UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-35224

Xunlei Limited

3709 Baishi Road

Nanshan District, Shenzhen, 518000

The People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Exhibit Index

Exhibit 99.1—Press Release—Xunlei Announces Unaudited Financial Results for the First Quarter Ended March 31, 2024

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

By: |

/s/ Naijiang (Eric) Zhou |

| |

Name: |

Naijiang (Eric) Zhou |

| |

Title: |

Chief Financial Officer |

Date: May 16, 2024

Exhibit 99.1

XUNLEI ANNOUNCES UNAUDITED FINANCIAL RESULTS

FOR THE FIRST QUARTER ENDED MARCH 31, 2024

Shenzhen, China, May 16, 2024 (GLOBE NEWSWIRE)

- Xunlei Limited ("Xunlei" or the "Company") (Nasdaq: XNET), a leading technology company providing distributed cloud

services in China, today announced its unaudited financial results for the first quarter ended March 31, 2024.

First Quarter 2024 Financial Highlights:

| · | Total

revenues were US$80.4 million, representing a decrease of 19.0% year-over-year. |

| · | Cloud

computing revenues were US$30.2 million, representing a decrease of 7.8% year-over-year. |

| · | Subscription

revenues were US$33.1 million, representing an increase of 12.9% year-over-year. |

| · | Live

streaming and other internet value-added services (“Live streaming and other IVAS”)

revenues were US$17.1 million, representing a decrease of 54.1% year-over-year. |

| · | Gross

profit was US$42.8 million, representing an increase of 8.2% year-over-year, and gross

profit margin was 53.3% in the first quarter, compared with 39.9% in the same period of 2023. |

| · | Net

income was US$3.6 million in the first quarter, compared with US$1.2 million in the same

period of 2023. |

| · | Non-GAAP

net income was US$4.5 million in the first quarter, compared with US$5.5 million in the

same period of 2023. |

| · | Diluted

earnings per ADS was approximately US$0.06 in the first quarter, compared with US$0.02

in the same period of 2023. |

Mr. Jinbo Li, Chairman and Chief Executive Officer

of Xunlei, stated that, “We had a good start to the year delivering Q1 revenue in line with our expectations and quarterly profitability,

driven by a higher gross margin and an increased gross profit. In particular, our subscription revenue grew by 12.9% year-over-year as

a result of a larger premium subscriber base and our continuing efforts on user acquisition. I am deeply grateful to our team for their

unwavering efforts to manage and grow our existing businesses while exploring growth opportunities.”

"During 2024, we will accelerate our efforts

to transform our business. Among our initiatives, we intend to proactively embrace decentralized and AI-driven technologies and harness

their capabilities to strengthen our operations, enrich user experience and gain a competitive edge as large language models (LLMs) are

emerging as a revolutionary technology that will profoundly change our lives. Although we expect it to be an uphill task, we have strong

confidence that we can make progress given Xunlei's rich heritage of innovation and entrepreneurial spirit. In addition, we will consider

all options to make our Company more nimble and focused to pursue growth opportunities," concluded Mr. Li.

First Quarter 2024 Financial Results

Total Revenues

Total revenues were US$80.4 million, representing

a decrease of 19.0% year-over-year. The decrease in total revenues was mainly attributable to the decreased revenues generated from our

live streaming business as result of the downsize of our domestic audio live streaming operations since June 2023.

Revenues from cloud computing were US$30.2 million,

representing a decrease of 7.8% year-over-year. The decrease in cloud computing revenues was mainly due to the decreased revenues generated

from certain of our major customers of cloud computing services and the decrease in sales of cloud computing hardware devices.

Revenues from subscription were US$33.1 million,

representing an increase of 12.9% year-over-year. The increase in subscription revenues was mainly driven by the increase in the number

of subscribers. The number of subscribers was 5.76 million as of March 31, 2024, compared with 4.84 million as of March 31, 2023. The

average revenue per subscriber for the first quarter was RMB39.5, compared with RMB41.0 in the same period of 2023. The lower average

revenue per subscriber was due to the more promotional activities we conducted during the quarter.

