0001487712false00014877122025-02-132025-02-130001487712us-gaap:CommonClassAMember2025-02-132025-02-130001487712al:SeriesAMediumTermNotesMember2025-02-132025-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934 | | |

| February 13, 2025 |

Date of Report (Date of earliest event reported) |

AIR LEASE CORPORATION

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

Delaware | 001-35121 | 27-1840403 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 2000 Avenue of the Stars, | Suite 1000N | | |

| Los Angeles, | California | | 90067 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (310) 553-0555 | | |

Not Applicable (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock | AL | New York Stock Exchange |

| 3.700% Medium-Term Notes, Series A, due April 15, 2030 | AL30 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On February 13, 2025, Air Lease Corporation (the “Company”) issued a press release announcing its financial results for the three months and year ended December 31, 2024.

The information in this Item 2.02 and the related information in Exhibit 99.1 attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit 104 The cover page from this Current Report on Form 8-K formatted in Inline XBRL

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| AIR LEASE CORPORATION | |

| | | | |

Date: February 13, 2025 | /s/ Gregory B. Willis | |

| Gregory B. Willis | |

| Executive Vice President and Chief Financial Officer

| |

Air Lease Corporation Announces Fourth Quarter and Fiscal Year 2024 Results

Los Angeles, California, February 13, 2025 — Air Lease Corporation (ALC) (NYSE: AL) announces financial results for the three months and year ended December 31, 2024.

“ALC generated record revenues in 2024, driven by our $5 billion in aircraft purchases from our orderbook, and $1.7 billion in aircraft sales. Looking forward, we expect lease rates and aircraft valuations to rise, supporting the value of our business. We remain optimistic about the ongoing benefits of these trends, given aircraft shortages are anticipated to persist for several years to come,” said John L. Plueger, Chief Executive Officer and President, and Steven F. Udvar-Házy, Executive Chairman of the Board.

Fourth Quarter and Fiscal Year 2024 Results

The following table summarizes our operating results for the three months and year ended December 31, 2024 and 2023 (in millions, except per share amounts and percentages):

Operating Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2024 | | 2023 | | $ change | | % change | | 2024 | | 2023 | | $ change | | % change |

| Revenues | $ | 712.9 | | | $ | 716.6 | | | $ | (3.7) | | | (0.5) | % | | $ | 2,733.7 | | | $ | 2,685.0 | | | $ | 48.7 | | | 1.8 | % |

| Operating expenses | (572.9) | | | (517.2) | | | (55.7) | | | 10.8 | % | | (2,200.4) | | | (1,998.4) | | | (202.0) | | | 10.1 | % |

| | | | | | | | | | | | | | | |

| (Write-off) of Russian fleet, net of recoveries | — | | | 67.0 | | | (67.0) | | | — | | | — | | | 67.0 | | | (67.0) | | | — | |

| Income before taxes | 140.0 | | | 266.4 | | | (126.4) | | | (47.4) | % | | 533.3 | | | 753.6 | | | (220.3) | | | (29.2) | % |

| Net income attributable to common stockholders | $ | 92.5 | | | $ | 210.6 | | | $ | (118.1) | | | (56.1) | % | | $ | 372.1 | | | $ | 572.9 | | | $ | (200.8) | | | (35.0) | % |

| Diluted earnings per share | $ | 0.83 | | | $ | 1.89 | | | $ | (1.06) | | | (56.1) | % | | $ | 3.33 | | | $ | 5.14 | | | $ | (1.81) | | | (35.2) | % |

Adjusted net income before income taxes(1) | $ | 150.4 | | | $ | 213.9 | | | $ | (63.5) | | | (29.7) | % | | $ | 574.2 | | | $ | 733.6 | | | $ | (159.4) | | | (21.7) | % |

Adjusted diluted earnings per share before income taxes(1) | $ | 1.34 | | | $ | 1.92 | | | $ | (0.58) | | | (30.2) | % | | $ | 5.13 | | | $ | 6.58 | | | $ | (1.45) | | | (22.0) | % |

Key Financial Ratios

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Pre-tax margin | 19.6% | | 37.2% | | 19.5% | | 28.1% |

Adjusted pre-tax margin(1) | 21.1% | | 29.8% | | 21.0% | | 27.3% |

| Pre-tax return on common equity (trailing twelve months) | | | | | 7.4% | | 11.8% |

Adjusted pre-tax return on common equity (trailing twelve months)(1) | | | | | 8.9% | | 12.1% |

——————————————————————

(1) Adjusted net income before income taxes, adjusted diluted earnings per share before income taxes, adjusted pre-tax margin and adjusted pre-tax return on common equity have been adjusted to exclude the effects of certain non-cash items, such as non-cash deemed dividends for redemption of preferred stock, and one-time or non-recurring items that are not expected to continue in the future, such as net write-offs and recoveries related to our former Russian fleet. See note 1 under the Consolidated Statements of Operations included in this earnings release for a discussion of the non-GAAP measures and a reconciliation to their most comparable GAAP financial measures.

Highlights

•During the fourth quarter, we took delivery of 18 aircraft from our orderbook, representing approximately $1.3 billion in aircraft investments, ending the period with 489 aircraft in our owned fleet and over $32 billion in total assets.

