false

0001620179

0001620179

2024-11-19

2024-11-19

0001620179

us-gaap:CommonStockMember

2024-11-19

2024-11-19

0001620179

xela:SixPercentSeriesBCumulativeConvertiblePerpetualPreferredStockParValueDollar0.0001PerShareMember

2024-11-19

2024-11-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 19, 2024

EXELA TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-36788 |

|

47-1347291 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

|

2701 E. Grauwyler Rd.

Irving, TX |

|

75061 |

| (Address of principal executive offices) |

|

(Zip Code) |

Company’s telephone number, including area

code: (214) 740-6500

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading

Symbol |

|

Name of Each Exchange

on

Which Registered |

| Common Stock, Par Value $0.0001 per share |

|

XELA |

|

(1) |

6.00% Series B Cumulative Convertible

Perpetual Preferred Stock, par value $0.0001

per share |

|

XELAP |

|

(1) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

| ¨ |

Emerging growth company |

| ¨ | If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

(1) On November 6, 2024, the Nasdaq Stock Market

LLC (“Nasdaq”) notified the Company that Nasdaq had determined to delist the Company’s Common Stock and that trading

of the Company’s securities would be suspended at the open of trading on November 8, 2024. Nasdaq will file a Form 25 with the SEC

notifying the SEC of Nasdaq’s determination to remove the Company’s securities from listing on Nasdaq. As a result of the

delisting, since November 8, 2024, the Company’s Common Stock and Series B Cumulative Convertible Perpetual Preferred Stock have

been traded on the over-the-counter market under the symbols “XELA” and “XELAP”, respectively.

Item 1.01 Entry into a Material Definitive

Agreement.

On November 19 and 21, 2024, certain holders of

the outstanding Series A Perpetual Convertible Preferred Stock, par value $0.0001 per share (each a “Holder,” collectively,

the “Holders,” and such shares, the “Series A Preferred Stock”) of Exela Technologies, Inc. (the “Company”)

exchanged 1,525,666 shares of Series A Preferred Stock for 21,385,694 shares of the Company’s common stock, par value $0.0001 per

share (“Common Stock”) at an exchange price of $1.18 per share of Common Stock and valuing each share of Series A Preferred

Stock at its accumulated liquidation preference (the “Exchange”), pursuant to a preferred stock exchange agreement, by and

among the Company and the Holders (the “Exchange Agreement”). The Exchange Agreement also contains customary representations,

warranties, and covenants of the Company and of each of the Holders.

The foregoing description of the terms of the

Exchange Agreement is qualified in its entirety by the provisions of the Form of Exchange Agreement, which is filed as Exhibit 10.1 hereto

and incorporated by reference herein.

Since certain holders of the Series A Preferred

Stock are or may be deemed to be affiliated with certain directors and executive officers of the Company, including Messrs. Par Chadha,

Ronald Cogburn, James Reynolds, Matthew Brown and Suresh Yannamani, the Company’s Board of Directors formed a special committee

of independent directors (the “Special Committee”) to consider and approve the Exchange. In determining that the Exchange

was fair to, and in the best interest of, the Company and its shareholders, the Special Committee relied in part on the analysis of a

reputable independent financial advisor, which was engaged by the Special Committee to provide an accurate valuation of the Series A Preferred

Stock.

Following the closing of the Exchange the number

of shares of Series A Preferred Stock outstanding decreased from 2,778,111 to 1,252,445 and the number of shares of Common Stock outstanding

increased from the previously reported 6,365,363 to 27,751,057. Company’s capital stock consists of outstanding shares .

Item 3.02. Unregistered Sales of Equity Securities.

The description of the Exchange Agreement and

the issuance of the shares of Common Stock thereunder set forth in Item 1.01 above is incorporated by reference into this Item 3.02. The

shares of Common Stock issued pursuant to the Exchange Agreement were issued solely to former holders of Series A Preferred Stock, upon

exchange pursuant to the exemption from registration provided under Section 3(a)(9) of the Securities Act of 1933, as amended (the “Securities

Act”) and/or Section 4(a)(2) of the Securities Act. These exemptions are available to the Company because the shares of Common Stock

were exchanged by the Company with a limited number of its existing security holders with no commission or other remunerations being paid

or given for soliciting such an exchange.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: November 25, 2024

| |

EXELA TECHNOLOGIES, INC. |

| |

|

|

| |

By: |

/s/ Zach Maul |

| |

|

Name: Zach Maul |

| |

|

Title: Secretary |

Exhibit 10.1

PREFERRED STOCK EXCHANGE AGREEMENT

This PREFERRED STOCK EXCHANGE

AGREEMENT (this “Agreement”) is made and entered into as of the date set forth on the signature page hereto, by

and between Exela Technologies, Inc., a Delaware corporation (the “Company”), and the holder listed on the signature

page hereto (the “Holder”).

