Yoshiharu Global Co. (NASDAQ: YOSH) ("Yoshiharu" or the "Company"),

a restaurant operator specializing in authentic Japanese ramen

& rolls, today reported results for the third quarter ended

September 30, 2024.

Third Quarter 2024 and Recent Operational

Highlights

- Grand opening of a new restaurant

in San Clemente, CA, bringing the number of locations to 15 with 2

additional locations under construction.

- Entered into a non-binding

Memorandum of Understanding (“MoU”) with Chengdu Octaday

Entertainment Group through a Master License Agreement (“MLA”) for

the Sichuan Province in China to introduce Yoshiharu Global’s

Expanding Cuisine in Sichuan Province, China, with a rich and

diverse culture and home to over 83 million people.

- Entered into a non-binding MoU with

Xing Sheng Group through a MLA for the Liaoning Province in China

to introduce a new flagship Yoshiharu restaurant in Shenyang,

China, home to over 43 million people.

- Announced the planned entry into

the lucrative and growing Korean BBQ (“KBBQ”) category, with

synergies with existing ramen business expected to drive expanding

market opportunity and footprint in high growth category.

- Closed a non-brokered $1.0 million

private placement investment from an accredited investor and

intends to use these proceeds for the expansion into the KBBQ

segment.

- Nine months 2024 revenue increased

36.3% to $9.2 million.

- Restaurant-level contribution

increased to $1.0 million for the nine-months ended September 30,

2024 from $543,000 in the same period last year.

Management Commentary

“The third quarter of 2024 was highlighted by

strong revenue growth, the grand opening of our 15th location, and

new partnerships and initiatives, all positioning us to grow the

brand and move us steadily towards profitability,” said James Chae,

Yoshiharu’s President, CEO and Chairman of the Board. “In the

quarter, revenue growth was driven by our restaurant service across

Southern California, Las Vegas and diversified mix of service

channels, including takeout and delivery. We have successfully

optimized operating expenses while maintaining a strong Average

Unit Volume (“AUV”) comparable to previous periods, despite

continued headwinds from input costs, consumer price sensitivity,

and higher cost of capital.

“We continued to expand our presence and cuisine

in both the US and international dining scenes in the third

quarter. We celebrated the grand opening of our newest US location

in San Clemente, CA, a classic beach town destination known for its

beaches, world class surfing and vibrant dining scene. The new

location benefits from excellent access and high visibility to I-5,

drawing an estimated 8,300 visits a day and over 3 million visits a

year, surrounded by an affluent population of more than 69,000 with

an average household income of over $145,000 within a 3-mile

radius.

“In China, two new strategic non-binding

Memorandum of Understandings (“MoU”) through Master License

Agreements (“MLA”) will enable us to open locations across China.

With Chengdu Octaday Entertainment Group, we are aiming to

introduce Yoshiharu Global’s expanding cuisine in Sichuan Province,

China, home to over 83 million people. The partnership presents

multiple opportunities to open locations within Chengdu Octaday’s

30 corporate owned and managed hotels, theme parks and other

destination attractions. We also partnered with Xing Sheng Group to

introduce a new flagship Yoshiharu restaurant in Shenyang, China,

home to over 43 million people. Xing Sheng Group’s real estate arm

specializes in developing tourist attraction centers in Shenyang

and is currently constructing China’s largest water park. This

partnership offers us a prime opportunity to develop a flagship

location within the water park, catering to both local residents

and visiting tourists.

“Recently we announced a new initiative to enter

the lucrative and growing Korean BBQ (“KBBQ”) category, a highly

complementary addition to our ramen business. Demand for KBBQ

cuisine in the US has grown along with the popularity of Korean

street food and the interest in new international flavors. The

communal and interactive nature of KBBQ, with its extensive menus

and relatively affordable prices, is a large part of this appeal.

