| Income tax provision | (3,453) | | | (806) | | | (6,704) | | | (2,879) | |

| Net earnings | $ | 1,536 | | | $ | 8,395 | | | $ | 27,012 | | | $ | 22,032 | |

| | | | | | | |

| Per share information: | | | | | | | |

| Basic earnings per share | $ | 0.01 | | | $ | 0.05 | | | $ | 0.16 | | | $ | 0.13 | |

| Diluted earnings per share | $ | 0.01 | | | $ | 0.05 | | | $ | 0.16 | | | $ | 0.13 | |

| Weighted average shares outstanding used in the computation of net earnings per share: | | | | |

| Basic | 162,727 | | | 164,472 | | | 163,929 | | | 163,238 | |

| Diluted | 171,835 | | | 166,313 | | | 169,451 | | | 165,271 | |

| | | | | | | |

| Stock-based compensation expense by function: | | | | | | | |

| Cost of revenue | $ | 192 | | | $ | 256 | | | $ | 757 | | | $ | 996 | |

| Research and development expense | 3,191 | | | 4,103 | | | 13,700 | | | 15,753 | |

| Sales and marketing expense | 1,818 | | | 2,285 | | | 5,984 | | | 9,661 | |

| General and administrative expense | 3,884 | | | (31) | | | 12,264 | | | (14,368) | |

| Total stock-based compensation expense | $ | 9,085 | | | $ | 6,613 | | | $ | 32,705 | | | $ | 12,042 | |

| | | | | | | |

| | | | | | | | | | | |

| VIMEO, INC. CONSOLIDATED BALANCE SHEET |

| ($ in thousands) |

| December 31,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Cash and cash equivalents | $ | 325,276 | | | $ | 301,372 | |

| Accounts receivable, net | 24,648 | | | 26,605 | |

| Prepaid expenses and other current assets | 24,732 | | | 23,491 | |

| Total current assets | 374,656 | | | 351,468 | |

| | | |

| Leasehold improvements and equipment, net | 456 | | | 607 | |

| Goodwill | 245,406 | | | 245,406 | |

| Intangible assets with definite lives, net | 1,239 | | | 2,629 | |

| Other non-current assets | 21,064 | | | 22,810 | |

| TOTAL ASSETS | $ | 642,821 | | | $ | 622,920 | |

| | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| LIABILITIES: | | | |

| Accounts payable, trade | $ | 4,473 | | | $ | 4,696 | |

| | | |

| Deferred revenue | 161,923 | | | 168,610 | |

| Accrued expenses and other current liabilities | 56,027 | | | 53,573 | |

| Total current liabilities | 222,423 | | | 226,879 | |

| | | |

| | | |

| Other long-term liabilities | 11,601 | | | 13,809 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| SHAREHOLDERS' EQUITY: | | | |

| Common stock | 1,620 | | | 1,585 | |

| Class B common stock | 94 | | | 94 | |

| | | |

| | | |

| Preferred stock | — | | | — | |

| Additional paid-in capital | 801,367 | | | 774,587 | |

| Accumulated deficit | (366,323) | | | (393,335) | |

| Accumulated other comprehensive loss | (1,180) | | | (699) | |

| Treasury stock | (26,781) | | | — | |

| Total shareholders' equity | 408,797 | | | 382,232 | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 642,821 | | | $ | 622,920 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| VIMEO, INC. CONSOLIDATED STATEMENT OF CASH FLOWS |

| ($ in thousands) |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows from operating activities: | | | | | | | |

| Net earnings | $ | 1,536 | | $ | 8,395 | | | $ | 27,012 | | $ | 22,032 | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | | | | | |

| Stock-based compensation expense | 9,085 | | | 6,613 | | | 32,705 | | | 12,042 | |

