- Leading institutional investors participated in this financing,

including funds and accounts managed by BlackRock

- The additional $300M in equity capital reinforces its already

strong financial position as it eyes strong demand in the defense

market and beyond for its planned hybrid aircraft

- Archer has long maintained one of the strongest balance sheets

in its industry, and this additional capital further strengthens

its position bringing its total liquidity to ~$1 billion

Today Archer announced it has raised $301.75M1, further

reinforcing Archer’s strong financial position and strategically

positioning it to accelerate the development of its hybrid aircraft

platform for the defense market and beyond. Leading institutional

investors participated in this financing, including funds and

accounts managed by BlackRock. This raise brings Archer’s total

liquidity position to ~$1B. Archer has long maintained one of the

strongest balance sheets in the industry, and this additional

capital further strengthens its position.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250211879370/en/

With its further reinforced balance

sheet, Archer continues to be well-positioned for its

commercialization effort. (Photo: Business Wire)

Archer launched Archer Defense in December to develop

next-generation aircraft for defense applications. The first

product from this division is planned to be a hybrid-propulsion,

vertical-take-off-and landing aircraft.

Adam Goldstein, founder and CEO of Archer said, “I believe the

opportunity for advanced vertical lift aircraft across defense

appears to be substantially larger than I originally expected. As a

result, we are raising additional capital to help us invest in

critical capabilities like composites and batteries to help enable

us to capture this opportunity and more.”

With its further reinforced balance sheet, Archer also continues

to be well-positioned for its commercialization effort. Paired with

the completion of construction of its ARC manufacturing facility,

continued progress towards FAA certification and launch of its

cross-industry consortium in the UAE, Archer is tracking well

towards its goals in 2025 and beyond.

Today, Archer is also releasing certain of its preliminary

estimated financial results for the fourth quarter of 2024,

reporting that its GAAP operating expenses will be within the range

of $120 million to $140 million and total non-GAAP operating

expenses are in line with its guidance range of $95 million to $110

million. Archer is also confirming that it does not expect that its

total non-GAAP operating expenses for the first quarter of 2025

will materially increase over this Q4 guided range.

The financing provided for the purchase and sale of 35,500,000

shares of Archer’s Class A common stock at a price of $8.50 per

share based on a volume-weighted average price of the Class A

common stock, in a registered direct offering. The net proceeds

from the offering announced today will be used for the development

of next generation aircraft manufacturing capabilities related to

this effort, including batteries and composites, and the remainder

for general corporate purposes. The shares of Class A common stock

were offered pursuant to an automatic shelf registration statement

on Form S-3ASR (File No. 333-284812) filed with the United States

Securities and Exchange Commission (“SEC”) on February 11, 2025,

which became automatically effective upon filing. Moelis &

Company LLC is acting as the exclusive placement agent in

connection with this offering.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any securities of Archer, nor shall

there be any sale of these securities in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of such

state or jurisdiction. A prospectus supplement relating to the

shares of Class A common stock will be filed by the Company with

the SEC.

About Archer

Archer is designing and developing the key enabling technologies

and aircraft necessary to power the future of aviation. To learn

more, visit www.archer.com.

________________________ 1 Amount reflects the expected

aggregate gross proceeds from this offering prior to deducting

placement agent fees and estimated offering expenses

Forward-Looking Statements

This press release contains forward-looking statements regarding

Archer’s future business plans and expectations, including the

satisfaction of customary closing conditions related to the

offering, Archer’s expected use of proceeds, statements regarding

our expected financial results for the first quarter of 2025, the

pace at which we intend to develop our hybrid aircraft, the

potential size of the business opportunity for a hybrid aircraft,

and the potential size of the defense opportunity. These

forward-looking statements are only predictions and may differ

materially from actual results due to a variety of factors. The

risks and uncertainties that could cause actual results to differ

from the results predicted are more fully detailed in our filings

with the Securities and Exchange Commission (SEC), including our

most recent Annual Report on Form 10-K and most recent Quarterly

Report on Form 10-Q, which are or will be available on our investor

relations website at investors.archer.com and on the SEC website at

www.sec.gov. In addition, please note that any forward-looking

statements contained herein are based on assumptions that we

believe to be reasonable as of the date of this press release. We

undertake no obligation to update these statements as a result of

new information or future events.

The preliminary financial estimates furnished above are based on

management's preliminary determinations and current expectations as

of the date hereof, and such information is inherently uncertain.

The preliminary estimates provided herein have been prepared by,

and are the responsibility of, management of the Company. The

Company's independent registered public accounting firm has not

audited, reviewed, compiled, or performed any procedures with

respect to the preliminary estimates, and, accordingly, does not

express an opinion or any form of assurance with respect thereto.

These preliminary estimates are subject to completion of the

Company's financial closing and review procedures and are not a

comprehensive statement of the Company's financial results as of,

or for the period ended, December 31, 2024. Actual results may

differ materially from these preliminary estimates as a result of

the completion of the Company's financial closing and review

procedures, final adjustments and other developments that may arise

between now and the time that the Company's financial results for

such period are finalized. Liquidity figures presented herein are

based on September 30, 2024 cash and cash equivalents, as adjusted

for Archer’s preliminary results for the fourth quarter of 2024

presented herein, gross proceeds from our December 2024 capital

raise and the gross proceeds from the transactions described herein

and do not give effect to cash used since January 1, 2025 or

expenses from the transactions described herein.

