Vasta Platform Limited (NASDAQ: VSTA) – “Vasta” or

the “Company,” announces today its financial and operating results

for the third quarter of 2021 (3Q21) ended September 30, 2021.

Financial results are expressed in Brazilian Reais and are

presented in accordance with International Financial Reporting

Standards (IFRS).

HIGHLIGHTS

- Vasta concluded

the 2021 cycle with a 7% subscription revenue growth over the same

period of last year, or 11% excluding PAR (our hybrid subscription

product based on textbooks). Total net revenue fell 12%, however,

as the non-subscription revenue was severely impacted by the

deterioration in the textbook business, on the back of Covid-19

(higher reuse of textbooks).

- In the third

quarter, net revenue contracted 10% year on year, owing to the

different seasonality of the ACV recognition observed in 2021, with

the concentration of deliveries in some brands in the second

quarter.

- Adjusted EBITDA

totaled R$ 168 million in the 2021 cycle, a drop of 35% versus the

2020 cycle, driven by the reduction in net revenue, coupled with

higher provision for doubtful accounts (PDA) and the enhancement in

our corporate structure following the IPO in July 2020.

Additionally, it was recorded in the 3Q21 a write-off of editorial

costs amounting to R$ 20 million, referring to a rationalization of

our portfolio considering the changes in the textbook business and

our editorial strategy. Excluding this effect, adjusted EBITDA

totaled R$ 188 million, 27% lower versus the 2020 cycle, yielding a

margin of 21%. In the 3Q21, adjusted EBITDA was negative in R$ 29

million, or R$ 9 million excluding the write-off.

- The higher PDA

reflects the company’s care with provisioning standards, amidst a

difficult period for some of our partner schools and the textbook

distribution channel. Since the beginning of the pandemic, we have

opted to support our partners by extending payment terms instead of

granting discounts.

- Vasta recorded

adjusted net profit of R$ 28 million in the 2021 cycle, 57% down

year-on-year.

- On October 26,

Vasta announced a distribution agreement with Instituto

Presbiteriano Mackenzie, pursuant to which Vasta will be the sole

and exclusive distributor of the Mackenzie Learning System across

all of the basic education segments in Brazil.

- On October 29,

Vasta concluded the acquisition of Eleva platform, its biggest

acquisition since the IPO. This transaction adds not only a

sizeable and complementary portfolio of schools to Vasta’s

portfolio, but also a long-term contract through which Vasta will

be the exclusive provider of learning systems to almost all K-12

schools held by Eleva.

- The B2B2C

platform debuted in October, with Plurall MyTeacher (private

classes platform) and Plurall Adapta (adaptive learning platform)

recording their first sales.

- On October 31,

and with two months to go in the commercial campaign, the 2022

preliminary ACV totaled R$ 888 million, an organic growth of 20%

versus the subscription revenue collected in the 2021 cycle, or 29%

excluding paper-based PAR. With Eleva, the 2022 preliminary ACV was

R$ 974 million, 32% higher year-on-year. Nearly 100% of our new

sales have come from tradition learning systems, complementary

solutions, or the newly launched digital textbook platform (which

is offered on a fee-per-student basis).

MESSAGE FROM MANAGEMENT

In the third quarter, we concluded the 2021

cycle (4Q20 to 3Q21), one of the most challenging periods of our

history. The adverse effects originated by the second wave of

Covid-19 severely hit our business, leading to disappointing and

below-potential operating results. The 2021 ACV of R$ 853 million

(23% higher than the 2020 ACV) translated into R$ 741 million

subscription revenue, a quite unusual gap in our industry, on the

back of an unexpected dropout at our partner schools combined with

a higher reuse of textbooks. At the same time, the non-subscription

revenue declined 53%, due to the deterioration in the textbook

business combined with our focus on bringing non-subscription

clients to the subscription universe, our core business.

Notwithstanding all the challenges, we delivered a 7% growth in

subscription revenue, or 11% excluding PAR (highly dependent on

textbooks).

We have reasons to say that the worst was left

behind. With the social isolation measures almost fully lifted in

the country (as most of Brazilian population is already immunized

against Covid-19), we can expect the 2022 school year to be a

regular one, without unexpected student dropouts that in the 2021

cycle led to subscription revenue substantially different from the

ACV. While we don’t expect non-subscription revenue to recover

strongly going forward, we don’t foresee reasons for another sharp

reduction either. These two factors mean that Vasta is back to the

growth territory in 2022, recovering the ground lost in 2021.

If 2021 was a lost year in terms of financial

results, it has been a great year for the expansion of our Plurall

platform, still the absolute leader in terms of K-12 web traffic.

We particularly celebrate the debut of our B2B2C services: Plurall

MyTeacher (private classes platform) and Plurall Adapta (adaptive

learning platform) recorded their first sales in October. As it

happens with products of this nature, first sales are quite small,

but long-term potential is sound, and it could materialize

exponentially once the product is better known by our Plurall

community. Plurall Store, which offers a series of complementary

solutions in partnership with education companies from all over the

world, is also live in October, underscoring our platform’s

potential to continue expanding through a crescent number of

solutions to our clients, ultimately increasing client loyalty and

enhancing our long-term growth potential.

