Apartment Investment and Management Company (“Aimco”) (NYSE:

AIV) announced today fourth quarter and full year 2015 results.

Chairman and Chief Executive Officer Terry Considine said: “2015

was a solid year for Aimco with average monthly revenue per

apartment home better by 10%; leverage reduced by 11%; consensus

NAV per share increased by 11%; and AFFO per share higher by 12%.

We feel well prepared for 2016.”

“As we look inwardly at the Aimco business, we see continued

solid demand and rising rents for our apartment homes. This makes

us optimistic. Looking outside the Aimco business, we see the

potential for overbuilding in some local markets and we take note

of uncertainty in financial markets and in the general economy.

This makes us conservative… and glad of the stability provided by

the diversification of our portfolio across markets and price

points, our limited exposure to redevelopment and development, and

our liquid, low leverage balance sheet with limited dependence on

capital markets.”

Chief Financial Officer Paul Beldin added: “In addition to

guidance for 2016, we published today a forecast for 2017. We are

providing an early look at 2017 to show our best guess as to the

interplay of the possible slowing of rent growth; the lease-up of

three communities, one in the Bay Area, one in Boston, and one in

Cambridge; the reduction of non-core earnings; and the continuing

reduction in our offsite costs. The net effect is improved

portfolio quality, lower leverage, increased AFFO per share, and a

higher quality of earnings.”

“By the end of 2017, we project average revenues per apartment

home to exceed $2,000; the ratio of Debt and Preferred Equity to

EBITDA to be about 6.3x; and AFFO per share to be up about 12%

compared to 2016.”

Financial Results: Fourth Quarter and

Full Year AFFO Up 12%

FOURTH

QUARTER FULL YEAR (all items per common share -

diluted)

2015 2014 2015

2014 Net income $ 0.43 $ 0.25

$ 1.52 $ 2.06

Funds From

Operations (FFO) $ 0.58

$ 0.54 $ 2.22

$ 2.07 Add back Aimco's share of

preferred equity redemption related amounts $ —

$ — $ 0.01 $ —

Pro

forma Funds From Operations (Pro forma FFO) $

0.58 $ 0.54

$ 2.23 $ 2.07

Deduct Aimco share of Capital Replacements $ (0.10 )

$ (0.11 ) $ (0.35 ) $ (0.39 )

Adjusted Funds From

Operations (AFFO) $ 0.48

$ 0.43 $ 1.88

$ 1.68

Pro forma FFO (per diluted common share) -

Year-over-year, fourth quarter Pro forma FFO increased 7% as a

result of: strong Property Net Operating Income growth; increased

contribution from redevelopment and acquisition communities; and

lower interest expense due to lower debt balances. These increases

were partially offset by lower income tax benefit and by the loss

of income from apartment communities that were sold in 2014 and

2015.

Adjusted Funds from Operations (per diluted common

share) - Year-over-year, fourth quarter AFFO increased 12% as a

result of higher Pro forma FFO and lower capital replacement

spending. As Aimco concentrates its investment capital in

higher-quality, higher price point apartment communities, its free

cash flow margins are increasing and contributing to higher

AFFO.

Operating Results: Full Year

Conventional Same Store NOI Up 5.6%

FOURTH

QUARTER FULL YEAR

Year-over-Year Sequential

Year-over-Year 2015

2014 Variance

3rd Qtr. Variance 2015

2014 Variance

Average Rent Per Apartment Home $ 1,597 $

1,526 4.7 % $ 1,577 1.3 %

$ 1,564 $ 1,495 4.6 % Other Income Per

Apartment Home 173 167

3.6 % 183 (5.5 )%

179 173 3.5 % Average Revenue

Per Apartment Home $ 1,770 $ 1,693

4.5 % $ 1,760 0.6 % $ 1,743

$ 1,668 4.5 % Average Daily Occupancy

95.5 % 95.7 % (0.2 )%

95.6 % (0.1 )% 95.9 %

95.9 % — %

$ in Millions

Revenue $ 163.6 $ 156.8

4.3 % $ 162.9 0.4 % $ 646.7

$ 619.0 4.5 % Expenses

49.7 47.6 4.4 %

51.9 (4.3 )% 203.6

199.5 2.1 % NOI $ 113.9 $ 109.2

4.3 % $ 111.0 2.6 % $

443.1 $ 419.5 5.6 %

Conventional Same Store Rental Rates - Aimco measures

changes in rental rates by comparing, on a lease-by-lease basis,

the rate on a newly executed lease to the rate on the expiring

lease for that same apartment. Newly executed leases are classified

either as a new lease, where a vacant apartment is leased to a new

customer, or as a renewal.

