0001487712false00014877122025-02-132025-02-130001487712us-gaap:CommonClassAMember2025-02-132025-02-130001487712al:SeriesAMediumTermNotesMember2025-02-132025-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934 | | |

| February 13, 2025 |

Date of Report (Date of earliest event reported) |

AIR LEASE CORPORATION

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

Delaware | 001-35121 | 27-1840403 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 2000 Avenue of the Stars, | Suite 1000N | | |

| Los Angeles, | California | | 90067 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (310) 553-0555 | | |

Not Applicable (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock | AL | New York Stock Exchange |

| 3.700% Medium-Term Notes, Series A, due April 15, 2030 | AL30 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01 Regulation FD Disclosure

On February 13, 2025, the Company held a conference call to discuss its financial results for the three months and year ended December 31, 2024. A copy of the conference call transcript is furnished herewith and attached hereto as Exhibit 99.1.

The information in this Item 7.01 and the related information in Exhibit 99.1 attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit 104 The cover page from this Current Report on 8-K formatted in Inline XBRL

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| AIR LEASE CORPORATION | |

| | | | |

| Date: February 14, 2025 | /s/ Gregory B. Willis | |

| Gregory B. Willis | |

| Executive Vice President and Chief Financial Officer

| |

2 - 13 - 2025

Air Lease Corporation

Q4 2024 Earnings Conference Call

TOTAL PAGES: 20

Air Lease Corporation

Q4 2024 Earnings Conference Call

CORPORATE SPEAKERS:

Jason Arnold

Air Lease Corporation; Head of Investor Relations

John Plueger

Air Lease Corporation; Chief Executive Officer and President

Steven Udvar-Házy

Air Lease Corporation; Executive Chairman

Gregory Willis

Air Lease Corporation; Executive Vice President and Chief Financial Officer

PARTICIPANTS:

Catherine O'Brien

Goldman Sachs; Analyst

Terry Ma

Barclays; Analyst

Jamie Baker

JPMorgan; Analyst

Moshe Orenbuch

TD Cowen; Analyst

Hillary Cacanando

Deutsche Bank; Analyst

Stephen Trent

Citi; Analyst

Ronald Epstein

Bank of America; Analyst

PRESENTATION:

Operator: Good afternoon. (Operator Instructions) At this time, I would like to welcome everyone to the Air Lease fourth quarter 2024 Earnings Conference Call. (Operator Instructions) I would now like to turn the call over to Mr. Jason Arnold, Head of Investor Relations. Mr. Arnold, you may begin your conference.

Jason Arnold: Thanks, (Krista). And good afternoon, everyone.

Welcome to Air Lease Corporation’s fourth quarter and full year 2024 earnings call. This is Jason Arnold.

I’m joined today by Steve Hazy, our Executive Chairman; John Plueger, our Chief Executive Officer and President; and Greg Willis, our Executive Vice President and Chief Financial Officer.

Earlier today we published our fourth quarter and full year 2024 results. A copy of our earnings release is available on the Investors section of our website at airleasecorp.com.

This conference call is being webcast and recorded today Thursday, February 13, 2025.

The webcast will be available for replay on our website. At this time all participants to the call are in listen-only mode.

Before we begin, please note that certain statements in this conference call including certain answers to your questions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act.

This includes without limitation statements regarding the state of the airline industry, the impact of aircraft and engine delivery delays and manufacturing flaws, our aircraft sales pipeline and our future operations and performance.

These statements and any projections as to our future performance represent management’s current estimates and speak only as of today’s date. These estimates involve risks and uncertainties that could cause actual results to differ materially from expectations.

Please refer to our filings with the Securities and Exchange Commission for a more detailed description of risk factors that may affect our results. Air Lease Corporation assumes no obligation to update any forward-looking statements or information in light of new information or future events.

In addition, we may discuss certain financial measures such as adjusted net income before income taxes, adjusted diluted earnings per share before income taxes and adjusted pretax return on equity, which are non-GAAP measures. A description of our reasons for utilizing these non-GAAP measures, as well as our definition of them and the reconciliation to corresponding GAAP measures can be found in the earnings release and 10-K we issued today. This release can be found in both the Investors and the Press section of our website.

Similar to last quarter, given ongoing litigation, we won’t be able to take any questions about our Russia fleet insurance claims. Lastly, as a reminder, unauthorized recording of this conference call is not permitted. I’ll now turn the call over to our Chief Executive Officer and President, John Plueger.

John Plueger: Well thanks, Jason. Hello. And good afternoon, everyone. Thank you for joining our call today.

During the fourth quarter, Air Lease generated revenues of $713 million and $0.83 in diluted earnings per share. Our results benefited from the continued expansion of our fleet, offset by lower end of lease revenue as compared to the prior year. I’m also happy to report that

full year 2024 revenue and ending fleet net book value reached record levels in the history of our company.

