XWELL, Inc. (Nasdaq: XWEL) ("XWELL" or the "Company"), an authority

in wellness solutions for people on the go, today reported results

for the third quarter ended September 30, 2023.

Financial and Business

Highlights:

- The Company’s airport XpresSpa

business segment delivered revenue growth of approximately 39%

versus the comparable quarter in 2022.

- The Company continues to focus on

reducing its cost structure and simplifying its processes in order

to reach profitability in 2024.

- The Company realized the first

milestone of its out of airport U.S. expansion strategy with the

acquisition of profitable Naples Wax Center.

- The Company continued growing

internationally with the opening of its 11th XpresSpa location in

Abu Dhabi International Airport and the successful launch of its

retail product strategy in Europe beginning with its Amsterdam spa

locations in Schiphol Airport.

- XWELL and Ginkgo Bioworks expanded

the CDC Traveler-based Genomic Surveillance Program to test for

more than 30 known priority pathogens.

- Third quarter 2023 results included

non-cash goodwill and intangible asset impairment charges totaling

approximately $6.8 million. The non-cash charges will not have any

impact on XWELL’s cash flows or liquidity, were primarily related

to its HyperPointe segment and other intangible assets related to

Treat and are in accordance with accounting requirements.

- On a GAAP basis, the loss from

operations for the third quarter of 2023 was approximately $10.5

million. On a Non-GAAP basis, excluding the non-cash impairment

charges, the Company's loss from operations for the third quarter

of 2023 would have been $3.7 million compared with a loss of

operations of $7.1 million in the comparable quarter in 2022.

- Demonstrating the effect of the

Company’s cost-savings initiatives, third quarter 2023 total cost

of sales decreased 43% from the same quarter in 2022 and third

quarter 2023 general and administrative expenses decreased 35% from

the third quarter of 2022.

“Our entire team remains focused on executing

its operational excellence strategy to optimize its cost structure

and simplify its business processes to return to profitability as

quickly as possible,” commented Scott Milford, XWELL’s Chief

Executive Officer. “During the quarter, we advanced our retail

growth initiatives, continued to grow internationally, and extended

the long-term value of our biosurveillance partnership. Further

accelerating our growth potential, we acquired Naples Wax Center

near the end of the quarter. A foundation for our out of airport

business, Naples Wax Center is well-situated with multiple growth

levers including expansion across the Southeast, cross-selling

opportunities, and adding new Wellness services to their

locations.”

Mr. Milford added, “As we expand our wellness

portfolio further, including plans to extend into other

transportation hubs, continued off-airport growth through M&A,

and launching a new platform for independent Wellness providers,

our organization has become better structured to deliver consistent

growth. We remain committed to improving our operating performance

and profitability in 2024.”

Travel Wellness Portfolio - XpresSpa®

and Treat™XpresSpa and its Treat brand are leading airport

retailers of wellness services and related products, with 34

locations in 15 airports globally.

In October 2023, XpresSpa launched a new

website, www.xpresspa.com that includes an updated menu of services

such as stretch as well as a new scheduling tool allowing travelers

to make appointments for services before they arrive at the

airport. The website was rolled out along with a strategic brand

re-design that coincided with XpresSpa’s 20th anniversary.

XWELL also continues to innovate in its airport

locations bringing new technologies and trends, including new

tech-forward equipment, adding new products in-store and on-line,

as well as deploying plans to refresh the look and appearance of

some XpresSpa locations. These automated offerings include Novo XT

massage chairs, HydroMassage units and fully autonomous, AI-powered

express manicure units, provide self-care to guests while bringing

operational efficiency to the Company’s business model.

This week, the Company is celebrating the grand

opening of a new XpresSpa in Abu Dhabi International Airport. The

new spa is a valuable extension to its portfolio and is poised to

capitalize on a growing UAE traveler base, which saw approximately

52 million passengers move through Abu Dhabi International Airport

and Dubai International Airport in the first six months of 2023.

Strategically, XWELL’s continued international expansion allows

management the opportunity to further leverage its expertise in

providing premium wellness services to more international

passengers who appreciate health and wellness services and are

willing to spend more in pursuit of their well-being. To further

strengthen its international position, XpresSpa launched its

successful retail strategy internationally during the quarter

beginning with its locations in Schiphol Airport in Amsterdam.

In addition to retail unit growth, XWELL is

actively pursuing plans to extend its reach across other

transportation hubs such as train stations and other travel venues.

Details will be announced upon execution of lease agreements.