2015

1st Qtr. 2nd Qtr. 3rd

Qtr. Oct Nov Dec

4th Qtr. Full Year Renewal rent

increases 4.8 % 5.1 % 6.0 % 5.7 %

5.3 % 5.6 % 5.6 % 5.5 % New lease rent

increases 1.2 % 5.7 % 6.6 % 3.4 %

1.1 % 1.5 % 2.1 % 4.4 % Weighted

average rent increases 2.8 % 5.4 % 6.3 %

4.4 % 2.7 % 3.5 % 3.6 % 4.9 %

Redevelopment: Scope Expanded at The

Sterling

During fourth quarter, Aimco invested $19.7 million in

redevelopment and also approved a plan to expand its phased

redevelopment of The Sterling, a mixed-use community with 535

apartment homes located in Center City Philadelphia. Since 2014,

Aimco has completed the redevelopment of 236 apartment homes, or

44% of the total as planned, at a cost consistent with

underwriting, and with rents in excess of Aimco underwriting. These

results led to Aimco's decision to develop an additional five

floors containing 130 apartment homes for an additional investment

of approximately $13 million.

Also during fourth quarter, Aimco achieved stabilized occupancy

at its Ocean House redevelopment community, located in La Jolla,

California. Stabilized occupancy was achieved a quarter ahead of

schedule and at rents above underwriting.

Development: Progressing as

Planned

During fourth quarter, Aimco invested $35.3 million in two

development communities. Construction continued on plan at Aimco's

One Canal development, located in the historic Bulfinch Triangle

neighborhood of Boston’s West End. One Canal will include 310

apartment homes and 22,000 square feet of commercial space. Aimco

expects completion of construction in second quarter 2016.

During fourth quarter, Aimco began the lease-up of its Vivo

community located in Cambridge, Massachusetts, and as of December

31, 2015, 15% of the 91 homes were occupied. Leasing activity

during fourth quarter was in line with underwriting. Amenity

finishes, including completion of a fitness center and finishes for

a rooftop terrace, are scheduled to be completed in the summer of

2016.

Portfolio Management: Revenue Per

Apartment Home Up 10% to 1,840

Aimco's portfolio strategy seeks predictable rent growth from a

portfolio of “A,” “B” and “C+” quality apartment communities,

averaging “B/B+” in quality, and diversified among the largest

coastal and job growth markets in the U.S., as measured by total

apartment value. Aimco's target markets are primarily coastal

markets, and also include several Sun Belt cities and Chicago,

Illinois.

Aimco measures quality based on property rents compared to local

market average rents as reported by REIS, a third-party provider of

commercial real estate performance information and analysis. Aimco

defines property quality as follows: “A” quality properties are

those with rents greater than 125% of the local market average; “B”

quality properties are those with rents between 90% and 125% of the

local market average; “C+” quality properties are those with rents

greater than $1,100 per month but lower than 90% of the local

market average. For third quarter 2015, the most recent period for

which REIS information is available, Aimco Conventional apartment

rents averaged 111% of local market average rents.

Aimco's portfolio strategy is to sell each year the lowest-rated

5% to 10% of its portfolio and to reinvest the proceeds from such

sales in redevelopment, selective development, and acquisition of

higher quality apartment communities. Through this disciplined

approach to capital recycling, Aimco has significantly increased

the quality of its portfolio. From December 31, 2011 to December

31, 2015, Aimco:

- Increased its period-end Conventional

portfolio average revenue per apartment home by 46% to $1,840. This

rate of growth reflects the impact of market rent growth, and more

significantly, the impact of portfolio management through

dispositions, redevelopment and acquisitions.

- Increased its Conventional portfolio

free cash flow margin by 13% through the sale of lower-rated

communities and reinvestment in communities of greater quality

commanding higher rents; and

- Increased to 91% the percentage of its

Conventional Property Net Operating Income earned in Aimco target

markets.

As a result of these efforts, as of September 30, 2015, the most

recent period for which market information is available,

approximately 51%, 32% and 17% of Aimco's portfolio is invested in

“A,” “B” and “C+” quality apartment homes, respectively.

As Aimco executes its portfolio strategy, it expects to increase

Conventional portfolio average revenue per apartment home at a rate

greater than market rent growth; to increase free cash flow

margins; and to increase to 95% or more the percentage of its

Conventional Property Net Operating Income earned in Aimco target

markets.

