UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event

reported): February 3, 2016 (February 2, 2016)

ARLINGTON ASSET INVESTMENT CORP.

(Exact name of Registrant as specified in

its charter)

| Virginia |

|

54-1873198 |

|

001-34374 |

|

(State or Other Jurisdiction

of Incorporation or Organization)

|

|

(I.R.S. Employer Identification No.) |

|

(Commission File Number) |

1001 Nineteenth Street North

Arlington, VA 22209

(Address of principal executive offices)

(Zip code)

(703) 373-0200

(Registrant’s telephone number including

area code)

N/A

(Former name or former address, if changed

from last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. | Results of Operations and Financial Condition. |

Arlington Asset Investment

Corp. (the “Company”) issued a press release on February 2, 2016 announcing its financial results for the quarter and

full year ended December 31, 2015. A copy of the press release is attached hereto as Exhibit 99.1 (the “Press Release”).

The information in Item

2.02 of this Current Report on Form 8-K, including Exhibit 99.1 furnished pursuant to Item 9.01, shall not be deemed “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities under that Section.

Furthermore, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 furnished pursuant to Item

9.01, shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933.

The Company has posted an updated investor

presentation to its website, www.arlingtonasset.com. A copy of the slide presentation is attached as Exhibit 99.2 hereto

and incorporated herein by reference.

Forward-Looking Statements Disclaimer

This Current Report

on Form 8-K contains “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, including those relating to the fair value and future market price of the Company’s Class

A common stock, future market conditions, interest rates, portfolio allocation, financing costs, portfolio hedging, prepayments,

advances from the Federal Home Loan Bank of Cincinnati, direct repo, and the effect of actions of the U.S. government, including

the Federal Reserve, the Federal Housing Finance Agency and the U.S. Treasury, on our results. Forward-looking statements typically

are identified by use of the terms such as “believe,” “expect,” “anticipate,” “estimate,”

“plan,” “continue,” “intend,” “should,” “may” or similar expressions.

Forward-looking statements are based on the Company's beliefs, assumptions and expectations of the Company's future performance,

taking into account all information currently available to the Company. The Company cannot assure you that actual results will

not vary from the expectations contained in the forward-looking statements. All of the forward-looking statements are subject to

numerous possible events, factors and conditions, many of which are beyond the control of the Company and not all of which are

known to the Company, including, without limitation, market conditions and those described in the Company's Annual Report on Form

10-K for the fiscal year ended December 31, 2014 and other documents which have been filed with the Securities and Exchange Commission.

All forward-looking statements speak only as of the date on which they are made. New risks and uncertainties arise over time, and

it is not possible to predict those events or how they may affect us. Except as required by law, the Company is not obligated to,

and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events

or otherwise.

| Item 9.01. | Financial Statements and Exhibits. |

| 99.1 |

Arlington Asset Investment Corp. Press Release dated February 2, 2016. |

| |

|

| 99.2 |

Investor Presentation dated February 2, 2016 posted to the Company’s website. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ARLINGTON ASSET INVESTMENT CORP. |

|

| |

|

|

|

| Date: February 3, 2016 |

|

|

|

| |

By: |

/s/ Richard E. Konzmann |

|

| |

Name: |

Richard E. Konzmann |

|

| |

Title: |

Executive

Vice Presidet, Chief Financial

Officer and Treasurer |

|

EXHIBIT INDEX

|

Exhibit

No. |

|

Description

|

| |

|

|

| 99.1 |

|

Arlington Asset Investment Corp. Press Release dated February 2, 2016. |

| |

|

|

| 99.2 |

|

Investor Presentation dated February 2, 2016 posted to the Company’s website. |

Exhibit 99.1

Contacts:

Media: 703.373.0200 or ir@arlingtonasset.com

Investors: Rich Konzmann at 703.373.0200 or ir@arlingtonasset.com

Arlington Asset Investment Corp. Reports

Fourth Quarter and Full Year 2015 Financial Results

ARLINGTON, VA, February 2, 2016

– Arlington Asset Investment Corp. (NYSE: AI) (the “Company” or “Arlington”) today reported non-GAAP

core operating income of $30.3 million for the quarter ended December 31, 2015, or $1.31 per diluted share. Excluding realized

gains and losses on private-label mortgage-backed securities (“MBS”), the Company reported non-GAAP core operating

income of $31.1 million, or $1.35 per diluted share. A reconciliation of non-GAAP core operating income measures to GAAP net income

(loss) appears at the end of this press release.

Fourth Quarter 2015 Financial Highlights

| · | $1.31 per diluted share of non-GAAP core operating income |

| · | $1.35 per diluted share of non-GAAP core operating income excluding gain (loss) on private-label

MBS |

| · | $0.82 per diluted share of net income |

| · | $0.86 per diluted share of total comprehensive income |

| · | $21.05 per share of book value |

| · | $0.625 per share dividend declared |

| · | Repurchased 48,695 shares of common stock for $0.6 million |

| · | Subsequent to year-end, fully repaid outstanding Federal Home Loan Bank (“FHLB”) advances |

Full Year 2015 Financial Highlights

| · | $5.91 per diluted share of non-GAAP core operating income |

| · | $5.30 per diluted share of non-GAAP core operating income excluding gain (loss) on private-label

MBS |

| · | $(3.02) per diluted share of net loss |

| · | $(4.04) per diluted share of total comprehensive loss |

| · | $3.00 per share dividend declared |

“Less volatile market conditions

and lower prepayment speeds in Arlington’s agency MBS portfolio during the fourth quarter contributed to an improvement in

the Company’s book value per share at year-end. Arlington’s private-label MBS portfolio continued its steady credit

improvement trend and exhibited flat price performance during the quarter,” said J. Rock Tonkel, Jr., the Company's President

and Chief Executive Officer. “Renewed volatility subsequent to year-end accompanied by declines in global growth expectations,

risk assets and forward interest rates have produced additional spread widening between the Company’s interest rate hedges

and its agency MBS to date this year. Looking forward from today, Arlington should benefit from enhanced agency MBS spreads, its

flexible allocation to private-label MBS and tax-advantaged structure, although we remain cautious given global uncertainty and

market conditions. In addition, our sizeable stock repurchase authorization remains available to enhance shareholder returns going

forward.”

Other Fourth Quarter Highlights

As of December 31, 2015, the Company’s

agency investment portfolio totaled $4,254.6 million consisting of $3,865.3 million of agency MBS and $389.3 million of net long

to-be-announced (“TBA”) agency securities. As of December 31, 2015, the Company’s $3,865.3 million of fixed-rate

agency MBS were comprised of the following:

| · | $714.9 million of 3.5% 30-year MBS |

| · | $3,016.5 million of 4.0% 30-year MBS |

| · | $133.9 million of 4.5% 30-year MBS |

As of December 31, 2015, the Company’s

agency MBS had a weighted average original cost of $105.85 and a weighted average market price of $105.84. The Company’s

fixed-rate agency MBS were specifically selected for their prepayment protections with approximately 48% of the Company’s

agency MBS portfolio in specified pools of low loan balance loans, approximately 20% in specified pools of loans issued under the

Home Affordable Refinance Program (“HARP”), while the remainder includes specified pools of loans originated in certain

geographic areas, loans with low FICO scores or loans with other characteristics selected for the prepayment protection. Weighted

average pay-up premiums on the Company’s agency MBS portfolio, which represent the estimated price premium of agency MBS

backed by specified pools over a generic TBA agency security, decreased modestly to approximately 1/2 of a point as of December

31, 2015 compared to approximately 3/5 of a point as of September 30, 2015. The three-month constant prepayment rate (“CPR”)

for the Company’s agency MBS decreased to 7.15% as of December 31, 2015, compared to 8.16% as of September 30, 2015.