On October 26, we announced a distribution

agreement with Instituto Presbiteriano Mackenzie (“Mackenzie”),

pursuant to which Vasta will be the sole and exclusive distributor

of the Mackenzie Learning System across all of the basic education

segments in Brazil. Mackenzie, a meaningful participant in the

educational sector in Brazil since its foundation, shall remain

responsible for the development of the didactic and learning

materials of the Mackenzie Learning System and the definition of

the system’s pedagogy and methodology. Vasta shall be responsible

for support services, technological products and all services

relating to the commercialization and expansion of the Mackenzie

Learning System brand. The Agreement will start in 2022, in a

long-term basis, already contributing to the 2022 ACV.

Finally, on October 29 we closed the acquisition

of Eleva platform, our biggest acquisition since the IPO. This

transaction adds not only a sizeable and complementary portfolio of

schools to our platform, but also a long-term contract through

which Vasta will be the exclusive provider of learning systems to

almost all K-12 schools held by Eleva, uniquely positioning Vasta

to benefit from the consolidation of the fragmented K-12 market.

The expected base purchase price (subject to adjustments based on

2021 and 2022 results) is R$ 580 million, to which an estimated net

cash adjustment of approximately R$ 32 million will be added. This

amount will be paid in installments over the next five years, all

adjusted by the positive variation of Brazil’s interbank deposit

rate (CDI). The first installment, in the amount of R$ 160 million,

was paid on the closing date.

On October 31, the 2022 preliminary ACV totaled

R$ 888 million, an organic growth of 20% versus the subscription

revenue collected in the 2021 cycle, with the commercial campaign

still two months to go. Excluding paper-based PAR, the organic

growth is 29%, as nearly 100% of our new sales have come from

tradition learning systems, complementary solutions, or from the

digital textbook platform offered on a fee-per-student basis,

reflecting our focus on reducing exposure to the paper-based

textbook channel. With Eleva, the preliminary 2022 ACV totaled R$

974 million, a 32% growth versus our 2021 subscription revenue. We

will update the 2022 ACV number when campaign ends. It is important

to mention that in our projections we factor in neither the return

of students who dropped out from our partners schools’ base in 2021

nor the normalization in the volume of textbooks typically acquired

through PAR contracts in a regular year – this means that the 2021

ACV gap of R$112 million could be captured in the upcoming

years.

Despite the macroeconomic deterioration, our

premium brands Anglo and pH have had a strong performance during

this sales campaign, reassuring our perception that quality and

reputation remain the name of the game in this business. In this

campaign, we have also counted with Fibonacci, our new premium

learning system developed in partnership with Colegio Fibonacci, a

top-10 school in the National High School Test (ENEM) for more than

10 years. Complementary solutions have continued to ramp-up its

penetration over the client base, evidencing the potential of this

segment – in the 2021 cycle, only 25% of partner schools adopted

our complementary solutions, being 84% of these adopting only one

solution.

OPERATING PERFORMANCE

Student Base – Subscription Models

| Values

in R$ '000 |

|

2021 |

|

2020 |

|

% Y/Y |

|

2019 |

|

% Y/Y |

|

Partner Schools - Core Content |

|

4,508 |

|

|

4,167 |

|

|

8.2 |

% |

|

3,400 |

|

|

22.6 |

% |

| Partner

Schools - Complementary Solutions |

|

1,114 |

|

|

636 |

|

|

75.2 |

% |

|

417 |

|

|

52.5 |

% |

|

Students - Core Content |

|

1,335,152 |

|

|

1,311,147 |

|

|

1.8 |

% |

|

1,185,799 |

|

|

10.6 |

% |

|

Students - Complementary Content |

|

307,941 |

|

|

213,058 |

|

|

44.5 |

% |

|

133,583 |

|

|

59.5 |

% |

| Note: Students

enrolled in partner schools. |

From 2019 to 2021, Vasta grew 33% its partner

schools base, reflecting the success of the commercial strategy.

Although the volume of enrolled students in the 2021 cycle was

below its full potential, we retained our client base with

long-term contracts, which represents additional growth potential

without acquisition costs should our partner schools’ base is

restored in the upcoming years. Additionally, only 25% of our

clients adopt complementary solutions, which underscores the high

growth potential of this segment. Finally, to this client base it

will be added the schools currently served by Eleva and the new

schools that joined Vasta’s platform during the 2022 sales

campaign.

FINANCIAL PERFORMANCE

Net Revenue

|

|

|

3Q21 |

|

3Q20 |

|

% Y/Y |

|

2021 Cycle |

|

2020 Cycle |

|

% Y/Y |

|

Subscription |

|

96,207 |

|

|

105,849 |

|

|

-9.1 |

% |

|

740,709 |

|

|

691,924 |

|

|

7.1 |

% |

|

Subscription ex-PAR |

|

86,647 |

|

|

108,335 |

|

|

-20.0 |

% |

|

609,083 |

|

|

551,014 |

|

|

10.5 |

% |

|

Traditional Learning Systems |

|

87,256 |

|

|

107,967 |

|

|

-19.2 |

% |

|

546,342 |

|

|

508,751 |

|

|

7.4 |

% |

|

Complementary Solutions |

|

(609 |

) |

|

368 |

|

|

n.m. |

|

62,741 |

|

|

42,264 |

|

|

48.5 |

% |

|

PAR |

|

9,560 |

|

|

(2,486 |

) |

|

n.m. |

|

131,626 |

|

|

140,910 |

|

|

-6.6 |

% |

|

Non-subscription |

|

30,985 |

|

|

35,566 |

|

|

-12.9 |

% |

|

152,013 |

|

|

324,990 |

|

|

-53.2 |

% |

| Total

Net Revenue |

|

127,192 |

|

|

141,415 |

|

|

-10.1 |

% |

|

892,722 |

|

|

1,016,914 |

|

|

-12.2 |

% |

| Note: n.m.: not

meaningful |

In the third quarter, net revenue contracted 10%

versus the same quarter of 2020, owing to the different seasonality

of the ACV recognition observed in 2021, with the concentration of

deliveries in some brands in the second quarter, and to the 13%

decrease in non-subscription revenue.

