VERISIGN INC/CA0001014473false00010144732025-02-062025-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2025

VERISIGN, INC.

(Exact Name of Registrant as Specified in its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| | | | | | | | |

| | |

| 000-23593 | | 94-3221585 |

(Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | |

| | | |

| 12061 Bluemont Way, | | |

| Reston, | Virginia | | 20190 |

| (Address of principal executive offices) | | (Zip Code) |

(703) 948-3200

(Registrant’s Telephone Number, Including Area Code)

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 Par Value Per Share | VRSN | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging growth company | ☐ |

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | |

Item 2.02. | Results of Operations and Financial Condition. |

On February 6, 2025, VeriSign, Inc. (the “Company”) announced its financial results for the fiscal quarter and year ended December 31, 2024. A copy of this press release is attached hereto as Exhibit 99.1.

The Company is required to disclose annually the following non-guarantor subsidiary financial information pursuant to section 4.2(d) of the indentures governing the Company’s senior notes due 2025 and 2027:

As of December 31, 2024, the Company’s non-guarantor subsidiaries collectively had (1) liabilities (excluding intercompany liabilities) of $509.0 million (15.1% of the Company’s consolidated total liabilities), of which $424.2 million were deferred revenues, (2) assets (excluding intercompany assets) of $640.0 million (45.5% of the Company’s consolidated total assets), of which $418.3 million were cash, cash equivalents and marketable securities and (3) assets (excluding cash, cash equivalents and marketable securities, and intercompany assets) of $221.7 million (27.5% of the Company’s consolidated total assets, excluding cash, cash equivalents and marketable securities).

For the twelve months ended December 31, 2024, the Company’s non-guarantor subsidiaries collectively had Adjusted EBITDA of $368.2 million (31.1% of the Company’s consolidated Adjusted EBITDA), which includes intercompany transactions with the Company. Such intercompany transactions represent the majority of the Company’s non-guarantor subsidiaries’ aggregate expenses. Intercompany transactions and allocations of revenues and costs between the parent and the non-guarantor subsidiaries can vary significantly. Therefore, the Company believes that period-to-period comparisons of Adjusted EBITDA of the Company’s non-guarantor subsidiaries may not necessarily be meaningful.

Adjusted EBITDA is a non-GAAP financial measure and is calculated in accordance with the terms of the indentures governing the Company’s senior notes. Adjusted EBITDA refers to net income before interest, taxes, depreciation and amortization, stock-based compensation, and unrealized gain/loss on hedging agreements. Management believes that Adjusted EBITDA supplements the financial data prepared in accordance with GAAP by providing investors with additional information that allows them to have a clearer picture of the Company’s operations and financial performance and the comparability of the Company’s operating results from period to period. The presentation of this additional information is not meant to be considered in isolation nor as a substitute for results prepared in accordance with GAAP. The table below reconciles the Company’s consolidated Net Income, which is the most directly comparable financial measure calculated and presented in accordance with GAAP, to the Company’s consolidated non-GAAP Adjusted EBITDA for the year ended December 31, 2024.

| | | | | |

| Year Ended

December 31, 2024 |

| (in millions) |

| Net Income | $ | 785.7 | |

| Interest expense | 75.3 | |

| Income tax expense | 236.2 | |

| Depreciation and amortization | 36.9 | |

| Stock-based compensation | 61.1 | |

| Unrealized gain on hedging agreements | (9.9) | |

| Non-GAAP Adjusted EBITDA | $ | 1,185.3 | |

The information in this Item 2.02 of Form 8-K and the Exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

Exhibit Number | | Description |

| |

| 99.1 | | |

| | |

| 104 | | Inline XBRL for the cover page of this Current Report on Form 8-K |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | VERISIGN, INC. |

| | |

Date: February 6, 2025 | | By: | | /s/ Thomas C. Indelicarto |

| | Thomas C. Indelicarto |

| | Executive Vice President, General Counsel and Secretary |

Verisign Reports Fourth Quarter and Full Year 2024 Results

RESTON, VA - Feb. 6, 2025 - VeriSign, Inc. (NASDAQ: VRSN), a global provider of critical internet infrastructure and domain name registry services, today reported financial results for the fourth quarter and full year 2024.

Fourth Quarter Financial Results

VeriSign, Inc. and subsidiaries (“Verisign”) reported revenue of $395 million for the fourth quarter of 2024, up 3.9 percent from the same quarter in 2023. Operating income was $264 million for the fourth quarter of 2024, compared to $256 million for the same quarter of 2023. Verisign reported net income of $191 million and diluted earnings per share (diluted “EPS”) of $2.00 for the fourth quarter of 2024, compared to net income of $265 million and diluted EPS of $2.60 for the same quarter in 2023. Net income for the fourth quarter of 2023 included the recognition of certain income tax benefits that were noted in the Q4 2023 earnings release issued on Feb. 8, 2024, which increased net income by $69.3 million and increased diluted EPS by $0.68.