•Sold 14 aircraft during the fourth quarter for $544 million in sales proceeds.

•We have approximately $1.1 billion of aircraft in our sales pipeline1, which includes approximately $1.0 billion in flight equipment held for sale as of December 31, 2024 and $178 million of aircraft subject to letters of intent.

•We have placed 100% and 85% of our expected orderbook on long-term leases for aircraft delivering through the end of 2026 and 2027, respectively, and have placed approximately 62% of our entire orderbook delivering through 2029.

•We ended the quarter with $29.5 billion in committed minimum future rental payments consisting of $18.3 billion in contracted minimum rental payments on the aircraft in our existing fleet and $11.2 billion in minimum future rental payments related to aircraft which will deliver between 2025 through 2029.

•During the fourth quarter, we raised approximately $1.3 billion in committed debt financings, including a $966.5 million unsecured three-year term loan bearing interest at one-month Term SOFR plus a margin of 1.125% and ended the year with total liquidity of $8.1 billion.

•On February 11, 2025, our board of directors approved our quarterly cash dividend of $0.22 per share on our outstanding Class A common stock. This quarterly dividend of $0.22 per share will be paid on April 7, 2025 to holders of record of our Class A common stock as of March 18, 2025.

Financial Overview

Fourth Quarter 2024 vs. Fourth Quarter 2023

Our rental revenues for the three months ended December 31, 2024 decreased by approximately 1%, to $639 million, as compared to the three months ended December 31, 2023. Despite the continued growth of our fleet, our rental revenues decreased, primarily due to lower end of lease revenue of approximately $54 million as compared to the prior period, due to fewer aircraft returns during the three months ended December 31, 2024.

Our aircraft sales, trading and other revenues for the three months ended December 31, 2024 increased by 2%, to $74 million, as compared to the three months ended December 31, 2023, primarily driven by an increase in gains from aircraft sales. We recorded $65 million in gains from the sale of 14 aircraft for the three months ended December 31, 2024, compared to $54 million in gains from the sale of eight aircraft for the three months ended December 31, 2023.

Our net income attributable to common stockholders for the three months ended December 31, 2024 was $93 million, or $0.83 per diluted share, as compared to $211 million, or $1.89 per diluted share, for the three months ended December 31, 2023. Net income attributable to common stockholders decreased primarily due to higher interest expense driven by the increase in our composite cost of funds and overall outstanding debt balance. In addition, in the fourth quarter of 2023, we recognized a net benefit of approximately $67 million for the three months ended December 31, 2023 for the settlement of insurance claims under S7’s insurance policies related to four aircraft in our owned fleet and our equity interest in certain aircraft in our managed fleet that were previously on lease to S7.

Adjusted net income before income taxes during the three months ended December 31, 2024 was $150 million, or $1.34 per adjusted diluted share, as compared to $214 million, or $1.92 per adjusted diluted share, for the three months ended December 31, 2023. Adjusted net income before income taxes decreased primarily due to higher interest expense, driven by the increase in our composite cost of funds and overall outstanding debt balance.

Full Year 2024 vs. Full Year 2023

Our rental revenues for the year ended December 31, 2024 increased by 0.4%, to $2.5 billion, as compared to the year ended December 31, 2023. The increase in our rental revenues is primarily due to the growth of our fleet, offset by a decrease in end of lease revenue of approximately $100 million as compared to the prior period, due to fewer aircraft returns during the year ended December 31, 2024, as well as a slight decrease in our lease yields due to the sales of older aircraft with higher lease yields and the purchases of new aircraft with lower initial lease yields.

1 Aircraft in our sales pipeline is as of December 31, 2024, and includes letters of intent and sale agreements signed through February 13, 2025.

Our aircraft sales, trading and other revenues for the year ended December 31, 2024 increased by 18%, to $246 million, as compared to the year ended December 31, 2023 primarily driven by an increase in gains from aircraft sales. We recorded $170 million in gains from the sale of 39 aircraft for the year ended December 31, 2024, compared to $146 million in gains from the sale of 25 aircraft for the year ended December 31, 2023.

Our net income attributable to common stockholders for the year ended December 31, 2024, was $372 million, or $3.33 per diluted share, as compared to $573 million, or $5.14 per diluted share, for the year ended December 31, 2023. Our net income attributable to common stockholders decreased from the prior year period primarily due to higher interest expense, driven by the increase in our composite cost of funds and overall outstanding debt balance, partially offset by the increase in revenue as discussed above. In addition, we recognized a net benefit of approximately $67 million for the year ended December 31, 2023, for the settlement of insurance claims under S7’s insurance policies related to four aircraft in our owned fleet and our equity interest in certain aircraft in our managed fleet that were previously on lease to S7.

Adjusted net income before income taxes during the year ended December 31, 2024, was $574 million, or $5.13 per adjusted diluted share, as compared to $734 million, or $6.58 per adjusted diluted share, for the year ended December 31, 2023. Adjusted net income before income taxes decreased primarily due to higher interest expense, driven by the increase in our composite cost of funds and overall outstanding debt balance, partially offset by the increase in revenue as discussed above.

