BlueLinx Holdings Inc. (NYSE:BXC), a leading U.S.

wholesale distributor of building products, today reported

financial results for the three months ended March 30, 2024.

FIRST QUARTER 2024 HIGHLIGHTS

- Net sales of $726 million

- Gross profit of $128 million, gross margin of 17.6% and

specialty products margin of 20.7%, which includes a net benefit of

approximately $7 million related to import duties from prior

periods

- Net income of $17 million, or $2.00 diluted earnings per

share

- Adjusted net income of $19 million, or $2.14 adjusted diluted

earnings per share (non-GAAP)

- Adjusted EBITDA of $39 million (non-GAAP), or 5.3% of net

sales, which includes a net benefit of approximately $7 million

related to import duties from prior periods

- Operating cash used of ($31) million and free cash flow of

($37) million (non-GAAP)

- Available liquidity of $828 million, including $481 million of

cash and cash equivalents

- Net debt of ($133) million and net leverage ratio of (0.8x),

excluding real property finance lease liabilities

“We are off to a solid start to 2024, despite ongoing

deflationary pressures associated with our specialty business and

January weather conditions that adversely impacted volumes. We are

pleased with the results for the quarter as volumes recovered and

we maintained strong margins in specialty and structural products,”

said Shyam Reddy, President, and CEO of BlueLinx. “I am excited

about the team we have in place to execute our sales growth

strategy through uncertain market conditions. Our strong liquidity

gives us the flexibility to pursue our strategic initiatives and

opportunistically return capital to shareholders.”

“Our Adjusted EBITDA of $39 million came in better than expected

due to the higher margins in both specialty and structural

products, as well as the net positive impact of import duty items

of approximately $7 million related to products sold during prior

periods. We were pleased with our results and our financial

position remains strong with a net leverage ratio of only (0.8x)

and available liquidity of $828 million,” said Andy Wamser, Chief

Financial Officer of BlueLinx.

FIRST QUARTER 2024 FINANCIAL PERFORMANCE

In the first quarter of 2024, net sales were $726 million, a

decrease of $72 million, or 9.0% when compared to the first quarter

of 2023. Gross profit was $128 million, a decrease of $6 million,

or 4.4%, year-over-year, and gross margin was 17.6%, up 90 basis

points from the same period last year.

Net sales of specialty products, which includes products such as

engineered wood, siding, millwork, outdoor living, industrial

products and specialty lumber and panels, decreased $64 million, or

11%, to $504 million. This decline was due to deflationary impacts

across several specialty categories. Gross profit from specialty

product sales was $104 million, a decrease of $3 million, or 2%,

compared to the first quarter of last year. Gross margin was 20.7%

compared to 18.8% in the prior year period, which includes the net

benefit of import duty-related items from prior periods during the

current quarter. Not including this net benefit, specialty

products’ gross margin was 19.4% in the current quarter. The duty

items were related to changes in retroactive rates for anti-dumping

duties and to classification adjustments for certain goods imported

by the Company.

Net sales of structural products, which includes products such

as lumber, plywood, oriented strand board, rebar, and remesh,

decreased $8 million, or 3%, to $222 million in the first quarter

and gross profit from sales of structural products decreased $3

million from $27 million in the prior year period. The decrease in

structural sales and gross profit was due primarily to lower

framing lumber volumes when compared to the elevated levels in the

prior year period. Gross margin on structural product sales was

10.6% in the first quarter, down from 11.7% in the prior year

period.

Selling, general and administrative (“SG&A”) expenses were

$91 million in the first quarter, comparable with the prior year

period.

Net income was $17 million, or $2.00 per diluted share, versus

$18 million, or $1.94 per diluted share, in the prior year period.

Adjusted net income was $19 million, or $2.14 per diluted share

compared to $23 million, or $2.53 per diluted share in the first

quarter of last year.

Adjusted EBITDA was $39 million, or 5.3% of net sales, for the

first quarter of 2024, compared to $47 million, or 5.9% of net

sales in the first quarter of 2023, which includes the net benefit

of duty-related items. Not including these duty-related items,

Adjusted EBITDA was $32 million, or 4.4% of net sales in the first

quarter.

Net cash used in operating activities was $31 million in the

first quarter of 2024 compared to $89 million of net cash provided

by operating activities in the prior year period, and free cash

flow was ($37) million. The decrease in cash generated during the

first quarter was driven by seasonal changes in working capital.

