Ambac Shareholders Approve Sale of Legacy Financial Guarantee Business

17 October 2024 - 7:05AM

Business Wire

Approximately 95% of Votes Cast Approved the

Transaction

Ambac Financial Group, Inc. (“Ambac”) (NYSE: AMBC), an insurance

holding company, announced that at the special meeting of

shareholders (the “Special Meeting”) held earlier today, its

shareholders voted to approve the proposed purchase agreement under

which funds managed by Oaktree Capital Management, L.P. will

acquire its legacy financial guarantee businesses, Ambac Assurance

Corporation and Ambac Assurance UK Limited (the “Sale”

proposal).

“We are pleased to reach this important milestone towards the

completion of the Sale and thank our shareholders for their

overwhelming support,” Ambac President and Chief Executive Officer

Claude LeBlanc said. “The Sale represents a meaningful step in a

robust and thorough process to maximize the value of our legacy

financial guarantee insurance business and enable us to achieve our

strategy to transform Ambac into a specialty property and casualty

insurance platform. We look forward to finalizing the transaction

upon regulatory approval.”

Based on the final vote count from today’s Special Meeting,

Ambac received the requisite approval from holders of a majority of

the total outstanding shares of its common stock as of the record

date, with approximately 95% of the votes cast approving the Sale

proposal. Ambac will file the final vote results, as certified by

the independent inspector of election, on a Form 8-K with the U.S.

Securities and Exchange Commission.

The transaction is expected to close in the fourth quarter of

2024 or first quarter of 2025, subject to receiving U.S. and U.K.

regulatory approval and other customary closing conditions.

Moelis & Company LLC served as exclusive financial advisor

and Debevoise & Plimpton LLP provided legal counsel to

Ambac.

About Ambac

Ambac Financial Group, Inc. (“Ambac”) is an insurance holding

company headquartered in New York City. Ambac’s core business is a

growing specialty P&C distribution and underwriting platform.

Ambac’s common stock trades on the New York Stock Exchange under

the symbol “AMBC”. Ambac is committed to providing timely and

accurate information to the investing public, consistent with our

legal and regulatory obligations. To that end, we use our website

to convey information about our businesses, including the

anticipated release of quarterly financial results, quarterly

financial, statistical, and business-related information. For more

information, please go to www.ambac.com.

The Amended and Restated Certificate of Incorporation of Ambac

contains substantial restrictions on the ability to transfer

Ambac’s common stock. Subject to limited exceptions, any attempted

transfer of common stock shall be prohibited and void to the extent

that, as a result of such transfer (or any series of transfers of

which such transfer is a part), any person or group of persons

shall become a holder of 5% or more of Ambac’s common stock or a

holder of 5% or more of Ambac’s common stock increases its

ownership interest.

Forward-Looking Statements

In this Press Release, we have included statements that may

constitute “forward-looking statements” within the meaning of the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. Words such as “estimate,” “project,” “plan,”

“believe,” “anticipate,” “intend,” “planned,” “potential” and

similar expressions, or future or conditional verbs such as “will,”

“should,” “would,” “could,” and “may,” or the negative of those

expressions or verbs, identify forward-looking statements. We

caution readers that these statements are not guarantees of future

performance. Forward-looking statements are not historical facts

but instead represent only our beliefs regarding future events,

which may by their nature be inherently uncertain and some of which

may be outside our control. These statements may relate to plans

and objectives with respect to the future, among other things which

may change. We are alerting you to the possibility that our actual

results may differ, possibly materially, from the expected

objectives or anticipated results that may be suggested, expressed

or implied by these forward-looking statements. Important factors

that could cause our results to differ, possibly materially, from

those indicated in the forward-looking statements include, among

others, those discussed under “Risk Factors” in our most recent SEC

filed quarterly or annual report.

Any or all of management’s forward-looking statements here or in

other publications may turn out to be incorrect and are based on

management’s current belief or opinions. Ambac’s and its

subsidiaries’ (collectively, “Company”) actual results may vary

materially, and there are no guarantees about the performance of

Ambac’s securities. Among events, risks, uncertainties or factors

that could cause actual results to differ materially are: (1) the

high degree of volatility in the price of Ambac’s common stock; (2)

uncertainty concerning the Company’s ability to achieve value for

holders of its securities, whether from Ambac Assurance Corporation

(“AAC”) and its subsidiaries or from the specialty property and

casualty insurance business, the insurance distribution business,

or related businesses; (3) inadequacy of reserves established for

losses and loss expenses and the possibility that changes in loss

reserves may result in further volatility of earnings or financial

results; (4) potential for rehabilitation proceedings or other

regulatory intervention or restrictions against AAC; (5) credit

risk throughout the Company’s business, including but not limited

to credit risk related to insured residential mortgage-backed

securities, student loan and other asset securitizations, public

finance obligations (including risks associated with Chapter 9 and

other restructuring proceedings), issuers of securities in our

investment portfolios, and exposures to reinsurers and insurance

distribution partners; (6) our inability to effectively reduce

insured financial guarantee exposures or achieve recoveries or

investment objectives; (7) the Company’s inability to generate the

significant amount of cash needed to service its debt and financial

obligations, and its inability to refinance its indebtedness; (8)

the Company’s substantial indebtedness could adversely affect the

Company’s financial condition and operating flexibility; (9) the

Company may not be able to obtain financing, refinance its

outstanding indebtedness, or raise capital on acceptable terms or

at all due to its substantial indebtedness and financial condition;