As of December 31, 2015, the Company’s

net long TBA securities had a net notional amount of $375.0 million, purchase price of $389.8 million and market value of $389.3

million resulting in a net GAAP carrying fair value of $(0.6) million. The Company accounts for its TBA mortgage portfolio as derivative

instruments and recognizes income from TBA dollar rolls as a component of net investment gains and losses in the Company’s

financial statements. As of December 31, 2015, the Company’s $389.3 million of net long TBA securities were comprised of

the following:

| · | $283.5 million of 3.5% 30-year MBS |

| · | $105.8 million of 4.0% 30-year MBS |

During the fourth quarter of 2015, the

Company modified the types of instruments it uses to hedge its agency MBS investment portfolio. The Company closed its Eurodollar

and interest rate swap future contracts and generally replaced them with centrally cleared interest rate swap agreements and U.S.

Treasury note futures. As of December 31, 2015, the total notional amount of the Company’s interest rate hedges on its agency

investment portfolio was $2,835 million comprised of interest rate swap agreements and U.S. Treasury note futures. The total hedge

notional amount as a percentage of the Company’s outstanding repurchase agreement and FHLB advance financing on its agency

MBS and net long TBA position was 71% as of December 31, 2015 compared to 79% as of September 30, 2015. As of December 31, 2015,

the Company had $750 million in notional amount of two-year interest rate swap agreements with a weighted average pay fixed rate

of 1.04% and a remaining weighted average maturity of 1.9 years and $750 million in notional amount of 10-year interest rate swap

agreements with a weighted average pay fixed rate of 2.12% and a remaining weighted average maturity of 9.9 years. As of December

31, 2015, the Company also had $1,335 million in notional 10-year U.S. Treasury note futures that were

purchased during the fourth quarter when the 10-year U.S. Treasury note rate was 2.22% on a weighted average basis and had a market

rate of 2.27% as of December 31, 2015.

Interest

income less interest expense on short-term financing on the Company’s agency MBS portfolio for the fourth quarter of 2015

was $31.5 million. The amortization of net premiums on the Company’s agency MBS is reflected in the Company’s GAAP

net income and changes in book value through net investment gains and losses rather than through net interest income and core

operating income. For the quarter ended December 31, 2015, the estimated amortization of the Company’s net premium on its

agency MBS, if amortized in proportion to the principal payments received during the period as a percentage of face value at the

time of purchase, would have been approximately $5.9 million, or $0.25 per diluted share. Beginning in 2016, the Company intends

to change its accounting policy for recognizing interest income on its agency MBS by amortizing purchase premiums as an adjustment

to net interest income. During the fourth quarter of 2015, the Company recorded net investment losses on its agency investment

portfolio of $44.9 million and net investment gains on its related derivative hedging instruments of $39.8 million for a net investment

loss on its hedged agency MBS portfolio of $5.1 million. In recent quarters, the Company’s

increased allocation of capital to agency MBS has resulted in growth in the Company’s net interest income and core operating

income. With this growth in the agency MBS portfolio, the economic costs of the Company’s hedge instruments have grown proportionately.

The economic costs of the Company’s hedge instruments are reflected in GAAP net income and changes in book value through

net investment gains and losses rather than through net interest income and core operating income, with the exception of the net

periodic interest costs of the Company’s interest rate swap agreements, which are reflected in core operating income.

As of December 31, 2015, the Company’s

private-label MBS portfolio consisted of $169.8 million in face value with an amortized cost basis of $114.7 million and a fair

value of $130.4 million. During the fourth quarter of 2015, the Company sold private-label MBS for sale proceeds of $5.5 million,

realizing a GAAP gain of $0.3 million. Net sale proceeds from these private-label MBS after deducting associated repurchase financing

was $2.4 million. Interest income less interest expense on short-term financing on the Company’s private-label MBS portfolio

for the fourth quarter of 2015 was $2.7 million, including non-cash accretion of $1.6 million required under GAAP.

As of December 31, 2015, the Company had

$2,797.6 million of repurchase agreements outstanding with a weighted average rate of 61 basis points and $786.9 million of FHLB

advances outstanding with a weighted average rate of 36 basis points secured by an aggregate of $3,751.8 million of agency MBS

at fair value. As of December 31, 2015, the Company also had $37.2 million of repurchase agreements outstanding with a weighted

average rate of 242 basis points secured by $70.5 million of private-label MBS at fair value.

FHLB Membership and Advances

In September 2015, the Company’s

wholly-owned captive insurance subsidiary was granted membership to the FHLB of Cincinnati. On January 12, 2016, the regulator

of the FHLB system, the Federal Housing Finance Agency (“FHFA”), released a final rule that amends regulations governing

FHLB membership, including preventing captive insurance companies from being eligible for FHLB membership. Under the terms of

the final rule, the Company’s captive insurance company is required to terminate its membership and repay its existing advances

within one year following the effective date of the final rule. In addition, the Company’s captive insurance company is

prohibited from taking new advances or renewing existing maturing advances during the one-year transition period. The final rule

becomes effective on February 19, 2016. The Company has repaid all of its outstanding FHLB advances, funded primarily through

repurchase agreement financing.

Corporate Tax Structure

The Company is subject to taxation as

a corporation under Subchapter C of the Internal Revenue Code of 1986, as amended. As of December 31, 2015, the Company had $107

million of net operating loss carry-forwards that begin to expire in 2027 and $241 million of net capital loss carry-forwards

that begin to expire in 2019. For GAAP accounting purposes, as of December 31, 2015 the Company had a deferred tax asset of $97.5

million, or $4.24 per share, which reflects a partial valuation allowance against its net capital loss-carryforwards.

Stock Repurchase Program

In October 2015, the Company’s board

of directors authorized an increase in the Company’s share repurchase program pursuant to which the Company may repurchase

up to 2.0 million shares of its Class A common stock. During the fourth quarter, the Company repurchased 48,695 shares at an average

price of $12.15 per share for a total purchase price of $0.6 million.

Distributions to Shareholders

The Company has announced the tax characteristics of the distributions paid on its common stock in calendar year 2015. The Company

has determined that all of its cash distributions paid to shareholders in calendar year 2015 were returns of capital. Shareholders

should receive a Form 1099-DIV containing this information from their brokers, transfer agents or other institutions.

The Company’s board of directors

previously approved a distribution to common shareholders of $0.625 per share for the fourth quarter of 2015 that was paid on January

29, 2016 to shareholders of record as of December 31, 2015.

The tax characterization of the Company’s

distributions to shareholders is determined annually and reported to shareholders on Form 1099-DIV after the end of the calendar

year. As a C-corporation, distributions to shareholders of current or accumulated earnings

and profits are qualified dividends eligible for the 23.8% federal income tax rate whereas similar distributions to shareholders

by a REIT of current or accumulated earnings and profits are nonqualified dividends subject to the higher 43.4% tax rate on ordinary

income inclusive of the 3.8% Medicare tax. Any distributions in excess of current or accumulated

earnings and profits would be reported as returns of capital instead of qualified dividends. Distributions that are classified

as returns of capital are nontaxable to the extent they do not exceed a shareholder's adjusted tax basis in the Company's stock,

or as a capital gain to the extent that the amount of the distribution exceeds a shareholder's adjusted tax basis in the Company's

stock.

Conference Call

The Company will hold a conference

call for investors at 9:00 A.M. Eastern Time on Wednesday, February 3, 2016 to discuss the results. Investors

wishing to listen to the earnings call may do so via the Internet at: http://www.arlingtonasset.com/index.php?s=19.

Replays of the earnings call will be

available for 60 days via webcast at the Internet address provided above, beginning two hours after the call ends.

Additional Information

The Company will make available additional quarterly information

for the benefit of its shareholders through a supplemental presentation that will be available at the Company's website, www.arlingtonasset.com.

The presentation will be available on the Webcasts and Presentations section located under the Events tab of the Company's

website.

About the Company

Arlington Asset Investment Corp. (NYSE:

AI) is a principal investment firm that currently invests primarily in mortgage-related and other assets. The Company is headquartered

in the Washington, D.C. metropolitan area. For more information, please visit www.arlingtonasset.com.