2024 Financial Results

Verisign reported revenue of $1.56 billion for 2024, up 4.3 percent from 2023. Operating income was $1.06 billion for 2024 compared to $1.00 billion in 2023. Verisign reported net income of $786 million and diluted EPS of $8.00 for 2024, compared to net income of $818 million and diluted EPS of $7.90 in 2023. Net income for the full year of 2023 included the recognition of certain income tax benefits, noted above, which increased net income by $69.3 million and increased diluted EPS by $0.67.

“In 2024 we extended our unparalleled record of uninterrupted availability for .com and .net resolution to more than 27 years. We also successfully renewed our .com registry agreement with ICANN and the Cooperative Agreement with the National Telecommunications and Information Administration,” said Jim Bidzos, Executive Chairman and Chief Executive Officer.

Financial Highlights

•Verisign ended 2024 with cash, cash equivalents, and marketable securities of $600 million, a decrease of $326 million from year-end 2023.

•Cash flow from operations was $232 million for the fourth quarter of 2024 and $903 million for the full year of 2024 compared with $204 million for the same quarter in 2023 and $854 million for the full year of 2023.

•Deferred revenues as of Dec. 31, 2024, totaled $1.30 billion, an increase of $58 million from year-end 2023.

•During the fourth quarter of 2024, Verisign repurchased 1.4 million shares of its common stock for $260 million. During the full year of 2024, Verisign repurchased 6.6 million shares of its common stock for $1.21 billion. As of Dec. 31, 2024, there was $1.02 billion remaining for future share repurchases under the share repurchase program which has no expiration date.

Business Highlights

•On Nov. 27, 2024, Verisign announced the renewal of the .com Registry Agreement with the Internet Corporation for Assigned Names and Numbers (ICANN), pursuant to which Verisign will remain the sole registry operator for the .com registry through Nov. 30, 2030.

•On Nov. 29, 2024, the National Telecommunications and Information Administration (NTIA) announced the renewal of the Cooperative Agreement with Verisign for a six-year term.

•Verisign ended the fourth quarter of 2024 with 169.0 million .com and .net domain name registrations in the domain name base, a 2.1 percent decrease from the end of the fourth quarter of 2023, and a net decrease of 0.5 million registrations during the fourth quarter of 2024.

•In the fourth quarter of 2024, Verisign processed 9.5 million new domain name registrations for .com and .net, as compared to 9.0 million for the same quarter in 2023.

•The final .com and .net renewal rate for the third quarter of 2024 was 72.2 percent compared to 73.5 percent for the same quarter in 2023. Renewal rates are not fully measurable until 45 days after the end of the quarter.

Today’s Conference Call

Verisign will host a live conference call today at 4:30 p.m. (EST) to review the fourth quarter and full year 2024 results. The call will be accessible by direct dial at (888) 676-VRSN (U.S.) or (786) 789-4797 (international), conference ID: Verisign. A listen-only live web cast of the conference call and accompanying slide presentation will also be available at https://investor.verisign.com. An audio archive of the call will be available at https://investor.verisign.com/events.cfm. This news release and the financial information discussed on today’s conference call are available at https://investor.verisign.com.

About Verisign

Verisign (NASDAQ: VRSN), a global provider of critical internet infrastructure and domain name registry services, enables internet navigation for many of the world’s most recognized domain names. Verisign helps enable the security, stability, and resiliency of the Domain Name System and the internet by providing root zone maintainer services, operating two of the 13 global internet root servers, and providing registration services and authoritative resolution for the .com and .net top-level domains, which support the majority of global e-commerce. To learn more please visit verisign.com.