The net source of cash generated in the prior year period was

driven by significant inventory reduction efforts.

CAPITAL ALLOCATION AND FINANCIAL POSITION

During the first quarter of 2024, we invested $5 million of cash

in capital investments to improve our distribution facilities and

upgrade our fleet, compared to $9 million of cash investments in

the first quarter of 2023. During the first quarter of 2024, we

also entered into finance leases for $8 million of fleet upgrades.

We have $91.4 million of share repurchase authorization remaining

under our current repurchase program. Under our remaining share

repurchase authorization, we may repurchase shares of our common

stock at any time or from time to time, without prior notice,

subject to prevailing market conditions and other

considerations.

As of March 30, 2024, total debt was $348 million, consisting of

$300 million of senior secured notes that mature in 2029 and $48

million of finance leases, excluding real property finance lease

liabilities. Available liquidity was $828 million which included an

undrawn revolving credit facility that had $346 million of

availability plus cash and cash equivalents of $481 million. Net

debt was ($133) million, resulting in a net leverage ratio of

(0.8x) on trailing twelve-month Adjusted EBITDA of $175

million.

SECOND QUARTER 2024 UPDATE

Through the first four weeks of the second quarter of 2024,

specialty product gross margin was in the range of 18% to 19% and

structural product gross margin was in the range of 10% to 11%.

Average daily sales volumes were slightly improved versus the first

quarter of 2024.

CONFERENCE CALL INFORMATION

BlueLinx will host a conference call on May 1, 2024, at 10:00

a.m. Eastern Time, accompanied by a supporting slide

presentation.

A webcast of the conference call and accompanying presentation

materials will be available in the Investor Relations section of

the BlueLinx website at https://investors.bluelinxco.com, and a

replay of the webcast will be available at the same site shortly

after the webcast is complete.

To participate in the live teleconference:

Domestic Live: 1-888-660-6392 Passcode: 9140086

To listen to a replay of the teleconference, which will be

available through May 15, 2024:

Domestic Replay: 1-800-770-2030 Passcode: 9140086

ABOUT BLUELINX

BlueLinx (NYSE: BXC) is a leading U.S. wholesale distributor of

residential and commercial building products with both branded and

private-label SKUs across product categories such as lumber,

panels, engineered wood, siding, millwork, and industrial products.

With a strong market position, broad geographic coverage footprint

servicing 50 states, and the strength of a locally focused sales

force, we distribute a comprehensive range of products to our

customers which include national home centers, pro dealers,

cooperatives, specialty distributors, regional and local dealers

and industrial manufacturers. BlueLinx provides a wide range of

value-added services and solutions to our customers and suppliers,

and we operate our business through a broad network of distribution

centers. To learn more about BlueLinx, please visit

www.bluelinxco.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements.

Forward-looking statements include, without limitation, any

statement that predicts, forecasts, indicates or implies future

results, performance, liquidity levels or achievements, and may

contain the words “believe,” “anticipate,” “could,” “expect,”

“estimate,” “intend,” “may,” “project,” “plan,” “should,” “will,”

“will be,” “will likely continue,” “will likely result,” “would,”

or words or phrases of similar meaning.

The forward-looking statements in this press release include

statements about our confidence in the Company’s long-term growth

strategy; our ability to capitalize on supplier-led price increases

and our value-added services; our areas of focus and management

initiatives; the demand outlook for construction materials and

expectations regarding new home construction, repair and remodel

activity and continued investment in existing and new homes; our

positioning for long-term value creation; our efforts and ability

to generate profitable growth; our ability to increase net sales in

specialty product categories; our ability to generate profits and

cash from sales of specialty products; our multi-year capital

allocation plans; our ability to manage volatility in wood-based

commodities; our improvement in execution and productivity; our

efforts and ability to maintain a disciplined capital structure and

capital allocation strategy; our ability to maintain a strong

balance sheet; our ability to focus on operating improvement

initiatives and commercial excellence; and whether or not the

Company will continue any share repurchases.

Forward-looking statements in this press release are based on

estimates and assumptions made by our management that, although

believed by us to be reasonable, are inherently uncertain.

