0001158449false00011584492024-12-192024-12-1900011584492024-09-132024-09-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 19, 2024

ADVANCE AUTO PARTS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-16797 | 54-2049910 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

4200 Six Forks Road, Raleigh, North Carolina 27609

(Address of principal executive offices) (Zip Code)

(540) 362-4911

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Securities Registered Pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value | | AAP | | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

INFORMATION TO BE INCLUDED IN THE REPORT

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 19, 2024, Advance Auto Parts, Inc. (the “Company”) appointed Michael Beland to the position of Senior Vice President, Controller and Chief Accounting Officer, effective January 5, 2025.

Mr. Beland, 53, joins the Company from Driven Brands Holdings, Inc., a public franchise provider of consumer and commercial automotive services, where he has served as Senior Vice President and Chief Accounting Officer since July 2021. He previously served at Wolfspeed, Inc. (formerly Cree, Inc.), a public manufacturer of silicon carbide materials and devices for power applications, as Assistant Corporate Controller from June 2017 to October 2017 and as Corporate Controller from October 2017 to July 2021. He also previously served as Executive Director, Assistant Corporate Controller of PPD, LLC, a leading global contract research organization, from December 2010 to May 2017 and as Vice President, Corporate Controller & Compliance Officer of OrthoSynetics, Inc., an orthodontic practice management company, from January 2008 to December 2010. Earlier in his career, Mr. Beland served in manager roles at leading public accounting firms including Arthur Anderson, Grant Thornton and PricewaterhouseCoopers, as well as Director of Accounting Research and Policy at The Shaw Group Inc. He holds a B.S.B.A. and a Masters degree in Accounting and is a Certified Public Accountant and Chartered Global Management Accountant.

In connection with his appointment, Mr. Beland and the Company have entered into a compensation arrangement, pursuant to which Mr. Beland will be entitled to an annual base salary of $400,000 and is eligible to participate in the Company’s annual incentive bonus plan with a bonus target of 65 percent of base salary (“Target Bonus Amount”) and a maximum bonus opportunity of 200 percent of the Target Bonus Amount, based on performance as measured against applicable bonus criteria. He will also receive a one-time cash signing bonus of $200,000, payable in two installments upon hire and at one year from hire, that he will be required to repay if he voluntarily resigns his employment with the Company prior to completion of two years of service and a one-time equity grant of approximately $410,000 aggregate principal value of restricted stock units, vesting ratably over three years dependent upon continued employment with the Company.

Mr. Beland is eligible to receive annual equity grants under the Company’s 2023 Omnibus Incentive Compensation Plan (the “2023 Plan”) consistent with the Company’s compensation program for other executives of the Company. The grant date fair value of Mr. Beland’s annual equity grant for the 2025-2027 performance period is expected to be approximately $350,000 and is expected to consist of 50% performance-based share units and 50% restricted-stock units.

Mr. Beland and the Company have entered into a loyalty agreement, effective January 5, 2025, that provides for an initial one-year agreement term and extends the agreement thereafter each day for an additional day until the Company provides at least 90 days’ notice of intention not to extend the agreement. Under the agreement, upon termination of employment by the Company without Cause (not in connection with a change in control) or upon termination of employment by the Company without Cause within 12 months after a change in control, Mr. Beland would be entitled to: (1) severance equal to one times the sum of (a) his base salary and (b) an amount equal to the pro rata portion of any annual bonus that would have been payable to him, provided that the criteria for such bonus other than his continued employment have been satisfied; (2) outplacement assistance, at a cost to the Company not to exceed $12,000, for a period of up to 12 months; (3) continued medical, dental and vision benefits for up to 52 weeks post-termination at the same cost as active employees; and (4) treatment of equity awards as set forth in the 2023 Plan and the applicable award agreements. Any severance benefits paid would be subject to Mr. Beland’s execution (without revocation) of a general release of claims against the Company.

Pursuant to the terms of his loyalty agreement, Mr. Beland is subject to certain restrictive covenants, including, among others, non-disclosure of confidential information, non-disparagement and, for a year following termination of employment, non-competition, and non-solicitation and non-interference of customers, suppliers, employees, agents or independent contractors.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Exhibit Description |

| |

| 101.1 | Pursuant to Rule 406 of Regulation S-T, the cover page to this Current Report on Form 8-K is formatted in Inline XBRL. |

| 104.1 | Cover Page Interactive Data File (embedded within the Inline XBRL document included in Exhibit 101.1) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | ADVANCE AUTO PARTS, INC. |

| | (Registrant) |

| | |

| Date: December 20, 2024 | | /s/ Ryan P. Grimsland |

| | Ryan P. Grimsland |

| | Executive Vice President, Chief Financial Officer |

Cover

|

Dec. 19, 2024 |

Sep. 13, 2024 |

| Cover Page [Abstract] |

|

|

| Document Type |

8-K

|

|

| Document Period End Date |

Dec. 19, 2024

|

|

| Entity Registrant Name |

ADVANCE AUTO PARTS, INC.

|

|

| Entity Address, Address Line One |

|

4200 Six Forks Road

|

| Entity Address, City or Town |

|

Raleigh

|

| Entity Address, State or Province |

|

NC

|

| Entity Address, Postal Zip Code |

|

27609

|

| City Area Code |

|

540

|

| Local Phone Number |

|

362-4911

|

| Written Communications |

|

false

|

| Soliciting Material |

|

false

|

| Pre-commencement Tender Offer |

|

false

|

| Pre-commencement Issuer Tender Offer |

|

false

|

| Entity Emerging Growth Company |

|

false

|

| Entity Central Index Key |

0001158449

|

|

| Amendment Flag |

false

|

|

| Title of 12(b) Security |

|

Common Stock, $0.0001 par value

|

| Security Exchange Name |

|

NYSE

|

| Entity Incorporation, State or Country Code |

|

DE

|

| Entity File Number |

|

001-16797

|

| Entity Tax Identification Number |

|

54-2049910

|

| Trading Symbol |

|

AAP

|

| Document Information [Line Items] |

|

|

| Document Type |

8-K

|

|

| Entity Registrant Name |

ADVANCE AUTO PARTS, INC.

|

|

| X |

- Definition

+ References

+ Details

| Name: |

aap_CoverPageAbstract |

| Namespace Prefix: |

aap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

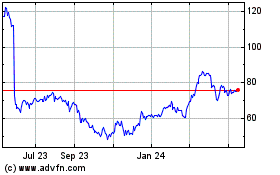

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

From Dec 2024 to Jan 2025

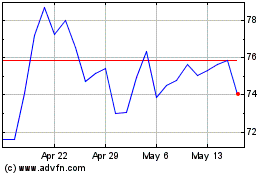

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

From Jan 2024 to Jan 2025