| Amortization of intangibles | 348 | | | 348 | | | 1,390 | | | 2,839 | |

| Depreciation | 43 | | | 799 | | | 356 | | | 1,997 | |

| Provision for credit losses | 649 | | | 451 | | | 993 | | | 777 | |

| | | | | | | |

| Loss on the sale of an asset | — | | | — | | | — | | | 37 | |

| Non-cash lease expense | 1,042 | | | 1,039 | | | 4,352 | | | 4,449 | |

| Other adjustments, net | (10) | | | 280 | | | 54 | | | 1,333 | |

| Changes in assets and liabilities: |

| Accounts receivable | (295) | | | (2,378) | | | (1,090) | | | 1,075 | |

| Prepaid expenses and other assets | (4,773) | | | (3,193) | | | (542) | | | (5,180) | |

| Accounts payable and other liabilities | 4,340 | | | (1,534) | | | (3,031) | | | (7,744) | |

| Deferred revenue | (1,161) | | | (838) | | | (5,338) | | | 4,128 | |

| Net cash provided by operating activities | 10,804 | | | 9,982 | | | 56,861 | | | 37,785 | |

| Cash flows from investing activities: | | | | | | | |

| | | | | | | |

| Capital expenditures | (49) | | | — | | | (222) | | | (108) | |

| Proceeds from the sale of an asset | — | | | — | | | — | | | 639 | |

| | | | | | | |

| Net cash (used in) provided by investing activities | (49) | | | — | | | (222) | | | 531 | |

| Cash flows from financing activities: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Amounts related to settlement of equity awards | (1,635) | | | (717) | | | (6,878) | | | (6,414) | |

| Proceeds from exercise of stock options | 1,059 | | | 625 | | | 1,106 | | | 759 | |

| Purchases of treasury stock | (9,608) | | | — | | | (26,405) | | | — | |

| Contingent consideration payment | — | | | — | | | — | | | (5,774) | |

| Other, net | — | | | — | | | — | | | (266) | |

| Net cash used in financing activities | (10,184) | | | (92) | | | (32,177) | | | (11,695) | |

| Total cash provided | 571 | | | 9,890 | | | 24,462 | | | 26,621 | |

| Effect of exchange rate changes on cash and cash equivalents and restricted cash | (99) | | | 655 | | | (405) | | | (19) | |

| Net increase in cash and cash equivalents and restricted cash | 472 | | | 10,545 | | | 24,057 | | | 26,602 | |

| Cash and cash equivalents and restricted cash at beginning of period | 325,021 | | | 290,891 | | | 301,436 | | | 274,834 | |

| Cash and cash equivalents and restricted cash at end of period | $ | 325,493 | | | $ | 301,436 | | | $ | 325,493 | | | $ | 301,436 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

|

| VIMEO, INC. DISAGGREGATED REVENUE AND OPERATING METRICS |

| (In thousands except ARPU) |

| | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Disaggregated Revenue | | | | | | | |

| Self-Serve & Add-Ons | $ | 65,350 | | | $ | 71,171 | | | $ | 271,691 | | | $ | 285,529 | |

| Vimeo Enterprise | 22,998 | | | 16,808 | | | 83,191 | | | 56,499 | |

| Other | 14,808 | | | 17,565 | | | 62,124 | | | 75,186 | |

| Total revenue | $ | 103,156 | | | $ | 105,544 | | | $ | 417,006 | | | $ | 417,214 | |

