- Total revenue from continuing operations increased 89% for

the year to $236 million

- Total Specialty P&C Insurance premium increased 74% for

the year to $876 million

Ambac Financial Group, Inc. (NYSE: AMBC) ("Ambac" or "AFG"), an

insurance holding company, today reported its results for the

Fourth Quarter 2024.

Fourth Quarter 2024 and Full Year Highlights

- Strategic Business Transition:

- Ambac advanced its strategic transformation by entering the

final stages of the sale of its Legacy Financial Guarantee

business, a pivotal move positioning the company for long-term

growth.

- This resulted in a loss on disposal of $(570) million in the

quarter, resulting from our adoption of the discontinued operations

accounting standard for the legacy business, leading to a

consolidated net loss to Ambac common stockholders of $(548)

million or $(10.23) per diluted share. The loss resulting from the

accounting change is not the result of any change in the economics

of financial terms of the sale of our business to funds managed by

Oaktree Capital Partners for $420 million, as previously

reported.

- Consolidated net loss included a net loss from continuing

operations attributable to common shareholders of $(22) million or

$0.70 per share for the quarter; per share results includes an add

back for adjustments to non-controlling interests.

- Significant Specialty P&C Insurance Premium Growth:

- Total P&C premium production grew to $265 million in the

quarter, an 88% increase over the fourth quarter of 2023.

- Insurance Distribution ("Cirrata") Growth Acceleration:

- Total revenue grew to $44 million for the quarter, an increase

of 257% over last year, and to $99 million for the year, an

increase of 93% over 2023.

- Launch of 4 new MGAs since the acquisition of Beat Capital, in

addition to 2 new launches Beat started pre-acquisition

- Net loss from continuing operations to Ambac common

stockholders of $(6) million and $(7) million for the quarter and

year, respectively.

- Adjusted EBITDA to Ambac common stockholders of $5 million for

the quarter, up 270%, and $13 million for the year, up 43%. The

full year figure includes only 5 months of consolidated Beat

results.

- Specialty P&C Insurance ("Everspan") Enhanced

Profitability:

- Combined ratio improved by 380 bps over the fourth quarter of

2023 to 96.5%

- Net income from continuing operations of $2 million and $10

million for the quarter and year, compared to $1 million and $0.3

million in the prior year, respectively.

Claude LeBlanc, President and Chief Executive Officer, stated,

"Our P&C operating businesses had record performances in 2024,

generating nearly $900 million in premiums across the platform.

Cirrata earned nearly $20 million of Adjusted EBITDA, up from $11

million the prior year, and Everspan contributed another $5

million, an increase of 400% over last year. We continue to focus

on our growth strategy, which is anchored in both strategic

acquisitions and organic growth, driven primarily by the launch of

new MGAs. On the new MGA launch front, we more than doubled our

expectations last year with the launch of six new MGAs, four since

acquiring Beat. Looking at 2025 our pipeline for organic and

strategic growth remains very strong. Our commitment to technology,

efficiency, and talent keeps Ambac at the forefront in terms of

delivering innovation and market expansion and positions us well to

enhance value for our shareholders."

LeBlanc continued, “In addition to expanding our P&C

business, in early 2025 we substantially completed the separation

of our legacy and P&C businesses' financial and technology

platforms to ensure a smooth transition ahead of the close of the

Legacy sale. The close of the sale remains subject only to

Wisconsin regulatory approval, which we anticipate later this

quarter or early next quarter. I look forward to a very exciting

year for Ambac in 2025."

Ambac's Fourth Quarter 2024

and Year-to-Date Summary Results

Year ended December

31,

($ in thousands, except per share

data)1

4Q2024

4Q2023

2024

2023

Gross written premium

$

59,987

$

90,736

$

382,771

$

273,287

Net premiums earned

18,931

24,945

99,005

51,911

Commission income

38,009

12,192

92,023

51,281

Program fees

3,989

2,460

13,506

8,437

Net investment income

3,557

3,588

14,448

13,159

Net investment gains (losses), including

impairments

(4,455

)

1

(497

)

19

Net gains (losses) on derivative

contracts

(2,043

)

69

4,016

(279

)

Other revenue

7,234

67

13,314

200

Losses and loss adjustment expenses

9,826

16,805

72,626

36,712

Policy acquisition costs

7,850

5,851

23,666

10,557

Commission expense

13,667

7,392

40,876

29,465

General and administrative expenses

40,444

20,960

129,166

66,985

Intangible amortization

8,901

1,137

17,602

4,152

Interest expense

5,634

—

9,379

—

Pretax income (loss) from continuing

operations

(21,100

)

(8,825

)

(59,845

)

(24,221

)

Provision (benefit) for income taxes from

continuing operations

(157

)

274

(924

)

(989

)

Net income (loss) from continuing

operations

(20,943

)

(9,099

)

(58,921

)

(23,232

)

Net income (loss) from continuing

operations attributable to Ambac shareholders

(22,163

)

(9,208

)

(59,282

)

(24,551

)

Net income (loss) from discontinued

operations

(526,102

)

(6,480

)

(497,167

)

28,183

Net income (loss) attributable to Ambac

shareholders

(548,265

)

(15,688

)

(556,449

)

3,632

Net income (loss) attributable to common

stockholders per diluted share 3

$

(10.23

)

$

(0.24

)

$

(10.71

)

$

0.18

EBITDA 2

(5,850

)

(7,296

)

(30,518

)

(18,991

)

Adjusted EBITDA2

5,057

(3,507

)

8,643

(5,879

)

Adjusted EBITDA to Ambac common

stockholders2

516

(3,833

)

2,195

(7,981

)

Adjusted net income (loss) 2

(1,135

)

(4,171

)

(2,158

)

(5,968

)

Adjusted net income (loss) attributable to

Ambac stockholders

(5,676

)

(4,497

)

(8,606

)