WHEREAS,

the Holder owns certain shares of the Company’s Series A Perpetual Convertible Preferred Stock, par value $0.0001 per share

(the “Preferred Stock”);

WHEREAS,

the number of shares of Preferred Stock held by the Holder is set forth on Schedule 1 attached hereto;

WHEREAS,

in order to improve the capital structure of the Company, the Company and the Holder desire to enter into this Agreement, pursuant to

which, among other things, the Company and the Holder shall exchange the Preferred Stock identified on Schedule 1 (the “Preferred

Shares”) for the number of shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”)

as calculated below (the “Exchange”);

WHEREAS,

the Common Stock trades on the OTC Pink Market;

WHEREAS,

following the Exchange, the Preferred Shares shall be automatically cancelled and terminated and the Holder shall have no further rights

pursuant to the Preferred Shares; and

WHEREAS,

the Exchange is being made in reliance upon the exemption from registration provided by Section 3(a)(9) of the Securities Act

of 1933, as amended (the “Securities Act”) and/or under Section 4(a)(2) of the Securities Act for transactions

by an issuer not involving a public offering.

NOW,

THEREFORE, in consideration of the premises and mutual covenants set forth herein, and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

1. The

Exchange. At the Closing (as defined below), the Company and the Holder shall exchange the Preferred Shares for Common Stock, as follows:

(a) Closing.

The Exchange shall occur remotely via the release of the Company’s signature on the third business day following the filing of the

Company’s Form 10-Q for the quarter ended September 30, 2024 or other public release of results for such quarter (the

“Closing”).

(b) Exchange

Shares. At the Closing, the Holder shall be entitled to receive such number of shares of Common Stock equal to the product of (x) the

number of Preferred Shares and (y) the Liquidation Preference (as defined in the Certificate of Designations, Preferences,

Rights And Limitations of Series A Perpetual Convertible Preferred Stock of Exela Technologies, Inc. dated as of July 12,

2017 as of the date of the Closing, divided by the Share Price (as defined below) (the “Exchange Shares”). No

fractional shares or scrip representing fractional shares shall be issued in connection with the Exchange. As to any fraction of a share

which the Holder would otherwise be entitled pursuant to the Exchange, the Company shall at its election, either pay a cash adjustment

in respect of such final fraction in an amount equal to such fraction multiplied by the Share Price or round up to the next whole share.

“Share Price” for purposes of this Agreement means a price that is the lesser of (x) the closing price of the

Company’s Common Stock as reported on the OTC Pink as of 4 p.m. on the business day immediately preceding the Closing or (y) the

average closing price of the Common Stock for the two (2) trading days immediately preceding the Closing.

(c) Delivery.

At the Closing, the Company shall deliver the Exchange Shares to the Holder (in electronic form as evidenced by the records of the Company

and its transfer agent). At the Closing, and without further action, the Holder shall be deemed to have delivered to the Company (or its

designee) for exchange and cancellation all of the original book entry Preferred Shares held by Holder.

(d) Consideration.

At the Closing, the Exchange Shares shall be issued to the Holder in exchange for the Preferred Shares without the payment of any other

consideration by the Holder. The Holder hereby agrees that, upon and subject to the Closing, all of the Company’s obligations to

the Holder under the terms and conditions of the Preferred Stock with respect to the Preferred Shares shall be automatically terminated

and cancelled in full without any further action required, and that this Section 1(c) shall constitute an instrument of termination

and cancellation of such shares of Preferred Stock.

(e) [RESERVED].

(f) Registration

Rights. The Company confirms that the Exchange Shares shall be subject to any registration rights the Holder may have with the Company;

provided that the Company and Holder shall work together in good faith to give effect to those rights as necessary given the Company is

no longer listed on national securities exchange.

(g) Other

Documents. The Company and the Holder shall execute and/or deliver such other documents and agreements as are reasonably necessary

to effectuate the Exchange pursuant to the terms of this Agreement.

2. Representations

and Warranties.

(a) Holder

Representations and Warranties. The Holder hereby represents and warrants to the Company:

(i) The

Holder is either an individual or an entity validly existing and in good standing under the laws of the jurisdiction of its organization.