Flight Equipment Portfolio

As of December 31, 2024, the net book value of our fleet increased to $28.2 billion, compared to $26.2 billion as of December 31, 2023. As of December 31, 2024, we owned 489 aircraft in our aircraft portfolio, comprised of 355 narrowbody aircraft and 134 widebody aircraft, and we managed 60 aircraft. The weighted average fleet age and weighted average remaining lease term of flight equipment subject to operating lease as of December 31, 2024 was 4.6 years and 7.2 years, respectively. We had a globally diversified customer base comprised of 116 airlines in 58 countries as of December 31, 2024.

The following table summarizes the key portfolio metrics of our fleet as of December 31, 2024 and 2023:

| | | | | | | | | | | |

| December 31, 2024 | | December 31, 2023 |

| Net book value of flight equipment subject to operating lease | $ | 28.2 | billion | | $ | 26.2 | billion |

Weighted-average fleet age(1) | 4.6 years | | 4.6 years |

Weighted-average remaining lease term(1) | 7.2 years | | 7.0 years |

| | | |

Owned fleet(2) | 489 | | 463 |

| Managed fleet | 60 | | 78 |

| Aircraft on order | 269 | | 334 |

| Total | 818 | | 875 |

| | | |

| Current fleet contracted rentals | $ | 18.3 | billion | | $ | 16.4 | billion |

| Committed fleet rentals | $ | 11.2 | billion | | $ | 14.6 | billion |

| Total committed rentals | $ | 29.5 | billion | | $ | 31.0 | billion |

| | | |

| | | |

| (1) Weighted-average fleet age and remaining lease term calculated based on net book value of our flight equipment subject to operating lease. |

(2) As of December 31, 2024 and 2023, our owned fleet count included 30 and 14 aircraft classified as flight equipment held for sale, respectively, and 15 and 12 aircraft classified as net investments in sales-type leases, respectively, which are all included in Other assets on the Consolidated Balance Sheet. |

The following table details the regional concentration of our flight equipment subject to operating leases:

| | | | | | | | | | | | | | |

| | December 31, 2024 | | December 31, 2023 |

| Region | | % of Net Book Value | | % of Net Book Value |

| Europe | | 41.4 | % | | 37.7 | % |

| Asia Pacific | | 35.8 | % | | 39.8 | % |

| Central America, South America, and Mexico | | 9.5 | % | | 9.0 | % |

| The Middle East and Africa | | 7.0 | % | | 7.9 | % |

| U.S. and Canada | | 6.3 | % | | 5.6 | % |

| Total | | 100.0 | % | | 100.0 | % |

The following table details the composition of our owned fleet by aircraft type:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2024 | | December 31, 2023 |

| Aircraft type | | Number of

Aircraft | | % of Total | | Number of

Aircraft | | % of Total |

| Airbus A220-100 | | 7 | | | 1.4 | % | | 2 | | | 0.4 | % |

| Airbus A220-300 | | 22 | | | 4.5 | % | | 13 | | | 2.8 | % |

| Airbus A319-100 | | — | | | — | % | | 1 | | | 0.2 | % |

| Airbus A320-200 | | 23 | | | 4.7 | % | | 28 | | | 6.0 | % |

| Airbus A320-200neo | | 23 | | | 4.7 | % | | 25 | | | 5.4 | % |

| Airbus A321-200 | | 19 | | | 3.9 | % | | 23 | | | 5.0 | % |

| Airbus A321-200neo | | 108 | | | 22.1 | % | | 95 | | | 20.6 | % |

Airbus A330-200(1) | | 13 | | | 2.7 | % | | 13 | | | 2.8 | % |

| Airbus A330-300 | | 5 | | | 1.0 | % | | 5 | | | 1.1 | % |

| Airbus A330-900neo | | 28 | | | 5.7 | % | | 23 | | | 5.0 | % |

| Airbus A350-900 | | 17 | | | 3.5 | % | | 14 | | | 3.0 | % |

| Airbus A350-1000 | | 8 | | | 1.6 | % | | 7 | | | 1.5 | % |

| Boeing 737-700 | | 2 | | | 0.4 | % | | 3 | | | 0.6 | % |

| Boeing 737-800 | | 61 | | | 12.5 | % | | 73 | | | 15.8 | % |

| Boeing 737-8 MAX | | 59 | | | 12.1 | % | | 52 | | | 11.2 | % |

| Boeing 737-9 MAX | | 30 | | | 6.1 | % | | 29 | | | 6.3 | % |

| Boeing 777-200ER | | 1 | | | 0.2 | % | | 1 | | | 0.2 | % |

| Boeing 777-300ER | | 24 | | | 4.9 | % | | 24 | | | 5.2 | % |

| Boeing 787-9 | | 26 | | | 5.3 | % | | 25 | | | 5.4 | % |

| Boeing 787-10 | | 12 | | | 2.5 | % | | 6 | | | 1.3 | % |

| Embraer E190 | | 1 | | | 0.2 | % | | 1 | | | 0.2 | % |

Total(2) | | 489 | | | 100.0 | % | | 463 | | | 100.0 | % |

| | | | | | | | |

| | | | | | | | |

(1) As of December 31, 2024 and 2023, aircraft count includes two Airbus A330-200 aircraft classified as freighters. |

| (2) As of December 31, 2024 and 2023, our owned fleet count included 30 and 14 aircraft classified as flight equipment held for sale, respectively, and 15 and 12 aircraft classified as net investments in sales-type leases, respectively, which are all included in Other assets on the Consolidated Balance Sheet. |

