UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

August

29, 2024

Commission

File Number 001-37974

VIVOPOWER

INTERNATIONAL PLC

(Translation

of registrant’s name into English)

The

Scalpel, 18th Floor, 52 Lime Street

London

EC3M 7AF

United

Kingdom

+44-203-667-5158

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form

20- F ☒ Form 40-F ☐

On August 29, 2024, Tembo e-LV B.V. (“Tembo”), a subsidiary

of NASDAQ listed VivoPower International PLC (“VVPR”, the “Company”), issued a press release announcing that it

has executed a definitive Business Combination Agreement (the “Business Combination Agreement”) at a combined enterprise value

of US$904m.with the NASDAQ listed Cactus Acquisition Corp. 1 Limited, a Cayman Islands exempted company (“CCTS”). An independent

third party fairness opinion was satisfactorily completed and the BCA was signed after a four month period of due diligence.

A

copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

This

Report on Form 6-K, including Exhibit 99.1, is hereby incorporated by reference into the Company’s Registration Statements on Form

S-8 (File Nos. 333-227810, 333-251546, 333-268720, 333-273520), Form F-3 (File No. 333-276509) and Form F-1 (File No. 333-267481).

Forward-Looking

Statements

The information in this Report on Form 6-K includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform

Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,”

“forecast,” “intend,” “may,” “will,” “expect,” “continue,” “should,”

“would,” “anticipate,” “believe,” “seek,” “target,” “predict,”

“potential,” “seem,” “future,” “outlook” or other similar expressions that predict or

indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that a

statement is not forward-looking. These forward-looking statements include, but are not limited to, statements regarding estimates and

forecasts of financial and performance metrics and projections of market opportunity and market share; references with respect to the

anticipated benefits of the proposed Business Combination and the projected future financial performance of CCTS, Tembo and Holdco (being

Tembo Group B.V., a private company with limited liability incorporated under the laws of the Netherlands and a wholly owned subsidiary

of Tembo) following the proposed Business Combination; changes in the market for Tembo’s products and services and expansion plans

and opportunities; Tembo’s ability to successfully execute its expansion plans and business initiatives; ability for Tembo to raise

funds to support its business; the sources and uses of cash of the proposed Business Combination; the anticipated capitalization and enterprise

value of Holdco following the consummation of the proposed Business Combination; the projected technological developments of Tembo and

its competitors; ability of Tembo to control costs associated with operations; the ability to manufacture efficiently at scale; anticipated

investments in research and development and the effect of these investments and timing related to commercial product launches; and expectations

related to the terms and timing of the proposed Business Combination. These statements are based on various assumptions, whether or not

identified in this Report on Form 6-K, and on the current expectations of the Company’s, Tembo’s and CCTS’s management

and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not

intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement

of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many

actual events and circumstances are beyond the control of Tembo, CCTS, the Company and Holdco. These forward-looking statements are subject

to a number of risks and uncertainties, including the occurrence of any event, change or other circumstances that could give rise to the

termination of the Business Combination Agreement; the risk that the Business Combination disrupts current plans and operations as a result

of the announcement and consummation of the transactions described herein; the inability to recognize the anticipated benefits of the

Business Combination; the ability to obtain or maintain the listing of the Holdco’s securities on The Nasdaq Stock Market, following

the Business Combination, including having the requisite numbers of shareholders and free-trading shares; costs related to the Business