(ii) This

Agreement has been duly authorized, validly executed and delivered by the Holder and is a valid and binding agreement and obligation of

the Holder enforceable against the Holder in accordance with its terms, subject only to the limitations on enforcement by general principles

of equity and by bankruptcy or other laws affecting the enforcement of creditors’ rights generally, and the Holder has full power

and authority to execute and deliver this Agreement and the other agreements and documents referred to in Section 1(g) and to

perform its obligations hereunder and thereunder.

(iii) The

Holder is an accredited investor (as defined in Rule 501(a) of Regulation D under the Securities Act) and/or either alone or

together with its representatives, has such knowledge, sophistication and experience in business and financial matters so as to be capable

of evaluating the merits and risks of the prospective investment in the Exchange Shares, and has so evaluated the merits and risks of

such investment. The Holder is able to bear the economic risk of an investment in the Exchange Shares and, at the present time, is able

to afford a complete loss of such investment.

(iv) The

Holder has been furnished with materials relating to the Exchange that have been requested by the Holder, including the Company SEC Documents

(as defined below), and the Holder has had the opportunity to review the Company SEC Documents. The Holder has been afforded the opportunity

to ask questions of the Company. Neither such inquiries nor any other investigation conducted by or on behalf of the Holder or its representatives

or counsel will modify, amend or affect the Holder’s right to rely on the truth, accuracy and completeness of the Company SEC Documents

and the Company’s representations and warranties contained in this Agreement. The Holder understands that nothing in the Company

SEC Documents, this Agreement or any other materials presented to the Holder in connection with the Exchange constitutes legal, tax or

investment advice. The Holder has consulted such legal, tax and investment advisors as it, in its sole discretion, has deemed necessary

or appropriate in connection with the Exchange.

(v) The

Holder understands that the Exchange Shares are being offered, sold, issued and delivered to it in reliance upon specific provisions of

federal and applicable state securities laws, and that the Company is relying upon the truth and accuracy of the representations, warranties,

agreements, acknowledgments and understandings of the Holder set forth herein for purposes of qualifying for exemptions from registration

under the Securities Act and applicable state securities laws. The Holder understands that no United States federal or state agency or

any other government or governmental agency has passed on or made any recommendation or endorsement of the Exchange Shares or the fairness

or suitability of the investment in the Exchange Shares nor have such authorities passed upon or endorsed the merits of the Exchange.

(vi) The

Holder is not acquiring the Exchange Shares as a result of any advertisement, article, notice or other communication regarding the Exchange

Shares published in any newspaper, magazine or similar media or broadcast over television or radio or presented at any seminar or any

other general advertisement.

(vii) The

Holder acknowledges that the offer, sale, issuance and delivery of the Exchange Shares to it is intended to be exempt from registration

under the Securities Act, by virtue of Section 3(a)(9) thereof and/or under Section 4(a)(2) of the Securities Act

for transactions by an issuer not involving a public offering. The Holder understands that the Exchange Shares may be sold or transferred

only in compliance with all federal and applicable state securities laws.

(viii) The

Holder understands that the Preferred Shares are, and as such the Exchange Shares will be, “restricted securities” and that

neither the Preferred Shares of the Exchange Share have been registered under the Securities Act or any applicable state securities law

and the Holder is acquiring the Exchange Shares as principal for its own account and not with a view to or for distributing or reselling

such Exchange Shares or any part thereof in violation of the Securities Act or any applicable state securities law, has no present intention

of distributing any of such Exchange Shares in violation of the Securities Act or any applicable state securities law and has no direct

or indirect arrangement or understandings with any other persons to distribute or regarding the distribution of such Exchange Shares in

violation of the Securities Act or any applicable state securities law (this representation and warranty not limiting such Holder’s

right to sell the Exchange Shares in compliance with applicable federal and state securities laws).

(ix) The

Holder owns and holds, beneficially and of record, the entire right, title, and interest in and to the Preferred Shares free and clear

of all rights and Encumbrances (as defined below). The Holder has full power and authority to transfer and dispose of the Preferred Shares

to the Company free and clear of any right or Encumbrance. Other than the transactions contemplated by this Agreement, there is no outstanding

vote, plan, pending proposal, or other right of any person to acquire all or any of the Preferred Shares. As used herein, “Encumbrances”

shall mean any security or other property interest or right, claim, lien, pledge, option, charge, security interest, contingent or conditional

sale, or other title claim or retention agreement, interest or other right or claim of third parties, whether perfected or not perfected,

voluntarily incurred or arising by operation of law, and including any agreement (other than this Agreement) to grant or submit to any

of the foregoing in the future. Except as set forth on Schedule 1, the Preferred Shares constitute all of the Preferred Stock owned or

held of record or beneficially owned or held by the Holder.