Revenues from live streaming and other IVAS were

US$17.1 million, representing a decrease of 54.1% year-over-year. The decrease of live streaming and other IVAS revenues was mainly due

to the downsize of our domestic audio live streaming operations since June 2023.

Costs of Revenues

Costs of revenues were US$37.1 million, representing

46.2% of our total revenues, compared with US$59.3 million, or 59.8% of the total revenues, in the same period of 2023. The decrease

in costs of revenues was mainly attributable to the decreased revenue-sharing costs for our live streaming business, which was consistent

with the decrease in live streaming revenues.

Bandwidth costs, as included in costs of revenues,

were US$27.1 million, representing 33.8% of our total revenues, compared with US$29.1 million, or 29.3% of the total revenues, in the

same period of 2023. The decrease was primarily due to the decreased bandwidth usage for the development of innovative products and the

decrease in revenues of cloud computing service during the quarter.

The remaining costs of revenues mainly consisted

of costs related to the revenue-sharing costs for our live streaming business, payment handling charges, cost of inventories sold and

depreciation of servers and other equipment.

Gross Profit and Gross Profit Margin

Gross profit for the first quarter of 2024 was

US$42.8 million, representing an increase of 8.2% year-over-year. Gross profit margin was 53.3% in the first quarter, compared with 39.9%

in the same period of 2023. The increase in gross profit was mainly driven by the increase in gross profit generated from our subscription

business. The increase in gross profit margin was mainly attributable to the increased portion of subscription revenues to total revenues,

which has a higher gross profit margin as well as the decreased portion of live streaming revenues to total revenues, which has a relatively

lower gross profit margin.

Research and Development Expenses

Research and development expenses for the first

quarter were US$17.6 million, representing 22.0% of our total revenues, compared with US$18.0 million, or 18.2% of our total revenues,

in the same period of 2023. The decrease was primarily due to the decrease in employee compensation incurred during the quarter.

Sales and Marketing Expenses

Sales and marketing expenses for the first quarter

were US$10.1 million, representing 12.5% of our total revenues, compared with US$9.3 million, or 9.4% of our total revenues, in the same

period of 2023. The increase was primarily due to more marketing expenses incurred during the quarter for our subscription and overseas

live streaming businesses as part of our ongoing efforts on user acquisition.

General and Administrative Expenses

General and administrative expenses for the first

quarter were US$11.1 million, representing 13.9% of our total revenues, compared with US$11.7 million, or 11.8% of our total revenues,

in the same period of 2023. The decrease was primarily due to the decreased share-based compensation expenses, partially offset by the

increase in labor costs during the quarter.

Operating Income

Operating income was US$4.0 million, compared

with an operating income of US$0.7 million in the same period of 2023. The increase in operating income was primarily attributable to

the increase in gross profit from our subscription business during the quarter.

Other Income, Net

Other income, net was US$0.3 million, compared

with other income, net of US$1.4 million in the same period of 2023. The decrease was primarily due to a one-time write-off for one of

our long-term investments and a decrease in subsidy income we received during the quarter.

Net Income and Earnings Per ADS

Net income was US$3.6 million, compared with

US$1.2 million in the same period of 2023. Non-GAAP net income was US$4.5 million in the first quarter of 2024, compared with US$5.5

million in the same period of 2023. The increase of net income was primarily attributable to the increase in gross profit of our subscription

business, partially offset by the decrease in other income as discussed in the preceding paragraph. The decrease in non-GAAP net income

was primarily attributable to the increase in labor costs (excluding share-based compensation expenses) as compared with the same period

of 2023.

Diluted earnings per ADS in the first quarter

of 2024 was approximately US$0.06 as compared to US$0.02 in the same period of 2023.

