- GAAP Net Earnings of $0.01 per share and FFO Before Special

Items of $0.31 per share

- Core Same-Property NOI Growth of 5.5%

- GAAP and Cash Spreads on New Leases of 82% and 55% Driven by

the Street Portfolio

- Increased Full Year 2024 Guidance of FFO Before Special

Items

- Increased Quarterly Dividend by 5.6%

- Approximately $150 million of Accretive Core and Investment

Management Transactions Completed or in Advanced Stages of

Negotiation

Acadia Realty Trust (NYSE: AKR) (“Acadia” or the “Company”)

today reported operating results for the quarter ended June 30,

2024. All per share amounts are on a fully-diluted basis, where

applicable. Acadia owns and operates a high-quality core real

estate portfolio ("Core" or "Core Portfolio") of street and

open-air retail properties in the nation's most dynamic retail

corridors, along with an investment management platform that

targets opportunistic and value-add investments through its

institutional co-investment vehicles ("Investment Management").

Kenneth F. Bernstein, President and CEO

of Acadia Realty Trust, commented:

“We had another strong quarter driven by

the acceleration of growth within our key Street markets. In light

of our strong performance, we have increased our earnings guidance

along with our quarterly dividend. Furthermore, we have made

progress on strategically positioning and strengthening our balance

sheet. Finally, our pipeline of actionable and accretive investment

opportunities across our key markets and Investment Management

platform is accelerating."

SECOND QUARTER AND RECENT HIGHLIGHTS

- NAREIT FFO per share of $0.25 and FFO Before Special

Items per share of $0.31

- Core Same-Property NOI Growth of 5.5% in the second

quarter driven by growth of approximately 12% from the Street

Portfolio

- Updated 2024 Guidance (refer to guidance table on page

7)

- New Core GAAP and Cash Rent Spreads of 82% and 55%,

respectively, for the second quarter driven by Street leases in

Chicago and Washington, D.C.

- Increased Quarterly Dividend by $0.01 to $0.19 per

Common Share or an approximate 5.6% increase, driven by continued

internal growth

- Core Signed Not Open ("SNO") Pipeline (excluding

redevelopments) increased from $7.7 million as of March 31, 2024,

to $8.1 million of annualized base rent ("ABR") as of June 30,

2024, representing approximately 6% of in-place rents

- Strengthened Balance Sheet Metrics and Liquidity:

- Announced $100 million of inaugural private placement unsecured

notes

- Completed the previously disclosed extension and expansion of

its unsecured credit facility at existing credit spreads

- No significant Core debt maturities until 2027 and limited

interest rate exposure

- Net Debt-to-EBITDA for the Core Portfolio improved to 5.8x

during the quarter

FINANCIAL RESULTS

A complete reconciliation, in dollars and per share amounts, of

(i) net income attributable to Acadia to FFO (as defined by NAREIT

and Before Special Items) attributable to common shareholders and

common OP Unit holders and (ii) operating income to NOI is included

in the financial tables of this release. Amounts discussed below

are net of noncontrolling interests and all per share amounts are

on a fully-diluted basis.

Financial Results

2024

2023

2Q

2Q

Net earnings per share attributable to

Acadia

$0.01

$0.09

Depreciation of real estate and

amortization of leasing costs (net of noncontrolling interest

share)

0.23

0.27

Loss on disposition of properties (net of

noncontrolling interests' share)

0.01

—

Noncontrolling interest in Operating

Partnership

—

0.01

NAREIT Funds From Operations per share

attributable to Common Shareholders and Common OP Unit

holders

$0.25

$0.37

Net unrealized holding loss (gain)1

0.03

(0.01)

Realized gains and promotes1

0.03

—

Funds From Operations Before Special

Items per share attributable to Common Shareholders and Common OP

Unit holders

$0.31

$0.36

Less: Non-cash gain from BBBY lease

termination2

—

(0.08)

Funds From Operations Before Special

Items per share attributable to Common Shareholders and Common OP

Unit holders, excluding non-cash BBBY gain

$0.31

$0.28

________

1. It is the Company's policy to exclude unrealized gains and

losses from FFO Before Special items and to include realized gains

related to the Company's investment in Albertsons. The Company

realized investment gains of $3.6 million on 175,000 shares for the

quarter ended June 30, 2024. Refer to the "Notes to Financial

Highlights" page 14 of this document.