Debt Financing Activities

We ended the fourth quarter of 2024 with total debt financing, net of discounts and issuance costs, of $20.2 billion. As of December 31, 2024, 79.0% of our total debt financing was at a fixed rate and 97.3% was unsecured. As of December 31, 2024, our composite cost of funds was 4.14%. We ended the quarter with total liquidity of $8.1 billion.

As of the end of the periods presented, our debt portfolio was comprised of the following components (dollars in millions, except percentages):

| | | | | | | | | | | |

| December 31, 2024 | | December 31, 2023 |

| Unsecured | | | |

| Senior unsecured securities | $ | 16,047 | | $ | 16,330 |

| Term financings | 3,629 | | 1,628 |

| Revolving credit facility | 170 | | 1,100 |

| Total unsecured debt financing | 19,846 | | 19,058 |

| Secured | | | |

| Term financings | 354 | | 101 |

| Export credit financing | 190 | | 205 |

| Total secured debt financing | 544 | | 306 |

| | | |

| Total debt financing | 20,390 | | 19,364 |

| Less: Debt discounts and issuance costs | (180) | | (181) |

| Debt financing, net of discounts and issuance costs | $ | 20,210 | | $ | 19,183 |

| Selected interest rates and ratios: | | | |

Composite interest rate(1) | 4.14% | | 3.77% |

Composite interest rate on fixed-rate debt(1) | 3.74% | | 3.26% |

| Percentage of total debt at a fixed-rate | 79.00% | | 84.71% |

| | | |

| | | |

| (1) This rate does not include the effect of upfront fees, facility fees, undrawn fees or amortization of debt discounts and issuance costs. |

Conference Call

In connection with this earnings release, Air Lease Corporation will host a conference call on February 13, 2025 at 4:30 PM Eastern Time to discuss the Company's financial results for the fourth quarter of 2024.

Investors can participate in the conference call by dialing 1 (800) 715-9871 domestic or 1 (646) 307-1963 international. The passcode for the call is 7572001.

The conference call will also be broadcast live through a link on the Investors page of the Air Lease Corporation website at www.airleasecorp.com. Please visit the website at least 15 minutes prior to the call to register, download and install any necessary audio software. A replay of the broadcast will be available on the Investors page of the Air Lease Corporation website.

For your convenience, the conference call can be replayed in its entirety beginning on February 13, 2025 until 11:59 PM ET on February 20, 2025. If you wish to listen to the replay of this conference call, please dial 1 (800) 770-2030 domestic or 1 (647) 362-9199 international and enter passcode 7572001.

About Air Lease Corporation (NYSE: AL)

Air Lease Corporation is a leading global aircraft leasing company based in Los Angeles, California that has airline customers throughout the world. Air Lease Corporation and its team of dedicated and experienced professionals are principally engaged in purchasing new commercial aircraft and leasing them to its airline customers worldwide through customized aircraft leasing and financing solutions. Air Lease Corporation routinely posts information that may be important to investors in the “Investors” section of its website at www.airleasecorp.com. Investors and potential investors are encouraged to consult Air Lease Corporation’s website regularly for important information. The information contained on, or that may be accessed through, Air Lease Corporation’s website is not incorporated by reference into, and is not a part of, this press release.

Contact

| | |

| Investors: |

Jason Arnold

Vice President, Investor Relations

Email: investors@airleasecorp.com |

|

| Media: |

Laura Woeste

Senior Manager, Media and Investor Relations

Email: press@airleasecorp.com |

|

Ashley Arnold

Senior Manager, Media and Investor Relations

Email: press@airleasecorp.com |

Forward-Looking Statements

This press release contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Those statements appear in a number of places in this press release and include statements regarding, among other matters, our future aircraft deliveries and rental revenues, which may be impacted by aircraft and engine delivery delays and manufacturing flaws, our aircraft sales pipeline and expectations, and payment of our future dividends. Words such as “can,” “could,” “may,” “predicts,” “potential,” “will,” “projects,” “continuing,” “ongoing,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and “should,” and variations of these words and similar expressions, are used in many cases to identify these forward-looking statements. Any such forward-looking statements are not guarantees of future performance and involve risks, uncertainties, and other factors that may cause our actual results, performance or achievements, or industry results to vary materially from our future results, performance or achievements, or those of our industry, expressed or implied in such forward-looking statements. Such factors include, among others:

•our inability to obtain additional capital on favorable terms, or at all, to acquire aircraft, service our debt obligations and refinance maturing debt obligations;

•increases in our cost of borrowing, decreases in our credit ratings, or changes in interest rates;

•our inability to generate sufficient returns on our aircraft investments through strategic aircraft acquisitions and profitable leasing;