In the 2021 cycle (4Q20 to 3Q21), subscription

ex-PAR revenue increased 11%, while PAR was down 7%, reflecting the

challenging environment for textbook sales. Within subscription

revenue, we highlight the strength of complementary solutions, up

49% in the cycle. Non-subscription revenue decreased 53%,

reflecting the impacts of the pandemic in the purchase of textbooks

during the 2021 back-to-school period, in addition to the migration

of former non-subscription clients to our subscription products,

being a key driver for the 12% total net revenue decline in the

cycle.

Adjusted EBITDA

| Values

in R$ '000 |

|

3Q21 |

|

3Q20 |

|

% Y/Y |

|

2021 Cycle |

|

2020 Cycle |

|

% Y/Y |

|

Net (loss) profit |

|

(70,821 |

) |

|

(40,605 |

) |

|

74.4 |

% |

|

(116,286 |

) |

|

(27,591 |

) |

|

321.5 |

% |

|

(+) Income tax and social contribution |

|

(32,963 |

) |

|

(18,593 |

) |

|

77.3 |

% |

|

(54,248 |

) |

|

(13,436 |

) |

|

303.7 |

% |

|

(+) Net financial result |

|

18,154 |

|

|

18,912 |

|

|

-4.0 |

% |

|

58,987 |

|

|

128,586 |

|

|

-54.1 |

% |

|

(+) Depreciation and amortization |

|

50,593 |

|

|

43,516 |

|

|

16.3 |

% |

|

194,446 |

|

|

162,701 |

|

|

19.5 |

% |

|

EBITDA |

|

(35,037 |

) |

|

3,229 |

|

|

n.m. |

|

82,899 |

|

|

250,259 |

|

|

-66.9 |

% |

|

EBITDA Margin |

|

-27.5 |

% |

|

2.3 |

% |

|

(29.8 |

) |

|

9.3 |

% |

|

26.2 |

% |

|

(16.9 |

) |

|

(+) Non-recurring expenses |

|

603 |

|

|

- |

|

|

n.m. |

|

6,324 |

|

|

922 |

|

|

585.9 |

% |

|

(+) IPO-related expenses |

|

- |

|

|

- |

|

|

n.m. |

|

50,580 |

|

|

- |

|

|

n.m. |

|

(+) Share-based compensation plan |

|

5,834 |

|

|

3,824 |

|

|

52.5 |

% |

|

28,461 |

|

|

6,004 |

|

|

374.0 |

% |

|

Adjusted EBITDA |

|

(28,600 |

) |

|

7,053 |

|

|

n.m. |

|

168,264 |

|

|

257,185 |

|

|

-34.6 |

% |

|

Adjusted EBITDA Margin |

|

-22.5 |

% |

|

5.0 |

% |

|

(27.5 |

) |

|

18.8 |

% |

|

26.9 |

% |

|

(8.0 |

) |

| Note: n.m.: not

meaningful |

Adjusted EBITDA was negative in R$ 29 million in

3Q21, mostly driven by the unfavorable revenue seasonality of the

third quarter (which hinders the dilution of fixed costs), by the

higher provision for doubtful accounts (PDA) and by the enhancement

in our corporate structure following the company’s IPO in July

2020, while the 3Q20 was favored by savings of R$ 2.7 million in

personnel expenses, captured from reduced work journeys allowed by

the provisional measure 936. Additionally, it was recorded in the

3Q21 a write-off of editorial costs amounting to R$ 20 million,

referring to a rationalization of our portfolio considering the

changes in the textbook business and our editorial strategy.

Excluding this effect, our adjusted EBITDA was negative in R$ 9

million. In the cycle, our adjusted EBITDA totaled R$ 168 million,

or R$ 188 million excluding the editorial cost write-off (-27%

versus 2020 cycle).

Adjusted net income

| Values

in R$ '000 |

|

3Q21 |

|

3Q20 |

|

% Y/Y |

|

2021 Cycle |

|

2020 Cycle |

|

% Y/Y |

|

(Loss) Profit before taxes |

|

(103,784 |

) |

|

(59,198 |

) |

|

75.3 |

% |

|

(170,534 |

) |

|

(41,027 |

) |

|

315.7 |

% |

| (-)

Taxes paid |

|

- |

|

|

- |

|

|

n.m. |

|

(1,167 |

) |

|

(4,611 |

) |

|

-74.7 |

% |

| (+)

Non-recurring expenses |

|

603 |

|

|

- |

|

|

n.m. |

|

6,324 |

|

|

922 |

|

|

585.9 |

% |

| (+)

Share-based compensation plan |

|

5,834 |

|

|

3,824 |

|

|

52.5 |

% |

|

28,461 |

|

|

6,004 |

|

|

374.0 |

% |

|

(+) IPO-related expenses |

|

- |

|

|

- |

|

|

n.m. |

|

50,580 |

|

|

- |

|

|

n.m. |

|

(+) Amortization of intangible assets(1) |

|

28,987 |

|

|

29,043 |

|

|

-0.2 |

% |

|

114,794 |

|

|

104,760 |

|

|

9.6 |

% |

|

Adjusted net (loss) profit |

|

(68,360 |

) |

|

(26,331 |

) |

|

159.6 |

% |

|

28,458 |

|

|

66,048 |

|

|

-56.9 |

% |

| (1) From business

combinations. Note: n.m.: not meaningful |

In the cycle, adjusted net profit totaled R$ 28 million, 57%

down year-on-year.