Forward-looking statements involve risks and uncertainties that may

cause our business, strategy, or actual results to differ

materially from the forward-looking statements. These risks and

uncertainties include those discussed in greater detail in our

filings with the Securities and Exchange Commission. We operate in

a changing environment in which new risks can emerge from time to

time. It is not possible for management to predict all of these

risks, nor can it assess the extent to which any factor, or a

combination of factors, may cause our business, strategy, or actual

results to differ materially from those contained in

forward-looking statements. Factors that may cause these

differences include, among other things: housing market conditions;

pricing and product cost variability; volumes of product sold;

competition; the cyclical nature of the industry in which we

operate; consolidation among competitors, suppliers, and customers;

disintermediation risk; loss of products or key suppliers and

manufacturers; our dependence on international suppliers and

manufacturers for certain products; effective inventory management

relative to our sales volume or the prices of the products we

produce; business disruptions; potential acquisitions and the

integration and completion of such acquisitions; information

technology security risks and business interruption risks; the

ability to attract, train, and retain highly qualified associates

and other key personnel while controlling related labor costs;

exposure to product liability and other claims and legal

proceedings related to our business and the products we distribute;

natural disasters, catastrophes, fire, wars or other unexpected

events; the impacts of climate change; successful implementation of

our strategy; wage increases or work stoppages by our union

employees; costs imposed by federal, state, local, and other

regulations; compliance costs associated with federal, state, and

local environmental protection laws; the effects of epidemics,

global pandemics or other widespread public health crises and

governmental rules and regulations; fluctuations in our operating

results; our level of indebtedness and our ability to incur

additional debt to fund future needs; the covenants of the

instruments governing our indebtedness limiting the discretion of

our management in operating the business; the potential to incur

more debt; the fact that we have consummated certain sale leaseback

transactions with resulting long-term non-cancelable leases, many

of which are or will be finance leases; the fact that we lease many

of our distribution centers, and we would still be obligated under

these leases even if we close a leased distribution center;

inability to raise funds necessary to finance a required repurchase

of our senior secured notes; a lowering or withdrawal of debt

ratings; changes in our product mix; increases in fuel and other

energy prices or availability of third-part freight providers;

changes in insurance-related deductible/retention reserves based on

actual loss development experience; the possibility that the value

of our deferred tax assets could become impaired; changes in our

expected annual effective tax rate could be volatile; the costs and

liabilities related to our participation in multi-employer pension

plans could increase; the risk that our cash flows and capital

resources may be insufficient to service our existing or future

indebtedness; interest rate risk, which could cause our debt

service obligations to increase; and changes in, or interpretation

of, accounting principles.

Given these risks and uncertainties, we caution you not to place

undue reliance on forward-looking statements. We expressly disclaim

any obligation to update or revise any forward-looking statement as

a result of new information, future events or otherwise, except as

required by law.

NON-GAAP MEASURES AND SUPPLEMENTAL FINANCIAL

INFORMATION

The Company reports its financial results in accordance with

GAAP. The Company also believes that presentation of certain

non-GAAP measures may be useful to investors and may provide a more

complete understanding of the factors and trends affecting the

business than using reported GAAP results alone. Any non-GAAP

measures used herein are reconciled to their most directly

comparable GAAP measures herein or in the financial tables

accompanying this news release. The Company cautions that non-GAAP

measures should be considered in addition to, but not as a

substitute for, the Company’s reported GAAP results. The Company

further cautions that its non-GAAP measures, as used herein, are

not necessarily comparable to other similarly titled measures of

other companies due to differences in methods of calculation.

Adjusted EBITDA and Adjusted EBITDA Margin. BlueLinx defines

Adjusted EBITDA as an amount equal to net income (loss) plus

interest expense and all interest expense related items, income

taxes, depreciation and amortization, and further adjusted for

certain non-cash items and other special items, including

compensation expense from share based compensation, one-time

charges associated with the legal, consulting, and professional

fees related to our merger and acquisition activities, gains or

losses on sales of properties, amortization of deferred gains on

real estate, and expense associated with our restructuring

activities, such as severance, in addition to other significant

and/or one-time, nonrecurring, non-operating items.

The Company presents Adjusted EBITDA because it is a primary

measure used by management to evaluate operating performance.

Management believes this metric helps to enhance investors’ overall

understanding of the financial performance and cash flows of the

business. Management also believes Adjusted EBITDA is helpful in

highlighting operating trends. Adjusted EBITDA is frequently used

by securities analysts, investors, and other interested parties in

their evaluation of companies, many of which present an Adjusted

EBITDA measure when reporting their results.

