Total Revenue Growth of 49% Led by 59%

Increase in Project Revenue

Total Project Backlog up 22% Y/Y to $4.5

billion; Contracted Backlog up 56% Y/Y

Record 209 MWe Energy Assets Placed into

Operation YTD Exceeding FY Guidance

New Contracts Drive $180 million Y/Y

Increase in O&M Backlog

Reaffirming 2024 Guidance

Third Quarter 2024 Financial Highlights:

- Revenues of $500.9 million

- Net income attributable to common shareholders of $17.6

million

- GAAP EPS of $0.33

- Non-GAAP EPS of $0.32

- Adjusted EBITDA of $62.2 million

Ameresco, Inc. (NYSE:AMRC), a leading cleantech integrator

specializing in energy efficiency and renewable energy, today

announced financial results for the fiscal quarter ended September

30, 2024. The Company also furnished supplemental information in

conjunction with this press release in a Current Report on Form

8-K. The supplemental information, which includes Non-GAAP

financial measures, has been posted to the “Investors” section of

the Company’s website at www.ameresco.com. Reconciliations of

Non-GAAP measures to the appropriate GAAP measures are included

herein. All financial result comparisons made are against the prior

year period unless otherwise noted.

CEO George Sakellaris commented, “Our team continued to deliver

excellent results with year-on-year quarterly revenue growth of 49%

and record Adjusted EBITDA of over $62 million, growing 44% in the

third quarter, reflecting strong demand for Ameresco’s unique blend

of services across our customer base. Each of our four business

lines achieved strong year-on-year growth, led by Projects, Energy

Assets and O&M, where revenues increased at substantial

double-digit rates. At the same time, we brought over 40MWe of

Energy Assets into operation, resulting in a year-to-date total of

209 MWe – a record number for Ameresco and already above our full

year guidance of 200MWe. New business activity remained robust with

our total Project Backlog growing to $4.5 billion at the end of the

quarter, an increase of 22% from last year. Importantly, our

continued focus on contract conversion helped drive a 56% increase

in contracted backlog to a record $1.9 billion. We also had a very

strong quarter with our recurring O&M business adding over $180

million in additional backlog versus last year."

Third Quarter Financial Results

(All financial result comparisons made are against the prior

year period unless otherwise noted.)

(in millions)

Q3 2024

Q3 2023

Revenue

Net Income (1)

Adj. EBITDA

Revenue

Net Income (1)

Adj. EBITDA

Projects

$385.4

$9.9

$20.6

$242.7

$13.5

$16.4

Energy Assets

$59.1

$2.7

$33.3

$44.3

$5.5

$21.6

O&M

$28.4

$3.8

$5.1

$22.8

$2.4

$3.9

Other

$27.9

$1.2

$3.1

$25.4

$0.0

$1.4

Total (2)

$500.9

$17.6

$62.2

$335.1

$21.3

$43.3

(1) Net Income represents net income

attributable to common shareholders.

(2) Numbers in table may not sum due to

rounding.

Total revenue increased 49.4% to $500.9 million with significant

growth across all four of our business lines. Projects revenue grew

58.8%, as our focus on execution and conversion of our backlog

continued to yield positive results. Energy Assets revenue grew an

impressive 33.4% driven by growth in operating assets placed in

service. O&M revenue increased 24.6% reflecting a solid

attachment rate to our growing projects business and strong

execution on our contracts. Other revenue increased 9.8%. Gross

margin of 15.4% reflects a larger contribution from lower-margin

projects, and additional costs associated with the SCE projects as

previously discussed during prior periods. SG&A decreased

slightly contributing to improved operating leverage.

Net income attributable to common shareholders was $17.6 million

compared to $21.3 million during the same period last year impacted

by higher interest-related and depreciation expenses. Those

interest costs included a $3.7 million non-cash negative adjustment

to mark certain interest rate derivatives to market compared to a

$3.0 million favorable adjustment last year. Additionally, the

results for the third quarter last year included a discrete tax

benefit of $7.2 million related to a prior year Section 179D tax

deduction. GAAP and Non-GAAP EPS of $0.33 and $0.32,

respectively.

Adjusted EBITDA of $62.2 million, representing our single

largest quarter, increased 43.6%.