Accounts receivable and provision for doubtful

accounts

| Values

in R$ '000 |

|

3Q21 |

|

3Q20 |

|

% Y/Y |

|

2Q21 |

|

% Q/Q |

|

Gross accounts receivable |

|

249,628 |

|

|

274,264 |

|

|

-9.0 |

% |

|

336,958 |

|

|

-25.9 |

% |

|

Provision for doubtful accounts (PDA) |

|

(39,103 |

) |

|

(26,929 |

) |

|

45.2 |

% |

|

(37,898 |

) |

|

3.2 |

% |

|

Coverage index |

|

15.7 |

% |

|

9.8 |

% |

|

5.8 |

|

|

11.2 |

% |

|

4.4 |

|

| Net

accounts receivable |

|

210,525 |

|

|

247,335 |

|

|

-14.9 |

% |

|

299,060 |

|

|

-29.6 |

% |

| Average

days of accounts receivable(1) |

|

85 |

|

|

88 |

|

|

(3 |

) |

|

119 |

|

|

(34 |

) |

| (1) Balance of

net accounts receivable divided by the last-twelve-month net

revenue, multiplied by 360. |

The increase in the provision for doubtful

accounts (PDA) in the 3Q21 reflects our care with our provisioning

standards. Consequently, the coverage index increased to 15.7% in

3Q21 from 9.8% in 3Q20, while the average days of receivable fell 3

days in the yearly comparison, at 85 days.

Since the beginning of the pandemic, our

approach to credit issues faced by our school partners has been to

extend payment terms instead of granting discounts. With the

expected normalization of school activities in the upcoming school

year, we expect an improvement in the receivable collection of this

client segment in 2022. The textbook distribution channel has also

been hit by the fast deterioration in sales, causing some of our

clients to fall back in payments. As commented before, nearly 100%

of our new sales contracted to the 2022 were composed of learning

systems, complementary solutions, or digital textbooks; therefore,

we are gradually reducing our exposure to the physical textbook

distribution channel.

Financial leverage

| Values

in R$ '000 |

|

3Q21 |

|

2Q21 |

|

1Q21 |

|

4Q20 |

|

Financial debt |

|

812,016 |

|

|

505,951 |

|

|

687,203 |

|

|

793,341 |

|

|

Accounts payable from business combinations |

|

73,713 |

|

|

65,201 |

|

|

62,973 |

|

|

48,055 |

|

| Total

debt |

|

885,729 |

|

|

571,152 |

|

|

750,176 |

|

|

841,396 |

|

| Cash

and cash equivalents |

|

377,862 |

|

|

335,098 |

|

|

415,093 |

|

|

311,156 |

|

|

Marketable securities |

|

317,178 |

|

|

81,090 |

|

|

259,581 |

|

|

491,102 |

|

| Net

debt |

|

190,689 |

|

|

154,964 |

|

|

75,502 |

|

|

39,138 |

|

| Net

debt/LTM adjusted EBITDA |

|

1.13 |

|

|

0.76 |

|

|

0.36 |

|

|

0.15 |

|

Vasta ended the 3Q21 with a net debt position of

R$ 191 million, 1.1x the adjusted EBITDA of last twelve months.

CONFERENCE CALL INFORMATION

Vasta will discuss its third quarter 2021

results on November 11, 2021, via a conference call at 5:00 p.m.

Eastern Time. To access the call (ID: 1557069), please dial: +1

(833) 519-1336 or +1 (914) 800-3898. A live and archived webcast of

the call will be available on the Investor Relations section of the

Company’s website at https://ir.vastaplatform.com.

ABOUT VASTA

Vasta is a leading, high-growth education

company in Brazil powered by technology, providing end-to-end

educational and digital solutions that cater to all needs of

private schools operating in the K-12 educational segment,

ultimately benefiting all of Vasta’s stakeholders, including

students, parents, educators, administrators and private school

owners. Vasta’s mission is to help private K-12 schools to be

better and more profitable, supporting their digital

transformation. Vasta believes it is uniquely positioned to help

schools in Brazil undergo the process of digital transformation and

bring their education skill set to the 21st century. Vasta promotes

the unified use of technology in K-12 education with enhanced data

and actionable insight for educators, increased collaboration among

support staff and improvements in production, efficiency and

quality. For more information, please visit

ir.vastaplatform.com.

CONTACT

Investor Relations ri@somoseducacao.com.br

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking

statements that can be identified by the use of forward-looking

words such as “anticipate,” “believe,” “could,” “expect,” “should,”

“plan,” “intend,” “estimate” and “potential,” among others.

Forward-looking statements appear in a number of places in this

press release and include, but are not limited to, statements

regarding our intent, belief or current expectations.