(8,070

)

Adjusted net income (loss) per diluted

share 2

$

(0.12

)

$

(0.10

)

$

(0.18

)

$

(0.18

)

Weighted-average diluted shares

outstanding (in millions)

48,129

45,589

46,970

45,637

(1)

Some financial data in this press release

may not add up due to rounding

(2)

See Non-GAAP Financial Data section of

this press release for further information

(3)

Per diluted share includes the impact of

adjusting redeemable noncontrolling interests to current redemption

value

Earnings Call and Webcast

On February 27, 2025, at 8:30am ET, Claude LeBlanc, President

and Chief Executive Officer, and David Trick, Executive Vice

President and Chief Financial Officer, will discuss Ambac's fourth

quarter 2024 results during a conference call. A live audio webcast

of the call will be available through the Investor Relations

section of Ambac’s website,

https://ambac.com/investor-relations/events-and-presentations/.

Participants may also listen via telephone by dialing (877)

407-9716 (Domestic) or (201) 493-6779 (International).

The webcast will be archived on Ambac's website. A replay of the

call will be available through March 13, 2025, and can be accessed

by dialing (Domestic) (844) 512-2921 or (International) (412)

317-6671; and using ID#13751202

Additional information is included in an operating supplement

and presentations at Ambac's website at www.ambac.com.

Total Specialty P&C Insurance Production

Specialty P&C Insurance production, which includes gross

premiums written by Ambac's Specialty P&C Insurance segment and

premiums placed by the Insurance Distribution segment, totaled $265

million in the fourth quarter of 2024, an increase of 88% from the

fourth quarter of 2023.

Specialty P&C Insurance revenues are dependent on gross

premiums written, as specialty program insurance companies earn

premiums based on the portion of gross premiums written retained

(i.e. net premiums written) and fees on gross premiums written that

are ceded to reinsurers. Insurance Distribution revenues are

dependent on premium volume, as Managing General

Agents/Underwriters and brokers receive commissions based on the

amount of premiums placed (i.e. gross premiums written on behalf of

insurance carriers) with insurance carriers.

Three Months Ended December

31,

Year Ended December

31,

($ in thousands)

2024

2023

% Change

2024

2023

% Change

Specialty Property & Casualty

Insurance Gross Premiums Written

$

59,987

$

90,736

(34

)%

$

382,771

$

273,287

40

%

Insurance Distribution Premiums Placed

204,909

50,155

309

%

493,372

230,606

114

%

Specialty P&C Insurance Production

$

264,896

$

140,891

88

%

$

876,141

$

503,893

74

%

Results of Operations by Segment

Insurance Distribution Segment

Three Months Ended December

31,

Year Ended December

31,

($ in thousands)

2024

2023

% Change

2024

2023

% Change

Total revenues

$

44,070

$

12,331

257

%

$

99,236

$

51,546

93

%

Pretax income (loss)

$

(4,958

)

$

606

(77

)%

$

(7,809

)

$

7,289

(207

)%

Pretax income (loss) to Ambac common

stockholders

$

(6,178

)

$

496

(1346

)%

$

(8,172

)

$

5,971

(237

)%

EBITDA1

$

9,833

$

1,757

460

%

$

19,653

$

11,483

71

%

Pretax income margin2

(11.3

)%

5.0

%

-1630 bps

(7.9

)%

14.1

%

-2210 bps

EBITDA margin 3

22.3

%

14.2

%

810 bps

19.8

%

22.3

%

-250 bps

Adjusted EBITDA

$

9,829

$

1,757

459

%

$

19,901

$

11,483

73

%

Adjusted EBITDA to Ambac common

stockholders

$

5,288

$

1,431

270

%

$

13,453

$

9,381

43

%

Organic Growth

(3.2

)%

5.4

%

(1)

EBITDA is prior to the impact of income

attributable to noncontrolling interests, relating to subsidiaries

where Ambac does not own 100%, of $4,541 and $326 for the three

months ended December 31, 2024 and 2023, and $6,448 and $2,102 for

the years ended December 31, 2024 and 2023, respectively.

(2)

Represents Pretax income divided by total

revenues

(3)

See Non-GAAP Financial Data section of

this press release for further information

- Premiums placed and revenue grew during the fourth quarter of

2024 compared to the fourth quarter of 2023 driven primarily by the

inclusion of Beat Capital's results. Organic growth for the quarter

was negatively impacted primarily by A&H production, mostly due

to weak market conditions in Employer Stop Loss and short-term

medical lines.

- Adjusted EBITDA to Ambac common stockholders of $5.3 million

for the quarter was up from $1.4 million in the fourth quarter of

2023. Adjusted EBITDA margin of 22.3% for the quarter compared to

14.2% last year was driven primarily by the addition of Beat. The

impact of de-novo/start-up losses on Adjusted EBITDA to Ambac

common stockholders was approximately $2.4 million in the fourth

quarter.

Specialty Property & Casualty Insurance Segment

Three Months Ended December

31,

Year Ended December

31,

($ in thousands)

2024

2023

% Change

2024

2023

% Change

Gross premium written

$

59,987

$

90,736

(34

)%

$

382,771

$

273,287

40

%

Net premiums written

$

(2,608

)

$

36,749

(107

)%

$

88,682

$

79,824

11

%

Total revenue

$

24,818

$

28,607

(42

)%

$

126,320

$

64,101

97

%

Losses and loss expense

$

9,826

$

16,805

42

%

$

72,626

$

36,712

98

%

Net income (loss) from continuing

operations

$

1,836

$

1,092

68

%

$

10,469

$

335

3025

%

Adj. EBITDA to Ambac common

stockholders

$

2,698

$

1,384

95

%

$

5,136

$

1,017

405

%

Combined Ratio

96.5

%

100.3

%

-380 bps

101.6

%

106.5

%

490 bps

- Gross premium written ("GPW") and net premium written ("NPW")

both contracted during the fourth quarter of 2024 relative to the

fourth quarter of 2023 due to Everspan's cancellation of a personal

lines non-standard auto reinsurance program in the fourth quarter

of 2024.