Balance Sheet and Cash Flow Metrics

($ in millions)

September 30, 2024

Total Corporate Debt (1)

$272.5

Corporate Debt Leverage Ratio

(2)

2.8X

Total Energy Asset Debt (3)

$1,388.3

Energy Asset Book Value (4)

$1,882.6

Energy Debt Advance Rate (5)

74%

Q3 Cash Flows from Operating

Activities

$25.1

Plus: Q3

Proceeds from Federal ESPC Projects

$9.3

Equals: Q3 Adjusted Cash from

Operations

$34.4

8-quarter rolling average Cash

Flows from Operating Activities

($4.5)

Plus: 8-quarter rolling average

Proceeds from Federal ESPC Projects

$43.5

Equals: 8-quarter rolling average

Adjusted Cash from Operations

$39.0

(1) Subordinated Debt, term loans and

drawn amounts on the revolving line of credit

(2) Debt to EBITDA, as calculated under

our Sr. Secured Credit Facility

(3) Term loans, sale-leasebacks and

construction loan project financings for our Energy Assets in

operations and in-construction and development

(4) Book Value of our Energy Assets in

operations and in-construction and development

(5) Total Energy Asset Debt divided by

Energy Asset Book Value

The Company ended the quarter with $113.5 million in cash. Our

total corporate debt including our subordinated debt, term loans

and drawn amounts on our revolving line of credit was $272.5

million, with our corporate leverage ratio as calculated under our

Sr. Secured Credit Facility continued to decline to 2.8X, below our

3.5x covenant level. During the quarter we successfully executed

approximately $237.0 million in project financing commitments to

fund the continued growth of our Energy Asset business, of which we

received net proceeds of $57.0 million. Our Energy Asset Debt was

$1.4 billion with an Energy Debt Advance rate of 74% on the Energy

Asset Book Value. Our Adjusted Cash from Operations during the

quarter was $34.4 million. Our 8-quarter rolling average Adjusted

Cash from Operations was $39.0 million.

($ in millions)

At September 30, 2024

Awarded Project Backlog (1)

$2,656

Contracted Project Backlog

$1,853

Total Project Backlog

$4,509

12-month Contracted Backlog

(2)

$977

O&M Revenue Backlog

$1,421

12-month O&M Backlog

$91

Energy Asset Visibility (3)

$3,175

Operating Energy Assets

715 MWe

Ameresco's Net Assets in

Development (4)

589 MWe

(1) Customer contracts that have

not been signed yet

(2) We define our 12-month

backlog as the estimated amount of revenues that we expect to

recognize in the next twelve months from our fully-contracted

backlog

(3) Estimated contracted revenue

and incentives during PPA period plus estimated additional revenue

from operating RNG assets over a 20-year period, assuming RINs at

$1.50/gallon and brown gas at $3.50/MMBtu with $3.00/MMBtu for LCFS

on certain projects

(4) Net MWe capacity includes

only our share of any jointly owned assets

- Ameresco’s Assets in Development ended the quarter at 595 MWe.

After subtracting Ameresco’s partners’ minority interests,

Ameresco’s owned capacity of Assets in Development at quarter end

was 589 MWe.

- Ameresco brought 42 MWe of Energy Assets into operation,

including the 11.7 MWe Keller Canyon RNG plant and 27 MWe battery

storage at the remaining 3 United Power sites.

Subsequent Events

Today Ameresco announced the promotion of four key leaders at

Ameresco: Michael Bakas, Nicole Bulgarino, Peter Christakis, and

Louis Maltezos. Over the past few years, the Company has

experienced significant growth, necessitating a management

structure that is both visionary and resilient to drive continued

profitable growth.

- Michael Bakas has been appointed President - Renewable Fuels.

Michael will continue to focus on the expansion of our renewable

fuels asset class, which includes one of the most robust pipelines

of plants in the country.

- Nicole Bulgarino has been appointed President - Federal and

Utility Infrastructure. In this role, Nicole will continue to

oversee our expanding Federal business while also driving the

development of emerging utility infrastructure opportunities.

- Peter Christakis has been appointed President - East USA,

Greece & Project Risk. In this capacity, Peter will manage our

East region while also expanding our pipeline of solar projects.

