TeraWulf Inc. (Nasdaq: WULF) (“TeraWulf” or the “Company”), a

leading owner and operator of vertically integrated,

next-generation digital infrastructure powered by predominantly

zero-carbon energy, today provided its unaudited monthly production

and operations update for December 2024.

December 2024 Production and Operations

Highlights

- Bitcoin

Production: Self-mined 158 bitcoin, with an average daily

production rate of approximately 5.1 bitcoin.

- Operating

Capacity: Achieved 9.7 EH/s of installed self-mining

capacity, a 94.0% year-over-year increase.

- Power

Costs: Achieved an average power cost of $62,805 per

bitcoin mined, equivalent to approximately $0.078/kWh, excluding

proceeds from demand response and ancillary services.

|

Key Metrics1 |

December 2024 |

November 2024 |

|

Bitcoin Self-Mined |

|

158 |

|

|

115 |

|

|

Value per Bitcoin Self-Mined2 |

$ |

98,326 |

|

$ |

83,947 |

|

|

Power Cost per Bitcoin Self-Mined |

$ |

62,805 |

|

$ |

41,190 |

|

|

Avg. Operating Hash Rate (EH/s)3 |

|

8.4 |

|

|

5.9 |

|

|

Nameplate Miner Efficiency (J/TH)4 |

|

19.2 |

|

|

19.2 |

|

Management Commentary

“In December, we finalized data center lease

agreements totaling over 70 MW of our infrastructure, representing

a potential revenue opportunity exceeding $1 billion over the

initial 10-year terms," said Paul Prager, TeraWulf’s Chief

Executive Officer. "These agreements are a significant milestone

for TeraWulf, not only representing our entry into HPC hosting but

also demonstrating the immense value of our sustainable and

scalable digital infrastructure.”

Prager added, “We are in active discussions with

additional tenants to utilize the remaining 178 MW of near-term HPC

hosting capacity at Lake Mariner, including our inaugural partner,

Core42. Core42 retains a time-limited option for an additional 135

MW of capacity to be delivered in early 2026, further emphasizing

the growing demand for our low-cost, predominantly zero-carbon

infrastructure. In parallel, we are evaluating strategic site

acquisition opportunities to extend our footprint beyond the 750 MW

potential at Lake Mariner, solidifying our leadership in the next

generation of digital infrastructure.”

Production and Operations

Update

TeraWulf’s commitment to operational excellence and

sustainability continues to drive its growth across the Company’s

bitcoin mining and HPC hosting businesses.

As of December 31, 2024, TeraWulf's

operational bitcoin mining capacity was 195 MW with an installed

self-mining hash rate of approximately 9.7 EH/s. December’s average

hash rate was 8.4 EH/s, reflecting performance tuning to optimize

margins in a higher winter power price environment. Construction of

miner building 5 (MB-5, 50 MW) is proceeding on schedule, with

foundation pours completed and building framing underway, with

target completion in mid Q1 2025.

On the WULF Compute front, under the recently

announced data center lease agreements, TeraWulf will deliver more

than 70 MW of turn-key data center infrastructure to host Core42’s

HPC operations at the Lake Mariner facility in Upstate New York.

The infrastructure will include the WULF Den (2.5 MW), CB-1 (20

MW), and CB-2 (50 MW), which have all been fully funded.

About TeraWulf

TeraWulf develops, owns, and operates

environmentally sustainable, next-generation data center

infrastructure in the United States, specifically designed for

Bitcoin mining and high-performance computing. Led by a team of

seasoned energy entrepreneurs, the Company owns and operates the

Lake Mariner facility situated on the expansive site of a now

retired coal plant in Western New York. Currently, TeraWulf

generates revenue primarily through Bitcoin mining, leveraging

predominantly zero-carbon energy sources, including hydroelectric

and nuclear power. Committed to environmental, social, and

governance (ESG) principles that align with its business

objectives, TeraWulf aims to deliver industry-leading economics in

mining and data center operations at an industrial scale.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995, as amended.