- Combined ratio improved to 96.5% for the fourth quarter of 2024

compared to 100.3% in the fourth quarter of 2023 and 100.5% in the

third quarter of 2024.

- The loss and loss expense ratio for the fourth quarter of 2024

was 51.9% compared to 67.4% for the fourth quarter of 2023.

Favorable performance across a number of programs accounted for the

improvement, which more than offset additional development in

commercial auto. The loss ratio in the fourth quarter was impacted

by 8.6% of prior period development, with 3.3% stemming from a

management decision to reserve to the high end of the actuarial

range for run-off programs.

- The expense ratio(1) of 44.6% for the fourth quarter of 2024

was up from 32.9% in the prior year period as a sliding scale

commissions adjustment, linked to loss ratios on certain programs,

increased the expense ratio by 14.9% in the fourth quarter of 2024

compared to a (1.2)% reduction in the prior year period, due to

improved underwriting performance.

(1)

Expense Ratio is defined as acquisition

costs and general and administrative expenses, reduced by program

fees, divided by net premiums earned

Discontinued Operations

- This quarter, following the shareholder vote approving the sale

of the Legacy Financial Guarantee segment, the business was moved

to held for sale accounting and placed into discontinued

operations. The sale is anticipated to close by early second

quarter pending the final outstanding approval from the Wisconsin

OCI.

- Ambac recognized a $570 million expected loss on the sale of

the Legacy Financial Guarantee business, which was partially offset

by $44 million of net income from the Legacy Financial Guarantee

business primarily related to the impact of higher discount rates

on losses incurred.

- In preparation for the close, the company has undertaken a full

technology and operational separation, allowing the continuing

business to operate independently of the discontinued

business.

AFG Corporate (holding company only)

Corporate consists of our holding company and shared services

operations ("Corporate"). Corporate provides financial,

technological and human resources to Ambac's two segments and is

responsible for the functioning of AFG as a publicly traded

company.

Corporate loss of $(18) million and $(63) million for the fourth

quarter and full year 2024. Corporate expenses were $15 million and

$75 million for the fourth quarter and full year of 2024,

respectively, up from $13 million and $41 million for the

comparable periods in 2023. Corporate expenses include certain

expenses charged to AAC that must be reported within results from

continuing operations in accordance with US GAAP. The increase in

Corporate expenses from 2023 to 2024 mainly related to costs

associated with the Beat acquisition as well as costs (prior to the

October proxy vote) related to the sale of the Legacy Financial

Guarantee business.

AFG on a standalone basis, excluding its ownership interests in

its Specialty P&C Insurance, Insurance Distribution, and Legacy

Financial Guarantee subsidiaries, had net assets of $119 million as

of December 31, 2024. Assets included cash and liquid securities of

$74 million and other investments of $28 million.

Capital Activity

During the fourth quarter of 2024 962,141 shares were

repurchased at an average price of $12.48 per share. An additional

239,791 shares were repurchased during the first quarter of 2025 at

an average price of $11.71 per share. Combined these repurchases

totaled approximately $14.8 million, with approximately $35 million

remaining on the current repurchase authorization.

Consolidated Ambac Financial Group, Inc. Stockholders' Equity

and NCI Impact

Stockholders’ equity at December 31, 2024, was $857 million, or

$18.43 per share compared to $1.47 billion or $30.89 per share as

of September 30, 2024. The net loss attributable to common

shareholders of $548 million was somewhat offset by net unrealized

investment gains of $35 million and foreign exchange translation

gains of $73 million.

Calculation of Earnings Per Share

Diluted net income per share is computed by dividing net income

attributable to common stockholders, including the adjustment to

redemption value of the redeemable controlling interest, by the

basic weighted-average shares outstanding plus all potentially

dilutive common shares outstanding during the period. The following

table provides a reconciliation of net income attributable to

common stockholders to the numerator in the diluted earnings per

share calculation, together with the resulting earnings per share

amounts:

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Net income (loss) from continuing

operations attributable to Ambac shareholders

$

(22,163

)

$

(9,208

)

$

(59,282

)

$

(24,551

)

Adjustment for Redeemable NCI

55,762

4,855

53,210

4,792

Numerator of diluted EPS

$

33,599

$

(4,353

)

$

(6,072

)

$

(19,759

)

Per Share — Diluted

$

0.70

$

(0.10

)

$

(0.13

)

$

(0.43

)

Net income (loss) attributable to Ambac

shareholders

$

(548,265

)

$

(15,688

)

$

(556,449

)

$

3,632

Adjustment for Redeemable NCI

55,762

4,855

53,210

4,792

Numerator of diluted EPS

$

(492,503

)

$

(10,833

)

$

(503,239

)

$

8,424

Per Share — Diluted

$

(10.23

)

$

(0.24

)

$

(10.71

)

$

0.18

WASO-Diluted

48,129

45,589

46,970

45,637

Non-GAAP Financial Data

In addition to reporting the Company’s quarterly financial

results in accordance with GAAP, the Company is reporting non-GAAP

financial measures: EBITDA, Organic Revenue Growth Rate (Insurance

Distribution segment only), Adjusted Net Income and Adjusted Net

Income Margin, Adjusted EBITDA and Adjusted EBITDA Margin. These

amounts are derived from our consolidated financial information,

but are not presented in our consolidated financial results.