•the failure of an aircraft or engine manufacturer to meet its contractual obligations to us, including or as a result of labor strikes, aviation supply chain constraints, manufacturing flaws or technical or other difficulties with aircraft or engines before or after delivery;

•our ability to recover losses related to aircraft detained in Russia, including through insurance claims and related litigation;

•obsolescence of, or changes in overall demand for, our aircraft;

•changes in the value of, and lease rates for, our aircraft, including as a result of aircraft oversupply, manufacturer production levels, our lessees’ failure to maintain our aircraft, inflation, and other factors outside of our control;

•impaired financial condition and liquidity of our lessees, including due to lessee defaults and reorganizations, bankruptcies or similar proceedings;

•increased competition from other aircraft lessors;

•the failure by our lessees to adequately insure our aircraft or fulfill their contractual indemnity obligations to us, or the failure of such insurers to fulfill their contractual obligations;

•increased tariffs and other restrictions on trade;

•changes in the regulatory environment, including changes in tax laws and environmental regulations;

•other events affecting our business or the business of our lessees and aircraft manufacturers or their suppliers that are beyond our or their control, such as the threat or realization of epidemic diseases, natural disasters, terrorist attacks, war or armed hostilities between countries or non-state actors; and

•any additional factors discussed under “Part I — Item 1A. Risk Factors,” in our Annual Report on Form 10-K for the year ended December 31, 2024, and other Securities and Exchange Commission (“SEC”) filings, including future SEC filings.

All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from expectations. You are therefore cautioned not to place undue reliance on such statements. Any forward-looking statement speaks only as of the date on which it is made, and we do not intend and undertake no obligation to update any forward-looking information to reflect actual results or events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

###

Air Lease Corporation and Subsidiaries

CONSOLIDATED BALANCE SHEETS

(In thousands, except share and par value amounts)

| | | | | | | | | | | |

| December 31, 2024 | | December 31, 2023 |

| (unaudited) |

| Assets | | | |

| Cash and cash equivalents | $ | 472,554 | | | $ | 460,870 | |

| Restricted cash | 3,550 | | | 3,622 | |

| Flight equipment subject to operating leases | 34,168,919 | | | 31,787,241 | |

| Less accumulated depreciation | (5,998,453) | | | (5,556,033) | |

| 28,170,466 | | | 26,231,208 | |

| Deposits on flight equipment purchases | 761,438 | | | 1,203,068 | |

| Other assets | 2,869,888 | | | 2,553,484 | |

| Total assets | $ | 32,277,896 | | | $ | 30,452,252 | |

| Liabilities and Shareholders’ Equity | | | |

| Accrued interest and other payables | $ | 1,272,984 | | | $ | 1,164,140 | |

| Debt financing, net of discounts and issuance costs | 20,209,985 | | | 19,182,657 | |

| Security deposits and maintenance reserves on flight equipment leases | 1,805,338 | | | 1,519,719 | |

| Rentals received in advance | 136,566 | | | 143,861 | |

| Deferred tax liability | 1,320,397 | | | 1,281,837 | |

| Total liabilities | $ | 24,745,270 | | | $ | 23,292,214 | |

| Shareholders’ Equity | | | |

Preferred Stock, $0.01 par value; 50,000,000 shares authorized at each of December 31, 2024 and December 31, 2023; 900,000 (aggregate liquidation preference of $900,000) shares issued and outstanding at December 31, 2024; 10,600,000 (aggregate liquidation preference of $850,000) shares issued and outstanding at December 31, 2023 | $ | 9 | | | $ | 106 | |

Class A common stock, $0.01 par value; 500,000,000 shares authorized; 111,376,884 and 111,027,252 shares issued and outstanding at December 31, 2024 and December 31, 2023, respectively | 1,114 | | | 1,110 | |

Class B Non-Voting common stock, $0.01 par value; authorized 10,000,000 shares; no shares issued or outstanding | — | | | — | |

| Paid-in capital | 3,364,712 | | | 3,287,234 | |

| Retained earnings | 4,147,218 | | | 3,869,813 | |

| Accumulated other comprehensive income | 19,573 | | | 1,775 | |

| Total shareholders’ equity | $ | 7,532,626 | | | $ | 7,160,038 | |

| Total liabilities and shareholders’ equity | $ | 32,277,896 | | | $ | 30,452,252 | |

Air Lease Corporation and Subsidiaries

CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except share, per share amounts and percentages)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Year Ended