We determine our Adjusted EBITDA Margin, which we sometimes

refer to as our Adjusted EBITDA as a percentage of net sales, by

dividing our Adjusted EBITDA for the applicable period by our net

sales for the applicable period. We believe that this ratio is

useful to investors because it more clearly defines the quality of

earnings and operational efficiency of translating sales to

profitability.

Our Adjusted EBITDA and Adjusted EBITDA Margin are not

presentations made in accordance with GAAP and are not intended to

present superior measures of our financial condition from those

measures determined under GAAP. Adjusted EBITDA and Adjusted EBITDA

Margin, as used herein, are not necessarily comparable to other

similarly titled captions of other companies due to differences in

methods of calculation. These non-GAAP measures are reconciled in

the “Reconciliation of Non-GAAP Measurements” table later in this

release.

Adjusted Net Income and Adjusted Earnings Per Share. BlueLinx

defines Adjusted Net Income as Net Income adjusted for certain

non-cash items and other special items, including compensation

expense from share based compensation, one-time charges associated

with the legal, consulting, and professional fees related to our

merger and acquisition activities, gains or losses on sales of

properties, amortization of deferred gains on real estate, and

expense associated with our restructuring activities, such as

severance, in addition to other significant and/or one-time,

nonrecurring, non-operating items, further adjusted for the tax

impacts of such reconciling items. BlueLinx defines Adjusted

Earnings Per Share (basic and/or diluted) as the Adjusted Net

Income for the period divided by the weighted average outstanding

shares (basic and/or diluted) for the periods presented. We believe

that Adjusted Net Income and Adjusted Earnings Per Share (basic

and/or diluted) are useful to investors to enhance investors’

overall understanding of the financial performance of the business.

Management also believes Adjusted Net Income and Adjusted Earnings

Per Share (basic and/or diluted) are helpful in highlighting

operating trends.

Our Adjusted Net Income and Adjusted Earnings Per Share (basic

and/or diluted) are not presentations made in accordance with GAAP

and are not intended to present superior measures of our financial

condition from those measures determined under GAAP. Adjusted Net

Income and Adjusted Earnings Per Share (basic or diluted), as used

herein, are not necessarily comparable to other similarly titled

captions of other companies due to differences in methods of

calculation. These non-GAAP measures are reconciled in the

“Reconciliation of Non-GAAP Measurements” table later in this

release.

Free Cash Flow. BlueLinx defines free cash flow as net cash

provided by operating activities less total capital expenditures.

Free cash flow is a measure used by management to assess our

financial performance, and we believe it is useful for investors

because it relates the operating cash flow of the Company to the

capital that is spent to continue and improve business operations.

In particular, free cash flow indicates the amount of cash

generated after capital expenditures that can be used for, among

other things, investment in our business, strengthening our balance

sheet, and repayment of our debt obligations. Free cash flow does

not represent the residual cash flow available for discretionary

expenditures since there may be other nondiscretionary expenditures

that are not deducted from the measure. Free cash flow is not a

presentation made in accordance with GAAP and is not intended to

present a superior measure of financial condition from those

determined under GAAP. Free cash flow, as used herein, is not

necessarily comparable to other similarly titled captions of other

companies due to differences in methods of calculation. This

non-GAAP measure is reconciled in the “Reconciliation of Non-GAAP

Measurements” table later in this release.