We present non-GAAP supplemental financial information because

we believe such information is of interest to the investment

community, and that it provides greater transparency and enhanced

visibility into the underlying drivers and performance of our

businesses on a basis that may not be otherwise apparent on a GAAP

basis. We view these non-GAAP financial measures as important

indicators when assessing and evaluating our performance on a

segmented and consolidated basis and they are presented to improve

the comparability of our results between periods by eliminating the

impact of the items that may not be representative of our core

operating performance. These non-GAAP financial measures are not

substitutes for the Company’s GAAP reporting, should not be viewed

in isolation and may differ from similar reporting provided by

other companies, which may define non-GAAP measures differently

The following paragraphs define each non-GAAP financial measure.

A tabular reconciliation of the non-GAAP financial measure and the

most comparable GAAP financial measure is also presented below.

EBITDA — EBITDA is net

income (loss) before interest expense, income taxes, depreciation

and amortization of intangible assets.

The following table reconciles net income (loss) to the non-GAAP

measure, EBITDA on a consolidation and segment basis.

($ in thousands)

Specialty Property &

Casualty Insurance

Insurance Distribution

Corporate & Other

Consolidated

Three Months

Ended December 31, 2024

Net income (loss) (1) from continuing

operations

$

1,836

$

(4,786

)

$

(17,995

)

$

(20,944

)

Adjustments:

Interest expense

—

5,639

—

5,639

Income taxes

730

(172

)

(714

)

(156

)

Depreciation

—

251

464

715

Amortization of intangible assets

—

8,901

—

8,901

EBITDA (2)

$

2,566

$

9,833

$

(18,245

)

$

(5,845

)

Three Months

Ended December 31, 2023

Net income (loss) (1) from continuing

operations

$

1,092

$

568

$

(10,758

)

$

(9,099

)

Adjustments:

Interest expense

—

—

—

—

Income taxes

48

38

189

275

Depreciation

—

12

376

388

Amortization of intangible assets

—

1,139

—

1,139

EBITDA (2)

$

1,140

$

1,757

$

(10,193

)

$

(7,297

)

(1)

Net income (loss) is prior to the impact

of noncontrolling interests.

(2)

EBITDA is prior to the impact of

noncontrolling interests, relating to subsidiaries where Ambac does

not own 100%, of $4,541 and $326 for the three months ended

December 31, 2024 and 2023, respectively. These noncontrolling

interests are in the Insurance Distribution segment.

($ in thousands)

Specialty Property &

Casualty Insurance

Insurance Distribution

Corporate & Other

Consolidated

Year Ended

December 31, 2024

Net income (loss) (1) from continuing

operations

$

10,469

$

(6,881

)

$

(62,509

)

$

(58,921

)

Adjustments:

Interest expense

—

9,379

—

9,379

Income taxes

1,753

(928

)

(1,748

)

(923

)

Depreciation

—

481

1,864

2,345

Amortization of intangible assets

—

17,602

—

17,602

EBITDA (2)

$

12,222

$

19,653

$

(62,393

)

$

(30,518

)

Year Ended

December 31, 2023

Net income (loss) (1) from continuing

operations

$

335

$

7,133

$

(30,701

)

$

(23,232

)

Adjustments:

Interest expense

—

—

—

—

Income taxes

48

156

(1,193

)

(989

)

Depreciation

—

42

1,036

1,078

Amortization of intangible assets

—

4,152

—

4,152

EBITDA (2)

$

383

$

11,483

$

(30,858

)

$

(18,991

)

(1)

Net income (loss) is prior to the impact

of noncontrolling interests.

(2)

EBITDA is prior to the impact of

noncontrolling interests, relating to subsidiaries where Ambac does

not own 100%, of $6,448 and $2,102 for the years ended December 31,

2024 and 2023, respectively. These noncontrolling interests are in

the Insurance Distribution segment.

Adjusted EBITDA and Adjusted EBITDA Margin — We define

Adjusted EBITDA as net income (loss) before interest, taxes,

depreciation, amortization, change in fair value of contingent

consideration and certain items of income and expense, including

share-based compensation expense, acquisition and integration

related expenses, severance, and other exceptional or non-recurring

items, including those related to raising capital. We believe that

adjusted EBITDA is an appropriate measure of operating performance

because it eliminates the impact of income and expenses that may

obfuscate business performance, and that the presentation of this

measure enhances an investor's understanding of our financial

performance.

EBITDA margin — EBITDA margin is

EBITDA divided by total revenues. We report EBITDA margin for the

Insurance Distribution segment only.

Three Months Ended December

31,

Year Ended December

31,

($ in thousands)

2024

2023

2024

2023

Net income (loss) (Continuing

Operations)

$

(20,943

)

$

(9,099

)

$

(58,921

)

$

(23,232

)

Adjustments:

Add: Interest expense

5,634

—

9,379

—

Add: Income tax expense

(157

)

274

(923

)

(989

)

Add: Depreciation

714

390

2,345

1,078

Add: Intangible amortization

8,902

1,139

17,602

4,152

EBITDA

(5,850

)

(7,296

)

(30,518

)

(18,991

)

Impact of noncontrolling interests

(4,541

)

(326

)

(6,448

)

(2,102

)

EBITDA to common shareholders

(10,391

)

(7,622

)

(36,966

)

(21,093

)

Net income margin

(32.1

)%

(21.0

)%

(25.0

)%

(18.6

)%

Net income margin to Ambac common

stockholders

(34.0

)%

(21.3

)%

(25.1

)%

(19.7

)%

EBITDA margin

(9.0

)%

(16.8

)%

(12.9

)%

(15.2

)%

EBITDA margin to Ambac common

stockholders

(15.9

)%

(17.6

)%

(15.7

)%

(16.9

)%

Add: Acquisition and integration related

expenses

1,561

110

27,388

567

Add: Equity-based compensation expense

2,821

3,748

9,355

12,266

Add: Severance and restructuring

expense

362

—

7,600

—

Add: Other non-operating (income)

losses

6,163

(69

)

(5,182

)

279

Adjusted EBITDA

$

5,057

$

(3,507

)

$

8,643

$

(5,879

)

Adjusted EBITDA attributable to Ambac

common stockholders

$

516

$

(3,833

)

$

2,195

$

(7,981

)

Adjusted EBITDA Margin

7.8

%

(8.1

)%

3.7

%

(4.7

)%

Adjusted EBITDA Margin to Ambac common

stockholders

0.8

%

(8.8

)%

0.9

%

(6.4

)%

Organic Revenue Growth & Rate (Insurance Distribution

Only.) — Organic revenue is based on commissions and fees for

the relevant period by excluding (i) the first twelve months of

commissions and fees generated from acquisitions and (ii)

commissions and fees from divestitures (iii) and other items such

as contingent commissions and the impact of changes in foreign

exchange rates.