Additionally, Peter will lead our centralized procurement and

corporate risk initiatives to provide significant corporate support

across the organization.

- Louis Maltezos has been appointed President – Central &

Western USA, Canada. Louis will continue unifying these regions and

concentrating on our core markets. He and his team will also work

on expanding our Smart Solutions portfolio by promoting new

building controls, efficiency initiatives, and advanced water

metering offerings across our customer base.

Summary and Outlook

“With our record project backlog, expanding portfolio of

operating Energy Assets and growing base of long-term O&M

contracts, Ameresco is very well positioned for future growth. As

we look ahead to 2025, we believe the need for our smart solutions

that provide energy resiliency, cost savings and infrastructure

upgrades will continue to be in very high demand. We have all the

elements in place to achieve another year of impressive growth in

revenue and faster growth in profitability while continuing to

capture growing business opportunities,” Mr. Sakellaris

concluded.

Ameresco is reaffirming its full year 2024 guidance which is

included in the table below. Our guidance range reflects revenue

and Adjusted EBITDA growth of 27% and 35%, respectively, at the

midpoints. While we expect higher Interest Expense and Other in the

range of $70 million to $75 million, we are also maintaining our

Non-GAAP EPS guidance, largely driven by our estimated annual tax

benefit rate.

FY 2024 Guidance

Ranges

Revenue

$1.70 billion

$1.80 billion

Gross Margin

16.0%

16.5%

Adjusted EBITDA

$210 million

$230 million

Interest Expense & Other

$70 million

$75 million

Non-GAAP EPS

$1.15

$1.35

The Company’s Adjusted EBITDA and Non-GAAP EPS guidance excludes

the impact of redeemable non-controlling interest activity,

one-time charges, asset impairment charges, changes in contingent

consideration, restructuring activities, as well as any related tax

impact.

Conference Call/Webcast Information

The Company will host a conference call today at 4:30 p.m. ET to

discuss third quarter 2024 financial results, business and

financial outlook, and other business highlights. To participate on

the day of the call, dial 1-888-596-4144, or internationally

1-646-968-2525, and enter the conference ID: 9604248, approximately

10 minutes before the call. A live, listen-only webcast of the

conference call will also be available over the Internet.

Individuals wishing to listen can access the call through the

“Investors” section of the Company’s website at www.ameresco.com.

If you are unable to listen to the live call, an archived webcast

will be available on the Company’s website for one year.

Use of Non-GAAP Financial Measures

This press release and the accompanying tables include

references to adjusted EBITDA, Non- GAAP EPS, Non-GAAP net income

and adjusted cash from operations, which are Non-GAAP financial

measures. For a description of these Non-GAAP financial measures,

including the reasons management uses these measures, please see

the section following the accompanying tables titled “Exhibit A:

Non-GAAP Financial Measures”. For a reconciliation of these

Non-GAAP financial measures to the most directly comparable

financial measures prepared in accordance with GAAP, please see

Non-GAAP Financial Measures and Non-GAAP Financial Guidance in the

accompanying tables.

About Ameresco, Inc.

Founded in 2000, Ameresco, Inc. (NYSE:AMRC) is a leading

cleantech integrator and renewable energy asset developer, owner

and operator. Our comprehensive portfolio includes solutions that

help customers reduce costs, decarbonize to net zero, and build

energy resiliency while leveraging smart, connected technologies.

From implementing energy efficiency and infrastructure upgrades to

developing, constructing, and operating distributed energy

resources – we are a trusted sustainability partner. Ameresco has

successfully completed energy saving, environmentally responsible

projects with Federal, state and local governments, utilities,

healthcare and educational institutions, housing authorities, and

commercial and industrial customers. With its corporate

headquarters in Framingham, MA, Ameresco has more than 1,500

employees providing local expertise in North America and Europe.

For more information, visit www.ameresco.com.