Statements concerning interest rates, portfolio

allocation, financing costs, portfolio hedging, prepayments, dividends, book value, FHLB advances, direct repo, and any other guidance

on present or future periods constitute forward-looking statements that are subject to a number of factors, risks and uncertainties

that might cause actual results to differ materially from stated expectations or current circumstances. These factors include,

but are not limited to, changes in interest rates, increased costs of borrowing, decreased interest spreads, changes in political

and monetary policies, changes in default rates, changes in prepayment rates, changes in the Company’s returns, changes in

the use of the Company’s tax benefits, changes in the agency MBS asset yield, changes in the Company’s monetization

of net operating loss carry-forwards, changes in the Company’s ability to generate cash earnings and dividends, preservation

and utilization of our net operating loss and net capital loss carry-forwards, impacts of changes to and changes by Fannie Mae

and Freddie Mac, actions taken by the U.S. Federal Reserve, the Federal Housing Finance Agency and the U.S. Treasury, availability

of opportunities that meet or exceed the Company’s risk adjusted return expectations, ability and willingness to make future

dividends, ability to generate sufficient cash through retained earnings to satisfy capital needs, ability to realize book value

growth through reflation of private-label MBS, and general economic, political, regulatory and market conditions. These and other

material risks are described in the Company's Annual Report on Form 10-K for the year ended December 31, 2014 and any other documents

filed by the Company with the SEC from time to time, which are available from the Company and from the SEC, and you should read

and understand these risks when evaluating any forward-looking statement.

Financial data to follow

ARLINGTON ASSET INVESTMENT CORP.

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands, except per share amounts)

(Unaudited)

| | |

| | |

| | |

| |

| ASSETS | |

December 31, 2015 | | |

September 30, 2015 | | |

December 31, 2014 | |

| | |

| | |

| | |

| |

| Cash and cash equivalents | |

$ | 36,987 | | |

$ | 13,529 | | |

$ | 33,832 | |

| Interest receivable | |

| 11,936 | | |

| 11,459 | | |

| 10,701 | |

| Sold securities receivable | |

| - | | |

| 28,035 | | |

| - | |

| Mortgage-backed securities, at fair value | |

| | | |

| | | |

| | |

| Private-label securities | |

| 130,435 | | |

| 134,789 | | |

| 267,437 | |

| Agency securities | |

| 3,865,316 | | |

| 3,790,044 | | |

| 3,414,340 | |

| Derivative assets, at fair value | |

| 12,991 | | |

| 3,863 | | |

| 1,267 | |

| Deferred tax assets, net | |

| 97,530 | | |

| 103,319 | | |

| 125,607 | |

| Deposits | |

| 29,429 | | |

| 87,258 | | |

| 160,427 | |

| Other assets | |

| 20,182 | | |

| 9,938 | | |

| 4,120 | |

| Total assets | |

$ | 4,204,806 | | |

$ | 4,182,234 | | |

$ | 4,017,731 | |

| | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Liabilities: | |

| | | |

| | | |

| | |

| Repurchase agreements | |

$ | 2,834,780 | | |

$ | 3,153,756 | | |

$ | 3,179,775 | |

| Federal Home Loan Bank advances | |

| 786,900 | | |

| 308,500 | | |

| - | |

| Interest payable | |

| 2,436 | | |

| 1,200 | | |

| 1,106 | |

| Accrued compensation and benefits | |

| 5,170 | | |

| 4,293 | | |

| 6,067 | |

| Dividend payable | |

| 14,504 | | |

| 14,553 | | |

| 20,195 | |

| Derivative liabilities, at fair value | |

| 553 | | |

| 53,514 | | |

| 124,308 | |

| Purchased securities payable | |

| - | | |

| 92,107 | | |

| - | |

| Other liabilities | |

| 1,132 | | |

| 1,003 | | |

| 1,006 | |

| Long-term debt | |

| 75,300 | | |

| 75,300 | | |

| 40,000 | |

| Total liabilities | |

| 3,720,775 | | |

| 3,704,226 | | |

| 3,372,457 | |

| | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Equity: | |

| | | |

| | | |

| | |

| Common stock | |

| 230 | | |

| 230 | | |

| 230 | |

| Additional paid-in capital | |

| 1,898,085 | | |

| 1,897,472 | | |

| 1,897,027 | |

| Accumulated other comprehensive income, net of taxes | |

| 12,371 | | |

| 11,334 | | |

| 35,872 | |

| Accumulated deficit | |

| (1,426,655 | ) | |

| (1,431,028 | ) | |

| (1,287,855 | ) |

| Total equity | |

| 484,031 | | |

| 478,008 | | |

| 645,274 | |

| | |

| | | |

| | | |

| | |

| Total liabilities and equity | |

$ | 4,204,806 | | |

$ | 4,182,234 | | |

$ | 4,017,731 | |

| | |

| | | |

| | | |

| | |

| Book value per share | |

$ | 21.05 | | |

$ | 20.75 | | |

$ | 28.09 | |

| | |

| | | |

| | | |

| | |

| Shares outstanding (in thousands) (1) | |

| 22,994 | | |

| 23,042 | | |

| 22,973 | |

| (1) | Represents shares of Class A common stock and Class B

common stock outstanding plus vested restricted stock units convertible into Class A common stock less unvested restricted Class

A common stock. |

ARLINGTON ASSET INVESTMENT CORP.

CONSOLIDATED

STATEMENTS OF OPERATIONS

| (Dollars in thousands, except per share data) | |

Three Months Ended | | |

Fiscal Year Ended | |

| (Unaudited) | |

December 31, | | |

December 31, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| INTEREST INCOME | |

| | | |

| | | |

| | | |

| | |

| Interest on agency securities | |

$ | 35,475 | | |

$ | 31,297 | | |

$ | 139,244 | | |

$ | 97,900 | |

| Interest on private-label securities | |

| 2,880 | | |

| 5,012 | | |

| 15,322 | | |

| 25,597 | |

| Other | |

| 9 | | |

| 7 | | |

| 27 | | |

| 50 | |

| Total interest income | |

| 38,364 | | |

| 36,316 | | |

| 154,593 | | |

| 123,547 | |

| | |

| | | |

| | | |

| | | |

| | |

| INTEREST EXPENSE | |

| | | |

| | | |

| | | |

| | |

| Interest on short-term debt | |

| 4,237 | | |

| 2,901 | | |

| 14,701 | | |

| 9,181 | |

| Interest on long-term debt | |

| 1,184 | | |

| 553 | | |

| 4,188 | | |

| 2,210 | |

| Total interest expense | |

| 5,421 | | |

| 3,454 | | |

| 18,889 | | |

| 11,391 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net interest income | |

| 32,943 | | |

| 32,862 | | |

| 135,704 | | |

| 112,156 | |

| | |

| | | |

| | | |

| | | |

| | |

| INVESTMENT LOSS, NET | |

| | | |

| | | |

| | | |

| | |

| Realized gain on sale of available-for-sale investments, net | |

| 291 | | |

| 4,431 | | |

| 17,725 | | |

| 17,257 | |

| Other-than-temporary impairment charges | |

| (2,417 | ) | |

| (298 | ) | |

| (2,417 | ) | |

| (449 | ) |

| (Loss) gain on trading investments, net | |

| (43,383 | ) | |

| 39,723 | | |

| (64,388 | ) | |

| 84,152 | |

| Gain (loss) from derivative instruments, net | |

| 38,207 | | |

| (77,844 | ) | |

| (105,349 | ) | |

| (140,353 | ) |

| Other, net | |

| 1,628 | | |

| 291 | | |

| 2,050 | | |

| 706 | |

| Total investment loss, net | |

| (5,674 | ) | |

| (33,697 | ) | |

| (152,379 | ) | |

| (38,687 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER EXPENSES | |

| | | |

| | | |

| | | |

| | |

| Compensation and benefits | |

| 2,567 | | |

| 3,326 | | |

| 9,719 | | |

| 13,467 | |

| Other operating expenses | |

| 1,216 | | |

| 1,154 | | |

| 4,448 | | |

| 4,602 | |

| Total other expenses | |

| 3,783 | | |

| 4,480 | | |

| 14,167 | | |

| 18,069 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) before income taxes | |

| 23,486 | | |

| (5,315 | ) | |

| (30,842 | ) | |

| 55,400 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax provision | |

| 4,675 | | |

| 25,651 | | |

| 38,561 | | |

| 47,647 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

$ | 18,811 | | |

$ | (30,966 | ) | |

$ | (69,403 | ) | |

$ | 7,753 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic earnings (loss) per share | |