Organic revenue growth is the change in organic revenue

period-to-period, with prior period results adjusted to (i) include

commissions and fees that were excluded from organic revenue in the

prior period and reached the twelve-month owned mark in the current

period, and (ii) exclude commissions and fees related to

divestitures from organic revenue.

Organic revenue growth rate to Total revenue growth rate, the

most directly comparable GAAP measure, for each of the periods

indicated is as follows (in percentages):

Three Months Ended December

31,

Year Ended December

31,

($ in thousands)

2024

2023

% Growth

2024

2023

% Growth

Total Insurance Distribution revenue

(1)

$

44,070

$

12,331

257

%

$

99,236

$

51,546

48

%

Less: Acquired revenues

(32,269

)

—

(45,202

)

—

Less: Profit commission and contingent

commission income

(963

)

(1,140

)

(4,273

)

(4,489

)

Total Organic Revenue & Growth

Percentage

10,838

11,191

(3.2

)%

49,761

47,057

5.4

%

(1)

Total Insurance Distribution revenue

includes investment income

Adjusted Net Income and Adjusted Net Income Margin — We

define Adjusted net income as net income (loss) attributable to

Ambac adjusted for depreciation, amortization, change in fair value

of contingent consideration and certain items of income and

expense, including share-based compensation expense, acquisition

and integration related expenses, severance and non-recurring

income and loss items that, in the opinion of management,

significantly affect the period-over-period assessment of operating

results, and the related tax effect of those adjustments. Per share

amounts exclude any impact of revaluing non-controlling interests

as otherwise reported under GAAP earnings per share. We believe

that adjusted net income is an appropriate measure of operating

performance because it eliminates the impact of income and expenses

that may obfuscate business performance.

Three Months Ended December

31,

Year Ended December

31,

($ in thousands)

2024

2023

2024

2023

Net income (loss) (Continuing

Operations)

$

(20,943

)

$

(9,099

)

$

(58,921

)

$

(23,232

)

Adjustments:

Add: Acquisition and integration related

expenses

1,561

110

27,388

567

Add: Intangible amortization

8,901

1,139

17,602

4,152

Add: Equity-based compensation expense

2,821

3,748

9,355

12,266

Add: Severance and restructuring

expense

362

—

7,600

—

Add: Other non-operating (income)

losses

6,163

(69

)

(5,182

)

279

Adjusted net income (loss) before tax and

NCI

(1,135

)

(4,171

)

(2,158

)

(5,968

)

Income tax effects

—

—

—

—

Adjusted net income (loss) before NCI

(1,135

)

(4,171

)

(2,158

)

(5,968

)

Net (income) loss attributable to

noncontrolling interest

(4,541

)

(326

)

(6,448

)

(2,102

)

Adjusted net income (loss) attributable

to Ambac stockholders

$

(5,676

)

$

(4,497

)

$

(8,606

)

$

(8,070

)

Earnings Per Share:

Diluted earnings per share from continuing

operations

$

0.70

$

(0.10

)

$

(0.13

)

$

(0.43

)

Less: adjustment to redemption value

(1.16

)

(0.11

)

(1.13

)

(0.11

)

Add: adjustments to net income (loss)

0.41

0.11

1.21

0.38

Less: adjustments attributable to

noncontrolling interest

(0.07

)

—

(0.13

)

(0.03

)

Adjusted net income (loss) per diluted

share

$

(0.12

)

$

(0.10

)

$

(0.18

)

$

(0.18

)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Net income (loss) margin

(32.1

)%

(21.0

)%

(25.0

)%

(18.6

)%

Adjusted Net income (loss) after NCI

margin

(8.7

)%

(10.4

)%

(3.6

)%

(6.5

)%

About Ambac

Ambac Financial Group, Inc. (“Ambac” or “AFG”) is an insurance

holding company headquartered in New York City. Ambac’s core

business is a growing specialty P&C distribution and

underwriting platform. Ambac also has a legacy financial guarantee

business in run-off which we have agreed to sell to funds managed

by Oaktree Capital Management pending regulatory approval. Ambac’s

common stock trades on the New York Stock Exchange under the symbol

“AMBC”. Ambac is committed to providing timely and accurate

information to the investing public, consistent with our legal and

regulatory obligations. To that end, we use our website to convey

information about our businesses, including the anticipated release

of quarterly financial results, quarterly financial, statistical

and business-related information. For more information, please go

to www.ambac.com.

The Amended and Restated Certificate of Incorporation of Ambac

contains substantial restrictions on the ability to transfer

Ambac’s common stock. Subject to limited exceptions, any attempted

transfer of common stock shall be prohibited and void to the extent

that, as a result of such transfer (or any series of transfers of

which such transfer is a part), any person or group of persons

shall become a holder of 5% or more of Ambac’s common stock or a

holder of 5% or more of Ambac’s common stock increases its

ownership interest.