Out-of-Airport Wellness Portfolio -

Naples Wax Center®XWELL’s first off-airport brand, Naples

Wax Center, is a group of upscale hair removal and aesthetic

services boutiques with current locations in Florida. Acquired in

mid-September 2023 for approximately $1.5 million, Naples Wax

Center provides core products and service including face and body

waxing as well as a range of skincare and cosmetic products from

its current three locations. XWELL intends to grow the Naples Wax

Center portfolio by 8-10 locations during the next 12-18 months and

intends to expand Naples Wax Centers into a full-service aesthetic

experience. Management will share additional details

about its off-airport expansion strategy as those details are

finalized.

The Company also continues to pursue

opportunities for new acquisitions that will complement XWELL’s out

of airport growth strategy with the goal of making wellness and

self-care more approachable to more customers.

Life Sciences & Biosurveillance --

XpresCheck® and HyperPointe™The Company XpresTest, Inc.

subsidiary (“XpresCheck”), in collaboration with the Centers for

Disease Control and Prevention (“CDC”) and Ginkgo Bioworks (NYSE:

DNA), currently operates eight biosurveillance stations in six of

the nation’s busiest airports. On August 17, 2023, the Company

announced that the CDC renewed the traveler-based SARS-CoV-2

Genomic Surveillance program through a new one-year contract. The

partnership supports public health and biosecurity services with a

contract value totaling approximately $16 million.

More recently, on November 6, 2023, XWELL and

Ginkgo announced they’re expanding their work with the CDC’s

Traveler-based Genomic Surveillance program (TGS) to test for more

than 30 additional priority pathogens, in addition to SARS-CoV-2.

The program expansion launched in late October 2023 at four of the

program’s six major international airports (New York, JFK, San

Francisco, Boston, and Washington DC, Dulles).

TGS is a flexible, multimodal platform that

consists of three complementary approaches of sample collection

from arriving international travelers at U.S. airports, including

voluntary nasal swabbing, aircraft wastewater, and airport

wastewater sampling to enhance early detection of new SARS-CoV-2

variants and other pathogens, and fills gaps in global

surveillance.

As background, in late 2021, in collaboration

with the CDC and Ginkgo Bioworks, XpresCheck began conducting

biosurveillance monitoring aimed at identifying existing and new

SARS-CoV-2 variants. During the third quarter of 2022, XpresCheck,

in partnership with Ginkgo Bioworks were awarded a new contract in

continuation of their support to the CDC’s traveler-based

SARS-CoV-2 Genomic Surveillance program. In the first quarter of

2023, in addition to SARS-CoV-2, XpresCheck and Ginkgo

Bioworks expanded their support of the program to include a

pilot study monitoring influenza viruses. This provided an

additional source of viral surveillance to inform the selection of

influenza vaccine viruses for the 2023-2024 flu season.

Additionally, at the beginning of the third

quarter of 2023, the Company began reporting operating results for

HyperPointe within its XpresCheck business. Beginning in June 2020,

and following its acquisition by XWELL in January 2022,

HyperPointe’s management team and suite of services and technology

have been utilized to develop and deploy the technological

infrastructure necessary to scale the growth of the XpresCheck

business. HyperPointe’s experience in this space continues to play

a critical role in the expansion of ongoing biosurveillance efforts

created in partnership with Ginkgo Bioworks and the CDC.

HyperPointe is a leading digital healthcare and

data analytics relationship marketing agency, servicing the global

healthcare and pharmaceutical industry. HyperPointe has significant

experience in patient and healthcare professional marketing and

deep technological experience with CXM (customer experience

management) and data analytics.

Liquidity and Financial

ConditionAs of September 30, 2023, the Company had cash

and cash equivalents, excluding restricted cash, of approximately

$4.8 million, marketable securities of approximately $21.3 million,

total net working capital of approximately $21.7 million, and no

long-term debt.

Summary Third Quarter 2023 Financial

ResultsTotal revenue during the third quarter ended

September 30, 2023, was $7.5 million compared to $10.7 million in

the prior year third quarter. The decline in revenue was primarily

related to the relaxation of COVID-19 testing requirements by the

United States and other countries in 2022 and the closure of

XpresCheck locations.

Revenue for the third quarter of 2023 primarily

consisted of approximately $5.0 million from XpresSpa locations and

Treat locations and $4.2 million from XpresTest, which includes

XWELL’s bio-surveillance partnership and its HyperPointe segment.

Of note, while Naples Wax Center revenue was nominal given it was

acquired near the end of the third quarter of 2023, it is expected

to contribute more fully to future period revenues and operating

results.

Non-Cash Goodwill and Intangible Asset

Impairment ChargesIn accordance with accounting requirements, third

quarter 2023 results included non-cash goodwill and intangible

asset impairment charges totaling approximately $6.8 million,

primarily related to its HyperPointe unit and other intangible

assets related to Treat.