Armed with a $1.0 investment for this initiative, we believe we can

capitalize on the resource and ingredient synergies between our

existing offerings and KBBQ concept to enhance purchasing power,

attract a wider audience, and explore cross-promotion opportunities

to further solidify and expand the Yoshiharu brand. We also plan to

explore further collaborative opportunities with Xing Sheng

Group.

“Looking ahead, we are expanding our US

geographic footprint with two more locations currently under

construction and expected to open in Menifee, CA in December 2024

and Ontario, CA in January 2025. We continue to focus on the

bottom-line as we remain keen on reaching profitability in the near

future, supported by new initiatives such as adding kiosks across

our stores and utilizing cooking robots to reduce labor costs. We

are poised for additional growth with two new partnerships in China

and expansion into the Korean BBQ segment. Taken together, we

believe our multi-dimensional growth strategy will expand the

Yoshiharu brand and build long-term shareholder value,” concluded

Chae.

Third Quarter 2024 Financial

Results

Revenues increased 48.9% to $3.0 million

compared to $2.0 million in the prior year period. The increase was

primarily driven by the three new Las Vegas restaurants acquired in

April 2024.

Total restaurant operating expenses were $3.1

million compared to $2.2 million in the prior year period. The

increase was primarily driven by increases in revenues from the

three new Las Vegas restaurants acquired.

Operating loss increased to ($1.0) million

compared to a loss of ($0.8) million in the prior year period as a

result of higher general and administrative driven by the

acquisition of Las Vegas entities.

Adjusted EBITDA, a non-GAAP measure defined

below, was $(0.7) million compared to $(0.6) million in the prior

year period.

Net loss was ($1.2) million compared to a net

loss of ($0.9) million in the prior year period primarily due to an

increase in expenses following the acquisition of Las Vegas.

Nine Months 2024 Financial

Results

Revenues increased 36.3% to $9.2 million

compared to $6.7 million in the prior year period. The increase was

primarily driven by three new Las Vegas restaurants acquired in

April 2024.

Restaurant-level contribution margin was 11.0%

compared to 8.1% in the prior period with the increase in revenue

from the LV acquisition and the management efforts to control the

costs.

Total restaurant operating expenses were $8.7

million compared to $6.6 million in the prior year period. The

increase was due to increases in in revenue. As a percentage of the

revenue, the operating expenses were 96% compared to 98% in the

prior period.

Operating loss improved to ($2.8) million

compared to a loss of $(2.9) million in the prior year period.

Adjusted EBITDA, a non-GAAP measure defined

below, was $(1.9) million compared to $(2.0) million in the prior

year period.

Net loss was $3.2 million compared to a net loss

of $3.0 million in the prior year period. The increase was

primarily due to an increase in expenses following the acquisition

of Las Vegas.

The Company’s cash balance totaled $1.7 million

on September 30, 2024, compared to $1.4 million on December 31,

2023.

For more information regarding Yoshiharu’s

financial results, including financial tables, please see our Form

10-Q for quarter ended September 30, 2024 filed with the U.S.

Securities and Exchange Commission (the “SEC"). The Company’s SEC

filings can be found on the SEC’s website at www.sec.gov or the

Company’s investor relations site at ir.yoshiharuramen.com.

About Yoshiharu Global Co.

Yoshiharu is a fast-growing restaurant operator

and was born out of the idea of introducing the modernized Japanese

dining experience to customers all over the world. Specializing in

Japanese ramen, Yoshiharu gained recognition as a leading ramen

restaurant in Southern California within six months of its 2016

debut and has continued to expand its top-notch restaurant service

across Southern California and Las Vegas, currently owning and

operating 14 restaurants.

For more information, please visit

www.yoshiharuramen.com.