$ | 0.82 | | |

$ | (1.35 | ) | |

$ | (3.02 | ) | |

$ | 0.39 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted earnings (loss) per share | |

$ | 0.82 | | |

$ | (1.35 | ) | |

$ | (3.02 | ) | |

$ | 0.38 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding - basic (in thousands) | |

| 23,034 | | |

| 22,973 | | |

| 23,002 | | |

| 20,043 | |

| Weighted average shares outstanding - diluted (in thousands) | |

| 23,066 | | |

| 22,973 | | |

| 23,002 | | |

| 20,397 | |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER COMPREHENSIVE INCOME (LOSS), NET OF TAXES | |

| | | |

| | | |

| | | |

| | |

Unrealized gains (losses) on available-for-sale securities

(net of taxes of $(164), $(1,084), $(4,281), and $633, respectively) | |

$ | (258 | ) | |

$ | (1,702 | ) | |

$ | (7,033 | ) | |

$ | 995 | |

Reclassification in investment (loss) gain, net, related to sales and other-than-temporary impairment charges on available-for-sale

securities (net of tax of $824, $(1,458), $(4,155) and $(5,324), respectively) | |

| 1,295 | | |

| (3,116 | ) | |

| (16,468 | ) | |

| (11,392 | ) |

| Comprehensive income (loss) | |

$ | 19,848 | | |

$ | (35,784 | ) | |

$ | (92,904 | ) | |

$ | (2,644 | ) |

In addition to the financial results reported

in accordance with generally accepted accounting principles as consistently applied in the United States (“GAAP”),

the Company calculated non-GAAP core operating income for the three months and years ended December 31, 2015 and 2014. In determining

core operating income, the Company excludes certain legacy litigation expenses and adjusts net income determined in accordance

with GAAP for the following non-cash and other items:

| · | compensation costs associated with stock-based awards; |

| · | non-cash accretion of private-label MBS purchase discounts; |

| · | private-label MBS purchase discount accretion realized upon sale or repayment; |

| · | other-than-temporary impairment charges; |

| · | other-than-temporary impairment charges realized upon sale or repayment; |

| · | both realized and unrealized gains and losses on agency MBS; |

| · | unrealized gains and losses and early termination net settlement payments or receipts on interest

rate swap agreements; |

| · | both realized and unrealized gains on losses on all other derivative instruments; and |

| · | non-cash income tax provisions. |

In determining core operating income, the

Company includes the periodic interest costs of its interest rate swap agreements, which the Company first began to enter into

during the fourth quarter of 2015.

The Company’s investment strategy

for its agency MBS portfolio is to generate a net interest margin on the leveraged assets and hedge the market value of the assets,

expecting that the fluctuations in the market value of the agency MBS and related hedges should largely offset each other over

time. As a result, the Company excludes both the realized and unrealized fluctuations in the gains and losses in the assets and

hedges, except for the periodic interest costs of interest rate swap agreements, on its hedged agency MBS portfolio when assessing

the underlying core operating income of the Company. However, the Company’s investment strategy for its private-label MBS

portfolio is to generate a total cash return comprised of both interest income collected and the cash return realized when the

private-label MBS are sold that equals the difference between the sale price and the discount to par paid at acquisition. Therefore,

the Company excludes non-cash accretion of private-label MBS purchase discounts from non-GAAP core operating income, but includes

realized cash gains or losses on its private-label MBS portfolio in core operating income to reflect the total cash return on those

securities over their holding period. Since the timing of realized cash gains or losses on private-label MBS may vary significantly

between periods, the Company also reports core operating income excluding gains on private-label MBS.

These non-GAAP core operating income measurements

are used by management to analyze and assess the Company’s operating results on its portfolio and assist with the determination

of the appropriate level of dividends. The Company believes that these non-GAAP measurements assist investors in understanding

the impact of these non-core items and non-cash expenses on our performance and provides additional clarity around our earnings

capacity and trends. A limitation of utilizing this non-GAAP measure is that the GAAP accounting effects of these events do in

fact reflect the underlying financial results of our business and these effects should not be ignored in evaluating and analyzing

our financial results. Additional limitations of core operating income are that it does not include economic financing costs on

the Company’s hedging instruments (with the exception of periodic net interest costs of interest rate swap agreements) or

amortization of premiums or discounts on the Company’s agency MBS whereas those amounts are both reflected in net income

determined in accordance with GAAP and changes in book value. Therefore, the Company believes net income on a GAAP basis and these

core operating income measures on a non-GAAP basis should be considered together.

The following is a reconciliation of GAAP

net income to non-GAAP core operating income measures for the three months and years ended December 31, 2015 and 2014 (dollars

in thousands):

| ARLINGTON ASSET INVESTMENT CORP. | |

| | |

| | |

| | |

| |

| NON-GAAP CORE OPERATING INCOME | |

| | |

| | |

| | |

| |

| (Dollars in thousands, except per share data) | |

Three Months Ended | | |

Fiscal Year Ended | |

| (Unaudited) | |

December 31, | | |

December 31, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| GAAP net income (loss) | |

$ | 18,811 | | |

$ | (30,966 | ) | |

$ | (69,403 | ) | |

$ | 7,753 | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Legacy litigation expenses | |

| - | | |

| - | | |

| - | | |

| 54 | |

| Non-cash income tax provision | |

| 5,480 | | |

| 25,254 | | |

| 37,515 | | |

| 46,354 | |

| Stock compensation | |

| 853 | | |

| 834 | | |

| 1,145 | | |

| 3,814 | |

| Net realized and unrealized loss on trading MBS and hedge instruments | |

| 3,879 | | |

| 38,022 | | |

| 168,339 | | |

| 55,830 | |

| Net realized gain on private-label MBS | |

| (291 | ) | |

| (4,431 | ) | |

| (17,725 | ) | |

| (17,257 | ) |

| Other-than-temporary impairment charges | |

| 2,417 | | |

| 298 | | |

| 2,417 | | |

| 449 | |

| | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP core operating income excluding gain on private-label MBS | |

| 31,149 | | |

| 29,011 | | |

| 122,288 | | |

| 96,997 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net realized gain on private-label MBS | |

| 291 | | |

| 4,431 | | |

| 17,725 | | |

| 17,257 | |

| Other-than-temporary impairment charges realized upon sale or repayment | |

| - | | |

| (1,154 | ) | |

| (7,303 | ) | |

| (5,180 | ) |

| Purchase discount accretion of private-label MBS realized upon sale or repayment | |

| 485 | | |

| 1,453 | | |

| 12,199 | | |

| 4,074 | |

| Non-cash interest income related to purchase discount accretion of private-label MBS | |

| (1,633 | ) | |

| (2,315 | ) | |

| (8,453 | ) | |

| (12,570 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP core operating income | |

$ | 30,292 | | |

$ | 31,426 | | |

$ | 136,456 | | |

$ | 100,578 | |

| | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP core operating income excluding gain on private-label MBS per diluted share | |

$ | 1.35 | | |

$ | 1.24 | | |

$ | 5.30 | | |

$ | 4.76 | |

| | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP core operating income per diluted share | |