| | | | | | | |

| | | | | | | |

| Operating Metrics | | | | | | | |

| Self-Serve & Add-Ons: | | | | | | | |

| Subscribers | 1,227.7 | | | 1,379.7 | | | 1,227.7 | | | 1,379.7 | |

| Average Subscribers | 1,251.5 | | | 1,388.5 | | | 1,303.7 | | | 1,442.4 | |

| ARPU | $ | 208 | | | $ | 203 | | | $ | 208 | | | $ | 198 | |

| Bookings | $ | 63,738 | | | $ | 67,976 | | | $ | 260,667 | | | $ | 281,548 | |

| | | | | | | |

| Vimeo Enterprise: | | | | | | | |

| Subscribers | 4.0 | | | 3.3 | | | 4.0 | | | 3.3 | |

| Average Subscribers | 3.9 | | | 3.2 | | | 3.7 | | | 2.8 | |

| ARPU | $ | 23,493 | | | $ | 20,953 | | | $ | 22,755 | | | $ | 20,269 | |

| Bookings | $ | 30,180 | | | $ | 21,649 | | | $ | 98,640 | | | $ | 71,435 | |

| | | | | | | |

| Other: | | | | | | | |

| Subscribers | 50.0 | | | 67.0 | | | 50.0 | | | 67.0 | |

| Average Subscribers | 51.7 | | | 69.0 | | | 58.5 | | | 80.1 | |

| ARPU | $ | 1,139 | | | $ | 1,010 | | | $ | 1,062 | | | $ | 938 | |

| Bookings | $ | 10,591 | | | $ | 11,552 | | | $ | 43,727 | | | $ | 50,106 | |

RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES

($ in millions; rounding differences may occur)

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | |

| 2024 | | 2023 | | 2022 | | | | |

| Reconciliation of non-GAAP cost of revenue: | | | | | | | | | |

GAAP Cost of revenue | $ | 22.9 | | | $ | 23.3 | | | $ | 24.7 | | | | | |

| % of Revenue | 22% | | 22% | | 23% | | | | |

| Less: Stock-based compensation expense | 0.2 | | | 0.3 | | | 0.3 | | | | | |

| | | | | | | | | |

| Non-GAAP Cost of revenue | $ | 22.7 | | | $ | 23.0 | | | $ | 24.4 | | | | | |

| % of Revenue | 22% | | 22% | | 23% | | | | |

| | | | | | | | | |

| Reconciliation of non-GAAP gross profit: | | | | | | | | | |

GAAP Gross profit | $ | 80.3 | | | $ | 82.3 | | | $ | 80.9 | | | | | |

| Gross Margin | 78% | | 78% | | 77% | | | | |

| Add back: Stock-based compensation expense | 0.2 | | | 0.3 | | | 0.3 | | | | | |

| | | | | | | | | |

| Non-GAAP Gross Profit | $ | 80.4 | | | $ | 82.5 | | | $ | 81.2 | | | | | |

| Non-GAAP Gross Margin | 78% | | 78% | | 77% | | | | |

| | | | | | | | | |

| Reconciliation of non-GAAP operating expenses: | | | | | | | | | |

GAAP Research and development expense | $ | 27.7 | | | $ | 26.0 | | | $ | 23.1 | | | | | |

| % of Revenue | 27% | | 25% | | 22% | | | | |

| Less: Stock-based compensation expense | 3.2 | | | 4.1 | | | 1.1 | | | | | |

| | | | | | | | | |

| Non-GAAP Research and development expense | $ | 24.5 | | | $ | 21.9 | | | $ | 22.0 | | | | | |

| % of Revenue | 24% | | 21% | | 21% | | | | |

| | | | | | | | | |

GAAP Sales and marketing expense | $ | 31.1 | | | $ | 35.0 | | | $ | 40.6 | | | | | |

| % of Revenue | 30% | | 33% | | 38% | | | | |

| Less: Stock-based compensation expense | 1.8 | | | 2.3 | | | 3.6 | | | | | |

| | | | | | | | | |

| Non-GAAP Sales and marketing expense | $ | 29.3 | | | $ | 32.7 | | | $ | 37.0 | | | | | |

| % of Revenue | 28% | | 31% | | 35% | | | | |

| | | | | | | | | |

GAAP General and administrative expense | $ | 19.8 | | | $ | 14.5 | | | $ | 22.2 | | | | | |

| % of Revenue | 19% | | 14% | | 21% | | | | |

| Less: Stock-based compensation expense | 3.9 | | | — | | | 7.0 | | | | | |

| Less: Contingent consideration fair value adjustments | — | | | — | | | (0.5) | | | | | |

| | | | | | | | | |

| Non-GAAP General and administrative expense | $ | 15.9 | | | $ | 14.6 | | | $ | 15.7 | | | | | |

| % of Revenue | 15% | | 14% | | 15% | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES

($ in millions; rounding differences may occur)

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | |

| 2024 | | 2023 | | 2022 | | | | |

| | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Reconciliation of net earnings (loss) to Adjusted EBITDA: | | | | | | | | | |

| Net earnings (loss) | $ | 1.5 | | | $ | 8.4 | | | $ | (5.1) | | | | | |

| Add back: | | | | | | | | | |

| Income tax provision | 3.5 | | | 0.8 | | | 0.5 | | | | | |

| Other income, net | (3.7) | | | (3.6) | | | (2.1) | | | | | |

| | | | | | | | | |

| Interest expense | — | | | — | | | 0.1 | | | | | |

| Operating income (loss) | 1.3 | | | 5.6 | | | (6.5) | | | | | |

| Operating Income (Loss) Margin | 1% | | 5% | | (6)% | | | | |

| Add back: | | | | | | | | | |

| Stock-based compensation expense | 9.1 | | | 6.6 | | | 12.1 | | | | | |

| Depreciation | — | | | 0.8 | | | 0.1 | | | | | |

| Amortization of intangibles | 0.3 | | | 0.3 | | | 1.2 | | | | | |

| Contingent consideration fair value adjustments | — | | | — | | | (0.5) | | | | | |

| | | | | | | | | |

| Adjusted EBITDA | $ | 10.7 | | | $ | 13.3 | | | $ | 6.5 | | | | | |

| Adjusted EBITDA Margin | 10% | | 13% | | 6% | | | | |

| | | | | | | | | |

| Computation of Free Cash Flow: | | | | | | | | | |

| Net cash provided by operating activities | $ | 10.8 | | | $ | 10.0 | | | $ | 1.7 | | | | | |

| Add: Restructuring costs | — | | | — | | | 0.4 | | | | | |

| | | | | | | | | |

| Less: Capital expenditures | — | | | — | | | (0.1) | | | | | |

| Free Cash Flow | $ | 10.8 | | $ | 10.0 | | | $ | 1.9 | | | | | |

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL OUTLOOK

($ in millions; rounding differences may occur)

| | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended March 31, 2025 | | | | Twelve Months Ended December 31, 2025 |

| Operating loss to Adjusted EBITDA: | | | | | | | | | | | |

| Operating loss | | | | | $ | (9.4) | | | | | $ | (4.8) | | | |

| Add back: | | | | | | | | | | | |

| Stock-based compensation expense | | | | | 9.1 | | | | | 30.9 | | | |

| Depreciation | | | | | — | | | | | 0.2 | | | |

| Amortization of intangibles | | | | | 0.3 | | | | | 1.2 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Adjusted EBITDA | | | | | $ | — | | | | | $ | 27.5 | | | |

PRINCIPLES OF FINANCIAL REPORTING

We have provided in this press release certain non-GAAP financial measures, including Adjusted EBITDA, non-GAAP gross profit, non-GAAP operating expenses, and free cash flow, to supplement our financial information presented in accordance with GAAP. We use these non-GAAP financial measures internally in analyzing our financial results and believe that they are useful to investors as an additional tool to evaluate ongoing operating results and trends and in comparing our financial results with other companies in our industry, many of which present similar non-GAAP financial measures. However, our presentation of these non-GAAP financial measures may differ from the presentation of similarly titled measures by other companies. Adjusted EBITDA is one of the metrics on which our internal budgets are based and also one of the metrics by which management is compensated. We believe that investors should have access to, and we are obligated to provide, the same set of tools that we use in analyzing our results. These non-GAAP financial measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. We endeavor to compensate for the limitations of the non-GAAP measures presented by providing the comparable GAAP measure with equal or greater prominence and descriptions of the reconciling items, including quantifying such items, to derive the non-GAAP measure. We encourage investors to examine the reconciling adjustments between the GAAP and corresponding non-GAAP measure.