Safe Harbor Statement

Any statements in this press release about future expectations,

plans and prospects for Ameresco, Inc., including statements about

market conditions, pipeline, visibility, backlog, pending

agreements, financial guidance including estimated future revenues,

net income, adjusted EBITDA, Non-GAAP EPS, gross margin, effective

tax rate, and capital investments, as well as statements about our

financing plans, the impact the IRA, the impact of changes in the

U.S. administration, supply chain disruptions, shortage and cost of

materials and labor, and other macroeconomic and geopolitical

challenges; our expectations related to our agreement with SCE

including the impact of delays and any requirement to pay

liquidated damages, and other statements containing the words

“projects,” “believes,” “anticipates,” “plans,” “expects,” “will”

and similar expressions, constitute forward-looking statements

within the meaning of The Private Securities Litigation Reform Act

of 1995. Actual results may differ materially from those indicated

by such forward looking statements as a result of various important

factors, including: demand for our energy efficiency and renewable

energy solutions; the timing of, and ability to, enter into

contracts for awarded projects on the terms proposed or at all; the

timing of work we do on projects where we recognize revenue on a

percentage of completion basis; the ability to perform under signed

contracts without delay and in accordance with their terms and

related liquidated and other damages we may be subject to; the

fiscal health of the government and the risk of government

shutdowns; our ability to complete and operate our projects on a

profitable basis and as committed to our customers; our cash flows

from operations and our ability to arrange financing to fund our

operations and projects; our customers’ ability to finance their

projects and credit risk from our customers; our ability to comply

with covenants in our existing debt agreements including the

requirement to raise additional subordinated debt; the impact of

macroeconomic challenges, weather related events and climate change

on our business; our reliance on third parties for our construction

and installation work; availability and cost of labor and equipment

particularly given global supply chain challenges, tariffs and

global trade conflicts; global supply chain challenges, component

shortages and inflationary pressures; changes in federal, state and

local government policies and programs related to energy efficiency

and renewable energy; the ability of customers to cancel or defer

contracts included in our backlog; the output and performance of

our energy plants and energy projects; cybersecurity incidents and

breaches; regulatory and other risks inherent to constructing and

operating energy assets; the effects of our acquisitions and joint

ventures; seasonality in construction and in demand for our

products and services; a customer’s decision to delay our work on,

or other risks involved with, a particular project; the addition of

new customers or the loss of existing customers; market price of

our Class A Common stock prevailing from time to time; the nature

of other investment opportunities presented to our Company from

time to time; risks related to our international operation and

international growth strategy; and other factors discussed in our

most recent Annual Report on Form 10-K and our quarterly reports on

Form 10-Q. The forward-looking statements included in this press

release represent our views as of the date of this press release.

We anticipate that subsequent events and developments will cause

our views to change. However, while we may elect to update these

forward-looking statements at some point in the future, we

specifically disclaim any obligation to do so. These

forward-looking statements should not be relied upon as

representing our views as of any date subsequent to the date of

this press release.

AMERESCO, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

amounts)

September 30,

December 31,

2024

2023

(unaudited)