Non-GAAP Financial Measures

EBITDA is defined as net income (loss) before

interest, income taxes and depreciation and amortization. Adjusted

EBITDA is defined as EBITDA plus stock-based compensation expense,

non-cash lease expense and asset disposals, closure costs and

restaurant impairments, as well as certain items, such as employee

retention credit, litigation accrual, and certain executive

transition costs, that we believe are not indicative of our core

operating results. Adjusted EBITDA margin is defined as Adjusted

EBITDA divided by sales. EBITDA, and Adjusted EBITDA are non-GAAP

measures which are intended as supplemental measures of our

performance and are neither required by, nor presented in

accordance with, GAAP. The Company believes that EBITDA, and

Adjusted EBITDA provide useful information to management and

investors regarding certain financial and business trends relating

to its financial condition and operating results. However, these

measures may not provide a complete understanding of the operating

results of the Company as a whole and such measures should be

reviewed in conjunction with its GAAP financial results.

The Company believes that the use of EBITDA, and

Adjusted EBITDA provides an additional tool for investors to use in

evaluating ongoing operating results and trends and in comparing

its financial measures with those of comparable companies, which

may present similar non-GAAP financial measures to investors.

However, you should be aware when evaluating EBITDA, and Adjusted

EBITDA that in the future the Company may incur expenses similar to

those excluded when calculating these measures. In addition, the

Company’s presentation of these measures should not be construed as

an inference that its future results will be unaffected by unusual

or non-recurring items. The Company’s computation of Adjusted

EBITDA may not be comparable to other similarly titled measures

computed by other companies, because all companies may not

calculate Adjusted EBITDA in the same fashion.

Because of these limitations, EBITDA, and

Adjusted EBITDA should not be considered in isolation or as a

substitute for performance measures calculated in accordance with

GAAP. The Company compensates for these limitations by relying

primarily on its GAAP results and using EBITDA, and Adjusted EBITDA

on a supplemental basis. You should review the reconciliation of

net loss to EBITDA, and Adjusted EBITDA in the Company’s SEC

filings and not rely on any single financial measure to evaluate

its business.

The full reconciliation of net loss to EBITDA

and Adjusted EBITDA is set forth in our Form 10-Q for the quarter

ended September 30, 2024 which can be found on the SEC ‘s website

at www.sec.gov or the Company’s investor relations site at

ir.yoshiharuramen.com.

Forward Looking Statements

This press release includes certain

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995, including without

limitation, statements regarding our position to execute on our

growth strategy, and our ability to expand our leadership position.