Additional details of the impairment charge and

its impact on the Company's financial statements will be included

in XWELL’s quarterly report on Form 10-Q filed with the SEC. XWELL

accounts for goodwill under FASB ASC 350-30, Intangibles-Goodwill

and Other. Goodwill represents the cost of a business acquisition

in excess of the fair value of the net assets acquired. Goodwill is

not amortized and is reviewed for impairment annually, or more

frequently if facts and circumstances indicate that it is more

likely than not that the fair value of a reporting unit is less

than its carrying amount, including goodwill. If the carrying

amount exceeds fair value, goodwill of the reporting unit is

considered impaired, and that excess is recognized as a goodwill

impairment loss.

The non-cash impairment charge will not have any

impact on the cash flows or liquidity. Additionally, HyperPointe

remains key to the operating strategy of Company’s XpresCheck

segment and does not alter XWELL’s positive outlook for its

bio-surveillance business.

Cost of SalesCost of sales decreased to

approximately $6.4 million for the third quarter of 2023 compared

with approximately $9.3 million in the third quarter of 2022.

Operating ExpensesTotal operating expenses were

approximately $11.6 million for the third quarter of 2023, compared

to approximately $9.0 million for the comparable 2022 quarter. This

increase was primarily the result of non-cash impairment charges

incurred during the third quarter of 2023. On a Non-GAAP basis,

excluding non-cash impairment charges, the Company's total

operating expenses for the third quarter of 2023 would have been

$4.8 million.

Income from OperationsThird quarter 2023 results

included non-cash impairment charges totaling approximately $6.8

million. On the GAAP basis, the loss from operations for the third

quarter of 2023 was approximately $10.5 million compared with a

loss from operations of $7.7 million in the comparable quarter in

2022. On a Non-GAAP basis, excluding non-cash impairment charges,

the Company's loss from operations for the third quarter of 2023

would have been $3.7 million.

Net Income Attributable to Common

ShareholdersNet loss attributable to common shareholders was

approximately $10.6 million for the third quarter of 2023 compared

to net loss attributable to common shareholders of approximately

$7.8 million in the third quarter of 2022.

About XWELL, Inc. XWELL,

Inc. (Nasdaq: XWEL) is a leading global health and wellness holding

company operating multiple brands: XpresSpa®, Treat™, Naples Wax

Center®, XpresCheck® and HyperPointe™.

- XpresSpa and its Treat brand are

leading airport retailers of wellness services and related

products, with 34 locations in 15 airports globally.

- Naples Wax Center is a group of

upscale skin care boutiques, with three locations currently

operating.

- XpresCheck is a provider of

screening and diagnostic testing in partnership with the CDC and

Concentric by Ginkgo, conducting bio-surveillance monitoring in its

airport locations to identify new SARS-CoV2 variants of interest

and concern as well as other pathogens entering the country from

across the world.

- HyperPointe is a leading digital

healthcare and data analytics relationship company serving the

global healthcare industry.

Forward-Looking Statements

This press release may contain "forward-looking"

statements within the meaning of Section 27A of the Securities Act

of 1933, and Section 21E of the Securities Exchange Act of 1934.

These include statements preceded by, followed by or that otherwise

include the words "believes," "expects," "anticipates,"

"estimates," "projects," "intends," "should," "seeks," "future,"

"continue," or the negative of such terms, or other comparable

terminology. Forward-looking statements relating to expectations

about future results or events, including the Company’s current

plans and expectations relating to the business and operations and

future store openings for Naples Wax Center, are based upon

information available to XWELL as of today's date and are not

guarantees of the future performance of the Company, and actual

results may vary materially from the results and expectations

discussed. Additional information concerning these and other risks

is contained in the Company’s Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K, and

other Securities and Exchange Commission filings. All

subsequent written and oral forward-looking statements concerning

XWELL, or other matters and attributable to XWELL or any person

acting on its behalf are expressly qualified in their entirety by

the cautionary statements above. XWELL does not undertake any

obligation to publicly update any of these forward-looking

statements to reflect events or circumstances that may arise after

the date hereof.

MediaMike

ReillyMWWmreilly@mww.com

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d1fb7f9f-a0fb-4061-bdae-1e145f4888f9

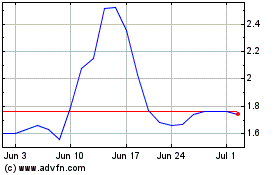

XWELL (NASDAQ:XWEL)

Historical Stock Chart

From Dec 2024 to Jan 2025

XWELL (NASDAQ:XWEL)

Historical Stock Chart

From Jan 2024 to Jan 2025