2. Results for the quarter ended June 30, 2023 included a

non-cash gain of $7.8 million, or $0.08 per share from the

termination of the Bed Bath and Beyond ("BBBY") below-market lease

at 555 9th Street in San Francisco.

Amounts reflected in the below Net Income,

NAREIT FFO and FFO Before Special Items for the quarter ended June

30, 2023 included a non-cash nonrecurring gain of $7.8 million, or

$0.08 per share, from the termination of a below-market lease.

Net Income

- Net income for the quarter ended June 30, 2024 was $1.2

million, or $0.01 per share.

- This compares with net income of $9.0 million, or $0.09 per

share for the quarter ended June 30, 2023.

NAREIT FFO

- NAREIT Funds From Operations ("NAREIT FFO") for the quarter

ended June 30, 2024 was $28.5 million, or $0.25 per share.

- This compares with NAREIT FFO of $38.2 million, or $0.37 per

share, for the quarter ended June 30, 2023.

FFO Before Special Items

- Funds From Operations ("FFO") Before Special Items for the

quarter ended June 30, 2024 was $34.4 million, or $0.31 per share,

which includes $3.6 million, or $0.03 per share, of realized

investment gains (175,000 shares of Albertsons' stock sold at an

average price of $20.52 per share).

- This compares with FFO Before Special Items of $36.5 million,

or $0.36 per share for the quarter ended June 30, 2023.

CORE PORTFOLIO PERFORMANCE

Same-Property NOI

- Same-Property Net Operating Income ("NOI") growth, excluding

redevelopments, increased 5.5% for the second quarter, driven by an

increase of approximately 12% from the Street Portfolio.

Leasing and Occupancy Update

- For the quarter ended June 30, 2024, conforming GAAP and cash

leasing spreads on new leases were 82% and 55%, respectively,

driven by Street leases in Chicago and Washington, D.C.

- As of June 30, 2024, the Core Portfolio was 94.8% leased and

91.8% occupied compared to 94.4% leased and 91.8% occupied as of

March 31, 2024.

- Core SNO (excluding redevelopments) increased to $8.1 million

of ABR at June 30, 2024, representing approximately 6% of in-place

rents. This is a 5% increase from the $7.7 million of SNO as of

March 31, 2024.

TRANSACTIONAL ACTIVITY

Core Portfolio Acquisitions

- Georgetown, Washington, D.C. During the second quarter,

the Company strategically funded a $7.6 million advance to one of

its partners in the Georgetown Renaissance Collection, in which the

Company currently owns a 20% interest. This advance is secured by

the partner's 10.8% interest in Renaissance and provides the

Company with the near-term possibility to increase its ownership

while also strategically positioning the Company to even further

consolidate its ownership interest in Renaissance in the future.

The Georgetown Renaissance Collection is a high-end retail

portfolio consisting of over 318,000 square feet across 20

buildings in Washington, D.C.'s Georgetown neighborhood.

- Manhattan and Brooklyn, New York. The Company is in

advanced stages of negotiations to acquire retail portfolios in

Manhattan and Brooklyn. The aggregate purchase price of these

portfolios is approximately $75 million and is expected to be day

one earnings accretive with the opportunity for positive

mark-to-market rent adjustments going forward.

Investment Management Acquisitions

- Shops at Grand Avenue, Queens, New York. As previously

announced, in May 2024, the Company formed a strategic relationship

with J.P. Morgan Asset Management ("JPM") to pursue the acquisition

of retail assets, including assets owned by the Company. This

venture commenced with the Company selling a 95% interest in Shops

at Grand, a grocery-anchored shopping center, to J.P. Morgan Real

Estate Income Trust, Inc., which is externally advised and

sponsored by J.P. Morgan Investment Management Inc., in a

transaction which valued the asset at $48 million, exclusive of

transaction costs. The Company retained a 5% interest and will

continue to manage day-to-day operations entitling it to earn

management, leasing, and construction fees along with the

opportunity to earn a promote upon the ultimate disposition of the

asset.