December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (unaudited) |

| Revenues | | | | | | | | |

| Rental of flight equipment | | $ | 638,941 | | $ | 644,074 | | $ | 2,487,955 | | $ | 2,477,607 |

| Aircraft sales, trading and other | | 73,954 | | 72,494 | | 245,702 | | 207,370 |

| Total revenues | | 712,895 | | 716,568 | | 2,733,657 | | 2,684,977 |

| | | | | | | | |

| Expenses | | | | | | | | |

| Interest | | 207,305 | | 169,355 | | 781,996 | | 654,910 |

| Amortization of debt discounts and issuance costs | | 14,051 | | 13,639 | | 54,823 | | 54,053 |

| Interest expense | | 221,356 | | 182,994 | | 836,819 | | 708,963 |

| | | | | | | | |

| Depreciation of flight equipment | | 294,387 | | 273,113 | | 1,143,761 | | 1,068,772 |

| Write-off of Russian fleet, net of (recoveries) | | — | | (67,022) | | — | | (67,022) |

| Selling, general and administrative | | 48,340 | | 49,798 | | 185,933 | | 186,015 |

| Stock-based compensation expense | | 8,856 | | 11,285 | | 33,887 | | 34,615 |

| Total expenses | | 572,939 | | 450,168 | | 2,200,400 | | 1,931,343 |

| Income before taxes | | 139,956 | | 266,400 | | 533,257 | | 753,634 |

| Income tax expense | | (27,035) | | (45,349) | | (105,553) | | (139,012) |

| Net income | | $ | 112,921 | | $ | 221,051 | | $ | 427,704 | | $ | 614,622 |

| Preferred stock dividends | | (20,373) | | (10,425) | | (55,631) | | (41,700) |

| Net income attributable to common stockholders | | $ | 92,548 | | $ | 210,626 | | $ | 372,073 | | $ | 572,922 |

| | | | | | | | |

| Earnings per share of common stock: | | | | | | | | |

| Basic | | $ | 0.83 | | $ | 1.90 | | $ | 3.34 | | $ | 5.16 |

| Diluted | | $ | 0.83 | | $ | 1.89 | | $ | 3.33 | | $ | 5.14 |

| Weighted-average shares of common stock outstanding | | | | | | | | |

| Basic | | 111,376,884 | | 111,027,252 | | 111,325,481 | | 111,005,088 |

| Diluted | | 111,901,756 | | 111,410,767 | | 111,869,386 | | 111,438,589 |

| | | | | | | | |

| Other financial data | | | | | | | | |

| Pre-tax margin | | 19.6% | | 37.2% | | 19.5% | | 28.1% |

| Pre-tax return on common equity (trailing twelve months) | | 7.4% | | 11.8% | | 7.4% | | 11.8% |

Adjusted net income before income taxes(1) | | $ | 150,359 | | $ | 213,877 | | $ | 574,205 | | $ | 733,580 |

Adjusted diluted earnings per share before income taxes(1) | | $ | 1.34 | | $ | 1.92 | | $ | 5.13 | | $ | 6.58 |

Adjusted pre-tax margin(1) | | 21.1% | | 29.8% | | 21.0% | | 27.3% |

Adjusted pre-tax return on common equity (trailing twelve months)(1) | | 8.9% | | 12.1% | | 8.9% | | 12.1% |

(1)Adjusted net income before income taxes (defined as net income attributable to common stockholders excluding the effects of certain non-cash items, such as non-cash deemed dividends upon redemption of our Series A preferred stock, one-time or non-recurring items that are not expected to continue in the future, such as net write-offs and recoveries related to our former Russian fleet, and certain other items, adjusted pre-tax margin (defined as adjusted net income before income taxes divided by total revenues), adjusted diluted earnings per share before income taxes (defined as adjusted net income before income taxes divided by the weighted average diluted common shares outstanding) and adjusted pre-tax return on common equity (defined as adjusted net income before income taxes divided by average common shareholders' equity) are measures of operating performance that are not defined by GAAP and should not be considered as an alternative to net income attributable to common stockholders, pre-tax margin, earnings per share, diluted earnings per share and pre-tax return on common equity, or any other performance measures derived in accordance with GAAP. Adjusted net income before income taxes, adjusted pre-tax margin, adjusted diluted earnings per share before income taxes and adjusted pre-tax return on common equity are

Air Lease Corporation and Subsidiaries

CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except share, per share amounts and percentages)

presented as supplemental disclosure because management believes they provide useful information on our earnings from ongoing operations.

Management and our board of directors use adjusted net income before income taxes, adjusted pre-tax margin, adjusted diluted earnings per share before income taxes and adjusted pre-tax return on common equity to assess our consolidated financial and operating performance. Management believes these measures are helpful in evaluating the operating performance of our ongoing operations and identifying trends in our performance, because they remove the effects of certain non-cash items, one-time or non-recurring items that are not expected to continue in the future and certain other items. Adjusted net income before income taxes, adjusted pre-tax margin, adjusted diluted earnings per share before income taxes and adjusted pre-tax return on common equity, however, should not be considered in isolation or as a substitute for analysis of our operating results or cash flows as reported under GAAP. Adjusted net income before income taxes, adjusted pre-tax margin, adjusted diluted earnings per share before income taxes and adjusted pre-tax return on common equity do not reflect our cash expenditures or changes in our cash requirements for our working capital needs. In addition, our calculation of adjusted net income before income taxes, adjusted pre-tax margin, adjusted diluted earnings per share before income taxes and adjusted pre-tax return on common equity may differ from the adjusted net income before income taxes, adjusted pre-tax margin, adjusted diluted earnings per share before income taxes and adjusted pre-tax return on common equity or analogous calculations of other companies in our industry, limiting their usefulness as a comparative measure.

