0001084048false00010840482023-08-032023-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported) August 3, 2023

Ziff Davis, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

Delaware | | 0-25965 | | 47-1053457 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

114 5th Avenue, 15th Floor

New York, New York 10011

(Address of principal executive offices)

(212) 503-3500

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

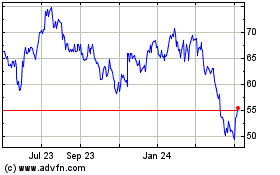

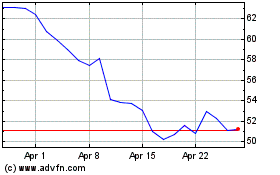

| Common Stock, $0.01 par value | ZD | Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On August 3, 2023, Ziff Davis, Inc. (the “Company”) issued a press release (the “Press Release”) announcing its preliminary unaudited financial results for the second quarter ended June 30, 2023 and reaffirming its financial guidance for fiscal year 2023.

A copy of the Press Release is furnished as Exhibit 99.1 to this Form 8-K.

Item 7.01 Regulation FD Disclosure.

On August 4, 2023, at 8:30 a.m. Eastern Time, the Company will host its second quarter 2023 earnings conference call and Webcast. Via the Webcast, the Company will present portions of its August 2023 Investor Presentation, which contains a summary of the Company’s preliminary unaudited financial results for the fiscal quarter ended June 30, 2023, financial estimates for fiscal year 2023, and certain other financial and operating information regarding the Company. A copy of this presentation is furnished as Exhibit 99.2 to this Form 8-K.

NOTE: The information in this Item 7.01 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Such forward-looking statements are subject to numerous assumptions, risks and uncertainties that could cause actual results to differ materially from those described in such statements. Such forward-looking statements are based on management’s expectations or beliefs as of August 3, 2023. Factors that might cause such differences include, but are not limited to, a variety of economic, competitive, and regulatory factors, many of which are beyond the Company’s control and are described in the Company’s Annual Report on Form 10-K filed by the Company on March 1, 2023 with the Securities and Exchange Commission (the “SEC”) and the other reports the Company files from time to time with the SEC. The Company undertakes no obligation to revise or publicly release any updates to such statements based on future information or actual results.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Ziff Davis, Inc. (Registrant) |

| | | |

| Date: | August 3, 2023 | By: | /s/ Jeremy Rossen |

| | | Jeremy Rossen

Executive Vice President, General Counsel and Secretary |

Ziff Davis Reports Second Quarter 2023 Financial Results and

Reaffirms 2023 Guidance

NEW YORK, NY -- Ziff Davis, Inc. (NASDAQ: ZD) (“Ziff Davis” or “the Company”) today reported unaudited financial results for the second quarter ended June 30, 2023.

“We are cautiously optimistic about the second half of the year, as we are seeing some positive trends in our businesses,” said Vivek Shah, Chief Executive Officer of Ziff Davis. “We are especially enthusiastic about our recently announced strategic partnership with Xyla, which we believe will accelerate AI enablement across our portfolio."

SECOND QUARTER 2023 RESULTS

•Q2 2023 quarterly revenues decreased 3.4% to $326.0 million compared to $337.4 million for Q2 2022.

•Income from operations decreased 15.2% to $38.9 million compared to $45.9 million for Q2 2022.

•Net income (loss) increased to $16.7 million compared to $(46.4) million for Q2 2022 primarily due to losses on our investment in Consensus Cloud Solutions, Inc. (“Consensus”) in Q2 2022 that did not recur.

•Net income (loss) per diluted share(2) increased to $0.36 in Q2 2023 compared to $(0.99) for Q2 2022.

•Adjusted EBITDA(1) for the quarter decreased 9.6% to $106.7 million compared to $118.0 million for Q2 2022.

•Adjusted net income(1) decreased 19.9% to $59.6 million compared to $74.4 million for Q2 2022.

•Adjusted net income per diluted share(1)(2) (or “Adjusted diluted EPS”) for the quarter decreased 19.6% to $1.27 compared to $1.58 for Q2 2022.

•Net cash provided by operating activities was $39.7 million in Q2 2023 compared to $76.0 million in Q2 2022. Free cash flow(1) was $14.5 million in Q2 2023 compared to $52.6 million in Q2 2022.

•Ziff Davis ended the quarter with approximately $829.3 million in cash, cash equivalents, and investments after deploying approximately $62.7 million primarily related to share repurchases and approximately $1.5 million during the quarter for current and prior year acquisitions.

The following table reflects additional results for the three and six months ended June 30, 2023 and 2022, respectively (in millions, except per share amounts).

| | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | % Change | Six months ended

June 30, | % Change |

| 2023 | 2022 | | 2023 | 2022 |

| Revenues | | | | | | | |

| Digital Media | $252.8 | $258.4 | | (2.2)% | $487.0 | $493.0 | (1.2)% |

| Cybersecurity and Martech | $73.2 | $79.0 | | (7.3)% | $146.2 | $159.4 | (8.3)% |

Total revenue(3) | $326.0 | $337.4 | | (3.4)% | $633.2 | $652.4 | (3.0)% |

| Income from operations | $38.9 | $45.9 | | (15.2)% | $65.2 | $76.4 | (14.7)% |

| Operating income margin | 11.9% | 13.6% | | (1.7)% | 10.3% | 11.7% | (1.4)% |

| Net income (loss) | $16.7 | $(46.4) | | 135.9% | $9.1 | $(21.9) | 141.6% |

Net income (loss) per diluted share(2) | $0.36 | $(0.99) | | 136.4% | $0.19 | $(0.47) | 140.4% |

Adjusted EBITDA(1) | $106.7 | $118.0 | | (9.6)% | $201.0 | $218.8 | (8.1)% |

Adjusted EBITDA margin(1) | 32.7% | 35.0% | | (2.3)% | 31.7% | 33.5% | (1.8)% |

Adjusted net income(1) | $59.6 | $74.4 | | (19.9)% | $111.3 | $132.4 | (15.9)% |

Adjusted diluted EPS(1)(2) | $1.27 | $1.58 | | (19.6)% | $2.37 | $2.81 | (15.7)% |

| Net cash provided by operating activities | $39.7 | $76.0 | | (47.8)% | $155.0 | $192.5 | (19.5)% |

Free cash flow(1) | $14.5 | $52.6 | | (72.4)% | $99.8 | $138.6 | (28.0)% |

Notes:

| | | | | | | | |

| (1) | | For definitions of non-GAAP financial measures and reconciliations of GAAP to non-GAAP financial measures refer to section “Non-GAAP Financial Measures,” further in this report. |

| (2) | | The estimated GAAP effective tax rates were approximately 27.2% and (33.2)% for the three months ended June 30, 2023 and 2022, respectively, and 23.7% and 12,760.8% for the six months ended June 30, 2023 and 2022, respectively. The estimated Adjusted effective tax rates were approximately 24.8% and 22.7% for the three months ended June 30, 2023 and 2022, respectively, and 24.3% and 22.9% for the six months ended June 30, 2023 and 2022, respectively. |

| (3) | | The revenues associated with each of the businesses may not foot precisely since each is presented independently. |

ZIFF DAVIS GUIDANCE

The Company reaffirms its guidance for fiscal year 2023 as follows (in millions, except per share data):

| | | | | | | | | | | | | | | | | |

| | | 2023 Range of Estimates | | |

| | | Low | | High | | | | |

| Revenue | | | $ | 1,350.0 | | | $ | 1,408.0 | | | | | |

| Adjusted EBITDA | | | $ | 479.0 | | | $ | 514.0 | | | | | |

| Adjusted diluted EPS* | | | $ | 6.02 | | | $ | 6.54 | | | | | |

* Adjusted diluted EPS for 2023 excludes share-based compensation ranging between $32 million and $34 million, amortization of acquired intangibles, and the impact of any currently unanticipated items, in each case net of tax. It is anticipated that the Adjusted effective tax rate for 2023 will be between 23.0% and 25.0%.

A reconciliation of forward-looking Adjusted EBITDA and Adjusted diluted EPS to the corresponding GAAP guidance financial measures is not available without unreasonable effort due, primarily, to variability and difficulty in making accurate forecasts and projections of non-operating matters that may arise in the future.