Forward-Looking Statements

In this press release, statements that may constitute

“forward-looking statements” within the meaning of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Words such as “estimate,” “project,” “plan,” “believe,”

“anticipate,” “intend,” “planned,” “potential” and similar

expressions, or future or conditional verbs such as “will,”

“should,” “would,” “could,” and “may,” or the negative of those

expressions or verbs, identify forward-looking statements. We

caution readers that these statements are not guarantees of future

performance. Forward-looking statements are not historical facts,

but instead represent only our beliefs regarding future events,

which may by their nature be inherently uncertain and some of which

may be outside our control. These statements may relate to plans

and objectives with respect to the future, among other things which

may change. We are alerting you to the possibility that our actual

results may differ, possibly materially, from the expected

objectives or anticipated results that may be suggested, expressed

or implied by these forward-looking statements. Important factors

that could cause our results to differ, possibly materially, from

those indicated in the forward-looking statements include, among

others, those discussed under “Risk Factors” in our most recent SEC

filed quarterly or annual report.

Any or all of management’s forward-looking statements here or in

other publications may turn out to be incorrect and are based on

management’s current belief or opinions. Ambac Financial Group’s

(“AFG”) and its subsidiaries’ (collectively, “Ambac” or the

“Company”) actual results may vary materially, and there are no

guarantees about the performance of Ambac’s securities. Among

events, risks, uncertainties or factors that could cause actual

results to differ materially are: (1) the high degree of volatility

in the price of AFG’s common stock; (2) failure to consummate the

proposed sale of all of the common stock of Ambac Assurance

Corporation (“AAC”) and the transactions contemplated by the

related stock purchase agreement (the “Sale Transactions”) in a

timely manner or at all; (3) disruptions from the proposed Sale

Transactions, including from litigation, that may harm Ambac’s

business, including current plans and operations; (4) potential

adverse reactions or changes to business relationships resulting

from the announcement or completion of the proposed Sale

Transactions; (5) uncertainty concerning the Company’s ability to

achieve value for holders of its securities from the specialty

property and casualty insurance business, the insurance

distribution business, or related businesses; (6) inadequacy of

reserves established for losses and loss expenses and the

possibility that changes in loss reserves may result in further

volatility of earnings or financial results; (7) risks historically

reported by the Company with respect to the legacy financial

guarantee business, which may continue to affect the Company if the

Sale Transactions are not consummated; (8) credit risk throughout

Ambac’s business, including but not limited to exposures to

reinsurers and insurance distribution partners; (9) the Company’s

inability to generate the significant amount of cash needed to

service its debt and financial obligations, and its inability to

refinance its indebtedness; (10) the Company’s substantial

indebtedness could adversely affect the Company’s financial

condition and operating flexibility; (11) the Company may not be

able to obtain financing, refinance its outstanding indebtedness,

or raise capital on acceptable terms or at all due to its

substantial indebtedness and financial condition; (12) greater than

expected underwriting losses in the Company’s specialty property

and casualty insurance business; (13) failure of specialty

insurance program partners to properly market, underwrite or

administer policies; (14) inability to obtain reinsurance coverage

or charge rates for insurance on expected terms; (15) loss of key

relationships for production of business in specialty property and

casualty and insurance distribution businesses or the inability to

secure such additional relationships to produce expected results;

(16) the impact of catastrophic public health, environmental or

natural events, or global or regional conflicts; (17) the risk that

the Company’s risk management policies and practices do not

anticipate certain risks and/or the magnitude of potential for

loss; (18) restrictive covenants in agreements and instruments that

impair Ambac’s ability to pursue or achieve its business

strategies; (19) disagreements or disputes with the Company’s

insurance regulators; (20) failure of a financial institution in

which we maintain cash and investment accounts; (21) adverse

impacts from changes in prevailing interest rates; (22) events or

circumstances that result in the impairment of our intangible

assets and/or goodwill that was recorded in connection with Ambac’s

acquisitions; (23) the risk of litigation, regulatory inquiries,

investigations, claims or proceedings, and the risk of adverse

outcomes in connection therewith; (24) the Company’s ability to

adapt to the rapid pace of regulatory change; (25) actions of

stakeholders whose interests are not aligned with broader interests

of Ambac's stockholders; (26) system security risks, data

protection breaches and cyber attacks; (27) failures in services or

products provided by third parties; (28) political developments

that disrupt the economies where the Company has insured exposures

or the markets in which our insurance programs operate; (29) our

inability to attract and retain qualified executives, senior

managers and other employees, or the loss of such personnel; (30)

fluctuations in foreign currency exchange rates; (31) failure to

realize our business expansion plans, including failure to

effectively onboard new program partners, or failure of such plans

to create value; (32) greater competition for our specialty

property and casualty insurance business and/or our insurance

distribution business; (33) loss or lowering of the AM Best rating

for our property and casualty insurance company subsidiaries; (34)

disintermediation within the insurance industry or greater

competition from technology-based insurance solutions or

non-traditional insurance markets; (35) adverse effects of market

cycles in the property and casualty insurance industry; (36)

variations in commission income resulting from timing of policy

renewals and the net effect of new and lost business production;

(37) variations in contingent commissions resulting from the

effects insurance losses; (38) reliance on a limited number of

counterparties to produce revenue in our specialty property and

casualty insurance and insurance distribution businesses; (39)

changes in law or in the functioning of the healthcare market that

impair the business model of our accident and health managing

general underwriter; (40) difficulties in identifying appropriate

acquisition or investment targets, properly evaluating the business

and prospects of acquired businesses, businesses in which we

invest, or targets, integrating acquired businesses into our

business or failures to realize expected synergies from

acquisitions or new business investments; (41) failure to realize

expected benefits from investments in technology; (42) harmful acts

and omissions of our business counterparts; and (43) other risks

and uncertainties that have not been identified at this time.

The following table presents segment financial results and

includes the non-GAAP measure, EBITDA on a segment and consolidated

basis.

