false

0001113809

0001113809

2024-05-30

2024-05-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 30, 2024

Build-A-Bear Workshop, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

|

001-32320

|

|

43-1883836

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

415 South 18th St., St. Louis, Missouri

|

|

63103

|

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(314) 423-8000

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

BBW

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On May 30, 2024, Build-A-Bear Workshop, Inc. (the “Company”) issued a press release setting forth results for the Company’s 2024 first fiscal quarter ended May 4, 2024. A copy of the Company’s press release is being furnished as Exhibit 99.1 and hereby incorporated by reference.

* * * * *

The Company reports its financial results in accordance with generally accepted accounting principles (“GAAP”). In the press release furnished as Exhibit 99.1 hereto, the Company has supplemented the reporting of its financial information determined in accordance with GAAP with certain non-GAAP financial measures. These results are included as a complement to results provided in accordance with GAAP because management believes these non-GAAP financial measures help identify underlying trends in the Company’s business and provide useful information to both management and investors by excluding certain items that may not be indicative of the Company’s core operating results. These measures should not be considered as a substitute for or superior to GAAP results.

The information furnished in, contained, or incorporated by reference into Item 2.02 above, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 (the “Securities Act”), as amended, or the Exchange Act, regardless of any general incorporation language in such filing. In addition, this report (including Exhibit 99.1) shall not be deemed an admission as to the materiality of any information contained herein that is required to be disclosed solely as a requirement of Item 2.02.

This Current Report on Form 8-K and the press release attached hereto as Exhibit 99.1 contain certain statements that may be deemed to be “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements in this report and in such exhibit not dealing with historical results are forward-looking and are based on various assumptions. The forward-looking statements in this report and in such exhibit are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in or implied by the statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, among other things: statements regarding the Company’s goals, intentions, and expectations; business plans and growth strategies; estimates of the Company’s risks and future costs and benefits; forecasted demographic and economic trends relating to the Company’s industry; and other risk factors referred to from time to time in filings made by the Company with the Securities and Exchange Commission. Forward-looking statements speak only as to the date they are made. The Company does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made. The Company disclaims any intent or obligation to update these forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit

Number

|

Description of Exhibit

|

| |

|

|

99.1

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BUILD-A-BEAR WORKSHOP, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: May 30, 2024

|

By:

|

/s/ Voin Todorovic

|

|

|

|

Name:

|

Voin Todorovic

|

|

|

|

Title:

|

Chief Financial Officer

|

|

Exhibit 99.1

BUILD-A-BEAR WORKSHOP REPORTS FIRST QUARTER FISCAL 2024 RESULTS

ST. LOUIS, MO (May 30, 2024) – Build-A-Bear Workshop, Inc. (NYSE: BBW) today announced results for the first quarter of fiscal year 2024 ended May 4, 2024.

| |

●

|

First quarter revenues were $114.7 million, a decrease of 4.4%, pre-tax income was $15.0 million, a decrease of 22.3%, and diluted earnings per share was $0.82, a decrease of 16.3%

|

| |

●

|

The Company reiterates its fiscal 2024 guidance with expectations for growth in total revenues and pre-tax income, as well as net new unit growth of at least 50 experience locations globally

|

| |

●

|

For first quarter 2024, the Company returned $12.1 million to shareholders in the form of share repurchases and a quarterly dividend

|

“Although first quarter results were slightly below internal expectations due to some continued web demand challenges and a weaker spending environment, we remain confident in our annual guidance,” commented Sharon Price John, President and Chief Executive Officer of Build-A-Bear Workshop. “As we continue to execute on our strategic initiatives to leverage the power of the Build-A-Bear brand, we expect to see positive momentum as the year progresses across a number of fronts. These include our omni-channel integration and new global experience locations across our corporately-operated, partner-operated, and franchise store models, such as recently opened partner locations in Italy, Colombia, and France.” Ms. John continued, “We also recently launched a new brand campaign, 'The Stuff You Love,' to commemorate more than a quarter-century of creating and celebrating cherished memories worldwide, with a user-generated-content contest for consumers to share their own special moments.”