Earnings Conference Call and Audio Webcast

Ziff Davis will host a live audio webcast and conference call discussing its second quarter 2023 financial results on Friday, August 4, 2023, at 8:30AM ET. The live webcast and call will be accessible by phone by dialing (844) 985-2014 or via www.ziffdavis.com. Following the event, the audio recording and presentation materials will be archived and made available at www.ziffdavis.com.

About Ziff Davis

Ziff Davis, Inc. (NASDAQ: ZD) is a vertically focused digital media and internet company whose portfolio includes leading brands in technology, shopping, gaming and entertainment, connectivity, health, cybersecurity, and martech. For more information, visit www.ziffdavis.com.

Contact:

Alan Steier

Investor Relations

Ziff Davis, Inc.

investor@ziffdavis.com

Rebecca Wright

Corporate Communications

Ziff Davis, Inc.

press@ziffdavis.com

“Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995: Certain statements in this Press Release are “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995, including those contained in Vivek Shah’s quote and the “Ziff Davis Guidance” section regarding the Company’s expected fiscal 2023 financial performance. These forward-looking statements are based on management’s current expectations or beliefs and are subject to numerous assumptions, risks, and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These factors and uncertainties include, among other items: the Company’s ability to grow advertising revenues, profitability, and cash flows, particularly in light of an uncertain U.S. or worldwide economy, including the possibility of economic downturn or recession; the Company’s ability to make interest and debt payments; the Company’s ability to identify, close, and successfully transition acquisitions; subscriber growth and retention; variability of the Company’s revenue based on changing conditions in particular industries and the economy generally; protection of the Company’s proprietary technology or infringement by the Company of intellectual property of others; the risk of losing critical third-party vendors or key personnel; the risks associated with fraudulent activity, system failure, or a security breach; risks related to our ability to adhere to our internal controls and procedures; the risk of adverse changes in the U.S. or international regulatory environments, including but not limited to the imposition or increase of taxes or regulatory-related fees; the risks related to supply chain disruptions, inflationary conditions, and rising interest rates; the risk of liability for legal and other claims; and the numerous other factors set forth in Ziff Davis’ filings with the Securities and Exchange Commission (“SEC”). For a more detailed description of the risk factors and uncertainties affecting Ziff Davis, refer to the 2022 Annual Report on Form 10-K filed by Ziff Davis on March 1, 2023, and the other reports filed by Ziff Davis from time-to-time with the SEC, each of which is available at www.sec.gov. The forward-looking statements provided in this press release, including those contained in Vivek Shah’s quote and in the “Ziff Davis Guidance” portion regarding the Company’s expected fiscal 2023 financial performance are based on limited information available to the Company at this time, which is subject to change. Although management’s expectations may change after the date of this Press Release, the Company undertakes no obligation to revise or update these statements.

ZIFF DAVIS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED, IN THOUSANDS) | | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Cash and cash equivalents | $ | 679,090 | | | $ | 652,793 | |

| | | |

| Short-term investments | 35,816 | | | 58,421 | |

Accounts receivable, net of allowances of $7,511 and $6,868, respectively | 285,909 | | | 304,739 | |

| Prepaid expenses and other current assets | 74,044 | | | 68,319 | |

| | | |

| Total current assets | 1,074,859 | | | 1,084,272 | |

| Long-term investments | 114,356 | | | 127,871 | |

Property and equipment, net of accumulated amortization of $296,223 and $255,586, respectively | 192,380 | | | 178,184 | |

| Intangible assets, net | 401,639 | | | 462,815 | |

| Goodwill | 1,599,896 | | | 1,591,474 | |

| Deferred income taxes | 8,561 | | | 8,523 | |

| Other assets | 77,598 | | | 80,131 | |

| TOTAL ASSETS | $ | 3,469,289 | | | $ | 3,533,270 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Accounts payable | $ | 127,145 | | | $ | 120,829 | |

| Accrued employee related costs | 33,659 | | | 42,178 | |

| Other accrued liabilities | 52,702 | | | 39,539 | |

| Income taxes payable, current | 11,052 | | | 19,712 | |

| Deferred revenue, current | 188,725 | | | 187,904 | |

| | | |

| Accrued liabilities and other current liabilities | 22,760 | | | 22,286 | |

| Total current liabilities | 436,043 | | | 432,448 | |

| Long-term debt | 1,000,178 | | | 999,053 | |

| Deferred revenue, noncurrent | 8,303 | | | 9,103 | |

| Deferred income taxes | 58,198 | | | 79,007 | |

| Income taxes payable, noncurrent | 8,486 | | | 11,675 | |

| Other long-term liabilities | 95,399 | | | 109,373 | |

| TOTAL LIABILITIES | 1,606,607 | | | 1,640,659 | |

| | | |

| | | |

| Common stock | 464 | | | 473 | |

| Additional paid-in capital | 448,920 | | | 439,681 | |

| | | |

| Retained earnings | 1,492,879 | | | 1,537,830 | |

| Accumulated other comprehensive loss | (79,581) | | | (85,373) | |

| TOTAL STOCKHOLDERS’ EQUITY | 1,862,682 | | | 1,892,611 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 3,469,289 | | | $ | 3,533,270 | |

ZIFF DAVIS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED, IN THOUSANDS EXCEPT SHARE AND PER SHARE DATA) | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Total revenues | $ | 326,016 | | | $ | 337,356 | | | $ | 633,158 | | | $ | 652,424 | |

| Operating costs and expenses: | | | | | | | |

| Cost of revenues | 47,421 | | | 46,004 | | | 93,151 | | | 92,104 | |

| Sales and marketing | 119,934 | | | 123,777 | | | 235,854 | | | 241,539 | |

| Research, development, and engineering | 17,817 | | | 19,721 | | | 35,731 | | | 38,148 | |

| General and administrative | 101,949 | | | 101,967 | | | 203,212 | | | 204,184 | |

| | | | | | | |

| Total operating costs and expenses | 287,121 | | | 291,469 | | | 567,948 | | | 575,975 | |

| Income from operations | 38,895 | | | 45,887 | | | 65,210 | | | 76,449 | |

| Interest expense, net | (10,483) | | | (9,569) | | | (14,963) | | | (19,859) | |

| Gain on debt extinguishment, net | — | | | 2,613 | | | — | | | 1,393 | |

| | | | | | | |

| (Loss) gain on investments, net | — | | | (48,243) | | | 357 | | | (48,243) | |

| Unrealized loss on short-term investments held at the reporting date, net | (3,196) | | | (27,317) | | | (23,541) | | | (18,366) | |

| Other (loss) income, net | (1,503) | | | 6,345 | | | (2,411) | | | 8,744 | |

| Income (loss) before income taxes and loss from equity method investment, net | 23,713 | | | (30,284) | | | 24,652 | | | 118 | |

| Income tax expense | (6,461) | | | (10,051) | | | (5,845) | | | (15,131) | |

| Loss from equity method investment, net | (573) | | | (6,101) | | | (9,755) | | | (6,886) | |

| Net income (loss) | $ | 16,679 | | | $ | (46,436) | | | $ | 9,052 | | | $ | (21,899) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic | $ | 0.36 | | | $ | (0.99) | | | $ | 0.19 | | | $ | (0.47) | |

| Diluted | $ | 0.36 | | | $ | (0.99) | | | $ | 0.19 | | | $ | (0.47) | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 46,798,800 | | | 46,978,709 | | | 46,892,504 | | | 47,016,351 | |

| Diluted | 46,798,800 | | | 46,978,709 | | | 46,892,504 | | | 47,016,351 | |

ZIFF DAVIS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED, IN THOUSANDS) | | | | | | | | | | | |

| | Six months ended June 30, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | 9,052 | | | $ | (21,899) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Depreciation and amortization | 111,479 | | | 118,943 | |

| Non-cash operating lease costs | 5,924 | | | 5,913 | |

| Share-based compensation | 17,619 | | | 14,420 | |

| Provision for credit losses (benefit) on accounts receivable | 1,819 | | | (1,376) | |