We purchased 18 new aircraft from our orderbook during the quarter, adding $1.3 billion in flight equipment to our balance sheet and we sold 14 aircraft for approximately $540 million in sales proceeds. The weighted average age of our fleet was stable quarter-over-quarter at 4.6 years, while weighted average lease term remaining extended slightly to 7.2 years. Fleet utilization remains very robust at 100%.

Our fourth quarter deliveries came in better than expected as the OEMs pushed to achieve their own delivery goals and objectives ahead of year-end. On a full year basis, the $5 billion in deliveries we received hit the midpoint of the $4.5 billion to $5.5 billion range we outlined to you at the beginning of last year.

For 2025, we expect to receive $3 billion to $3.5 billion of new aircraft delivered from our orderbook, with around $800 million anticipated to deliver in the first quarter of ‘25. I would also note that approximately 80% of our deliveries expected for 2025 are Boeing aircraft, so any additional challenges emerging in Boeing’s production efforts could be impactful. With the lower forecast expenditures on new aircraft deliveries for 2025 compared to 2024, ALC will have the ability to largely self-fund those deliveries from operating cash flow plus aircraft sales. This means reduced funding needs from the debt capital markets. In effect, for 2025, we anticipate debt funding of approximately $2 billion including refinancing of remaining 2025 debt maturities. So we will have less overall financing in 2025, where it appears that financing rates will remain elevated. Greg will discuss this further and we believe, by the way, that the same situation will exist for 2026.

Expected deliveries from our forward orderbook are fully placed through 2026, and the team is working diligently to achieve the highest possible lease rates on our remaining deliveries in 2027 and beyond. Our young fleet and sizable new orderbook, with delivery positions well inside of any available manufacturers, continues to position us exceptionally well in the current commercial aircraft supply-constrained environment. This strong environment is also continuing to drive up lease rates.

So to that point, I’d like to share some specific information that I hope you find useful as we report here on our full year 2024. Now I won’t be updating these specific comments or examples every quarter, but simply wanted to give you a flavor of what we are seeing in the overall context.

First, during Q4, ALC executed lease extensions covering 23 single-aisle aircraft including Boeing 737-800, Boeing 737-8 MAX, A321ceos and one E190. In aggregate, that pool of aircraft extensions resulted in higher lease rates and lease rate factors than those just prior to extension. This is very significant in that lease rates normally are lower during a lease extension compared to when the aircraft delivered new.

Second, year-to-date in 2025, ALC has agreed to lease extensions on six Boeing 777-300ER aircraft across two airlines. The aggregate total lease rates and lease rate

factors were largely in line with what they were prior to the extension, and I would add also significantly higher than the lease rates indicated currently for those aircraft by well-known appraisal firms. This points to the growing strength of widebody aircraft, which historically have always lagged narrowbody aircraft. In fact, we believe that widebody demand has surged faster than narrowbody demand over the past six months. Steve will comment on this further in his remarks.

Third, our Q4 new aircraft deliveries represented the highest delivery yield in a quarter in over four years.

Fourth, as you recall during Covid, we had a number of leases that were restructured or signed at relatively low lease rate factors as a product of the challenges facing our customers at that point in time. Approximately $5 billion net book value of these lower-yielding leases will mature by the end of 2026. As these leases mature and expire through 2026, we continue to be optimistic about lease rate extensions at significantly higher lease rates, or re-leasing to the next lessee at significantly higher lease rates, as we are seeing today.

Now at the same time we must recognize we are in an environment where interest rates have not fallen as rapidly as most of us expected a year ago. In fact, looking forward, it appears that interest rates will remain elevated for a longer period of time than we anticipated. Looking back over the past 24-plus months, it can still be said that overall, interest rates rose more than lease rates from their historic lows. Let me also remind you that we undertook a program several years ago to reduce our China content, and we have done so very effectively. That continued in 2024, wherein almost half of our aircraft sales were aircraft on lease to China. We made healthy gains on those sales, yet I want to remind you that those China leases were very profitable, in fact, some of our highest yielding leases, so this also affects our margins looking forward. With these factors, it is taking and will take a bit longer for increased lease margins being seen in our financial results. Nevertheless, we expect to see a moderately sized steady upward trajectory in fleet lease yields each year for the next three to four years based on our views of the market and assumptions around our sales activity and interest rate environment over the same period.

At the same time, we are reaping the benefits of higher aircraft values in our aircraft sales. Strong commercial aircraft demand continues to support our sales efforts and gain on sale margins. Our gain on sale margins for fourth quarter ‘24 and full year ‘24 were very robust, reflecting this environment. Our sales pipeline remains solid at $1.1 billion, a consistently healthy gain on sale margins. We envision an overall sales outlook of about $1.5 billion for 2025, around $400 million of which is expected to close in the first quarter.

