UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number: 001-38146

ZK

INTERNATIONAL GROUP CO., LTD.

(Translation

of registrant’s name into English)

c/o Zhejiang Zhengkang Industrial Co., Ltd.

No. 678 Dingxiang Road, Binhai Industrial Park

Economic & Technology Development Zone

Wenzhou, Zhejiang Province

People’s Republic of China 325025

Tel: +86-577-86852999

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

On September 30, 2024,

the Company issued a press release entitled “ZK International Group Co., Ltd. Announces Record Revenue of $52.89 Million, an Increase

of 6.5% for the First Half of Fiscal Year 2024.” A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated

herein by reference.

Exhibit Index

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| Date: September 30, 2024 |

ZK INTERNATIONAL GROUP CO., LTD. |

| |

|

|

| |

By: |

/s/ Jiancong Huang |

| |

Name: |

Jiancong Huang |

| |

Title: |

Chief Executive Officer and Chairman of the Board |

Exhibit 99.1

ZK International Group Co., Ltd. Announces Record Revenue of $52.89 Million, an Increase of 6.5% for the First Half of Fiscal Year 2024

WENZHOU, China, September

30, 2024 -- ZK International Group Co., Ltd. (ZKIN) ("ZK International" or the "Company"), a

designer, engineer, manufacturer, and supplier of patented high-performance stainless steel and carbon steel pipe products primarily used

for water and gas supplies, today announced its unaudited financial results for the six months ended March 31, 2024.

Financial

Highlights for the First Half of Fiscal Year 2024

| | |

For the Six Months Ended March 31, | |

|

| ($ millions, except per share data) | |

2024 | | |

2023 | | |

% Change | |

|

| Revenue | |

$ | 52.89 | | |

$ | 49.66 | | |

| 6.50 | % |

|

| Gross profit | |

$ | 3.35 | | |

$ | 3.17 | | |

| 5.68 | % |

|

| Gross margin | |

| 6.33 | % | |

| 6.38 | % | |

| -0.05 | % |

pp* |

| Income (loss) from operations | |

$ | (0.16 | ) | |

$ | 0.14 | | |

| (2.14 | )% |

|

| Operating margin | |

| (0.31 | )% | |

| 0.29 | % | |

| 0.60 | % |

pp* |

| Net loss | |

$ | (0.48 | ) | |

$ | (0.06 | ) | |

| - | |

|

| Diluted earnings per share | |

$ | (0.01 | ) | |

$ | 0.00 | | |

| - | |

|

* pp: percentage point(s)

| |

· |

Revenue increased by 6.50% to a record $52.89 million for the six months ended March 31, 2024 from approximately $49.66 million for the six months ended March 31, 2023. During the first fiscal half of 2024, we observed an increase of demand for our piping products, primarily attributable to the real estate market recovery during the fiscal period. Raw materials price, especially the price of nikel which is an important component of stainless steel, also increased. To minimize the impact the rise of raw material price, we increased our weighted average selling price (“ASP”) during the period. |

| |

· |

Gross profit increased by 5.68% to $3.35 million. Gross margin was 6.33%, compared to 6.38% for the same period of the prior fiscal period. The rising costs of raw materials, particularly for stainless steel coil which is a key component of our products, has outpaced the increase of our ASP which led to a slight decline in gross margin. |

| |

· |

Loss from operations was $0.16 million, compared to income from operations of $0.14 million for the same period of the prior fiscal year. Operating margin was (0.31)%, compared to 0.29% for the same period of the prior fiscal year. |

| |

· |

Net loss was $0.48 million. This compared to a net loss of $0.06 million for the same period of the prior fiscal year. |

Financial

Results for the First Half of Fiscal Year 2023

Revenue

Revenue

increased by $3,231,757 or 6.50%, to $52,887,156 for the six months ended March 31, 2024 from $49,655,399 for the six months ended March

31, 2023. During the first fiscal half of 2024, we observed an increase of demand for our piping products, primarily attributable

to the real estate market recovery during the fiscal period. Raw materials price, especially the price of nikel which is an important

component of stainless steel, also increased. To minimize the impact the rise of raw material price, we increased our weighted average

selling price (“ASP”) during the period.