Combination; changes in domestic and foreign business, market, financial, political and legal conditions; risks relating to the uncertainty

of certain projected financial information and other forecasts with respect to Tembo; Tembo’s ability to successfully and timely

develop, manufacture, sell and expand its technology and products, including implementing its growth strategy and satisfactory fulfillment

of existing orders; Tembo’s ability to adequately manage any supply chain risks, including the purchase of a sufficient supply of

critical components incorporated into its current and future product offerings; risks relating to Tembo’s operations and business,

including information technology and cybersecurity risks, failure to adequately forecast supply and demand, including order volume and

fulfillment, loss of key customers or distribution relationships and deterioration in relationships between Tembo and its employees; Tembo’s

ability to successfully collaborate with business partners; demand for Tembo’s current and future offerings; risks that orders that

have been placed for Tembo’s products are cancelled or modified; risks related to increased competition; risks relating to potential

disruption in the transportation and shipping infrastructure, including trade policies and export controls; risks that Tembo is unable

to secure or protect its intellectual property; risks of product liability or regulatory lawsuits relating to Tembo’s products and

services; risks that Holdco experiences difficulties managing its growth and expanding operations; the inability of the parties to successfully

or timely consummate the proposed Business Combination, including the risk that any required shareholder or regulatory approvals are not

obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits

of the proposed Business Combination; the outcome of any legal proceedings that may be instituted against Tembo, the Company, CCTS, Holdco

or others following announcement of the proposed Business Combination and transactions contemplated thereby; the ability of Tembo to execute

its business model, including market acceptance of its planned products and services and achieving sufficient production volumes at acceptable

quality levels and prices; technological improvements by Tembo’s peers and competitors; and those risk factors discussed in documents

of Holdco, the Company and CCTS filed, or to be filed, with the SEC. If any of these risks materialize or our assumptions prove incorrect,

actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that

none of the Company, Tembo or CCTS presently know or that the Company, Tembo or CCTS currently believe are immaterial that could also

cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect

the Company’s, Tembo’s or CCTS’s expectations, plans or forecasts of future events and views as of the date of this

Report on Form 6-K. The Company, Tembo, CCTS and Holdco anticipate that subsequent events and developments will cause the Company’s,

Tembo’s or CCTS’s assessments to change. However, while the Company, Tembo, CCTS and Holdco may elect to update these forward-looking

statements at some point in the future, the Company, Tembo, CCTS and Holdco specifically disclaim any obligation to do so. Investors are

referred to the most recent reports filed with the SEC by the Company and CCTS. Investors are cautioned not to place undue reliance upon

any forward-looking statements, which speak only as of the date made, and we undertake no obligation to update or revise the forward-looking

statements, whether as a result of new information, future events or otherwise.

Additional

Information and Where to Find It

Holdco

intends to file with the SEC a Registration Statement on Form F-4 (as may be amended, the “Registration Statement”), which

will include a preliminary proxy statement of CCTS and a prospectus of Holdco in connection with the proposed Business Combination. The

definitive proxy statement and other relevant documents will be mailed to shareholders of CCTS as of a record date to be established

for voting on the proposed Business Combination. SHAREHOLDERS OF CCTS AND OTHER INTERESTED PARTIES ARE URGED TO READ, WHEN AVAILABLE,

THE PRELIMINARY PROXY STATEMENT, AND AMENDMENTS THERETO, AND THE DEFINITIVE PROXY STATEMENT IN CONNECTION WITH CCTS’S SOLICITATION

OF PROXIES FOR THE EXTRAORDINARY GENERAL MEETING OF ITS SHAREHOLDERS TO BE HELD TO APPROVE THE BUSINESS COMBINATION BECAUSE THESE DOCUMENTS

WILL CONTAIN IMPORTANT INFORMATION ABOUT CCTS, TEMBO, HOLDCO AND THE BUSINESS COMBINATION. Shareholders will also be able to obtain copies

of the Registration Statement and the proxy statement/prospectus, without charge, once available, on the SEC’s website at www.sec.gov

or by directing a request to CCTS at Cactus Acquisition Corp. 1 Ltd, 4B Cedar Brook Drive, Cranbury, NJ 08512, telephone: (609) 495-2222.

