Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

05 June 2024 - 7:25AM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Issuer Free Writing Prospectus dated June 4, 2024 Supplementing the Preliminary Prospectus Supplement dated June 4, 2024

Registration Statement No. 333-279084

Pricing Term Sheet

Becton, Dickinson and Company

€1,000,000,000 3.828% Notes due 2032

(the “Notes”)

|

Issuer:

|

Becton, Dickinson and Company (the “Company”)

|

| |

|

|

Aggregate Principal Amount Offered:

|

€1,000,000,000

|

| |

|

|

Maturity Date:

|

June 7, 2032

|

| |

|

|

Trade Date:

|

June 4, 2024

|

| |

|

|

Settlement Date:

|

June 7, 2024 (T+3)*

|

| |

|

|

Type of Offering:

|

SEC Registered

|

| |

|

|

Coupon (Interest Rate):

|

3.828%

|

| |

|

|

Price to Public (Issue Price):

|

100.000% of principal amount

|

| |

|

|

Underwriting Discount:

|

0.400%

|

| |

|

|

Yield to Maturity:

|

3.828%

|

| |

|

|

Spread to Benchmark German Government Security:

|

+134.5 basis points

|

| |

|

|

Benchmark German Government Security:

|

0.000% DBR due February 15, 2032

|

| |

|

|

Benchmark German Government Security Price/Yield:

|

82.800% / 2.483%

|

| |

|

|

Mid-Swap Yield:

|

2.778%

|

| |

|

|

Spread to Mid-Swap Yield:

|

+105 basis points

|

| |

|

|

Interest Payment Dates:

|

Annually, on June 7, commencing June 7, 2025.

|

| |

|

|

Day Count Convention:

|

ACTUAL/ACTUAL (ICMA)

|

|

Optional Redemption:

|

The Notes will be redeemable at the Company’s option, in whole or in part, at any time and from time to time prior to March 7, 2032 (three months prior to the maturity date), at a redemption price equal to the greater of (1) 100% of the

principal amount of the Notes to be redeemed and (2) the sum of the present values of the remaining scheduled payments on the Notes being redeemed, discounting such payments to the redemption date on an annual basis (ACTUAL/ACTUAL (ICMA)) at

the applicable comparable government bond rate, plus 25 basis points, plus, in each case, accrued and unpaid interest thereon to, but excluding, the redemption date.

At any time on or after March 7, 2032 (three months prior to the maturity date), the Notes will be redeemable at the Company’s option, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the

principal amount of the Notes to be redeemed, plus accrued and unpaid interest thereon to, but excluding, the redemption date.

|

|

Redemption for Tax Reasons:

|

If, as a result of any change in, or amendment to, the tax laws of the United States, or the official interpretation thereof, the Company becomes or, based upon a written opinion of independent counsel selected by the Company, will become

obligated to pay additional amounts with respect to the Notes, the Company may at any time at its option redeem, in whole, but not in part, the Notes at 100% of the principal amount plus accrued and unpaid interest to the date of redemption.

|

| |

|

|

Change of Control:

|

If a change of control triggering event occurs, unless the Company has exercised its right to redeem the Notes as described under “Optional Redemption,” the Company will be required to make an offer to each holder of the outstanding Notes

to repurchase all or any portion of such holder’s Notes at a purchase price of 101% of the principal amount plus accrued and unpaid interest to, but excluding, the date of purchase.

|

| |

|

|

Settlement:

|

Euroclear/Clearstream

|

| |

|

|

Listing:

|

Application will be made to have the Notes listed on the New York Stock Exchange.

|

| |

|

|

Concurrent Offering:

|

Concurrently with this offering, Becton Dickinson Euro Finance S.à r.l. (“BD Finance”), which is an indirect, wholly-owned finance subsidiary of the Company, is offering €800,000,000 aggregate principal amount of 4.029% Notes due 2036 (the

“Concurrent Offering”). The notes offered by BD Finance will be fully and unconditionally guaranteed on a senior unsecured basis by the Company. The Company may, in the near term, also consider pursuing additional capital markets

transactions, including potential offerings of U.S. dollar-denominated senior notes.

The Concurrent Offering is being made by means of a separate prospectus supplement and not by means of the prospectus supplement to which this pricing term sheet relates. This communication is not an offer to sell or a solicitation of an

offer to buy any securities being offered in the Concurrent Offering. The closing of this offering and the Concurrent Offering is not conditioned on each other.

|

| |

|

|

Common Code/ISIN:

|

283900436 / XS2839004368

|

| |

|

|

Denominations:

|

€100,000 x €1,000

|

| |

|

|

Stabilization:

|

Stabilization/FCA

|

|

Joint Book-Running Managers:

|

Citigroup Global Markets Limited

Barclays Bank PLC

BNP Paribas

J.P. Morgan Securities plc

Wells Fargo Securities International Limited

MUFG Securities (Europe) N.V.

Scotiabank (Ireland) Designated Activity Company

U.S. Bancorp Investments, Inc.

|

|

Co-Managers:

|

Academy Securities, Inc.

ING Bank N.V, Belgian Branch

Intesa Sanpaolo IMI Securities Corp.

Loop Capital Markets LLC

R. Seelaus & Co., LLC

Siebert Williams Shank & Co., LLC

Standard Chartered Bank

The Toronto-Dominion Bank

|

|

* |

Under Rule 15c6-1 under the Securities Exchange Act of 1934, trades in the secondary market generally are required to settle in one business day, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who

wish to trade the Notes prior to the business day preceding the settlement date will be required, by virtue of the fact that the Notes initially settle on the third business day following the Trade Date, to specify an alternate settlement

arrangement at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to trade the Notes prior to their date of delivery hereunder should consult their advisors.

|

The Issuer has filed a registration statement with the SEC (including a prospectus and a preliminary prospectus supplement), for the offering to which this communication relates.

Before you invest, you should read the prospectus and the preliminary prospectus supplement in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the Guarantor, the Issuer and this

offering. You may get these documents for free by visiting EDGAR on the SEC Web site at http://www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the

prospectus if you request it by contacting Citigroup Global Markets Limited toll-free at 1-800-831-9146, Barclays Bank PLC toll-free at 1-888-603-5847, BNP Paribas toll-free at 1-800-854-5674, J.P. Morgan Securities plc at +44-20-7134-2468 or Wells

Fargo Securities International Limited at +44-20-3942-8530.

This pricing term sheet supplements the preliminary prospectus supplement dated June 4, 2024 relating to the prospectus dated May 2, 2024.

MiFID II and/or the UK MiFIR Product Governance Rules professionals/ECPs-only / No PRIIPs KID – Manufacturer target market (MIFID II product governance and/or the UK MiFIR

Product Governance Rules) is eligible counterparties and professional clients only (all distribution channels). No PRIIPs key information document (KID) has been prepared as not available to retail investors in EEA or the United Kingdom.

Any disclaimers or other notices that may appear below are not applicable to this communication and should be disregarded. Such disclaimers or other notices were automatically

generated as a result of this communication being sent via Bloomberg or another email system.

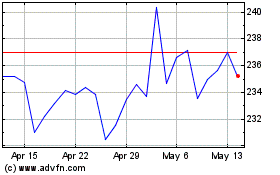

Becton Dickinson (NYSE:BDX)

Historical Stock Chart

From May 2024 to Jun 2024

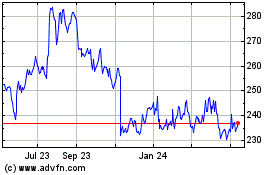

Becton Dickinson (NYSE:BDX)

Historical Stock Chart

From Jun 2023 to Jun 2024