TAFE Urges AGCO to Address Critical Questions Regarding its Strategic Priorities During 2024 Analyst Day

19 December 2024 - 11:00PM

Business Wire

Tractors and Farm Equipment Limited (together with certain of

its affiliates, “TAFE” or “we”) is the largest shareholder of AGCO

Corporation (NYSE: AGCO) (“AGCO” or the “Company”) with a 16.3%

long-term, strategic equity stake in the Company.

Today, TAFE urged management to address the following questions

during its upcoming Analyst Day, which is scheduled to be held at 9

A.M. Eastern Standard Time on December 19, 2024. TAFE believes

these questions are of critical interest to shareholders and have a

direct bearing on the Company’s valuation relative to peers. TAFE’s

questions are in the context of AGCO’s lagging performance compared

to peers, successive quarters of performance misses and downward

revisions in guidance, diminishing competitive position and value

erosion through failed acquisitions, as well as investors’

expectations for earnings resilience across cycles.

Key Questions for AGCO

Management

- Given that the agricultural equipment market appears soft

heading into 2025, how have AGCO’s assumptions shifted for North

America, Europe and South America? What are the risks and

opportunities that would impact these regions? Based on these, is

there a likelihood of further downside?

- If the cyclical downturn is prolonged, what is AGCO’s forecast

for its revenue performance under its current Farmer-First

strategy, which focuses on multiple high-value brands with

relatively low associated volume?

- Does management believe that the Company’s response to the

industry cycle is differentiated and will help close its margin gap

to peers? All industry players, including CNH Industrial NV and

Deere & Company, have resorted to much larger cost containment

to minimize the impact of the downcycle.

- Fendt is an important growth opportunity for AGCO’s North

American business. What are management’s assumptions for the

expected impact of tariffs on sales, prices and margins for each of

AGCO’s brands – especially Fendt?

- In the context of the possibility of a tariff regime change in

North America and Fendt’s globalization plan, does AGCO foresee an

impact on its manufacturing footprint and investment programs in

North and South America?

- AGCO has emphasized that tools like automation and AI are core

to its competitive position in high horsepower. However, the

Company has disclosed consistent sales declines across the

horsepower categories through the first nine months of 2024 – with

faster declines in higher horsepower categories recently.1 Have

AGCO’s premium technology and smart farming solutions had any

observable impact on margin volatility across market cycles?

- How have Trimble’s revenue and margins performed following the

2023 joint venture and what is the 2025 outlook?

- How should shareholders think about the return on investment

over the next two to three years, expressed in higher sales and

profits, that should result from acquiring, developing and

deploying advanced technologies?

- Is the Company planning to take steps to launch a portfolio

review to assess its risk profile and current approach to capital

allocation?

- Does the environmental sustainability of AGCO’s products and

services create an opportunity to differentiate the Company

vis-à-vis peers?

TAFE looks forward to management answering these critical

questions, as we are supportive of AGCO taking all steps to enhance

the long-term value of its shares.

About TAFE

TAFE - Tractors and Farm Equipment Limited, is an Indian tractor

major incorporated in 1960 at Chennai, India. One of the largest

tractor manufacturers in the world and the second largest in India,

TAFE sells over 180,000 tractors annually.

TAFE has earned the trust of customers with its range of

high-quality products, low cost of operation and a strong

distribution network of over 1600+ dealers. TAFE exports tractors

to over 80 countries, powering farms in Asia, Africa, Europe, the

Americas, and Russia.

Besides tractors, TAFE and its subsidiaries have diverse

business interests in areas such as farm-machinery, diesel engines

and gensets, agro-industrial engines, engineering plastics, gears

and transmission components, hydraulic pumps and cylinders, vehicle

franchises and plantations.

TAFE is committed to Total Quality Management (TQM). In the

recent past, various manufacturing plants of TAFE have garnered

numerous ‘TPM Excellence’ awards from the Japan Institute of Plant

Maintenance (JIPM), as well as a number of other regional awards

for TPM excellence. TAFE's tractor plants are certified under

international standards ISO 9001 for efficient quality management

systems and under ISO 14001 for environment-friendly operations. In

2013, TAFE was presented the coveted ‘Agriculture Leadership Award'

by Agriculture Today Magazine and the ‘Corporate Citizen of the

Year Award’ by Public Relations Council of India (PRCI). TAFE was

also named the ‘Best Employer in India 2013’ by Aon Hewitt and has

the distinction of receiving commendation for ‘Significant

Achievement on the Journey Towards Business Excellence’ by the

CII-EXIM Bank - Business Excellence Award jury in 2012.

1 Company Securities and Exchange

Commission filings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241219944015/en/

Longacre Square Partners Charlotte Kiaie / Bela Kirpalani, (646)

386-0091 TAFE@longacresquare.com

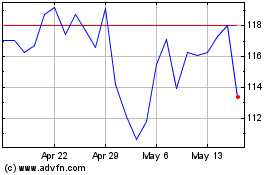

AGCO (NYSE:AGCO)

Historical Stock Chart

From Feb 2025 to Mar 2025

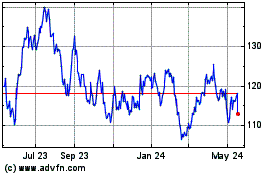

AGCO (NYSE:AGCO)

Historical Stock Chart

From Mar 2024 to Mar 2025