| Deferred income taxes, net | (18,330) | | | (10,266) | |

| Gain on extinguishment of debt, net | — | | | (1,393) | |

| | | |

| | | |

| Loss from equity method investments | 9,755 | | | 6,886 | |

| Unrealized loss on short-term investments held at the reporting date | 23,541 | | | 18,366 | |

| (Gain) loss on investment, net | (357) | | | 48,243 | |

| Other | 3,834 | | | 2,106 | |

| Decrease (increase) in: | | | |

| Accounts receivable | 20,470 | | | 77,168 | |

| Prepaid expenses and other current assets | (13,038) | | | 5,804 | |

| Other assets | (4,030) | | | (4,990) | |

| Increase (decrease) in: | | | |

| Accounts payable | (1,332) | | | (36,504) | |

| Deferred revenue | (1,777) | | | (11,882) | |

| Accrued liabilities and other current liabilities | (9,594) | | | (17,055) | |

| Total operating cash provided by continuing operations | 155,035 | | | 192,484 | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (55,250) | | | (53,876) | |

| Acquisition of businesses, net of cash received | (9,492) | | | (92,425) | |

| | | |

| Investment in available-for-sale securities | — | | | (15,000) | |

| | | |

| | | |

| | | |

| Proceeds from sale of equity investments | 3,174 | | | — | |

| | | |

| | | |

| Other | (3,753) | | | — | |

| Net cash used in investing activities | (65,321) | | | (161,301) | |

| Cash flows from financing activities: | | | |

| | | |

| Payment of debt | — | | | (72,853) | |

| | | |

| | | |

| Proceeds from term loan | — | | | 89,991 | |

| Debt extinguishment costs | — | | | (756) | |

| | | |

| Repurchase of common stock | (62,678) | | | (76,345) | |

| Issuance of common stock under employee stock purchase plan | 4,724 | | | 5,235 | |

| Proceeds from exercise of stock options | — | | | 148 | |

| Deferred payments for acquisitions | (6,679) | | | (7,094) | |

| Other | 21 | | | (5) | |

| Net cash (used in) provided by financing activities | (64,612) | | | (61,679) | |

| Effect of exchange rate changes on cash and cash equivalents | 1,195 | | | (16,056) | |

| Net change in cash and cash equivalents | 26,297 | | | (46,552) | |

| Cash and cash equivalents at beginning of year | 652,793 | | | 694,842 | |

| Cash and cash equivalents at end of year | $ | 679,090 | | | $ | 648,290 | |

Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements, which are prepared and presented in accordance with U.S. generally accepted accounting principles (“GAAP”), we use the following non-GAAP financial measures: Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income (loss), Adjusted net income (loss) per diluted share, Free cash flow, and Adjusted effective tax rate (collectively the “non-GAAP financial measures”). The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We use these non-GAAP financial measures for financial and operational decision making and as a means to evaluate period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance and liquidity by excluding certain items that may not be indicative of our recurring core business operating results or, in certain cases, may be non-cash in nature. We believe that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, and analyzing future periods. These non-GAAP financial measures also facilitate management’s internal comparisons to our historical performance and liquidity. We believe these non-GAAP financial measures are useful to investors both because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) they are used by our institutional investors and the analyst community to help them analyze the health of our business.

These non-GAAP financial measures are not measures presented in accordance with GAAP, and our use of these terms may vary from that of other companies. These non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles. These non-GAAP financial measures have limitations in that they do not reflect all of the amounts associated with the Company’s results of operations determined in accordance with GAAP.

Non-GAAP financial measures exclude the certain items listed below. Excluding these items from the non-GAAP measures facilitates comparisons to historical operating results and comparisons to peers, many of which exclude similar items. We believe that non-GAAP financial measures excluding these items provide meaningful supplemental information regarding operational performance. We further believe these measures are useful to investors in that they allow for greater transparency of certain line items in the Company’s financial statements.

Adjusted EBITDA is defined as Net income (loss) with adjustments to reflect the addition or elimination of certain items including:

•Interest expense, net;

•(Gain) loss on debt extinguishment, net;

•(Gain) loss on sale of business;

•Unrealized (gain) loss on short-term investments held at the reporting date, including the unrealized (gain) loss on our investment in Consensus;

•(Gain) loss on investments, net;

•Other (income) expense, net;

•Income tax (benefit) expense;

•(Income) loss from equity method investments, net;

•Depreciation and amortization;

•Share-based compensation;

•Acquisition, integration, and other costs, including adjustments to contingent consideration, lease terminations, retention bonuses, other acquisition-specific items, and other costs, such as severance and legal settlements;

•Disposal related costs associated with disposal of certain businesses;

•Lease asset impairments and other charges; and

•Goodwill impairment on business.

Adjusted EBITDA margin is calculated by dividing Adjusted EBITDA by Revenue.

Adjusted net income (loss) is defined as Net income (loss) with adjustments to reflect the addition or elimination of certain statement of operations items including, but not limited to:

•Interest costs related to the difference between the imputed and coupon interest expense associated with the 4.625% Senior Notes and a charge that the Company determined to be penalty interest associated with 1.75% Convertible Notes in each period presented;

•(Gain) loss on debt extinguishment, net;

•(Gain) loss on sale of business;

•Unrealized (gain) loss on short-term investments held at the reporting date, including the unrealized (gain) loss on our investment in Consensus;

•(Gain) loss on investments, net;

•(Income) loss from equity method investments, net;

•Amortization of patents and intangible assets that we acquired;

•Goodwill impairment on business;

•Share-based compensation;

•Acquisition, integration and other costs, including adjustments to contingent consideration, lease terminations, retention bonuses, other acquisition-specific items, and other costs, such as severance and legal settlements;

•Disposal related costs associated with disposal of certain businesses;

•Lease asset impairments and other charges; and

•Dilutive effect of the convertible debt.

Adjusted net income (loss) per diluted share is calculated by dividing Adjusted net income (loss) by the diluted weighted average shares of common stock outstanding that excludes the effect of convertible debt dilution.

Free cash flow is defined as Net cash provided by operating activities, less purchases of property and equipment, plus changes in contingent consideration.

ZIFF DAVIS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS)

The following table sets forth a reconciliation of Net income (loss) to Adjusted EBITDA: | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) | $ | 16,679 | | | $ | (46,436) | | | $ | 9,052 | | | $ | (21,899) | |

| Interest expense, net | 10,483 | | | 9,569 | | | 14,963 | | | 19,859 | |

| Gain on debt extinguishment, net | — | | | (2,613) | | | — | | | (1,393) | |

| | | | | | | |

| Unrealized loss on short-term investments held at the reporting date | 3,196 | | | 27,317 | | | 23,541 | | | 18,366 | |

| Loss (gain) on investments, net | — | | | 48,243 | | | (357) | | | 48,243 | |

| Other loss (income), net | 1,503 | | | (6,345) | | | 2,411 | | | (8,744) | |

| Income tax expense | 6,461 | | | 10,051 | | | 5,845 | | | 15,131 | |

| (Gain) loss from equity method investment, net | (927) | | | 6,101 | | | 8,255 | | | 6,886 | |

| Depreciation and amortization | 56,856 | | | 59,872 | | | 111,479 | | | 118,943 | |

| Share-based compensation | 9,217 | | | 7,703 | | | 17,619 | | | 14,420 | |

| Acquisition, integration, and other costs | 3,369 | | | 3,431 | | | 6,894 | | | 4,965 | |

| Disposal related costs | 60 | | | 65 | | | 209 | | | 1,304 | |

| Lease asset impairments and other charges | (221) | | | 1,079 | | | 1,098 | | | 2,744 | |

| | | | | | | |

| Adjusted EBITDA | $ | 106,676 | | | $ | 118,037 | | | $ | 201,009 | | | $ | 218,825 | |

ZIFF DAVIS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS)