Fourth Quarter 2015 Portfolio Transactions - In fourth

quarter, Aimco sold three Conventional apartment communities with

964 apartment homes for $146.6 million in gross proceeds. Aimco's

share of net sales proceeds after repayment of property debt and

transaction costs was $93.6 million. Fourth quarter sales included

the last two apartment communities Aimco owned in Phoenix, Arizona.

Aimco did not acquire any apartment communities during the fourth

quarter.

Year-End Portfolio - Fourth quarter 2015 Conventional

portfolio average monthly revenue per apartment home was $1,840, a

10% increase compared to fourth quarter 2014, as a result of

year-over-year Same Store monthly revenue per apartment home growth

of 4.5%, the sale of Conventional Apartment Communities with

average monthly revenues per apartment home substantially lower

than those of the retained portfolio, and reinvestment of the sales

proceeds through redevelopment and acquisition of apartment

communities with better prospects and higher rents.

Balance Sheet and Liquidity: Leverage

lower by 11%

Components of Aimco Leverage

AS OF DECEMBER 31, 2015

$ in Millions Amount % of Total

Weighted Avg.Maturity

(Yrs.)

Aimco share of long-term, non-recourse property debt $

3,706.9 93 % 8.1 Outstanding borrowings on revolving

credit facility 27.0 1 % 2.8 Preferred

securities 247.7 6 % Perpetual Total leverage

$ 3,981.6 100 % n/a

Leverage Ratios

Aimco target leverage ratios are: Debt and Preferred Equity to

EBITDA below 7.0x; and EBITDA to Interest and Preferred Dividends

greater than 2.5x. Aimco also tracks Debt to EBITDA and EBITDA to

Interest ratios. See the Glossary for definitions of these

metrics.

TRAILING-TWELVE-MONTHSENDED

DECEMBER 31,

2015 2014 Debt to EBITDA*

6.4x 6.5x Debt and Preferred Equity to EBITDA* 6.8x

7.0x EBITDA to Interest 3.1x 2.7x EBITDA to

Interest and Preferred Dividends 2.8x 2.5x

* The Debt to EBITDA and Debt and Preferred Equity to EBITDA

ratios presented for 2014 were adjusted on a pro-forma basis to

reflect $367 million of net proceeds from Aimco's January 2015

stock offering. Actual 2014 Debt to EBITDA and 2014 Debt and

Preferred Equity to EBITDA ratios were 7.1x and 7.6x,

respectively.

Future leverage reduction is expected both from earnings growth,

especially as apartment communities now being redeveloped or

developed are completed and leased, and from regularly scheduled

property debt amortization funded from retained earnings.

Liquidity

Aimco's only recourse debt at December 31, 2015, was its

revolving credit facility, which Aimco uses for working capital and

other short-term purposes, and to secure letters of credit.

At year-end, Aimco had outstanding borrowings on its revolving

credit facility of $27.0 million and available capacity of $536.6

million, net of $36.4 million of letters of credit backed by the

facility. Aimco also held cash and restricted cash on hand of

$134.9 million.

Finally, Aimco held apartment communities in its unencumbered

asset pool with a total estimated fair market value of

approximately $1.8 billion.

Equity Activity

Dividend - As previously announced, the Aimco Board of

Directors declared a quarterly cash dividend of $0.33 per share of

Class A Common Stock for the quarter ended December 31, 2015.

On an annualized basis, this represents an increase of 12% compared

to the dividends paid during 2015. This dividend is payable on

February 29, 2016, to stockholders of record on February 19,

2016.

2016 Outlook

($ Amounts represent Aimco

Share)

