CPC Issues Letter to Fellow XWELL, Inc. Shareholders Revealing Intention Behind Recent Schedule 13D Filing & Lawsuit Against Entrenched Board of Directors

24 July 2024 - 11:00PM

Today, CPC Pain & Wellness SPV, LLC (“CPC”), a

significant XWELL, Inc. (Nasdaq: XWEL) (“XWELL” or the “Company”)

shareholder that beneficially owns 394,200 or 9.42% of XWELL’s

outstanding shares, issued the below letter to its fellow

shareholders. The letter informs shareholders of CPC’s recent

lawsuit filing against the incumbent members of XWELL’s Board of

Directors for breach of their fiduciary duties and for the Board’s

wrongful and inequitable efforts to prevent CPC from nominating a

competing slate of directors and consequently denying shareholders

the opportunity to choose who they elect to XWELL’s Board at the

upcoming annual shareholder meeting. In its letter, CPC details how

current Board members have personally benefited from XWELL while

overseeing an astounding decline in XWELL shareholder value and

substantial net losses. CPC also shares in the below letter its

vision for restoring and maximizing shareholder value.

The full text of CPC’s letter to fellow XWELL

shareholders is below.

July 24, 2024

Dear Fellow Shareholders:

On Friday, July 19, 2024, CPC Pain &

Wellness SPV, LLC (“CPC”) filed suit against incumbent members of

XWELL’s Board of Directors (the “Board”), Chairman Bruce T.

Bernstein and directors Michael Lebowitz, Robert Weinstein, Gaëlle

Wizenberg, and Scott R. Milford (collectively, the “Entrenched

Directors”), for, among other reasons, breach of their fiduciary

duties and unlawful, unenforceable, and inequitable application of

XWELL’s bylaws to reject CPC’s notice of intent to propose its own

slate of directors for election at the 2024 annual shareholder

meeting. This rejection by the Entrenched Directors prohibits you,

our fellow shareholders, from having any other choice beyond the

slate of incumbent directors, who through negligence, self-interest

and complacency have decimated the value of the Company in which

you are invested.

CPC—which beneficially owns 394,200 XWELL shares

or, based on the most recent practicable information on XWELL’s

outstanding share numbers, 9.42% of outstanding XWELL shares—was

compelled to file suit when the named Entrenched Directors

improperly and inequitably invoked an advance notice bylaw

provision included in XWELL’s Third Amended and Restated Bylaws

(the “Bylaws”) to prevent any reasonable opportunity for CPC to

nominate individuals to stand for election to the Board at the not

yet scheduled 2024 XWELL annual shareholder meeting. At 9:00 p.m.

(EDT) on June 21, 2024, the Entrenched Directors used the Bylaws as

a sword to unlawfully and inequitably reject CPC’s director

nomination notice, demanding a response—with less than 48 hours’

notice—by “close of business” on Sunday, June 23, 2024. CPC

provided a thorough response by the suggested deadline only to then

have XWELL once again unreasonably reject CPC’s nominations—citing

pretextual, inaccurate and nonexistent deficiencies—and, this time,

disallowing CPC to further respond to correct any perceived

deficiencies. Through these actions, it is evident that the

Entrenched Directors intend to embed themselves in office at all

costs by preventing XWELL’s shareholders from nominating a

competing slate of director candidates—ultimately denying XWELL

shareholders the opportunity to choose who they elect to the Board

at the annual meeting of shareholders later this year.

The Entrenched Directors have good reason to

want to insulate themselves from shareholder opinions and votes,

having personally benefited while overseeing an astounding decline

in XWELL shareholder value and substantial net losses. On February

8, 2016—the day Bernstein joined the Board—the closing price of

XWELL’s common stock was $1,788 per share (accounting for

subsequent reverse stock splits) on the Nasdaq exchange. Since

February 2016, XWELL’s common stock has declined in value by

approximately 99%. As of July 23, 2024, XWELL’s stock closed at

approximately $1.85 per share.