Participants

in the Solicitation

CCTS,

Tembo, the Company, Holdco and their respective directors and officers may be deemed participants in the solicitation of proxies of CCTS

shareholders in connection with the proposed transaction. More detailed information regarding the directors and officers of CCTS is contained

in CCTS’s filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was

filed with the SEC on April 15, 2024, and is available free of charge at the SEC’s website at www.sec.gov. Information regarding

the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of CCTS’s shareholders in connection

with the proposed Business Combination and other matters to be voted upon at the meeting of CCTS’s shareholders will be set forth

in the Registration Statement for the transaction when available.

No

Offer or Solicitation

This

Report on Form 6-K shall not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or in respect

of the proposed transaction. This Report on Form 6-K shall also not constitute an offer to sell or the solicitation of an offer to buy

any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall

be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption

therefrom.

EXHIBIT INDEX

Exhibit

99.1 — Press Release

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| Date:

August 29, 2024 |

VivoPower

International PLC |

| |

|

| |

/s/

Kevin Chin |

| |

Kevin

Chin |

| |

Executive

Chairman |

Exhibit

99.1

Tembo

E-LV, a subsidiary of Nasdaq-listed VivoPower International PLC (“VVPR”) executes a definitive Business Combination Agreement

with CCTS for a combined enterprise value of US $904 million

Independent

third-party fairness opinion was obtained and satisfactorily completed

Pro

forma fully diluted combined enterprise value assumes no public trust redemptions

LONDON,

29 August 2024 – Tembo E-LV B.V. (“Tembo”), a subsidiary of Nasdaq-listed B Corporation, VivoPower International

PLC (Nasdaq: VVPR) (“VivoPower”), today announced that it has executed a definitive Business Combination Agreement (“BCA”)

with Cactus Acquisition Corp. 1 Limited, a Cayman Islands exempted special purpose acquisition company (Nasdaq: CCTS, CCTSW, CCTSU) (“CCTS”).

The

BCA assigns a pro forma enterprise value to the combination of Tembo and CCTS, assuming no redemptions by CCTS public shareholders at

or before closing of US$904 million and precludes any further direct investment into Tembo.

The

BCA was entered into by the parties following due diligence and receipt by the CCTS board of directors of a fairness opinion from an

independent third party.

The

parties expect a registration statement on Form F-4 to be filed with the U.S. Securities and Exchange Commission (the “SEC”)

in connection with the proposed transaction (the “Business Combination”), which they are working to close, subject to satisfaction

(or waiver, as applicable) of closing conditions, including, without limitation, the completion of the SEC review process and approval

of the transaction by CCTS shareholders, prior to the end of calendar year 2024.

In

connection with the Business Combination, the parties will submit to Nasdaq an application to list the securities of a newly formed company

(“Tembo Group”) established in connection with the transaction on Nasdaq.

Advisors

Chardan

is acting as exclusive financial and capital markets advisor to VivoPower and Tembo. White & Case LLP is serving as U.S. legal advisor

to VivoPower and Tembo; NautaDutilh N.V. is serving as Dutch legal counsel to VivoPower and Tembo. Ellenoff Grossman & Schole LLP

is serving as U.S. legal advisor to CCTS; De Metz Advocaten N.V. is serving as Dutch counsel to CCTS.

About

Tembo

Tembo

electric utility vehicles (EUVs) are a 100% electric solution for ruggedised and/or customised applications for fleet owners

in the mining, agriculture, energy utilities, defence, police, construction, infrastructure, government, humanitarian, and game safari

industries. Tembo provides safe, high-performance off-road and on-road electric utility vehicles. Its core purpose is to provide safe

and reliable electrification solutions for utility vehicle fleet owners, helping to perpetuate useful life, reduce costs, maximise return

on assets, meet ESG goals and seeks to further the circular economy. Tembo is a subsidiary of VivoPower, a Nasdaq listed B Corporation.

About

VivoPower

VivoPower

is an award-winning global sustainable energy solutions B Corporation company focused on electric solutions for off-road and on-road

customised and ruggedised fleet applications as well as ancillary financing, charging, battery and microgrids solutions.

