AvalonBay Communities, Inc. (NYSE: AVB) (the “Company”) reported

Earnings per Share – diluted (“EPS”), Funds from Operations

attributable to common stockholders - diluted (“FFO”) per share and

Core FFO per share (as defined in this release) for the three and

nine months ended September 30, 2024 and 2023 as detailed

below.

Q3 2024

Q3 2023

% Change

EPS

$

2.61

$

1.21

115.7

%

FFO per share (1)

$

2.88

$

2.48

16.1

%

Core FFO per share (1)

$

2.74

$

2.66

3.0

%

YTD 2024

YTD 2023

% Change

EPS

$

5.62

$

4.86

15.6

%

FFO per share (1)

$

8.36

$

7.69

8.7

%

Core FFO per share (1)

$

8.21

$

7.89

4.1

%

(1) For additional detail on reconciling

items between net income attributable to common stockholders, FFO

and Core FFO, see Definitions and Reconciliations, table 3.

The following table compares the Company’s actual results for

EPS, FFO per share and Core FFO per share for the three months

ended September 30, 2024 to its results for the prior year

period:

Q3 2024 Results Compared to Q3

2023

Per Share

EPS

FFO

Core FFO

Q3 2023 per share reported results

$

1.21

$

2.48

$

2.66

Same Store Residential NOI (1)

0.06

0.06

0.06

Other Residential NOI

0.11

0.11

0.11

Overhead and other

(0.02

)

(0.02

)

(0.02

)

Capital markets and transaction

activity

(0.06

)

(0.06

)

(0.06

)

Unconsolidated investment income and

management fees

(0.01

)

(0.01

)

(0.01

)

Non-core items (2)

0.32

0.32

—

Real estate gains, depreciation expense

and other

1.00

—

—

Q3 2024 per share reported results

$

2.61

$

2.88

$

2.74

(1) Consists of increases of $0.14 in

revenue and $0.08 in operating expenses.

(2) For detail of non-core items, see

Definitions and Reconciliations, table 3.

The following table compares the Company’s actual results for

EPS, FFO per share and Core FFO per share for the three months

ended September 30, 2024 to its July 2024 outlook:

Q3 2024 Results Compared to

July 2024 Outlook

Per Share

EPS

FFO

Core FFO

Projected per share (1)

$

2.74

$

2.64

$

2.71

Same Store Residential NOI (2)

0.01

0.01

0.01

Other Residential and Commercial NOI

0.01

0.01

0.01

Capital markets and transaction

activity

0.01

0.01

0.01

Non-core items (3)

0.21

0.21

—

Real estate gains, depreciation expense

and other

(0.37

)

—

—

Q3 2024 per share reported results

$

2.61

$

2.88

$

2.74

(1) The mid-point of the Company's July

2024 outlook.

(2) Consists of favorable operating

expenses of $0.01.

(3) For detail of non-core items, see

Definitions and Reconciliations, table 3.

The following table compares the Company’s actual results for

EPS, FFO per share and Core FFO per share for the nine months ended

September 30, 2024 to its results for the prior year period:

YTD 2024 Results Compared to

YTD 2023

Per Share

EPS

FFO

Core FFO

YTD 2023 per share reported results

$

4.86

$

7.69

$

7.89

Same Store Residential NOI (1)

0.27

0.27

0.27

Other Residential NOI

0.28

0.28

0.28

Overhead and other

(0.07

)

(0.07

)

(0.07

)

Capital markets and transaction

activity

(0.13

)

(0.14

)

(0.14

)

Unconsolidated investment income and

management fees

(0.02

)

(0.02

)

(0.02

)

Non-core items (2)

0.35

0.35

—

Real estate gains, depreciation expense

and other

0.08

—

—

YTD 2024 per share reported results

$

5.62

$

8.36

$

8.21

(1) Consists of increases of $0.47 in

revenue and $0.20 in operating expenses.

(2) For detail of non-core items, see

Definitions and Reconciliations, table 3.

Same Store Operating Results for the Three Months Ended

September 30, 2024 Compared to the Prior Year Period

Same Store Residential revenue increased $20,205,000, or 3.1%,

to $671,508,000. Same Store Residential operating expenses

increased $11,035,000, or 5.4%, to $214,844,000 and Same Store

Residential NOI increased $9,170,000, or 2.0%, to $456,664,000.

The following table presents percentage changes in Same Store

Residential revenue, operating expenses and NOI for the three

months ended September 30, 2024 compared to the three months ended

September 30, 2023:

Q3 2024 Compared to Q3

2023

Same Store Residential

Revenue

(1)

Opex

(2)

% of Q3 2024

NOI

NOI

New England

4.2

%

1.8

%

5.4

%

13.5

%

Metro NY/NJ

2.8

%

5.5

%

1.5

%

19.6

%

Mid-Atlantic

3.5

%

10.4

%

0.4

%

15.5

%

Southeast FL

2.0

%

9.0

%

(1.9

)%

3.2

%

Denver, CO

0.8

%

0.4

%

1.0

%

1.6

%

Pacific NW

4.8

%

2.7

%

5.7

%

6.7

%

N. California

1.7

%

5.1

%

0.4

%

16.5

%

S. California

3.6

%

5.0

%

2.9

%

22.3

%

Other Expansion Regions

(1.6

)%

4.3

%

(5.0

)%

1.1

%

Total

3.1

%

5.4

%

2.0

%

100.0

%

(1) See full release for additional

detail.

(2) See full release for discussion of

variances.

Same Store Operating Results for the Nine Months Ended

September 30, 2024 Compared to the Prior Year Period

Same Store Residential revenue increased $67,094,000, or 3.5%,

to $1,992,789,000. Same Store Residential operating expenses

increased $28,516,000, or 4.8%, to $619,574,000 and Same Store

Residential NOI increased $38,578,000, or 2.9%, to

$1,373,215,000.