Voin Todorovic, Chief Financial Officer of Build-A-Bear Workshop added, “As previously shared, we had planned first quarter to have unfavorable expense timing, and while results were lower than expected, the quarter was significantly more profitable than any pre-Covid first quarter since our IPO, demonstrating the sustainability of our transformed business model. In conjunction with Build-A-Bear’s strong cash flow generation, and our confidence in the company's continued financial performance, we have returned nearly $30 million to shareholders in the form of share repurchases and a quarterly dividend over the past twelve months, inclusive of $12 million in the first quarter."

First Quarter Fiscal 2024 Results

(13 weeks ended May 4, 2024, compared to the 13 weeks ended April 29, 2023)

|

●

|

Total revenues were $114.7 million and decreased 4.4%

|

| |

o

|

Net retail sales were $107.9 million and decreased 3.8%

|

| |

o

|

Consolidated e-commerce demand (online orders fulfilled from either the Company’s warehouse or its stores) decreased 11.3%

|

| |

o

|

Commercial and international franchise revenues were a combined $6.9 million and decreased 13.7%

|

|

●

|

Pre-tax income was $15.0 million, or 13.1% of total revenues, a decrease of 300 basis points, driven by a 350-basis point increase in Selling, General and Administrative (“SG&A”) expense, mainly from higher wage rates, expense timing, and general inflationary pressures, partially offset by an increase in interest income and gross margin expansion.

|

|

●

|

Diluted earnings per share (“EPS”) was $0.82, a decline of 16.3%, reflecting lower pretax income, partially offset by a lower tax rate, as well as a reduction in share count.

|

|

●

|

Earnings before interest, taxes, depreciation and amortization (“EBITDA”) was $18.3 million, a decline of 18.3%, and represented 15.9% of total revenues.

|

Store Activity

For the quarter, the company had net new unit growth of six global experience locations, comprised of five partner-operated locations and three franchise locations, less the net closure of two corporately-managed locations. At the end of the first quarter, Build-A-Bear had 531 global locations through a combination of its corporately-managed, partner-operated, and franchise models. Globally, this reflects 357 corporately-managed stores, 97 partner-operated stores, and 77 franchise stores.

Balance Sheet

At first quarter end, cash and cash equivalents totaled $38.2 million, an increase of $5.4 million, or 16.5%, compared to $32.8 million at first quarter-end last year. The Company finished the quarter with no borrowings under its revolving credit facility.

For the first quarter, capital expenditures totaled $2.4 million.

Inventory at quarter end was $64.0 million, reflecting a decline of $2.5 million, or 3.7% compared to first quarter-end last year. The Company remains comfortable with the level and composition of its inventory.

Return of Capital to Shareholders

For the first quarter, the Company utilized $9.2 million in cash to repurchase 343,406 shares of its common stock and paid a $2.9 million quarterly cash dividend to shareholders.

Since first quarter-end through May 29, the Company utilized $2.0 million in cash to repurchase an additional 66,476 shares of its common stock, with $15.0 million remaining under the Board authorized $50.0 million stock repurchase program adopted on August 31, 2022.

2024 Outlook

The Company reaffirms its fiscal 2024 outlook with expectations of delivering growth in total revenues and pre-tax income compared to our 53-week fiscal 2023:

| |

●

|

Total revenue growth on a low-to-mid-single-digit percentage basis

|

| |

●

|

Pre-tax income growth on a low-single-digit percentage basis

|

For comparative purposes, the company notes that the additional week in fiscal 2023 was approximately $7 million in total revenues with an estimated 35% flow-through to EBITDA.

For fiscal 2024, as compared to the 2023 non-GAAP 52-week year, the Company expects:

| |

●

|

Total revenue growth on a mid-single-digit percentage basis

|

| |

●

|

Pre-tax income growth on a mid-single-digit percentage basis

|

In addition, for fiscal 2024, the Company currently expects:

| |

●

|

Net new unit growth of at least 50 experience locations, through a combination of corporately-managed, partner-operated, and franchised business models

|

| |

●

|

Capital expenditures in the range of $18 million to $20 million

|

| |

●

|

Depreciation and amortization in the range of $15 million to $16 million

|

| |

●

|

Tax rate to approximate 26%, excluding discrete items

|

The Company’s guidance considers a variety of factors including anticipated ongoing inflationary pressures and increased freight costs. Additionally, the Company’s outlook assumes no further material changes in the macroeconomic or geopolitical environment, or relevant foreign currency exchange rates.