Net Debt, Net Debt Excluding Real Property Finance Lease

Liabilities, Overall Net Leverage Ratio, and Net Leverage Ratio

Excluding Real Property Finance Lease Liabilities. BlueLinx

calculates Net Debt as its total short- and long-term debt,

including outstanding balances under our term loan and revolving

credit facility and the total amount of its obligations under

finance leases, less cash and cash equivalents. Net Debt Excluding

Real Property Finance Lease Liabilities is calculated in the same

manner as Net Debt, except the total amount of obligations under

real estate finance leases are excluded. Although our credit

agreements do not contain leverage covenants, a net leverage ratio

excluding finance lease obligations for real property is included

within the terms of our revolving credit agreement. We believe that

Net Debt and Net Debt Excluding Real Property Finance Lease

Liabilities are useful to investors because our management reviews

both metrics as part of its management of overall liquidity,

financial flexibility, capital structure and leverage, and

creditors and credit analysts monitor our net debt as part of their

assessments of our business. We determine our Overall Net Leverage

Ratio by dividing our Net Debt by Twelve-Month Trailing Adjusted

EBITDA. Our calculation of Net Leverage Ratio Excluding Real

Property Finance Lease Liabilities is determined by dividing our

Net Debt Excluding Real Property Finance Lease Liabilities by

Twelve-Month Trailing Adjusted EBITDA. We believe that these ratios

are useful to investors because they are indicators of our ability

to meet our future financial obligations. In addition, our Net

Leverage Ratio is a measure that is frequently used by investors

and creditors. Our Net Debt, Net Debt Excluding Real Property

Finance Lease Liabilities, Overall Net Leverage Ratio, and Net

Leverage Ratio Excluding Real Property Finance Lease Liabilities

are not made in accordance with GAAP and are not intended to

present a superior measure of our financial condition from measures

and ratios determined under GAAP. The calculations of our Net Debt,

Net Debt Excluding Real Property Finance Lease Liabilities, Overall

Net Leverage Ratio, and Net Leverage Ratio Excluding Real Property

Finance Lease Liabilities are presented in the table on page 11.

Net Debt, Net Debt Excluding Real Property Finance Lease

Liabilities, Overall Net Leverage Ratio, and Net Leverage Ratio

Excluding Real Property Finance Lease Liabilities, as used herein,

are not necessarily comparable to other similarly titled captions

of other companies due to differences in methods of

calculation.

BLUELINX HOLDINGS INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended

March 30, 2024

April 1, 2023

($ amounts in thousands,

except per share amounts)

Net sales

$

726,244

$

797,904

Cost of products sold

598,563

664,365

Gross profit

127,681

133,539

Gross margin

17.6

%

16.7

%

Operating expenses (income):

Selling, general, and administrative

91,250

91,174

Depreciation and amortization

9,433

7,718

Amortization of deferred gains on real

estate

(984

)

(984

)

Other operating expenses

314

3,116

Total operating expenses

100,013

101,024

Operating income

27,668

32,515

Non-operating expenses:

Interest expense, net

4,624

7,687

Other expense, net

—

594

Income before provision for income

taxes

23,044

24,234

Provision for income taxes

5,552

6,422

Net income

$

17,492

$

17,812

Basic earnings per share

$

2.02

$

1.96

Diluted earnings per share

$

2.00

$

1.94

BLUELINX HOLDINGS INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

March 30, 2024

December 30, 2023

(In thousands, except share

data)

ASSETS

Current assets:

Cash and cash equivalents

$

481,309

$

521,743

Accounts receivable, less allowances of

$3,293 and $3,398, respectively

288,244

228,410

Inventories, net

370,942

343,638

Other current assets

32,165

26,608

Total current assets

1,172,660

1,120,399

Property and equipment, at cost

406,918

396,321

Accumulated depreciation

(175,757

)

(170,334

)

Property and equipment, net

231,161

225,987

Operating lease right-of-use assets

34,869

37,227

Goodwill

55,372

55,372

Intangible assets, net

29,768

30,792

Deferred income tax asset, net

53,629

53,256

Other non-current assets

14,186

14,568

Total assets

$

1,591,645

$

1,537,601

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

171,715

$

157,931

Accrued compensation

13,642

14,273

Finance lease liabilities - current

12,157

11,178

Operating lease liabilities - current

5,824

6,284

Real estate deferred gains - current

3,935

3,935

Other current liabilities

41,873

24,961

Total current liabilities

249,146

218,562

Long-term debt

294,073

293,743

Finance lease liabilities - noncurrent

279,910

274,248

Operating lease liabilities -

noncurrent

30,248

32,519

Real estate deferred gains -

noncurrent

65,648

66,599

Other non-current liabilities

19,399

17,644

Total liabilities

938,424

903,315

Commitments and contingencies

Stockholders' Equity:

Preferred Stock, $0.01 par value,

30,000,000 shares authorized, none issued

—

—

Common Stock, $0.01 par value, 20,000,000

shares authorized, 8,661,738 and 8,650,046 outstanding,

respectively

87

87

Additional paid-in capital

166,503

165,060

Retained earnings

486,631

469,139

Total stockholders’ equity

653,221

634,286

Total liabilities and stockholders’

equity

$

1,591,645

$

1,537,601

BLUELINX HOLDINGS INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Three Months Ended