ASSETS Current assets: Cash and cash equivalents

$

113,502

$

79,271

Restricted cash

71,868

62,311

Accounts receivable, net

230,298

153,362

Accounts receivable retainage, net

43,466

33,826

Costs and estimated earnings in excess of billings

572,804

636,163

Inventory, net

11,973

13,637

Prepaid expenses and other current assets

155,353

123,391

Income tax receivable

4,468

5,775

Project development costs, net

20,819

20,735

Total current assets

1,224,551

1,128,471

Federal ESPC receivable

565,964

609,265

Property and equipment, net

16,777

17,395

Energy assets, net

1,882,588

1,689,424

Deferred income tax assets, net

36,607

26,411

Goodwill, net

75,922

75,587

Intangible assets, net

5,387

6,808

Operating lease assets

77,609

58,586

Restricted cash, non-current portion

19,021

12,094

Other assets

77,812

89,735

Total assets

$

3,982,238

$

3,713,776

LIABILITIES, REDEEMABLE NON-CONTROLLING INTERESTS AND

STOCKHOLDERS' EQUITY Current liabilities: Current portions of

long-term debt and financing lease liabilities, net

$

343,247

$

322,247

Accounts payable

399,244

402,752

Accrued expenses and other current liabilities

101,259

108,831

Current portions of operating lease liabilities

12,242

13,569

Billings in excess of cost and estimated earnings

108,020

52,903

Income taxes payable

655

1,169

Total current liabilities

964,667

901,471

Long-term debt and financing lease liabilities, net of current

portion, unamortized discount and debt issuance costs

1,317,517

1,170,075

Federal ESPC liabilities

520,497

533,054

Deferred income tax liabilities, net

2,601

4,479

Deferred grant income

6,806

6,974

Long-term operating lease liabilities, net of current portion

58,007

42,258

Other liabilities

102,645

82,714

Redeemable non-controlling interests, net

42,761

46,865

Stockholders' equity: Preferred stock, $0.0001 par value, 5,000,000

shares authorized, no shares issued and outstanding at September

30, 2024 and December 31, 2023

-

-

Class A common stock, $0.0001 par value, 500,000,000 shares

authorized, 36,544,586 shares issued and 34,442,751 shares

outstanding at September 30, 2024, 36,378,990 shares issued and

34,277,195 shares outstanding at December 31, 2023

3

3

Class B common stock, $0.0001 par value, 144,000,000 shares

authorized, 18,000,000 shares issued and outstanding at September

30, 2024 and December 31, 2023

2

2

Additional paid-in capital

336,425

320,892

Retained earnings

615,503

595,911

Accumulated other comprehensive loss, net

(2,803)

(3,045)

Treasury stock, at cost, 2,101,835 shares at September 30, 2024 and

2,101,795 shares at December 31, 2023

(11,788)

(11,788)

Stockholders' equity before non-controlling interest

937,342

901,975

Non-controlling interests

29,395

23,911

Total stockholders’ equity

966,737

925,886

Total liabilities, redeemable non-controlling interests and

stockholders' equity

$

3,982,238

$

3,713,776

AMERESCO, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(In thousands, except per

share amounts) (Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenues

$

500,873

$

335,149

$

1,237,261

$

933,265

Cost of revenues

423,734

271,493

1,047,960

761,012

Gross profit

77,139

63,656

189,301

172,253

Earnings from unconsolidated entities

159

526

724

1,356

Selling, general and administrative expenses

42,139

42,752

125,920

125,466

Operating income

35,159

21,430

64,105

48,143

Other expenses, net

21,469

10,642

51,399

27,883

Income before income taxes

13,690

10,788

12,706

20,260

Income tax benefit

(3,324)

(10,054)

(3,324)

(10,552)

Net income

17,014

20,842

16,030

30,812

Net loss (income) attributable to non-controlling interests and

redeemable non-controlling interests

585

423

3,642

(2,077)

Net income attributable to common shareholders

$

17,599

$

21,265

$

19,672

$

28,735

Net income per share attributable to common shareholders: Basic

$

0.34

$

0.41

$

0.37

$

0.55

Diluted

$

0.33

$

0.40

$

0.37

$

0.54

Weighted average common shares outstanding: Basic

52,413

52,209

52,352

52,104

Diluted

53,243

53,300

53,098

53,259

AMERESCO, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (in thousands) (Unaudited)

Nine Months Ended September

30,

2024

2023

Cash flows from operating activities: Net income

$

16,030

$

30,812

Adjustments to reconcile net income to net cash flows from

operating activities: Depreciation of energy assets, net

57,352

42,847

Depreciation of property and equipment

3,699

2,849

Increase in contingent consideration

87

705

Accretion of ARO liabilities

243

194

Amortization of debt discount and debt issuance costs

3,764

3,407

Amortization of intangible assets

1,615

1,681

Provision for bad debts

1,292

637

Loss on disposal of assets

515

18

Non-cash project revenue related to in-kind leases

(2,971)

-

Earnings from unconsolidated entities

(724)

(1,356)

Net gain from derivatives

(267)

(3,306)

Stock-based compensation expense

10,368

12,318

Deferred income taxes, net

(3,914)

(13,089)

Unrealized foreign exchange (gain) loss

(898)

1,148

Changes in operating assets and liabilities: Accounts receivable

(64,045)

58,135

Accounts receivable retainage

(9,753)

4,589

Federal ESPC receivable

(110,841)

(143,647)

Inventory, net

1,664

570

Costs and estimated earnings in excess of billings

126,694

5,260

Prepaid expenses and other current assets

15,112

(10,925)

Income taxes receivable, net

798

590

Project development costs

(4,456)

(4,638)

Other assets

(4,664)

(2,080)

Accounts payable, accrued expenses and other current liabilities

13,511

(38,444)