Gross

Profit

Our

gross profit increased by 181,368, or 5.68%, to $3,350,010 for the six months ended March 31, 2024 from $3,168,642 for the six months

ended March 31, 2023. Gross profit margin was 6.33% for the six months ended March 31, 2024, as compared to 6.38% for the six months ended

March 31, 2023. The increase of our gross profit was mainly attributable to the recovery of domestic real estate market. However,

the rising costs of raw materials, particularly for stainless steel coil which is a key component of our products, has outpaced

the increase of our ASP which led to a slight decline in gross margin.

Selling

and Marketing Expenses

We

incurred $880,824 in selling and marketing expenses for the six months ended March 31, 2024, compared to $ 963,655 for the six months

ended March 31, 20223. Selling and marketing expenses decreased by $82,831, or 8.60%, during the six months ended March 31, 2024 compared

to the six months ended March 31, 2023. This slight decrease is primarily due to decreased marketing expenses.

General

and Administrative expenses

We

incurred $ 2,010,566 in general and administrative expenses for the six months ended March 31, 2024, compared to $1,443,743 for the six

months ended March 31, 2023. General and administrative expenses increased by $566,823 or 39.26%, for the six months ended March 31, 2024

compared to the same period in 2023. The increase is primarily due to increase in consulting expenses and employee salaries.

Research

and Development Expenses

We

incurred $622,805 in research and development expenses for the six months ended March 31, 2024, compared to $619,511 for the six months

ended March 31, 2023. R&D expenses increased by $3,294, or 0.53%, for the six months ended March 31, 2024 compared to the same period

in 2023.

Income

(loss) from Operations

As

a result of the factors described above, we incurred operating loss of $164,185 for the six months ended March 31, 2024, compared to operating

income of $141,734 for the six months ended March 31, 2023, a decrease of operating income of $305,919.

Other

Income (Expenses)

Our

interest income and expenses were $7,868 and $411,045, respectively, for the six months ended March 31, 2024, compared to interest income

and expenses of $25,123 and $386,527, respectively, for the six months ended March 31, 2023.

Net

Income (loss)

As

a result of the factors described above, we incurred net loss of $481,753 for the six months ended March 31, 2024, compared to net income

of $57,080 for the six months ended March 31, 2023, a decrease in profit of $424,673.

Financial

Condition

As

of March 31, 2024, cash and cash equivalents, restricted cash and short-term investments totaled $5.06 million, compared to $5.05 million

as of September 30, 2023. Short-term bank borrowings were $13.34 million as of March 31, 2024, compared to $9.39 million as of September

30, 2023.

Accounts

receivable was $20.56 million as of March 31, 2024, compared to $14.97 million as of September 30, 2023. Inventories were $13.39 million

as of March 31, 2024, compared to $17.94 million as of September 30, 2023. Accounts payable was $2.18 million as of March 31, 2024, compared

to $2.61 million as of September 30, 2023.

Total

current assets and current liabilities were $62.05 million and $40.03 million, respectively, leading to a current ratio of 1.55 as of

March 31, 2024. This compared to total current assets and current liabilities were $43.25 million and $24.89 million, respectively, and

current ratio of 1.74 as of September 30, 2023.

About ZK International Group

Co., Ltd.

ZK International Group Co., Ltd.

is a China-based designer, engineer, manufacturer, and supplier of patented high-performance stainless steel and carbon steel pipe

products that require sophisticated water or gas pipeline systems. The Company owns 33 patents, 21 trademarks, 2 Technical Achievement

Awards, and 10 National and Industry Standard Awards. ZK International is Quality Management System Certified (ISO9001), Environmental

Management System Certified (ISO1401), and a National Industrial Stainless Steel Production Licensee that is focused on supplying steel

piping for the multi-billion dollar industries of Gas and Water sectors. ZK has supplied stainless steel pipelines for over 2,000

projects, including the Beijing National Airport, the "Water Cube", and "Bird's Nest", which were venues for the 2008

Beijing Olympics. Emphasizing superior properties and durability of its steel piping, ZK International is providing a solution for

the delivery of high quality, highly sustainable, environmentally sound drinkable water not only to the China market but also

to international markets such as Europe, East Asia, and Southeast Asia.

For more information please visit www.ZKInternationalGroup.com.

Additionally, please follow the Company on Twitter, Facebook, YouTube, and Weibo.

For further information on the Company's SEC filings please visit www.sec.gov.