Forward-looking statements are based on our management’s beliefs

and assumptions and on information currently available to our

management. Such statements are subject to risks and uncertainties,

and actual results may differ materially from those expressed or

implied in the forward-looking statements due to of various

factors, including (i) general economic, financial, political,

demographic and business conditions in Brazil, as well as any other

countries we may serve in the future and their impact on our

business; (ii) fluctuations in interest, inflation and exchange

rates in Brazil and any other countries we may serve in the future;

(iii) our ability to implement our business strategy and expand our

portfolio of products and services; (iv) our ability to adapt to

technological changes in the educational sector; (v) the

availability of government authorizations on terms and conditions

and within periods acceptable to us; (vi) our ability to continue

attracting and retaining new partner schools and students; (vii)

our ability to maintain the academic quality of our programs;

(viii) the availability of qualified personnel and the ability to

retain such personnel; (ix) changes in the financial condition of

the students enrolling in our programs in general and in the

competitive conditions in the education industry; (x) our

capitalization and level of indebtedness; (xi) the interests of our

controlling shareholder; (xii) changes in government regulations

applicable to the education industry in Brazil; (xiii) government

interventions in education industry programs, that affect the

economic or tax regime, the collection of tuition fees or the

regulatory framework applicable to educational institutions; (xiv)

cancellations of contracts within the solutions we characterize as

subscription arrangements or limitations on our ability to increase

the rates we charge for the services we characterize as

subscription arrangements; (xv) our ability to compete and conduct

our business in the future; (xvi) our ability to anticipate changes

in the business, changes in regulation or the materialization of

existing and potential new risks; (xvii) the success of operating

initiatives, including advertising and promotional efforts and new

product, service and concept development by us and our competitors;

(xviii) changes in consumer demands and preferences and

technological advances, and our ability to innovate to respond to

such changes; (xix) changes in labor, distribution and other

operating costs; our compliance with, and changes to, government

laws, regulations and tax matters that currently apply to us; (xx)

the effectiveness of our risk management policies and procedures,

including our internal control over financial reporting; (xxi)

health crises, including due to pandemics such as the COVID-19

pandemic and government measures taken in response thereto; (xxii)

other factors that may affect our financial condition, liquidity

and results of operations; and (xxiii) other risk factors discussed

under “Risk Factors.” Forward-looking statements speak only as of

the date they are made, and we do not undertake any obligation to

update them in light of new information or future developments or

to release publicly any revisions to these statements in order to

reflect later events or circumstances or to reflect the occurrence

of unanticipated events.

NON-GAAP FINANCIAL MEASURES

This press release presents our EBITDA, Adjusted

EBITDA, Free Cash Flow and Adjusted Cash Conversion Ratio, Adjusted

Net (Loss) Profit, which are information for the convenience of

investors. EBITDA, Adjusted EBITDA, Free Cash Flow, Adjusted Cash

Conversion Ratio and Adjusted Net (Loss) Profit are the key

performance indicators used by us to measure financial operating

performance. Our management believes that these non-GAAP financial

measures provide useful information to investors and shareholders.

We also use these measures internally to establish budgets and

operational goals to manage and monitor our business, evaluate our

underlying historical performance and business strategies and to

report our results to the board of directors.

We calculate EBITDA as Net profit (loss) for the

period / year plus income taxes and social contribution plus/minus

net finance result plus depreciation and amortization. The EBITDA

measure provides useful information to assess our operational

performance.

We calculate Adjusted EBITDA as EBITDA

plus/minus: (a) share-based compensation expenses, mainly due to

the grant of additional shares to Somos’ employees in connection

with the change of control of Somos to Cogna (for further

information refer to note 23 (a) to the Consolidated Financial

Statements); (b) Bonus IPO expenses, share based payments offered

to certain employees and executives as result of IPO process and

(c) other non-recurring expenses composed substantially by

restructuring provisions. We understand that such adjustments are

relevant and should be considered when calculating our Adjusted

EBITDA, which is a practical measure to assess our operational

performance that allows us to compare it with other companies that

operates in the same segment.

We calculate Free Cash Flow as the net cash

flows from operating activities as presented in the statement of

cash flows of our financial statements adjusted by debt-like

instruments (reverse factoring instruments) less cash flows

required for: (i) acquisition of property, plant and equipment;

(ii) addition to intangible assets; and (iii) acquisition of

subsidiaries. We consider Free Cash Flow to be a liquidity measure,

therefore, we adjust our Free Cash Flow metric with amounts that

directly impacted the cash flows in the period in addition to the

operating activities. The Free Cash Flow measure provides useful

information to management and investors about the amount of cash

generated by our operations, deducting for investments in property

and equipment to maintain and grow our business.

We calculate Adjusted Cash Conversion Ratio as

the cash flows from operating activities divided by Adjusted EBITDA

for the relevant period.

We calculate Adjusted net (loss) profit as the

net (loss) profit from the period as presented in Statement of

Profit or Loss and Other Comprehensive Income adjusted by the same

Adjusted EBITDA items, however, added by (a) Amortization of

intangible assets from M&A, that includes goodwill and other

assets and (b) taxes paid composed by cash effect over income tax

and social contribution expenses.