From time to time, we provide forward-looking outlook information, including for Adjusted EBITDA. Adjusted EBITDA used in our outlook will differ from net earnings (loss) and operating income (loss) in ways similar to the reconciliations provided above and the definitions of Adjusted EBITDA provided below.

Definitions of Non-GAAP Measures

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization ("Adjusted EBITDA") is defined as operating income (loss) excluding: (1) stock-based compensation expense; (2) depreciation; (3) amortization of intangible assets; (4) gains and losses recognized on changes in the fair value of contingent consideration arrangements; and (5) restructuring costs associated with exit or disposal activities such as a reduction in force or reorganization. We believe this measure is useful for analysts and investors as this measure allows a more meaningful comparison between our performance and that of our competitors. The above items are excluded from our Adjusted EBITDA measure because these items are either non-cash or non-recurring in nature and are collectively referred to as "Adjusted EBITDA Non-GAAP Adjustments." Adjusted EBITDA has certain limitations because it excludes the impact of these expenses.

Adjusted EBITDA Margin is Adjusted EBITDA, divided by revenue.

Non-GAAP Cost of Revenue excludes stock-based compensation expense and restructuring costs.

Non-GAAP Gross Profit excludes stock-based compensation expense and restructuring costs included in Cost of revenue.

Non-GAAP Gross Margin is Non-GAAP Gross Profit, divided by revenue.

Non-GAAP Operating Expenses include Non-GAAP Research and development expense, Non-GAAP Sales and marketing expense, and Non-GAAP General and administrative expense. These Non-GAAP operating expenses exclude Adjusted EBITDA Non-GAAP Adjustments in their respective expense items.

Free Cash Flow is defined as net cash provided by, or used in, operating activities excluding restructuring costs and contingent consideration payments included in operating activities, less cash used for capitalized software development costs and capital expenditures. We believe Free Cash Flow is useful to investors as a liquidity measure because it measures our ability to generate or use cash.

Items That Are Excluded From Non-GAAP Measures

Stock-based compensation expense consists of expense associated with the grants of Vimeo stock-based awards. These expenses are not paid in cash and we view the economic costs of stock-based awards to be the dilution to our share base. We also consider the dilutive impact of stock-based awards in GAAP diluted earnings per share, to the extent such impact is dilutive.

Depreciation is a non-cash expense relating to our leasehold improvements and equipment and is computed using the straight-line method to allocate the cost of depreciable assets to operations over their estimated useful lives, or, in the case of leasehold improvements, the lease term, if shorter.

Amortization of intangible assets are non-cash expenses related to capitalized software development costs or acquisitions. Amortization of capitalized software development costs is computed using the straight-line method to allocate the cost of such assets to

operations over their estimated useful lives. At the time of an acquisition, the identifiable definite-lived intangible assets of the acquired company are valued and amortized over their estimated useful lives. We believe that acquired intangible assets represent costs incurred by the acquired company to build value prior to acquisition and the related amortization is not an ongoing cost of doing business.

Gains and losses recognized on changes in the fair value of contingent consideration arrangements are accounting adjustments to report contingent consideration liabilities at fair value. These adjustments can be highly variable and are excluded from our assessment of performance because they are considered non-operational in nature and, therefore, are not indicative of current or future performance or the ongoing cost of doing business.

Restructuring costs consist of costs associated with exit or disposal activities such as severance and other post-employment benefits paid in connection with a reduction-in-force or reorganization. We consider these costs to be non-recurring in nature and therefore, are not indicative of current or future performance or the ongoing cost of doing business.

