false000000743100000074312025-03-102025-03-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 10, 2025

ARMSTRONG WORLD INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Pennsylvania |

|

1-2116 |

|

23-0366390 |

(State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

2500 Columbia Avenue P.O. Box 3001 Lancaster, Pennsylvania |

|

17603 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (717) 397-0611

NA

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $0.01 par value per share |

|

AWI |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Section 7 – Regulation FD

Item 7.01 Regulation FD Disclosure.

On March 10, 2025, Armstrong World Industries, Inc. (the "Company") posted an updated Investor Presentation to its website in anticipation of upcoming investor meetings. The Investor Presentation may be accessed through the “Investors” section of the Company’s website, www.armstrongceilings.com. A copy of the Investor Presentation is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished herewith and shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Act, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

ARMSTRONG WORLD INDUSTRIES, INC. |

|

|

By: |

|

/s/ Austin K. So |

|

|

Austin K. So |

|

|

SVP General Counsel, Head of Government Relations & Chief Sustainability Officer |

Date: March 10, 2025

Armstrong World Industries�Investor Presentation March 2025 Exhibit 99.1

Safe Harbor Statement Disclosures in this presentation contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation, those relating to future financial and operational results, market and broader economic conditions and guidance. Those statements provide our future expectations or forecasts and can be identified by our use of words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “outlook,” “target,” “predict,” “may,” “will,” “would,” “could,” “should,” “seek,” and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance or results, including full year guidance. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. As a result, our actual results may differ materially from our expected results and from those expressed in our forward-looking statements. A more detailed discussion of the risks and uncertainties that could cause our actual results to differ materially from those projected, anticipated or implied is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of our reports on Form 10-K and Form 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”), including our Annual Report on Form 10-K for the period ended December 31, 2024. Forward-looking statements speak only as of the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law. In addition, we will be referring to non-Generally Accepted Accounting Principles in the United States (“GAAP”) financial measures within the meaning of SEC Regulation G. A reconciliation of the differences between these measures with the most directly comparable financial measures calculated in accordance �with GAAP is included within this presentation and available on the Investor Relations page of our website at www.armstrongceilings.com. The full year guidance in this presentation is effective only as of the date it was given, February 25, 2025, and will not be updated or affirmed unless and until we publicly announce updated or affirmed guidance.

Basis of Presentation Explanation Results throughout this presentation are presented on a normalized basis. We remove the impact of certain discrete expenses and income in certain measures including adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”), adjusted diluted earnings per share (“EPS”) and adjusted free cash flow. The Company excludes certain acquisition related expenses (i.e. – impact of adjustments related to the fair value of inventory, contingent third-party professional fees, changes in the fair value of contingent consideration and deferred compensation accruals1 for acquisitions). The Company also excludes all acquisition-related intangible amortization from adjusted net earnings and in calculations of adjusted diluted EPS. Examples of other excluded items have included plant closures, restructuring charges and related costs, impairments, separation costs and other cost reduction initiatives, environmental site expenses and environmental insurance recoveries, endowment level charitable contributions, the impact of defined benefit plan settlements, gains and losses on sales or impairment of fixed assets, and certain other gains and losses. The Company also excludes income/expense from its U.S. Retirement Income Plan (“RIP”) in the non-GAAP results as it represents the actuarial net periodic benefit credit/cost recorded. For all periods presented, the Company was not required to and did not make cash contributions to the RIP based on guidelines established by the Pension Benefit Guaranty Corporation, nor does the Company expect to make cash contributions to the plan in 2025. Adjusted free cash flow is defined as cash from operating and investing activities, adjusted to remove the impact of cash used or proceeds received for acquisitions and divestitures, environmental site expenses and environmental insurance recoveries. Management's adjusted free cash flow measure includes returns of investment from WAVE and cash proceeds received from the settlement of company-owned life insurance policies, which are presented within investing activities on our consolidated statement of cash flows. Investors should not consider non-GAAP measures as a substitute for GAAP measures. Excluding adjusted diluted EPS, non-GAAP figures are rounded to the nearest million and corresponding percentages are based on unrounded figures. Operating Segments: “MF”: Mineral Fiber, “AS”: Architectural Specialties, “UC”: Unallocated Corporate All dollar figures throughout the presentation are in $ millions, except per share data, and all comparisons are versus the applicable prior-year period unless otherwise noted. Figures may not sum due to rounding. 1. The deferred compensation accruals were for cash and stock awards that are recorded over each awards’ respective vesting period, as such payments were subject to the sellers’ and employees’ continued employment with the Company.