March 30, 2024

April 1, 2023

(In thousands)

Cash flows from operating

activities:

Net income

$

17,492

$

17,812

Adjustments to reconcile net income to

cash (used in) provided by operations:

Depreciation and amortization

9,433

7,718

Amortization of debt discount and issuance

costs

330

329

Provision for deferred income taxes

(373

)

213

Amortization of deferred gains from real

estate

(984

)

(984

)

Share-based compensation

2,350

4,569

Changes in operating assets and

liabilities:

Accounts receivable

(59,834

)

(47,333

)

Inventories

(27,304

)

74,989

Accounts payable

13,784

25,420

Other current assets

(5,557

)

5,953

Other assets and liabilities

19,528

279

Net cash (used in) provided by operating

activities

(31,135

)

88,965

Cash flows from investing

activities:

Proceeds from sale of assets

127

37

Property and equipment investments

(5,447

)

(9,008

)

Net cash used in investing activities

(5,320

)

(8,971

)

Cash flows from financing

activities:

Repurchase of shares to satisfy employee

tax withholdings

(907

)

(570

)

Principal payments on finance lease

liabilities

(3,072

)

(2,133

)

Net cash used in financing activities

(3,979

)

(2,703

)

Net change in cash and cash

equivalents

(40,434

)

77,291

Cash and cash equivalents at beginning of

period

521,743

298,943

Cash and cash equivalents at end of

period

$

481,309

$

376,234

BLUELINX HOLDINGS INC.

SUPPLEMENTAL FINANCIAL

INFORMATION

(Unaudited)

The following schedule presents our

revenues disaggregated by specialty and structural product

category:

Three Months Ended

March 30, 2024

April 1, 2023

($ amounts in

thousands)

Net sales by product category:

Specialty products

$

503,834

$

567,838

Structural products

222,410

230,066

Total net sales

$

726,244

$

797,904

Gross profit by product category:

Specialty products

$

104,049

$

106,627

Structural products

23,632

26,912

Total gross profit

$

127,681

$

133,539

Gross margin % by product category:

Specialty products

20.7

%

18.8

%

Structural products

10.6

%

11.7

%

Consolidated gross margin %

17.6

%

16.7

%

BLUELINX HOLDINGS INC.

RECONCILIATION OF NON-GAAP

MEASUREMENTS

(Unaudited)

The following schedule reconciles Net

income to Adjusted EBITDA (non-GAAP):

Three Months Ended

Trailing Twelve Months

Ended

March 30, 2024

April 1, 2023

March 30, 2024

April 1, 2023

(In thousands)

Net income

$

17,492

$

17,812

$

47,358

$

180,579

Adjustments:

Depreciation and amortization

9,433

7,718

33,758

28,585

Interest expense, net

4,624

7,687

21,083

38,666

Provision for income taxes

5,552

6,422

32,937

57,685

Share-based compensation expense

2,350

4,569

9,836

12,024

Amortization of deferred gains on real

estate

(984

)

(984

)

(3,934

)

(3,934

)

Gain from sales of property(1)

—

—

—

(144

)

Pension settlement and related

expenses(1)(2)

—

594

32,223

594

Acquisition-related costs(1)(3)

—

100

178

1,355

Restructuring and other(1)(4)

314

3,016

1,212

6,982

Adjusted EBITDA - non-GAAP

$

38,781

$

46,934

$

174,651

$

322,392

(1)

Reflects non-recurring items of

approximately $0.3 million in the current quarter and approximately

$3.7 million in the prior year period. For the trailing twelve

months ended, reflects approximately $33.6 million of non-recurring

items in the current period and $8.8 million of non-recurring items

in the prior period.

(2)

Reflects expenses related to our

previously disclosed settlement of the BlueLinx Corporation Hourly

Retirement Plan (defined benefit) in 4Q 2023.

(3)

Reflects primarily legal, professional,

technology and other integration costs.

(4)

Reflects costs related to our

restructuring activities, such as severance, and other one-time

non-operating items.