$ | 1.31 | | |

$ | 1.35 | | |

$ | 5.91 | | |

$ | 4.93 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average diluted shares outstanding | |

| 23,066 | | |

| 23,316 | | |

| 23,088 | | |

| 20,397 | |

| | |

| | | |

| | | |

| | | |

| | |

The following tables present information

on the Company’s investment and hedge portfolio as of December 31, 2015 (unaudited, dollars in thousands):

| Agency MBS: | |

| | |

| | |

| | |

| | |

| |

| | |

Face Amount | | |

Fair Value | | |

Market Price | | |

Coupon | | |

Weighted

Average Life | |

| 30-year fixed rate: | |

| | |

| | |

| | |

| | |

| |

| 3.5% | |

$ | 691,622 | | |

$ | 714,925 | | |

$ | 103.37 | | |

| 3.50 | % | |

| 7.0 | |

| 4.0% | |

| 2,837,244 | | |

| 3,016,444 | | |

| 106.32 | | |

| 4.00 | % | |

| 5.5 | |

| 4.5% | |

| 123,010 | | |

| 133,921 | | |

| 108.87 | | |

| 4.50 | % | |

| 4.6 | |

| 5.5% | |

| 23 | | |

| 26 | | |

| 111.77 | | |

| 5.50 | % | |

| 5.0 | |

| Total/weighted average | |

$ | 3,651,899 | | |

$ | 3,865,316 | | |

| 105.84 | | |

| 3.92 | % | |

| 5.8 | |

| Net TBA Securities: | |

| | |

| | |

| | |

| |

| | |

Net Notional Amount | | |

Average Net Contractual Forward Price | | |

Average Net Market Price | | |

Fair Value | |

| 30-year fixed rate: | |

| | |

| | |

| | |

| |

| 3.5% | |

$ | 275,000 | | |

$ | 283,928 | | |

$ | 283,469 | | |

$ | (459 | ) |

| 4.0% | |

| 100,000 | | |

| 105,883 | | |

| 105,789 | | |

| (94 | ) |

| Total | |

$ | 375,000 | | |

$ | 389,811 | | |

$ | 389,258 | | |

$ | (553 | ) |

| Private-label MBS: | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Face value | |

$ | 169,757 | | |

| | | |

| | | |

| | |

| Discount | |

$ | (55,031 | ) | |

| | | |

| | | |

| | |

| Amortized cost | |

$ | 114,726 | | |

| | | |

| | | |

| | |

| Net unrealized gain | |

$ | 15,710 | | |

| | | |

| | | |

| | |

| Fair market value | |

$ | 130,436 | | |

| | | |

| | | |

| | |

| Fair market value (as a % of face value) | |

| 76.8 | % | |

| | | |

| | | |

| | |

| Quarterly GAAP yield (annualized) | |

| 9.78 | % | |

| | | |

| | | |

| | |

| Weighted average coupon | |

| 3.03 | % | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Private-Label MBS Loan Collateral Statistics: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| 60+ days delinquent | |

| 11.9 | % | |

| | | |

| | | |

| | |

| Credit enhancement | |

| 0.1 | % | |

| | | |

| | | |

| | |

| Constant default rate (3-month) | |

| 4.7 | % | |

| | | |

| | | |

| | |

| Loss severity (3-month) | |

| 32.1 | % | |

| | | |

| | | |

| | |

| Voluntary prepayment rate (3-month) | |

| 6.1 | % | |

| | | |

| | | |

| | |

| Interest Rate Swaps: | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Years to Maturity | |

Notional Amount | | |

Average Fixed Pay

Rate | | |

Fair Value | | |

Average Remaining Maturity (Years) | |

| | |

| | |

| | |

| | |

| |

| Less than 2 years | |

$ | 750,000 | | |

| 1.04 | % | |

$ | 1,166 | | |

| 1.9 | |

| Greater than 9 years | |

| 750,000 | | |

| 2.12 | % | |

| 4,987 | | |

| 9.9 | |

| Total/weighted average | |

$ | 1,500,000 | | |

| 1.58 | % | |

$ | 6,153 | | |

| 5.9 | |

| | |

| | | |

| | | |

| | | |

| | |

| U.S. Treasury Note Futures: | |

| | |

| | |

| | |

| |

| | |

Notional Amount | | |

Fair Value | | |

Contract Maturity | | |

| |

| | |

| | | |

| | | |

| | | |

| | |

| 10-year U.S. Treasury note futures | |

$ | 1,335,000 | | |

$ | 6,813 | | |

| March 2016 | | |

| | |

Exhibit 99.2

Investor Presentation – Fourth Quarter 2015 February 2, 2016

1 Information Related to Forward - Looking Statements This presentation contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 19 95. These include statements regarding future results or expectations about our investments, interest rates, portfolio allocation, divi den ds, financing agreements, returns on invested capital, investment strategy, taxes, portfolio, earnings, book value, housing market, compens ati on, growth in capital, agency MBS spreads, prepayments, hedging instruments, duration, credit performance of private - label MBS, cash flow and benefit of deferred tax asset value. Forward - looking statements can be identified by forward - looking language, including words such as “be lieves,” “anticipates,” “views,” “expects,” “estimates,” “intends,” “may,” “plans,” “projects,” “potential,” “prospective,” “will” and si milar expressions, or the negative of these words. Such forward - looking statements are based on facts and conditions as they exist at the time such statements are made. Forward - looking statements are also based on predictions as to future facts and conditions, the accurate p rediction of which may be difficult and involve the assessment of events beyond our control. Forward - looking statements are further based on various operating and return assumptions. Caution must be exercised in relying on forward - looking statements. Due to known and unknown risks, actual results may differ materially from expectations or projections. You should carefully consider these risks when you make a decision concerning an investment in our common stock or senior not es , along with the following factors, among others, that may cause our actual results to differ materially from those described in any for ward - looking statements: availability of, and our ability to deploy, capital; growing our business primarily through a strategy focused on ac quiring primarily private - label mortgage - backed securities (“MBS”) and agency MBS; yields on MBS; our ability to successfully implement our hedgin g strategy; our ability to realize reflation on our private - label MBS; the credit performance of our private - label MBS; current co nditions and adverse developments in the residential mortgage market and the overall economy; potential risk attributable to our mortgage - rel ated portfolios; impacts of regulatory changes, including actions taken by the SEC, the U.S. Federal Reserve, the Federal Housing Fin ance Agency and the U.S. Treasury and changes affecting Fannie Mae and Freddie Mac; overall interest rate environment and changes in inte res t rates, interest rate spreads, the yield curve and prepayment rates; changes in anticipated earnings and returns; the amount and grow th in our cash earnings and distributable income; growth in our book value per share; our ability to maintain adequate liquidity; our use of le verage and dependence on repurchase agreements and other short - term borrowings to finance our mortgage - related holdings; the loss of our ex clusion from the definition of an “investment company” under the Investment Company Act of 1940; our ability to forecast our tax attr ibu tes and protect and use our net operating loss carry - forwards and net capital loss carry - forwards to offset future taxable income and ga ins; changes in our business, acquisition, leverage, asset allocation, operational, hedging and financing strategies and policies; our abilit y a nd willingness to make future dividends; changes in, and our ability to remain in compliance with, law, regulations or governmental policies af fec ting our business; and the factors described in the sections entitled “Risk Factors” in our Annual Report on Form 10 - K for the year ended December 31, 2014, subsequent Quarterly Reports on Form 10 - Q and other documents filed by the Company with the SEC from time to time. You sh ould not place undue reliance on these forward - looking statements, which apply only as of the date of this presentation. We undertak e no obligation to update or revise any forward - looking statement, whether written or oral, relating to matters discussed in this presentation, except as may be required by applicable securities laws.

2 Company Overview ; Arlington Asset Investment Corp. (“AI” or the “Company”) is an investment firm focused on securitized residential mortgage assets - Invests in high quality liquid assets with predictable cash flows and substantial hedges - Internally - managed - Structured as a C - corp to optimize investment strategy and taxes ; Our hybrid investment portfolio is positioned to benefit from normalization of interest rates and the housing market - Portfolio consists of agency and private - label MBS NYSE Ticker AI Share Price (2/1/16) $11.14 Dividend Yield (2/1/16) (1) 22.4% Market Cap (2/1/16 ) $256 million Total Assets (12/31/15) $4.2 billion Book Value P er Share (12/31/15) $21.05 (1) Assumes a quarterly dividend of $0.625.