- The Walk at Highwoods Preserve, Tampa, Florida. In July

2024, the Company completed the acquisition of a property for $30.7

million, inclusive of transaction costs, within its Investment

Management platform. This 141,000 square foot open-air shopping

center is anchored by Home Goods and Michaels. Acadia is in active

negotiations to bring in a strategic institutional investor to

complete the capitalization of this property.

The above-mentioned pending Core and Investment Management

transactions are subject to final agreement between the parties,

customary closing conditions and market uncertainty. Thus, no

assurances can be given that the Company will successfully close on

any of these transactions on the anticipated timeline or at

all.

Investment Management Dispositions

- Fund IV and Fund V. During the second quarter, Fund IV

completed the disposition of two street retail assets at 2207 &

2208-2216 Fillmore, located in San Francisco, California for $14.1

million and repaid the mortgage of $6.4 million. Fund IV also

completed the disposition of the Paramus Plaza asset located in

Paramus, New Jersey for $36.8 million and repaid the $27.9 million

mortgage. In June 2024, the Company completed the sale of an

outparcel at Canton Marketplace, a Fund V asset, for $2.2

million.

BALANCE SHEET

- $100 Million of Private Unsecured Notes: On July 30,

2024, the Company entered into an agreement with an institutional

investor for the Company's inaugural private placement offering of

unsecured notes, pursuant to which the Company would sell $100

million of senior unsecured notes comprised of an $80 million and

$20 million note with a five- and three- year term, respectively.

The five-year and three-year notes will bear interest at fixed

annual rates of 5.94% and 5.86%, respectively, based on credit

spreads of 150 and 125 basis points over the five- and three- year

U.S. Treasury bonds as of the date of pricing (May 21, 2024),

respectively. The notes are expected to be funded during the third

quarter of 2024, subject to customary closing conditions. Thus, no

assurance can be given that the Company will successfully close on

the transaction.

- Extension and Expansion of $750 Million Unsecured Credit

Facility: Completed in April 2024, the new four-year term

extended the maturity to 2028 (with two additional six-month

extension options to 2029) and was increased by $50 million. The

facility was oversubscribed, maintained the pricing spread and

improved its financial covenant package.

- Equity Activity: Raised gross proceeds of $28.8 million

during the second quarter of 2024 from the sale of approximately

1.7 million shares through the Company's at-the-market issuance

program using the proceeds to accretively de-leverage the balance

sheet and match-fund accretive investment transactions.

- No Significant Core Debt Maturities until 2027 and Limited

Interest Rate Exposure: 4.0%, 0.2%, and 6.1% of Core debt

maturing in 2024, 2025 and 2026, respectively. At June 30, 2024,

the Company had $827 million of Core notional swap agreements with

various maturities through 2030 that provide virtually no base

interest rate exposure within the Core Portfolio until 2027.

- Debt-to-EBITDA Metrics: Core Net Debt-to-EBITDA improved

to 5.8x at June 30, 2024 from 6.1x at March 31, 2024. Refer to the

second quarter 2024 Supplemental Information package for

reconciliations and details on financial ratios.

DIVIDEND

Increased Quarterly Dividend by $0.01 to $0.19 per Common

Share: The Company's Board of Trustees has authorized a third

quarter cash dividend of $0.19 per common share. The 5.6% increase

from the prior quarterly dividend was driven by the Company's

continued internal growth. The quarterly dividend is payable on

October 15, 2024 to holders of record as of September 30, 2024.

