Buenaventura Issues 144A/Reg S Offering of US$650 million Senior Unsecured Notes Due 2032

05 February 2025 - 8:11AM

Business Wire

Compañia de Minas Buenaventura S.A.A. (“Buenaventura” or

“the Company”) (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s

largest publicly-traded precious metals mining company, announced

today the successful issuance of its senior unsecured notes (the

“Notes”) due 2032 in an aggregate amount of US$650 million. The

Notes mature on February 4, 2032 and bear interest at a rate of

6.800% per annum.

The Notes were offered by means of a private placement to

qualified institutional buyers in accordance with Rule 144A under

the Securities Act of 1933, as amended (the “Securities Act”), and

outside the United States to non-U.S. persons in accordance with

Regulation S under the Securities Act. The Notes are fully and

unconditionally guaranteed jointly and severally by Inversiones

Colquijirca S.A., Procesadora Industrial Río Seco S.A. and

Consorcio Energético Huancavelica S.A.

Buenaventura intends to use the net proceeds from this offering

to refinance its outstanding 5.500% Senior Notes due 2026 and for

general corporate purposes. This transaction will contribute to

strengthening the Company’s credit profile and extending

maturities. The success of our bond issuance is an important

reflection of investors’ confidence in our Company.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy any securities, nor will there be

any sale of these securities, in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any

state or jurisdiction. The Notes have not been registered under the

Securities Act, or any applicable state securities laws, and have

been offered only to qualified institutional buyers pursuant to

Rule 144A promulgated under the Securities Act and outside the

United States to non-U.S. persons in accordance with Regulation S

under the Securities Act. Unless so registered, the Notes may not

be offered or sold in the United States except pursuant to an

exemption from the registration requirements of the Securities Act

and any applicable state securities laws.

Company Description

Compañía de Minas Buenaventura S.A.A. is Peru’s largest,

publicly traded precious and base metals Company and a major holder

of mining rights in Peru. The Company is engaged in the

exploration, mining development, processing and trade of gold,

silver and other base metals via wholly-owned mines and through its

participation in joint venture projects. Buenaventura currently

operates several mines in Peru (Orcopampa*, Uchucchacua*, Julcani*,

Tambomayo*, La Zanja*, El Brocal and Coimolache).

The Company owns 19.58% of Sociedad Minera Cerro Verde, an

important Peruvian copper producer (a partnership with

Freeport-McMorRan Inc. and Sumitomo Corporation).

For a printed version of the Company’s 2023 Form 20-F, please

contact the persons indicated above, or download a PDF format file

from the Company’s web site. (*) Operations wholly owned by

Buenaventura

Note on Forward-Looking Statements

This press release may contain forward-looking information (as

defined in the U.S. Private Securities Litigation Reform Act of

1995) that involve risks and uncertainties, including those

concerning Cerro Verde’s costs and expenses, results of

exploration, the continued improving efficiency of operations,

prevailing market prices of gold, silver, copper and other metals

mined, the success of joint ventures, estimates of future

explorations, development and production, subsidiaries’ plans for

capital expenditures, estimates of reserves and Peruvian political,

economic, social and legal developments. These forward-looking

statements reflect the Company’s view with respect to Cerro Verde’s

future financial performance. Actual results could differ

materially from those projected in the forward-looking statements

as a result of a variety of factors discussed elsewhere in this

Press Release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250204642708/en/

Contacts in Lima: Daniel Dominguez, Chief Financial

Officer (511) 419 2540

Sebastián Valencia, Head of Investor Relations (511)

419 2591 / sebastian.valencia@buenaventura.pe

Contact in NY: Barbara Cano (646) 452 2334

barbara@inspirgroup.com

Company Website:

https://buenaventura.com/en/inversionista/

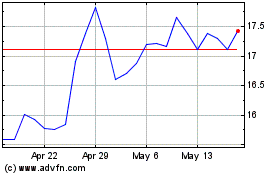

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Feb 2025 to Mar 2025

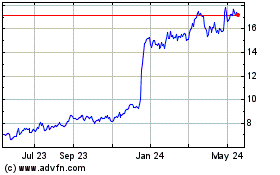

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Mar 2024 to Mar 2025