The following table presents percentage changes in Same Store

Residential revenue, operating expenses and NOI for the nine months

ended September 30, 2024 compared to the nine months ended

September 30, 2023:

YTD 2024 Compared to YTD

2023

Same Store Residential

Revenue

(1)

Opex

(2)

% of YTD 2024

NOI

NOI

New England

4.4

%

1.8

%

5.7

%

13.4

%

Metro NY/NJ

3.5

%

6.2

%

2.3

%

19.8

%

Mid-Atlantic

3.2

%

8.6

%

0.9

%

15.4

%

Southeast FL

2.1

%

6.3

%

(0.2

)%

3.3

%

Denver, CO

1.6

%

(1.7

)%

3.0

%

1.6

%

Pacific NW

3.8

%

3.2

%

4.0

%

6.6

%

N. California

1.3

%

5.2

%

(0.2

)%

16.4

%

S. California

5.2

%

3.7

%

5.9

%

22.4

%

Other Expansion Regions

(1.2

)%

(0.1

)%

(1.8

)%

1.1

%

Total

3.5

%

4.8

%

2.9

%

100.0

%

(1) See full release for additional

detail.

(2) See full release for discussion of

variances.

Development Activity

During the three months ended September 30, 2024, the Company

completed the development of two communities:

- Avalon Bothell Commons I, located in Bothell, WA; and

- Kanso Milford, located in Milford, MA.

These communities contain an aggregate of 629 apartment homes

and 9,200 square feet of commercial space and were constructed for

an aggregate Total Capital Cost of $299,000,000.

During the three months ended September 30, 2024, the Company

started the construction of four apartment communities:

- Avalon Tech Ridge I, located in Austin, TX;

- Avalon Carmel, located in Charlotte, NC;

- Avalon Plano, located in Plano, TX; and

- Avalon Oakridge I, located in Durham, NC.

These communities are expected to contain an aggregate of 1,418

apartment homes. Estimated Total Capital Cost at completion for

these Development communities is $450,000,000. Avalon Carmel and

Avalon Plano are being developed through the Company's Developer

Funding Program ("DFP").

During the nine months ended September 30, 2024, the

Company:

- completed the development of five wholly-owned communities

containing an aggregate of 1,530 apartment homes and 9,200 square

feet of commercial space for an aggregate Total Capital Cost of

$650,000,000; and

- started the construction of seven apartment communities. These

communities are expected to contain an aggregate of 2,321 apartment

homes. Estimated Total Capital Cost at completion for these

Development communities is $834,000,000.

At September 30, 2024, the Company had 19 wholly-owned

Development communities under construction that are expected to

contain 6,855 apartment homes and 56,000 square feet of commercial

space. Estimated Total Capital Cost at completion for these

Development communities is $2,683,000,000.

Disposition Activity

During the three months ended September 30, 2024, the Company

sold two wholly-owned communities:

- AVA Theater District, located in Boston, MA; and

- Avalon Darien, located in Darien, CT.

In aggregate, these communities contain 587 apartment homes and

were sold for $332,000,000 and a weighted average Market Cap Rate

of 5.0%, resulting in a gain in accordance with GAAP of

$172,986,000 and an Economic Gain of $94,661,000.

During the nine months ended September 30, 2024, the Company

sold five wholly-owned communities containing an aggregate of 1,069

apartment homes and 12,000 square feet of commercial space. These

communities were sold for $513,700,000 and a weighted average

Market Cap Rate of 5.1%, resulting in a gain in accordance with

GAAP of $241,367,000 and an Economic Gain of $116,732,000.

In October 2024, the Company sold Avalon New Canaan, located in

New Canaan, CT. Avalon New Canaan contains 104 apartment homes and

was sold for $75,000,000.

Acquisition Activity

During the three months ended September 30, 2024, the Company

acquired three wholly-owned communities:

- Avalon Perimeter Park, located in Morrisville, NC, containing

262 apartment homes for a purchase price of $66,500,000;

- Avalon Cherry Hills, located in Englewood, CO, containing 306

apartment homes for a purchase price of $95,000,000; and

- AVA Balboa Park, located in San Diego, CA, containing 100

apartment homes and 1,700 square feet of commercial space for a

purchase price of $51,000,000.

During the nine months ended September 30, 2024, the Company

acquired four wholly-owned communities containing 968 apartment

homes and 1,700 square feet of commercial space for a total

purchase price of $274,600,000.

In October 2024, the Company acquired Avalon Townhomes at Bee

Cave, located in Bee Cave, TX, containing 126 townhomes for a

purchase price of $49,000,000.

Structured Investment Program ("SIP") Activity

As of September 30, 2024, the Company had seven commitments to

fund either mezzanine loans or preferred equity investments for the

development of multifamily projects in the Company's markets, up to

$191,585,000 in the aggregate. During the nine months ended

September 30, 2024, the Company did not enter into any new SIP

commitments. At September 30, 2024, the Company's investment

commitments had a weighted average rate of return of 11.5% and a

weighted average initial maturity date of December 2026. As of

September 30, 2024, the Company had funded $162,373,000 of these

commitments.

Liquidity and Capital Markets

At September 30, 2024, the Company had $552,356,000 in

unrestricted cash and cash equivalents.

As of September 30, 2024, the Company did not have any

borrowings outstanding under its $2,250,000,000 unsecured revolving

credit facility (the "Credit Facility") or its $500,000,000

unsecured commercial paper note program. The commercial paper

program is backstopped by the Company's commitment to maintain

available borrowing capacity under its Credit Facility in an amount

equal to actual borrowings under the program.

The Company’s annualized Net Debt-to-Core EBITDAre (as defined

in this release) for the third quarter of 2024 was 4.2 times and

Unencumbered NOI (as defined in this release) for the nine months

ended September 30, 2024 was 95%.

During the three months ended September 30, 2024, under its

current continuous equity program, the Company entered into forward

contracts to sell 203,297 shares of common stock with settlement

expected to occur no later than December 31, 2025 at a gross

weighted average price of $219.92 per share for approximate

proceeds of $44,066,000, net of fees. Subsequently, on September 5,

2024, in connection with an underwritten offering of shares, the

Company entered into forward contracts to sell 3,680,000 shares of

common stock with settlement expected to occur no later than

December 31, 2025 at a discount to the closing price of $226.52 per

share for approximate proceeds of $808,606,000, net of offering

fees and discounts. The proceeds that the Company expects to

receive on the date or dates of settlement are subject to certain

customary adjustments during the term of the forward contract for

the Company's dividends and a daily interest adjustment.

During the nine months ended September 30, 2024, the Company

issued $400,000,000 principal amount of unsecured notes in a public

offering under its existing shelf registration statement for net

proceeds before offering costs of $396,188,000. The notes mature in

June 2034 and were issued with a 5.35% coupon. The effective

interest rate of the notes is 5.05%, including the impact of

offering costs and hedging activity.