Such forward-looking statements include statements concerning

anticipated future events and expectations that are not historical

facts. All statements, other than statements of historical fact,

are statements that could be deemed forward-looking statements. In

addition, forward-looking statements are typically identified by

words such as “plan,” “believe,” “goal,” “target,” “aim,” “expect,”

“anticipate,” “intend,” “outlook,” “estimate,” “forecast,”

“project,” “continue,” “could,” “may,” “might,” “possible,”

“potential,” “predict,” “should,” “would” and other similar words

and expressions, although the absence of these words or expressions

does not mean that a statement is not forward-looking.

Forward-looking statements are based on the current expectations

and beliefs of TeraWulf’s management and are inherently subject to

a number of factors, risks, uncertainties and assumptions and their

potential effects. There can be no assurance that future

developments will be those that have been anticipated. Actual

results may vary materially from those expressed or implied by

forward-looking statements based on a number of factors, risks,

uncertainties and assumptions, including, among others: (1)

conditions in the cryptocurrency mining industry, including

fluctuation in the market pricing of bitcoin and other

cryptocurrencies, and the economics of cryptocurrency mining,

including as to variables or factors affecting the cost, efficiency

and profitability of cryptocurrency mining; (2) competition among

the various providers of cryptocurrency mining services; (3)

changes in applicable laws, regulations and/or permits affecting

TeraWulf’s operations or the industries in which it operates,

including regulation regarding power generation, cryptocurrency

usage and/or cryptocurrency mining, and/or regulation regarding

safety, health, environmental and other matters, which could

require significant expenditures; (4) the ability to implement

certain business objectives and to timely and cost-effectively

execute integrated projects; (5) failure to obtain adequate

financing on a timely basis and/or on acceptable terms with regard

to growth strategies or operations; (6) loss of public confidence

in bitcoin or other cryptocurrencies and the potential for

cryptocurrency market manipulation; (7) adverse geopolitical or

economic conditions, including a high inflationary environment; (8)

the potential of cybercrime, money-laundering, malware infections

and phishing and/or loss and interference as a result of equipment

malfunction or break-down, physical disaster, data security breach,

computer malfunction or sabotage (and the costs associated with any

of the foregoing); (9) the availability, delivery schedule and cost

of equipment necessary to maintain and grow the business and

operations of TeraWulf, including mining equipment and

infrastructure equipment meeting the technical or other

specifications required to achieve its growth strategy; (10)

employment workforce factors, including the loss of key employees;

(11) litigation relating to TeraWulf and/or its business; and (12)

other risks and uncertainties detailed from time to time in the

Company’s filings with the Securities and Exchange Commission

(“SEC”). Potential investors, stockholders and other readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date on which they were

made. TeraWulf does not assume any obligation to publicly update

any forward-looking statement after it was made, whether as a

result of new information, future events or otherwise, except as

required by law or regulation. Investors are referred to the full

discussion of risks and uncertainties associated with

forward-looking statements and the discussion of risk factors

contained in the Company’s filings with the SEC, which are

available at www.sec.gov.

Investors: Investors@terawulf.com

Media: media@terawulf.com

1 All figures except Bitcoin Self-Mined are

estimates and remain subject to standard month-end adjustments. 2

Computed as the weighted-average opening price of bitcoin on each

respective day the Bitcoin Self-Mined is earned.3 While nameplate

mining inventory as of December 31, 2024 for Lake Mariner is

estimated at 9.7 EH/s, actual monthly hash rate performance depends

on a variety of factors, including (but not limited to) performance

tuning to increase efficiency and maximize margin, scheduled

outages (scopes to improve reliability or performance), unscheduled

outages, curtailment due to participation in various cash

generating demand response programs, derate of ASICs due to adverse

weather and ASIC maintenance and repair. Performance in November

was impacted by planned outage for electrical upgrades and miner

fleet upgrade work.4 Nameplate miner efficiency excludes auxiliary

load.

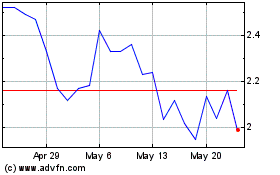

TeraWulf (NASDAQ:WULF)

Historical Stock Chart

From Dec 2024 to Jan 2025

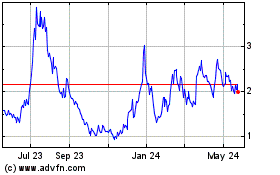

TeraWulf (NASDAQ:WULF)

Historical Stock Chart

From Jan 2024 to Jan 2025