The following table shows the reconciliation of the numerator for adjusted pre-tax margin (in thousands, except percentages): | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (unaudited) |

| Reconciliation of the numerator for adjusted pre-tax margin (net income attributable to common stockholders to adjusted net income before income taxes): | | | | | | | |

| Net income attributable to common stockholders | $ | 92,548 | | $ | 210,626 | | $ | 372,073 | | $ | 572,922 |

| Amortization of debt discounts and issuance costs | 14,051 | | 13,639 | | 54,823 | | 54,053 |

| Write-off of Russian fleet, net of (recoveries) | — | | (67,022) | | — | | (67,022) |

| Stock-based compensation expense | 8,856 | | 11,285 | | 33,887 | | 34,615 |

| Income tax expense/(benefit) | 27,035 | | 45,349 | | 105,553 | | 139,012 |

Deemed dividend adjustment(a) | 7,869 | | — | | 7,869 | | — |

| Adjusted net income before income taxes | $ | 150,359 | | $ | 213,877 | | $ | 574,205 | | $ | 733,580 |

| | | | | | | |

| Denominator for adjusted pre-tax margin: | | | | | |

| Total revenues | $ | 712,895 | | $ | 716,568 | | $ | 2,733,657 | | $ | 2,684,977 |

Adjusted pre-tax margin(b) | 21.1% | | 29.8% | | 21.0% | | 27.3% |

| | | | | | | |

| | | | | | | |

| (a) This adjustment consists of a deemed dividend related to the redemption of our Series A preferred stock. The deemed dividend relates to initial costs related to the issuance of our Series A Preferred Stock. |

| (b) Adjusted pre-tax margin is adjusted net income before income taxes divided by total revenues |

Air Lease Corporation and Subsidiaries

CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except share, per share amounts and percentages)

The following table shows the reconciliation of the numerator for adjusted diluted earnings per share before income taxes (in thousands, except share and per share amounts): | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (unaudited) |

| Reconciliation of the numerator for adjusted diluted earnings per share (net income attributable to common stockholders to adjusted net income before income taxes): | | | | | | | |

| Net income attributable to common stockholders | $ | 92,548 | | | $ | 210,626 | | | $ | 372,073 | | | $ | 572,922 | |

| Amortization of debt discounts and issuance costs | 14,051 | | | 13,639 | | | 54,823 | | | 54,053 | |

| Write-off of Russian fleet, net of (recoveries) | — | | | (67,022) | | | — | | | (67,022) | |

| Stock-based compensation expense | 8,856 | | | 11,285 | | | 33,887 | | | 34,615 | |

| Income tax expense/(benefit) | 27,035 | | | 45,349 | | | 105,553 | | | 139,012 | |

| Deemed dividend adjustment | 7,869 | | | — | | | 7,869 | | | — | |

| Adjusted net income before income taxes | $ | 150,359 | | | $ | 213,877 | | | $ | 574,205 | | | $ | 733,580 | |

| | | | | | | |

| Denominator for adjusted diluted earnings per share: | | | | | | | |

| Weighted-average diluted common shares outstanding | 111,901,756 | | | 111,410,767 | | | 111,869,386 | | 111,438,589 |

| | | | | | | |

| | | | | | | |

Adjusted diluted earnings per share before income taxes(c) | $ | 1.34 | | | $ | 1.92 | | | $ | 5.13 | | | $ | 6.58 | |

| | | | | | | |

| | | | | | | |

| (c) Adjusted diluted earnings per share before income taxes is adjusted net income before income taxes divided by weighted-average diluted common shares outstanding |

The following table shows the reconciliation of pre-tax return on common equity to adjusted pre-tax return on common equity (in thousands, except percentages): | | | | | | | | | | | |

| Trailing Twelve Months Ended

December 31, |

| 2024 | | 2023 |

| (unaudited) |

| Reconciliation of the numerator for adjusted pre-tax return on common equity (net income/(loss) attributable to common stockholders to adjusted net income before income taxes): | | | |

| Net income/(loss) attributable to common stockholders | $ | 372,073 | | $ | 572,922 |

| Amortization of debt discounts and issuance costs | 54,823 | | 54,053 |

| Write-off of Russian fleet, net of (recoveries) | — | | (67,022) |

| Stock-based compensation expense | 33,887 | | 34,615 |

| Income tax expense | 105,553 | | 139,012 |

| Deemed dividend adjustment | 7,869 | | — |

| Adjusted net income before income taxes | $ | 574,205 | | $ | 733,580 |

| | | |

| Reconciliation of denominator for pre-tax return on common equity to adjusted pre-tax return on common equity: | | | |

| Common shareholders' equity as of beginning of the period | $ | 6,310,038 | | $ | 5,796,363 |

| Common shareholders' equity as of end of the period | $ | 6,632,626 | | $ | 6,310,038 |

| Average common shareholders' equity | $ | 6,471,332 | | $ | 6,053,201 |

| | | |

Adjusted pre-tax return on common equity(d) | 8.9% | | 12.1% |

| | | |

| | | |

| (d) Adjusted pre-tax return on common equity is adjusted net income before income taxes divided by average common shareholders’ equity |