FULL YEAR2016

FULL YEAR2015

Net Income per share

$0.37 to $0.47 $1.52

Pro forma FFO per share

$2.23 to $2.33 $2.23

AFFO per share

$1.91 to $2.01 $1.88

Select Components of FFO

Conventional Same Store Operating Measures

Revenue change compared to prior year 4.50% to

5.00% 4.5% Expense change compared to prior year

2.50% to 3.00% 2.1% NOI change compared to prior year

5.25% to 6.25% 5.6%

Non-Core Earnings Amortization

of deferred tax credit income $19M $24M Non-recurring

investment management revenues $1M to $3M $1M

Historic Tax Credit benefit $8M to $11M $13M Other

tax benefits, net $8M to $10M $17M

Total Non-Core

Earnings $36M - $43M $55M

Offsite Costs

Property management expenses $24M $25M

General and administrative expenses $42M $43M

Investment management expenses $5M $6M

Total

Offsite Costs $71M $74M

Capital Investments

Redevelopment and development $180M to

$220M $233M Property upgrades $70M to $75M

$49M Capital replacements $45M to $50M $49M

Transactions

Property dispositions $450M to $500M

$386M Property acquisitions $320M $129M

Portfolio Quality

Fourth quarter Conventional property average revenue per

apartment home ~$1,950 $1,840

Balance Sheet Debt

to Trailing-Twelve-Month EBITDA ~6.3x 6.4x Debt and

Preferred Equity to Trailing-Twelve-Month EBITDA ~6.7x

6.8x Value of unencumbered properties ~$2.0B

~$1.8B ($ Amounts represent

Aimco Share)

FIRSTQUARTER 2016

Net income per share $0.04 to

$0.08

Pro forma FFO per share $0.52 to $0.56

AFFO

per share $0.44 to $0.48

Conventional Same Store Operating Measures NOI

change compared to fourth quarter 2015 -2.00% to -1.00% NOI

change compared to first quarter 2015 4.50% to 5.50%

2016 Pro forma FFO and AFFO Reconciliations

Aimco's 2016 outlook reflects continuation of the strategy Aimco

has executed over the last several years. This strategy focuses on

excellence in property operations; value creation through

redevelopment and occasional development; portfolio management

based on a disciplined approach to capital recycling and

simplification of the business; a safe, flexible, and liquid

balance sheet; and a simple business model executed by a

performance-oriented and collaborative team. As Aimco continues to

execute this consistent strategy, 2016 FFO and AFFO growth are

expected to be muted compared to 2015. This projected lower rate of

growth is primarily the result of several factors as follows:

- Accelerating Same Store revenue and Net

Operating Income growth in 2016 compared to 2015, adding $0.17 per

share to AFFO;

- Declining Net Operating Income caused

by selling stabilized communities to fund lease-up communities with

no current income, reducing AFFO compared to 2015 by $0.15 per

share;

- Declining non-core earnings as Aimco

continues to simplify its business, lowering AFFO by $0.10 per

share; and

- Declining offsite costs as Aimco scales

its overhead to its more focused activities, adding $0.02 to AFFO

per share.

Aimco published today in a separate document its forecast for

2017, which reflects accelerating FFO and AFFO growth compared to

2016 with: continued growth in Same Store revenue and Net Operating

Income; earn-in of income from lease-up communities; a continued

reduction in non-core earnings; and declining offsite costs.

Aimco's 2016 Outlook and 2017 Forecast may be found on its website

at http://www.aimco.com/investors/events-presentations/presentations.

($ Per share, at the midpoint of Aimco's

Outlook)

2015 Pro forma

FFO $2.23 Continuing

Operations Conventional Same Store NOI growth

0.17 Conventional Redevelopment NOI growth 0.06 Other

Conventional Non-Same Store NOI growth 0.01 Affordable

Property NOI growth 0.04

Total NOI growth

0.28 Transactions and

Development Acquisition Property NOI contribution

0.03 Lease-up Property NOI contribution — Lost NOI

from property sales (0.15) Change in interest expense

attributable to transactions and development (0.04)

Net

Impact of Transactions and Development (0.16)

Changes in Non-Core Earnings

Amortization of deferred tax credit income (0.03)

Non-recurring investment management revenues — Income tax

benefit (including a $0.02 decrease in Historic Tax Credit benefit)

(0.07)

Net Impact of Changes in Non-Core Earnings

(0.10) Reduction in interest

expense due to lower property debt balances 0.04 Offsite

costs 0.02 Impact of share count changes (0.02)

Other, net (0.01)

2016 Pro forma

FFO $2.28 ($ Per

share, guidance and forecast at the midpoint)

2015 AFFO $ 1.88

Change in Pro forma FFO 0.05 Capital

Replacement spending on sold properties 0.01 Other

changes in Capital Replacement spending 0.01 Impact

of share count changes 0.01

2016 AFFO $ 1.96

Earnings Conference Call

Information

Live Conference Call: Conference Call

Replay: Friday, February 5, 2016 at 1:00 p.m. ET Replay

available until 9:00 a.m. ET on April 5, 2016 Domestic Dial-In

Number: 1-888-317-6003 Domestic Dial-In Number: 1-877-344-7529

International Dial-In Number: 1-412-317-6061 International Dial-In

Number: 1-412-317-0088 Passcode: 9850959 Passcode: 10078593

Live webcast and replay:

http://www.aimco.com/investors

Supplemental Information

The full text of this Earnings Release and the Supplemental

Information referenced in this release are available on Aimco's

website at http://www.aimco.com/investors.