(b) Company

Representations and Warranties. The Company hereby represents and warrants to the Holder:

(i) The

Company has been duly incorporated and is validly existing and in good standing under the laws of the State of Delaware, with full corporate

power and authority to own, lease and operate its properties and to conduct its business as currently conducted, and is duly registered

and qualified to conduct its business and is in good standing in each jurisdiction or place where the nature of its properties or the

conduct of its business requires such registration or qualification, except where the failure to so register or qualify would not have

a Material Adverse Effect (as defined below). For purposes of this Agreement, “Material Adverse Effect” shall mean

any material adverse effect on the business, operations, properties, or financial condition of the Company and its subsidiaries and/or

any condition, circumstance, or situation that would prohibit or otherwise materially interfere with the ability of the Company to perform

any of its obligations under this Agreement.

(ii) The

Exchange Shares have been duly authorized by all necessary corporate action, and, when issued and delivered in accordance with the terms

hereof, the Exchange Shares shall be validly issued and outstanding, fully paid and non-assessable, free and clear of all liens, encumbrances

and rights of refusal of any kind.

(iii) This

Agreement has been duly authorized, validly executed and delivered on behalf of the Company and is a valid and binding agreement and obligation

of the Company enforceable against the Company in accordance with its terms, subject to any limitations on enforcement by general principles

of equity and by bankruptcy or other laws affecting the enforcement of creditors’ rights generally, and the Company has full power

and authority to execute and deliver this Agreement and the other agreements and documents contemplated hereby and to perform its obligations

hereunder and thereunder.

(iv) The

Company represents that it has not paid, and shall not pay, any commissions or other remuneration, directly or indirectly, to any third

party for the solicitation of the Exchange pursuant to this Agreement. Other than the exchange of the Preferred Shares, the Company has

not received and will not receive any consideration from the Holder for the Exchange Shares.

(v) The

Company has filed all reports, schedules, forms, statements and other documents required to be filed by the Company as of the date hereof

(including exhibits and all other information incorporated therein), and any required amendments to any of the foregoing, with the United

States Securities and Exchange Commission (the “SEC,” and such filings, the “Company SEC Documents”). As

of their respective filing dates, each of the Company SEC Documents complied in all material respects with the requirements of the Securities

Act and of the Securities Exchange Act of 1934, as amended, and the rules and regulations of the SEC promulgated thereunder, applicable

to such Company SEC Document. No Company SEC Document contains any untrue statement of a material fact or omits to state a material fact

required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were

made, not misleading. No inquiries or any other investigation conducted by or on behalf of Holder or its representatives or counsel will

modify, amend or affect Holder’s right to rely on the truth, accuracy and completeness of the Company SEC Documents and the Company’s

representations and warranties contained in this Agreement.

(vi) The

Company hereby represents and warrants as of the date hereof and covenants and agrees from and after the date hereof that none of the

terms offered to any other person or entity with respect to the Preferred Stock and relating to the terms, conditions and transactions

contemplated hereby (each an “Exchange Document”), is or will be more favorable to such person or entity than those

of the Holder and this Agreement. If, and whenever on or after the date hereof, the Company enters into an Exchange Document with such

favorable terms, then (i) the Company shall provide notice thereof to the Holder immediately following the occurrence thereof and

(ii) the terms and conditions of this Agreement shall be, without any further action by the Holder or the Company, automatically

amended and modified in an economically and legally equivalent manner such that the Holder shall receive the benefit of the more favorable

terms and/or conditions (as the case may be), provided that upon written notice to the Company at any time the Holder may elect not to

accept the benefit of any such amended or modified term or condition, in which event the term or condition contained in this Agreement

shall apply to the Holder as it was in effect immediately prior to such amendment or modification as if such amendment or modification

never occurred with respect to the Holder. The provisions of this Section 2(b)(vi) shall apply similarly and equally to each

Exchange Document.

(vii) The

execution, delivery and performance of this Agreement by the Company and the consummation by the Company of the transactions contemplated

hereby (including, without limitation, the issuance of the Exchange Shares) will not (i) result in a violation of the certificate

of incorporation or bylaws of the Company or (ii) conflict with, or constitute a default (or an event which with notice or lapse

of time or both would become a default) in any respect under, or give to others any rights of termination, amendment, acceleration or

cancellation of, any agreement, indenture or instrument to which the Company or any of its subsidiaries is a party, or (iii) result

in a violation of any law, rule, regulation, order, judgment or decree (including foreign, federal and state securities laws and regulations

and the rules and regulations by which any property or asset of the Company or any of its subsidiaries is bound or affected).