GUIDANCE

The Company updated its annual 2024 guidance as follows:

- Net earnings per share to $0.07-$0.11 from $0.07-$0.13

- NAREIT FFO per share to $1.09-$1.13 from $1.09-$1.15

- FFO Before Special Items per share to $1.26-$1.32 from

$1.24-$1.32

2024 Guidance

Revised

Prior 1

Net earnings per share attributable to

Acadia

$0.07-$0.11

$0.07-$0.13

Depreciation of real estate and

amortization of leasing costs (net of noncontrolling interest

share)

1.01

1.01

Noncontrolling interest in Operating

Partnership

0.01

0.01

NAREIT Funds from operations per share

attributable to Common Shareholders and Common OP Unit

holders

$1.09-$1.13

$1.09-$1.15

Net unrealized holding loss 2,3

0.04

0.02

Realized gains and promotes 3

0.13-0.15

0.13-0.15

Funds From Operations Before Special

Items per share attributable to Common Shareholders and Common OP

Unit holders

$1.26-$1.32

$1.24-$1.32

________

1. The prior guidance range represents the reaffirmed guidance

on April 29, 2024, in conjunction with first quarter 2024

earnings.

2. This primarily relates to the unrealized mark-to-market holding

loss related to the Company’s investment in Albertsons, which was

recognized in NAREIT FFO for the six months ended June 30, 2024.

The Company has not reflected any forward-looking estimates

involving future unrealized holding gains or losses (i.e. changes

in share price) on Albertsons in its 2024 guidance assumptions.

3. It is the Company’s policy to exclude unrealized gains

and losses from FFO Before Special Items and to include and provide

guidance for any anticipated realized gains related to the

Company’s investment in Albertsons within FFO Before Special Items.

The Company realized investment gains of $7.6 million on 350,000

shares for the six months ended June 30, 2024. Refer to the "Notes

to Financial Highlights" page 14 of this document.

The Company is providing a projection of anticipated net

earnings solely to satisfy the disclosure requirements of the

Securities and Exchange Commission (the "SEC"). The Company's

projections are based on management's current beliefs and

assumptions about the Company's business, and the industry and the

markets in which it operates; there are known and unknown risks and

uncertainties associated with these projections. There can be no

assurance that the Company's actual results will not differ from

the guidance set forth above. The Company assumes no obligation to

update publicly any forward-looking statements, including its 2024

earnings guidance, whether as a result of new information, future

events or otherwise. Refer to the "Safe Harbor Statement"

disclosures on page 8 of this document.

CONFERENCE CALL

Management will conduct a conference call on Wednesday, July 31,

2024 at 11:00 AM ET to review the Company’s earnings and operating

results. Participant registration and webcast information is listed

below.

Live Conference Call

Date:

Wednesday, July 31, 2024

Time:

11:00 AM ET

Participant call:

Second Quarter 2024 Dial-In

Participant webcast:

Second Quarter 2024 Webcast

Webcast Listen-only and Replay:

www.acadiarealty.com/investors under

Investors, Presentations & Events

The Company uses, and intends to use, the Investors page of its

website, which can be found at

https://www.acadiarealty.com/investors, as a means of disclosing

material nonpublic information and of complying with its disclosure

obligations under Regulation FD, including, without limitation,

through the posting of investor presentations and certain portfolio

updates. Additionally, the Company also uses its LinkedIn profile

to communicate with its investors and the public. Accordingly,

investors are encouraged to monitor the Investors page of the

Company's website and its LinkedIn profile, in addition to

following the Company’s press releases, SEC filings, public

conference calls, presentations and webcasts.

About Acadia Realty Trust

Acadia Realty Trust is an equity real estate investment trust

focused on delivering long-term, profitable growth. Acadia owns and

operates a high-quality core real estate portfolio ("Core" or "Core

Portfolio") of street and open-air retail properties in the

nation's most dynamic retail corridors, along with an investment

management platform that targets opportunistic and value-add

investments through its institutional co-investment vehicles

("Investment Management"). For further information, please visit

www.acadiarealty.com.