Fourth Quarter and Full Year 2024 Financial Outlook

For its fourth quarter and full year 2024 financial outlook, the

Company expects the following:

Projected EPS, Projected FFO and

Projected Core FFO Outlook (1)

Q4 2024

Full Year 2024

Low

High

Low

High

Projected EPS

$

1.61

—

$

1.71

$

7.23

—

$

7.33

Projected FFO per share

$

2.67

—

$

2.77

$

11.03

—

$

11.13

Projected Core FFO per share

$

2.78

—

$

2.88

$

10.99

—

$

11.09

(1) See Definitions and Reconciliations,

table 9, for reconciliations of Projected FFO per share and

Projected Core FFO per share to Projected EPS.

Full Year 2024 Financial

Outlook

Full Year 2024

vs. Full Year 2023

Low

High

Same Store:

Residential revenue change

3.4

%

—

3.6

%

Residential Opex change

4.3

%

—

4.7

%

Residential NOI change

2.8

%

—

3.2

%

The following table compares the Company’s actual results for

EPS, FFO per share and Core FFO per share for the third quarter

2024 to the mid-point of its fourth quarter 2024 financial

outlook:

Q3 2024 Results Compared to Q4

2024 Outlook

Per Share

EPS

FFO

Core FFO

Q3 2024 per share reported results

$

2.61

$

2.88

$

2.74

Same Store Residential revenue

0.02

0.02

0.02

Same Store Residential Opex

0.07

0.07

0.07

Development and Other Stabilized

Residential NOI

0.01

0.01

0.01

Capital markets and transaction

activity

(0.03

)

(0.03

)

(0.03

)

Overhead and other

0.02

0.02

0.02

Non-core items (1)

(0.25

)

(0.25

)

—

Gain on sale of real estate and

depreciation expense

(0.79

)

—

—

Projected per share - Q4 2024 outlook

(2)

$

1.66

$

2.72

$

2.83

(1) For detail of non-core items, see

Definitions and Reconciliations, table 3 and table 9.

(2) Represents the mid-point of the

Company's outlook.

The following table compares the mid-point of the Company’s

October 2024 full year outlook for EPS, FFO per share and Core FFO

per share to its July 2024 outlook:

October 2024 Full Year Outlook

Compared

to July 2024 Full Year

Outlook

Per Share

EPS

FFO

Core FFO

Projected per share - July 2024 outlook

(1)

$

7.44

$

10.94

$

11.02

Same Store Residential revenue

—

—

—

Same Store Residential Opex

0.02

0.02

0.02

Development and Other Stabilized

Residential NOI

(0.01

)

(0.01

)

(0.01

)

Capital markets and transaction

activity

0.01

0.01

0.01

Non-core items (2)

0.12

0.12

—

Gain on sale of real estate and

depreciation expense

(0.30

)

—

—

Projected per share - October 2024 outlook

(1)

$

7.28

$

11.08

$

11.04

(1) Represents the mid-point of the

Company's outlook.

(2) For detail of non-core items, see

Definitions and Reconciliations, table 3 and table 9.

Other Matters

The Company will hold a conference call on November 5, 2024 at

11:00 AM ET to review and answer questions about this release, its

third quarter 2024 results, the Attachments (described below) and

related matters. To participate on the call, dial 877-407-9716.

To hear a replay of the call, which will be available from

November 5, 2024 at 4:00 PM ET to December 5, 2024, dial

844-512-2921 and use replay passcode: 13740500. A webcast of the

conference call will also be available at https://investors.avalonbay.com, and an online

playback of the webcast will be available for at least seven days

following the call.

The Company produces Earnings Release Attachments (the

"Attachments") that provide detailed information regarding

operating, development, redevelopment, disposition and acquisition

activity. These Attachments are considered a part of this earnings

release and are available in full with this earnings release via

the Company's website at https://investors.avalonbay.com. To receive future

press releases via e-mail, please submit a request through

https://investors.avalonbay.com/news-events/email-alerts.

In addition to the Attachments, the Company is providing a

teleconference presentation that will be available on the Company's

website at https://investors.avalonbay.com subsequent to this

release and before the market opens on November 5, 2024.

About AvalonBay Communities, Inc.

AvalonBay Communities, Inc., a member of the S&P 500, is an

equity REIT in the business of developing, redeveloping, acquiring

and managing apartment communities in leading metropolitan areas in

New England, the New York/New Jersey Metro area, the Mid-Atlantic,

the Pacific Northwest, and Northern and Southern California, as

well as in the Company's expansion regions of Raleigh-Durham and

Charlotte, North Carolina, Southeast Florida, Dallas and Austin,

Texas, and Denver, Colorado. As of September 30, 2024, the Company

owned or held a direct or indirect ownership interest in 305

apartment communities containing 92,908 apartment homes in 12

states and the District of Columbia, of which 19 communities were

under development. More information may be found on the Company’s

website at https://www.avalonbay.com.

For additional information, please contact Jason Reilley, Vice

President of Investor Relations, at 703-317-4681.

Forward-Looking Statements

This release, including its Attachments, contains

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The Company intends

such forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995. You can identify

forward-looking statements by the Company’s use of the words

“believe,” “expect,” “anticipate,” “intend,” “estimate,” “assume,”

“project,” “plan,” “may,” “shall,” “will,” “pursue,” “outlook” and

other similar expressions that predict or indicate future events

and trends and that do not report historical matters. These

statements include, among other things, statements regarding the

Company’s intent, belief, forecasts, assumptions or expectations

with respect to: potential development, redevelopment, acquisition

or disposition of communities; the timing and cost of completion of

communities under construction, reconstruction, development or

redevelopment; the timing of lease-up, occupancy and stabilization

of communities; the pursuit of land for future development; the

anticipated operating performance of communities; cost, yield,

revenue, NOI and earnings estimates; the impact of landlord-tenant

laws and rent regulations; the Company’s expansion into new

regions; declaration or payment of dividends; joint venture

activities; the Company’s policies regarding investments,

indebtedness, acquisitions, dispositions, financings and other

matters; the Company’s qualification as a REIT under the Internal

Revenue Code of 1986, as amended; the real estate markets in

regions where the Company operates and in general; the availability

of debt and equity financing; interest rates, inflation and other

general economic conditions and their potential impacts; trends

affecting the Company’s financial condition or results of

operations; regulatory changes that may affect the Company; and the

impact of legal proceedings.