Given this overall backdrop, let me discuss capital allocation. For 2025, it’s going to be quite simple. We’ve told you that besides funding our orderbook, our top priority is to get back to our target debt-to-equity ratio of 2.5:1. We expect to be there by the end of 2025, perhaps even earlier. So in 2025, we are focused first on debt reduction. Once we hit our target debt to equity level, we will, as always, consider all capital allocation avenues

including incremental aircraft or fleet purchases, capital return to shareholders, M&A possibilities, whichever we deem the best deployment of capital for our shareholders.

Let me conclude a bit off topic, but importantly, to comment on the tragic fires that devastated Los Angeles, our hometown, recently. You all read and saw firsthand the unprecedented devastation in our city. Despite a number of our employees being evacuated, I am incredibly thankful above all that none of our employees suffered the loss of their homes or any other tragedies. During this period of crisis, I am proud that the ALC team maintained normal business operations during this time without skipping a beat. At the same time we are all profoundly saddened by the loss of life and property of others less fortunate. Many of our employees spent time helping others in need and while we offered financial assistance to all employees for any fire-related housing or other costs, most declined, wishing instead that ALC make a meaningful contribution to those who saved our homes and our lives. As such, I’m pleased to advise that ALC is donating $0.5 million to L.A. City and County fire departments with our profound gratitude and heartfelt thanks.

So let me now turn the call over to Steve Hazy to offer some additional commentary. Steve?

Steven Udvar-Hazy: Thank you, John. I’d first like to underscore John’s comments and my thanks to our team for their dedication to our company and our colleagues in the L.A. fires. I’m very proud of the way our team responded in offering help and assistance to each other as well as family, friends and neighbors in their communities to overcome the tragic destruction witnessed in Los Angeles during January.

We are very pleased to report record revenues and fleet size during 2024, and view Air Lease as very well positioned for the current environment as we move forward in 2025 and beyond. Demand for commercial jet aircraft is extremely high, and our own fleet and large orderbook consists of some of the most attractive commercial aircraft types on the market. There’s rarely an airline customer meeting that goes by that we are not asked to find more aircraft for them, and nearly all of our leases maturing are being extended at very strong, profitable lease rates. The phenomenon of lease extension rates exceeding initial new aircraft lease rate is truly exceptional. Second leases are typically signed with a step down in the lease rate, given the depreciation of the aircraft over time, so it’s a pretty remarkable environment where lease rates are actually stepping up on a second lease to such high levels. As John noted, I do also point out that the drag of the lower yields of the restructured leases that we did during the pandemic and early deliveries in the pandemic season should begin to weigh less heavily on our overall fleet yield as the lower lease rate terms end and they’re extended at market rates with the existing airline or with a new airline.

Demand for our new commercial aircraft is being further supported by exceptionally strong passenger traffic volumes. According to recent data released by IATA, total passenger traffic volumes rose by more than 10% during 2024 versus 2023, reaching all-time record levels. International volumes were the strongest segment in the market, rising an amazing 14% year-over-year and practically, all markets growing in double digits or near very strong double-digit rates. Asia Pacific remains the leading international market globally, rising 25%

during the year. While this dramatic pace of growth is likely to slow somewhat in the years ahead, as growth rates normalize, we continue to see this region as being a significant source of expansion worldwide. Latin America, the Middle East, Africa and Europe were growth leaders in the international segment last year. Domestic volumes, meanwhile, delivered a solid 6% rate of growth during the last year, which is more or less in line with the longer-term industry averages of approximately 2x the pace of GDP growth on a global level. Passenger load factors also continue to rise, reaching approximately an average of 84% for the full year of 2024. These are exceptionally robust levels, breaking records in a number of regions and markets. Asia Pacific region load factors, for example, achieved a record all-time high in 2024. 15 to 20 years ago, developing markets and international load factors were exciting if they moved into the high 70% range. While now some are approaching, and in some cases, even exceeding 90% load factor levels. High demand and low supply of commercial aircraft is certainly a component driving load factors to achieve these record levels. As a reminder, Air Lease clearly benefits from strong passenger traffic volume expansion, though we are not dependent on it, as we focus on replacing aging airline fleets with new technology fuel-efficient aircraft and economically profitable leases.

Much of the market focus on recent years has been on narrowbody supply/demand imbalances, but I want to expand on John’s comments highlighting the widebody side as well. Widebody demand was more muted during the period in which the industry was recovering from the pandemic. But now things have changed. We are seeing extremely strong international passenger traffic over the last year or two and in particular, the shortfall of widebody availability is becoming increasingly apparent. This combination of accelerating widebody demand, relatively modest production rates and continued aging of the in-place operational widebody jets is developing into what we expect to be a protracted shortfall of good widebody aircraft over multiple years to come. John mentioned on the call the extension of six of our 777-300ER aircrafts to date in 2025. We’re also seeing the strengthening demand supporting similar dynamics to our other widebodies, including our A330s coming up for lease expiration. This backdrop of strong demand and limited production is appearing to repeat the same path and characteristics as witnessed in the narrowbody market already, which should definitely support strength in the value of our widebody fleet. It is very difficult to foresee a significant ramping up of OEM production rates that could address this expected shortfall, especially with the ongoing delays in the 777X program.