Glossary & Reconciliations of

Non-GAAP Financial and Operating Measures

Financial and operating measures found in this Earnings Release

and the Supplemental Information include certain financial measures

used by Aimco management that are measures not defined under

accounting principles generally accepted in the United States, or

GAAP. These measures are defined in the Glossary in the

Supplemental Information and, where appropriate, reconciled to the

most comparable GAAP measures.

About Aimco

Aimco is a real estate investment trust that is focused on the

ownership and management of quality apartment communities located

in the largest markets in the United States. Aimco is one of the

country's largest owners and operators of apartments, with 196

communities in 22 states and the District of Columbia. Aimco common

shares are traded on the New York Stock Exchange under the ticker

symbol AIV, and are included in the S&P 500. For more

information about Aimco, please visit our website at www.aimco.com.

Forward-looking

Statements

This Earnings Release and Supplemental Information contain

forward-looking statements within the meaning of the federal

securities laws, including, without limitation, statements

regarding projected results and specifically forecasts of: first

quarter and full year 2016 results, including but not limited to:

Pro forma FFO and selected components thereof; AFFO; Aimco's

redevelopment and development investments, timelines and Net

Operating Income contribution; Aimco’s acquisition and lease-up

timelines and Net Operating Income contribution; expectations

regarding sales of Aimco's apartment communities and the use of

proceeds thereof; and Aimco liquidity and leverage metrics.

These forward-looking statements are based on management's

judgment as of this date and include certain risks and

uncertainties. Risks and uncertainties include, but are not limited

to: Aimco's ability to maintain current or meet projected

occupancy, rental rates and property operating results; the effect

of acquisitions, dispositions, redevelopments and developments; our

ability to meet budgeted costs and timelines, and achieve budgeted

rental rates related to our developments and redevelopments; our

ability to meet timelines and budgeted rental rates related to our

lease-up properties; and our ability to comply with debt covenants,

including financial coverage ratios.

Actual results may differ materially from those described in

these forward-looking statements and, in addition, will be affected

by a variety of risks and factors, some of which are beyond the

control of Aimco, including, without limitation: real estate risks,

including fluctuations in real estate values and the general

economic climate in the markets in which we operate and competition

for residents in such markets; national and local economic

conditions, including the pace of job growth and the level of

unemployment; financing risks, including the availability and cost

of capital markets financing and the risk that our cash flows from

operations may be insufficient to meet required payments of

principal and interest; the risk that our earnings may not be

sufficient to maintain compliance with debt covenants; the amount,

location and quality of competitive new supply; the terms of

governmental regulations that affect Aimco and interpretations of

those regulations; the competitive environment in which Aimco

operates; the timing of acquisitions, dispositions, redevelopments

and developments; insurance risk, including the cost of insurance;

natural disasters and severe weather such as hurricanes;

litigation, including costs associated with prosecuting or

defending claims and any adverse outcomes; energy costs; and

possible environmental liabilities, including costs, fines or

penalties that may be incurred due to necessary remediation of

contamination of apartment communities presently or previously

owned by Aimco. In addition, Aimco's current and continuing

qualification as a real estate investment trust involves the

application of highly technical and complex provisions of the

Internal Revenue Code and depends on its ability to meet the

various requirements imposed by the Internal Revenue Code, through

actual operating results, distribution levels and diversity of

stock ownership.

Readers should carefully review Aimco's financial statements and

the notes thereto, as well as the section entitled “Risk Factors”

in Item 1A of Aimco's Annual Report on Form 10-K for the year ended

December 31, 2014, and the other documents Aimco files from

time to time with the Securities and Exchange Commission.

These forward-looking statements reflect management's judgment

as of this date, and Aimco assumes no obligation to revise or

update them to reflect future events or circumstances. This press

release does not constitute an offer of securities for sale.