Safe Harbor Statement

This news release contains

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. Without limiting the generality

of the foregoing, words such as "may," "will," "expect," "believe," "anticipate," "intend,"

"could," "estimate" or "continue" or the negative or other variations thereof or comparable terminology

are intended to identify forward-looking statements. In addition, any statements that refer to expectations, projections or other characterizations

of future events or circumstances are forward-looking statements. These forward-looking statements are not guarantee of future performance

and are subject to certain risks, uncertainties, and assumptions that are difficult to predict and many of which are beyond the control

of ZK International. Actual results may differ from those projected in the forward-looking statements due to risks and uncertainties,

as well as other risk factors that are included in the Company’s filings with the U.S. Securities and Exchange Commission. Although

ZK International believes that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could

prove inaccurate and, therefore, there can be no assurance that the results contemplated in forward-looking statements will be realized.

In light of the significant uncertainties inherent in the forward-looking information included herein, the inclusion of such information

should not be regarded as a representation by ZK International or any other person that their objectives or plans will be achieved. ZK

International does not undertake any obligation to revise the forward-looking statements contained herein to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated events.

ZK

International Group Co., Ltd. and Subsidiaries

Consolidated

Statements of Income and Comprehensive Income (Loss)

For

the Six Months Ended March 31, 2024 and 2023 (Unaudited)

(IN U.S. DOLLARS, EXCEPT SHARE

DATA)

| | |

For the

Six Months Ended

March 31, | |

| | |

2024 | | |

2023 | |

| Revenues | |

| 52,887,156 | | |

$ | 49,655,399 | |

| Cost of sales | |

| 49,537,146 | | |

| 46,486,756 | |

| Gross profit | |

| 3,350,010 | | |

| 3,168,642 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Selling and marketing expenses | |

| 880,824 | | |

| 963,655 | |

| General and administrative expenses | |

| 2,010,566 | | |

| 1,443,743 | |

| Research and development costs | |

| 622,805 | | |

| 619,511 | |

| Total operating expenses | |

| 3,514,195 | | |

| 3,026,909 | |

| | |

| | | |

| | |

| Operating Income | |

| 164,185 | | |

| 141,734 | |

| | |

| | | |

| | |

| Other income (expenses): | |

| | | |

| | |

| Interest expenses | |

| (411,045 | ) | |

| (386,527 | ) |

| Interest income | |

| 7,868 | | |

| 25,123 | |

| Other income (expenses), net | |

| 92,816 | | |

| 162,590 | |

| Total other income (expenses), net | |

| (310,361 | ) | |

| (198,814 | ) |

| | |

| | | |

| | |

| Income (Loss) before income taxes | |

| (474,546 | ) | |

| (57,080 | ) |

| | |

| | | |

| | |

| Income tax provision | |

| - | | |

| - | |

| | |

| | | |

| | |

| Net income (loss) | |

| (481,753 | ) | |

| (57,080 | ) |

| Net income (loss) attributable to non-controlling interests | |

| | | |

| 1,663 | |

| | |

| | | |

| | |

| Net income (loss) attributable to ZK International Group Co., Ltd. | |

| (481,753 | ) | |

| (55,417 | ) |

| | |

| | | |

| | |

| Net income (loss) | |

| (481,753 | ) | |

| (57,080 | ) |

| | |

| | | |

| | |

| Other comprehensive income: | |

| | | |

| | |

| Foreign currency translation adjustment | |

| | | |

| (1,912,369 | ) |

| | |

| | | |

| | |

| Total comprehensive

income (loss) | |

| (481,753 | ) | |

| (1,969,449 | ) |

| Comprehensive income (loss) attributable to non-controlling interests | |

| (9,284 | ) | |

| (10,076 | ) |

| Comprehensive income attributable to ZK International Group Co., Ltd. | |

| (472,468 | ) | |

| (1,979,525 | ) |

| | |

| | | |

| | |

| Basic and diluted earnings per share | |

| | | |

| | |

| Basic | |

| - | | |

| - | |

| Diluted | |

| - | | |

| - | |

| Weighted average number of shares outstanding | |

| | | |

| | |

| Basic | |

| 31,445,962 | | |

| 30,392,940 | |

| Diluted | |

| 31,445,962 | | |

| 30,518,893 | |

ZK

International Group Co., Ltd. and Subsidiaries

Consolidated

Balance Sheets

As

of March 31, 2024 and September 30, 2023 (Unaudited)

