Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

15 May 2024 - 6:13AM

Edgar (US Regulatory)

Free Writing Prospectus

Filed Pursuant to Rule 433

Registration No.: 333-264453,

333-264453-01, 333-264453-02, 333-264453-04

May 14, 2024

Pricing Term Sheet

May 14, 2024

WarnerMedia

Holdings, Inc.

€650,000,000 4.302% Senior Notes due 2030

€850,000,000 4.693% Senior Notes due 2033

|

|

|

|

|

|

|

|

| Security : |

|

4.302% Senior Notes due 2030 |

|

4.693% Senior Notes due 2033 |

|

|

|

| Aggregate Principal Amount Offered: |

|

€650,000,000 |

|

€850,000,000 |

|

|

|

| Issuer: |

|

WarnerMedia Holdings, Inc. |

|

WarnerMedia Holdings, Inc. |

|

|

|

| Parent Guarantor: |

|

Warner Bros. Discovery, Inc. |

|

Warner Bros. Discovery, Inc. |

|

|

|

| Subsidiary Guarantors: |

|

Discovery Communications, LLC, Scripps Networks Interactive, Inc. and, in the future, each wholly-owned domestic subsidiary of the Parent Guarantor that is a borrower or guarantees the payment of any debt under the Senior Credit

Facility or any Material Debt (each as defined in the preliminary prospectus supplement relating to the Notes) |

|

Discovery Communications, LLC, Scripps Networks Interactive, Inc. and, in the future, each wholly-owned domestic subsidiary of the Parent Guarantor that is a borrower or guarantees the payment of any debt under the Senior Credit

Facility or any Material Debt (each as defined in the preliminary prospectus supplement relating to the Notes) |

|

|

|

| Security Type / Format: |

|

Senior Notes / SEC Registered |

|

Senior Notes / SEC Registered |

|

|

|

| Maturity Date: |

|

January 17, 2030 |

|

May 17, 2033 |

|

|

|

| Coupon (Interest Rate): |

|

4.302% |

|

4.693% |

|

|

|

| Price to Public (Issue Price): |

|

100.000% of principal amount |

|

100.000% of principal amount |

|

|

|

| Underwriting Discount: |

|

0.35% |

|

0.50% |

|

|

|

| Yield to Maturity: |

|

4.306% |

|

4.693% |

|

|

|

| Spread to Benchmark Bund: |

|

+177.1 bps |

|

+219.9 bps |

|

|

|

| Benchmark Bund: |

|

DBR 2.100% due November 15, 2029 |

|

DBR 2.300% due February 15, 2033 |

|

|

|

| Benchmark Bund Price and Yield: |

|

97.790 / 2.535% |

|

98.490 / 2.494% |

|

|

|

| Spread to Mid-Swap Yield |

|

+145 bps |

|

+190 bps |

|

|

|

| Mid-Swap Yield |

|

2.856% |

|

2.793% |

|

|

| Net Proceeds to Issuer: |

|

The Issuer expects the net proceeds from this offering of Notes to be approximately €1.49 billion after deducting the underwriting discounts and estimated expenses related to the

offering. |

|

|

|

|

|

| Interest Payment Dates: |

|

January 17 of each year, beginning January 17, 2025 |

|

May 17 of each year, beginning May 17, 2025 |

|

|

|

| Day Count Convention: |

|

ACTUAL / ACTUAL (ICMA) |

|

ACTUAL / ACTUAL (ICMA) |

|

|

|

| Make-whole Call: |

|

30 basis points (prior to December 17, 2029) |

|

35 basis points (prior to February 17, 2033) |

|

|

|

| Par Call: |

|

On or after December 17, 2029 (one month prior to the maturity date of the Notes) |

|

On or after February 17, 2033 (three months prior to the maturity date of the Notes) |

|

|

|

| Tax Redemption: |

|

100% |

|

100% |

|

|

|

| Change of Control: |

|

If a change of control triggering event occurs, the Issuer must offer to repurchase the Notes at a purchase price of 101% of the principal amount of Notes plus accrued and unpaid interest, if any, to, but excluding, the date of

repurchase. |

|

If a change of control triggering event occurs, the Issuer must offer to repurchase the Notes at a purchase price of 101% of the principal amount of Notes plus accrued and unpaid interest, if any, to, but excluding, the date of

repurchase. |

|

|

|

| Trade Date: |

|

May 14, 2024 |

|

May 14, 2024 |

|

|

|

| Settlement Date: |

|

May 17, 2024 (T+3) |

|

May 17, 2024 (T+3) |

|

|

|

| Denominations: |

|

€100,000 and integral multiples of €1,000 in excess thereof |

|

€100,000 and integral multiples of €1,000 in excess thereof |

|

|

|

| Business Day Convention: |

|

Following Business Day Convention |

|

Following Business Day Convention |

|

|

|

| Listing: |

|

Application will be made to list the Notes on the Nasdaq Bond Exchange |

|

Application will be made to list the Notes on the Nasdaq Bond Exchange |

|

|

|

| Clearing and Settlement: |

|

Euroclear / Clearstream |

|

Euroclear / Clearstream |

|

|

|

| Stabilization: |

|

Stabilization / FCA |

|

Stabilization / FCA |

|

|

|

| Law: |

|

State of New York |

|

State of New York |

|

|

|

| Common Code / ISIN: |

|

282180553 / XS2821805533 |

|

272162115 / XS2721621154 |

|

|

|

| Ratings*: |

|

Baa3 Moody’s Investors Service, Inc.