Cash Balance

As of March 31, 2024, the Company had cash, cash

equivalents and short-term investments of US$272.5 million, compared with US$271.9 million as of December 31, 2023. The increase

in cash, cash equivalents and short-term investments was mainly due to the net cash generated from operating activities and proceeds

from bank borrowings, partially offset by repayment of bank borrowings, spending on share buybacks and payment for a long-term investment

during the quarter.

Share Repurchase Program

In June 2023, Xunlei announced that its Board

of Directors had authorized the repurchase of up to US$20 million of its shares over the next 12 months. As of March 31, 2024, the Company

had spent approximately US$4.7 million on share buybacks under the aforesaid share repurchase program.

Guidance for the Second Quarter of 2024

For the second quarter of 2024, Xunlei estimates

total revenues to be between US$79 million and US$84 million, and the midpoint of the range represents a quarter-over-quarter increase

of approximately 1.4%. This estimate represents management's preliminary view as of the date of this press release, which is subject

to change and any change could be material.

Conference Call Information.

Xunlei's management will host a conference

call at 8:00 a.m. U.S. Eastern Time on May 16, 2024 (8:00 p.m. Beijing/Hong Kong Time), to discuss the Company's quarterly

results and recent business developments.

Participant Online Registration: https://register.vevent.com/register/BIdabe6e2da6f24af7b92fb89604dbbb7c

Please register to join the conference using

the link provided above and dial in 10 minutes before the call is scheduled to begin. Once registered, the participants will receive

an email with personal PIN and dial-in information, and participants can choose to access either via Dial-In or Call Me. A kindly reminder

that "Call Me" does not work for China number.

The Company will also broadcast a live audio

webcast of the conference call. The webcast will be available at http://ir.xunlei.com. Following the earnings conference call, an archive

of the call will be available at https://edge.media-server.com/mmc/p/rp84j2yv

About Xunlei

Founded in 2003, Xunlei Limited (Nasdaq: XNET)

is a leading technology company providing distributed cloud services in China. Xunlei provides a wide range of products

and services across cloud acceleration, shared cloud computing and digital entertainment to deliver an efficient, smart and safe internet

experience.

Safe Harbor Statement

This press release contains statements of a forward-looking

nature. These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of

1995. You can identify these forward-looking statements by terminology such as "will," "expects," "believes,"

"anticipates," "future," "intends," "plans," "estimates" and similar statements. Among

other things, the management's quotations and the "Guidance" section in this press release, as well as the Company's strategic,

operational and acquisition plans, contain forward-looking statements. These forward-looking statements involve known and unknown risks

and uncertainties and are based on current expectations, assumptions, estimates and projections about the Company and the industry. Forward-looking

statements involve inherent risks and uncertainties, including but not limited to: the Company's ability to continue to innovate and

provide attractive products and services to retain and grow its user base; the Company's ability to keep up with technological developments

and users' changing demands in the internet industry; the Company's ability to convert its users into subscribers of its premium services;

the Company's ability to deal with existing and potential copyright infringement claims and other related claims; the Company’s

ability to react to the governmental actions for its scrutiny of internet content in China and the Company's ability to compete effectively.

Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you

that its expectations will turn out to be correct, and investors are cautioned that actual results may differ materially from the anticipated

results. Further information regarding risks and uncertainties faced by the Company is included in the Company's filings with the U.S.

Securities and Exchange Commission. All information provided in this press release is as of the date of the press release, and the Company

undertakes no obligation to update any forward-looking statements to reflect subsequent occurring events or circumstances, or changes

in its expectations, except as may be required by law.

About Non-GAAP Financial Measures

To supplement Xunlei's consolidated financial

results presented in accordance with United States Generally Accepted Accounting Principles ("GAAP"), Xunlei uses the following

measures defined as non-GAAP financial measures by the United States Securities and Exchange Commission: (1) non-GAAP operating income,

(2) non-GAAP net income, (3) non-GAAP basic and diluted earnings per share for common shares, and (4) non-GAAP basic and diluted earnings

per ADS. The presentation of the non-GAAP financial information is not intended to be considered in isolation or as a substitute for

the financial information prepared and presented in accordance with GAAP.