(IN U.S. DOLLARS)

| | |

2024 (Unaudited) | | |

2023 | |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 4,945,913 | | |

$ | 4,994,411 | |

| Restricted cash | |

| 65,379 | | |

| 50,995 | |

| Short-term Investment | |

| 48,650 | | |

| 48,145 | |

| Accounts receivable, net of allowance for doubtful accounts of $6,686,864 and $6,617,485, respectively | |

| 20,556,288 | | |

| 14,967,186 | |

| Notes receivable | |

| 269,424 | | |

| 54,825 | |

| Other receivables | |

| 6,022,949 | | |

| 383,413 | |

| Due from related parties | |

| 1,532,776 | | |

| - | |

| Inventories | |

| 13,390,249 | | |

| 17,937,425 | |

| Advance to suppliers | |

| 15,216,014 | | |

| 4,810,044 | |

| Total current assets | |

| 62,047,642 | | |

| 43,246,444 | |

| Property, plant and equipment, net | |

| 7,822,460 | | |

| 7,836,017 | |

| Right-of use asset | |

| 18,573 | | |

| 43,840 | |

| Intangible assets, net | |

| 1,446,461 | | |

| 1,437,384 | |

| Long-term accounts receivable | |

| 5,585,636 | | |

| 5,527,682 | |

| Long-term investment | |

| 302,760 | | |

| 285,540 | |

| TOTAL ASSETS | |

$ | 77,223,532 | | |

$ | 58,668,977 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 2,178,436 | | |

$ | 2,611,220 | |

| Accrued expenses and other current liabilities | |

| 1,634,393 | | |

| 4,964,892 | |

| Lease liability - current portion | |

| 21,977 | | |

| 21,749 | |

| Accrued payroll and welfare | |

| 1,867,631 | | |

| 1,918,415 | |

| Advance from customers | |

| 16,847,355 | | |

| 821,694 | |

| Due to related parties | |

| 128,903 | | |

| 1,111,001 | |

| Convertible debentures | |

| 4,011,224 | | |

| 4,011,224 | |

| Short-term bank borrowings | |

| 13,336,426 | | |

| 9,388,706 | |

| Notes payables | |

| - | | |

| 41,118 | |

| Income tax payable | |

| - | | |

| 669 | |

| Total current liabilities | |

| 40,026,345 | | |

| 24,890,689 | |

| Bank borrowings – non-current | |

| 8,617,093 | | |

| 8,527,686 | |

| Lease liability - long term portion | |

| 11,935 | | |

| 11,811 | |

| TOTAL LIABILITIES | |

$ | 48,655,373 | | |

$ | 33,430,186 | |

| | |

| | | |

| | |

| Equity | |

| | | |

| | |

| Common stock, no par value, 50,000,000 shares authorized, 30,392,940 and 30,392,940 shares issued and outstanding, respectively | |

| | | |

| | |

| Additional paid-in capital | |

| 76,386,898 | | |

| 72,886,898 | |

| Statutory surplus reserve | |

| 3,176,556 | | |

| 3,176,556 | |

| Subscription receivable | |

| (125,000 | ) | |

| (125,000 | ) |

| Retained earnings | |

| (48,140,252 | ) | |

| (47,666,657 | ) |

| Accumulated other comprehensive income (loss) | |

| (2,878,739 | ) | |

| (3,190,985 | ) |

| Total equity attributable to ZK International Group Co., Ltd. | |

| 28,419,463 | | |

| 25,080,812 | |

| Equity attributable to non-controlling interests | |

| 148,696 | | |

| 157,980 | |

| Total equity | |

| 28,568,159 | | |

| 25,238,792 | |

| TOTAL LIABILITIES AND EQUITY | |

$ | 77,223,532 | | |

$ | 58,668,977 | |

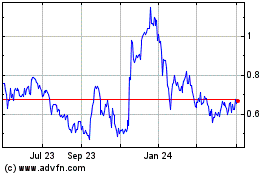

ZK (NASDAQ:ZKIN)

Historical Stock Chart

From Mar 2025 to Apr 2025

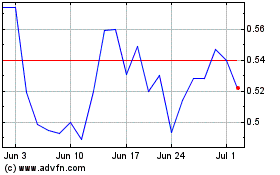

ZK (NASDAQ:ZKIN)

Historical Stock Chart

From Apr 2024 to Apr 2025