The Company cannot assure the future results or outcome of the

matters described in these statements; rather, these statements

merely reflect the Company’s current expectations of the

approximate outcomes of the matters discussed. The Company does not

undertake a duty to update these forward-looking statements, and

therefore they may not represent the Company’s estimates and

assumptions after the date of this release. You should not rely on

forward-looking statements because they involve known and unknown

risks, uncertainties and other factors, some of which are beyond

the Company’s control. These risks, uncertainties and other factors

may cause the Company’s actual results, performance or achievements

to differ materially from the anticipated future results,

performance or achievements expressed or implied by these

forward-looking statements. You should carefully review the

discussion under Part I, Item 1A. “Risk Factors” of the Company’s

Form 10-K for the year ended December 31, 2023 and Part II, Item

1A. “Risk Factors” in subsequent quarterly reports on Form 10-Q for

further discussion of risks associated with forward-looking

statements.

Some of the factors that could cause the Company’s actual

results, performance or achievements to differ materially from

those expressed or implied by these forward-looking statements

include, but are not limited to, the following: the Company may

fail to secure development opportunities due to an inability to

reach agreements with third parties to obtain land at attractive

prices or to obtain desired zoning and other local approvals; the

Company may abandon or defer development opportunities for a number

of reasons, including changes in local market conditions which make

development less desirable, increases in costs of development,

increases in the cost of capital or lack of capital availability,

resulting in losses; construction costs of a community may exceed

original estimates; the Company may not complete construction and

lease-up of communities under development or redevelopment on

schedule, resulting in increased interest costs and construction

costs and a decrease in expected rental revenues; occupancy rates

and market rents may be adversely affected by competition and local

economic and market conditions which are beyond the Company’s

control; the Company’s cash flows from operations and access to

cost-effective capital may be insufficient for the development of

the Company’s pipeline, which could limit the Company’s pursuit of

opportunities; an outbreak of disease or other public health event

may affect the multifamily industry and general economy; the

Company’s cash flows may be insufficient to meet required payments

of principal and interest, and the Company may be unable to

refinance existing indebtedness or the terms of such refinancing

may not be as favorable as the terms of existing indebtedness; the

Company may be unsuccessful in its management of joint ventures and

the REIT vehicles that are used with certain joint ventures; new or

existing laws and regulations implementing rent control or rent

stabilization, or otherwise limiting the Company’s ability to

increase rents, charge fees or evict tenants, may impact its

revenue or increase costs; the Company’s expectations, estimates

and assumptions as of the date of this filing regarding legal

proceedings are subject to change; the Company’s assumptions and

expectations in its financial outlook may prove to be too

optimistic; the possibility that the Company may choose to pay

dividends in its stock instead of cash, which may result in

stockholders having to pay taxes with respect to such dividends in

excess of the cash received, if any; and investments made under the

SIP may not be repaid as expected or the development may not be

completed on schedule, which could require the Company to engage in

litigation, foreclosure actions, and/or first party project

completion to recover its investment, which may not be recovered in

full or at all in such event.

Definitions and Reconciliations

Non-GAAP financial measures and other capitalized terms, as used

in this earnings release, are defined, reconciled and further

explained on Attachment 12, Definitions and Reconciliations of

Non-GAAP Financial Measures and Other Terms. Attachment 12 is

included in the full earnings release available at the Company’s

website at https://investors.avalonbay.com. This wire

distribution includes only the following definitions and

reconciliations.

Average Monthly Revenue per Occupied

Home is calculated by the Company as Residential revenue in

accordance with GAAP, divided by the weighted average number of

occupied apartment homes.

Commercial represents results

attributable to the non-apartment components of the Company's

mixed-use communities and other non-residential operations.

Development is composed of

consolidated communities that are either currently under

construction, or were under construction and were completed during

the current year. These communities may be partially or fully

complete and operating.

EBITDA, EBITDAre and Core EBITDAre

are considered by management to be supplemental measures of our

financial performance. EBITDA is defined by the Company as net

income or loss computed in accordance with GAAP before interest

expense, income taxes, depreciation and amortization. EBITDAre is

calculated by the Company in accordance with the definition adopted

by the Board of Governors of the National Association of Real

Estate Investment Trusts (“Nareit”), as EBITDA plus or minus losses

and gains on the disposition of depreciated property, plus

impairment write-downs of depreciated property, with adjustments to

reflect the Company's share of EBITDAre of unconsolidated entities.

Core EBITDAre is the Company’s EBITDAre as adjusted for non-core

items outlined in the table below. By further adjusting for items

that are not considered part of the Company’s core business

operations, Core EBITDAre can help one compare the core operating

and financial performance of the Company between periods. A

reconciliation of EBITDA, EBITDAre and Core EBITDAre to net income

is as follows (dollars in thousands):

TABLE 1

Q3

2024

Net income

$

372,519

Interest expense and loss on

extinguishment of debt

65,640

Income tax expense

782

Depreciation expense

212,122

EBITDA

$

651,063

Gain on sale of communities

(172,973

)

Unconsolidated entity EBITDAre adjustments

(1)

4,129

EBITDAre

$

482,219

Unconsolidated entity gains, net

(25,261

)

Structured Investment Program loan

reserve

(813

)

Advocacy contributions

3,732

Hedge accounting activity

25

Executive transition compensation

costs

200

Severance related costs

738

Expensed transaction, development and

other pursuit costs, net of recoveries

252

Other real estate activity

(314

)

Legal settlements and costs

781

Core EBITDAre

$

461,559

(1) Includes joint venture interest,

taxes, depreciation, gain on dispositions of depreciated real

estate and impairment losses, if applicable, included in net

income.

Economic Gain is calculated by the

Company as the gain on sale in accordance with GAAP, less

accumulated depreciation through the date of sale and any other

adjustments that may be required under GAAP accounting. Management

generally considers Economic Gain to be an appropriate supplemental

measure to gain on sale in accordance with GAAP because it helps

investors to understand the relationship between the cash proceeds

from a sale and the cash invested in the sold community. The

Economic Gain for disposed communities is based on their respective

final settlement statements. A reconciliation of the aggregate

Economic Gain to the aggregate gain on sale in accordance with GAAP

for the wholly-owned communities disposed of during the three and

nine months ended September 30, 2024 is as follows (dollars in

thousands):

TABLE 2

Q3 2024

YTD 2024

Gain on sale in accordance with GAAP

$

172,986

$

241,367

Accumulated Depreciation and Other

(78,325

)

(124,635

)

Economic Gain

$

94,661

$

116,732

Economic Occupancy is defined as

total possible Residential revenue less vacancy loss as a

percentage of total possible Residential revenue. Total possible

Residential revenue (also known as “gross potential”) is determined

by valuing occupied units at contract rates and vacant units at

Market Rents. Vacancy loss is determined by valuing vacant units at

current Market Rents. By measuring vacant apartments at their

Market Rents, Economic Occupancy takes into account the fact that

apartment homes of different sizes and locations within a community

have different economic impacts on a community’s gross revenue.