Billings in excess of cost and estimated earnings

42,215

10,104

Other liabilities

6,796

1,200

Cash flows from operating activities

99,222

(40,421)

Cash flows from investing activities: Purchases of property and

equipment

(3,053)

(4,597)

Capital investments in energy assets

(341,794)

(445,540)

Capital investments in major maintenance of energy assets

(13,597)

(8,024)

Net proceeds from equity method investments

13,091

-

Asset acquisition, net of cash acquired

-

6,206

Contributions to equity method investments

(10,442)

(3,489)

Grant award received on energy asset

403

-

Acquisitions, net of cash received

-

(9,183)

Loans to joint venture investments

-

(566)

Cash flows from investing activities

(355,392)

(465,193)

Cash flows from financing activities: Payments of debt discount and

debt issuance costs

(10,114)

(8,635)

Proceeds from exercises of options and ESPP

1,899

3,384

Payments on senior secured revolving credit facility, net

(33,400)

(115,000)

Proceeds from long-term debt financings

663,598

728,600

Proceeds from Federal ESPC projects

129,399

107,303

Net proceeds from energy asset receivable financing arrangements

5,216

12,514

Contributions from non-controlling interests

33,789

499

Distributions to non-controlling interest

(1,367)

(20,521)

Distributions to redeemable non-controlling interests, net

(418)

(494)

Payment on seller's promissory note

(41,941)

(12,500)

Payments on debt and financing leases

(441,603)

(162,749)

Cash flows from financing activities

305,058

532,401

Effect of exchange rate changes on cash

1,827

(980)

Net increase in cash, cash equivalents, and restricted cash

50,715

25,807

Cash, cash equivalents, and restricted cash, beginning of period

153,676

149,888

Cash, cash equivalents, and restricted cash, end of period

$

204,391

$

175,695

Non-GAAP Financial Measures

(Unaudited, in thousands)

Three Months Ended September

30, 2024

Adjusted EBITDA:

Projects

Energy

Assets

O&M

Other

Consolidated

Net income attributable to common

shareholders

$

9,865

$

2,686

$

3,801

$

1,247

$

17,599

Impact from redeemable non-controlling

interests

—

(911

)

—

—

(911

)

Plus (less): Income tax provision

(benefit)

2,859

(7,383

)

596

604

(3,324

)

Plus: Other expenses, net

3,993

16,983

163

330

21,469

Plus: Depreciation and amortization

864

21,516

320

753

23,453

Plus: Stock-based compensation

2,842

426

201

195

3,664

Plus: Contingent consideration,

restructuring and other charges

218

17

5

4

244

Adjusted EBITDA

$

20,641

$

33,334

$

5,086

$

3,133

$

62,194

Adjusted EBITDA margin

5.4

%

56.4

%

17.9

%

11.2

%

12.4

%

Three Months Ended September

30, 2023

Adjusted EBITDA:

Projects

Energy

Assets

O&M

Other

Consolidated

Net income (loss) attributable to common

shareholders

$

13,465

$

5,454

$

2,393

$

(47

)

$

21,265

Impact from redeemable non-controlling

interests

—

(587

)

—

—

(587

)

(Less) plus: Income tax (benefit)

provision

(6,953

)

(3,766

)

717

(52

)

(10,054

)

Plus: Other expenses, net

5,042

4,970

227

403

10,642

Plus: Depreciation and amortization

1,134

14,902

311

707

17,054

Plus: Stock-based compensation

3,128

570

293

328

4,319

Plus: Contingent consideration,

restructuring and other charges

595

14

4

52

665

Adjusted EBITDA

$

16,411

$

21,557

$

3,945

$

1,391

$

43,304

Adjusted EBITDA margin

6.8

%

48.7

%

17.3

%

5.5

%

12.9

%

Nine Months Ended September

30, 2024

Adjusted EBITDA:

Projects

Energy

Assets

O&M

Other

Consolidated

Net income attributable to common

shareholders

$

1,415

$

5,082

$

10,601

$

2,574

$

19,672

Impact from redeemable non-controlling

interests

—

(3,766

)

—

—

(3,766

)

Plus (less): Income tax provision

(benefit)

2,859

(7,383

)

596

604

(3,324

)