Armstrong World Industries, Inc. An Americas leader in the design and manufacturing of innovative interior & exterior architectural applications including ceilings, specialty walls and exterior metal solutions FULL YEAR 2024 CONSOLIDATED RESULTS1 $1,446M Net Sales $6.31 ADJUSTED DILUTED EPS* $298M ADJUSTED FREE CASH FLOW* $486M ADJUSTED EBITDA* EDUCATION 30% TRANSPORTATION 10% OFFICE 30% RETAIL 10% HEALTHCARE 20% *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. | **Based on internal company estimates. | 1. Includes impacts from Unallocated Corporate segment. | 2. Excluding 7 WAVE facilities. NYSE AWI Net sales $986M Adj. EBITDA* $406M Mineral Fiber Joint Venture Net sales $460M Adj. EBITDA* $82M Architectural Specialties Headquartered in Lancaster, PA For more than 160 years, �we have built our business on trust and integrity ~3,600 Employees 20 Operating�Facilities2 Key Verticals and contribution to AWI Net Sales**

The Armstrong Purpose Making a positive difference in the spaces where we… LIVE WORK LEARN HEAL PLAY It matters to us, and it matters to our stakeholders

Our workforce will be safe, diverse, inclusive and fulfilled, and we will actively contribute to our local communities. Our electricity will be either directly or indirectly sourced through renewable energy, and we will reduce carbon, GHG waste and water impacts of our products and solutions. We are committed to responsible sourcing and to providing transparency in our products. In addition, we will design our products to minimize waste and pollution, support circularity and contribute to the regeneration of natural systems. Three Pillars guide our sustainability program, each with their own ambitions.�We aim to lead a transformation in the design and building of spaces so that occupants, owners, operators and communities can thrive. Our Approach AWI Sustainability Website Additional Resources: 2024 Sustainability Report Healthy and �Circular Products Healthy Planet Thriving People �and Communities Sustainability is Integral to Our Success

Creating a Differentiated and Focused Building Products Company 1. AWI Net Sales represents AWI on a Continuing Operations (Americas, ceilings and walls only) basis. 2013 2016 2021 2024 Added digital capabilities to better serve our customers Sold International business to focus�on the Americas Began expanding�AS portfolio with acquisitions Separated from flooring company to focus on ceilings and walls 9%�CAGR 6%�CAGR 2%�CAGR AWI Net Sales1 Pre-Spin Launched innovative energy saving ceilings Completed 12 AS acquisitions since 2017

Unique company in an attractive industry Complementary, high performing segments Strong financial returns Consistent & focused growth strategy Value Creation for Shareholders Why Invest in AWI?

Unique company in an attractive industry Complementary, high performing segments Strong financial returns Consistent & focused growth strategy Value Creation for Shareholders Why Invest in AWI?

Strong and trusted brand Broadest, most innovative product portfolio Specification excellence through deep and long-standing relationships with architects and designers Large manufacturing scale with strong exclusive �distribution partners Operational excellence supporting best-in-class �service and quality A culture that fosters empowerment, innovation, �teamwork and execution across functional areas Consolidated industry structure with exposure �to diverse end markets Large Mineral Fiber installed base (est. at ~39 Billion ft2)* generates stable and repeating repair & remodel demand Highly specified, high-value products with few cost-effective substitutes Customers demonstrate brand loyalty;�rewarding performance, service and innovation Ceilings are an integral part of evolving solutions to meet increasing demand for total indoor environmental quality Ceiling and wall solutions matter in designing high-performing spaces Uniquely Positioned to Win in an Attractive Category *Based on internal company estimates. Attractive Category Ceilings and wall category has distinctive attributes in the building products industry Why We Win As the industry leader, AWI is advantageously positioned to win within this category