Xunlei believes that these non-GAAP financial

measures provide meaningful supplemental information to investors regarding the Company's operating performance by excluding share-based

compensation expenses, which is not expected to result in future cash payments. These non-GAAP financial measures also facilitate management's

internal comparisons to Xunlei's historical performance and assist the Company's financial and operational decision making. A limitation

of using these non-GAAP financial measures is that these non-GAAP measures exclude share-based compensation charge that has been and

will continue to be for the foreseeable future a recurring expense in Xunlei's results of operations. Management compensates for these

limitations by providing specific information regarding the GAAP amounts excluded from each non-GAAP measure. The accompanying reconciliation

tables at the end of this release include details on the reconciliations between GAAP financial measures that are most directly comparable

to the non-GAAP financial measures the Company has presented.

XUNLEI LIMITED

UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts

expressed in thousands of USD, except for share, per share (or ADS) data)

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

US$ | | |

US$ | |

| Assets | |

| | |

| |

| | |

| | |

| |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

| 127,607 | | |

| 170,802 | |

| Short-term investments | |

| 144,902 | | |

| 101,078 | |

| Accounts receivable, net | |

| 34,340 | | |

| 31,210 | |

| Inventories | |

| 1,918 | | |

| 2,219 | |

| Due from related parties | |

| 12,915 | | |

| 12,644 | |

| Prepayments and other current

assets | |

| 10,593 | | |

| 9,423 | |

| Total current assets | |

| 332,275 | | |

| 327,376 | |

| | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | |

| Restricted cash | |

| 300 | | |

| - | |

| Long-term investments | |

| 31,700 | | |

| 32,134 | |

| Deferred tax assets | |

| 553 | | |

| 478 | |

| Property and equipment, net | |

| 58,430 | | |

| 60,028 | |

| Intangible assets, net | |

| 5,732 | | |

| 5,697 | |

| Goodwill | |

| 20,790 | | |

| 20,826 | |

| Due from a related party, non-current portion | |

| 19,615 | | |

| 19,619 | |

| Long-term prepayments and other non-current assets | |

| 3,292 | | |

| 1,953 | |

| Right-of-use assets | |

| 483 | | |

| 575 | |

| Total assets | |

| 473,170 | | |

| 468,686 | |

| | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

| 25,513 | | |

| 24,430 | |

| Due to related parties | |

| 17 | | |

| - | |

| Contract liabilities, current portion | |

| 37,558 | | |

| 36,375 | |

| Lease liabilities | |

| 375 | | |

| 276 | |

| Income tax payable | |

| 7,892 | | |

| 6,391 | |

| Accrued liabilities and other payables | |

| 56,458 | | |

| 53,708 | |

| Short-term bank borrowings and current

portion of long-term bank borrowings | |

| 7,853 | | |

| 6,906 | |

| Total current liabilities | |

| 135,666 | | |

| 128,086 | |

| | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | |

| Contract liabilities, non-current portion | |

| 881 | | |

| 846 | |

| Lease liabilities, non-current portion | |

| 136 | | |

| 229 | |

| Deferred tax liabilities | |

| 472 | | |

| 513 | |

| Bank borrowings, non-current portion | |

| 9,251 | | |

| 15,539 | |

| Total liabilities | |

| 146,406 | | |

| 145,213 | |

| | |

| | | |

| | |

| Equity | |

| | | |

| | |

| Common shares (US$0.00025 par value, 1,000,000,000 shares authorized, 375,001,940

shares issued and 323,525,556 shares outstanding as at December 31, 2023; 375,001,940 issued and 321,875,001 shares outstanding as