FFO and Core FFO are generally

considered by management to be appropriate supplemental measures of

our operating and financial performance. FFO is calculated by the

Company in accordance with the definition adopted by Nareit. FFO is

calculated by the Company as Net income or loss attributable to

common stockholders computed in accordance with GAAP, adjusted for

gains or losses on sales of previously depreciated operating

communities, cumulative effect of a change in accounting principle,

impairment write-downs of depreciable real estate assets,

write-downs of investments in affiliates due to a decrease in the

value of depreciable real estate assets held by those affiliates

and depreciation of real estate assets, including similar

adjustments for unconsolidated partnerships and joint ventures,

including those from a change in control. FFO can help one compare

the operating and financial performance of a real estate company

between periods or as compared to different companies because

adjustments such as (i) gains or losses on sales of previously

depreciated property or (ii) real estate depreciation may impact

comparability between companies as the amount and timing of these

or similar items can vary among owners of identical assets in

similar condition based on historical cost accounting and useful

life estimates. Core FFO is the Company's FFO as adjusted for

non-core items outlined in the table below. By further adjusting

for items that we do not consider be part of our core business

operations, Core FFO can help with the comparison of core operating

performance of the Company between periods. A reconciliation of Net

income attributable to common stockholders to FFO and to Core FFO

is as follows (dollars in thousands):

TABLE 3

Q3

Q3

YTD

YTD

2024

2023

2024

2023

Net income attributable to common

stockholders

$

372,519

$

172,031

$

799,902

$

686,856

Depreciation - real estate assets,

including joint venture adjustments

210,992

199,546

628,677

602,023

Distributions to noncontrolling

interests

—

—

—

25

Gain on sale of previously depreciated

real estate

(172,973

)

(22,121

)

(241,459

)

(209,430

)

Casualty loss on real estate

—

3,499

2,935

8,550

FFO attributable to common

stockholders

410,538

352,955

1,190,055

1,088,024

Adjusting items:

Unconsolidated entity (gains) losses, net

(1)

(25,261

)

827

(34,823

)

(4,024

)

Joint venture promote (2)

—

(424

)

—

(1,496

)

Structured Investment Program loan reserve

(3)

(813

)

539

(771

)

415

Loss on extinguishment of consolidated

debt

—

150

—

150

Hedge accounting activity

25

65

80

256

Advocacy contributions

3,732

—

5,914

200

Executive transition compensation

costs

200

300

304

944

Severance related costs

738

993

1,979

2,493

Expensed transaction, development and

other pursuit costs, net of recoveries (4)

252

18,070

3,857

21,318

Other real estate activity

(314

)

(237

)

(636

)

(707

)

For-sale condominium imputed carry cost

(5)

21

110

62

534

Legal settlements and costs

781

14

2,289

64

Income tax expense (6)

782

4,372

698

7,715

Core FFO attributable to common

stockholders

$

390,681

$

377,734

$

1,169,008

$

1,115,886

Weighted average common shares outstanding

- diluted

142,516,684

142,198,099

142,376,434

141,448,675

Earnings per common share - diluted

$

2.61

$

1.21

$

5.62

$

4.86

FFO per common share - diluted

$

2.88

$

2.48

$

8.36

$

7.69

Core FFO per common share - diluted

$

2.74

$

2.66

$

8.21

$

7.89

(1) Amounts consist primarily of net

unrealized gains on technology investments.

(2) Amount for 2023 is for the Company's

recognition of its promoted interest in Archstone Multifamily

Partners AC LP.

(3) Changes are the expected credit losses

associated with the Company's lending commitments primarily under

its SIP. The timing and amount of any actual losses that will be

incurred, if any, is to be determined.

(4) Amounts for 2023 include write-offs of

$17,111 for three development opportunities in Northern and

Southern California and the Mid-Atlantic that the Company

determined are no longer probable.

(5) Represents the imputed carry cost of

the for-sale residential condominiums at The Park Loggia. The

Company computes this adjustment by multiplying the Total Capital

Cost of completed and unsold for-sale residential condominiums by

the Company's weighted average unsecured debt effective interest

rate.

(6) Amounts for 2023 are primarily for the

recognition of taxes associated with The Park Loggia

dispositions.

Interest Coverage is calculated by

the Company as Core EBITDAre divided by interest expense. Interest

Coverage is presented by the Company because it provides rating

agencies and investors an additional means of comparing our ability

to service debt obligations to that of other companies. A

calculation of Interest Coverage for the three months ended

September 30, 2024 is as follows (dollars in thousands):

TABLE 4

Core EBITDAre (1)

$

461,559

Interest expense (2)

$

65,640

Interest Coverage

7.0 times

(1) For additional detail, see Definitions

and Reconciliations, table 1.

(2) Excludes the impact of non-core hedge

accounting activity.

Market Cap Rate is defined by the

Company as Projected NOI of a single community for the first 12

months of operations (assuming no repositioning), less an estimate

of typical capital expenditure allowance per apartment home,

divided by the gross sales price for the community. Projected NOI,

as referred to above, represents management’s estimate of projected

rental revenue minus projected operating expenses before interest,

income taxes (if any), depreciation and amortization. For this

purpose, management’s projection of operating expenses for the

community includes a management fee of 2.5% and an estimate of

typical market costs for insurance, payroll and other operating

expenses for which the Company may have proprietary advantages not

available to a typical buyer. The Market Cap Rate, which may be

determined in a different manner by others, is a measure frequently

used in the real estate industry when determining the appropriate

purchase price for a property or estimating the value for a

property. Buyers may assign different Market Cap Rates to different

communities when determining the appropriate value because they (i)

may project different rates of change in operating expenses and

capital expenditure estimates and (ii) may project different rates

of change in future rental revenue due to different estimates for

changes in rent and occupancy levels. The weighted average Market

Cap Rate is weighted based on the gross sales price of each

community.