Wrapping up my comments, I’m very excited about Air Lease’s prospects for 2025 and beyond. We look forward to enjoying the higher lease rates on our new aircraft from our very sizable orderbook, along with robust lease rates on new extensions as further normalization of the yield curve over time which combined should be highly beneficial to our operating performance ahead. I will also remind you of the deep underlying value of our own fleet, which is carried at historical depreciated cost, as well as our orderbook positions, which are for slots well inside of any available aircraft from the OEMs and at prices that could not be duplicated at present. A significant part of the orderbook that we have today that is still yet to deliver were contracts that we negotiated in 2021. Our orderbook has significant value, and none of that is carried or reflected on our balance sheet at this time.

I would like to now turn over the call to our CFO, Greg Willis, for his comments on our financial situation.

Gregory Willis:

Thank you, Steve. And good afternoon, everyone. During the fourth quarter, Air Lease generated total revenues of $713 million, which was comprised of approximately $639 million of rental revenue and $74 million of aircraft sales, trading and other activities.

Rental revenue was in-line with the fourth quarter of ‘23, and lease yields remained essentially flat. Rental revenues have benefited from the growth of our fleet, offset by significantly lower end of lease revenue. As a reminder, we recognized $60 million in end of lease revenue in the prior period, which as compared to the current period, was $6 million. As we have messaged before, we continue to anticipate lower levels of end of lease revenue due to higher extension rates attributable to the supply shortage of commercial aircraft. As John discussed earlier, this environment has led to higher lease rates on extensions and has served to increase the value of these aircraft in our fleet.

Sales proceeds for the quarter approximated $540 million from the sale of 14 aircraft. These sales generated $65 million in gains, representing roughly a 14% gain on sale margin. We continue to expect to see healthy margins towards the upper end of our historical range of 8% to 10% based on our current sales pipeline of $1.1 billion. These gains continue to reflect the significant value embedded in our fleet, which we carry on the balance sheet at depreciated cost.

Moving on to expenses. Interest expense rose by approximately $38 million year-over-year, driven by a 37-basis-point increase in our composite cost of funds to 4.14% at year-end. Increased financing costs and higher debt balances were the primary contributors to the year-over-year increase in interest expense. However, as compared to the third quarter of ‘24, our composite rate declined slightly as we benefited from the Fed rate cuts in ‘24. At year-end, roughly 79% of our borrowings were fixed rate versus floating, just inside our 80% target. We continue to benefit from our largely fixed rate borrowings, which has meaningfully moderated the impact of the current interest rate environment.

Depreciation expense continues to track the growth of our fleet. SG&A expense declined relative to the prior year, while also declining as a percentage of revenue relative to the prior year’s quarter. It’s also worth noting that we did benefit from a $67 million Russia insurance recovery in the fourth quarter of ‘23.

Moving on to our financing activities for the quarter. In mid-October, we redeemed our outstanding $250 million Series A preferred stock, utilizing the proceeds from the lower cost $300 million Series D preferred stock that we issued in the third quarter. During the fourth quarter, we raised approximately $1.3 billion in debt financings. This was comprised primarily of a $1 billion three-year syndicated unsecured bank term loan, priced at one month SOFR plus 1.125%. This capital is primarily sourced from new Asian banks helping us to grow our bank group to a global base of 83 financial institutions. Additionally, I’d like to

highlight that we have launched a $2 billion commercial paper program in late January of this year. We believe our commercial paper program should serve to reduce our borrowing costs as CP rates at present are approximately 80 basis points lower than the rate on our revolving credit facility. The CP program also represents another funding channel to further diversify our access to capital.

Our debt-to-equity ratio at the end of the fourth quarter was 2.68x on a GAAP basis, which net of cash on the balance sheet, is approximately 2.6x, relatively flat quarter-over-quarter when adjusted for the impact of the timing difference of the preferred stock issuance and redemption last year. And with our lower CapEx outlook for the next few years, we anticipate reaching our leverage target by the end of the year, which should increase our financial flexibility. Our strong liquidity position of $8.1 billion as of quarter end, $30 billion of unencumbered asset base and $30 billion of contracted rentals remain key pillars of the strength of our business.

As John and Steve outlined, we expect our portfolio lease yields to steadily increase at a moderate pace over the next several years. This is driven by an increase in yields on our attractively placed orderbook aircraft delivering over the next several years, higher-than-anticipated lease extension rates, given the strong market dynamics that we see persisting through the next several years. The continued seasoning of our existing fleet and the roll-off of our Covid-era leases. However, turning to margins, we still expect to experience some headwinds given the current elevated interest rate environment, which look to keep our adjusted margins in ‘25 generally around the levels we recorded in ‘24.

