Berry Global Group, Inc. (NYSE: BERY) (“Berry”) announced today

the commencement by Berry Global, Inc., Berry’s wholly owned

subsidiary (the “Issuer”), of an offer to exchange up to

$800,000,000 of the Issuer’s new 5.650% First Priority Senior

Secured Notes due 2034 and up to $800,000,000 of the Issuer’s new

5.800% First Priority Senior Secured Notes due 2031 (collectively,

the “Exchange Notes”), for an equal amount of the Issuer’s

outstanding unregistered 5.650% First Priority Senior Secured Notes

due 2034 and unregistered 5.800% First Priority Senior Secured

Notes due 2031 (collectively, the “Outstanding Notes”), in a

transaction registered under the Securities Act of 1933, as

amended. The exchange offers are being conducted upon the terms and

subject to the conditions set forth in a prospectus dated January

14, 2025, and the related letter of transmittal.

The Exchange Notes are identical in all material respects to the

Outstanding Notes, except that (i) the Exchange Notes will be

registered under the Securities Act of 1933 and will not bear any

legend restricting their transfer; (ii) the Exchange Notes bear a

different CUSIP number than the Outstanding Notes; (iii) the

Exchange Notes will not be subject to transfer restrictions or

entitled to registration rights; and (iv) the Exchange Notes will

not be entitled to additional interest provisions applicable to the

Outstanding Notes in some circumstances relating to the timing of

the exchange offers.

The exchange offers are limited to holders of the Outstanding

Notes. The exchange offers are scheduled to expire at 5:00 p.m.

Eastern Time on February 11, 2025, unless extended. Outstanding

Notes tendered pursuant to the exchange offers may be withdrawn at

any time prior to the expiration date by following the procedures

set forth in the offering prospectus and the related letter of

transmittal.

Copies of the prospectus and the related letter of transmittal

may be obtained from U.S. Bank Trust Company, National Association,

which is serving as the exchange agent for the exchange offers. The

address, telephone and facsimile number of U.S. Bank Trust Company,

National Association are as follows:

By Hand, Overnight Mail, Courier, or

Registered or Certified Mail:

By Facsimile:

For Information or Confirmation by

Telephone:

US Bank

111 Fillmore Ave

St. Paul, MN 55107

Attention: Corporate Actions

Reference: Berry Global, Inc.

(651) 466-7367

Attention: Specialized Finance Group

cts.specfinance@usbank.com

(800) 934-6802

About Berry Global

At Berry Global Group, Inc. (NYSE: BERY), we create innovative

packaging solutions that we believe make life better for people and

the planet. We do this every day by leveraging our unmatched global

capabilities, sustainability leadership, and deep innovation

expertise to serve customers of all sizes around the world.

Harnessing the strength in our diversity and industry-leading

talent of over 34,000 global employees across more than 200

locations, we partner with customers to develop, design, and

manufacture innovative products with an eye toward the circular

economy. The challenges we solve and the innovations we pioneer

benefit our customers at every stage of their journey. For more

information, visit our website, or connect with us on LinkedIn or

X.

Forward-Looking Statements

Certain statements and information in this release that are not

historical, including statements relating to the Notes and the

expected future performance of the Company, may constitute

“forward-looking statements” within the meaning of the federal

securities laws and are presented pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

You can identify forward-looking statements because they contain

words such as “believes,” “expects,” “may,” “will,” “should,”

“would,” “could,” “seeks,” “approximately,” “intends,” “plans,”

“estimates,” “projects,” “outlook,” “anticipates” or “looking

forward,” or similar expressions that relate to our strategy,

plans, intentions, or expectations. All statements we make relating

to our estimated and projected earnings, margins, costs,

expenditures, cash flows, growth rates, and financial results or to

our expectations regarding future industry trends are

forward-looking statements. In addition, we, through our senior

management, from time to time make forward-looking public

statements concerning our expected future operations and

performance and other developments.