The following tables reconciles Net income

and Diluted earnings per share to Adjusted net income (non-GAAP)

and Adjusted diluted earnings per share (non-GAAP):

Three Months Ended

March 30, 2024

April 1, 2023

(In thousands, except per

share data)

Net income

$

17,492

$

17,812

Adjustments:

Share-based compensation expense

2,350

4,569

Amortization of deferred gains on real

estate

(984

)

(984

)

Pension settlement and related

expenses(1)

—

594

Acquisition-related costs(2)

—

100

Restructuring and other(3)

314

3,016

Tax impacts of reconciling items above

(4)

(405

)

(1,933

)

Adjusted net income - non-GAAP

$

18,767

$

23,174

Basic EPS

$

2.02

$

1.96

Diluted EPS

$

2.00

$

1.94

Weighted average shares outstanding -

Basic

8,653

9,059

Weighted average shares outstanding -

Diluted

8,741

9,157

Adjusted Basic EPS - non-GAAP

$

2.16

$

2.55

Adjusted Diluted EPS - non-GAAP

$

2.14

$

2.53

(1)

Reflects expenses related to our

previously disclosed settlement of the BlueLinx Corporation Hourly

Retirement Plan in 4Q 2023.

(2)

Reflects primarily legal, professional,

technology and other integration costs.

(3)

Reflects costs related to our

restructuring activities, such as severance, and other one-time

non-operating items.

(4)

Tax impact calculated based on the

effective tax rate for the respective three-month periods

presented.

The following schedule presents our

Adjusted EBITDA margin (non-GAAP) as a percentage of net sales:

Three Months Ended

March 30, 2024

April 1, 2023

($ amounts in

thousands)

Net sales

$

726,244

$

797,904

Adjusted EBITDA - non-GAAP

38,781

46,934

Adjusted EBITDA margin - non-GAAP

5.3

%

5.9

%

The following schedule presents Net Debt

and the Net Leverage Ratio for the trailing twelve months:

Three Months Ended

March 30, 2024

April 1, 2023

($ amounts in

thousands)

Long term debt(1)

$

300,000

$

300,000

Finance lease liabilities for equipment

and vehicles

48,445

27,162

Finance lease liabilities for real

property

243,622

243,602

Total debt and finance leases

592,067

570,764

Less: available cash and cash

equivalents

481,309

376,234

Net Debt (total debt and all finance lease

liabilities, excluding cash)

$

110,758

$

194,530

Net Debt, excluding finance lease

liabilities for real property

$

(132,864

)

$

(49,072

)

Twelve-Month Trailing Adjusted EBITDA -

non-GAAP, see above reconciliation

$

174,651

$

322,392

Net Leverage Ratio

0.6

x

0.6

x

Net Leverage Ratio Excluding Real

Property Finance Lease Liabilities(2)

(0.8

x)

(0.2

x)

(1)

For the three months ended March 30, 2024,

and April 1, 2023, our long-term debt is comprised of $300.0

million of senior-secured notes issued in October 2021. These notes

are presented under the long-term debt caption of our unaudited

condensed consolidated balance sheets at $294.1 million and $292.8

million as of March 30, 2024 and April 1, 2023, respectively. This

presentation is net of their unamortized discount of $2.9 million

and $3.4 million and the combined carrying value of our unamortized

debt issuance costs of $3.0 million and $3.9 million as of March

30, 2024, and April 1, 2023, respectively. Our senior secured notes

are presented in this table at their face value for the purposes of

calculating our net leverage ratios.

(2)

Net leverage ratio excluding finance lease

obligations for real property is included within the terms of our

revolving credit agreement.

The following schedule presents free cash

flow:

Three Months Ended

March 30, 2024

April 1, 2023

(In thousands)

Net cash (used in) provided by operating

activities

$

(31,135

)

$

88,965

Less: Property and equipment

investments

(5,447

)

(9,008

)

Free cash flow - non-GAAP

$

(36,582

)

$

79,957

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240430867938/en/

Tom Morabito Investor Relations Officer (470) 394-0099

investor@bluelinxco.com

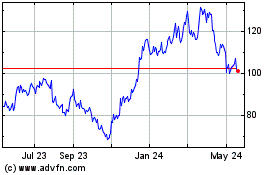

BlueLinx (NYSE:BXC)

Historical Stock Chart

From Nov 2024 to Dec 2024

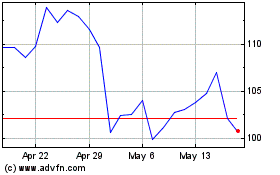

BlueLinx (NYSE:BXC)

Historical Stock Chart

From Dec 2023 to Dec 2024