Note Regarding Non-GAAP Financial Measures

In this press release, the Company’s financial results are provided both in accordance with generally accepted accounting principles (GAAP) and using certain non-GAAP financial measures. In particular, the Company provides historic income adjusted to exclude certain costs, which are non-GAAP financial measures. These results are included as a complement to results provided in accordance with GAAP because management believes these non-GAAP financial measures help identify underlying trends in the Company’s business and provide useful information to both management and investors by excluding certain items that may not be indicative of the Company’s core operating results. These measures should not be considered a substitute for or superior to GAAP results. These non-GAAP financial measures are defined and reconciled to the most comparable GAAP measure later in this document.

Webcast and Conference Call Information

At 9:00 AM ET today, Build-A-Bear Workshop will host a conference call with investors and financial analysts to discuss its financial results. The conference call will be webcast on Build-Bear’s Investor Relations website, https://ir.buildabear.com.

The dial-in number for the live conference call is (877) 407-3982 or (201) 493-6780 for international callers. The access code is Build-A-Bear. The call is expected to conclude by 10 AM ET.

A replay of the conference call webcast will be available in the investor relations website for one year. A telephone replay will be available beginning at approximately 1:00 PM ET today until 11:59 PM ET on June 6, 2024. The telephone replay is available by calling (412) 317-6671 (toll/international) or (844) 512-2921 (toll free). The access code is 13745995.

About Build-A-Bear

Since its beginning in 1997, Build-A-Bear has evolved to become a beloved multi-generational brand focused on its mission to “add a little more heart to life” where guests of all ages make their own “furry friends” in celebration and commemoration of life moments. Guests create their own stuffed animals by participating in the stuffing, dressing, accessorizing, and naming of their own teddy bears and other plush toys based on the Company’s own intellectual property and in conjunction with a variety of best-in-class licenses. The hands-on and interactive nature of our more than 500 company-owned, partner-operated and franchise experience locations around the world, combined with Build-A-Bear’s pop-culture appeal, often fosters a lasting and emotional brand connection with consumers, and has enabled the Company to expand beyond its retail stores to include e-commerce sales on www.buildabear.com and non-plush branded consumer categories via out-bound licensing agreements with leading manufacturers, as well as the creation of engaging content via Build-A-Bear Entertainment (a subsidiary of Build-A-Bear Workshop, Inc.). Build-A-Bear Workshop, Inc. (NYSE: BBW) posted consolidated total revenues of $486.1 million for fiscal 2023. For more information, visit the Investor Relations section of buildabear.com.

Forward-Looking Statements

This press release contains certain statements that are, or may be considered to be, “forward-looking statements” for the purpose of federal securities laws, including, but not limited to, statements that reflect our current views with respect to future events and financial performance. We generally identify these statements by words or phrases such as “may,” “might,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “intend,” “predict,” “future,” “potential” or “continue,” the negative or any derivative of these terms and other comparable terminology. All the information concerning our future liquidity, future revenues, margins and other future financial performance and results, achievement of operating of financial plans or forecasts for future periods, sources and availability of credit and liquidity, future cash flows and cash needs, success and results of strategic initiatives and other future financial performance or financial position, as well as our assumptions underlying such information, constitute forward-looking information.

These statements are based only on our current expectations and projections about future events. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by these forward-looking statements, including those factors discussed under the caption entitled “Risks Related to Our Business” and “Forward-Looking Statements” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on April 18, 2024 and other periodic reports filed with the SEC which are incorporated herein.