Air Lease Corporation and Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

| | | | | | | | | | | |

| Year Ended

December 31, |

| 2024 | | 2023 |

| (unaudited) |

| Operating Activities | | | |

| Net income | $ | 427,704 | | | $ | 614,622 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation of flight equipment | 1,143,761 | | | 1,068,772 | |

| Write-off of Russian fleet, net of (recoveries) | — | | | (67,022) | |

| Stock-based compensation expense | 33,887 | | | 34,615 | |

| Deferred taxes | 63,021 | | | 133,358 | |

| Amortization of prepaid lease costs | 101,800 | | | 75,389 | |

| Amortization of discounts and debt issuance costs | 54,823 | | | 54,053 | |

| Gain on aircraft sales, trading and other activity | (228,466) | | | (226,945) | |

| Changes in operating assets and liabilities: | | | |

| Other assets | 12,521 | | | 48,310 | |

| Accrued interest and other payables | 75,172 | | | 13,333 | |

| Rentals received in advance | (7,204) | | | (1,605) | |

| Net cash provided by operating activities | 1,677,019 | | | 1,746,880 | |

| Investing Activities | | | |

| Acquisition of flight equipment | (3,727,416) | | | (3,789,113) | |

| Payments for deposits on flight equipment purchases | (446,343) | | | (433,452) | |

| Proceeds from aircraft sales, trading and other activity | 1,524,711 | | | 1,684,814 | |

| Proceeds from settlement of insurance claim | — | | | 64,714 | |

| Acquisition of aircraft furnishings, equipment and other assets | (387,255) | | | (305,346) | |

| Net cash used in investing activities | (3,036,303) | | | (2,778,383) | |

| Financing Activities | | | |

| Net proceeds from preferred stock issuance | 295,012 | | | — | |

| Redemption of preferred stock | (250,000) | | | — | |

| Cash dividends paid on Class A common stock | (93,481) | | | (88,792) | |

| | | |

| Cash dividends paid on preferred stock | (47,762) | | | (41,700) | |

| Tax withholdings on stock-based compensation | (9,387) | | | (3,354) | |

| Net change in unsecured revolving facility | (930,000) | | | 80,000 | |

| Proceeds from debt financings | 5,201,695 | | | 2,993,732 | |

| Payments in reduction of debt financings | (3,210,028) | | | (2,593,338) | |

| Debt issuance costs | (10,277) | | | (13,052) | |

| Security deposits and maintenance reserve receipts | 452,022 | | | 398,345 | |

| Security deposits and maintenance reserve disbursements | (26,898) | | | (15,863) | |

| Net cash provided by financing activities | 1,370,896 | | | 715,978 | |

| Net increase/(decrease) in cash | 11,612 | | | (315,525) | |

| Cash, cash equivalents and restricted cash at beginning of period | 464,492 | | | 780,017 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 476,104 | | | $ | 464,492 | |

| Supplemental Disclosure of Cash Flow Information | | | |

Cash paid during the period for interest, including capitalized interest of $42,390 and $43,093 at December 31, 2024 and 2023, respectively | $ | 794,330 | | | $ | 693,826 | |

| Cash paid for income taxes | $ | 57,433 | | | $ | 7,801 | |

| Supplemental Disclosure of Noncash Activities | | | |

| Buyer furnished equipment, capitalized interest and deposits on flight equipment purchases applied to acquisition of flight equipment and other assets | $ | 1,192,974 | | | $ | 827,377 | |

| Flight equipment subject to operating leases reclassified to flight equipment held for sale | $ | 1,821,084 | | | $ | 1,730,212 | |

| Transfer of flight equipment to investment in sales-type lease | $ | 106,043 | | | $ | 66,907 | |

| Cash dividends declared on Class A common stock, not yet paid | $ | 24,503 | | | $ | 23,316 | |

v3.25.0.1

Cover Page Cover Page

|

Feb. 13, 2025 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 13, 2025

|

| Entity Registrant Name |

AIR LEASE CORPORATION

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35121

|

| Entity Tax Identification Number |

27-1840403

|

| Entity Address, Address Line One |

2000 Avenue of the Stars,

|

| Entity Address, Address Line Two |

Suite 1000N

|

| Entity Address, City or Town |

Los Angeles,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90067

|

| City Area Code |

310

|

| Local Phone Number |

553-0555

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001487712

|

| Amendment Flag |

false

|

| Class A Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock

|

| Trading Symbol |

AL

|

| Security Exchange Name |

NYSE

|

| Series A Medium-Term Notes |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.700% Medium-Term Notes, Series A, due April 15, 2030

|

| Trading Symbol |

AL30

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=al_SeriesAMediumTermNotesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

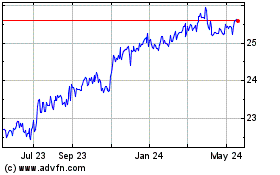

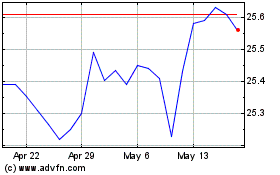

Air Lease (NYSE:AL-A)

Historical Stock Chart

From Jan 2025 to Feb 2025

Air Lease (NYSE:AL-A)

Historical Stock Chart

From Feb 2024 to Feb 2025