These forward-looking statements include, but are not limited to,

the Company's beliefs, plans, goals, objectives, expectations,

assumptions, estimates, intentions, future performance, other

statements that are not historical facts and statements identified

by words such as "expects", "anticipates", "intends", "plans",

"believes", "seeks", "estimates" or words of similar meaning. These

forward-looking statements reflect our current views about our

plans, intentions, expectations, strategies and prospects, which

are based on the information currently available to us and on

assumptions we have made. Although we believe that our plans,

intentions, expectations, strategies and prospects as reflected in,

or suggested by, these forward-looking statements are reasonable,

we can give no assurance that the plans, intentions, expectations

or strategies will be attained or achieved. Forward-looking

statements involve inherent risks and uncertainties which could

cause actual results to differ materially from those in the

forward-looking statements, as a result of various factors

including those risks and uncertainties described in the Risk

Factors and Management's Discussion and Analysis of Financial

Condition and Results of Operations sections of our filings with

the SEC including our Form 10-K for the year ended December 31,

2023, and subsequent reports we file with the SEC from time to

time, which can be found on the SEC's website at www.sec.gov. Such

risks, uncertainties, and other factors include, but are not

limited to: the risk that our plans to maintain and increase

liquidity may not be successful to remediate our past operating

losses; the risk that we may not be able to successfully implement

our growth strategy if we are unable to identify appropriate sites

for restaurant locations, expand in existing and new markets,

obtain favorable lease terms, attract guests to our restaurants or

hire and retain personnel; that our operating results and growth

strategies will be closely tied to the success of our future

franchise partners and we will have limited control with respect to

their operations; the risk that we may face negative publicity or

damage to our reputation, which could arise from concerns regarding

food safety and foodborne illness or other matters; the risk that

that minimum wage increases and mandated employee benefits could

cause a significant increase in our labor costs; and the risk that

our marketing programs may not be successful, and our new menu

items, advertising campaigns and restaurant designs and remodels

may not generate increased sales or profits. We urge you to

consider those risks and uncertainties in evaluating our

forward-looking statements. We caution readers not to place undue

reliance upon any such forward-looking statements, which speak only

as of the date made. The Company undertakes no obligation to update

these statements for revisions or changes after the date of this

release, except as required by law.