at March 31, 2024) | |

| 80 | | |

| 81 | |

| Additional paid-in-capital | |

| 482,237 | | |

| 482,484 | |

| Accumulated other comprehensive loss | |

| (19,017 | ) | |

| (18,913 | ) |

| Statutory reserves | |

| 8,142 | | |

| 8,142 | |

| Treasury shares (51,476,384 shares and 53,126,939 shares as at December 31,

2023 and March 31, 2024, respectively) | |

| 13 | | |

| 12 | |

| Accumulated deficits | |

| (143,305 | ) | |

| (146,944 | ) |

| Total Xunlei Limited's shareholders' equity | |

| 328,150 | | |

| 324,862 | |

| Non-controlling interests | |

| (1,386 | ) | |

| (1,389 | ) |

| Total liabilities and shareholders'

equity | |

| 473,170 | | |

| 468,686 | |

XUNLEI LIMITED

Unaudited

Condensed Consolidated Statements of Income

(Amounts

expressed in thousands of USD, except for share, per share (or ADS) data)

| |

|

Three

months ended |

|

| |

|

Mar 31, |

|

|

Dec 31, |

|

|

Mar 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2023 |

|

| |

|

US$ |

|

|

US$ |

|

|

US$ |

|

| Revenues, net of rebates

and discounts |

|

|

80,359 |

|

|

|

77,143 |

|

|

|

99,226 |

|

| Business taxes and surcharges |

|

|

(379 |

) |

|

|

(287 |

) |

|

|

(314 |

) |

| Net revenues |

|

|

79,980 |

|

|

|

76,856 |

|

|

|

98,912 |

|

| Costs of revenues |

|

|

(37,139 |

) |

|

|

(36,785 |

) |

|

|

(59,315 |

) |

| Gross profit |

|

|

42,841 |

|

|

|

40,071 |

|

|

|

39,597 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development expenses |

|

|

(17,642 |

) |

|

|

(19,497 |

) |

|

|

(18,046 |

) |

| Sales and marketing expenses |

|

|

(10,061 |

) |

|

|

(9,350 |

) |

|

|

(9,280 |

) |

| General and administrative expenses |

|

|

(11,132 |

) |

|

|

(11,618 |

) |

|

|

(11,722 |

) |

| Credit loss write-back /(expenses), net |

|

|

26 |

|

|

|

(293 |

) |

|

|

181 |

|

| Total operating expenses |

|

|

(38,809 |

) |

|

|

(40,758 |

) |

|

|

(38,867 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income/(loss) |

|

|

4,032 |

|

|

|

(687 |

) |

|

|

730 |

|

| Interest income |

|

|

1,221 |

|

|

|

1,318 |

|

|

|

1,049 |

|

| Interest expense |

|

|

(242 |

) |

|

|

(300 |

) |

|

|

(430 |

) |

| Other income, net |

|

|

290 |

|

|

|

3,523 |

|

|

|

1,353 |

|

| Income

before income taxes |

|

|

5,301 |

|

|

|

3,854 |

|

|

|

2,702 |

|

| Income tax expenses |

|

|

(1,663 |

) |

|

|

(137 |

) |

|

|

(1,484 |

) |

| Net income |

|

|

3,638 |

|

|

|

3,717 |

|

|

|

1,218 |

|

| Less: net (loss)/income attributable

to non-controlling interest |

|

|

(1 |

) |

|

|

12 |

|

|

|

92 |

|

| Net income attributable to common

shareholders |

|

|

3,639 |

|

|

|

3,705 |

|

|

|

1,126 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share for common shares |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

0.0113 |

|

|

|

0.0114 |

|

|

|

0.0035 |

|

| Diluted |

|

|

0.0112 |

|

|

|

0.0114 |

|

|

|

0.0035 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per ADS |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

0.0565 |

|

|

|

0.0570 |

|

|

|

0.0175 |

|

| Diluted |

|

|

0.0560 |

|

|

|

0.0570 |

|

|

|

0.0175 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares used in calculating: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