Three Months Ended December 31,

2024

Specialty Property &

Casualty Insurance

Insurance Distribution

Corporate & Other

Consolidated

($ in

thousands)

Gross premiums written

$

59,987

$

59,987

Net premiums written

(2,608

)

(2,608

)

Total revenues from Continuing

Operations

24,818

44,070

(3,666

)

65,222

Total expenses from Continuing

Operations

22,252

49,028

15,042

86,322

Pretax income (loss)

2,566

(4,958

)

(18,708

)

(21,100

)

Provision (benefit) for income taxes

730

(172

)

(715

)

(157

)

Net income (loss) from Continuing

Operations

$

1,836

$

(4,786

)

$

(17,993

)

$

(20,943

)

Adjustments to EBITDA

Add: Interest expense

$

—

$

5,634

$

—

$

5,634

Add: Income tax expense

730

(172

)

(715

)

(157

)

Add: Depreciation

—

251

463

714

Add: Intangible amortization

—

8,901

—

8,901

EBITDA from Continuing

Operations

$

2,566

$

9,829

$

(18,245

)

$

(5,850

)

EBITDA from Continuing Operations

attributable to

Ambac shareholders

$

2,566

$

5,288

$

(18,245

)

$

(10,391

)

Adjustments to Adjusted EBITDA

Add: Acquisition and integration related

expenses

$

—

$

—

$

1,561

$

1,561

Add: Equity-based compensation expense

132

—

2,689

2,821

Add: Severance and restructuring

expense

—

—

362

362

Add: Other non-operating (income)

losses

—

—

6,163

6,163

Adjusted EBITDA from Continuing

Operations

$

2,698

$

9,829

$

(7,470

)

$

5,057

Adjusted EBITDA from Continuing

Operations attributable to

Ambac shareholders

$

2,698

$

5,288

$

(7,470

)

$

516

Three Months Ended December 31,

2024

Specialty Property &

Casualty Insurance

Insurance Distribution

Corporate & Other

Consolidated

Net income (loss) (Continuing

Operations)

$

1,836

$

(4,786

)

$

(17,993

)

$

(20,943

)

Adjustments:

Add: Acquisition and integration related

expenses

—

—

1,561

1,561

Add: Intangible amortization

—

8,901

—

8,901

Add: Equity-based compensation expense

132

—

2,689

2,821

Add: Severance and restructuring

expense

—

—

362

362

Add: Other non-operating (income)

losses

—

—

6,163

6,163

Adjusted net income (loss) before tax and

NCI

1,968

4,115

(7,218

)

(1,135

)

Income tax effects

—

—

—

—

Adjusted net income (loss) before NCI

1,968

4,115

(7,218

)

(1,135

)

Net (income) loss attributable to

noncontrolling interest

—

(4,541

)

—

(4,541

)

Adjusted net income (loss) attributable

to Ambac stockholders

$

1,968

$

(426

)

$

(7,218

)

$

(5,676

)

Three Months Ended December 31,

2023

Specialty Property &

Casualty Insurance

Insurance Distribution

Corporate & Other

Consolidated

($ in

thousands)

Gross premiums written

$

90,736

$

90,736

Net premiums written

36,749

36,749

Total revenues from Continuing

Operations

28,607

12,331

2,385

43,323

Total expenses from Continuing

Operations

27,467

11,725

12,956

52,148

Pretax income (loss)

1,140

606

(10,571

)

(8,825

)

Provision (benefit) for income taxes

48

38

188

274

Net income (loss) from Continuing

Operations

$

1,092

$

568

$

(10,759

)

$

(9,099

)

Adjustments to EBITDA

Add: Interest expense

$

—

$

—

$

—

$

—

Add: Income tax expense

48

38

188

274

Add: Depreciation

—

12

378

390

Add: Intangible amortization

—

1,139

—

1,139

EBITDA from Continuing

Operations

$

1,140

$

1,757

$

(10,193

)

$

(7,296

)

EBITDA from Continuing Operations

attributable to

Ambac shareholders

$

1,140

$

1,431

$

(10,193

)

$

(7,622

)

Adjustments to Adjusted EBITDA

Add: Acquisition and integration related

expenses

$

—

$

—

$

110

$

110

Add: Equity-based compensation expense

244

—

3,504

3,748

Add: Severance and restructuring

expense

—

—

—

—

Add: Other non-operating (income)

losses

—

—

(69

)

(69

)

Adjusted EBITDA from Continuing

Operations

$

1,384

$

1,757

$

(6,648

)

$

(3,507

)

Adjusted EBITDA from Continuing

Operations attributable to

Ambac shareholders

$

1,384

$

1,431

$

(6,648

)

$

(3,833

)

Three Months Ended December 31,

2023

Specialty Property &

Casualty Insurance

Insurance Distribution

Corporate & Other

Consolidated

Net income (loss) (Continuing

Operations)

$

1,092

$

568

$

(10,759

)

$

(9,099

)

Adjustments:

Add: Acquisition and integration related

expenses

—

—

110

110

Add: Intangible amortization

—

1,139

—

1,139

Add: Equity-based compensation expense

244

—

3,504

3,748

Add: Other non-operating (income)

losses

—

—

(69

)

(69

)

Adjusted net income (loss) before tax and

NCI

1,336

1,707

(7,214

)

(4,171

)

Income tax effects

—

—

—

—

Adjusted net income (loss) before NCI

1,336

1,707

(7,214

)

(4,171

)

Net (income) loss attributable to

noncontrolling interest

—

(326

)

—

(326

)

Adjusted net income (loss) attributable

to Ambac stockholders

$

1,336

$

1,381

$

(7,214

)

$

(4,497

)

Results of Operations by Segment (Continued)

Year Ended December 31, 2024

Specialty Property &

Casualty Insurance

Insurance Distribution

Corporate & Other

Consolidated

($ in

thousands)

Gross premiums written

$

382,771

$

382,771

Net premiums written

88,682

88,682

Total revenues from Continuing

Operations

126,320

99,236

10,259

235,815

Total expenses from Continuing

Operations

114,098

107,045

74,516

295,660

Pretax income (loss)