Investor Relations

Contact:Larry W HolubDirectorMZ North

AmericaYOSH@mzgroup.us 312-261-6412

|

Yoshiharu Global Co.Unaudited Consolidated

Balance Sheets |

|

As of |

|

September 30,2024 |

|

|

December 31,2023 |

|

| |

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

1,712,064 |

|

|

$ |

1,462,326 |

|

|

Accounts receivable |

|

|

36,397 |

|

|

|

- |

|

|

Inventories |

|

|

89,462 |

|

|

|

73,023 |

|

| Total current assets |

|

|

1,837,923 |

|

|

|

1,535,349 |

|

| |

|

|

|

|

|

|

|

|

| Non-Current

Assets: |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

5,031,361 |

|

|

|

4,092,950 |

|

|

Operating lease right-of-use asset |

|

|

6,846,051 |

|

|

|

5,459,708 |

|

|

Intangible asset |

|

|

504,499 |

|

|

|

- |

|

|

Goodwill |

|

|

1,985,645 |

|

|

|

- |

|

|

Other assets |

|

|

1,106,597 |

|

|

|

1,931,357 |

|

| Total non-current assets |

|

|

15,474,153 |

|

|

|

11,484,015 |

|

| |

|

|

|

|

|

|

|

|

| Total

assets |

|

$ |

17,312,076 |

|

|

$ |

13,019,364 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

884,857 |

|

|

$ |

647,811 |

|

|

Line of credit |

|

|

1,000,000 |

|

|

|

1,000,000 |

|

|

Current portion of operating lease liabilities |

|

|

908,691 |

|

|

|

572,230 |

|

|

Current portion of bank notes payables |

|

|

169,814 |

|

|

|

414,378 |

|

|

Current portion of loan payable, EIDL |

|

|

2,669 |

|

|

|

10,536 |

|

|

Loans payable to financial institutions |

|

|

119,939 |

|

|

|

534,239 |

|

|

Due to related party |

|

|

1,770,796 |

|

|

|

24,176 |

|

|

Other payables |

|

|

1,078,291 |

|

|

|

65,700 |

|

| |

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

5,895,057 |

|

|

|

3,269,070 |

|

| Operating lease liabilities,

less current portion |

|

|

6,770,605 |

|

|

|

5,689,535 |

|

| Bank notes payables, less

current portion |

|

|

2,830,798 |

|

|

|

991,951 |

|

| Loan payable, EIDL, less

current portion |

|

|

415,422 |

|

|

|

415,329 |

|

| Notes payable to related

party |

|

|

600,000 |

|

|

|

- |

|

| Convertible notes to related

party |

|

|

1,200,000 |

|

|

|

- |

|

| Total liabilities |

|

|

17,711,882 |

|

|

|

10,365,885 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

equity |

|

|

|

|

|

|

|

|

|

Class A Common Stock - $0.0001 par value; 49,000,000 authorized

shares; 1,255,197 shares issued and outstanding at September 30,

2024 and 1,230,246 shares issued and outstanding at December 31,

2023 |

|

|

125 |

|

|

|

123 |

|

|

Class B Common Stock - $0.0001 par value; 1,000,000 authorized

shares; 100,000 shares issued and outstanding at September 30, 2024

and December 31, 2023 |

|

|

10 |

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

Additional paid-in capital |

|

|

12,143,969 |

|

|

|

11,994,119 |

|

|

Accumulated deficit |

|

|

(12,543,910 |

) |

|

|

(9,340,773 |

) |

|

Total stockholders’ equity (deficit) |

|

|

(399,806 |

) |

|

|

2,653,479 |

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

17,312,076 |

|

|

$ |

13,019,364 |

|

|

Yoshiharu Global Co.Unaudited Consolidated

Statements of Operations |

|

|

|

|

Nine months EndedSeptember

30, |

|

|

Three Months EndedSeptember

30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Food and beverage |

|

$ |

9,152,530 |

|

|

$ |

6,714,429 |

|

|

$ |

3,015,525 |

|

|

$ |

2,025,386 |

|

|

Total revenue |

|

|

9,152,530 |

|

|

|

6,714,429 |

|

|

|

3,015,525 |

|

|

|

2,025,386 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restaurant operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Food, beverages and supplies |

|

|

2,362,515 |

|

|

|

1,787,046 |

|

|

|

853,943 |

|

|

|

557,705 |

|

|

Labor |

|

|

4,125,195 |

|

|

|

3,129,198 |

|

|

|

1,344,534 |

|

|

|

1,125,717 |

|

|

Rent and utilities |

|

|

1,262,963 |

|

|

|

840,389 |

|

|

|

493,667 |

|

|

|

285,013 |

|

|

Delivery and service fees |

|

|

398,986 |

|

|

|

415,139 |

|

|

|

118,070 |

|

|

|

130,189 |

|

|

Depreciation |

|

|

596,701 |

|

|

|

396,388 |

|

|

|

246,374 |

|

|

|

144,701 |

|

|

Total restaurant operating expenses |

|

|

8,746,360 |

|

|

|

6,568,160 |

|

|

|

3,056,588 |

|

|

|

2,243,325 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net operating restaurant operating income (loss) |

|

|

406,170 |

|

|

|

146,269 |

|

|

|

(41,063 |

) |

|

|

(217,939 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

2,953,755 |

|

|

|

2,700,078 |

|

|

|

935,591 |

|

|

|

477,732 |

|

|

Related party compensation |

|

|

139,769 |

|

|

|

216,308 |

|

|

|

50,000 |

|

|

|

92,876 |

|

|

Advertising and marketing |

|

|

80,955 |

|

|

|

86,593 |

|

|

|

22,391 |

|

|

|

34,051 |

|

|

Total operating expenses |

|

|

3,174,479 |

|

|

|

3,002,979 |

|

|

|

1,007,982 |

|

|

|

604,659 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(2,768,309 |

) |

|

|

(2,856,710 |

) |

|

|

(1,049,045 |

) |

|

|

(822,598 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on disposal of fixed asset |