Safe Harbor Statement

Certain statements in this press release may contain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements, which are based on certain assumptions and describe the

Company's future plans, strategies and expectations are generally

identifiable by the use of words, such as “may,” “will,” “should,”

“expect,” “anticipate,” “estimate,” “believe,” “intend” or

“project,” or the negative thereof, or other variations thereon or

comparable terminology. Forward-looking statements involve known

and unknown risks, uncertainties and other factors that could cause

the Company's actual results and financial performance to be

materially different from future results and financial performance

expressed or implied by such forward-looking statements, including,

but not limited to: (i) macroeconomic conditions, including due to

geopolitical conditions and instability, which may lead to a

disruption of or lack of access to the capital markets, disruptions

and instability in the banking and financial services industries

and rising inflation; (ii) the Company’s success in implementing

its business strategy and its ability to identify, underwrite,

finance, consummate and integrate diversifying acquisitions and

investments; (including the potential acquisitions discussed in

this press release); (iii) changes in general economic conditions

or economic conditions in the markets in which the Company may,

from time to time, compete, and their effect on the Company’s

revenues, earnings and funding sources; (iv) increases in the

Company’s borrowing costs as a result of rising inflation, changes

in interest rates and other factors; (v) the Company’s ability to

pay down, refinance, restructure or extend its indebtedness as it

becomes due; (vi) the Company’s investments in joint ventures and

unconsolidated entities, including its lack of sole decision-making

authority and its reliance on its joint venture partners’ financial

condition; (vii) the Company’s ability to obtain the financial

results expected from its development and redevelopment projects;

(viii) the ability and willingness of the Company's tenants to

renew their leases with the Company upon expiration, the Company’s

ability to re-lease its properties on the same or better terms in

the event of nonrenewal or in the event the Company exercises its

right to replace an existing tenant, and obligations the Company

may incur in connection with the replacement of an existing tenant;

(ix) the Company’s potential liability for environmental matters;

(x) damage to the Company’s properties from catastrophic weather

and other natural events, and the physical effects of climate

change; (xi) the economic, political and social impact of, and

uncertainty surrounding, any public health crisis, such as the

COVID-19 Pandemic, which adversely affected the Company and its

tenants’ business, financial condition, results of operations and

liquidity; (xii) uninsured losses; (xiii) the Company’s ability and

willingness to maintain its qualification as a REIT in light of

economic, market, legal, tax and other considerations; (xiv)

information technology security breaches, including increased

cybersecurity risks relating to the use of remote technology; (xv)

the loss of key executives; and (xvi) the accuracy of the Company’s

methodologies and estimates regarding environmental, social and

governance (“ESG”) metrics, goals and targets, tenant willingness

and ability to collaborate towards reporting ESG metrics and

meeting ESG goals and targets, and the impact of governmental

regulation on its ESG efforts.

The factors described above are not exhaustive and additional

factors could adversely affect the Company’s future results and

financial performance, including the risk factors discussed under

the section captioned “Risk Factors” in the Company’s most recent

Annual Report on Form 10-K and other periodic or current reports

the Company files with the SEC. Any forward-looking statements in

this press release speak only as of the date hereof. The Company

expressly disclaims any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statements

to reflect any changes in the Company’s expectations with regard

thereto or changes in the events, conditions or circumstances on

which such forward-looking statements are based.

ACADIA REALTY TRUST AND

SUBSIDIARIES

Consolidated Statements of

Operations (1)

(Unaudited, Dollars and Common

Shares and Units in thousands, except per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenues

Rental income

$

85,626

$

88,141

$

171,663

$

168,878

Other

1,628

1,807

6,947

2,909

Total revenues

87,254

89,948

178,610

171,787

Expenses

Depreciation and amortization

34,281

34,056

69,221

67,229

General and administrative

10,179

10,643

19,947

20,589

Real estate taxes

9,981

11,381

22,327

22,860

Property operating

15,781

14,210

34,877

29,343

Total expenses

70,222

70,290

146,372

140,021

Gain (loss) on disposition of

properties

757

—

(441

)

—

Operating income

17,789

19,658

31,797

31,766

Equity in earnings (losses) of

unconsolidated affiliates

4,480

(1,437

)

4,168

(1,408

)

Interest income

5,413

4,970

10,651

9,788

Realized and unrealized holding (losses)

gains on investments and other

(2,364

)

1,815

(4,415

)

28,572

Interest expense

(23,581

)

(22,089

)

(47,290

)

(43,676

)

Income (loss) from continuing operations

before income taxes

1,737

2,917

(5,089

)