Diverse End Markets Drive Stability Throughout Cycles *12-to-24-month outlook based on internal company estimates and Dodge data and analytics. | **Based on internal company estimates. | 1. According to the Federal Aviation Administration. Retail Slightly Negative Lingering headwinds from online shopping balanced by population shifts to suburbs and multi-use in urban areas. Transportation Positive Funding infusion from Infrastructure Investment and Jobs Act totaling�$15 billion1 for airports through 2026. Healthcare Slightly Positive Continued growth in hospitals and urgent care centers driven�by demographic shifts Office Slightly Negative Vacancy rates in certain large metros and lingering economic uncertainty limiting discretionary spend; data center growth providing partial offset. Education Positive Healthy state & local government funding partially offset by demographic trends. R&D laboratory growth continues. % AWI Sales by Vertical** Outlook* Market Insights End Market Vertical Outlook*

Unique company in an attractive industry Complementary, high performing segments Strong financial returns Consistent & focused growth strategy Value Creation for Shareholders Why Invest in AWI?

Complementary Segments With Strong Profitability *Non-GAAP Measure. Reconciliations provided in the appendix of this presentation. | 1. CAGR represents 2019 to 2024 results. | 2. Based on internal company estimates. Mineral Fiber (MF) Segment Consistent AUV growth supported by innovation Targeted manufacturing productivity of ~3% annually Diverse verticals and project types lessen cyclicality Equity earnings contribution from WAVE Key Attributes Leveraged to major renovation and new construction High design, custom projects for statement spaces Lower capital requirements Strong growth and margin expansion opportunities Key Attributes $986M 2024 Net Sales 41% 2024 Adj. EBITDA Margin* 4% 5-Year Net Sales CAGR1 Architectural Specialties (AS) Segment Net Sales by�Project Type2 35% Major Reno 35% Repair and Remodel 30% New 50% Major Reno 50% New Net Sales by�Project Type2 $460M 2024 Net Sales 18% 2024 Adj. EBITDA Margin* 17% 5-Year Net Sales CAGR1

WAVE leverages the strengths and expertise of both parent companies Successful Joint Venture Creates Important Competitive Advantage Go to market expertise Steel procurement and supply chain management expertise Established in 1992 — 50/50�joint venture North American market leader�in ceiling suspension system (grid)�and integrated solutions Innovation mindset Nearly $500 million in sales in 2024 Over $750 million of cash �dividends to AWI since 2017 7 U.S. plants ~450 employees

Together Our Segments Enable the AWI Total Customer Experience AWI is uniquely positioned to efficiently deliver a broad range of innovative, highly-specified solutions to our customers Mineral�Fiber Architectural�Specialties Specification�Leadership Broadest Portfolio �of Products Brand Strength Operational�Excellence Best-in-Class Distribution Total Customer Experience

AWI is the Supplier of Choice for Large, Complex Projects Adobe North Tower, San Jose, CA Products Specified 2023 CISCA Award Winner Check out the full project here! AS: MetalWorks™ Custom Blades AS: Arktura® Vapor® Cluster AS: Turf® Custom Grid AS: Arktura® Vapor® Frequency AS: Tectum® AS: WoodWorks® MF: DesignFlex® WAVE: Axiom® MF: AirAssure®

Unique company in an attractive industry Complementary, high performing segments Strong financial returns Consistent & focused growth strategy Value Creation for Shareholders Why Invest in AWI?