We understand that, although Adjusted net (loss)

profit, EBITDA, Adjusted EBITDA, Free Cash Flow and Adjusted Cash

Conversion Ratio are used by investors and securities analysts in

their evaluation of companies, these measures have limitations as

analytical tools, and you should not consider them in isolation or

as substitutes for analysis of our results of operations as

reported under IFRS. Additionally, our calculations of Adjusted net

(loss) profit, Adjusted EBITDA, Free Cash Flow and Adjusted Cash

Conversion Ratio may be different from the calculation used by

other companies, including our competitors in the education

services industry, and therefore, our measures may not be

comparable to those of other companies.

REVENUE RECOGNITION AND

SEASONALITY

Our main deliveries of printed and digital

materials to our customers occur in the last quarter of each year

(typically in November and December), and in the first quarter of

each subsequent year (typically in February and March), and revenue

is recognized when the customers obtain control over the materials.

In addition, the printed and digital materials we provide in the

fourth quarter are used by our customers in the following school

year and, therefore, our fourth quarter results reflect the growth

in the number of our students from one school year to the next,

leading to higher revenue in general in our fourth quarter compared

with the preceding quarters in each year. Consequently, in

aggregate, the seasonality of our revenues generally produces

higher revenues in the first and fourth quarters of our fiscal

year. Thus, the numbers for the second quarter and third quarter

are usually less relevant. In addition, we generally bill our

customers during the first half of each school year (which starts

in January), which generally results in a higher cash position in

the first half of each year compared to the second half.

A significant part of our expenses is also

seasonal. Due to the nature of our business cycle, we need

significant working capital, typically in September or October of

each year, to cover costs related to production and inventory

accumulation, selling and marketing expenses, and delivery of our

teaching materials at the end of each year in preparation for the

beginning of each school year. As a result, these operating

expenses are generally incurred between September and December of

each year.

Purchases through our Livro Fácil e-commerce

platform are also very intense during the back-to-school period,

between November, when school enrollment takes place and families

plan to anticipate the purchase of products and services, and

February of the following year, when classes are about to start.

Thus, e-commerce revenue is mainly concentrated in the first and

fourth quarters of the year.

KEY BUSINESS METRICS

ACV Bookings is a non-accounting managerial

metric and represents our partner schools’ commitment to pay for

our solutions offerings. We believe it is a meaningful indicator of

demand for our solutions. We consider ACV Bookings is a helpful

metric because it is designed to show amounts that we expect to be

recognized as revenue from subscription services for the 12-month

period between October 1 of one fiscal year through September 30 of

the following fiscal year. We define ACV Bookings as the revenue we

would expect to recognize from a partner school in each school

year, based on the number of students who have contracted our

services, or “enrolled students,” that will access our content at

such partner school in such school year. We calculate ACV Bookings

by multiplying the number of enrolled students at each school with

the average ticket per student per year; the related number of

enrolled students and average ticket per student per year are each

calculated in accordance with the terms of each contract with the

related school. Although our contracts with our schools are

typically for 4-year terms, we record one year of revenue under

such contracts as ACV Bookings. ACV Bookings are calculated based

on the sum of actual contracts signed during the sales period and

assumes the historical rates of returned goods from customers for

the preceding 24-month period. Since the actual rates of returned

goods from sales during the period may be different from the

historical average rates and the actual volume of merchandise

ordered by our customers may be different from the contracted

amount, the actual revenue recognized during each period of a sales

cycle may be different from the ACV Bookings for the respective

sales cycle. Our reported ACV Bookings are subject to risks

associated with, among other things, economic conditions and the

markets in which we operate, including risks that our contracts may

be canceled or adjusted (including as a result of the COVID-19

pandemic).

FINANCIAL STATEMENTS

Consolidated Statements of Financial

Position

|

Assets |

September 30, 2021 |

|

|

December 31, 2020 |

|

| |

|

|

|

|

|

| Current assets |

|

|

|

|

|

| Cash and cash equivalents |

377,862 |

|

|

311,156 |

|

| Marketable securities |

317,178 |

|

|

491,102 |

|

| Trade receivables |

210,525 |

|

|

492,234 |

|

| Inventories |

240,636 |

|

|

249,632 |

|

| Taxes recoverable |

23,851 |

|

|

18,871 |

|

| Income tax and social

contribution recoverable |

5,672 |

|

|

7,594 |

|

| Prepayments |

37,632 |

|

|

27,461 |

|

| Other receivables |

1,489 |

|

|

124 |

|

| Related parties – other

receivables |

2,481 |

|

|

2,070 |

|

| Total current assets |

1,217,326 |

|

|

1,600,244 |

|

| |

|

|

|

|

|

| Non-current assets |

|

|

|

|

|

| Judicial deposits and escrow

accounts |

175,677 |

|

|

172,748 |

|

| Deferred income tax and social

contribution |

143,477 |

|

|

88,546 |

|

| Property, plant and

equipment |

164,989 |

|

|

192,006 |

|

| Intangible assets and

goodwill |

4,939,155 |

|

|

4,924,726 |

|

| Total non-current assets |

5,423,298 |

|

|

5,378,026 |

|

| |

|

|

|

|

|

| Total Assets |

6,640,624 |

|

|

6,978,270 |

|

Consolidated Statements of Financial

Position (continued)