3 ; Complementary hybrid portfolio comprised of ~$4.4 billion of high - quality, liquid securities - Hedged, prepayment protected fixed - rate agency MBS - Floating rate private - label MBS in re - REMIC form backed by prime and Alt - A collateral - Flexibility in allocating capital between agency and private - label MBS to achieve the highest risk adjusted returns MBS Investment Portfolio Overview ( 1 ) Agency MBS allocated capital is composed of MBS and its related interest receivable, repo, derivative instruments, deposits, net receivable or payable for unsettled securities and cash . Private - label MBS allocated capital is composed of MBS and its related repo . ( 2 ) Investment portfolio includes net long position in to - be - announced (“TBA”) securities representing forward contracts to purchase or sell agency MBS on a generic pool basis which are accounted for as derivatives on the Company’s financial statements . Investment Portfolio (2) Allocated Capital (1)

4 ; Fixed - rate agency MBS portfolio - Hedged to mitigate impact of increasing interest rates as economic environment shifts - Hedged agency MBS portfolio enables the Company to earn targeted investment spread over investment cycle despite mark - to - market fluctuations in book value - Specified agency MBS 100% selected for prepayment protections - 3 - month portfolio CPR of 7.15% (2) - Weighted average coupon of specified agency MBS of 3.92% (2) Agency MBS Investment Portfolio Overview As of December 31, 2015 (dollars in thousands) (1) Net long position in to - be - announced (“TBA”) securities represent forward contracts to purchase or sell agency MBS on a generic pool basis which are accounted for as derivatives with the net carrying value included in derivatives on the balance sheet . See slide 15 . (2) As of December 31 , 2015 . (3) Includes net long agency TBA position Agency Investment Portfolio by Issuance (2)(3) Fair Value Specified agency MBS 3,865,316$ Net long agency TBA (1) 389,258 Total 4,254,574$

5 Specified Agency MBS Investment Portfolio (1) Specified pools backed by original loan balances of up to $150K. (2) Specified pools backed by original loan balances between $150K and $175K. (3) Specified pools backed by loans refinanced through the Home Affordable Refinance Program (HARP) with original loan - to - values (LT V) of greater or equal to 80% but less than 95%. (4) Specified pools backed by loans refinanced through HARP with original LTVs of greater than or equal to 95%. (5) Specified pools backed by loans originated in NY or TX. (6) Other specified pools include pools backed by low FICO loans, 100% investor occupancy status loans, high LTV loans and season ed loans. (7) Average WAC represents the weighted average coupon of the underlying collateral. (8) Average age represents the weighted average age of the underlying collateral. (9) Actual 3 - month constant prepayment rate (CPR) represents annualized CPR published in Jan 2016 for securities held as of Dec 31, 2015. (10) Expected remaining life represents the weighted average expected remaining life of the security based on expected future CPR. (11) Duration is derived from Citi Yield Book model that are dependent upon inputs and assumptions which measures how much the pri ce of an asset or liability is expected to change if interest rates move in a parallel manner. Actual results could differ materially from these estimates . In addition, different models could generate materially different estimates using similar inputs and assumptions. 30 - Year Fixed - Rate Agency MBS Selected for Prepayment Characteristics (Dollars in thousands) MBS Coupon Face Amount Fair Value Market Price Average WAC (7) Average Age (Months) (8) Actual 3-Month CPR (9) Expected Avg Remaining Life (Years) (10) Duration (Years) (11) Low Loan Balance <= $150K (1) 3.5% 103,534$ 107,108$ 103.45$ 4.09% 7 1.98% 8.0 6.0 4.0% 690,106 735,751$ 106.61 4.62% 21 8.47% 6.0 4.3 793,640$ 842,859$ 106.20$ 4.55% 20 7.63% 6.2 4.5 Low Loan Balance <= $175K (2) 3.5% 64,870$ 66,983$ 103.26$ 4.11% 8 1.30% 7.3 5.6 4.0% 876,991 932,465$ 106.33 4.61% 19 8.81% 5.6 4.2 941,861$ 999,448$ 106.12$ 4.57% 19 8.29% 5.8 4.3 HARP LTV <95% (3) 3.5% 27,890$ 28,775$ 103.17$ 4.14% 11 0.10% 5.8 5.0 4.0% 312,945 332,039$ 106.10 4.50% 35 10.79% 5.4 4.4 4.5% 47,045 51,111$ 108.64 4.86% 61 6.85% 4.7 3.1 387,880$ 411,925$ 106.20$ 4.52% 37 9.55% 5.4 4.3 HARP LTV >=95% (4) 4.0% 256,297$ 272,471$ 106.31$ 4.50% 35 8.88% 5.7 4.6 4.5% 75,965 82,810$ 109.01 5.06% 38 11.59% 4.6 3.2 332,262$ 355,281$ 106.93$ 4.63% 36 9.50% 5.5 4.3 Geographic (5) 3.5% 463,341$ 479,043$ 103.39$ 4.09% 10 2.56% 7.1 5.7 4.0% 119,257 126,918$ 106.42 4.64% 18 9.22% 5.6 4.4 582,598$ 605,961$ 104.01$ 4.20% 11 3.92% 6.8 5.4 Other Specified Pools (6) 3.5% 31,987$ 33,015$ 103.21$ 4.28% 5 4.58% 2.9 2.1 4.0% 581,648 616,801$ 106.04 4.64% 15 4.64% 4.8 3.8 5.5% 23 26$ 111.77 5.92% 96 5.92% 5.0 3.3 613,658$ 649,842$ 105.90$ 4.62% 15 5.08% 4.7 3.7 Total 3.5% 691,622$ 714,924$ 103.37$ 4.10% 9 2.35% 7.0 5.5 4.0% 2,837,244 3,016,445$ 106.32 4.60% 22 8.21% 5.5 4.2 4.5% 123,010 133,921$ 108.87 4.98% 47 9.78% 4.6 3.2 5.5% 23 26$ 111.77 5.92% 96 5.83% 5.0 3.3 3,651,899$ 3,865,316$ 105.84$ 4.52% 21 7.15% 5.8 4.4

6 ; Floating rate private - label MBS with solid credit performance ; Primarily composed of mezzanine interests in re - REMIC securities collateralized by senior class REMIC securities ; Benefiting from ongoing improvement of housing fundamentals ; Focus on underlying collateral of prime jumbo and A lt - A loans - No subprime, no option ARMs - Higher home values and larger loan sizes (approximately $ 650K ) - Prime borrowers with greater financial flexibility and higher incomes - Stronger demographics with more desirable / stable housing markets ; Valued at 76.8% of face amount as of December 31, 2015 Private - Label MBS Portfolio Overview As of December 31, 2015 (dollars in thousands) Loan Collateral Statistics 60+ days delinquent 11.9% Credit enhancement 0.1% Constant default rate (3-month) 4.7% Loss severity (3-month) 32.1% Voluntary prepayment rate (3-month) 6.1% Original FICO 723 Original LTV 66% Weighted avg loan age (months) 114 Face amount 169,757$ Discount (55,031) Amortized cost 114,726 Net unrealized gain 15,709 Fair value 130,435$ Wtd Avg Coupon 3.03% Wtd Avg Yield 9.78%

7 Financing Summary ; 16 counterparties with access to 20 total counterparties ; Less than 10% of equity at risk with any one counterparty - 4.7% of equity at risk with largest counterparty - 19.5% of equity at risk with five largest counterparties ; FHFA issued rule in January 2016 effectively ending our membership in the FHLB of Cincinnati by February 2017 - All outstanding FHLB advances were repaid in January 2016 funded primarily with repo financing ; Expansion of funding sources in fourth quarter through “direct repo” arrangements Diversified Funding Sources As of December 31, 2015 (dollars in thousands) Outstanding Borrowing Collateral Fair Value Avg Interest Rate Avg Days to Maturity Agency Repo 2,797,561$ 2,946,684$ 0.61% 12.8 Agency FHLB advances 786,900 805,163 0.36% 11.6 Private-label Repo 37,219 70,511 2.42% 16.9 Total/Wtd Avg 3,621,680$ 3,822,358$ 0.57% 12.6 Counterparty Region Number of Counterparties Outstanding Borrowing Percent of Total North America 11 2,593,625$ 71.6% Europe 2 447,302 12.4% Asia 3 580,753 16.0% Total 16 3,621,680$ 100.0%