BBB- Standard & Poor’s Ratings Services

BBB- Fitch Ratings Ltd. |

|

Baa3 Moody’s Investors Service, Inc.

BBB- Standard & Poor’s Ratings Services

BBB- Fitch Ratings Ltd. |

|

|

|

| Joint Bookrunners: |

|

Barclays Bank PLC

Deutsche Bank AG, London Branch

Goldman Sachs & Co. LLC

Banco Santander, S.A.

Commerzbank Aktiengesellschaft |

|

Barclays Bank PLC

Deutsche Bank AG, London Branch

Goldman Sachs & Co. LLC

Banco Santander, S.A.

Commerzbank Aktiengesellschaft |

|

|

|

| Co-Managers: |

|

SMBC Nikko Capital Markets Limited ING Bank

N.V., Belgian Branch |

|

SMBC Nikko Capital Markets Limited ING Bank

N.V., Belgian Branch |

|

|

| Concurrent Tender Offer |

|

On May 14, 2024, in connection with its previously announced cash offer to purchase the Tender Offer Notes (as defined in the preliminary prospectus supplement relating to the Notes) (the “Tender Offer”),

subject to prioritized acceptance levels, the Issuer, WML and DCL announced that it has increased the Aggregate Tender Cap from the previously announced amount of |

2

|

|

|

|

|

|

|

$1,750,000,000 to $2,500,000,000, as such amount may be increased or decreased in the discretion of the Issuer, WML and DCL.

Based on the hypothetical reference yield and other assumptions described in the preliminary prospectus supplement, the Issuer, WML and DCL expect to purchase approximately $3.14 billion aggregate principal amount of Tender Offer Notes in the

Tender Offer for a combined aggregate purchase price (excluding accrued and unpaid interest) equal to the Aggregate Tender Cap.

See “Summary—Recent Developments—Concurrent Tender Offer” and “Capitalization”. |

*Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal by the assigning rating organization at any time.

The Issuer expects that delivery of the Notes will be made to investors on or about

May 17, 2024 which will be the third business day following the date of this pricing term sheet (such settlement being referred to as “T+3”). Under the E.U. Central Securities Depositaries Regulation, trades in the secondary market

generally are required to settle in two London business days, unless the parties to any such trade expressly agree otherwise. Also, under Rule 15c6-1 under the Exchange Act, trades in the secondary market are

required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes prior to the second business day before the date of delivery of the Notes hereunder will be

required, by virtue of the fact that the Notes initially settle in T+3, to specify an alternate settlement arrangement at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to trade the Notes during such

period should consult their advisors.

The Issuer has filed a registration statement (No. 333-264453)

(including a prospectus and a preliminary prospectus supplement) with the U.S. Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that

registration statement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively,

the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by contacting Barclays Bank PLC at +1-888-603-5847 (toll-free), Deutsche Bank AG, London Branch at +1 800 503 4611 (toll-free) or Goldman Sachs & Co. LLC at +1-866-471-2526 (toll-free).

Relevant stabilization regulations including FCA/ICMA apply. UK MiFIR

and MiFID II professionals/ECPs-only / No UK or EEA PRIIPs KID – Manufacturer target market (MiFID II and UK MiFIR product governance) is eligible counterparties and professional clients only (all distribution channels). No EEA or UK PRIIPs key

information document (KID) has been prepared as not available to retail in the EEA or the UK.

Prohibition of sales to EEA retail investors:

The Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (the “EEA”). For these purposes, a retail

investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU, as amended (“MiFID II”); (ii) a customer within the meaning of Directive (EU) 2016/97 (as

amended, the “Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in Article 2 of

Regulation (EU) 2017/1129 (as amended, the “Prospectus Regulation”).

3

Prohibition of sales to UK retail investors: The Notes are not intended to be offered, sold or

otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the UK. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client, as defined in point

(8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (the “EUWA”); (ii) a customer within the meaning of the provisions of the UK’s Financial

Services and Markets Act 2000 (as amended, the “FSMA”) and any rules or regulations made under the FSMA to implement the Insurance Distribution Directive, where that customer would not qualify as a professional client, as defined in point

(8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law of the UK by virtue of the EUWA; or (iii) not a qualified investor as defined in Article 2 of the Prospectus Regulation as it forms part of domestic

law by virtue of the EUWA.

Any disclaimer or other notice that may appear below is not applicable to this communication and should be disregarded.

Such disclaimer or notice was automatically generated as a result of this communication being sent by Bloomberg or another email system.

4

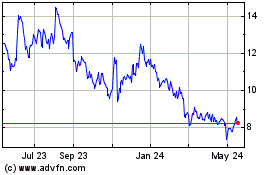

Warner Brothers Discovery (NASDAQ:WBD)

Historical Stock Chart

From Apr 2024 to May 2024

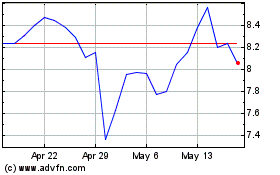

Warner Brothers Discovery (NASDAQ:WBD)

Historical Stock Chart

From May 2023 to May 2024