Reconciliation of Selected GAAP To Non-GAAP Results

Reconciliation of Total Operating Expenses (in millions;

unaudited): A reconciliation of preliminary total operating

expenses to preliminary non-GAAP total operating expenses for the

three months ended December 31, 2024 is set forth below.

Three Months Ended

December 31, 2024

(Low) (preliminary)

(High) (preliminary)

Total operating expenses

$120

$140

Adjusted to exclude the following:

Stock-based compensation(1)

(23)

(27)

Warrant expenses(2)

(2)

(3)

Non-GAAP total operating

expenses

$95

$110

- Amounts include stock-based compensation for options and

restricted stock units issued to both employees and non-employees,

including the grants issued to our founder in connection with the

closing of the business combination.

- Amounts include non-cash warrant costs, for the warrants issued

to Stellantis and others, in connection with certain services they

are providing to the Company.

We have not reconciled our non-GAAP total operating expenses

estimates because certain items that impact non-GAAP total

operating expenses are uncertain or out of our control and cannot

be reasonably predicted. In particular, stock-based compensation

expense is impacted by the future fair market value of our common

stock and other factors, all of which are difficult to predict,

subject to frequent change, or not within our control. The actual

amount of these expenses during Q1 2025 will have a significant

impact on our future GAAP financial results. Accordingly, a

reconciliation of non-GAAP total operating expenses is not

available without unreasonable effort.

Non-GAAP Financial Measures

To supplement our condensed consolidated financial results

prepared in accordance with GAAP, we use a number of non-GAAP

financial measures to help us in analyzing and assessing our

overall business performance, for making operating decisions and

for forecasting and planning future periods. We consider the use of

non-GAAP financial measures helpful in assessing our current

financial performance, ongoing operations and prospects for the

future as well as understanding financial and business trends

relating to our financial condition and results of operations.

While we use non-GAAP financial measures as a tool to enhance

our understanding of certain aspects of our financial performance

and to provide incremental insight into the underlying factors and

trends affecting our performance, we do not consider these measures

to be a substitute for, or superior to, the information provided by

GAAP financial measures. Consistent with this approach, we believe

that disclosing non-GAAP financial measures to the readers of our

financial statements provides useful supplemental data that, while

not a substitute for GAAP financial measures, can offer insight in

the review of our financial and operational performance and enables

investors to more fully understand trends in our current and future

performance.

In assessing our business during the quarter ended December 31,

2024, we excluded items in the following general categories from

one or more of our non-GAAP financial measures, certain of which

are described below:

Stock-Based Compensation Expense :

We believe that providing non-GAAP measures excluding stock-based

compensation expense, in addition to the GAAP measures, allows for

better comparability of our financial results from period to

period. We prepare and maintain our budgets and forecasts for

future periods on a basis consistent with this non-GAAP financial

measure. Further, companies use a variety of types of equity awards

as well as a variety of methodologies, assumptions and estimates to

determine stock-based compensation expense. We believe that

excluding stock-based compensation expenses enhances our ability

and the ability of investors to understand the impact of non-cash

stock-based compensation on our operating results and to compare

our results against the results of other companies.

Warrant Expenses : Expense from our

common stock warrants issued to Stellantis and vendors, which is

recurring (but non-cash). We exclude warrant expense for similar

reasons to our stock-based compensation expense.

Each of the non-GAAP financial measures presented in this

release should not be considered in isolation from, or as a

substitute for, a measure of financial performance prepared in

accordance with GAAP and are presented for supplemental

informational purposes only. Further, investors are cautioned that

there are inherent limitations associated with the use of each of

these non-GAAP financial measures as an analytical tool. In

particular, these non-GAAP financial measures have no standardized

meaning prescribed by GAAP and are not based on a comprehensive set

of accounting rules or principles and many of the adjustments to

the GAAP financial measures reflect the exclusion of items that are

recurring and may be reflected in our financial results for the

foreseeable future. In addition, the non-GAAP measures we use may

be different from non-GAAP measures used by other companies,

limiting their usefulness for comparison purposes. We compensate

for these limitations by providing specific information in the

reconciliation included in this release regarding the GAAP amounts

excluded from the non-GAAP financial measures. In addition, as

noted above, we evaluate the non-GAAP financial measures together

with the most directly comparable GAAP financial information.

Investors are encouraged to review the reconciliations of these

non-GAAP measures to their most directly comparable GAAP financial

measures included in this release.

Source: Archer Aviation Text: ArcherIR

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250211879370/en/

Archer Media Contacts The Brand Amp -

Archer@TheBrandAmp.com

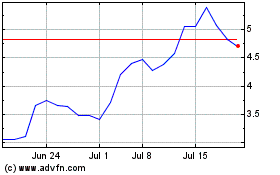

Archer Aviation (NYSE:ACHR)

Historical Stock Chart

From Jan 2025 to Feb 2025

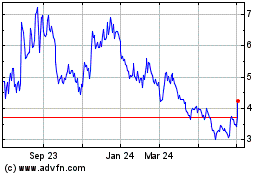

Archer Aviation (NYSE:ACHR)

Historical Stock Chart

From Feb 2024 to Feb 2025