8 ; Hedge notional was 71% of total outstanding repo and FHLB advances and net long TBA position as of December 31, 2015 ; Hedge position comprised of both longer and shorter term hedges comprised of: - 2 - year interest rate swaps ; $750MM of notional amount ; Weighted average pay fix rate of 1.04% ; Weighted average remaining maturity of 1.9 years - 10 - year interest rate swaps ; $750MM of notional amount ; Weighted average pay fix rate of 2.12% ; Weighted average remaining maturity of 9.9 years - 10 - year U.S. Treasury note futures ; $1,335MM of notional amount ; Future contracts that mature in March 2016 for settlement of short positions on 10 - year U.S. Treasury notes Hedgin g Summary Hedge Position Helps Mitigate Impact of Rising Rates on Agency Portfolio As of December 31, 2015 (dollars in thousands) (1) Duration is derived from Citi Yield Book model that are dependent upon inputs and assumptions which measures how much the price of an asset or liability is expected to change if interest rates move in a parallel manner. Actual results could differ materia lly from these estimates. In addition, different models could generate materially different estimates using similar inputs and assumptions. (2) Collateral deposit represents initial and variation margin held by the respective custodian which is generally set by the cen tra l clearing house. (3) Total liability and hedge duration is expressed in asset units. Long - term debt is excluded. Agency MBS Hedged Duration Gap Market Value/ Notional Duration (1) Specified agency MBS 3,865,316$ 4.4 Net long agency TBA 389,258 4.5 Total 4,254,574$ 4.4 Agency Repo and FHLB Advances (3,584,461)$ (0.1) Interest rate swap agreements (1,500,000) (5.3) 10-year U.S. Treasury note futures (1,335,000) (8.3) Total (3) (4.6) Net Duration Gap (0.2) Notional Amount Duration (1) Fair Value Collateral Deposit (2) Interest rate swap agreements 1,500,000$ (5.3) 6,153$ 17,434$ 10-year U.S. Treasury note futures 1,335,000 (8.3) 6,813 11,197 Total (3) 2,835,000$ (6.7) 12,966$ 28,631$

9 ; Our C - corp structure benefits stockholders by providing a tax - advantaged dividend as we continue to utilize our net operating loss and net capital loss carry - forwards - Net operating loss carry - forward of $107MM as of December 31, 2015 - Net capital loss carry - forward of $241MM as of December 31, 2015 - 22.4% annualized dividend yield (1) ; 30.2% annualized dividend yield, on a tax adjusted basis (2) ; S tructure provides flexibility as we are not required to distribute taxable earnings to stockholders - Provides option to reinvest earnings and opportunistically benefit from market dislocation - Allows investment flexibility as we are not bound by any substantial restrictions - Protects public debt holders as cash earnings are available to service debt without any negative tax implications ( 1 ) Based on the Company’s Class A common stock closing price on the NYSE of $ 11 . 14 on 2 / 1 / 2016 . The annual dividend rate presented is calculated by annualizing the 4 th quarter of 2015 dividend payment of $ 0 . 625 per share of Class A common stock . The Company maintains a variable dividend policy and the Board of Directors, in its sole discretion, approves the payment of dividends . Actual dividends in the future may differ materially from historical practice and from the annualized dividend rate presented . (2) The Company's distributions to shareholders of current or accumulated earnings and profits (“E&P”) are qualified dividends eligible for the 23 .8% federal income tax rate whereas similar distributions to shareholders by a REIT of current or accumulated E&P are nonqualified divide nds subject to the higher 43.4% tax rate on ordinary income. Any distributions in excess of current or accumulated E&P would be reported as a return of capi tal instead of qualified dividends. Distributions that are classified as returns of capital are nontaxable to the extent they do not exceed a shareholder’s adjus ted tax basis in the Company’s common stock, or as a capital gain to the extent that the amount of the distribution exceeds a shareholder’s adjusted tax bas is in the Company’s common stock. To provide the same after - tax return to a shareholder of distributions of current or accumulated E&P eligible for the 23.8% rate on qualified dividend income and otherwise subject to the maximum marginal rate on ordinary income, a REIT would be required to pay dividends providin g a 30.2% yield. For the calendar year 2015, all of the Company’s dividends were a return of capital. Corporate Structure Provides Flexibility and Capital Growth

10 ; 22% reduction of expenses from prior year and improved operating leverage ; Internally - managed structure provides operating leverage ; Alignment of interest between shareholders and management - Eliminates inherent conflicts of interest of externally managed structures ; Alignment of management compensation to Company performance ; Annual cash incentive compensation and long - term incentive stock compensation generally earned based on Company and stock performance ; Lower 2015 cash and stock incentive compensation due to Company performance Core Expenses as % of Investable Capital (1)(2) Efficient Internally Managed Structure (1) Core expense is calculated as expenses determined in accordance with GAAP less stock compensation and legacy litigation e xpe nses. (2) Average investable capital is composed of equity plus long - term debt less deferred tax assets, net . Annual GAAP and Core Expenses (1) 2011 2012 2013 2014 2015 Total GAAP Expenses $14,189 $17,446 $16,591 $18,069 $14,167 Total Core Expenses $12,372 $13,821 $12,984 $14,201 $13,022 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 5.67% 5.31% 3.26% 2.74% 2.59% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2011 2012 2013 2014 2015

11 Appendix

12 Balance Sheet (1) Represents shares of Class A common stock and Class B common stock outstanding plus vested restricted stock units convertible into Class A common stock less unvested restricted Class A common stock. (2) Tangible book value is calculated as total equity less deferred tax asset. (in thousands, except per share data) December 31, 2015 September 30, 2015 ASSETS: Cash 36,987$ 13,529$ Sold securities receivable - 28,035 Interest receivable 11,936 11,459 Private-label MBS 130,435 134,789 Agency MBS 3,865,316 3,790,044 Deposits 29,429 87,258 Deferred tax asset 97,530 103,319 Derivatives 12,991 3,863 Other assets 20,182 9,938 Total assets 4,204,806$ 4,182,234$ LIABILITIES AND EQUITY Liabilities: Repurchase agreements 2,834,780$ 3,153,756$ FHLB advances 786,900 308,500 Dividend payable 14,504 14,553 Derivatives 553 53,514 Purchased securities payable - 92,107 Accrued expenses and other liabilities 8,738 6,496 Long-term debt 75,300 75,300 Total liabilities 3,720,775 3,704,226 Equity: Common stock and paid-in capital 1,898,315 1,897,702 Accumulated other comprehensive income 12,371 11,334 Accumlated deficit (1,426,655) (1,431,028) Total equity 484,031 478,008 Total liabilities and equity 4,204,806$ 4,182,234$ Common shares outstanding (1) 22,994 23,042 GAAP book value per share 21.05$ 20.75$ Tangible book value per share (2) 16.81$ 16.26$