Statements in this announcement other than historical data and information constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 as amended and Section 21E of the Securities Exchange Act of 1934 as amended. These statements involve risks and uncertainties that could cause our actual results to differ materially from those stated or implied by such forward-looking statements. The potential risks and uncertainties include, among others, attempted security breaches, cyber-attacks, and DDoS attacks against our systems and services; the introduction of undetected or unknown defects in our systems or services; vulnerabilities in the global routing system; system interruptions or system failures; damage or interruptions to our data centers, data center systems or resolution systems; risks arising from our operation of root servers and our performance of the Root Zone Maintainer functions; any loss or modification of our right to operate the .com and .net gTLDs; changes or challenges to the pricing provisions of the .com Registry Agreement; new or existing governmental laws and regulations in the U.S. or other applicable non-U.S. jurisdictions; new laws, regulations, directives or ICANN policies that require us to obtain and maintain personal information of registrants; economic, legal, regulatory, and political risks associated with our international operations; unfavorable changes in, or interpretations of, tax rules and regulations; risks from the adoption of ICANN’s consensus and temporary policies, technical standards and other processes; the weakening of, changes to, the multi-stakeholder model of internet governance; the outcome of claims, lawsuits, audits or investigations; lower economic growth, particularly in China; our ability to compete in the highly competitive business environment in which we operate; changes in internet practices and behavior and the adoption of substitute technologies, or the negative impact of wholesale price increases; our ability to expand our services into developing and emerging economies; our ability to maintain strong relationships with registrars and their resellers; our ability to attract, retain and motivate highly skilled employees; and our ability to protect and enforce our intellectual property rights. More information about potential factors that could affect our business and financial results is included in our filings with the SEC, including in our Annual Report on Form 10-K for the year ended Dec. 31, 2023, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and, when filed, our Annual Report on Form 10-K for the year ended Dec. 31, 2024. Verisign undertakes no obligation to update any of the forward-looking statements after the date of this announcement.

Contacts

Investor Relations: David Atchley, datchley@verisign.com, 703-948-3447

Media Relations: David McGuire, davmcguire@verisign.com, 703-948-3800

©2025 VeriSign, Inc. All rights reserved. VERISIGN, the VERISIGN logo, and other trademarks, service marks, and designs are registered or unregistered trademarks of VeriSign, Inc. and its subsidiaries in the United States and in foreign countries. All other trademarks are property of their respective owners.

VERISIGN, INC.

CONSOLIDATED BALANCE SHEETS

(In millions, except par value)

(Unaudited)

| | | | | | | | | | | |

| December 31,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 206.7 | | | $ | 240.1 | |

| Marketable securities | 393.2 | | | 686.3 | |

| Other current assets | 63.9 | | | 61.9 | |

| Total current assets | 663.8 | | | 988.3 | |

| Property and equipment, net | 224.5 | | | 233.2 | |

| Goodwill | 52.5 | | | 52.5 | |

| Deferred tax assets | 281.3 | | | 301.0 | |

| Deposits to acquire intangible assets | 145.0 | | | 145.0 | |

| Other long-term assets | 39.4 | | | 29.0 | |

| Total long-term assets | 742.7 | | | 760.7 | |

| Total assets | $ | 1,406.5 | | | $ | 1,749.0 | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | | | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 257.8 | | | $ | 257.4 | |

| Deferred revenues | 973.5 | | | 931.1 | |

| Current senior notes | 299.8 | | | — | |

| Total current liabilities | 1,531.1 | | | 1,188.5 | |

| Long-term deferred revenues | 330.7 | | | 315.0 | |

| Long-term senior notes | 1,492.5 | | | 1,790.2 | |

| Long-term tax and other liabilities | 10.1 | | | 36.3 | |

| Total long-term liabilities | 1,833.3 | | | 2,141.5 | |

| Total liabilities | 3,364.4 | | | 3,330.0 | |

| Commitments and contingencies | | | |

| Stockholders’ deficit: | | | |

| Preferred stock—par value $.001 per share; Authorized shares: 5.0; Issued and outstanding shares: none | — | | | — | |

| Common stock and additional paid-in capital—par value $.001 per share; Authorized shares: 1,000.0; Issued shares: 355.2 at December 31, 2024 and 354.9 at December 31, 2023; Outstanding shares: 95.0 at December 31, 2024 and 101.3 at December 31, 2023 | 10,645.3 | | | 11,808.0 | |

| Accumulated deficit | (12,600.7) | | | (13,386.4) | |

| Accumulated other comprehensive loss | (2.5) | | | (2.6) | |

| Total stockholders’ deficit | (1,957.9) | | | (1,581.0) | |

| Total liabilities and stockholders’ deficit | $ | 1,406.5 | | | $ | 1,749.0 | |

| | | |

VERISIGN, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In millions, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | $ | 395.4 | | | $ | 380.4 | | | $ | 1,557.4 | | | $ | 1,493.1 | |

| Costs and expenses: | | | | | | | |

| Cost of revenues | 48.4 | | | 48.5 | | | 191.4 | | | 197.3 | |

| Research and development | 24.9 | | | 22.9 | | | 96.7 | | | 91.0 | |

| Selling, general and administrative | 58.3 | | | 52.7 | | | 211.1 | | | 204.2 | |