Plus: Other expenses, net

15,032

33,819

1,003

1,545

51,399

Plus: Depreciation and amortization

2,897

56,605

956

2,208

62,666

Plus: Stock-based compensation

7,713

1,305

670

680

10,368

Plus: Contingent consideration,

restructuring and other charges

930

100

15

96

1,141

Adjusted EBITDA

$

30,846

$

85,762

$

13,841

$

7,707

$

138,156

Adjusted EBITDA margin

3.4

%

55.1

%

17.3

%

9.5

%

11.2

%

Nine Months Ended September

30, 2023

Adjusted EBITDA:

Projects

Energy

Assets

O&M

Other

Consolidated

Net income attributable to common

shareholders

$

12,114

$

11,659

$

3,820

$

1,142

$

28,735

Impact from redeemable non-controlling

interests

—

869

—

—

869

(Less) plus: Income tax (benefit)

provision

(8,405

)

(3,920

)

1,336

437

(10,552

)

Plus: Other expenses, net

10,127

16,150

559

1,047

27,883

Plus: Depreciation and amortization

2,901

42,150

923

1,403

47,377

Plus: Stock-based compensation

8,629

1,783

904

1,002

12,318

Plus: Contingent consideration,

restructuring and other charges

1,147

48

15

211

1,421

Adjusted EBITDA

$

26,513

$

68,739

$

7,557

$

5,242

$

108,051

Adjusted EBITDA margin

4.0

%

50.9

%

11.1

%

7.0

%

11.6

%

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Non-GAAP net income and EPS:

Net income attributable to common

shareholders

$

17,599

$

21,265

$

19,672

$

28,735

Adjustment for accretion of tax equity

financing fees

(26

)

(26

)

(80

)

(81

)

Impact from redeemable non-controlling

interests

(911

)

(587

)

(3,766

)

869

Plus: Contingent consideration,

restructuring and other charges

244

665

1,141

1,421

Less: Income tax effect of Non-GAAP

adjustments

(63

)

(173

)

(296

)

(369

)

Non-GAAP net income

16,843

21,144

16,671

30,575

Diluted net income per common share

$

0.33

$

0.40

$

0.37

$

0.54

Effect of adjustments to net (loss)

income

(0.01

)

—

(0.05

)

0.03

Non-GAAP EPS

$

0.32

$

0.40

$

0.32

$

0.57

Adjusted cash from operations:

Cash flows from operating activities

$

25,091

$

(6,572

)

$

99,222

$

(40,421

)

Plus: proceeds from Federal ESPC

projects

9,271

30,604

129,399

107,303

Adjusted cash from operations

$

34,362

$

24,032

$

228,621

$

66,882

Other Financial Measures

(Unaudited, in thousands

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

New contracts and awards:

New contracts

$

585,824

$

341,140

$

1,433,940

$

799,380

New awards (1)

$

479,425

$

708,470

$

1,534,824

$

1,673,625

(1) Represents estimated future

revenues from projects that have been awarded, though the contracts

have not yet been signed

Non-GAAP Financial

Guidance

Adjusted earnings before

interest, taxes, depreciation and amortization (adjusted

EBITDA):

Year Ended December 31,

2024

Low

High

Operating income (1)

$112 million

$130 million

Depreciation and amortization

$85 million

$86 million

Stock-based compensation

$14 million

$15 million

Restructuring and other charges

$(1) million

$(1) million

Adjusted EBITDA

$210 million

$230 million

(1) Although net income is the

most directly comparable GAAP measure, this table reconciles

adjusted EBITDA to operating income because we are not able to

calculate forward-looking net income without unreasonable efforts

due to significant uncertainties with respect to the impact of

accounting for our redeemable non-controlling interests and

taxes.

Exhibit A: Non-GAAP Financial

Measures

We use the Non-GAAP financial measures defined and discussed

below to provide investors and others with useful supplemental

information to our financial results prepared in accordance with

GAAP. These Non-GAAP financial measures should not be considered as

an alternative to any measure of financial performance calculated

and presented in accordance with GAAP. For a reconciliation of

these Non-GAAP measures to the most directly comparable financial

measures prepared in accordance with GAAP, please see Non-GAAP

Financial Measures and Non-GAAP Financial Guidance in the tables

above.