25,042

Income tax provision

(155

)

(165

)

(186

)

(288

)

Net income (loss)

1,582

2,752

(5,275

)

24,754

Net loss attributable to redeemable

noncontrolling interests

2,292

1,091

4,846

3,166

Net (income) loss attributable to

noncontrolling interests

(2,431

)

5,433

5,141

(5,284

)

Net income attributable to Acadia

shareholders

$

1,443

$

9,276

$

4,712

$

22,636

Less: net income attributable to

participating securities

(290

)

(247

)

(577

)

(490

)

Net income attributable to Common

Shareholders

basic earnings per share

$

1,153

$

9,029

$

4,135

$

22,146

Income from continuing operations net of

income attributable to

participating securities for diluted

earnings per share

$

1,153

$

9,029

$

4,135

$

22,146

Weighted average shares for basic earnings

per share

103,592

95,260

102,860

95,225

Weighted average shares for diluted

earnings per share

103,592

95,260

102,860

95,225

Net earnings per share - basic

(2)

$

0.01

$

0.09

$

0.04

$

0.23

Net earnings per share - diluted

(2)

$

0.01

$

0.09

$

0.04

$

0.23

ACADIA REALTY TRUST AND

SUBSIDIARIES

Reconciliation of Consolidated

Net Income to Funds from Operations (1,3)

(Unaudited, Dollars and Common

Shares and Units in thousands, except per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income attributable to Acadia

$

1,443

$

9,276

$

4,712

$

22,636

Depreciation of real estate and

amortization of leasing costs (net of

noncontrolling interests' share)

26,291

28,248

53,378

54,692

Loss on disposition of properties (net of

noncontrolling interests' share)

568

—

843

—

Income attributable to Common OP Unit

holders

103

574

306

1,368

Distributions - Preferred OP Units

84

123

207

246

Funds from operations attributable to

Common Shareholders and Common OP Unit holders - Diluted

$

28,489

$

38,221

$

59,446

$

78,942

Adjustments for Special Items:

Unrealized holding loss (gain) (net of

noncontrolling interest share) (4)

2,308

(1,713

)

4,323

(1,779

)

Realized gain

3,586

—

7,580

—

Funds from operations before Special

Items attributable to Common Shareholders and Common OP Unit

holders

$

34,383

$

36,508

$

71,349

$

77,163

Funds From Operations per Share -

Diluted

Basic weighted-average shares outstanding,

GAAP earnings

103,592

95,260

102,860

95,225

Weighted-average OP Units outstanding

7,228

6,918

7,525

6,836

Assumed conversion of Preferred OP Units

to common shares

319

464

25

464

Assumed conversion of LTIP units and

restricted share units to

common shares

698

—

686

—

Weighted average number of Common Shares

and Common OP Units

111,837

102,642

111,096

102,525

Diluted Funds from operations, per Common

Share and Common OP Unit

$

0.25

$

0.37

$

0.54

$

0.77

Diluted Funds from operations before

Special Items, per Common Share and Common OP Unit

$

0.31

$

0.36

$

0.64

$

0.75

ACADIA REALTY TRUST AND

SUBSIDIARIES

Reconciliation of Consolidated

Operating Income to Net Property Operating Income (“NOI”)

(1)

(Unaudited, Dollars in

thousands)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Consolidated operating income

$

17,789

$

19,658

$

31,797

$

31,766

Add back:

General and administrative

10,179

10,643

19,947

20,589

Depreciation and amortization

34,281

34,056

69,221

67,229

(Gain) loss on disposition of

properties

(757

)

—

441

—

Less:

Above/below market rent, straight-line

rent and other adjustments

(2,869

)

(13,088

)

(7,477

)

(15,330

)

Consolidated NOI

58,623

51,269

113,929

104,254

Redeemable noncontrolling interest in

consolidated NOI

(1,381

)

(1,182

)

(2,422

)

(2,399

)

Noncontrolling interest in consolidated

NOI

(18,322

)

(13,730

)

(35,253

)

(28,205

)

Less: Operating Partnership's interest in

Investment Management NOI included above

(6,132

)