Consistent and Focused Strategy That Drives Value for Stakeholders Market-driven�product innovation Acquisitions to build greater market opportunity Enhances our competitive advantage Expands volume and AUV growth potential Creates shareholder value GROWTH STRATEGY EXPECTED OUTCOMES Customer-centric growth initiatives Strengthens our financial returns

New Products and Features Consistently Rewarded by the Market 1. Product Vitality Index represents the percent of total sales from products introduced in the last 5 years. Pre-Spin and Post-Spin refers to the separation from Armstrong Flooring, Inc., completed on April 1, 2016. 2. US and Canada Mineral Fiber Commercial only. Innovation focused on emerging market needs Demonstrated Innovation Focus Proven Ability to Consistently Deliver AUV Growth Product Vitality Index1 Mineral Fiber AUV (Average Unit Value)2 Key Innovation Attributes Pre-Spin Post-Spin Aesthetics Acoustics Fire Safety Labor Efficiency Sustainability 34% 16% 5%�CAGR

Next Innovation Focus: Reducing Energy Use�and Carbon in the Built Environment 1. Cooling energy savings according to research estimates measured in lab tests. Results may vary. | 2. Reduction in cradle-to-gate stages (A1-A3) impacts compared to standard Ultima® Panels. Carbon Impact�Case Studies University of�Maryland Medical Center New Hampshire�High School Recent�Product Launches Ultima® Low Embodied Carbon (LEC) Ceiling Panels Offers 43% reduction2 in embodied carbon using sustainably sourced, wood-generated biochar that sequesters carbon resulting�in a lower global warming potential. Templok® Energy Saving�Ceiling Panels Improves thermal comfort, reduces heating and cooling needs,�and contributes to a more efficient HVAC operation, resulting in a more sustainable, resilient space. Solutions Aligned�With Market Needs Deliver Energy Savings Reduce building HVAC costs�and energy consumption�by as much as 15%1 Achieve�Sustainability Goals Reduce embodied and operational carbon emissions for building owners and operators Enable LEED® Credits Contributes to decarbonization- focused credits in multiple areas

Sustainable, Energy Efficient Buildings Description Digital platform�to deliver�end-to-end ceiling solutions, accessing untouched demand Automated design service to deepen customer relationships, strengthen specifications & lower construction costs Focus on energy saving products, construction efficiency, circularity and IEQ (indoor environmental quality)… a secular tailwind for renovation Key stakeholders Facility managers,�small business owners, DIY Designers, architects, contractors, owners Building owners and occupants, designers, architects,�energy service companies GROWTH IMPACT Volume Repair and Remodel New and Major Reno New, Major Reno,�Repair and Remodel AUV Medium High High Strategic Initiatives Support Volume and AUV Growth *Based on internal company estimates. Large Installed Base Provides Sizable Opportunity to Influence Demand Annual Market New Construction* Annual Market Major Reno and Repair and Remodel Volume* STRATEGIC GROWTH INITIATIVES ~39 Billion*�ft2 of�installed base

Driving Profitable AS Topline Growth Through �both Acquisitions and Market Penetration 22 Acquisitions AWI’s scale and focus drive synergies to enhance profitability and create value EBITDA multiples: ~9x pre-synergy ~7x post-synergy1 AS Segment Net Sales 21% CAGR 2023 and 2024 acquisition post-synergies are based on future expected results.

Recent Acquisitions1 Expand Our Product Portfolio and Capabilities At-a-Glance Leader in the design, fabrication and engineering of highly crafted exterior architectural metal solutions ~160 employees $45M+ sales in 2024 2 production facilities At-a-Glance A design-driven category leader in translucent finishings ~390 employees 2 production facilities $90M+ sales in 2024 23 1. Armstrong completed the acquisition of 3form, LLC (“3form”) in April 2024 and the acquisition of A. Zahner Company (“Zahner”) in December 2024.

Advancing External Metal Capabilities to Unlock an Additional�$1B Architectural Specialties Market Opportunity “TAM”: Total Addressable Market. Based on internal company estimates. Today… Looking forward… ~$1.5B�TAM1 Interior Applications Primarily interior metal, wood, felt, glass reinforced gypsum and translucents $2.5B+ TAM1 Interior Applications Exterior Metal 2023 July 2024 December

Unique company in an attractive industry Complementary, high performing segments Strong financial returns Consistent & focused growth strategy Value Creation for Shareholders Why Invest in AWI?