We understand that, although measures similar to these Non-GAAP

financial measures are frequently used by investors and securities

analysts in their evaluation of companies, they have limitations as

analytical tools, and investors should not consider them in

isolation or as a substitute for the most directly comparable GAAP

financial measures or an analysis of our results of operations as

reported under GAAP. To properly and prudently evaluate our

business, we encourage investors to review our GAAP financial

statements included above, and not to rely on any single financial

measure to evaluate our business.

Adjusted EBITDA and Adjusted EBITDA Margin

We define adjusted EBITDA as net income attributable to common

shareholders, including impact from redeemable non-controlling

interests, before income tax (benefit) provision, other expenses

net, depreciation, amortization of intangible assets, accretion of

asset retirement obligations, contingent consideration expense,

stock-based compensation expense, energy asset impairment,

restructuring and other charges, gain or loss on sale of equity

investment, and gain or loss upon deconsolidation of a variable

interest entity. We believe adjusted EBITDA is useful to investors

in evaluating our operating performance for the following reasons:

adjusted EBITDA and similar Non-GAAP measures are widely used by

investors to measure a company's operating performance without

regard to items that can vary substantially from company to company

depending upon financing and accounting methods, book values of

assets, capital structures and the methods by which assets were

acquired; securities analysts often use adjusted EBITDA and similar

Non-GAAP measures as supplemental measures to evaluate the overall

operating performance of companies; and by comparing our adjusted

EBITDA in different historical periods, investors can evaluate our

operating results without the additional variations of depreciation

and amortization expense, accretion of asset retirement

obligations, contingent consideration expense, stock-based

compensation expense, impact from redeemable non-controlling

interests, restructuring and asset impairment charges. We define

adjusted EBITDA margin as adjusted EBITDA stated as a percentage of

revenue.

Our management uses adjusted EBITDA and adjusted EBITDA margin

as measures of operating performance, because they do not include

the impact of items that we do not consider indicative of our core

operating performance; for planning purposes, including the

preparation of our annual operating budget; to allocate resources

to enhance the financial performance of the business; to evaluate

the effectiveness of our business strategies; and in communications

with the board of directors and investors concerning our financial

performance.

Non-GAAP Net Income and EPS

We define Non-GAAP net income and earnings per share (EPS) to

exclude certain discrete items that management does not consider

representative of our ongoing operations, including energy asset

impairment, restructuring and other charges, impact from redeemable

non-controlling interest, gain or loss on sale of equity

investment, and gain or loss upon deconsolidation of a variable

interest entity. We consider Non-GAAP net income and Non-GAAP EPS

to be important indicators of our operational strength and

performance of our business because they eliminate the effects of

events that are not part of the Company's core operations.

Adjusted Cash from Operations

We define adjusted cash from operations as cash flows from

operating activities plus proceeds from Federal ESPC projects. Cash

received in payment of Federal ESPC projects is treated as a

financing cash flow under GAAP due to the unusual financing

structure for these projects. These cash flows, however, correspond

to the revenue generated by these projects. Thus, we believe that

adjusting operating cash flow to include the cash generated by our

Federal ESPC projects provides investors with a useful measure for

evaluating the cash generating ability of our core operating

business. Our management uses adjusted cash from operations as a

measure of liquidity because it captures all sources of cash

associated with our revenue generated by operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107150749/en/

Media Relations Leila Dillon, 508.661.2264,

news@ameresco.com

Investor Relations Eric Prouty, AdvisIRy Partners, 212.750.5800,

eric.prouty@advisiry.com Lynn Morgen, AdvisIRy Partners,

212.750.5800, lynn.morgen@advisiry.com

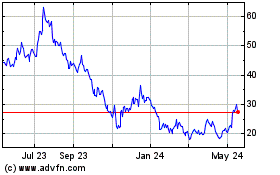

Ameresco (NYSE:AMRC)

Historical Stock Chart

From Jan 2025 to Feb 2025

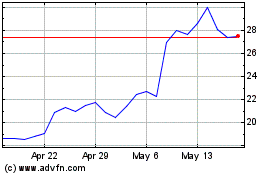

Ameresco (NYSE:AMRC)

Historical Stock Chart

From Feb 2024 to Feb 2025