|

Liabilities |

September 30, 2021 |

|

|

December 31, 2020 |

|

| |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

| Bonds and financing |

262,445 |

|

|

502,882 |

|

| Lease liabilities |

18,672 |

|

|

18,263 |

|

| Suppliers |

186,272 |

|

|

279,454 |

|

| Income tax and social

contribution payable |

17 |

|

|

1,761 |

|

| Salaries and social

contributions |

70,910 |

|

|

69,123 |

|

| Contract liabilities and

deferred income |

8,432 |

|

|

47,169 |

|

| Accounts payable for business

combination |

20,055 |

|

|

17,132 |

|

| Other liabilities |

3,106 |

|

|

4,285 |

|

| Other liabilities - related

parties |

39,677 |

|

|

135,307 |

|

| Loans from related

parties |

- |

|

|

20,884 |

|

| Total current liabilities |

609,586 |

|

|

1,096,260 |

|

| |

|

|

|

| Non-current liabilities |

|

|

|

| Bonds and financing |

549,571 |

|

|

290,459 |

|

| Lease liabilities |

129,375 |

|

|

154,840 |

|

| Accounts payable for business

combination |

53,658 |

|

|

30,923 |

|

| Provision for tax, civil and

labor losses |

641,307 |

|

|

613,933 |

|

| Contract liabilities and

deferred income |

4,607 |

|

|

6,538 |

|

| Total non-current

liabilities |

1,378,518 |

|

|

1,096,693 |

|

| |

|

|

|

| Shareholder’s Equity |

|

|

|

| Share capital |

4,820,815 |

|

|

4,820,815 |

|

| Capital reserve |

56,465 |

|

|

38,962 |

|

| Shares in treasury |

(11,765 |

) |

|

- |

|

| Accumulated losses |

(212,995 |

) |

|

(74,460 |

) |

| Total Shareholder's

Equity |

4,652,520 |

|

|

4,785,317 |

|

| |

|

|

|

| Total Liabilities and

Shareholder's Equity |

6,640,624 |

|

|

6,978,270 |

|

Consolidated Income

Statement

| |

Jul 01, to Sep 30, 2021 |

|

Jan 01, to Sep 30, 2021 |

|

Jul 01, to Sep 30, 2020 |

|

Jan 01, to Sep 30, 2020 |

| |

|

|

|

|

|

|

|

|

Net revenue from sales and services |

127,192 |

|

|

549,159 |

|

|

141,415 |

|

|

654,066 |

|

| Sales |

124,125 |

|

|

526,697 |

|

|

134,182 |

|

|

634,895 |

|

| Services |

3,067 |

|

|

22,462 |

|

|

7,233 |

|

|

19,171 |

|

| |

|

|

|

|

|

|

|

| Cost of goods sold and

services |

(79,381 |

) |

|

(260,910 |

) |

|

(62,230 |

) |

|

(277,985 |

) |

| |

|

|

|

|

|

|

|

| Gross profit |

47,811 |

|

|

288,249 |

|

|

79,185 |

|

|

376,081 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Operating income

(expenses) |

|

|

|

|

|

|

|

| General and administrative

expenses |

(96,402 |

) |

|

(304,208 |

) |

|

(83,458 |

) |

|

(265,752 |

) |

| Commercial expenses |

(33,947 |

) |

|

(119,040 |

) |

|

(35,841 |

) |

|

(116,437 |

) |

| Other operating income

(expenses) |

698 |

|

|

2,202 |

|

|

948 |

|

|

2,936 |

|

| Impairment losses on trade

receivables |

(3,790 |

) |

|

(21,998 |

) |

|

(1,121 |

) |

|

(12,704 |

) |

| |

|

|

|

|

|

|

|

| (Loss) Profit before finance

result and taxes |

(85,630 |

) |

|

(154,795 |

) |

|

(40,287 |

) |

|

(15,876 |

) |

| |

|

|

|

|

|

|

|

| Finance income |

10,532 |

|

|

21,793 |

|

|

5,942 |

|

|

14,579 |

|

| Finance costs |

(28,686 |

) |

|

(69,174 |

) |

|

(24,854 |

) |

|

(101,399 |

) |

| Finance result |

(18,154 |

) |

|

(47,381 |

) |

|

(18,912 |

) |

|

(86,820 |

) |

| |

|

|

|

|

|

|

|

| (Loss) Before income tax and

social contribution |

(103,784 |

) |

|

(202,176 |

) |

|

(59,199 |

) |

|

(102,696 |

) |

| |

|

|

|

|

|

|

|

| Income tax and social

contribution |

32,963 |

|

|

63,641 |

|

|

18,593 |

|

|

34,797 |

|

| |

|

|

|

|

|

|

|

| (Loss) for the period |

(70,821 |

) |

|

(138,535 |

) |

|

(40,606 |

) |

|

(67,899 |

) |

| |

|

|

|

|

|

|

|

| Total comprehensive (loss)