^ Resilient Business Model Creates Value for Shareholders *Non-GAAP measure. See appendix for reconciliation to the nearest GAAP measure. Delivering exceptional results despite a tough macro environment Net Sales ($M) Adjusted EBITDA* ($M) Adj Free Cash Flow* ($M) Adjusted Diluted EPS* 9% 3 Year CAGR 13% 3 Year CAGR 16% 3 Year CAGR 9% 3 Year CAGR $1,107 $1,446

Strong Cash Flow Profile Supports All Capital Allocation Priorities Adj. Free Cash Flow* Adj. Free Cash Flow Conversion*1 ~$1B of Adj. Free Cash Flow*�generated since 2021 Balanced Approach To Capital Allocation Capital Allocation Priorities Share Repurchases Acquisitions2 CapEx Cash Dividends $202 $287 $279 Reinvesting into �the business 1 Strategic acquisitions & partnerships 2 Returning cash�to shareholders 3 ($M) *Non-GAAP measure. See appendix for reconciliation to the nearest GAAP measure. | 1. Adj. Free Cash Flow Conversion represents Adjusted Free Cash Flow as a percentage of Adjusted EBITDA. 2. Reflects cash paid for acquisitions, net of or inclusive of cash acquired, recorded as a component of cash (used for) provided by investing activities. 2023 excludes the acquisition of software-related intellectual property. $312

Creating Value for Shareholders 1. The performance shown in the chart assumes $100 invested on December 31, 2022 through December 31, 2024, with dividends reinvested, and it should not be considered indicative of future performance. Unique company�in an attractive industry Complementary,�high performing segments Consistent & focused growth strategy Strong financial returns AWI Investor Value Proposition AWI vs S&P 500 and Russell 2000 AWI Russell 2000 S&P 500

Expecting strong sales and earnings growth Issuing Full Year 2025 Guidance Commentary1 Net Sales Adj. Diluted EPS* Adj. EBITDA* Adj. Free Cash Flow* $1,570M to $1,610M 9% to 11% YoY *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. Additional assumptions available in the appendix of this presentation. $525M to $545M 8% to 12% YoY $315M to $335M 6% to 12% YoY $6.85 to $7.15 9% to 13% YoY Choppy market outlook … expecting flattish Mineral Fiber volume Expect Mineral Fiber AUV growth above historical average … delivering Adj. EBITDA margin* expansion WAVE equity earnings to grow mid-single digits Recent acquisitions of 3form and Zahner add incremental sales and Adj. EBITDA* to Architectural Specialties

Appendix

Full Year 2025 Assumptions Segment Net Sales Adjusted EBITDA Margin* Mineral Fiber ~5% to ~6% growth ~ 42% Architectural Specialties ~20% growth ~ 18% Consolidated Metrics Full Year 2025 Capital expenditures $90M to $100M Depreciation and amortization $115M to $120M Interest expense $34M to $37M Book / cash tax rate ~25% / ~25% Shares outstanding ~43 to 44M Cash return of investment from joint venture $108M to $116M Shipping Days vs Prior Year 2024 2025 Q1 - (1) Q2 - - Q3 +1 - Q4 +1 - Full Year +2 (1) 31 *Non-GAAP measure.

2021 – 2024 Adjusted EBITDA Reconciliation For the Twelve Months Ended December 31, 2021 2022 2023 2024 Net Sales $1,107 $1,233 $1,295 $1,446 Net earnings $183 $203 $224 $265 Less: Net (loss) earnings from discontinued operations (2) 3 - - Earnings from continuing operations $185 $200 $224 $265 Add: Income tax expense, as reported 57 58 75 82 Earnings from continuing operations before tax $243 $258 $298 $347 Add: Interest/other income and expense, net 17 21 25 27 Operating income $260 $279 $324 $374 Add: RIP expense1 5 4 3 2 Add: Cost reduction initiatives and other - - 3 - Add: Net environmental expenses - - - 2 Add: Acquisition-related impacts2 10 19 11 4 Add: Loss on sales of fixed assets, net3 - - - 1 Adjusted operating income $275 $301 $340 $383 Add: Depreciation and amortization 97 84 89 103 Adjusted EBITDA $372 $385 $430 $486 Operating income margin (Operating income % of net sales) 23.5% 22.6% 25.0% 25.9% Adjusted EBITDA margin (Adj. EBITDA % of net sales) 33.6% 31.2% 33.2% 33.6% RIP expense represents only the plan service cost that is recorded within Operating income. For all periods presented, we were not required to and did not make cash contributions to our RIP. Represents the impact of acquisition-related adjustments for the fair value of inventory, contingent third-party professional fees, changes in fair value of contingent consideration, deferred compensation and restricted stock expenses. Includes the impact of a loss on sale of an undeveloped parcel of land adjacent to our corporate headquarters, partially offset by a gain on sale of our idled Mineral Fiber plant in St. Helens, Oregon.