The following table sets forth Revenues and a reconciliation of Income (loss) from operations to Adjusted EBITDA by segment: | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, 2023 |

| Digital

Media | | Cybersecurity

and Martech | | Corporate | | Total |

| Revenues | $ | 252,820 | | | $ | 73,196 | | | $ | — | | | $ | 326,016 | |

| | | | | | | |

| Income (loss) from operations | $ | 36,668 | | | $ | 13,565 | | | $ | (11,338) | | | $ | 38,895 | |

| | | | | | | |

| | | | | | | |

| Income from equity method investment, net | — | | | — | | | (1,500) | | | (1,500) | |

| Depreciation and amortization | 45,259 | | | 11,590 | | | 7 | | | 56,856 | |

| Share-based compensation | 4,070 | | | 1,283 | | | 3,864 | | | 9,217 | |

| Acquisition, integration, and other costs | 3,256 | | | 113 | | | — | | | 3,369 | |

| Disposal related costs | — | | | — | | | 60 | | | 60 | |

| Lease asset impairments and other charges | (275) | | | 54 | | | — | | | (221) | |

| | | | | | | |

| Adjusted EBITDA | $ | 88,978 | | | $ | 26,605 | | | $ | (8,907) | | | $ | 106,676 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, 2022 |

| Digital

Media | | Cybersecurity and Martech | | Corporate | | Total |

| Revenues | $ | 258,343 | | | $ | 79,013 | | | $ | — | | | $ | 337,356 | |

| | | | | | | |

| Income (loss) from operations | $ | 44,162 | | | $ | 13,023 | | | $ | (11,298) | | | $ | 45,887 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Depreciation and amortization | 47,545 | | | 12,263 | | | 64 | | | 59,872 | |

| Share-based compensation | 3,306 | | | 1,389 | | | 3,008 | | | 7,703 | |

| Acquisition, integration, and other costs | 3,183 | | | 239 | | | 9 | | | 3,431 | |

| Disposal related costs | — | | | — | | | 65 | | | 65 | |

| Lease asset impairments and other charges | 637 | | | 442 | | | — | | | 1,079 | |

| | | | | | | |

| Adjusted EBITDA | $ | 98,833 | | | $ | 27,356 | | | $ | (8,152) | | | $ | 118,037 | |

Tables above exclude certain intercompany allocations.

ZIFF DAVIS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

The following table sets forth a reconciliation of Net income (loss) to Adjusted net income with adjustments presented on after-tax basis:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, |

| 2023 | | Per diluted share* | | 2022 | | Per diluted share* |

| Net income (loss) | $ | 16,679 | | | $ | 0.36 | | | $ | (46,436) | | | $ | (0.99) | |

| | | | | | | |

| Interest costs | 5,509 | | | 0.12 | | | 83 | | | — | |

| Gain on debt extinguishment, net | — | | | — | | | (2,309) | | | (0.05) | |

| (Gain) loss on sale of business | 88 | | | — | | | — | | | — | |

| Unrealized (gain) loss on short-term investments held at the reporting date | 2,416 | | | 0.05 | | | 26,273 | | | 0.56 | |

| (Gain) loss on investments, net | — | | | — | | | 48,111 | | | 1.02 | |

| Loss (income) from equity method investment, net | (552) | | | (0.01) | | | 6,101 | | | 0.13 | |

| Amortization | 25,796 | | | 0.55 | | | 32,064 | | | 0.68 | |

| Share-based compensation | 7,181 | | | 0.15 | | | 6,798 | | | 0.14 | |

| Acquisition, integration, and other costs | 2,576 | | | 0.05 | | | 2,626 | | | 0.06 | |

| Disposal related costs | 44 | | | — | | | 305 | | | 0.01 | |

| Lease asset impairments and other charges | (160) | | | — | | | 808 | | | 0.02 | |

| | | | | | | |

| | | | | | | |

| Adjusted net income | $ | 59,577 | | | $ | 1.27 | | | $ | 74,424 | | | $ | 1.58 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended June 30, |

| 2023 | | Per diluted share* | | 2022 | | Per diluted share* |

| Net income (loss) | $ | 9,052 | | | $ | 0.19 | | | $ | (21,899) | | | $ | (0.47) | |

| Interest costs | 5,565 | | | 0.12 | | | 173 | | | — | |

| Gain on debt extinguishment, net | — | | | — | | | (1,393) | | | (0.03) | |

| (Gain) loss on sale of business | 88 | | | — | | | — | | | — | |

| Unrealized (gain) loss on short-term investments held at the reporting date | 17,681 | | | 0.38 | | | 17,322 | | | 0.37 | |

| (Gain) loss on investments, net | (268) | | | (0.01) | | | 48,111 | | | 1.01 | |

| Loss (income) from equity method investment, net | 8,630 | | | 0.18 | | | 6,886 | | | 0.15 | |

| Amortization | 50,418 | | | 1.08 | | | 64,462 | | | 1.37 | |

| Share-based compensation | 13,998 | | | 0.30 | | | 11,676 | | | 0.25 | |

| Acquisition, integration, and other costs | 5,153 | | | 0.11 | | | 3,826 | | | 0.08 | |

| Disposal related costs | 156 | | | — | | | 1,123 | | | 0.03 | |

| Lease asset impairment and other charges | 830 | | | 0.02 | | | 2,066 | | | 0.05 | |

| | | | | | | |

| | | | | | | |

| Adjusted net income | $ | 111,303 | | | $ | 2.37 | | | $ | 132,353 | | | $ | 2.81 | |

* The reconciliation of Net (loss) income per diluted share to Adjusted net income per diluted share may not foot since each is calculated independently.

ZIFF DAVIS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS)

The following are the adjustments to certain statement of operations items to derive Adjusted net income, which we believe provide useful information about our operating results and enhance the overall understanding of past financial performance and future prospects.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, 2023 |

| GAAP amount | Adjustments | Adjusted non-GAAP amount |

| Interest costs, net | | (Gain) loss on sale of business | Unrealized (gain) loss on short-term investments held at the reporting date | (Gain) loss on investments, net | (Income) loss from equity method investments, net | Amortization | Share-based compensation | Acquisition, integration, and other costs | Disposal related costs | Lease asset impairments and other charges | |

| Cost of revenues | $ | 47,421 | | $ | — | | | $ | — | | $ | — | | $ | — | | $ | — | | $ | (189) | | $ | (94) | | $ | (101) | | $ | — | | $ | — | | | $ | 47,037 | |

| Sales and marketing | $ | 119,934 | | — | | | — | | — | | — | | — | | — | | (1,038) | | (653) | | — | | — | | | $ | 118,243 | |

| Research, development, and engineering | $ | 17,817 | | — | | | — | | — | | — | | — | | — | | (958) | | (133) | | — | | — | | | $ | 16,726 | |

| General and administrative | $ | 101,949 | | — | | | — | | — | | — | | 1,500 | | (33,732) | | (7,127) | | (2,482) | | (60) | | 221 | | | $ | 60,269 | |

| | | | | | | | | | | | | | |

| Interest expense, net | $ | (10,483) | | 7,346 | | | — | | — | | — | | — | | — | | — | | — | | — | | — | | | $ | (3,137) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Unrealized loss on short-term investments held at period end | $ | (3,196) | | — | | | — | | 3,196 | | — | | — | | — | | — | | — | | — | | — | | | $ | — | |

| Other loss, net | $ | (1,503) | | — | | | 118 | | — | | — | | — | | — | | — | | — | | — | | — | | | $ | (1,385) | |

| Income tax expense | $ | (6,461) | | (1,837) | | | (30) | | (780) | | — | | 375 | | (8,125) | | (2,036) | | (793) | | (16) | | 61 | | | $ | (19,642) | |

| Loss from equity method investment, net | $ | (573) | | — | | | — | | — | | — | | 573 | | — | | — | | — | | — | | — | | | $ | — | |

| Total non-GAAP adjustments | | $ | 5,509 | | | $ | 88 | | $ | 2,416 | | $ | — | | $ | (552) | | $ | 25,796 | | $ | 7,181 | | $ | 2,576 | | $ | 44 | | $ | (160) | | | |