Along with its staggering loss in market value,

XWELL has reported a combined net operating loss of $207.3 million

from 2018 through 2023. XWELL’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2023, discloses revenue decreased

from $55.9 million in 2022 to $30.1 million in 2023 and its

shareholder equity dropped from $39.9 million to $13 million in the

same period. XWELL is also burning through its cash, going from

cash and cash equivalents of more than $109.1 million in the third

quarter of 2021 to approximately $19.1 million in the first quarter

of 2024, and is failing to generate revenue that will slow its cash

depletion or return the Company to profitability. Our proposed

slate of directors is looking to heighten the focus on cost

efficiencies and controls, driving the core business towards

profitability and being cash flow positive.

The aforementioned failings of XWELL have come

during the reign of Chairman Bernstein, who has never worked in the

healthcare, medical, pharmaceutical or wellness industries; who has

no experience operating spas or wellness centers—XWELL’s core

businesses; and who has earned no degrees in business or the

natural sciences. Bernstein currently serves as a director for

several other public companies, and on average those entities have

lost 79.9% of their value since he joined their boards. Based on

available SEC filings, Bernstein has earned compensation in excess

of $2.3 million from those other public companies. Bernstein yields

significant control of XWELL, serving on every committee of the

XWELL Board and chairing all but one of them. Bernstein received

cash and stock valued at $1,605,554 million for his services to

XWELL and its affiliates in 2021 and $424,022 and $338,450 for his

services in 2022 and 2023, respectively. Berstein owns or has

options to purchase 1.9% of the issued and outstanding shares of

XWELL’s common stock.

The Entrenched Directors have not done anything

meaningful to reverse the near complete loss of XWELL’s value. For

example, under the reign of Chairman Bernstein, the Entrenched

Directors have: (i) failed to increase XWELL’s revenue streams or

decrease its costs such that the Company returns to profitability;

(ii) failed to explain to XWELL’s shareholders their strategic

plan, if any, to improve XWELL’s financial condition; (iii)

struggled to expand the Company from an airport-based studio model

to both an airport and off-airport based service model; and (iv)

regularly awarded and paid themselves large compensation packages

at the expense of shareholders.

Shareholders have not had an opportunity to

alter the strategic direction of XWELL; at every annual shareholder

meeting since 2016, candidates nominated by the Board have run

unopposed. On June 17, 2024, CPC sought to change this and

delivered to XWELL its director nomination notice, which nominated

four highly experienced individuals—the CPC Nominees—for election

to the Board at this year’s not yet scheduled annual shareholder

meeting. However, as noted above, the Entrenched Directors took

every measure to obstruct CPC’s efforts to nominate a competing

slate of directors for election at the annual shareholder

meeting.

CPC’s vision is clear:

- Position XWELL

for sustained shareholder value creation by replacing the current

Board of Directors with directors who will put the shareholders’

interests ahead of their own personal financial gain;

- Improve the

health of XWELL’s current business by containing cost and

eliminating non-profitable sites, services and products in order to

stop the existing cash burn and preserve cash on the balance sheet;

and

- Explore a

strategy to use the Company’s cash to acquire high-demand,

high-margin businesses with significant positive cash flow in the

health and wellness space.

XWELL shareholders deserve the opportunity to

elect directors to the Board who possess the leadership,

appropriate background and expertise needed to successfully

navigate a course to profitability; who bring knowledge and

integrity to the table; and whose dedication to creating

shareholder value eclipses a propensity for self-gain.

Sincerely,

Richard WaldoManaging Member, CPC Pain & Wellness SPV,

LLC

Contact: MZ North America ABETTERXWELL@mzgroup.us

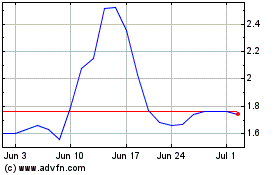

XWELL (NASDAQ:XWEL)

Historical Stock Chart

From Oct 2024 to Nov 2024

XWELL (NASDAQ:XWEL)

Historical Stock Chart

From Nov 2023 to Nov 2024