323,341,607 |

|

|

|

325,898,568 |

|

|

|

325,070,439 |

|

| Diluted |

|

|

323,491,768 |

|

|

|

326,160,722 |

|

|

|

325,635,649 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of ADSs

used in calculating: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

64,668,321 |

|

|

|

65,179,714 |

|

|

|

65,014,088 |

|

| Diluted |

|

|

64,698,354 |

|

|

|

65,232,144 |

|

|

|

65,127,130 |

|

XUNLEI

LIMITED

Reconciliation

of GAAP and Non-GAAP Results

(Amounts

expressed in thousands of USD, except for share, per share (or ADS) data)

| | |

Three

months ended | |

| | |

Mar 31, | | |

Dec 31, | | |

Mar 31, | |

| | |

2024 | | |

2023 | | |

2023 | |

| | |

US$ | | |

US$ | | |

US$ | |

| GAAP operating income/(loss) | |

| 4,032 | | |

| (687 | ) | |

| 730 | |

| Share-based compensation expenses | |

| 901 | | |

| 787 | | |

| 4,303 | |

| Non-GAAP operating income | |

| 4,933 | | |

| 100 | | |

| 5,033 | |

| | |

| | | |

| | | |

| | |

| GAAP net income | |

| 3,638 | | |

| 3,717 | | |

| 1,218 | |

| Share-based compensation expenses | |

| 901 | | |

| 787 | | |

| 4,303 | |

| Non-GAAP net income | |

| 4,539 | | |

| 4,504 | | |

| 5,521 | |

| | |

| | | |

| | | |

| | |

| GAAP earnings per share for common shares: | |

| | | |

| | | |

| | |

| Basic | |

| 0.0113 | | |

| 0.0114 | | |

| 0.0035 | |

| Diluted | |

| 0.0112 | | |

| 0.0114 | | |

| 0.0035 | |

| | |

| | | |

| | | |

| | |

| GAAP earnings per ADS: | |

| | | |

| | | |

| | |

| Basic | |

| 0.0565 | | |

| 0.0570 | | |

| 0.0175 | |

| Diluted | |

| 0.0560 | | |

| 0.0570 | | |

| 0.0175 | |

| | |

| | | |

| | | |

| | |

| Non-GAAP earnings per share for common shares: | |

| | | |

| | | |

| | |

| Basic | |

| 0.0140 | | |

| 0.0138 | | |

| 0.0167 | |

| Diluted | |

| 0.0140 | | |

| 0.0138 | | |

| 0.0167 | |

| | |

| | | |

| | | |

| | |

| Non-GAAP earnings per ADS: | |

| | | |

| | | |

| | |

| Basic | |

| 0.0700 | | |

| 0.0690 | | |

| 0.0835 | |

| Diluted | |

| 0.0700 | | |

| 0.0690 | | |

| 0.0835 | |

| | |

| | | |

| | | |

| | |

| Weighted average number of common shares used in calculating: | |

| | | |

| | | |

| | |

| Basic | |

| 323,341,607 | | |

| 325,898,568 | | |

| 325,070,439 | |

| Diluted | |

| 323,491,768 | | |

| 326,160,722 | | |

| 325,635,649 | |

| | |

| | | |

| | | |

| | |

| Weighted average number of ADSs used in calculating: | |

| | | |

| | | |

| | |

| Basic | |

| 64,668,321 | | |

| 65,179,714 | | |

| 65,014,088 | |

| Diluted | |

| 64,698,354 | | |

| 65,232,144 | | |

| 65,127,130 | |

CONTACT:

Investor Relations

Xunlei Limited

Email: ir@xunlei.com

Tel: +86 755 6111 1571

Website: http://ir.xunlei.com

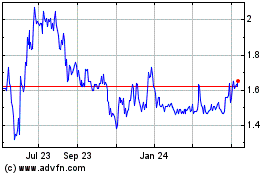

Xunlei (NASDAQ:XNET)

Historical Stock Chart

From Oct 2024 to Nov 2024

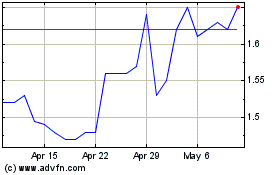

Xunlei (NASDAQ:XNET)

Historical Stock Chart

From Nov 2023 to Nov 2024