With that, I’d like to turn the call back over to Jason for the question and answer session of the call.

Jason Arnold: Thanks very much, Greg. This concludes our prepared commentary and remarks. For the question and answer session, we ask each participant to limit their time to one question and one follow-up. (Krista), please open the line for the Q&A session.

Operator: (Operator Instructions) And your first question comes from the line of Catherine O’Brien with Goldman Sachs.

Catherine O’Brien: So I think your comments on some of the puts and takes around lease margins and ROE. China is a bit of a headwind this year.

Some of the lease renewals are going to be a tailwind over the coming years.

Obviously, it’s a bit of a slow-moving ship as you turn through the portfolio.

But can you just walk us through, what do you think gets you back to mid-teen adjusted pretax ROEs that you saw before the pandemic?

Or do you think that’s achievable?

And just any rough sense of the timeline would be great.

John Plueger: Sure. Thanks, Catie. I’ll take that, and then I’ll ask Greg to comment. I think yes, I do think we are going to be able to achieve that mid-teens level that you spoke about, but it’s going to take two to three more years.

And we’ve outlined the factors on the positive side and any headwinds.

But given all that in consideration, I do believe that’s a reasonable timeframe outlook in the two- to three-year timeframe.

Gregory Willis: Yes.

I think obviously the big question is around the timing of interest rates and lease rates as well.

I mean -- but at the end of the day we -- obviously when it comes to capital allocation too, those are other factors that we have.

But I don’t see any impediment of reaching our ROE targets over a longer period of time. It’s just a question of how lease rates and interest rates evolve.

Catherine O’Brien: Got it. Makes sense.

Then I’m assuming your comment on reaching your leverage target is based on just core business trends, but correct me if I’m wrong?

Based on what you see in the market right now between incremental aircraft M&A or the value of AL shares, if you were to get back to your target debt to equity faster than you currently expect, what will be the right choice for AL shareholders?

John Plueger: We’ll make that determination at that time, Catie.

Steven Udvar-Hazy: But they’re all on top of our list. I view capital allocation as very important, with a view toward maximizing the value to our shareholders.

Once we get to the 2.5x area, which will hopefully happen sometime in the second half of this year, our Board will consider multiple scenarios including initiating a buyback program.

John Plueger: And one other appendage to that, Catie. I mean it should be obvious, but also when you’re looking at capital return to shareholders and our current stock price has a major bearing on that.

So we never predict where that will be.

But obviously as you know, that’s a key consideration.

Operator: Your next question comes from the line of Terry Ma with Barclays.

Terry Ma: Thank you. Good afternoon.

So I appreciate the comments on the direction of the overall fleet lease yield over the next few years.

But when you kind of factor in the forward curve and your planned funding needs, should we expect the net spread margin to go up by a similar amount?

Or is that going to be kind of depressed by just overall funding or interest rates?

John Plueger: Greg?

Gregory Willis: Yes. I think for ‘25, we thought that we’d be around the same levels as we did in ‘24. A lot of that depends on what happens with interest rates.

I mean it’s nice to see a nice, steady grind up of the lease yield over time. Which I think is a pretty powerful lever, but it does take time to make its way through the business.

Terry Ma: Got it.

Okay.

Then on the leases that you extended in the fourth quarter, like should we expect kind of the incremental pickup in yield rental revenue to kind of flow through in the first quarter?

Then any more color on the cadence of the remaining renewals?

Gregory Willis: Yes. I think it -- those that were signed in Q4 will roll through in ‘25.

Then as we work through the $5 billion of airplanes that are rolling off over the next two years. I think that will also provide an uplift to lease yields.

So I think you should expect a steady grind higher on the top line.

Then, I guess finally, you need to factor in, we don’t see the market changing given the supply/demand dynamics that are in play.

So we still see airplane shortages extending three to four years based upon what’s going on, on the production side.

So I think that’s going to create a shortage of airplanes that is going to contribute to both aircraft values and lease rates being strong for the next several years.

Steven Udvar-Hazy: Yes. And coupled, Greg and John, with the expirations of those leases that we renegotiated during Covid – as those progressively liberate us and allow us to get back to market lease rates, either by extension or repositioning those aircraft to new lessees. That will have a continual upward trend on the overall corporate lease yield.

Operator: Your next question comes from the line of Jamie Baker with JPMorgan.

Jamie Baker: So an argument that -- well a debate that Mark Streeter and I were having -- because we don’t really argue.

Have you thought about even greater aircraft sales into this strong market as a means of potentially improving the value proposition of the equity?

Or is the preference just to maintain the current level of sales and then wait for that pickup in deliveries at some point down the road?