income for the period |

(70,821 |

) |

|

(138,535 |

) |

|

(40,606 |

) |

|

(67,899 |

) |

| (Loss) per share |

|

|

|

|

|

|

|

| Basic |

(0.85 |

) |

|

(1.67 |

) |

|

(0.49 |

) |

|

(0.82 |

) |

| Diluted |

(0.84 |

) |

|

(1.65 |

) |

|

(0.49 |

) |

|

(0.82 |

) |

Consolidated Statement of Cash

Flows

| |

For the nine months ended June 30 |

| |

2021 |

|

2020 |

|

|

|

|

|

| CASH FLOWS FROM OPERATING

ACTIVITIES |

|

|

|

|

Loss before income tax and social contribution |

(202,176 |

) |

|

(102,696 |

) |

| Adjustments for: |

|

|

|

| Depreciation and

amortization |

149,492 |

|

|

129,059 |

|

| Impairment losses on trade

receivables |

21,998 |

|

|

12,704 |

|

| Provision for tax, civil and

labor losses |

(775 |

) |

|

(4,966 |

) |

| Interest on provision for tax,

civil and labor losses |

17,681 |

|

|

13,406 |

|

| Provision for obsolete

inventories |

13,936 |

|

|

11,941 |

|

| Interest on bonds and

financing |

24,272 |

|

|

46,725 |

|

| Refund liability and right to

returned goods |

2,115 |

|

|

(25,118 |

) |

| Imputed interest on

suppliers |

3,213 |

|

|

2,945 |

|

| Interest on accounts payable

for business combination |

811 |

|

|

1,394 |

|

| Share-based payment

expense |

17,503 |

|

|

- |

|

| Interest on lease

liabilities |

11,602 |

|

|

11,337 |

|

| Interest on marketable

securities incurred and not withdrawed |

(15,937 |

) |

|

(2,018 |

) |

| Disposals of right of use

assets and lease liabilities |

(3,481 |

) |

|

(1,023 |

) |

| Residual value of disposals of

property and equipment and intangible assets |

3,411 |

|

|

1,931 |

|

| |

|

|

|

| Changes in |

|

|

|

| Trade receivables |

262,120 |

|

|

133,798 |

|

| Inventories |

(5,618 |

) |

|

(37,941 |

) |

| Prepayments |

(10,157 |

) |

|

(4,629 |

) |

| Taxes recoverable |

(3,049 |

) |

|

22,090 |

|

| Judicial deposits and escrow

accounts |

(2,929 |

) |

|

1,029 |

|

| Other receivables |

(1,185 |

) |

|

2,828 |

|

| Suppliers |

(92,912 |

) |

|

(79,323 |

) |

| Salaries and social

charges |

1,062 |

|

|

9,484 |

|

| Tax payable/Income taxes and

social contribution |

7,775 |

|

|

6,267 |

|

| Contract liabilities and

deferred income |

(42,105 |

) |

|

3,510 |

|

| Other receivables and

liabilities from related parties |

(96,041 |

) |

|

219,010 |

|

| Other liabilities |

(1,880 |

) |

|

7,157 |

|

| Cash from operating

activities |

58,745 |

|

|

379,101 |

|

| |

|

|

|

| Income tax and social

contribution paid |

(1,167 |

) |

|

(5,234 |

) |

| Interest lease liabilities

paid |

(11,564 |

) |

|

(10,900 |

) |

| Payment of interest on bonds

and financing |

(24,946 |

) |

|

(49,403 |

) |

| Payment of provision for tax,

civil and labor losses |

(515 |

) |

|

(6,812 |

) |

| Net cash from operating

activities |

20,553 |

|

|

306,752 |

|

| |

|

|

|

| CASH FLOWS FROM INVESTING

ACTIVITIES |

|

|

|

| Acquisition of property and

equipment |

(9,452 |

) |

|

(3,730 |

) |

| Additions to intangible

assets |

(36,763 |

) |

|

(32,226 |

) |

| Acquisition of subsidiaries

net of cash acquired and payments of business combinations |

(33,591 |

) |

|

(8,703 |

) |

| Realization of investment in

marketable securities |

189,861 |

|

|

(705,097 |

) |

| Net cash applied in investing

activities |

110,055 |

|

|

(749,756 |

) |

| |

|

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES |

|

|

|

| Suppliers - related

parties |

(3,676 |

) |

|

(75,846 |

) |

| Loans from related

parties |

- |

|

|

65,600 |

|

| Payments of loans from related

parties |

(20,884 |

) |

|

- |

|

| Lease liabilities paid |

(15,308 |

) |

|

(9,207 |

) |

| Parent company's net

investment |

- |

|

|

4,197 |

|

| Issuance of common shares in

initial public offering |

- |

|

|

1,836,317 |

|

| Transaction costs in initial

public offering |

- |

|

|

(174,683 |

) |

| Acquisition of treasury

shares |

(11,765 |

) |

|

- |

|

| Payments of bonds and

financing |

(477,651 |

) |

|

(852,136 |

) |

| Issuance of public bonds net

off issuance costs |

497,000 |

|

|

- |

|

| Payments of accounts payable

for business combination |

(31,617 |

) |

|

- |

|

| Others |

- |

|

|

(76,642 |

) |

| Net cash applied in financing

activities |

(63,901 |

) |

|

717,600 |

|

| |

|

|

|

| NET INCREASE IN CASH AND CASH

EQUIVALENTS |

66,706 |

|

|

274,596 |

|

| |

|

|

|

| Cash and cash equivalents at

beginning of period |

311,156 |

|

|

43,287 |

|

| Cash and cash equivalents at

end of period |

377,862 |

|

|

317,883 |

|

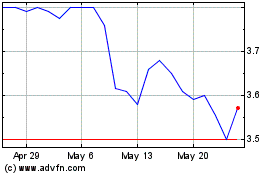

Vasta Platform (NASDAQ:VSTA)

Historical Stock Chart

From Oct 2024 to Nov 2024

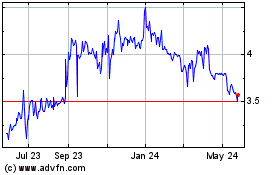

Vasta Platform (NASDAQ:VSTA)

Historical Stock Chart

From Nov 2023 to Nov 2024