These forward-looking statements are subject to risks and

uncertainties that may change at any time, and therefore, our

actual results may differ materially from those that we expected

due to a variety of factors, including without limitation: (1)

risks associated with our substantial indebtedness and debt

service; (2) changes in prices and availability of resin and other

raw materials and our ability to pass on changes in raw material

prices to our customers on a timely basis; (3) risks related to

acquisitions or divestitures and integration of acquired businesses

and their operations, and realization of anticipated cost savings

and synergies; (4) risks related to international business,

including transactional and translational foreign currency exchange

rate risk and the risks of compliance with applicable export

controls, sanctions, anti-corruption laws and regulations; (5)

increases in the cost of compliance with laws and regulations,

including environmental, safety, and climate change laws and

regulations; (6) labor issues, including the potential labor

shortages, shutdowns or strikes, or the failure to renew effective

bargaining agreements; (7) risks related to disruptions in the

overall global economy, persistent inflation, supply chain

disruptions, and the financial markets that may adversely impact

our business; (8) risk of catastrophic loss of one of our key

manufacturing facilities, natural disasters, and other unplanned

business interruptions; (9) risks related to weather-related events

and longer-term climate change patterns; (10) risks related to the

failure of, inadequacy of, or attacks on our information technology

systems and infrastructure; (11) risks that our restructuring

programs may entail greater implementation costs or result in lower

cost savings than anticipated; (12) risks related to future

write-offs of substantial goodwill; (13) risks of competition,

including foreign competition, in our existing and future markets;

(14) risks related to market conditions associated with our share

repurchase program; (15) risks related to market disruptions and

increased market volatility; (16) risks related to the occurrence

of an event, change or other circumstance that could give rise to

the termination of the agreement between Amcor and Berry; (17) the

risk that the conditions to the completion of the proposed

transaction (including shareholder and regulatory approvals) are

not satisfied in a timely manner or at all; (18) the risks arising

from the integration of the Amcor and Berry businesses; (19) the

risk that the anticipated benefits of the proposed transaction may

not be realized when expected or at all; (20) the risk of

unexpected costs or expenses resulting from the proposed

transaction; (21) the risk of litigation related to the proposed

transaction; (22) the risks related to disruption of management’s

time from ongoing business operations as a result of the proposed

transaction; (23) the risk that the proposed transaction may have

an adverse effect on the ability of Amcor and Berry to retain key

personnel and customers; (24) general economic, market and social

developments and conditions; (25) the evolving legal, regulatory

and tax regimes under which Amcor and Berry operate; (26) potential

business uncertainty, including changes to existing business

relationships, during the pendency of the proposed transaction that

could affect Amcor’s and/or Berry’s financial performance; (27)

other risks and uncertainties identified from time to time in

Amcor’s and Berry’s respective filings with the SEC, including the

Joint Proxy Statement/Prospectus to be filed with the SEC in

connection with the proposed transaction; and (28) the other

factors and uncertainties discussed in the section titled “Risk

Factors” in our Annual Report on Form 10-K filed on November 26,

2024 and subsequent filings with the Securities and Exchange

Commission. We caution you that the foregoing list of important

factors may not contain all of the material factors that are

important to you. Accordingly, readers should not place undue

reliance on those statements. All forward-looking statements are

based upon information available to us on the date hereof. All

forward-looking statements are made only as of the date hereof and

we undertake no obligation to update or revise any forward-looking

statement as a result of new information, future events or

otherwise, except as otherwise required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250114438919/en/

Dustin Stilwell VP, Investor Relations +1 812.306.2964

ir@berryglobal.com

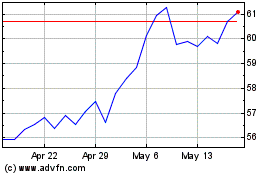

Berry Global (NYSE:BERY)

Historical Stock Chart

From Dec 2024 to Jan 2025

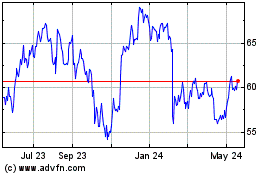

Berry Global (NYSE:BERY)

Historical Stock Chart

From Jan 2024 to Jan 2025