Does that make sense?

John Plueger: Yes.

Steven Udvar-Hazy: We are looking at that carefully.

John Plueger: Sorry. Let me just quickly start.

Then Steve will turn it over to you.

As I said in my remarks, we’re looking to be about $1.5 billion in sales in 2025.

That’s pretty close to the $1.7 billion we had in 2024. Sales programs are largely also opportunistic.

In the prior quarter, I also talked about the fact that we’re being approached from fairly significant buyers who want to do larger scale managed portfolios.

So with all these factors, we have to look at opportunities and what’s in front of us.

But generally speaking, I think we’re biased towards keeping about the same level of sales proceeds – that seems to be a good balance every year. If there is a strongly compelling reason why we should sell x amount of more, we’ll take a look at it.

But I think currently, our plans are to remain about our current levels.

Jamie Baker: Okay.

Steve, anything to add to that?

Steven Udvar-Hazy: I think we’re also are very interested in developing structures where we still maintain the relationships with the airline customer and bring in passive institutional investors into a managed structure vehicle where we have a small equity stake, but we have a large portion of the profitability in the end of lease disposition of those aircraft and a sizable management fee during the tenure of these arrangements.

So that could be an avenue where we may add some additional assets and transfer them to these new entities.

Jamie Baker: Okay. That’s helpful. All good points.

Then second, and I guess this gets back to the comment that Greg made in the prior question about the steady grind. AerCap had this slide that showed the percentage of, let’s call it, sort of cold, medium and hot leases as a percentage of total for each year.

The cold leases being the least profitable in reflecting aircraft that were placed at the bottom of the market. And again Steve, you commented on this just a moment ago.

But if we were to focus just on those less profitable leases at Air Lease, would you have an estimate for 2024, ‘25 and ‘26 as to what percentage of the book they represent?

Just trying to put a visual behind the burning off of these leases as they are being overtaken by the stronger deals that you’ve been talking about ever since John’s prepared remarks.

I hope that’s clear.

John Plueger: Greg, do you want to talk about that?

Gregory Willis: Yes.

We don’t have the page in front of us, but we’re familiar with the numbers, and that’s why we tried to give the color in the prepared remarks about a $5 billion worth of aircraft that were Covid-era leases that are rolling off over the next two years.

I think you can take that as a ratio of the overall fleet. That was our attempt to give some color about how quickly the lease yield can move forward.

Operator: Your next question comes from the line of Moshe Orenbuch with TD Cowen.

Moshe Orenbuch: I apologize for some of the background noise here.

As you look, John, at these lease renewals that are going on, are those getting better in this environment?

Like in other words, if you think about where they’ll be in ‘25 and ‘26 versus what you mentioned in terms of up slightly for narrowbodies, flat for widebodies. Is that improving in this environment or have they peaked?

John Plueger: Yes. The answer is unequivocally, yes. The examples I gave on the extensions we executed in the fourth quarter on the single-aisles, where the lease rates were higher than the initial term. And about flat on the widebodies, both of those are against the backdrop of typically lease rates step down after the initial lease term on new aircraft.

And so this is a very significant element that we see, and we see it continuing to strengthen in 2025 as we look at our leases that are subject to extension and that we’re discussing right now.

So look at it on a very robust level.

Moshe Orenbuch: But if you were at your leverage target today and everything is as it was today in other words, a lower level of deliveries into 2025, what would be at the top of your list for deploying capital?

Would it be -- would you be looking at sale leasebacks?

Would you be looking at a stock buyback with where the stock is?

Like could you maybe talk about that from a hypothetical standpoint?

John Plueger: Well from a hypothetical standpoint, I would just say based on where our stock is today, we look at that very, very strongly, and it’s a compelling value today. Having said that, as I said earlier, we’ll make that determination at such time when we get to our debt equity ratio.

But just know very certainly that this is a very strong possible avenue for the company.

But again, we withhold our decisions on that until such time as we are where we want to be.

Gregory Willis: Especially when you’re selling aircraft at a 14% premium to their carrying values and your stock is trading well above.

Moshe Orenbuch: Right.

Operator: Your next question comes from the line of Hillary Cacanando with Deutsche Bank.

Hillary Cacanando: So this question is more high level and not specific to your insurance situation.

So I’m hoping you could answer it.

But I was wondering if there’s a ceasefire agreement between Russia and Ukraine, could there be any impact to the lessors?

I guess more specifically, do you think there’s any chance that Russia can try to return the aircraft to the lessors, which I don’t think the lessors would want.

I don’t know if that’s even a possibility.

But I wanted to see if there’s any like high-level thoughts you could provide on a possible ceasefire.

John Plueger: Hillary, we’re just not going to comment on that.

Sorry.

Hillary Cacanando: Okay.

Okay. I figured as much.