(4,765

)

(11,473

)

(9,802

)

Add: Operating Partnership's share of

unconsolidated

joint ventures NOI (5)

2,251

4,141

6,212

8,100

Core Portfolio NOI

$

35,039

$

35,733

$

70,993

$

71,948

Reconciliation of

Same-Property NOI

(Unaudited, Dollars in

thousands)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Core Portfolio NOI

$

35,039

$

35,733

$

70,993

$

71,948

Less properties excluded from

Same-Property NOI

(2,961

)

(5,335

)

(6,887

)

(11,235

)

Same-Property NOI

$

32,078

$

30,398

$

64,106

$

60,713

Percent change from prior year period

5.5

%

5.6

%

Components of Same-Property NOI:

Same-Property Revenues

$

45,613

$

43,275

$

91,756

$

87,057

)

Same-Property Operating Expenses

(13,535

)

(12,877

)

(27,650

)

(26,344

Same-Property NOI

$

32,078

$

30,398

$

64,106

$

60,713

ACADIA REALTY TRUST AND

SUBSIDIARIES

Consolidated Balance Sheets

(1)

(Unaudited, Dollars in thousands,

except shares)

As of

June 30, 2024

December 31, 2023

ASSETS

Investments in real estate, at cost

Land

$

849,524

$

872,228

Buildings and improvements

3,106,413

3,128,650

Tenant improvements

283,309

257,955

Construction in progress

21,023

23,250

Right-of-use assets - finance leases

58,637

58,637

4,318,906

4,340,720

Less: Accumulated depreciation and

amortization

(871,994

)

(823,439

)

Operating real estate, net

3,446,912

3,517,281

Real estate under development

101,802

94,799

Net investments in real estate

3,548,714

3,612,080

Notes receivable, net ($1,520 and $1,279

of allowance for credit losses as of June 30, 2024 and December 31,

2023, respectively)

126,653

124,949

Investments in and advances to

unconsolidated affiliates

203,410

197,240

Other assets, net

213,779

208,460

Right-of-use assets - operating leases,

net

27,748

29,286

Cash and cash equivalents

31,915

17,481

Restricted cash

23,139

7,813

Marketable securities

21,668

33,284

Rents receivable, net

54,012

49,504

Assets of properties held for sale

—

11,057

Total assets

$

4,251,038

$

4,291,154

LIABILITIES, REDEEMABLE NONCONTROLLING

INTERESTS AND EQUITY

Liabilities:

Mortgage and other notes payable, net

$

955,069

$

930,127

Unsecured notes payable, net

644,313

726,727

Unsecured line of credit

96,446

213,287

Accounts payable and other liabilities

218,095

229,375

Lease liability - operating leases

29,964

31,580

Dividends and distributions payable

20,285

18,520

Distributions in excess of income from,

and investments in, unconsolidated affiliates

7,301

7,982

Total liabilities

1,971,473

2,157,598

Commitments and contingencies

Redeemable noncontrolling interests

40,874

50,339

Equity:

Acadia Shareholders' Equity

Common shares, $0.001 par value per share,

authorized 200,000,000 shares, issued and outstanding 105,266,580

and 95,361,676 shares, respectively

105

95

Additional paid-in capital

2,115,689

1,953,521

Accumulated other comprehensive income

47,621

32,442

Distributions in excess of accumulated

earnings

(381,9450

)

(349,141

)

Total Acadia shareholders’ equity

1,781,470

1,636,917

Noncontrolling interests

457,221

446,300

Total equity

2,238,691

2,083,217

Total liabilities, redeemable

noncontrolling interests, and equity

$

4,251,038

$

4,291,154

ACADIA REALTY TRUST AND SUBSIDIARIES

Notes to Financial Highlights:

1. For additional information and analysis concerning the

Company’s balance sheet and results of operations, reference is

made to the Company’s quarterly supplemental disclosures for the

relevant periods furnished on the Company's Current Report on Form

8-K, which is available on the SEC's website at www.sec.gov and on

the Company’s website at www.acadiarealty.com.