The

Company’s core purpose is to provide its customers with turnkey decarbonisation solutions that enable them to move toward net-zero

carbon status. VivoPower has operations and personnel covering Australia, Canada, the Netherlands, the United Kingdom, the United States,

the Philippines, and the United Arab Emirates.

About

Cactus Acquisition Corp.

Cactus

Acquisition Corp. 1 Limited is a blank check company formed for the purpose of effecting a merger, share exchange, asset acquisition,

share purchase, reorganisation or similar business combination.

Forward-Looking

Statements

The

information in this press release includes “forward-looking statements” within the meaning of the “safe harbor”

provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the

use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,”

“may,” “will,” “expect,” “continue,” “should,” “would,” “anticipate,”

“believe,” “seek,” “target,” “predict,” “potential,” “seem,”

“future,” “outlook” or other similar expressions that predict or indicate future events or trends or that are

not statements of historical matters, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking

statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics and projections

of market opportunity and market share; references with respect to the anticipated benefits of the proposed Business Combination and

the projected future financial performance of CCTS, Tembo and Pubco following the proposed Business Combination; changes in the market

for Tembo’s products and services and expansion plans and opportunities; Tembo’s ability to successfully execute its expansion

plans and business initiatives; ability for Tembo to raise funds to support its business; the sources and uses of cash of the proposed

Business Combination; the anticipated capitalization and enterprise value of Pubco following the consummation of the proposed Business

Combination; the projected technological developments of Tembo and its competitors; ability of Tembo to control costs associated with

operations; the ability to manufacture efficiently at scale; anticipated investments in research and development and the effect of these

investments and timing related to commercial product launches; and expectations related to the terms and timing of the proposed Business

Combination. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations

of VivoPower’s, Tembo’s and CCTS’s management and are not predictions of actual performance. These forward-looking

statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as,

a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult

or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Tembo, CCTS,

VivoPower and Pubco. These forward-looking statements are subject to a number of risks and uncertainties, including the occurrence of

any event, change or other circumstances that could give rise to the termination of the Business Combination Agreement, the risk that

the Business

|

|

|

Combination

disrupts current plans and operations as a result of the announcement and consummation of the transactions described herein; the inability

to recognize the anticipated benefits of the Business Combination; the ability to obtain or maintain the listing of the Pubco’s

securities on The Nasdaq Stock Market, following the Business Combination, including having the requisite number of shareholders and

free trading shares; costs related to the Business Combination; changes in domestic and foreign business, market, financial, political

and legal conditions; risks relating to the uncertainty of certain projected financial information and other forecasts with respect to

Tembo; Tembo’s ability to successfully and timely develop, manufacture, sell and expand its technology and products, including

implementing its growth strategy and satisfactory fulfillment of existing orders; Tembo’s ability to adequately manage any supply

chain risks, including the purchase of a sufficient supply of critical components incorporated into its product offerings; risks relating

to Tembo’s operations and business, including information technology and cybersecurity risks, failure to adequately forecast supply

and demand, including order volume and fulfillment, loss of key customers or distribution relationships and deterioration in relationships

between Tembo and its employees; Tembo’s ability to successfully collaborate with business partners; demand for Tembo’s current

and future offerings; risks that orders that have been placed for Tembo’s products are cancelled or modified; risks related to

increased competition; risks relating to potential disruption in the transportation and shipping infrastructure, including trade policies

and export controls; risks that Tembo is unable to secure or protect its intellectual property; risks of product liability or regulatory

lawsuits relating to Tembo’s products and services; risks that Pubco experiences difficulties managing its growth and expanding

operations; the inability of the parties to successfully or timely consummate the proposed Business Combination, including the risk that

any required shareholder or regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could

adversely affect the combined company or the expected benefits of the proposed Business Combination; the outcome of any legal proceedings

that may be instituted against Tembo, VivoPower, CCTS, Pubco or others following announcement of the proposed Business Combination and

transactions contemplated thereby; the ability of Tembo to execute its business model, including market acceptance of its planned products

and services and achieving sufficient production volumes at acceptable quality levels and prices; technological improvements by Tembo’s

peers and competitors; and those risk factors discussed in documents of Pubco, VivoPower and CCTS filed, or to be filed, with the SEC.