Consolidated Statements of

Operations

(in thousands, except per share data) (unaudited)

Three Months Ended Year Ended December

31, December 31, 2015 2014 2015

2014 REVENUES Rental and other property revenues $

239,646 $ 233,330 $ 956,954 $ 952,831 Tax credit and asset

management revenues 6,229 8,848 24,356 31,532

Total revenues 245,875 242,178 981,310

984,363

OPERATING EXPENSES Property operating

expenses 87,350 84,646 359,393 373,654 Investment management

expenses 1,261 3,758 5,855 7,310 Depreciation and amortization

79,482 71,465 306,301 282,608 Provision for real estate impairment

losses — 407 — 1,820 General and administrative expenses 9,451

12,787 43,178 44,092 Other expenses, net 2,847 5,307

10,368 12,529 Total operating expenses 180,391

178,370 725,095 722,013

Operating

income 65,484 63,808 256,215 262,350 Interest income 1,782

1,691 6,949 6,878 Interest expense (48,275 ) (52,358 ) (199,685 )

(220,971 ) Other, net (244 ) (772 ) 387 (829 )

Income

before income taxes and gain on dispositions 18,747 12,369

63,866 47,428 Income tax benefit 6,510 6,937 27,524

20,047

Income from continuing operations

25,257 19,306 91,390 67,475 Gain on dispositions of real estate,

net of tax 50,119 26,153 180,593 288,636

Net income 75,376 45,459 271,983 356,111

Noncontrolling interests: Net income attributable to noncontrolling

interests in consolidated real estate partnerships (694 ) (2,643 )

(4,776 ) (24,595 ) Net income attributable to preferred

noncontrolling interests in Aimco OP (1,735 ) (1,689 ) (6,943 )

(6,497 ) Net income attributable to common noncontrolling interests

in Aimco OP (3,291 ) (1,875 ) (11,554 ) (15,770 ) Net income

attributable to noncontrolling interests (5,720 ) (6,207 ) (23,273

) (46,862 )

Net income attributable to Aimco 69,656 39,252

248,710 309,249 Net income attributable to Aimco preferred

stockholders (2,757 ) (2,860 ) (11,794 ) (7,947 ) Net income

attributable to participating securities (260 ) (123 ) (950 )

(1,082 )

Net income attributable to Aimco common

stockholders $ 66,639 $ 36,269 $ 235,966 $

300,220 Earnings attributable to Aimco per common share -

basic and diluted: Income from continuing operations $ 0.43

$ 0.25 $ 1.52 $ 2.06 Net income $ 0.43

$ 0.25 $ 1.52 $ 2.06

Consolidated

Balance Sheets (in thousands) (unaudited)

December 31, 2015 December 31, 2014 ASSETS

Buildings and improvements $ 6,446,326 $ 6,259,318 Land 1,861,157

1,885,640 Total real estate 8,307,483 8,144,958

Accumulated depreciation (2,778,022 ) (2,672,179 ) Net real estate

5,529,461 5,472,779 Cash and cash equivalents 50,789 28,971

Restricted cash 86,956 91,445 Other assets 473,918 476,727 Assets

held for sale 3,070 27,106 Total assets $ 6,144,194

$ 6,097,028

LIABILITIES AND EQUITY

Non-recourse property debt $ 3,846,160 $ 4,022,809 Revolving credit

facility borrowings 27,000 112,330 Total indebtedness

3,873,160 4,135,139 Accounts payable 36,123 41,919 Accrued

liabilities and other 318,975 279,077 Deferred income 64,052 81,882

Liabilities related to assets held for sale 53 28,969

Total liabilities 4,292,363 4,566,986 Preferred

noncontrolling interests in Aimco OP 87,926 87,937 Equity:

Perpetual Preferred Stock 159,126 186,126 Class A Common Stock

1,563 1,464 Additional paid-in capital 4,064,659 3,696,143

Accumulated other comprehensive loss (6,040 ) (6,456 )

Distributions in excess of earnings (2,596,917 ) (2,649,542 ) Total

Aimco equity 1,622,391 1,227,735 Noncontrolling

interests in consolidated real estate partnerships 151,365 233,296

Common noncontrolling interests in Aimco OP (9,851 ) (18,926 )

Total equity 1,763,905 1,442,105 Total liabilities

and equity $ 6,144,194 $ 6,097,028

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160204006605/en/

AimcoElizabeth Coalson, 303-691-4350Vice

President-Investor RelationsorInvestor Relations,

303-691-4350investor@aimco.com

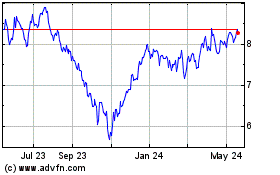

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

From Oct 2024 to Nov 2024

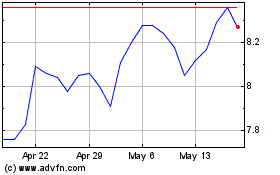

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

From Nov 2023 to Nov 2024