All our forward-looking statements are as of the date of this Press Release only. In each case, actual results may differ materially from such forward-looking information. We can give no assurance that such expectations or forward-looking statements will prove to be correct. An occurrence of or any material adverse change in one or more of the risk factors or other risks and uncertainties referred to in this Press Release or included in our other public disclosures or our other periodic reports or other documents or filings filed with or furnished to the SEC could materially and adversely affect our continuing operations and our future financial results, cash flows, available credit, prospects, and liquidity. Except as required by law, the Company does not undertake to publicly update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

All other brand names, product names, or trademarks belong to their respective holders.

Investor Relations Contact

Gary Schnierow, Vice President, Investor Relations & Corporate Finance

garys@buildabear.com

Media Relations Contact

pr@buildabear.com

###

|

BUILD-A-BEAR WORKSHOP, INC. AND SUBSIDIARIES

|

|

Unaudited Condensed Consolidated Statements of Operations

|

|

(dollars in thousands, except share and per share data)

|

| |

|

13 Weeks

|

|

|

|

|

|

|

13 Weeks

|

|

|

|

|

|

| |

|

Ended

|

|

|

|

|

|

|

Ended

|

|

|

|

|

|

| |

|

May 4,

|

|

|

% of Total

|

|

|

April 29,

|

|

|

% of Total

|

|

| |

|

2024

|

|

|

Revenues (1)

|

|

|

2023

|

|

|

Revenues (1)

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net retail sales

|

|

$ |

107,868 |

|

|

|

94.0 |

|

|

$ |

112,096 |

|

|

|

93.4 |

|

|

Commercial revenue

|

|

|

5,985 |

|

|

|

5.2 |

|

|

|

6,688 |

|

|

|

5.6 |

|

|

International franchising

|

|

|

877 |

|

|

|

0.8 |

|

|

|

1,266 |

|

|

|

1.0 |

|

|

Total revenues

|

|

|

114,730 |

|

|

|

100.0 |

|

|

|

120,050 |

|

|

|

100.0 |

|

|

Cost of merchandise sold:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of merchandise sold - retail (1)

|

|

|

49,415 |

|

|

|

45.8 |

|

|

|

50,904 |

|

|

|

45.4 |

|

|

Cost of merchandise sold - commercial (1)

|

|

|

2,533 |

|

|

|

42.3 |

|

|

|

3,358 |

|

|

|

50.2 |

|

|

Cost of merchandise sold - international franchising (1)

|

|

|

617 |

|

|

|

70.4 |

|

|

|

885 |

|

|

|

69.9 |

|

|

Total cost of merchandise sold

|

|

|

52,565 |

|

|

|

45.8 |

|

|

|

55,147 |

|

|

|

45.9 |

|

|

Consolidated gross profit

|

|

|

62,165 |

|

|

|

54.2 |

|

|

|

64,903 |

|

|

|

54.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expense

|

|

|

47,562 |

|

|

|

41.5 |

|

|

|

45,626 |

|

|

|

38.0 |

|

|

Interest (income) expense, net

|

|

|

(426 |

) |

|

|

(0.4 |

) |

|

|

(76 |

) |

|

|

(0.1 |

) |

|

Income before income taxes

|

|

|

15,029 |

|

|

|

13.1 |

|

|

|

19,353 |

|

|

|

16.1 |

|

|

Income tax expense

|

|

|

3,570 |

|

|

|

3.1 |

|

|

|

4,745 |

|

|

|

4.0 |

|

|

Net income

|

|

$ |

11,459 |

|

|

|

10.0 |

|

|

$ |

14,608 |

|

|

|

12.2 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.82 |

|

|

|

|

|

|

$ |

1.01 |

|

|

|

|

|

|

Diluted

|

|

$ |

0.82 |

|

|

|

|

|

|

$ |

0.98 |

|

|

|

|

|

|

Shares used in computing common per share amounts:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

13,925,957 |

|

|

|

|

|

|

|

14,457,858 |

|

|

|

|

|

|

Diluted

|

|

|

14,006,400 |

|

|

|

|

|

|

|

14,974,930 |

|

|

|

|

|

| |

(1)

|

Selected statement of operations data expressed as a percentage of total revenues, except cost of merchandise sold - retail, cost of merchandise sold - commercial and cost of merchandise sold - international franchising that are expressed as a percentage of net retail sales, commercial revenue and international franchising, respectively. Percentages will not total due to cost of merchandise sold being expressed as a percentage of net retail sales, commercial revenue or international franchising and immaterial rounding.