2. Diluted earnings per share reflects the potential dilution

that could occur if securities or other contracts to issue common

shares of the Company were exercised or converted into common

shares. The effect of the conversion of units of limited

partnership interest (“OP Units”) in Acadia Realty Limited

Partnership, the operating partnership of the Company (the

“Operating Partnership”), is not reflected in the above table; OP

Units are exchangeable into common shares on a one-for-one basis.

The income allocable to such OP units is allocated on the same

basis and reflected as noncontrolling interests in the consolidated

financial statements. As such, the assumed conversion of these OP

Units would have no net impact on the determination of diluted

earnings per share.

3. The Company considers funds from operations (“FFO”) as

defined by the National Association of Real Estate Investment

Trusts (“NAREIT”) and net property operating income (“NOI”) to be

appropriate supplemental disclosures of operating performance for

an equity REIT due to their widespread acceptance and use within

the REIT and analyst communities. In addition, the Company believes

that given the atypical nature of certain unusual items (as further

described below), “FFO Before Special Items” is also an appropriate

supplemental disclosure of operating performance. FFO, FFO Before

Special Items and NOI are presented to assist investors in

analyzing the performance of the Company. The Company believes they

are helpful as they exclude various items included in net income

(loss) that are not indicative of operating performance, such as

(i) gains (losses) from sales of real estate properties; (ii)

depreciation and amortization and (iii) impairment of depreciable

real estate properties. In addition, NOI excludes interest expense

and FFO Before Special Items excludes certain unusual items (as

further described below). The Company’s method of calculating FFO,

FFO Before Special Items and NOI may be different from methods used

by other REITs and, accordingly, may not be comparable to such

other REITs. Neither FFO nor FFO Before Special Items represent

cash generated from operations as defined by generally accepted

accounting principles (“GAAP”), or are indicative of cash available

to fund all cash needs, including distributions. Such measures

should not be considered as an alternative to net income (loss) for

the purpose of evaluating the Company’s performance or to cash

flows as a measure of liquidity.

- Consistent with the NAREIT definition, the Company defines FFO

as net income (computed in accordance with GAAP) excluding:

- gains (losses) from sales of real estate properties;

- depreciation and amortization;

- impairment of real estate properties;

- gains and losses from change in control; and

- after adjustments for unconsolidated partnerships and joint

ventures.

- Also consistent with NAREIT’s definition of FFO, the Company

has elected to include: the impact of the unrealized holding gains

(losses) incidental to its main business, including those related

to its RCP investments such as Albertsons in FFO.

- FFO Before Special Items begins with the NAREIT definition of

FFO and adjusts FFO (or as an adjustment to the numerator within

its earnings per share calculations) to take into account FFO

without regard to certain unusual items including:

- charges, income and gains that management believes are not

comparable and indicative of the results of the Company’s operating

real estate portfolio;

- the impact of the unrealized holding gains (losses) incidental

to its main business, including those related to its Retailer

Controlled Property Venture ("RCP") investments such as Albertsons;

and

- any realized income or gains from the Company’s investment in

Albertsons.

4. The Company defines Special Items to include (i) unrealized

holding losses or gains (net of noncontrolling interest share) on

investments and (ii) other costs that do not occur in the ordinary

course of our underwriting and investing business.

5. The pro-rata share of NOI is based upon the Operating

Partnership’s stated ownership percentages in each venture or

Investment Management’s operating agreement and does not include

the Operating Partnership's share of NOI from unconsolidated

partnerships and joint ventures within Investment Management.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730925942/en/

Sandra Liang (914) 288-3356

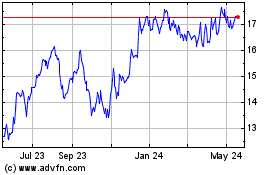

Acadia Realty (NYSE:AKR)

Historical Stock Chart

From Oct 2024 to Nov 2024

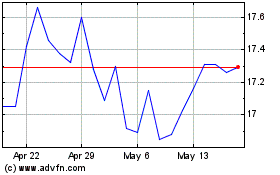

Acadia Realty (NYSE:AKR)

Historical Stock Chart

From Nov 2023 to Nov 2024