Then I guess when you talked about taking two to three years to get to the mid-teen level returns, are you assuming that interest rates remain at the same at the current level if there’s an interest rate hike?

Or is there are more cuts this year, will that two- to three-year assumption change?

John Plueger: Greg?

Gregory Willis: I think a lot of it depends on where interest rates are. I mean I think the mid-teen target is more of a longer-term target because there’s nothing fundamentally different in our business today. It’s just going to take a little bit of time for that stuff to make its way through our $30 billion balance sheet.

So if anything, I would emphasize that it’s going to take time to make it work its way through and some of it, of course will depend on how quickly and in which direction interest rates move.

Steven Udvar-Hazy: Also the cut in interest rates only affect our incremental borrowings. All of our existing bonds that were issued two, three, four years ago and do not roll off in this period, the interest rate on those bonds is what it is.

We can’t change that.

But if interest rates improve for us, it will affect all of our short-term bank borrowings and any new bond offerings.

But as Greg said, that number would have to be pretty substantial to have a major impact on the portfolio debt coming down proportionately.

Operator: Your next question comes from the line of Stephen Trent with Citi.

Stephen Trent: A quick one here, two quick ones here. First, when you think about what we know about tariffs today and I know there’s not a lot of information, but is it conceivable that leasing could actually gain a little favor over aircraft purchases in the case of Airbus or Embraer customers here that the impact of a tariff could be rolled over the long life of a lease as opposed to a onetime hit from purchasing on spot or -- and I know there’s not a lot of information. I’m just sort of high level, trying to get my brain around it.

Steven Udvar-Hazy: Well the first answer is that any tariffs or taxes on these type of transactions involving leasing or finance lease, operating lease, the airline, the lessee airline operator, is responsible for any such tariffs or duties or taxes. The second point I want to make is that a very large percentage of Airbus aircraft are either manufactured in the U.S., components, engines, avionics.

Same goes for Boeing. A lot of the components that go to Boeing aircraft are manufactured outside the United States.

So it’s going to be a pretty complex calculation to figure out what percentage of an Airbus A321 is U.S.-made even if it’s built in Europe versus being built here in Mobile, Alabama.

The same thing with Boeing. I mean big components of the 787s and 737s are manufactured outside the U.S.

Stephen Trent: Very helpful. Definitely appreciate the color. And just one other high level one for you here. I think on some of the previous calls, you guys have not expected aircraft supply to normalize for a couple of years.

What you’re seeing in the tea leaves from your suppliers, have your views on that changed at all?

Do you still think we’re a couple of years away from normalization of aircraft production?

John Plueger: No. Views have not changed whatsoever.

We see this over multi years, we don’t see any change at all.

We think aircraft are still going to be in short supply. The manufacturers are not going to achieve nearly the rate of production that they would want to achieve or they would need to make up for the last several years.

So we’re quite convinced we’re in this for a fairly long period of time.

Operator: Your next question comes from the line of Ron Epstein with Bank of America.

Ronald Epstein:

So maybe just following up on Steve’s last question. Do you have any sense when the industry will actually be back in equilibrium?

I mean how long is it going to take the industry to dig itself out of the hole in terms of the shortage of supply?

Steven Udvar-Hazy: If anything, Ron, we have been stretching out that timeframe, not shortening it. I’ll give you an example. The appetite of the airlines for spare engines to cover for engines that are in the shop for much longer periods and with longer lead times to an overhaul facility, to even just get in, creates a shortage of new engines.

Because today a larger percentage of the production of CFM LEAP, GTS engines and even Rolls-Royce Trent engines, are being allocated to cover airline operations today – AOGs today.

So that is a constraining factor on both Boeing and Airbus: getting enough engines to be able to increase production rates.

So that’s one factor.

The second factor is that during the pandemic, a lot of the smaller subcontractors for both airframe and engines and avionics and DSE, seats and galleys, reduced their staffing and cut back on their infrastructure. And now they’re being asked again to ramp it up, which means they have to invest more in machinery, in digital tools, get their hands on labor that’s trained.

And so those are all factors that are limiting the ability of the supply chain to get back to what you said was pre-pandemic levels.

It’s not an overnight process, as you can imagine.

But I would say the engine situation is the most visible to us in all the discussions we have with airlines.

Ronald Epstein: And would you say the airlines are getting accustomed to flying older equipment, meaning that maybe your leases will just last longer for the foreseeable period of time?

Steven Udvar-Hazy: Yes. We’re seeing that.

We’re seeing that particularly in North America, where with the refurbished old Northwest Airlines A320ceo, that’s more than 25, in some cases, 30 years old, with a refreshed interior, the customer who gets on the jetway doesn’t have any clue how old that aircraft is because most of them have been freshened up.

So a lot of the 767s, earlier generation 737s, A320s, A321s – are staying in service longer than what was originally anticipated.

This is to cover growth in traffic, as well as the delays in the deliveries that they’ve contracted for us.