13 Statement of Comprehensive Income (in thousands, except per share amounts) Fourth Quarter Third Quarter Fourth Quarter 2015 2015 2014 Interest income : Interest income on agency MBS 35,475$ 37,325$ 31,297$ Interest income on private-label MBS 2,880 3,244 5,012 Other 9 6 7 Total interest income 38,364 40,575 36,316 Interest expense: Interest on short-term debt 4,237 3,989 2,901 Interest on long-term debt 1,184 1,176 553 Total interest expense 5,421 5,165 3,454 Net interest income 32,943 35,410 32,862 Investment loss, net (5,674) (69,298) (33,697) Other expenses: Compensation and benefits 2,567 2,071 3,326 Other expenses 1,216 1,174 1,154 Total other expenses 3,783 3,245 4,480 Income (loss) before income taxes 23,486 (37,133) (5,315) Income tax provision 4,675 15,497 25,651 Net income (loss) 18,811 (52,630) (30,966) Other comprehensive income (loss): Unrealized gains (losses) on available-for-sale MBS, net of tax (258) (2,451) (2,018) Reclassifications related to available-for-sale MBS, net of tax 1,295 (1,122) (2,800) Comprehensive income (loss) 19,848$ (56,203)$ (35,784)$ Basic earnings (loss) per share 0.82$ (2.29)$ (1.35)$ Diluted earnings (loss) per share 0.82$ (2.29)$ (1.35)$ Weighted average shares outstanding - basic 23,034 23,021 22,973 Weighted average shares outstanding - diluted 23,066 23,021 22,973

14 Core Operating Income (1 ) ( 1) Core operating income is a non - GAAP measure. This non - GAAP core operating income measurement is used by management to analyz e and assess the Company’s operating results on its portfolio and assist with the determination of the appropriate level of dividends. The Co mpa ny believes that this non - GAAP measurement assists investors in understanding the impact of these non - core items and non - cash expenses on our performance and p rovides additional clarity around our earnings capacity and trends. A limitation of utilizing this non - GAAP measure is that the GAAP accounting effects of these events do in fact reflect the underlying financial results of our business and these effects should not be ignored in evaluating and analyzing our financia l r esults. Therefore, the Company believes net income on a GAAP basis and core operating income on a non - GAAP basis should be considered together. (in thousands, except per share amounts) Fourth Quarter Third Quarter Fourth Quarter 2015 2015 2014 GAAP net income (loss) 18,811$ (52,630)$ (30,966)$ Adjustments: Non-cash income tax provision 5,480 14,729 25,254 Stock compensation 853 (189) 834 Net realized and unrealized loss (gain) on trading MBS and derivative instruments 3,879 70,275 38,022 Realized gain on private-label MBS (291) (969) (4,431) Other-than-temporary impairment charges 2,417 - 298 Non-GAAP core operating income excluding gain on private-label MBS 31,149 31,216 29,011 Realized gain on private-label MBS 291 969 4,431 Other-than-temporary impairment charges realilzed upon sale or repayment - ( 1,222 ) ( 1,154 ) Purchase discount accretion of private-label MBS realized upon sale or repayment 485 1,912 1,453 Non-cash interest income related to purchase discount accretion of private-label MBS ( 1,633 ) ( 1,797 ) ( 2,315 ) Non-GAAP core operating income 30,292$ 31,078$ 31,426$ Non-GAAP core operating income excluding gain on private-label MBS per share 1.35$ 1.35$ 1.24$ Non-GAAP core operating income per share 1.31$ 1.35$ 1.35$ Weighted average diluted shares outstanding 23,066 23,065 23,316

15 TBA Agency Investment Portfolio (1) Net long position in to - be - announced (“TBA”) securities represent forward contracts to purchase or sell agency MBS on a generic pool basis which are accounted for as derivatives with the net carrying value included in derivatives on the balance sheet . (2) Duration is derived from Citi Yield Book model that are dependent upon inputs and assumptions which measures how much the price of an asset or liability is expected to change if interest rates move in a parallel manner . Actual results could differ materially from these estimates . In addition, different models could generate materially different estimates using similar inputs and assumptions . TBA Agency Portfolio Generates Additional Investment Income (Dollars in thousands) Net Notional Amount Average Net Contractual Price Average Net Market Price Fair Value Duration (Years) (2) 30-year fixed rate: 3.5% 275,000$ 283,928$ 283,469$ (459)$ 4.8 4.0% 100,000 105,883 105,789 (94) 3.5 Total/wtd avg 375,000$ 389,811$ 389,258$ (553)$ 4.5

16 Disclaimer : The numbers contained in the examples above are for illustrative purposes only and do not reflect Arlington Asset’s projections or forecasts . Any assumptions and estimates used may not be accurate and cannot be relied upon . Arlington Asset’s ROE for any given period may differ materially from these examples . The foregoing is not an example of, and does not represent, expected returns from an investment in Arlington Asset’s common stock . ( 1 ) Represents market value minus repo and FHLB advance financing plus hedges, deposits and related net working capital . ( 2 ) Based on a purchase of a 30 - year 4 . 0 % at a price of 106 . 34 and CPR of 8 . 0 . ( 3 ) Based on 12 / 31 / 2015 hedge notional and repo/FHLB advance financing balances as of 12 / 31 / 15 , executed interest rate swap and U . S . Treasury rates for hedge instruments outstanding as of 12 / 31 / 15 , and market repo/FHLB rates as of 12 / 31 / 15 . ( 4 ) Excluding non - cash accretion, based on average market value during the 4 th quarter of 2015 . Agency Portfolio Highlights At 12/31/15 ($ in Millions) Private - label Portfolio Highlights At 12/31/15 ($ in Millions) Market Value $3,865 Market Value (76.8% of Face Value) $130 Repo and FHLB Advance Financing $3,584 Repo Financing $37 Capital Allocation (1) $369 Capital Allocation $93 Agency Portfolio Economics Private - label Portfolio Economics Expected Yield (2) 3.14% Cash Yield (4) 3.9% Total Hedged Financing Cost (3) 1.53% Cash Repo Cost 2.4% Net Spread 1.61% Net Spread (4) 1.5% Target Leverage 8.0x Target Leverage 0.25x ROE 16.0% ROE (excluding appreciation) 4.3% Illustrative MBS Portfolio Returns

17 Historical Performance Quarterly Dividends (1) Quarterly Book Value per Share (2) Stock Price Premium/Discount to Book Value (4) 1) Quarterly annualized dividend yield based on last reported closing stock price on the last trading day of each quarter . 2) Tangible book value per share calculated as total equity less net deferred tax asset. 3) Stock price appreciation (or depreciation) plus reinvested dividends. Source: Bloomberg. 4) Stock price premium or discount to book value per share is based on stock price and book value per share at the end of the pe rio d. Total Stock Return (3)

18 ; Served as a Director of AI since co - founding the Company in 1989 ; Served as Vice Chairman and Chief Operating Officer from 1989 to 1999, Vice Chairman and Co - Chief Executive Officer from 1999 to 2003, Co - Chairman and Co - Chief Executive Officer from 2003 to 2005, Chairman and Chief Executive Officer from 2005 to 2014 and as Executive Chairman since 2014 ; Over 30 years experience ; Served as Chief Executive Officer since 2014, Chief Operating Officer since 2007, and a Director of AI since March 2007 ; From 2004 to 2007, Mr. Tonkel served as President and Head of Investment Banking at FBR & Co. ; Over 30 years experience J. Rock Tonkel, Jr President and Chief Executive Officer Richard E. Konzmann EVP and Chief Financial Officer Brian J. Bowers Chief Investment Officer and Portfolio Manager ; Prior to joining the Company in March 2015, Mr. Konzmann was with American Capital, Ltd., a publicly traded private equity firm and global asset manager of alternative investment funds including residential mortgage REITs, from 2002 until March 2015, most recently as Senior Vice President, Accounting ; 2 5 years experience ; Mr. Bowers joined the Company in 2000 ; Previously, he was the Chief Portfolio Strategist for BB&T Capital Markets and the Portfolio Manager/Plan Sponsor of CareFirst, Inc. ; Over 30 years experience Experienced Management Team Through Numerous Cycles Eric F. Billings Executive Chairman

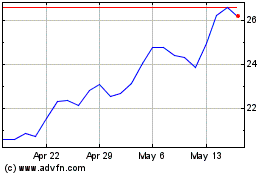

C3 AI (NYSE:AI)

Historical Stock Chart

From Jun 2024 to Jul 2024

C3 AI (NYSE:AI)

Historical Stock Chart

From Jul 2023 to Jul 2024