12,222

(7,809

)

(64,257

)

(59,844

)

Provision (benefit) for income taxes

1,753

(928

)

(1,748

)

(923

)

Net income (loss) from Continuing

Operations

$

10,469

$

(6,881

)

$

(62,509

)

$

(58,921

)

Adjustments to EBITDA

Add: Interest expense

$

—

$

9,379

$

—

$

9,379

Add: Income tax expense

1,753

(928

)

(1,748

)

(923

)

Add: Depreciation

—

481

1,864

2,345

Add: Intangible amortization

—

17,602

—

17,602

EBITDA from Continuing

Operations

$

12,222

$

19,653

$

(62,393

)

$

(30,518

)

EBITDA from Continuing Operations

attributable to

Ambac shareholders

$

12,222

$

13,205

$

(62,393

)

$

(36,966

)

Adjustments to Adjusted EBITDA

Add: Acquisition and integration related

expenses

$

—

$

—

$

27,388

$

27,388

Add: Equity-based compensation expense

414

—

8,941

9,355

Add: Severance and restructuring

expense

—

248

7,352

7,600

Add: Other non-operating (income)

losses

(7,500

)

—

2,318

(5,182

)

Adjusted EBITDA from Continuing

Operations

$

5,136

$

19,901

$

(16,394

)

$

8,643

Adjusted EBITDA from Continuing

Operations attributable to

Ambac shareholders

$

5,136

$

13,453

$

(16,394

)

$

2,195

Year Ended December 31, 2024

Specialty Property &

Casualty Insurance

Insurance Distribution

Corporate & Other

Consolidated

Net income (loss) (Continuing

Operations)

$

10,469

$

(6,881

)

$

(62,509

)

$

(58,921

)

Adjustments:

Add: Acquisition and integration related

expenses

—

—

27,388

27,388

Add: Intangible amortization

—

17,602

—

17,602

Add: Equity-based compensation expense

414

—

8,941

9,355

Add: Severance and restructuring

expense

—

248

7,352

7,600

Add: Other non-operating (income)

losses

(7,500

)

—

2,318

(5,182

)

Adjusted net income (loss) before tax and

NCI

3,383

10,969

(16,510

)

(2,158

)

Income tax effects

—

—

—

—

Adjusted net income (loss) before NCI

3,383

10,969

(16,510

)

(2,158

)

Net (income) loss attributable to

noncontrolling interest

—

(6,448

)

—

(6,448

)

Adjusted net income (loss) attributable

to Ambac stockholders

$

3,383

$

4,521

$

(16,510

)

$

(8,606

)

Year Ended December 31, 2023

Specialty Property &

Casualty Insurance

Insurance Distribution

Corporate & Other

Consolidated

($ in

thousands)

Gross premiums written

$

273,287

$

273,287

Net premiums written

79,824

79,824

Total revenues from Continuing

Operations

64,101

51,546

9,080

124,728

Total expenses from Continuing

Operations

63,718

44,257

40,974

148,949

Pretax income (loss)

383

7,289

(31,894

)

(24,221

)

Provision (benefit) for income taxes

48

156

(1,193

)

(989

)

Net income (loss) from Continuing

Operations

$

335

$

7,133

$

(30,701

)

$

(23,232

)

Adjustments to EBITDA

Add: Interest expense

$

—

$

—

$

—

$

—

Add: Income tax expense

48

156

(1,193

)

(989

)

Add: Depreciation

—

42

1,036

1,078

Add: Intangible amortization

—

4,152

—

4,152

EBITDA from Continuing

Operations

$

383

$

11,483

$

(30,858

)

$

(18,991

)

EBITDA from Continuing Operations

attributable to

Ambac shareholders

$

383

$

9,381

$

(30,858

)

$

(21,094

)

Adjustments to Adjusted EBITDA

Add: Acquisition and integration related

expenses

$

—

$

—

$

567

$

567

Add: Equity-based compensation expense

634

—

11,632

12,266

Add: Severance and restructuring

expense

—

—

—

—

Add: Other non-operating (income)

losses

—

—

279

279

Adjusted EBITDA from Continuing

Operations

$

1,017

$

11,483

$

(18,380

)

$

(5,879

)

Adjusted EBITDA from Continuing

Operations attributable to

Ambac shareholders

$

1,017

$

9,381

$

(18,380

)

$

(7,981

)

Year Ended December 31, 2023

Specialty Property &

Casualty Insurance

Insurance Distribution

Corporate & Other

Consolidated

Net income (loss) (Continuing

Operations)

$

335

$

7,133

$

(30,701

)

$

(23,232

)

Adjustments:

Add: Acquisition and integration related

expenses

—

—

567

567

Add: Intangible amortization

—

4,152

—

4,152

Add: Equity-based compensation expense

634

—

11,632

12,266

Add: Other non-operating (income)

losses

—

—

279

279

Adjusted net income (loss) before tax and

NCI

969

11,285

(18,223

)

(5,968

)

Income tax effects

—

—

—

—

Adjusted net income (loss) before NCI

969

11,285

(18,223

)

(5,968

)

Net (income) loss attributable to

noncontrolling interest

—

(2,102

)

—

(2,102

)

Adjusted net income (loss) attributable

to Ambac stockholders

$

969

$

9,183

$

(18,223

)

$

(8,070

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226610667/en/

Charles J. Sebaski Managing Director, Investor Relations (212)

208-3222 csebaski@ambac.com

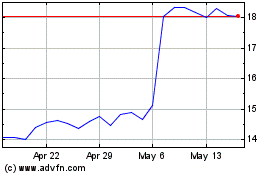

Ambac Financial (NYSE:AMBC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Ambac Financial (NYSE:AMBC)

Historical Stock Chart

From Mar 2024 to Mar 2025