All of that leads to us being asked to provide more aircraft than we have, where supply is limited and demand far outpaces our ability to get enough new airplanes.

Ronald Epstein: Then maybe just one last related question. And again this would be constrained by the supply chain, of course. Kind of all else being equal, do you think that the industry needs a third supplier now?

Because it seems like two isn’t enough.

Steven Udvar-Hazy: Well if you look at the size of the overall commercial jet population and the forecast that it’s going to grow to about 40,000 airplanes in the next six or seven years, there’s definitely room for a third party.

But I think that third party and the one that’s talked about most is Embraer, would need a partner in that program that has financial key pockets.

But that is one possible alternative.

I know the guys down in Brazil are working on that very hard. The big question in our mind, Ron, is what engines would go on that airplane.

Because if it’s the same old catalog, Leap 1A or 1B or the current GTS, which hopefully will get upgraded in 2027 – what engine would somebody put on that?

Because that is a big factor, there needs to be a step change improvement in the propulsion system. Not so much on fuel burn, but more on reliability, dependability and life on the wing.

Ronald Epstein: Yes. That makes sense.

Okay cool. Thank you.

Operator: Your Next question comes from the line of Catherine O’Brien with Goldman Sachs.

Catherine O’Brien: I just wanted to come back to the $5 billion number you gave. It was really helpful to helping us think through like what percentage of book values tied to these Covid-era leases over the next couple of years. Just in very rough numbers, understanding the backdrop might be different today.

It doesn’t sound like that’s what you guys think, sounds like you think it might even be better.

But if you could snap your fingers and write those leases at today’s lease rates, like what would the upside be on that pool of aircraft?

Steven Udvar-Hazy: It’s hard to say because it depends on the airlines, the length of the lease extension or the economics of shifting the aircraft in other airlines.

But the numbers could be anywhere from 30% to 50% higher than the lease rates we currently enjoy.

So as these leases come off that sort of charity period, I call it, to our customers to keep them alive and kicking, as those progressively come off between now and the fourth quarter of 2026, we are going to see marked improvement in the lease yields on those aircraft, especially since they’re being depreciated.

So the factor of the depreciated cost versus lease rate is going to be improving every quarter, once these charity periods are over.

Catherine O’Brien: Yes.

So doubly beneficial to lease yield.

Steven Udvar-Hazy: But Greg can give you color. Greg can comment on how much of this comes off every quarter or every six months.

Gregory Willis: Yes. I mean we gave some color that we thought that would modestly increase over the next four years. I think what that means is somewhere between 150 to 200 basis points in yield improvement over that period of time over the four-year period.

Catherine O’Brien: Per year, Greg, or the total period, sorry?

Gregory Willis: No. In total. Cumulatively.

John Plueger: Keep in mind, Catie, we’ve got basically just about a $30 billion net book of aircraft.

So these significant lease rate increases are very, very helpful.

But it’s trying to steer a pretty big aircraft carrier.

So it just takes a little bit more time to push the carrier around versus a little speedboat.

Operator: And that concludes our question and answer session. Mr. Arnold, I’ll turn the call back over to you.

Jason Arnold: Thanks everyone, for participating in our fourth quarter call.

We look forward to speaking with you again next quarter. Krista, thanks for your assistance. Please disconnect the line.

Operator: Ladies and gentlemen. this does conclude today’s conference call. Thank you for your participation. You may now disconnect.

v3.25.0.1

Cover Page Cover Page

|

Feb. 13, 2025 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 13, 2025

|

| Entity Registrant Name |

AIR LEASE CORPORATION

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35121

|

| Entity Tax Identification Number |

27-1840403

|

| Entity Address, Address Line One |

2000 Avenue of the Stars,

|

| Entity Address, Address Line Two |

Suite 1000N

|

| Entity Address, City or Town |

Los Angeles,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90067

|

| City Area Code |

310

|

| Local Phone Number |

553-0555

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001487712

|

| Amendment Flag |

false

|

| Class A Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock

|

| Trading Symbol |

AL

|

| Security Exchange Name |

NYSE

|

| Series A Medium-Term Notes |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.700% Medium-Term Notes, Series A, due April 15, 2030

|

| Trading Symbol |

AL30

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=al_SeriesAMediumTermNotesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

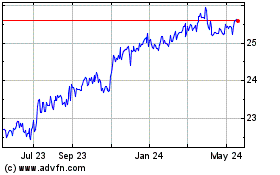

Air Lease (NYSE:AL-A)

Historical Stock Chart

From Jan 2025 to Feb 2025

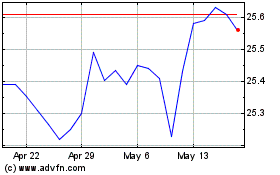

Air Lease (NYSE:AL-A)

Historical Stock Chart

From Feb 2024 to Feb 2025