Operating Metrics and Key Terms

Self-Serve & Add-Ons relates to our subscription plans sold directly online, and any add-on services tied to those online subscriptions such as bandwidth charges, which are sold through our sales force to subscribers of one of our plans if they exceed a certain threshold of bandwidth.

Vimeo Enterprise relates to our video offering designed for teams and organizations, which includes the same capabilities of Self-Serve & Add-Ons plus enterprise-grade features such as advanced security, custom user permissions, single-sign on for employees, interactive video tools, and marketing software integrations. Vimeo Enterprise is sold through our sales force and is often an upgrade from Vimeo's Self-Serve & Add-Ons as the number of users or use cases in an organization grows.

Other relates to products and services we offer outside of Self-Serve & Add-Ons and Vimeo Enterprise, primarily our over-the-top ("OTT") video monetization solution that allows customers to launch and run their own video streaming channel directly to their audience through a branded web portal, mobile apps and Internet-enabled TV apps. Other also includes Magisto, Livestream, Wibbitz, and WIREWAX.

Subscribers is the number of users who have an active subscription to one of Vimeo's paid plans measured at the end of the relevant period. Vimeo counts each customer with a subscription plan as a subscriber regardless of the number of users. In the case of customers who maintain subscriptions across Self-Serve & Add-Ons, Vimeo Enterprise, and Other, Vimeo counts one subscriber for each of the components in which they maintain one or more subscriptions. Vimeo does not count users or team members who have access to a subscriber's account as additional subscribers.

Average Subscribers is the sum of the number of Subscribers at the beginning and at the end of the relevant measurement period divided by two.

Average Revenue per User ("ARPU") is the annualized revenue for the relevant period divided by Average Subscribers. For periods that are less than a full year, annualized revenue is calculated by dividing the revenue for that particular period by the number of calendar days in the period and multiplying this value by the number of calendar days in that year.

Bookings consist of fixed fees for SaaS services, measured at the end of the relevant period, that subscribers have committed to pay during their subscription period which is generally 12 months, less refunds and chargebacks during the same period.

Gross Margin is revenue less cost of revenue, divided by revenue.

Operating Income (Loss) Margin is Operating income (loss), divided by revenue.

DILUTIVE SECURITIES

Vimeo has various dilutive securities. The table below details these securities as well as estimated dilution at various stock prices (shares in millions; rounding differences may occur).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares | | Avg. Exercise Price | | As of 2/13/2025 | Dilution at: |

| | | | | | | | | |

| Share Price | | | | | $ | 6.63 | | $ | 7.00 | | $ | 9.00 | | $ | 11.00 | | $ | 13.00 | |

| | | | | | | | | |

| Common Stock Outstanding as of 2/13/2025 | 164.9 | | | | | 164.9 | | 164.9 | | 164.9 | | 164.9 | | 164.9 | |

| | | | | | | | | |

| SARs and Stock Options | 8.8 | | | $ | 5.46 | | | — | | — | | 0.5 | | 1.6 | | 2.3 | |

| RSUs | 12.1 | | | | | 6.7 | | 6.7 | | 6.7 | | 6.7 | | 6.7 | |

| Total Estimated Dilution | | | | | 6.7 | | 6.7 | | 7.2 | | 8.3 | | 9.0 | |

| % Dilution | | | | | 4.1 | % | 4.1 | % | 4.4 | % | 5.0 | % | 5.4 | % |

| Total Estimated Diluted Shares Outstanding | | | | | 171.5 | | 171.5 | | 172.0 | | 173.1 | | 173.8 | |

The dilutive securities presentation is calculated using the methods and assumptions described below, which are different than those prescribed by GAAP.