2021 – 2024 Adjusted Diluted Earnings per Share Reconciliation For the Twelve Months Ended December 31, For the Twelve Months Ended December 31, 2021 2022 2023 2024 Earnings from continuing operations $185 $200 $224 $265 Add: Income tax expense, as reported 57 58 75 82 Earnings from continuing operations before income taxes $243 $258 $298 $347 (Less): RIP (credit) expense1 - (1) (1) (1) Add: Net environmental expenses - - - 2 Add: Cost reduction initiatives and other - - 3 - Add: Acquisition-related impacts2 10 19 11 4 Add: Acquisition-related amortization3 21 8 6 11 Add: Loss on sales of fixed assets, net4 - - - 1 Adjusted earnings from continuing operations before income taxes $274 $283 $318 $364 (Less): Adjusted income tax expense5 (65) (63) (79) (86) Adjusted earnings from continuing operations $209 $220 $238 $277 Diluted Shares Outstanding 47.9 46.4 44.8 44.0 Tax Rate6 24% 22% 25% 24% Diluted earnings (loss) per share from continuing operations $3.86 $4.30 $4.99 $6.02 Adjusted Diluted Earnings per share from continuing operations $4.36 $4.74 $5.32 $6.31 RIP (credit) expense represents the entire actuarial net periodic pension (credit) recorded as a component of earnings from continuing operations. For all periods presented, we were not required to and did not make cash contributions to our RIP. Represents the impact of acquisition-related adjustments for the fair value of inventory, contingent third-party professional fees, changes in fair value of contingent consideration, deferred compensation and restricted stock expenses. Represents acquisition-related intangible amortization, including customer relationships, developed technology, software, trademarks and brand names, non-compete agreements and other intangibles. Includes the impact of a loss on sale of an undeveloped parcel of land adjacent to our corporate headquarters, partially offset by a gain on sale of our idled Mineral Fiber plant in St. Helens, Oregon. Adjusted income tax expense is calculated using the tax rate multiplied by the adjusted earnings from continuing operations before income taxes. All years presented reflect the effective tax rate as reported.

2021 – 2024 Adjusted Free Cash Flow Reconciliation . Year Ended December 31, For the Three Months Ended March 31: 2021 2022 2023 2024 Net cash provided by operating activities $187 $182 $234 $267 Net cash (used for) provided by investing activities ($14) $28 ($10) ($79) Net cash provided by operating and investing activities $173 $211 $223 $188 Add: Acquisitions, net 1 3 27 129 Add: Payments related to the sale of international, net1 12 - - - (Less)/Add: Net environmental (recoveries) expenses (1) 1 1 - Add: Arktura deferred compensation2 5 5 8 6 Add: Contingent consideration in excess of acquisition-date fair value3 - 2 5 - (Less): Proceeds from sales of facilities4 - - - (24) Adjusted Free Cash Flow $190 $221 $263 $298 Net cash provided by operating & investing activities % of net sales 15.7% 17.1% 17.2% 13.0% Adjusted Free Cash Flow as a % of net sales 17.2% 17.9% 20.3% 20.6% Adjusted Free Cash Flow as a % of Adjusted EBITDA 51% 57% 61% 61% 1. Includes related income tax payments. 2. Contingent compensation payments related to the acquisition of Turf Design, Inc. 3. Contingent compensation payments related to 2020 acquisitions recorded as a component of net cash provided by operating activities. 4. Proceeds related to the sale of Architectural Specialties design center, our idled Mineral Fiber plant in St. Helens, Oregon and undeveloped land adjacent to our corporate headquarters.

