WaFd Bank Completes Sale of $2.8 Billion in Multi-Family Loans

22 June 2024 - 7:00AM

Business Wire

Washington Federal Bank ("WaFd Bank" or the "Bank"), the wholly

owned subsidiary of WaFd, Inc. (Nasdaq: WAFD) (the "Company"),

today announced the consummation of the sale of approximately $2.8

billion of multifamily commercial real estate loans (“CRE”) to Bank

of America, which in turn is selling the loans to funds managed by

Pacific Investment Management Company LLC (“PIMCO”). To our

knowledge, this represents the largest non-FDIC assisted CRE loan

sale ever. The sale of the multi-family loans was executed at no

loss to WaFd and provides immediate liquidity going forward.

WaFd Bank President and CEO Brent Beardall stated, “This should

prove to the investment community that the sky is not falling when

it comes to CRE loans. These are high quality loans and we believe

the purchase price is reflective of the low amount of credit risk

in the portfolio. Further, this sale was executed at 92-percent of

principal balance. That discount is almost entirely attributable to

changes in interest rates not the quality of these CRE loans. CRE

is a broad category which includes: multifamily, owner occupied,

industrial, hospitality, storage and office. When evaluating CRE

risk it is very important to understand the type of CRE, the

location and sponsor equity.”

Mr. Beardall continued, “These packaged loans all came from

Luther Burbank Savings in the acquisition by WaFd Bank in March of

this year. The sale of CRE loans was not a condition of the merger.

WaFd Bank has previously disclosed this loan sale gives the Bank

several immediate options including the option to either buy down

debt, originate new loans, buyback stock or a combination of all

three.”

Washington Federal Bank, a Washington state-chartered bank with

headquarters in Seattle, Washington, has 210 branches in nine

western states. To find out more about WaFd Bank, please visit our

website www.wafdbank.com. The Company uses its website to

distribute financial and other material information about the

Company.

Important Cautionary

Statements

The foregoing information should be read in conjunction with the

financial statements, notes and other information contained in the

Company’s Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K.

This press release contains statements about the Company’s

future that are not statements of historical or current fact. These

statements are “forward looking statements” for purposes of

applicable securities laws and are based on current information

and/or management's good faith belief as to future events. Words

such as “expects,” “anticipates,” “believes,” “estimates,”

“intends,” “forecasts,” “may,” “potential,” “projects,” and other

similar expressions or future or conditional verbs such as “will,”

“should,” “would,” and “could” are intended to help identify such

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Although the Company

believes any such statements are based on reasonable assumptions,

forward-looking statements should not be read as a guarantee of

future performance, and you are cautioned not to place undue

reliance on any forward-looking statements. The Company undertakes

no obligation to update or revise any forward-looking

statement.

By their nature, forward-looking statements involve inherent

risk and uncertainties including the following risks and

uncertainties, and those risks and uncertainties more fully

discussed under “Risk Factors” in the Company’s September 30, 2023

10-K, and Quarterly Reports on Form 10-Q which could cause actual

performance to differ materially from that anticipated by any

forward-looking statements. In particular, forward-looking

statements are subject to risks and uncertainties related to (i)

fluctuations in interest rate risk and market interest rates,

including the effect on our net interest income and net interest

margin; (ii) current and future economic conditions, including the

effects of declines in the real estate market, high unemployment

rates, inflationary pressures, a potential recession, the monetary

policies of the Federal Reserve, and slowdowns in economic growth;

(iii) risks related to the integration of the operations of Luther

Burbank Corporation; (iv) financial stress on borrowers (consumers

and businesses) as a result of higher interest rates or an

uncertain economic environment; (v) changes in deposit flows or

loan demands; (vi) the impact of bank failures or adverse

developments at other banks and related negative press about

regional banks and the banking industry in general; (vii) the

effects of natural or man-made disasters, calamities, or conflicts,

including terrorist events and pandemics (such as the COVID-19

pandemic) and the resulting governmental and societal responses;

(viii) global economic trends, including developments related to

Ukraine and Russia, and the evolving conflict in Israel and Gaza,

and related negative financial impacts on our borrowers; (ix)

litigation risks resulting in significant expenses, losses and

reputational damage; (x) our ability to identify and address

cyber-security risks, including security breaches, “denial of

service attacks,” “hacking” and identity theft; and (xi) other

economic, competitive, governmental, regulatory, and technological

factors affecting our operations, pricing, products and

services.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240621636804/en/

Brad Goode WaFd, Inc. 425 Pike Street, Seattle, WA 98101

Brad.Goode@wfd.com (206) 626-8178

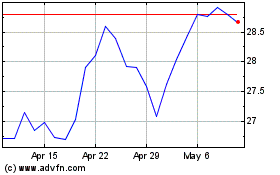

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Feb 2025 to Mar 2025

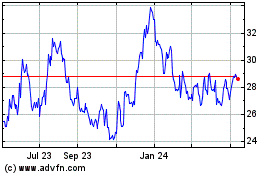

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Mar 2024 to Mar 2025