| Total costs and expenses | 131.6 | | | 124.1 | | | 499.2 | | | 492.5 | |

| Operating income | 263.8 | | | 256.3 | | | 1,058.2 | | | 1,000.6 | |

| Interest expense | (18.8) | | | (18.8) | | | (75.3) | | | (75.3) | |

| Non-operating income, net | 3.1 | | | 14.1 | | | 39.0 | | | 51.2 | |

| Income before income taxes | 248.1 | | | 251.6 | | | 1,021.9 | | | 976.5 | |

Income tax (expense) benefit | (56.6) | | | 13.1 | | | (236.2) | | | (158.9) | |

| Net income | 191.5 | | | 264.7 | | | 785.7 | | | 817.6 | |

Other comprehensive (loss) income | (0.1) | | | 0.4 | | | 0.1 | | | 0.1 | |

| Comprehensive income | $ | 191.4 | | | $ | 265.1 | | | $ | 785.8 | | | $ | 817.7 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | $ | 2.00 | | | $ | 2.60 | | | $ | 8.01 | | | $ | 7.91 | |

| Diluted | $ | 2.00 | | | $ | 2.60 | | | $ | 8.00 | | | $ | 7.90 | |

| Shares used to compute earnings per share | | | | | | | |

| Basic | 95.6 | | | 101.8 | | | 98.1 | | | 103.4 | |

| Diluted | 95.7 | | | 102.0 | | | 98.2 | | | 103.5 | |

VERISIGN, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

| | | | | | | | | | | |

| Year Ended December 31, |

| | 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 785.7 | | | $ | 817.6 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation of property and equipment | 36.9 | | | 44.1 | |

| Stock-based compensation expense | 61.1 | | | 59.7 | |

| Amortization of discount on investments in debt securities | (21.1) | | | (27.8) | |

| Other, net | 3.6 | | | 3.3 | |

| Changes in operating assets and liabilities: | | | |

| Other assets | (12.4) | | | (1.5) | |

| Other liabilities | (28.9) | | | (2.2) | |

| Deferred revenues | 58.1 | | | 27.0 | |

| Net deferred income taxes | 19.6 | | | (66.4) | |

| Net cash provided by operating activities | 902.6 | | | 853.8 | |

| Cash flows from investing activities: | | | |

| Proceeds from maturities and sales of marketable securities | 1,195.1 | | | 1,278.9 | |

| Purchases of marketable securities | (880.7) | | | (1,330.5) | |

| Purchases of property and equipment | (28.1) | | | (45.8) | |

| Net cash provided by (used in) investing activities | 286.3 | | | (97.4) | |

| Cash flows from financing activities: | | | |

| Repurchases of common stock | (1,225.6) | | | (901.4) | |

| Proceeds from employee stock purchase plan | 12.3 | | | 12.3 | |

| Payment of excise tax on repurchases of common stock | (8.2) | | | — | |

| Other financing activities | — | | | (0.7) | |

| Net cash used in financing activities | (1,221.5) | | | (889.8) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (0.8) | | | (0.1) | |

Net decrease in cash, cash equivalents and restricted cash | (33.4) | | | (133.5) | |

| Cash, cash equivalents, and restricted cash at beginning of period | 245.5 | | | 379.0 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 212.1 | | | $ | 245.5 | |

| Supplemental cash flow disclosures: | | | |

| Cash paid for interest | $ | 72.8 | | | $ | 72.8 | |

| Cash paid for income taxes, net of refunds received | $ | 230.5 | | | $ | 239.7 | |

v3.25.0.1

Document and Entity Information Document

|

Feb. 06, 2025 |

| Cover [Abstract] |

|

| Local Phone Number |

948-3200

|

| Document Type |

8-K

|

| Entity Registrant Name |

VERISIGN INC/CA

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 Par Value Per Share

|

| Pre-commencement Issuer Tender Offer |

false

|

| Pre-commencement Tender Offer |

false

|

| Soliciting Material |

false

|

| Written Communications |

false

|

| Entity Address, Address Line One |

12061 Bluemont Way,

|

| Entity File Number |

000-23593

|

| Entity Tax Identification Number |

94-3221585

|

| Entity Address, City or Town |

Reston,

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

20190

|

| Trading Symbol |

VRSN

|

| Entity Central Index Key |

0001014473

|

| Amendment Flag |

false

|

| Security Exchange Name |

NASDAQ

|

| Document Period End Date |

Feb. 06, 2025

|

| Entity Incorporation, State or Country Code |

DE

|

| City Area Code |

703

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

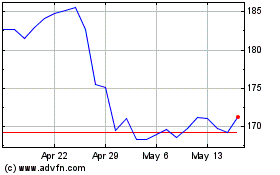

VeriSign (NASDAQ:VRSN)

Historical Stock Chart

From Jan 2025 to Feb 2025

VeriSign (NASDAQ:VRSN)

Historical Stock Chart

From Feb 2024 to Feb 2025