2024 Segment Adjusted EBITDA Reconciliation RIP expense represents only the plan service cost related to the RIP that is recorded within Operating Income. For all periods presented, we were not required to and did not make cash contributions to our RIP. Represents the impact of acquisition-related adjustments for the fair value of acquired inventory and changes in fair value of contingent consideration. Includes the impact of a loss on sale of an undeveloped parcel of land adjacent to our corporate headquarters, partially offset by a gain on sale of our idled Mineral Fiber plant in St. Helens, Oregon. Year Ended December 31, MF AS UC 2024 2024 2024 Net sales $986 $460 - Operating income (loss) $323 $55 ($4) Add: RIP expense1 - - 2 Add: Acquisition-related impacts2 - 3 - Add: Loss on sales of fixed assets, net3 1 - - Add: Net environmental expenses 2 - - Adjusted operating income (loss) $325 $59 ($1) Add: Depreciation and amortization 80 23 - Adjusted EBITDA $406 $82 ($1) Operating income margin (Operating income % of net sales) 32.7% 12.0% NM Adjusted EBITDA margin (Adj. EBITDA % of net sales) 41.2% 17.8% NM

Full Year 2025 Low High Net earnings $293 $297 Add: Income tax expense 96 102 Earnings before income taxes $389 $399 Add: Interest expense 34 37 Add: Other non-operating (income), net (14) (13) Operating income $409 $423 Add: RIP expense1 1 2 Adjusted operating income $410 $425 Add: Depreciation and amortization 115 120 Adjusted EBITDA $525 $545 RIP expense represents only the plan service cost that is recorded within Operating income. We do not expect to make cash contributions to our RIP. RIP (credit) represents the entire actuarial net periodic pension (credit) recorded as a component of net earnings. We do not expect to make any cash contributions to our RIP. Represents acquisition-related intangible amortization, including customer relationships, developed technology, software, trademarks and brand names, non-compete agreements, trade secrets and other intangibles. Adjusted income tax expense is based on an adjusted effective tax rate of approximately 25%, multiplied by adjusted earnings before income taxes. Adjusted diluted EPS guidance for 2025 is calculated based on approximately 43 to 44 million of diluted shares outstanding. 2025 Adj. EBITDA Guidance Reconciliation 36 Full Year 2025 Low High Net earnings $293 $297 Add: Income tax expense 96 102 Earnings before income taxes $389 $399 Add: RIP (credit)2 (1) (1) Add: Acquisition-related amortization3 13 15 Adjusted earnings before income taxes $401 $413 (Less): Adjusted income tax expense4 (101) (102) Adjusted net earnings $299 $311 Diluted net earnings per share $6.72 $6.84 Adjusted diluted net earnings per share5 $6.85 $7.15 2025 Adj. Diluted EPS Guidance Reconciliation Full Year 2025 Low High Net cash provided by operating activities $297 $319 Add: Return of investment from joint venture 108 116 (Less): Capital expenditures (90) (100) Adjusted Free Cash Flow $315 $335 2025 Adj. Free Cash Flow Guidance Reconciliation

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

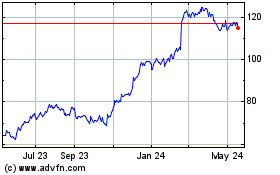

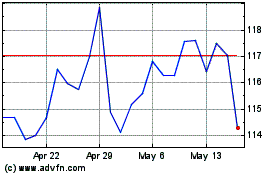

Armstrong World Industries (NYSE:AWI)

Historical Stock Chart

From Feb 2025 to Mar 2025

Armstrong World Industries (NYSE:AWI)

Historical Stock Chart

From Mar 2024 to Mar 2025