ZIFF DAVIS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, 2022 |

| GAAP amount | Adjustments | Adjusted non-GAAP amount |

| Interest costs, net | (Gain) loss on debt extinguishment | | Unrealized (gain) loss on short-term investments held at the reporting date | (Gain) loss on investments, net | (Income) loss from equity method investments, net | Amortization | Share-based compensation | Acquisition, integration, and other costs | Disposal related costs | Lease asset impairments and other charges | |

| Cost of revenues | $ | 46,004 | | $ | — | | $ | — | | | $ | — | | $ | — | | $ | — | | $ | (259) | | $ | (142) | | $ | (2) | | $ | — | | $ | — | | | $ | 45,601 | |

| Sales and marketing | $ | 123,777 | | — | | — | | | — | | — | | — | | — | | (1,106) | | (1,219) | | — | | (438) | | | $ | 121,014 | |

| Research, development, and engineering | $ | 19,721 | | — | | — | | | — | | — | | — | | — | | (851) | | (195) | | — | | — | | | $ | 18,675 | |

| General and administrative | $ | 101,967 | | — | | — | | | — | | — | | — | | (41,642) | | (5,604) | | (2,015) | | (64) | | (641) | | | $ | 52,001 | |

| | | | | | | | | | | | | | |

| Interest expense, net | $ | (9,569) | | 110 | | — | | | — | | — | | — | | — | | — | | — | | — | | — | | | $ | (9,459) | |

| Gain on debt extinguishment, net | $ | 2,613 | | — | | (3,069) | | | — | | — | | — | | — | | — | | — | | — | | — | | | $ | (456) | |

| | | | | | | | | | | | | | |

| Loss on investment, net | $ | (48,243) | | — | | — | | | — | | 48,243 | | — | | — | | — | | — | | — | | — | | | $ | — | |

| Unrealized loss on short-term investments held at period end | $ | (27,317) | | — | | — | | | 27,317 | | — | | — | | — | | — | | — | | — | | — | | | $ | — | |

| Other income, net | $ | 6,345 | | — | | — | | | — | | (174) | | — | | — | | — | | — | | — | | — | | | $ | 6,171 | |

| Income tax expense | $ | (10,051) | | (27) | | 760 | | | (1,044) | | 42 | | — | | (9,837) | | (905) | | (805) | | 241 | | (271) | | | $ | (21,897) | |

| Loss from equity method investment, net | $ | (6,101) | | — | | — | | | — | | — | | 6,101 | | — | | — | | — | | — | | — | | | $ | — | |

| Total non-GAAP adjustments | | $ | 83 | | $ | (2,309) | | | $ | 26,273 | | $ | 48,111 | | $ | 6,101 | | $ | 32,064 | | $ | 6,798 | | $ | 2,626 | | $ | 305 | | $ | 808 | | | |

ZIFF DAVIS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended June 30, 2023 |

| GAAP amount | Adjustments | Adjusted non-GAAP amount |

| Interest costs, net | | (Gain) loss on sale of business | Unrealized (gain) loss on short-term investments held at the reporting date | (Gain) loss on investments, net | (Income) loss from equity method investments, net | Amortization | Share-based compensation | Acquisition, integration, and other costs | Disposal related costs | Lease asset impairments and other charges | |

| Cost of revenues | $ | 93,151 | | $ | — | | | $ | — | | $ | — | | $ | — | | $ | — | | $ | (385) | | $ | (170) | | $ | (186) | | $ | — | | $ | — | | | $ | 92,410 | |

| Sales and marketing | $ | 235,854 | | — | | | — | | — | | — | | — | | — | | (1,962) | | (2,072) | | — | | — | | | $ | 231,820 | |

| Research, development, and engineering | $ | 35,731 | | — | | | — | | — | | — | | — | | — | | (1,741) | | (308) | | — | | — | | | $ | 33,682 | |

| General and administrative | $ | 203,212 | | — | | | — | | — | | — | | 1,500 | | (67,051) | | (13,746) | | (4,328) | | (209) | | (1,098) | | | $ | 118,280 | |

| | | | | | | | | | | | | | |

| Interest expense, net | $ | (14,963) | | 7,420 | | | — | | — | | — | | — | | — | | — | | — | | — | | — | | | $ | (7,543) | |

| Gain (loss) on debt extinguishment, net | $ | — | | — | | | — | | — | | — | | — | | — | | — | | — | | — | | — | | | $ | — | |

| Gain on sale of business | $ | — | | — | | | — | | — | | — | | — | | — | | — | | — | | — | | — | | | $ | — | |

| Gain on investment, net | $ | 357 | | — | | | — | | — | | (357) | | — | | — | | — | | — | | — | | — | | | $ | — | |

| Unrealized loss on short-term investments held at period end | $ | (23,541) | | — | | | — | | 23,541 | | — | | — | | — | | — | | — | | — | | — | | | $ | — | |

| Other loss, net | $ | (2,411) | | — | | | 118 | | — | | — | | — | | — | | — | | — | | — | | — | | | $ | (2,293) | |

| Income tax expense | $ | (5,845) | | (1,855) | | | (30) | | (5,860) | | 89 | | 375 | | (17,018) | | (3,621) | | (1,741) | | (53) | | (268) | | | $ | (35,827) | |

| Loss from equity method investment, net | $ | (9,755) | | — | | | — | | — | | — | | 9,755 | | — | | — | | — | | — | | — | | | $ | — | |

| Total non-GAAP adjustments | | $ | 5,565 | | | $ | 88 | | $ | 17,681 | | $ | (268) | | $ | 8,630 | | $ | 50,418 | | $ | 13,998 | | $ | 5,153 | | $ | 156 | | $ | 830 | | | |

ZIFF DAVIS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended June 30, 2022 |

| GAAP amount | Adjustments | Adjusted amount |

| Interest costs | (Gain) loss on debt extinguishment | | Unrealized (gain) loss on short-term investments held at the reporting date | (Gain) loss on investments, net | (Income) loss from equity method investments, net | Amortization | Share-based compensation | Acquisition, integration, and other costs | Disposal related costs | Lease asset impairments and other charges | |

| Cost of revenues | $ | 92,104 | | $ | — | | $ | — | | | $ | — | | $ | — | | $ | — | | $ | (538) | | $ | (226) | | $ | (54) | | $ | — | | $ | — | | | $ | 91,286 | |

| Sales and marketing | $ | 241,539 | | — | | — | | | — | | — | | — | | — | | (1,675) | | (1,385) | | — | | (961) | | | $ | 237,518 | |

| Research, development, and engineering | $ | 38,148 | | — | | — | | | — | | — | | — | | — | | (1,480) | | (413) | | — | | — | | | $ | 36,255 | |

| General and administrative | $ | 204,184 | | — | | — | | | — | | — | | — | | (82,865) | | (11,039) | | (3,113) | | (1,304) | | (1,783) | | | $ | 104,080 | |

| | | | | | | | | | | | | | |

| Interest expense, net | $ | (19,859) | | 231 | | — | | | — | | — | | — | | — | | — | | — | | — | | — | | | $ | (19,628) | |

| Gain on debt extinguishment, net | $ | 1,393 | | — | | (1,849) | | | — | | — | | — | | — | | — | | — | | — | | — | | | $ | (456) | |

| | | | | | | | | | | | | | |

| Loss on investment, net | $ | (48,243) | | — | | — | | | — | | 48,243 | | — | | — | | — | | — | | — | | — | | | $ | — | |

| Unrealized loss on short-term investments held at period end | $ | (18,366) | | — | | — | | | 18,366 | | — | | — | | — | | — | | — | | — | | — | | | $ | — | |

| Other income, net | $ | 8,744 | | — | | — | | | — | | (174) | | — | | — | | — | | — | | — | | — | | | $ | 8,570 | |

| Income tax expense | $ | (15,131) | | (58) | | 456 | | | (1,044) | | 42 | | — | | (18,941) | | (2,744) | | (1,139) | | (181) | | (678) | | | $ | (39,418) | |

| Loss from equity method investment, net | $ | (6,886) | | — | | — | | | — | | — | | 6,886 | | — | | — | | — | | — | | — | | | $ | — | |

| Total non-GAAP adjustments | | $ | 173 | | $ | (1,393) | | | $ | 17,322 | | $ | 48,111 | | $ | 6,886 | | $ | 64,462 | | $ | 11,676 | | $ | 3,826 | | $ | 1,123 | | $ | 2,066 | | | |

ZIFF DAVIS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS)