|

|

BUILD-A-BEAR WORKSHOP, INC. AND SUBSIDIARIES

|

|

Unaudited Condensed Consolidated Balance Sheets

|

|

(dollars in thousands, except per share data)

|

| |

|

May 4,

|

|

|

February 3,

|

|

|

April 29,

|

|

| |

|

2024

|

|

|

2024

|

|

|

2023

|

|

|

ASSETS

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and restricted cash

|

|

$ |

38,233 |

|

|

$ |

44,327 |

|

|

$ |

32,819 |

|

|

Inventories, net

|

|

|

64,024 |

|

|

|

63,499 |

|

|

|

66,489 |

|

|

Receivables, net

|

|

|

9,547 |

|

|

|

8,569 |

|

|

|

13,307 |

|

|

Prepaid expenses and other current assets

|

|

|

12,046 |

|

|

|

11,377 |

|

|

|

13,503 |

|

|

Total current assets

|

|

|

123,850 |

|

|

|

127,772 |

|

|

|

126,118 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating lease right-of-use asset

|

|

|

72,783 |

|

|

|

73,443 |

|

|

|

73,780 |

|

|

Property and equipment, net

|

|

|

53,897 |

|

|

|

55,262 |

|

|

|

50,385 |

|

|

Deferred tax assets

|

|

|

8,672 |

|

|

|

8,682 |

|

|

|

6,642 |

|

|

Other assets, net

|

|

|

6,074 |

|

|

|

7,166 |

|

|

|

4,785 |

|

|

Total Assets

|

|

$ |

265,276 |

|

|

$ |

272,325 |

|

|

$ |

261,710 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

14,793 |

|

|

$ |

16,170 |

|

|

$ |

13,686 |

|

|

Accrued expenses

|

|

|

19,552 |

|

|

|

19,954 |

|

|

|

27,272 |

|

|

Operating lease liability short term

|

|

|

24,276 |

|

|

|

25,961 |

|

|

|

27,843 |

|

|

Gift cards and customer deposits

|

|

|

16,620 |

|

|

|

18,134 |

|

|

|

18,637 |

|

|

Deferred revenue and other

|

|

|

3,432 |

|

|

|

3,514 |

|

|

|

5,010 |

|

|

Total current liabilities

|

|

|

78,673 |

|

|

|

83,733 |

|

|

|

92,448 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating lease liability long term

|

|

|

56,906 |

|

|

|

57,609 |

|

|

|

59,030 |

|

|

Other long-term liabilities

|

|

|

1,356 |

|

|

|

1,321 |

|

|

|

1,260 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock, par value $0.01 per share

|

|

|

139 |

|

|

|

142 |

|

|

|

149 |

|

|

Additional paid-in capital

|

|

|

64,065 |

|

|

|

66,330 |

|

|

|

70,324 |

|

|

Accumulated other comprehensive loss

|

|

|

(12,153 |

) |

|

|

(12,082 |

) |

|

|

(12,177 |

) |

|

Retained earnings

|

|

|

76,290 |

|

|

|

75,272 |

|

|

|

50,676 |

|

|

Total stockholders' equity

|

|

|

128,341 |

|

|

|

129,662 |

|

|

|

108,972 |

|

|

Total Liabilities and Stockholders' Equity

|

|

$ |

265,276 |

|

|

$ |

272,325 |

|

|

$ |

261,710 |

|

|

BUILD-A-BEAR WORKSHOP, INC. AND SUBSIDIARIES

|

|

Unaudited Selected Financial and Store Data

|

|

(dollars in thousands)

|

| |

|

13 Weeks

|

|

|

13 Weeks

|

|

| |

|

Ended

|

|

|

Ended

|

|

| |

|

May 4,

|

|

|

April 29,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

Other financial data:

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Retail gross margin ($) (1)

|

|

$ |

58,453 |

|

|

$ |

61,192 |

|

|

Retail gross margin (%) (1)

|

|

|

54.2 |

% |

|

|

54.6 |

% |

|

Capital expenditures (2)

|

|

$ |

2,430 |

|

|

$ |

3,065 |

|

|

Depreciation and amortization

|

|

$ |

3,658 |

|

|

$ |

3,080 |

|

| |

|

|

|

|

|

|

|

|

|

Store data (3):

|

|

|

|

|

|

|

|

|

|

Number of corporately-managed retail locations at end of period

|

|

|

|

|

|

|

North America

|

|

|

317 |

|

|

|

312 |

|

|

Europe

|

|

|

40 |

|

|

|

37 |

|

|

Total corporately-managed retail locations

|

|

|

357 |

|

|

|

349 |

|

| |

|

|

|

|

|

|

|

|

|

Number of franchised stores at end of period

|

|

|

77 |

|

|

|

63 |

|

| |

|

|

|

|

|

|

|

|

|

Number of third-party retail locations at end of period

|

|

|

97 |

|

|

|

70 |

|

| |

|

|

|

|

|

|

|

|

|

Corporately-managed store square footage at end of period (4)

|

|

|

|

|

|

|

North America

|

|

|

729,336 |

|

|

|

726,209 |

|

|

Europe

|

|

|

55,535 |

|

|

|

52,763 |

|

|

Total square footage

|

|

|

784,871 |

|

|

|

778,972 |

|

|

(1)

|

Retail gross margin represents net retail sales less cost of merchandise sold - retail. Retail gross margin percentage represents retail gross margin divided by net retail sales. Store impairment is excluded from retail gross margin.

|

|

(2)

|

Capital expenditures represents cash paid for property, equipment, and other assets.

|

|

(3)

|

Excludes e-commerce. North American stores are located in the United States and Canada. In Europe, stores are located in the United Kingdom and Ireland. Seasonal locations not included in store count.

|

|

(4)

|

Square footage for stores located in North America is leased square footage. Square footage for stores located in Europe is estimated selling square footage. Seasonal locations not included in the store count.

|

* Non-GAAP Financial Measures

|

BUILD-A-BEAR WORKSHOP, INC. AND SUBSIDIARIES

|

|

Reconciliation of GAAP to Non-GAAP figures

|

|

(dollars in thousands)

|

| |

|

13 Weeks

|

|

|

13 Weeks

|

|

| |

|

Ended

|

|

|

Ended

|

|

| |

|

May 4,

|

|

|

April 29,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Income before income taxes (pre-tax)

|

|

$ |

15,029 |

|

|

$ |

19,353 |

|

|

Interest (income) expense, net

|

|

|

(426 |

) |

|

|

(76 |

) |

|

Depreciation and amortization expense

|

|

|

3,658 |

|

|

|

3,080 |

|

|

Earnings before interest, taxes, depreciation and amortization (EBITDA)

|

|

$ |

18,261 |

|

|

$ |

22,357 |

|

v3.24.1.1.u2

Document And Entity Information

|

May 30, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Build-A-Bear Workshop, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 30, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-32320

|

| Entity, Tax Identification Number |

43-1883836

|

| Entity, Address, Address Line One |

415 South 18th St.

|

| Entity, Address, City or Town |

St. Louis

|

| Entity, Address, State or Province |

MO

|

| Entity, Address, Postal Zip Code |

63103

|

| City Area Code |

314

|

| Local Phone Number |

423-8000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

BBW

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001113809

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

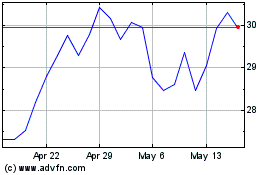

Build A Bear Workshop (NYSE:BBW)

Historical Stock Chart

From May 2024 to Jun 2024

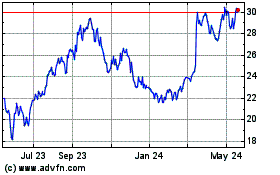

Build A Bear Workshop (NYSE:BBW)

Historical Stock Chart

From Jun 2023 to Jun 2024