Market Rents as reported by the

Company are based on the current market rates set by the Company

based on its experience in renting apartments and publicly

available market data. Market Rents for a period are based on the

average Market Rents during that period and do not reflect any

impact for cash concessions.

Net Debt-to-Core EBITDAre is

calculated by the Company as total debt (secured and unsecured

notes, and the Company's Credit Facility and commercial paper

program) that is consolidated for financial reporting purposes,

less consolidated cash and restricted cash, divided by annualized

third quarter 2024 Core EBITDAre. A calculation of Net Debt-to-Core

EBITDAre is as follows (dollars in thousands):

TABLE 5

Total debt principal (1)

$

8,434,910

Cash and cash equivalents and restricted

cash

(753,414

)

Net debt

$

7,681,496

Core EBITDAre (2)

$

461,559

Core EBITDAre, annualized

$

1,846,236

Net Debt-to-Core EBITDAre

4.2 times

(1) Balance at September 30, 2024 excludes

$43,090 of debt discount and deferred financing costs as reflected

in unsecured notes, net, and $16,558 of debt discount and deferred

financing costs as reflected in notes payable, net, on the

Condensed Consolidated Balance Sheets.

(2) For additional detail, see Definitions

and Reconciliations, table 1.

NOI is defined by the Company as

total property revenue less direct property operating expenses

(including property taxes), and excluding corporate-level income

(including management, development and other fees), property

management and other indirect operating expenses, net of corporate

income, expensed transaction, development and other pursuit costs,

net of recoveries, interest expense, net, loss on extinguishment of

debt, net, general and administrative expense, income from

unconsolidated investments, depreciation expense, income tax

(benefit) expense, casualty loss, (gain) loss on sale of

communities, other real estate activity and net operating income

from real estate assets sold or held for sale. The Company

considers NOI to be an important and appropriate supplemental

performance measure to net income because it helps both investors

and management to understand the core operations of a community or

communities prior to the allocation of any corporate-level property

management overhead or financing-related costs. NOI reflects the

operating performance of a community and allows for an easier

comparison of the operating performance of individual assets or

groups of assets. In addition, because prospective buyers of real

estate have different financing and overhead structures, with

varying marginal impact to overhead as a result of acquiring real

estate, NOI is considered by many in the real estate industry to be

a useful measure for determining the value of a real estate asset

or group of assets.

Residential NOI represents results attributable to the Company's

apartment rental operations, including parking and other ancillary

Residential revenue. Reconciliations of NOI and Residential NOI to

net income, as well as a breakdown of Residential NOI by operating

segment, are as follows (dollars in thousands):

TABLE 6

Q3

Q3

Q2

Q1

Q4

YTD

YTD

2024

2023

2024

2024

2023

2024

2023

Net income

$

372,519

$

171,790

$

254,007

$

173,557

$

242,066

$

800,083

$

686,372

Property management and other indirect

operating expenses, net of corporate income

40,149

33,554

37,553

35,204

34,706

112,906

99,606

Expensed transaction, development and

other pursuit costs, net of recoveries

1,573

18,959

1,417

4,245

10,267

7,235

23,212

Interest expense, net

55,769

48,115

57,078

54,766

49,471

167,613

156,521

Loss on extinguishment of debt, net

—

150

—

—

—

—

150

General and administrative expense

20,089

20,466

19,586

20,331

17,992

60,006

58,542

Income from unconsolidated investments

(30,720

)

(1,930

)

(4,822

)

(10,847

)

(1,709

)

(46,389

)

(11,745

)

Depreciation expense

212,122

200,982

206,923

212,269

210,694

631,314

606,271

Income tax expense (benefit)

782

4,372

(62

)

(22

)

2,438

698

7,715

Casualty loss

—

3,499

—

2,935

568

2,935

8,550

(Gain) loss on sale of communities

(172,973

)

(22,121

)

(68,556

)

70

(77,994

)

(241,459

)

(209,430

)

Other real estate activity

(314

)

(237

)

(181

)

(141

)

533

(636

)

(707

)

NOI from real estate assets sold or held

for sale

(2,036

)

(10,537

)

(7,997

)

(8,468

)

(9,173

)

(18,501

)

(39,005

)

NOI

496,960

467,062

494,946

483,899

479,859

1,475,805

1,386,052

Commercial NOI

(7,906

)

(7,959

)

(8,844

)

(8,024

)

(8,564

)

(24,774

)

(24,582

)

Residential NOI

$

489,054

$

459,103

$

486,102

$

475,875

$

471,295

$

1,451,031

$

1,361,470

Residential NOI

Same Store:

New England

$

61,564

$

58,383

$

62,269

$

59,921

$

59,358

$

183,754

$

173,787

Metro NY/NJ

89,631

88,323

91,551

90,054

89,866

271,236

265,083

Mid-Atlantic

70,439

70,125

70,448

70,678

71,565

211,565

209,667

Southeast FL

14,771

15,055

15,530

15,491

14,441

45,792

45,868

Denver, CO

7,254

7,185

7,249

7,353

7,213

21,856

21,210

Pacific NW

30,519

28,866

30,593

29,927

29,764

91,039

87,505

N. California

75,494

75,219

74,590

74,699

75,353

224,783

225,192

S. California

102,016

99,098

103,005

102,586

101,144

307,607

290,461

Other Expansion Regions

4,976

5,240

5,357

5,250

5,259

15,583

15,864

Total Same Store

456,664

447,494

460,592

455,959

453,963

1,373,215

1,334,637

Other Stabilized

18,416

11,619

16,422

15,563

15,150

50,401

27,698

Development/Redevelopment

13,974

(10

)

9,088

4,353

2,182

27,415

(865

)

Residential NOI

$

489,054

$

459,103

$

486,102

$

475,875

$

471,295

$

1,451,031

$

1,361,470

NOI as reported by the Company does not include the operating

results from assets sold or classified as held for sale. A

reconciliation of NOI from communities sold or classified as held

for sale is as follows (dollars in thousands):

TABLE 7

Q3

Q3

Q2

Q1

Q4

YTD

YTD

2024

2023

2024

2024

2023

2024

2023

Revenue from real estate assets sold or

held for sale

$

3,258

$

15,787

$

12,162

$

12,882

$

13,612

$

28,300

$

58,154

Operating expenses from real estate assets

sold or held for sale

(1,222

)