The following tables set forth a reconciliation of Net cash provided by operating activities to Free cash flow:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 | Q1 | | Q2 | | Q3 | | Q4 | | YTD |

| Net cash provided by operating activities | $ | 115,307 | | | $ | 39,728 | | | $ | — | | | $ | — | | | $ | 155,035 | |

| Less: Purchases of property and equipment | (30,017) | | | (25,233) | | | — | | | — | | | (55,250) | |

| | | | | | | | | |

| Free cash flow | $ | 85,290 | | | $ | 14,495 | | | $ | — | | | $ | — | | | $ | 99,785 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2022 | Q1 | | Q2 | | Q3 | | Q4 | | YTD |

| Net cash provided by operating activities | $ | 116,511 | | | $ | 75,973 | | | $ | 100,735 | | | $ | 43,225 | | | $ | 336,444 | |

| Less: Purchases of property and equipment | (30,502) | | | (23,374) | | | (26,891) | | | (25,387) | | | (106,154) | |

| | | | | | | | | |

| Free cash flow | $ | 86,009 | | | $ | 52,599 | | | $ | 73,844 | | | $ | 17,838 | | | $ | 230,290 | |

www.ziffdavis.com©2023 Ziff Davis. All rights reserved. SECOND QUARTER 2023 RESULTS August 3, 2023

2 Certain statements in this presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, particularly those regarding our 2023 Financial Guidance. Such forward-looking statements are subject to numerous assumptions, risks and uncertainties that could cause actual results to differ materially from those described in those statements. These forward-looking statements are based on management’s expectations or beliefs as of August 3, 2023. Readers should carefully review the Risk Factors slide of this presentation, as well as the risk factors set forth in our Annual Report on Form 10-K filed by us on March 1, 2023 with the Securities and Exchange Commission (“SEC”) and the other reports we file from time to time with the SEC. We undertake no obligation to revise or publicly release any updates to such statements based on future information or actual results. Such forward-looking statements address the following subjects, among others: • Future operating results • Ability to acquire businesses on acceptable terms and integrate and recognize synergies from acquired businesses • Deployment of cash and investment balances to grow the company • Subscriber growth, retention, usage levels and average revenue per account • Digital media and cloud services growth • International growth • New products, services, features and technologies • Corporate spending including stock repurchases • Intellectual property and related licensing revenues • Liquidity and ability to repay or refinance indebtedness • Systems capacity, coverage, reliability and security • Regulatory developments and taxes All information in this presentation speaks as of August 3, 2023 and any redistribution or rebroadcast of this presentation after that date is not intended and will not be construed as updating or confirming such information. Capitalized terms not otherwise defined in this presentation have the meanings set forth in Ziff Davis' August 3, 2023 earnings press release. Third-Party Information All third-party trademarks, including names, logos and brands, referenced by the Company in this presentation are property of their respective owners. All references to third-party trademarks are for identification purposes only and shall be considered nominative fair use under trademark law. Industry, Market and Other Data Certain information contained in this presentation concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market size, is based on reports from various sources. Because this information involves a number of assumptions and limitations, you are cautioned not to give undue weight to such information. We have not independently verified market data and industry forecasts provided by any of these or any other third-party sources referred to in this presentation. In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us. Non-GAAP Financial information Included in this presentation are certain financial measures that are not calculated in accordance with U.S. generally accepted accounting principles ("GAAP") and are designed to supplement, and not substitute, Ziff Davis’ financial information presented in accordance with GAAP. The non-GAAP measures as defined by Ziff Davis may not be comparable to similar non-GAAP measures presented by other companies. The presentation of such measures, which may include adjustments to exclude unusual or non-recurring items, should not be construed as an inference that Ziff Davis’ future results or leverage will be unaffected by other unusual or non-recurring items. Please see the appendix to this presentation for how we define these non-GAAP measures, a discussion of why we believe they are useful to investors and certain limitations thereof, and reconciliations thereof to the most directly comparable GAAP measures. Divested Businesses Unless otherwise specified, all financial data and operating metrics presented herein for Ziff Davis are presented giving effect to the February 2021 divestiture of the Voice assets in the United Kingdom, as well as the September 2021 sale of the Company’s B2B Backup businesses, together, (the “Divested Businesses”), and the separation of Consensus Cloud Solutions, Inc. (“Consensus”) as described in the Form 10 filed by Consensus with the Securities and Exchange Commission, as if they had occurred prior to the periods presented. Safe Harbor for Forward-looking Statements

3 Some factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements contained in this presentation include, but are not limited to, our ability and intention to: • Achieve business and financial objectives in light of burdensome domestic and international telecommunications, internet or other regulations, including regulations related to data privacy, access, security, retention, and sharing; • Successfully manage our growth, including but not limited to our operational and personnel-related resources, and integration of newly acquired businesses; • Successfully adapt to technological changes and diversify services and related revenues at acceptable levels of financial return; • Successfully develop and protect our intellectual property, both domestically and internationally, including our brands, patents, trademarks and domain names, and avoid infringing upon the proprietary rights of others; • Manage certain risks associated with environmental, social and governmental matters, including related reporting obligations, that could adversely affect our reputation and performance; • Recruit and retain key personnel; • Avoid disruptions to our operations, financial position, and reputation as a result of the collapse of certain banks and potentially other financial institutions; and • Other factors set forth in our Annual Report on Form 10-K filed by us on March 1, 2023 with the SEC and the other reports we file from time to time with the SEC. • Sustain growth or profitability, particularly in light of an uncertain U.S. or worldwide economy, including the possibility of an economic downturn or recession, continuing inflation, continuing supply chain disruptions and other factors and their related impact on customer acquisition and retention rates, customer usage levels, and credit and debit card payment declines; • Maintain and increase our customer base and average revenue per user; • Generate sufficient cash flow to make interest and debt payments, reinvest in our business, and pursue desired activities and businesses plans while satisfying restrictive covenants relating to debt obligations; • Acquire businesses on acceptable terms and successfully integrate and realize anticipated synergies from such acquisitions; • Continue to expand our businesses and operations internationally in the wake of numerous risks, including adverse currency fluctuations, difficulty in staffing and managing international operations, higher operating costs as a percentage of revenues, or the implementation of adverse regulations; • Maintain our financial position, operating results and cash flows in the event that we incur new or unanticipated costs or tax liabilities, including those relating to federal and state income tax and indirect taxes, such as sales, value-added and telecommunication taxes; • Accurately estimate the assumptions underlying our effective worldwide tax rate; • Maintain favorable relationships with critical third-party vendors whose financial condition will not negatively impact the services they provide; • Create compelling digital media content causing increased traffic and advertising levels and additional advertisers or an increase in advertising spend, and effectively target digital media advertisements to desired audiences; • Manage certain risks inherent to our business, such as costs associated with fraudulent activity, system failure or security breach; effectively maintaining and managing our billing systems; time and resources required to manage our legal proceedings; liability for legal and other claims; or adhering to our internal controls and procedures; • Compete with other similar providers with regard to price, service, functionality; Risk Factors

4 Q2 2023 Consolidated Financial Snapshot (1) 1. See slides 12-16 for a GAAP reconciliation of Adjusted EBITDA and Adjusted Diluted EPS.