3. Stock

Ownership Governance.

(a) Restrictions

on Transfers. The Holder hereby covenants with the Company that neither it nor any of its Affiliates will Dispose (as defined below)

of any of the Exchange Shares, except for sales pursuant to Rule 144 or pursuant to an effective registration statement or pursuant

to any other transaction for which registration is not required under the Securities Act. With respect to any sale of Exchange Shares

by the Holder pursuant to Rule 144 the Holder will (x) provide the Company with a copy of any notice required to be filed with

the SEC prior to the sale with respect to such Exchange Shares and (y) notify the Company within two (2) business days after

the completion of such sale transaction. As used in this Agreement, “Dispose” and variations thereof means any pledge,

sale, contract to sell, sale of any option or contract to purchase, purchase of any option or contract to sell, grant of any option, right

or warrant for the sale of, or other disposition of or transfer of any shares of Common Stock or any Common Stock equivalents.

(b) Remedies.

Without prejudice to the rights and remedies otherwise available to the parties, the Company shall be entitled to equitable relief by

way of injunction if the Holder or any permitted transferee breaches or threatens to breach any of the provisions of this Section 3.

4. Miscellaneous.

(a) Entire

Agreement. This Agreement constitutes the entire agreement and supersedes all other prior and contemporaneous agreements and understandings,

both oral and written, between the Holder and the Company with respect to the subject matter hereof.

(b) Amendment.

This Agreement may only be amended with the written consent of the Holder and the Company.

(c) Successors.

All the covenants and provisions of this Agreement by or for the benefit of the Holder or the Company shall bind and inure to the benefit

of their respective successors and assigns.

(d) Applicable

Law; Consent to Jurisdiction. The validity, interpretation and performance of this Agreement shall be governed in all respects by

the laws of the State of Delaware, without giving effect to conflicts of law principles that would result in the application of the substantive

laws of another jurisdiction. Each of the parties hereby agrees that any action, proceeding or claim against it arising out of or relating

in any way to this Agreement shall be brought and enforced in the courts of the State of Delaware or the United States District Court

for the District of Delaware, and irrevocably submits to such jurisdiction, which jurisdiction shall be exclusive. Each party hereby waives

any objection to such exclusive jurisdiction and that such courts represent an inconvenient forum.

(e) Counterparts.

This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall

constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic

signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com or drysign.exelatech.com ) or other transmission method

and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

(f) Severability.

Whenever possible, each provision of this Agreement shall be interpreted in such manner as to be effective and valid under applicable

law, but if any provision of this Agreement is held to be prohibited by or invalid under applicable law, such provision shall be ineffective

only to the extent of such prohibition or invalidity, without invalidating the remainder of this Agreement.

(g) No

Commissions. Neither the Company nor the Holder has paid or given, or will pay or give, to any person, any commission, fee or other

remuneration, directly or indirectly, in connection with the transactions contemplated by this Agreement.

********

IN

WITNESS WHEREOF, this Preferred Stock Exchange Agreement has been duly executed by the undersigned as of the date first written

above.

| |

HOLDER: |

| |

|

| |

(ENTITY) |

| |

|

| |

|

| |

(Print Entity Name) |

| |

(INDIVIDUAL) |

| |

|

| |

|

| |

(Signature) |

| |

|

| |

|

| |

(Print Name) |

ACKNOWLEDGEMENT

This Preferred Stock Exchange

Agreement is hereby accepted upon the terms and conditions set forth above.

SCHEDULE

1

SERIES A

PREFERRED STOCK BENEFICIALLY OWNED

PRIOR TO

EXCHANGE AND BEING EXCHANGED

| Shares

|

Number |

Preferred

Stock

(All

Series A held) |

|

Preferred

Shares

(Series A

to be Exchanged) |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=xela_SixPercentSeriesBCumulativeConvertiblePerpetualPreferredStockParValueDollar0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

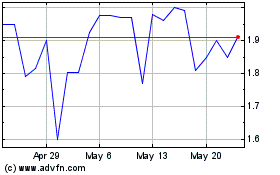

Exela Technologies (NASDAQ:XELAP)

Historical Stock Chart

From Nov 2024 to Dec 2024

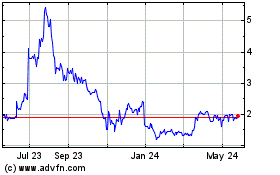

Exela Technologies (NASDAQ:XELAP)

Historical Stock Chart

From Dec 2023 to Dec 2024