(5,250

)

(4,165

)

(4,414

)

(4,439

)

(9,799

)

(19,149

)

NOI from real estate assets sold or held

for sale

$

2,036

$

10,537

$

7,997

$

8,468

$

9,173

$

18,501

$

39,005

Commercial NOI is composed of the following components (in

thousands):

TABLE 8

Q3

Q3

Q2

Q1

Q4

YTD

YTD

2024

2023

2024

2024

2023

2024

2023

Commercial Revenue

$

9,748

$

9,769

$

10,677

$

9,835

$

10,371

$

30,260

$

29,650

Commercial Operating Expenses

(1,842

)

(1,810

)

(1,833

)

(1,811

)

(1,807

)

(5,486

)

(5,068

)

Commercial NOI

$

7,906

$

7,959

$

8,844

$

8,024

$

8,564

$

24,774

$

24,582

Other Stabilized is composed of

completed consolidated communities that the Company owns, which

have Stabilized Operations as of January 1, 2024, or which were

acquired subsequent to January 1, 2023. Other Stabilized excludes

communities that are conducting or are probable to conduct

substantial redevelopment activities.

Projected FFO and Projected Core

FFO, as provided within this release in the Company’s

outlook, are calculated on a basis consistent with historical FFO

and Core FFO, and are therefore considered to be appropriate

supplemental measures to projected net income from projected

operating performance. A reconciliation of the ranges provided for

Projected FFO per share (diluted) for the fourth quarter and full

year 2024 to the ranges provided for projected EPS (diluted) and

corresponding reconciliation of the ranges for Projected FFO per

share to the ranges for Projected Core FFO per share are as

follows:

TABLE 9

Low

Range

High

Range

Projected EPS (diluted) - Q4 2024

$

1.61

$

1.71

Depreciation (real estate related)

1.53

1.53

Gain on sale of communities

(0.47

)

(0.47

)

Projected FFO per share (diluted) - Q4

2024

2.67

2.77

Expensed transaction, development and

other pursuit costs, net of recoveries

0.01

0.01

Advocacy contributions

0.10

0.10

Projected Core FFO per share (diluted) -

Q4 2024

$

2.78

$

2.88

Projected EPS (diluted) - Full Year

2024

$

7.23

$

7.33

Depreciation (real estate related)

5.94

5.94

Gain on sale of communities

(2.16

)

(2.16

)

Casualty loss on real estate

0.02

0.02

Projected FFO per share (diluted) - Full

Year 2024

11.03

11.13

Unconsolidated entity gains, net

(0.24

)

(0.24

)

Structured Investment Program loan

reserve

(0.01

)

(0.01

)

Severance related costs

0.02

0.02

Expensed transaction, development and

other pursuit costs, net of recoveries

0.04

0.04

Legal settlements and costs

0.02

0.02

Advocacy contributions

0.13

0.13

Projected Core FFO per share (diluted) -

Full Year 2024

$

10.99

$

11.09

Projected NOI, as used within this

release for certain Development communities and in calculating the

Market Cap Rate for dispositions, represents management’s estimate,

as of the date of this release (or as of the date of the buyer’s

valuation in the case of dispositions), of projected stabilized

rental revenue minus projected stabilized operating expenses. For

Development communities, Projected NOI is calculated based on the

first twelve months of Stabilized Operations following the

completion of construction. In calculating the Market Cap Rate,

Projected NOI for dispositions is calculated for the first twelve

months following the date of the buyer’s valuation. Projected

stabilized rental revenue represents management’s estimate of

projected gross potential minus projected stabilized economic

vacancy and adjusted for projected stabilized concessions plus

projected stabilized other rental revenue. Projected stabilized

operating expenses do not include interest, income taxes (if any),

depreciation or amortization, or any allocation of corporate-level

property management overhead or general and administrative costs.

In addition, projected stabilized operating expenses for

Development communities do not include property management fee

expense. Projected gross potential for Development communities and

dispositions is generally based on leased rents for occupied homes

and management’s best estimate of rental levels for homes which are

currently unleased, as well as those homes which will become

available for lease during the twelve-month forward period used to

develop Projected NOI. The weighted average Projected NOI as a

percentage of Total Capital Cost is weighted based on the Company’s

share of the Total Capital Cost of each community, based on its

percentage ownership.

Management believes that Projected NOI of the Development

communities, on an aggregated weighted average basis, assists

investors in understanding management's estimate of the likely

impact on operations of the Development communities when the assets

are complete and achieve stabilized occupancy (before allocation of

any corporate-level property management overhead, general and

administrative costs or interest expense). However, in this release

the Company has not given a projection of NOI on a company-wide

basis. Given the different dates and fiscal years for which NOI is

projected for these communities, the projected allocation of

corporate-level property management overhead, general and

administrative costs and interest expense to communities under

development is complex, impractical to develop, and may not be

meaningful. Projected NOI of these communities is not a projection

of the Company's overall financial performance or cash flow. There

can be no assurance that the communities under development will

achieve the Projected NOI as described in this release.

Redevelopment is composed of

consolidated communities where substantial redevelopment is in

progress or is probable to begin during the current year.

Redevelopment is considered substantial when (i) capital invested

during the reconstruction effort is expected to exceed the lesser

of $5,000,000 or 10% of the community’s pre-redevelopment basis and

(ii) physical occupancy is below or is expected to be below 90%

during or as a result of the redevelopment activity.

Residential represents results

attributable to the Company's apartment rental operations,

including parking and other ancillary Residential revenue.

Residential Revenue with Concessions on a

Cash Basis is considered by the Company to be a supplemental

measure to Residential revenue in conformity with GAAP to help

investors evaluate the impact of both current and historical

concessions on GAAP-based Residential revenue and to more readily

enable comparisons to revenue as reported by other companies. In

addition, Residential Revenue with Concessions on a Cash Basis

allows an investor to understand the historical trend in cash

concessions.