(10) greater than expected underwriting losses in the Company’s

specialty property and casualty insurance business; (11) failure of

specialty insurance program partners to properly market, underwrite

or administer policies; (12) inability to obtain reinsurance

coverage on expected terms; (13) loss of key relationships for

production of business in specialty property and casualty and

insurance distribution businesses or the inability to secure such

additional relationships to produce expected results; (14) the

impact of catastrophic public health, environmental or natural

events, or global or regional conflicts; (15) credit risks related

to large single risks, risk concentrations and correlated risks;

(16) risks associated with adverse selection as the Company’s

financial guarantee insurance portfolio runs off; (17) the risk

that the Company’s risk management policies and practices do not

anticipate certain risks and/or the magnitude of potential for

loss; (18) restrictive covenants in agreements and instruments that

impair the Company’s ability to pursue or achieve its business

strategies; (19) adverse effects on operating results or the

Company’s financial position resulting from measures taken to

reduce financial guarantee risks in its insured portfolio; (20)

disagreements or disputes with the Company's insurance regulators;

(21) loss of control rights in transactions for which we provide

financial guarantee insurance; (22) inability to realize expected

recoveries of financial guarantee losses; (23) risks attendant to

the change in composition of securities in the Company’s investment

portfolios; (24) failure of a financial institution in which we

maintain cash and investment accounts; (25) adverse impacts from

changes in prevailing interest rates; (26) events or circumstances

that result in the impairment of our intangible assets and/or

goodwill that was recorded in connection with the Company’s

acquisitions; (27) factors that may negatively influence the amount

of installment premiums paid to the Company; (28) the risk of

litigation, regulatory inquiries, investigations, claims or

proceedings, and the risk of adverse outcomes in connection

therewith; (29) the Company’s ability to adapt to the rapid pace of

regulatory change; (30) actions of stakeholders whose interests are

not aligned with broader interests of Ambac's stockholders; (31)

system security risks, data protection breaches and cyber attacks;

(32) regulatory oversight of Ambac Assurance UK Limited (“Ambac

UK”) and applicable regulatory restrictions may adversely affect

our ability to realize value from Ambac UK or the amount of value

we ultimately realize; (33) failures in services or products

provided by third parties; (34) political developments that disrupt

the economies where the Company has insured exposures; (35) our

inability to attract and retain qualified executives, senior

managers and other employees, or the loss of such personnel; (36)

fluctuations in foreign currency exchange rates; (37) failure to

realize our business expansion plans or failure of such plans to

create value; (38) greater competition for our specialty property

and casualty insurance business and/or our insurance distribution

business; (39) loss or lowering of the AM Best rating for our

property and casualty insurance company subsidiaries; (40)

disintermediation within the insurance industry or greater

competition from technology-based insurance solutions or

non-traditional insurance markets; (41) adverse effects of market

cycles in the property and casualty insurance industry; (42)

changes in law or in the functioning of the healthcare market that

impair the business model of our accident and health managing

general underwriter; (43) failure to consummate the proposed sale

of all of the common stock of AAC and the transactions contemplated

by the related stock purchase agreement (the “Sale Transactions”)

in a timely manner or at all; (44) potential litigation relating to

the proposed Sale Transactions; (45) disruptions from the proposed

Sale Transactions that may harm Ambac’s business, including current

plans and operations; (46) potential adverse reactions or changes

to business relationships resulting from the announcement or

completion of the proposed Sale Transactions; (47) difficulties in

integrating acquired businesses into our business or failures to

realize expected synergies from acquisitions; (48) failure to

realize expected benefits from investments in technology; (49)

harmful acts and omissions of our business counterparts; and (50)

other risks and uncertainties that have not been identified at this

time.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241016846309/en/

Investors: Charles J. Sebaski Managing Director, Investor

Relations (212) 208-3177 csebaski@ambac.com

Media: Kate Smith Director, Corporate Communications (212)

208-3452 ksmith@ambac.com

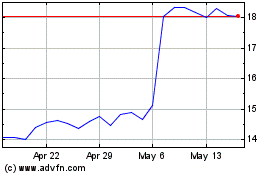

Ambac Financial (NYSE:AMBC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ambac Financial (NYSE:AMBC)

Historical Stock Chart

From Dec 2023 to Dec 2024