The estimated dilutive effect was calculated assuming the Company settles equity awards on a net basis; therefore, the dilutive effect is presented as the net number of shares expected to be issued upon vesting or exercise, adjusted for (i) the estimated income tax benefit from the tax deduction received upon the vesting or exercise of awards held in the U.S., as such tax benefit is assumed to be used to repurchase shares of Vimeo common stock and (ii) in the case of stock options, the strike price proceeds that are received by the Company and assumed to be used to repurchase shares of Vimeo common stock. The number of shares required to settle stock appreciation rights will be impacted by movement in the stock price of Vimeo.

OTHER INFORMATION

Cautionary Statement Regarding Forward-Looking Information

This press release and the Vimeo livestream which will be held at 5 p.m. Eastern Time on February 19, 2025, contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "will," "may," "could," "should," "would," "anticipates," "estimates," "expects," "plans," "projects," "forecasts," "intends," "targets," "seeks" and "believes," as well as variations of these words or comparable words, among others, generally identify forward-looking statements. These forward-looking statements include, among others, statements relating to Vimeo's expectations regarding future results of operations and financial condition, business strategy, and plans and objectives of management for future operations, including our plans with respect to our share repurchase authorization. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available. These forward-looking statements are subject to a number of known and unknown risks, uncertainties and assumptions. Actual results could differ materially from those contained in or implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: adverse changes in economic conditions, changes in the regulatory landscape, including, in particular, changes in laws that might increase the liability of online intermediaries for user-generated content and developments in AI laws, reputational damage caused by problematic user content or our decisions to remove (or not remove) it; changes in policies implemented by third party platforms upon which we rely for traffic and distribution of mobile apps, increased competition in the online video category, our ability to convert visitors into uploaders and uploaders into paying subscribers, our ability to retain paying subscribers by maintaining and improving our value proposition, our ability to provide video storage and streaming in a cost-effective manner, our ability to successfully attract customers through our sales force, our ability to protect sensitive data from unauthorized access, the integrity, quality, scalability and redundancy of our systems, technology and infrastructure (and those of third parties with which we do business), our ability to successfully operate in and expand into additional international markets, our ability to adequately protect our intellectual property rights and not infringe the intellectual property rights of third parties, foreign exchange currency rate fluctuations, the impact of geopolitical events on our business, the possibility that our historical consolidated and combined results may not be indicative of our future results and the other factors set forth in the section titled "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 to be filed with the Securities and Exchange Commission ("SEC") on February 19, 2025, as they may be updated by our periodic reports subsequently filed with the SEC. Other unknown or unpredictable factors that could also adversely affect Vimeo’s business, financial condition and results of operations may arise from time to time. In light of these risks and uncertainties, these forward-looking statements may not prove to be accurate. Accordingly, you should not place undue reliance on these forward-looking statements, which only reflect the views of Vimeo’s management as of the date of this communication. Vimeo does not undertake to update these forward-looking statements.

About Vimeo

Vimeo (NASDAQ: VMEO) is the world's most innovative video experience platform. We enable anyone to create high-quality video experiences to better connect and bring ideas to life. We proudly serve our community of millions of users – from creative storytellers to globally distributed teams at the world's largest companies – whose videos receive billions of views each month. Learn more at www.vimeo.com.

Contact Us

Vimeo Investor Relations

ir@vimeo.com

Vimeo Communications

Ronda Morra

press@vimeo.com

Cover Page

|

Feb. 19, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 19, 2025

|

| Entity Registrant Name |

VIMEO, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40420

|

| Entity Tax Identification Number |

85-4334195

|

| Entity Address, Address Line One |

330 West 34th Street

|

| Entity Address, Address Line Two |

5th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10001

|

| City Area Code |

212

|

| Local Phone Number |

524-8791

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01

|

| Trading Symbol |

VMEO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001837686

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

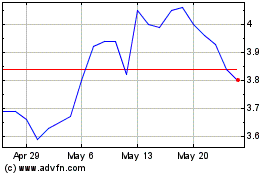

Vimeo (NASDAQ:VMEO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Vimeo (NASDAQ:VMEO)

Historical Stock Chart

From Feb 2024 to Feb 2025