5 1. Figures exclude any intercompany eliminations. 2. Net Advertising Revenue Retention = (Revenue Recognized by Prior Year Advertisers in Current Year Period (excluding revenue from acquisitions during the stub period)) / (Revenue Recognized by Prior Year Advertisers in Prior Year Period (excluding revenue from acquisitions during the stub period)). Excludes advertisers that generated less than $10,000 of revenue in the measurement period; combined retention is the weighted average net advertising revenue retention of the company. 3. Excludes advertisers that spent less than $2,500 in the quarter within certain divisions. 4. Total gross quarterly advertising revenues divided by advertisers as defined in footnote (3). Advertising Performance Quarterly Advertising Metrics Q1 Q2 Q3 Q4 Q1 Q2 Net Revenue Retention (2) 106.6% 99.6% 94.1% 92.0% 91.2% 89.8% Advertisers (3) 1,950 2,016 1,953 2,044 1,737 1,924 Quarterly Revenue per Advertiser (4) $87,214 $93,848 $95,710 $118,370 $89,857 $91,000 2022 2023

6 1. Figures exclude any intercompany eliminations. 2. Subscription metrics in prior periods in the table above have been adjusted for our Cybersecurity & Martech business as a result of gaining greater transparency into a reseller relationship enabling us to identify the underlying subscribers served by the reseller. Further, additional adjustments have been made to subscribers in the Cybersecurity & Martech business to further conform to the Company’s subscriber definition. As a result, 2022 Subscription metrics were adjusted as follows: Subscribers for Q1, Q2, Q3, and Q4 were increased by 70, 82, 95, and 112 thousand, respectively; Average Quarterly Revenue per Subscriber for Q1, Q2, Q3, and Q4 decreased by ($2.04), ($1.95), ($1.42), and ($1.65), respectively; and Churn Rate for Q1, Q2, Q3, and Q4 increased by 0.31%, 0.20%, 0.16%, and 0.23%, respectively. 2023 Subscription metrics were adjusted as follows for Q1: Subscribers increased by 122 thousand; Average Quarterly Revenue per Subscriber decreased by ($1.83); and Churn Rate increased by 0.05%. 3. Quarterly average of the month-end subscriber counts; inclusive of the Digital Media and Cybersecurity & Martech Businesses. A subscriber is defined a direct customer, including customers who have paused but not cancelled their subscription. If there is a reseller or a partner without visibility into the number of underlying subscribers served by the reseller, they are counted as one subscriber. Figures are listed in 000s. 4. Total gross quarterly subscription revenues divided by subscribers as defined in footnote (3); 5. “Churn Rate” = A / B. A = (average revenue per subscription in the prior month) x (number of cancels in current month), calcu lated at each business and aggregated. B = subscription revenue in the current month, calculated at each business and aggregated. Churn rate is presented on a quarterly basis. For Ookla, this is calculated by taking the sum of the monthly revenue from the specific cancelled agreements. Subscription Performance Quarterly Subscription Metrics (2) Q1 Q2 Q3 Q4 Q1 Q2 Subscribers (3) 2,202 2,475 3,146 3,144 3,138 3,175 Average Quarterly Revenue per Subscriber (4) $61.81 $55.69 $45.45 $44.67 $45.31 $44.51 Churn Rate (5) 3.53% 3.12% 3.71% 4.03% 3.33% 3.51% 2022 2023

7 1. The Company considers revenue from an acquired business to become organic revenue in the first month in which the Company can compare that full month in the current year against the corresponding full month under its ownership in the prior year. Organic Growth (1) Year over Year Growth Rates Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Q2 Organic Revenue (1) 9% 20% 12% 2% 10% (3%) (5%) (7%) (7%) (5%) (6%) (6%) Total Revenue 29% 42% 35% 10% 27% 5% 2% (1%) (3%) 1% (3%) (3%) 20232021 2022

8 Ziff Davis Capital Structure 1. Includes Ziff Davis’ retained stake in Consensus Cloud Solutions, Inc. 2. Reflects the face amount of the outstanding debt. ($ millions) June 30, 2023 Cash and Cash Equivalents $679 Short-term Investments (1) 36 Long-term Investments 114 Total Cash and Investments $829 4.625% High-Yield Notes $460 1.75% Convertible Notes 550 Total Gross Debt (2) $1,010 Multiple of Q2 2023 TTM Adj. EBITDA Gross Debt $1,010 2.1x Gross Debt less Cash $331 0.7x Gross Debt less Cash and Investments $181 0.4x

2023 FINANCIAL GUIDANCE

10 2023 Guidance (Forward-Looking Statements) 1. Refer to slides 12-16 for examples of adjustments to Adjusted EBITDA and Adjusted Diluted EPS. A reconciliation of forward-looking Adjusted EBITDA and Adjusted Diluted EPS to the corresponding GAAP guidance financial measures is not available without unreasonable effort due, primarily, to variability and difficulty in making accurate forecasts and projections of non-operating matters that may arise in the future. Ziff Davis reaffirms its annual guidance of Revenues, Adjusted EBITDA, and Adjusted Diluted EPS (1) $ in millions, except for per share amounts Low Midpoint High Midpoint YoY % Increase vs 2022A Revenue $1,350 $1,379 $1,408 (0.9%) Adjusted EBITDA (1) $479 $497 $514 (2.0%) Adjusted Diluted EPS (1) $6.02 $6.28 $6.54 (5.6%) Ziff Davis FY 2023 Guidance Range

SUPPLEMENTAL INFORMATION

12 GAAP Reconciliation – Adjusted EBITDA Note: Adjusted EBITDA is defined as Net income (loss) with adjustments to reflect the addition or elimination of certain items including: Interest expense, net; (Gain) loss on debt extinguishment, net; (Gain) loss on sale of business; Unrealized (gain) loss on short- term investments held at the reporting date, including the unrealized (gain) loss on our investment in Consensus Cloud Solutions, Inc. (“Consensus”); (Gain) loss on investments, net; Other (income) expense, net; Income tax (benefit) expense; (Income) loss from equity method investments, net; Depreciation and amortization; Share-based compensation; Acquisition, integration, and other costs, including adjustments to contingent consideration, lease terminations, retention bonuses, other acquisition-specific items, and other costs, such as severance and legal settlements; Disposal related costs associated with disposal of certain businesses; Lease asset impairments and other charges; and Goodwill impairment on business. $ in 000's Ziff Davis 2022 2023 Net (loss) income (46,436)$ 16,679$ Interest expense, net 9,569 10,483 Gain on debt extinguishment, net (2,613) - Unrealized loss on short-term investments held at the reporting date 27,317 3,196 Loss on investments, net 48,243 - Other (income) loss, net (6,345) 1,503 Income tax expense 10,051 6,461 Loss (gain) from equity method investment, net 6,101 (927) Depreciation and amortization 59,872 56,856 Share-based compensation 7,703 9,217 Acquisition, integration and other costs 3,431 3,369 Disposal related costs 65 60 Lease asset Impairments and other charges 1,079 (221) Adjusted EBITDA 118,037$ 106,676$ Three Months Ended June 30,

13 Q2 2023 and 2022 Reconciliation of GAAP to Non-GAAP Financial Measures Q2 2022 GAAP amount Interest Costs (Gain) loss on sale of business Unrealized (gain) loss on short- term investments held at the reporting date (Gain) loss on debt extinguishment, net Income (loss) from equity method investment, net Amortization Share-based compensation Acquisition, integration, and other costs Disposal related costs Lease asset impairments and other charges Adjusted non- GAAP amount $ in 000's Cost of revenues $46,004 $- $- $- $- $- ($259) ($142) ($2) $- $- $45,601 Sales and marketing $123,777 - - - - - - (1,106) (1,219) - (438) $121,014 Research, development, and engineering $19,721 - - - - - - (851) (195) - - $18,675 General and administrative $101,967 - - - - - (41,642) (5,604) (2,015) (64) (641) $52,001 Interest expense, net ($9,569) 110 - - - - - - - - - ($9,459) Gain on debt extinguishment, net $2,613 - (3,069) - - - - - - - - ($456) Loss on investment, net ($48,243) - - - 48,243 - - - - - - $- Unrealized loss on short-term investments held at period end ($27,317) - - 27,317 - - - - - - - $- Other income, net $6,345 - - - (174) - - - - - - $6,171 Income tax expense ($10,051) (27) 760 (1,044) 42 - (9,837) (905) (805) 241 (271) ($21,897) Loss from equity method investment, net ($6,101) - - - - 6,101 - - - - - $- Total non-GAAP Adjustments $83 ($2,309) $26,273 $48,111 $6,101 $32,064 $6,798 $2,626 $305 $808 Q2 2023 GAAP amount Interest Costs (Gain) loss on sale of business Unrealized (gain) loss on short- term investments held at the reporting date (Gain) loss on investments, net Income (loss) from equity method investment, net Amortization Share-based compensation Acquisition, integration, and other costs Disposal related costs Lease asset impairments and other charges Adjusted non- GAAP amount $ in 000's Cost of revenues $47,421 $- $- $- $- $- ($189) ($94) ($101) $- $- $47,037 Sales and marketing $119,934 - - - - - - (1,038) (653) - - $118,243 Research, development, and engineering $17,817 - - - - - - (958) (133) - - $16,726 General and administrative $101,949 - - - - 1,500 (33,732) (7,127) (2,482) (60) 221 $60,269 Interest expense, net ($10,483) 7,346 - - - - - - - - - ($3,137) Unrealized loss on short-term investments held at period end ($3,196) - - 3,196 - - - - - - - $- Other loss, net ($1,503) - 118 - - - - - - - - ($1,385) Income tax expense ($6,461) (1,837) (30) (780) - 375 (8,125) (2,036) (793) (16) 61 ($19,642) Loss from equity method investment, net ($573) - - - - 573 - - - - - $- Total non-GAAP Adjustments $5,509 $88 $2,416 - ($552) $25,796 $7,181 $2,576 $44 ($160)