|

|

- |

|

|

|

8,920 |

|

|

|

- |

|

|

|

- |

|

|

Other income |

|

|

12,207 |

|

|

|

14,774 |

|

|

|

- |

|

|

|

7,784 |

|

|

Interest |

|

|

(413,598 |

) |

|

|

(186,877 |

) |

|

|

(161,472 |

) |

|

|

(48,049 |

) |

|

Total other income (expense), net |

|

|

(401,391 |

) |

|

|

(163,183 |

) |

|

|

(161,472 |

) |

|

|

(40,265 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes |

|

|

(3,169,700 |

) |

|

|

(3,019,893 |

) |

|

|

(1,210,517 |

) |

|

|

(862,863 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax provision |

|

|

33,437 |

|

|

|

29,068 |

|

|

|

11,599 |

|

|

|

22,080 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(3,203,137 |

) |

|

$ |

(3,048,961 |

) |

|

$ |

(1,222,116 |

) |

|

$ |

(884,943 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(2.39 |

) |

|

|

(2.29 |

) |

|

|

(0.91 |

) |

|

|

(0.67 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

1,342,585 |

|

|

|

1,328,847 |

|

|

|

1,343,537 |

|

|

|

1,328,847 |

|

|

Yoshiharu Global

Co.Unaudited Consolidated Statements of Cash

Flows |

|

|

|

|

For the nine months endedSeptember

30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(3,203,137 |

) |

|

$ |

(3,048,961 |

) |

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

596,701 |

|

|

|

396,388 |

|

|

Amortization |

|

|

26,552 |

|

|

|

- |

|

|

Gain on disposal of fixed asset |

|

|

- |

|

|

|

(8,920 |

) |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(36,397 |

) |

|

|

- |

|

|

Inventories |

|

|

(3,654 |

) |

|

|

390 |

|

|

Other assets |

|

|

825,960 |

|

|

|

(564,775 |

) |

|

Accounts payable and accrued expenses |

|

|

199,483 |

|

|

|

(3,118 |

) |

|

Due to related party |

|

|

1,746,620 |

|

|

|

(142,106 |

|

|

Other payables |

|

|

1,012,591 |

|

|

|

59,785 |

|

| Net cash provided by (used in)

operating activities |

|

|

1,164,719 |

|

|

|

(3,311,317 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(437,042 |

) |

|

|

(1,339,132 |

) |

|

Acquisition of LV entities |

|

|

(1,800,000 |

) |

|

|

- |

|

| Net cash used in investing

activities |

|

|

(2,237,042 |

) |

|

|

(1,339,132 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

Advance from line of credit |

|

|

- |

|

|

|

500,000 |

|

|

Proceeds from borrowings for acquisition of LV entities |

|

|

900,000 |

|

|

|

812,000 |

|

|

Proceeds from borrowings |

|

|

1,138,164 |

|

|

|

- |

|

|

Repayments on bank notes payables |

|

|

(451,655 |

) |

|

|

(645,280 |

) |

|

Repayment of loan payable to financial institutions |

|

|

(414,300 |

) |

|

|

- |

|

|

Proceeds from sale of common shares |

|

|

149,852 |

|

|

|

- |

|

| Net cash provided by financing

activities |

|

|

1,322,061 |

|

|

|

666,720 |

|

| |

|

|

|

|

|

|

|

|

| Net increase (decrease) in

cash |

|

|

249,738 |

|

|

|

(3,983,729 |

) |

| |

|

|

|

|

|

|

|

|

| Cash – beginning of

period |

|

|

1,462,326 |

|

|

|

6,138,786 |

|

| |

|

|

|

|

|

|

|

|

| Cash – end of

period |

|

$ |

1,712,064 |

|

|

$ |

2,155,057 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures of non-cash financing activities: |

|

|

|

|

|

|

|

|

|

Note payable to related party |

|

$ |

600,000 |

|

|

|

- |

|

|

Convertible notes to related party |

|

$ |

1,200,000 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information |

|

|

|

|

|

|

|

|

|

Cash paid during the periods for: |

|

|

|

|

|

|

|

|

|

Interest |

|

$ |

401,861 |

|

|

$ |

186,877 |

|

|

Income taxes |

|

$ |

33,437 |

|

|

$ |

29,068 |

|

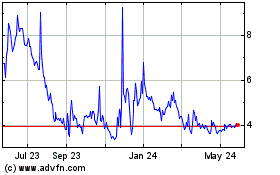

Yoshiharu Global (NASDAQ:YOSH)

Historical Stock Chart

From Oct 2024 to Nov 2024

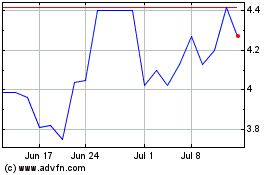

Yoshiharu Global (NASDAQ:YOSH)

Historical Stock Chart

From Nov 2023 to Nov 2024