A reconciliation of Same Store Residential revenue in conformity

with GAAP to Residential Revenue with Concessions on a Cash Basis

is as follows (dollars in thousands):

TABLE 10

Q3

Q3

Q2

YTD

YTD

2024

2023

2024

2024

2023

Residential revenue (GAAP basis)

$

671,508

$

651,303

$

663,970

$

1,992,789

$

1,925,695

Residential concessions amortized

3,719

4,142

4,172

12,129

10,969

Residential concessions granted

(5,087

)

(6,170

)

(2,484

)

(10,940

)

(12,516

)

Residential Revenue with Concessions on a

Cash Basis

$

670,140

$

649,275

$

665,658

$

1,993,978

$

1,924,148

Q3 2024 vs. Q3

2023

Q3 2024 vs. Q2

2024

YTD 2024 vs. YTD

2023

% change -- GAAP revenue

3.1

%

1.1

%

3.5

%

% change -- cash revenue

3.2

%

0.7

%

3.6

%

Same Store is composed of

consolidated communities where a comparison of operating results

from the prior year to the current year is meaningful as these

communities were owned and had Stabilized Operations, as defined

below, as of the beginning of the respective prior year period.

Therefore, for 2024 operating results, Same Store is composed of

consolidated communities that have Stabilized Operations as of

January 1, 2023, are not conducting or are not probable to conduct

substantial redevelopment activities and are not held for sale or

probable for disposition within the current year.

Stabilized Operations is defined as

operations of a community that occur after the earlier of (i)

attainment of 90% physical occupancy or (ii) the one-year

anniversary of completion of development or redevelopment.

Total Capital Cost includes all

capitalized costs projected to be or actually incurred to develop

the respective Development or Redevelopment community, including

land acquisition costs, construction costs, real estate taxes,

capitalized interest and loan fees, permits, professional fees,

allocated development overhead and other regulatory fees and a

contingency estimate, offset by proceeds from the sale of any

associated land or improvements, all as determined in accordance

with GAAP. Total Capital Cost also includes costs incurred related

to first generation commercial tenants, such as tenant improvements

and leasing commissions. For Redevelopment communities, Total

Capital Cost excludes costs incurred prior to the start of

redevelopment when indicated. With respect to communities where

development or redevelopment was completed in a prior period or the

current period, Total Capital Cost reflects the actual cost

incurred, plus any contingency estimate made by management. Total

Capital Cost for communities identified as having joint venture

ownership, either during construction or upon construction

completion, represents the total projected joint venture

contribution amount. For joint ventures not in construction, Total

Capital Cost is equal to gross real estate cost.

Uncollectible lease revenue and government

rent relief

The following table provides uncollectible Residential lease

revenue as a percentage of total Residential revenue in the

aggregate and excluding amounts recognized from government rent

relief programs in each respective period. Government rent relief

reduces the amount of uncollectible Residential lease revenue. The

Company expects the amount of rent relief recognized to continue to

decline in 2024 absent funding from the Federal government.

TABLE 11

Same Store Uncollectible

Residential Lease Revenue

Q3

Q3

Q2

Q1

2024

2023

2024

2024

Total

Excluding Rent Relief

Total

Excluding Rent Relief

Total

Excluding Rent Relief

Total

Excluding Rent Relief

New England

0.3

%

0.7

%

0.9

%

1.2

%

0.5

%

0.9

%

0.2

%

0.7

%

Metro NY/NJ

2.2

%

2.2

%

2.3

%

2.7

%

2.1

%

2.2

%

2.1

%

2.3

%

Mid-Atlantic

2.0

%

2.1

%

2.2

%

2.3

%

2.3

%

2.3

%

2.3

%

2.6

%

Southeast FL

2.2

%

2.3

%

3.3

%

3.5

%

1.7

%

1.8

%

2.4

%

2.4

%

Denver, CO

0.6

%

0.7

%

1.3

%

1.4

%

1.0

%

1.0

%

1.2

%

1.4

%

Pacific NW

1.0

%

1.1

%

1.6

%

1.9

%

1.4

%

1.4

%

0.9

%

1.0

%

N. California

0.9

%

1.0

%

1.2

%

1.3

%

1.3

%

1.3

%

1.1

%

1.2

%

S. California

1.9

%

1.9

%

2.4

%

2.5

%

2.2

%

2.4

%

2.1

%

2.4

%

Other Expansion Regions

2.4

%

2.5

%

0.8

%

0.8

%

1.5

%

1.5

%

1.2

%

1.2

%

Total Same Store

1.6

%

1.6

%

1.9

%

2.1

%

1.7

%

1.9

%

1.6

%

1.9

%

Unconsolidated Development is

composed of communities that are either currently under

construction, or were under construction and were completed during

the current year, in which we have an indirect ownership interest

through our investment interest in an unconsolidated joint venture.

These communities may be partially or fully complete and

operating.

Unencumbered NOI as calculated by

the Company represents NOI generated by real estate assets

unencumbered by outstanding secured notes payable as of September

30, 2024 as a percentage of total NOI generated by real estate

assets. The Company believes that current and prospective unsecured

creditors of the Company view Unencumbered NOI as one indication of

the borrowing capacity of the Company. Therefore, when reviewed

together with the Company’s Interest Coverage, EBITDA and cash flow

from operations, the Company believes that investors and creditors

view Unencumbered NOI as a useful supplemental measure for

determining the financial flexibility of an entity. A calculation

of Unencumbered NOI for the nine months ended September 30, 2024 is

as follows (dollars in thousands):

TABLE 12

YTD 2024

NOI

Residential NOI:

Same Store

$

1,373,215

Other Stabilized

50,401

Development/Redevelopment

27,415

Total Residential NOI

1,451,031

Commercial NOI

24,774

NOI from real estate assets sold or held

for sale

18,501

Total NOI generated by real estate

assets

1,494,306

Less NOI on encumbered assets

(73,420

)

NOI on unencumbered assets

$

1,420,886

Unencumbered NOI

95

%

Copyright © 2024 AvalonBay Communities, Inc.

All Rights Reserved

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241101881964/en/

Jason Reilley Vice President of Investor Relations

703-317-4681

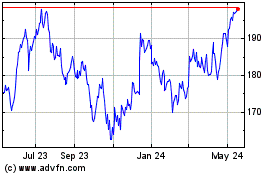

Avalonbay Communities (NYSE:AVB)

Historical Stock Chart

From Nov 2024 to Dec 2024

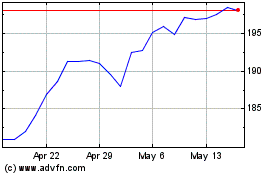

Avalonbay Communities (NYSE:AVB)

Historical Stock Chart

From Dec 2023 to Dec 2024