If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied

by these forward-looking statements. There may be additional risks that none of VivoPower, Tembo or CCTS presently know or that VivoPower,

Tembo or CCTS currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking

statements. In addition, forward-looking statements reflect VivoPower’s, Tembo’s or CCTS’s expectations, plans or forecasts

of future events and views as of the date of this press release. VivoPower, Tembo, CCTS and Pubco anticipate that subsequent events and

developments will cause VivoPower’s, Tembo’s or CCTS’s assessments to change. However, while VivoPower, Tembo, CCTS

and Pubco may elect to update these forward-looking statements at some point in the future, VivoPower, Tembo, CCTS and Pubco specifically

disclaim any obligation to do so. Investors are referred to the most recent reports filed with the SEC by VivoPower and CCTS. Investors

are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made, and we undertake

no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Additional

Information and Where to Find It

The

Registration Statement to be filed by Pubco with the SEC will include a preliminary proxy statement of CCTS and a prospectus of Pubco

in connection with the proposed Business Combination. The definitive proxy statement and other relevant documents will be mailed to shareholders

of CCTS as of a record date to be established for voting on the proposed Business Combination.

SHAREHOLDERS

OF CCTS AND OTHER INTERESTED PARTIES ARE URGED TO READ, WHEN AVAILABLE, THE PRELIMINARY PROXY STATEMENT, AND AMENDMENTS THERETO, AND

THE DEFINITIVE PROXY STATEMENT IN CONNECTION WITH CCTS’S SOLICITATION OF PROXIES FOR THE EXTRAORDINARY GENERAL MEETING OF ITS SHAREHOLDERS

TO BE HELD TO APPROVE THE BUSINESS COMBINATION BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT CCTS, TEMBO, PUBCO AND

THE BUSINESS COMBINATION.

Shareholders

will also be able to obtain copies of the Registration Statement and the proxy statement/prospectus, without charge, once available,

on the SEC’s website at www.sec.gov or by directing a request to CCTS at Cactus Acquisition Corp. 1 Ltd, 4B Cedar Brook Drive,

Cranbury, NJ 08512, telephone: (609) 495-2222.

Participants

in the Solicitation

Tembo,

VivoPower, CCTS, Pubco and their respective directors and officers may be deemed participants in the solicitation of proxies of CCTS

shareholders in connection with the proposed transaction. More detailed information regarding the directors and officers of CCTS is contained

in CCTS’s filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was

filed with the SEC on April 15, 2024, and is available free of charge at the SEC’s website at www.sec.gov. Information regarding

the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of CCTS’s shareholders in connection

with the proposed Business Combination and other matters to be voted upon at the meeting of CCTS’s shareholders will be set forth

in the Registration Statement for the transaction when available.

No

Offer or Solicitation

This

press release shall not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or in respect

of the proposed transaction. This press release shall also not constitute an offer to sell or the solicitation of an offer to buy any

securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall

be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption

therefrom.

Contact

Shareholder

Enquiries

shareholders@vivopower.com

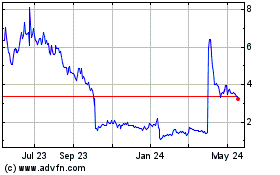

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Oct 2024 to Nov 2024

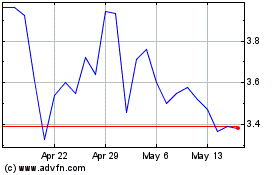

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Nov 2023 to Nov 2024