14 GAAP Reconciliation – Free Cash Flow (1) 1. Free cash flow is defined as net cash provided by operating activities, less purchases of property and equipment, plus changes in contingent consideration. $ in 000's Ziff Davis 2022 2023 2022 2023 Net cash provided by operating activities 75,973$ 39,728$ 192,484$ 155,035$ Less: Purchases of property and equipment (23,374) (25,233) (53,876) (55,250) Free cash flow (1) 52,599$ 14,495$ 138,608$ 99,785$ Three Months Ended June 30, Six Months Ended June 30,

15 Quarterly Adjusted Income Statement Excluding the Divested Businesses 1. Adjusted net income (loss) is defined as Net income (loss) with adjustments to reflect the addition or elimination of certain statement of operations items including, but not limited to: Interest costs related to the difference between the imputed and coupon interest expense associated with the 4.625% Senior Notes and a charge that the Company determined to be penalty interest associated with 1.75% Convertible Notes in each period presented; (Gain) loss on debt extinguishment, net; (Gain) loss on sale of business; Unrealized (gain) loss on short-term investments held at the reporting date, including the unrealized (gain) loss on our investment in Consensus; (Gain) loss on investments, net; (Income) loss from equity method investments, net; Amortization of patents and intangible assets that we acquired; Goodwill impairment on business; Share-based compensation; Acquisition, integration, and other costs, including adjustments to contingent consideration, lease terminations, retention bonuses, other acquisition-specific items, and other costs, such as severance and legal settlements; Disposal related costs associated with disposal of certain businesses; Lease asset impairments and other charges; and Dilutive effect of the convertible debt. 2. Adjusted Diluted EPS is calculated by dividing Adjusted net income (loss) by the diluted weighted average shares of common stock outstanding that excludes the effect of convertible debt dilution. $ in 000's (except for per share amounts) Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Advertising 177,288$ 198,385$ 198,794$ 263,608$ 170,067$ 189,198$ 186,922$ 241,949$ 156,082$ 175,083$ Subscriptions 117,937 124,591 135,488 134,451 136,070 137,811 142,972 140,467 142,164 141,357 Other 3,961 7,293 11,625 10,992 9,184 10,601 12,195 14,363 8,981 9,626 Less : Intercompany Eliminations (118) (292) (356) (423) (253) (254) (215) (79) (85) (50) Adjusted Revenues 299,068$ 329,977$ 345,551$ 408,628$ 315,068$ 337,356$ 341,874$ 396,700$ 307,142$ 326,016$ Cost of Revenues 37,906 44,306 45,797 45,286 45,686 45,599 52,233 50,329 45,373 47,037 Sales and Marketing 105,048 118,479 124,178 137,513 116,503 121,014 118,580 125,303 113,577 118,243 Research, Development and Engineering 18,679 16,764 18,319 20,923 17,580 18,675 16,910 17,227 16,956 16,726 General and Administrative 55,776 53,253 57,532 59,778 52,079 52,002 53,315 56,195 58,011 60,269 Adjusted Operating Income 81,659$ 97,175$ 99,725$ 145,128$ 83,220$ 100,066$ 100,836$ 147,646$ 73,225$ 83,741$ Add: Depreciation 14,244 14,899 15,613 16,487 17,568 17,971 19,278 20,658 21,108 22,935 Adjusted EBITDA 95,903$ 112,074$ 115,338$ 161,615$ 100,788$ 118,037$ 120,114$ 168,304$ 94,333$ 106,676$ Adjusted Net Income (1) 53,066 63,230 66,085 105,064 57,929 74,425 74,269 105,963 51,726 59,577 Adjusted Diluted EPS (2) excluding divested businesses $1.19 $1.41 $1.40 $2.18 $1.23 $1.58 $1.58 $2.26 $1.10 $1.27

16 Reconciliation of Financial Results Excluding the Divested Businesses $ in 000's (except for per share amounts) Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Revenues Stated Revenues 311,657$ 341,293$ 355,144$ 408,628$ 315,068$ 337,356$ 341,874$ 396,700$ 307,142$ 326,016$ Adjustments (12,589) (11,316) (9,593) - - - - - - - Total Adjusted Revenues 299,068$ 329,977$ 345,551$ 408,628$ 315,068$ 337,356$ 341,874$ 396,700$ 307,142$ 326,016$ Cost of Revenues Stated Cost of Revenues 43,137$ 48,333$ 49,062$ 45,286$ 45,686$ 45,599$ 52,233$ 50,329$ 45,373$ 47,037$ Adjustments (5,231) (4,027) (3,265) - - - - - - - Total Adjusted Cost of Revenues 37,906$ 44,306$ 45,797$ 45,286$ 45,686$ 45,599$ 52,233$ 50,329$ 45,373$ 47,037$ Sales and Marketing Stated Sales and Marketing 106,848$ 120,166$ 125,410$ 137,513$ 116,503$ 121,014$ 118,580$ 125,303$ 113,577$ 118,243$ Adjustments (1,800) (1,687) (1,232) - - - - - - - Total Adjusted Sales and Marketing 105,048$ 118,479$ 124,178$ 137,513$ 116,503$ 121,014$ 118,580$ 125,303$ 113,577$ 118,243$ Research, Development and Engineering Stated Research, Development and Engineering 18,933$ 17,041$ 18,534$ 20,923$ 17,580$ 18,675$ 16,910$ 17,227$ 16,956$ 16,726$ Adjustments (254) (277) (215) - - - - - - - Total Adjusted Research, Development and Engineering 18,679$ 16,764$ 18,319$ 20,923$ 17,580$ 18,675$ 16,910$ 17,227$ 16,956$ 16,726$ General and Administrative Stated General and Administrative 56,903$ 53,671$ 58,067$ 59,778$ 52,079$ 52,002$ 53,315$ 56,195$ 58,011$ 60,269$ Adjustments (1,127) (418) (535) - - - - - - - Total Adjusted General and Administrative 55,776$ 53,253$ 57,532$ 59,778$ 52,079$ 52,002$ 53,315$ 56,195$ 58,011$ 60,269$ Adjusted EBITDA Stated Adjusted EBITDA 100,705$ 116,977$ 119,709$ 161,615$ 100,788$ 118,037$ 120,114$ 168,304$ 94,333$ 106,676$ Adjustments (4,802) (4,903) (4,371) - - - - - - - Total Adjusted EBITDA 95,903$ 112,074$ 115,338$ 161,615$ 100,788$ 118,037$ 120,114$ 168,304$ 94,333$ 106,676$ Diluted EPS Stated Adjusted Non-GAAP Net Income per Diluted EPS 1.24$ 1.50$ 1.49$ 2.18$ 1.23$ 1.58$ 1.58$ 2.26$ 1.10$ 1.27$ Adjustments (0.05) (0.09) (0.09) - - - - - - - Total Adjusted Diluted EPS 1.19$ 1.41$ 1.40$ 2.18$ 1.23$ 1.58$ 1.58$ 2.26$ 1.10$ 1.27$

v3.23.2

Document and Entity Information Document

|

Aug. 03, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 03, 2023

|

| Entity Registrant Name |

Ziff Davis, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

0-25965

|

| Entity Tax Identification Number |

47-1053457

|

| Entity Address, Address Line One |

114 5th Avenue,

|

| Entity Address, Address Line Two |

15th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10011

|

| City Area Code |

212

|

| Local Phone Number |

503-3500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

ZD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001084048

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |