UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 12, 2024

Ciena Corporation

(Exact name of registrant as specified in its charter)

Commission File Number: 001-36250

Delaware

(State or other jurisdiction of incorporation)

7035 Ridge Road, Hanover, MD

(Address of principal executive offices)

23-2725311

(IRS Employer Identification No.)

21076

(Zip Code)

Registrant's telephone number, including area code: (410) 694-5700

Not Applicable

(Former name or former address, if changed since last report)

| | | | | | | | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

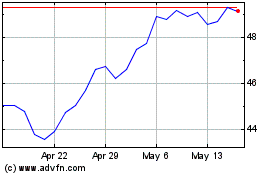

Common stock, $0.01 par value | CIEN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On December 12, 2024, Ciena Corporation ("Ciena") issued a press release announcing its financial results for its fiscal fourth quarter ended November 2, 2024. The text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this "Report"). As discussed in the press release, Ciena will be hosting an investor call to discuss its results of operations for its fiscal fourth quarter ended November 2, 2024.

In conjunction with the issuance of this press release, Ciena posted to the quarterly results page of the "Investors" section of www.ciena.com an accompanying investor presentation. The investor presentation is furnished as Exhibit 99.2 to this Report.

The information in Exhibits 99.1 and 99.2, as well as Item 2.02 of this Report, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement pursuant to the Securities Act of 1933, as amended. Investors are encouraged to review the “Investors” page of our website at www.ciena.com because, as with the other disclosure channels that we use, from time to time we may post material information exclusively on that site.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 11, 2024, Patrick H. Nettles, Ph.D., Executive Chair of Ciena’s Board of Directors (the “Board”), notified Ciena of his planned retirement and that he would not stand for re-election as a director at the end of his term at Ciena's 2025 Annual Meeting of Stockholders (the "Annual Meeting"). In connection with this decision, Dr. Nettles stepped down from his position as Executive Chair of the Board effective December 11, 2024. The Board has approved a decrease in the size of the Board from ten to nine directors, effective upon Dr. Nettles's departure from the Board following the Annual Meeting. The Board appointed Lawton W. Fitt as independent Chair of the Board in connection with and effective as of Dr. Nettles stepping down as Executive Chair. In connection with Ms. Fitt's appointment as independent Chair, the Board appointed Devinder Kumar to replace Ms. Fitt as chair of the Audit Committee of the Board, effective January 1, 2025.

As previously announced, Andrew C. Petrik, Ciena's Vice President, Principal Accounting Officer and Controller, will retire effective April 25, 2025. In connection with Mr. Petrik’s planned retirement, effective immediately following the filing of Ciena’s Annual Report on Form 10-K for the fiscal year ended November 2, 2024 with the Securities and Exchange Commission (the "SEC"), Mr. Petrik will cease to be Ciena's principal accounting officer and James E. Moylan, Jr., 73, our Senior Vice President and Chief Financial Officer, will assume the responsibilities of principal accounting officer. Ciena previously disclosed Mr. Moylan’s biographical information under the caption "Information About Our Executive Officers and Directors" in Part I, Item 1 of Ciena's Annual Report on Form 10-K for the fiscal year ended October 28, 2023, as filed with the SEC on December 15, 2023, which information is incorporated herein by reference. Mr. Moylan will not receive any additional compensation or equity awards in connection with his appointment as principal accounting officer.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On December 11, 2024, in connection with a periodic review of Ciena's bylaws, the Board adopted and approved Ciena’s Amended and Restated Bylaws (the “Amended Bylaws”). The amendments contained in the Amended Bylaws (i) clarify procedural mechanics and disclosure requirements in connection with stockholder nominations of directors and submission of stockholder proposals made in connection with annual and special meetings of stockholders, and (ii) make administrative and ministerial language updates.

The foregoing description of the amendments is qualified by reference to the text of the Amended Bylaws, a copy of which is filed as Exhibit 3.1 to this Report and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

In connection with the announcement of Dr. Nettles’s pending retirement and the appointment of Ms. Fitt as independent Chair of the Board, Ciena issued a press release, a copy of which is furnished as Exhibit 99.3 to this Report.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | | | | |

Exhibit Number | Description of Document |

| |

| 3.1 | |

99.1 |

|

99.2 |

|

| 99.3 | |

104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

| | |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized. |

| | | | | | | | |

| Ciena Corporation |

| | |

| | |

Date: December 12, 2024 | By: | /s/ Sheela Kosaraju |

| | Sheela Kosaraju |

| | Senior Vice President, General Counsel and Assistant Secretary |

AMENDED AND RESTATED BYLAWS

OF

CIENA CORPORATION

(Amended and Restated December 11, 2024)

ARTICLE I

Stockholders

Section 1. Annual Meeting. If required by applicable law, an annual meeting of the stockholders of the Corporation shall be held on such date, at such time and at such place, if any, within or without the State of Delaware as may be designated by the Board of Directors, for the purpose of electing directors and for the transaction of such other business as may be properly brought before the meeting.

Section 2. Special Meetings. Except as otherwise provided in the Certificate of Incorporation, a special meeting of the stockholders of the Corporation may be called at any time only (1) by the Board of Directors pursuant to a resolution adopted by a majority of the total number of authorized directors (whether or not there exist any vacancies in previously authorized directorships at the time any such resolution is presented to the Board for adoption), or (2) by the holders of not less than ten percent of all the shares entitled to cast votes at the meeting. Any special meeting of the stockholders shall be held on such date, at such time and at such place, if any, within or without the State of Delaware as the Board of Directors may designate. At a special meeting of the stockholders, no business shall be transacted and no corporate action shall be taken other than that stated in the notice of the meeting unless all of the stockholders are present in person or by proxy, in which case any and all business may be transacted at the meeting even though the meeting is held without notice.

Section 3. Notice of Meetings. Except as otherwise provided in these Bylaws or by law, a written notice of each meeting of the stockholders shall be given not less than ten nor more than sixty days before the date of the meeting to each stockholder of the Corporation entitled to vote at such meeting at their address as it appears on the records of the Corporation. The notice shall state the place, if any, date and hour of the meeting, the means of remote communications, if any, by which stockholders and proxy holders may be deemed present in person and vote at such meeting, and, in the case of a special meeting, the purpose or purposes for which the meeting is called.

Section 4. Notice of Stockholder Business and Nominations.

(A) Annual Meetings of Stockholders.

(1) Nominations of persons for election to the Board of Directors and the proposal of other business to be considered by the stockholders may be made at an annual meeting of stockholders only:

(a) pursuant to the Corporation’s notice of meeting (or any supplement thereto),

(b) by or at the direction of the Board of Directors, or

(c) by any stockholder of the Corporation who was a stockholder of record of the Corporation at the time the notice provided for in this Section 4 of this Article I is delivered to the Secretary of the Corporation, who is entitled to vote at the meeting and who complies with the notice procedures set forth in this Section 4.

(2) For any nominations or other business to be properly brought before an annual meeting by a stockholder pursuant to clause (c) of paragraph (A)(1) of this Section 4, the stockholder must have given timely notice thereof in writing to the Secretary of the Corporation and any such proposed business other than the nominations of persons for election to the Board of Directors must constitute a proper matter for stockholder action. To be timely, a stockholder’s notice shall be delivered to the Secretary at the principal executive offices of the

Corporation not later than the close of business on the ninetieth day nor earlier than the close of business on the one hundred twentieth day prior to the first anniversary of the preceding year’s annual meeting (provided, however, that in the event that the date of the annual meeting is more than thirty days before or more than seventy days after such anniversary date, notice by the stockholder must be so delivered not earlier than the close of business on the one hundred twentieth day prior to such annual meeting and not later than the close of business on the later of the ninetieth day prior to such annual meeting or the tenth day following the day on which public announcement of the date of such meeting is first made by the Corporation). In no event shall the public announcement of an adjournment or postponement of an annual meeting commence a new time period (or extend any time period) for the giving of a stockholder’s notice as described above.

(3) The stockholder’s notice required by paragraph (A)(2) of this Section 4 shall set forth:

(a) as to each person whom the stockholder proposes to nominate for election as a director (i) such nominee’s name, age, business address and, if known, residence address; (ii) all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case pursuant to and in accordance with Regulation 14A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”); (iii) the class and number of shares of capital stock of the Corporation which are directly or indirectly owned beneficially and of record by each such nominee as of the date of such notice; (iv) such person’s written consent to being named in a proxy statement as a nominee and to serving as a director if elected; (v) a questionnaire and a representation and agreement to furnish such information as may reasonably be required by the Corporation to determine the eligibility of such proposed nominee to serve as an independent director of the Corporation, or that could be material to a reasonable stockholder’s understanding of the independence and other qualifications, or lack thereof, of such nominee, that has been completed and signed by both such stockholder (as well as the beneficial owner, if any, on whose behalf the nomination is made) and such nominee (such form of questionnaire, representation and agreement to be made available following a written request by the stockholder and nominee delivered to the Secretary of the Corporation at the principal executive offices of the Corporation); (vi) a representation and agreement that such nominee is not and will not become party to (a) any agreement, arrangement or understanding with, and has not given any commitment or assurance to, any person or entity as to how such nominee, if elected as a director of the Corporation, will act, in such person’s capacity as a director of the Corporation, or vote on any issue or question in such person’s capacity as a director of the Corporation (a “Voting Commitment”) that has not been disclosed to the Corporation, (b) any Voting Commitment that could limit or interfere with the nominee’s ability to comply, if elected as a director of the Corporation, with such person’s fiduciary duties under applicable law or (c) any agreement, arrangement or understanding with any person or entity other than the Corporation with respect to any director or indirect compensation, reimbursement or indemnification in connection with service or action as a director of the Corporation that has not been disclosed to the Corporation; (vii) a representation made in such person’s individual capacity that such nominee would be in compliance, if elected as a director of the Corporation, with all applicable publicly disclosed corporate governance, ethics, conflict of interest, confidentiality and stock ownership and trading policies and principles of the Corporation, including codes of conduct; and (viii) a representation that the nominee, if elected as a director of the Corporation, intends to service the full term as a director;

(b) as to any other business that the stockholder proposes to bring before the meeting, a brief description of the business desired to be brought before the meeting, the text of the proposal or business (including the text of any resolutions proposed for consideration and in the event that such business includes a proposal to amend these Bylaws, the language of the proposed amendment), the reasons for conducting such business at the meeting and any material interest in such business of such stockholder and the beneficial owner, if any, on whose behalf the proposal is made; and

(c) as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made:

(i) the name and address of such stockholder, as they appear on the Corporation’s books, and of such beneficial owner;

(ii) the class and number of shares of capital stock of the Corporation which are directly or indirectly owned beneficially and of record by such stockholder and such beneficial owner and their respective affiliates and associates as of the date of such notice;

(iii) a description of any agreement, arrangement or understanding with respect to the nomination or proposal between or among such stockholder and such beneficial owner, any of their respective affiliates or associates, including any direct or indirect compensation and other material monetary agreements, arrangements or undertakings between such stockholder or such beneficial owner (and their respective affiliates) and any nominee (and their respective affiliates), which shall include all information that would be required to be disclosed pursuant to Rule 404 promulgated under Regulation S-K if the stockholder or beneficial owner were the “registrant” pursuant to Regulation S-K and if the nominee were a director or executive officer of such registrant;

(iv) a description of any class or series, if any, and number of options, warrants, puts, calls, convertible securities, stock appreciation rights or similar rights, obligations or commitments with an exercise or conversion privilege or a settlement payment or mechanism at a price related to any class or series of shares or other securities of the Corporation or with a value derived in whole or in part from the value of any class or series of shares or other securities of the Corporation, whether or not such instrument, right, obligation or commitment shall be subject to settlement in the underlying class or series of shares or other securities of the Corporation (each, a “Derivative Security”), which are, directly, or indirectly, beneficially owned by such stockholder or beneficial owner and their respective affiliates and associates, if any, and any other direct or indirect opportunity to profit or share in any profit derived from any increase or decrease in the value of shares or other securities of the Corporation;

(v) a description of the terms of any number of shares subject to any short interest in any securities of the Corporation in which the stockholder or beneficial owner or any of their respective affiliates and associates has an interest (for the purposes of these Bylaws, a person shall be deemed to have a short interest in a security if such stockholder of beneficial owner, directly or indirectly, through any proxy, contract, arrangement, understanding, relationship or otherwise), has the opportunity to profit or share in any profit derived from any decrease in the value of the subject security;

(vi) a description of any proxy, contract, agreement, arrangement, understanding or relationship, including any repurchase or similar so-called “stock borrowing” agreement or arrangement, the effect or intent of which is to mitigate loss to, manage risk or benefit of share price changes for, or increase or decrease the voting power of, such stockholder and such beneficial owner and any of their respective affiliates and associates, with respect to shares of stock of the Corporation;

(vii) a description of any performance-related fees (other than an asset-based fee) to which the stockholder, beneficial owner or any of their respective affiliates and associates may be entitled as a result of any increase or decrease in the value of shares of the Corporation or Derivative Interests;

(viii) a description of any proportionate interest in shares or other securities of the Corporation or Derivative Securities held, directly or indirectly, by a general or limited partnership, limited liability company or similar entity in which any such stockholder is (a) a general partner or, directly or indirectly, beneficially owns an interest in a general partner of such general or limited partnership, or (b) the manager, managing member, or directly or indirectly, beneficially owns an interest in the manager or managing member of such limited liability company or similar entity;

(ix) a representation that the stockholder is a holder of record of stock of the Corporation entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to propose such business or nominate the person(s) named in its notice;

(x) a description of any material pending or threatened legal proceedings involving the Corporation, or any of its respective directors or officers, to which such stockholder, beneficial owner or any of their respective affiliates and associates is a party;

(xi) a representation as to whether the stockholder or the beneficial owner, if any, intends or is part of a group which intends (a) to deliver a proxy statement and/or form of proxy to holders of at least sixty-seven percent (67%) of the Corporation’s outstanding capital stock in accordance with Rule 14a-19 promulgated under the Exchange Act, or such larger percentage required to approve or adopt the proposal or elect the nominee and solicit proxies from such stockholders in support of such proposal or nomination;

(xii) a completed and signed questionnaire referenced in paragraph (A)(3)(a)(ii) of this Section 4 of Article I; and

(xiii) any other information relating to such stockholder and beneficial owner, as a nominating stockholder or beneficial owner, that is required to be disclosed in solicitations of proxies for the election of directors in a contested election, or is otherwise required, in each case pursuant to Regulation 14A of the Exchange Act.

(4) By delivering notice pursuant to this Section 4 of Article I, a stockholder represents and warrants that all information contained in its notice, as of the deadline for submitting the notice, is true, accurate and complete in all respects, contains no false or misleading statements and such stockholder acknowledges that it intends for the Corporation and the Board of Directors to rely on such information as (a) being true, accurate and complete in all respects and (b) not containing any false or misleading statements. If the information submitted pursuant to this Section 4 by any stockholder proposing a nomination or other business for consideration at a meeting of stockholders shall not be true, correct and complete in all respects prior to the deadline for submitting notice, such information may be deemed not to have been provided in accordance with this Section 4 of Article I.

(5) Not later than 10 days after the record date for the meeting, the information required by this Section 4 of Article I shall be supplemented by the stockholder giving the notice to provide updated information as of the record date. The stockholder giving notice shall promptly notify the Corporation if it fails to satisfy any of the requirements set forth in Rule 14a-19 (or any successor provision) promulgated under the Exchange Act. A stockholder shall not have complied with this Section 4 of Article I if the stockholder (or beneficial owner, if any, on whose behalf the nomination is made) solicits or does not solicit, as the case may be, proxies or votes in support of such stockholder’s nominee in contravention of the representations with respect thereto required by this Section 4 of Article I or Rule 14a-19 (or any successor provision) promulgated under the Exchange Act. Upon request by the Corporation, if a stockholder provides notice pursuant to Rule 14a-19(b) (or any successor provision) promulgated under the Exchange Act, such stockholder shall deliver to the Corporation, no later than five business days prior to the applicable meeting of stockholders, reasonable evidence that it has met the requirements of Rule 14a-19(a)(3) (or any successor provision) promulgated under the Exchange Act. Unless otherwise required by law, if any stockholder provides notice pursuant to Rule 14a-19 (or any successor provision) promulgated under the Exchange Act and subsequently fails to comply with any of the requirements of Rule 14a-19(a)(2) or Rule 14a-19(a)(3) under the Exchange Act, then the Corporation shall disregard any proxies or votes solicited for such nominees and such nomination shall be disregarded. Notwithstanding the foregoing provisions of this Section 4 of Article I, a stockholder shall also comply with all applicable requirements of state and federal law, including the Exchange Act, the Certificate of Incorporation and these Bylaws with respect to any nomination set forth in this Section 4 of Article I.

(6) Unless otherwise required by applicable law, if the stockholder (or a qualified representative of the stockholder) does not appear at the annual meeting to present business, such business shall not be considered, notwithstanding that proxies in respect of such business may have been received by the Corporation.

(7) Any stockholder directly or indirectly soliciting proxies from other stockholders must use a proxy card color other than white, which shall be reserved for exclusive use by the Board of Directors.

(8) The foregoing notice requirements of this Section 4 shall be deemed satisfied by a stockholder with respect to business other than a nomination if the stockholder has notified the Corporation of their intention to present a proposal at an annual meeting in compliance with applicable rules and regulations promulgated under the Exchange Act and such stockholder’s proposal has been included in a proxy statement that has been prepared by the Corporation to solicit proxies for such annual meeting. The Corporation may require any proposed nominee to

furnish such other information as it may reasonably require to determine the eligibility of such proposed nominee to serve as a director of the Corporation.

(9) Notwithstanding anything in the second sentence of paragraph (A)(2) of this Section 4 to the contrary, in the event that the number of directors to be elected to the Board of Directors at an annual meeting is increased effective at the annual meeting and there is no public announcement by the Corporation naming the nominees for the additional directorships at least one hundred days prior to the first anniversary of the preceding year’s annual meeting, a stockholder’s notice required by this Section 4 shall also be considered timely, but only with respect to nominees for the additional directorships, if it shall be delivered to the Secretary at the principal executive offices of the Corporation not later than the close of business on the tenth day following the day on which such public announcement is first made by the Corporation.

(10) The number of nominees a stockholder may nominate for election at a meeting of stockholders (or in the case of a stockholder giving notice on behalf of a beneficial owner, the number of nominees a stockholder may nominate for election at a meeting of stockholders on behalf of a beneficial owner) shall not exceed the number of directors to be elected at such meeting.

(11) For the purposes of this Section 4, the term “affiliate” or “affiliates” and “associate” or “associates” shall have the meaning ascribed thereto under the Exchange Act.

(B) Special Meetings of Stockholders.

(1) Only such business shall be conducted at a special meeting of stockholders as shall have been brought before the meeting pursuant to the Corporation’s notice of meeting.

(2) Nominations of persons for election to the Board of Directors may be made at a special meeting of stockholders at which directors are to be elected pursuant to the Corporation’s notice of meeting (1) by or at the direction of the Board of Directors or any committee thereof, or (2) provided that the Board of Directors has determined that directors shall be elected at such meeting, by any stockholder of the Corporation who is a stockholder of record at the time the notice provided for in this Section 4 of this Article I is delivered to the Secretary of the Corporation, who is entitled to vote at the meeting and upon such election and who complies with the notice procedures set forth in this Section 4.

(3) In the event the Corporation calls a special meeting of stockholders for the purpose of electing one or more directors to the Board of Directors, any such stockholder entitled to vote in such election of directors may nominate a person or persons (as the case may be) for election to such position(s) as specified in the Corporation’s notice of meeting, if the stockholder’s notice required by paragraph (A)(2) of this Section 4 shall be delivered to the Secretary at the principal executive offices of the Corporation not earlier than the close of business on the one hundred twentieth day prior to such special meeting and not later than the close of business on the later of the ninetieth day prior to such special meeting or the tenth day following the day on which public announcement is first made of the date of the special meeting and of the nominees proposed by the Board of Directors to be elected at such meeting. In no event shall the public announcement of an adjournment or postponement of a special meeting commence a new time period (or extend any time period) for the giving of a stockholder’s notice as described above.

(C) General.

(1) Only such persons who are nominated in accordance with the procedures set forth in this Section 4 shall be eligible to be elected at an annual or special meeting of stockholders of the Corporation to serve as directors, and only such business shall be conducted at a meeting of stockholders as shall have been brought before the meeting in accordance with the procedures set forth in this Section 4.

(2) Except as otherwise provided by law, the chair of the meeting shall have the power and duty

(a) to determine whether a nomination, or any business proposed to be brought before the meeting, was made or proposed, as the case may be, in accordance with the procedures set forth in this Section 4 (including whether the stockholder or beneficial owner, if any, on whose behalf the nomination or proposal is made solicited

(or is part of a group which solicited) or did not so solicit, as the case may be, proxies in support of such stockholder’s nominee or proposal in compliance with such stockholder’s representation as required by clause (A)(3)(c)(vi) of this Section 4) and

(b) if any proposed nomination or business was not made or proposed in compliance with this Section 4, to declare that such nomination shall be disregarded or that such proposed business shall not be transacted.

(3) Notwithstanding the foregoing provisions of this Section 4, unless otherwise required by law, if the stockholder (or a qualified representative of the stockholder) does not appear at the annual or special meeting of stockholders of the Corporation to present a nomination or proposed business, such nomination shall be disregarded, and such proposed business shall not be transacted, notwithstanding that proxies in respect of such vote may have been received by the Corporation.

(4) For purposes of this Section 4, to be considered a qualified representative of the stockholder, a person must be authorized by a writing executed by such stockholder or an electronic transmission delivered by such stockholder to act for such stockholder as proxy at the meeting of stockholders and such person must produce such writing or electronic transmission, or a reliable reproduction of the writing or electronic transmission, at the meeting of stockholders.

(5) For purposes of this Section 4, “public announcement” shall include disclosure in a press release reported by the Dow Jones News Service, Associated Press or comparable national news service or in a document publicly filed by the Corporation with the Securities and Exchange Commission pursuant to Section 13, 14 or 15(d) of the Exchange Act.

(6) Notwithstanding the foregoing provisions of this Section 4, a stockholder shall also comply with all applicable requirements of the Exchange Act and the rules and regulations thereunder with respect to the matters set forth in this Section 4; provided, however, that any references in these Bylaws to the Exchange Act or the rules promulgated thereunder are not intended to and shall not limit any requirements applicable to nominations or proposals as to any other business to be considered pursuant to this Section 4 (including paragraphs (A)(1)(c) and (B) hereof), and compliance with paragraphs (A)(1)(c) and (B) of this Section 4 shall be the exclusive means for a stockholder to make nominations or submit other business (other than, as provided in the first sentence of paragraph (A)(4), matters brought properly under and in compliance with Rule 14a-8 of the Exchange Act, as may be amended from time to time). Nothing in this Section 4 shall be deemed to affect any rights (a) of stockholders to request inclusion of proposals in the Corporation’s proxy statement pursuant to applicable rules and regulations promulgated under the Exchange Act, or (b) of the holders of any series of Preferred Stock to elect directors pursuant to any applicable provisions of the Certificate of Incorporation.

Section 5. Quorum. At any meeting of the stockholders, the holders of a majority in voting power of the total outstanding shares of stock of the Corporation entitled to vote at such meeting, present in person or represented by proxy, shall constitute a quorum of the stockholders for all purposes, unless the representation of a larger number of shares shall be required by law, by the Certificate of Incorporation or by these Bylaws, in which case the representation of the number of shares so required shall constitute a quorum; provided that at any meeting of the stockholders at which the holders of any class of stock of the Corporation shall be entitled to vote separately as a class, the holders of a majority in voting power of the total outstanding shares of such class, present in person or represented by proxy, shall constitute a quorum for purposes of such class vote unless the representation of a larger number of shares of such class shall be required by law, by the Certificate of Incorporation or by these Bylaws. If a quorum is present when a meeting is convened, the subsequent withdrawal of stockholders, even though less than a quorum remains, shall not affect the validity of any action take at the meeting (or any adjournment thereof).

Section 6. Adjourned Meetings. Whether or not a quorum shall be present in person or represented at any meeting of the stockholders, the holders of a majority in voting power of the shares of stock of the Corporation present in person or represented by proxy and entitled to vote at such meeting may adjourn from time to time; provided, however, that if the holders of any class of stock of the Corporation are entitled to vote separately as a class upon any matter at such meeting, any adjournment of the meeting in respect of action by such class upon such

matter shall be determined by the holders of a majority in voting power of the shares of such class present in person or represented by proxy and entitled to vote at such meeting. It shall not be necessary to notify any stockholder of any adjournment of fewer than 30 days if the time and place, if any, and the means of remote communications, if any, by which stockholders may be deemed to be present in person and vote at such adjourned meeting are (a)announced at the meeting at which the adjournment is taken, (b) in the case of a meeting conducted by means of remote communications, displayed, during the time of the schedule meeting, on the same electronic network used to enable stockholders to participate in the meeting by means of remote communication or (c) set forth in the notice of meeting. At the adjourned meeting the stockholders, or the holders of any class of stock entitled to vote separately as a class, as the case may be, may transact only such business as might have been transacted by them at the original meeting and only such persons who could have been nominated at the original meeting can be nominated to serve as directors. If the adjournment is for more than thirty days, or if after the adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned meeting shall be given to each stockholder of record entitled to vote at the adjourned meeting.

Section 7. Organization.

(A) The Chair of the Board of Directors, or the President or, in their absence, a Vice President shall call meetings of the stockholders to order, and shall act as chair of such meetings. In the absence of the Chair of the Board of Directors, the President and all of the Vice Presidents, the holders of a majority in number of the shares of stock of the Corporation present in person or represented by proxy and entitled to vote at such meeting shall elect a chair.

(B) The Secretary of the Corporation shall act as Secretary of meetings of the stockholders; but in the absence of the Secretary, the chair may appoint any person to act as Secretary of the meeting. It shall be the duty of the Secretary to prepare and make, at least ten days before every meeting of stockholders, a complete list of stockholders entitled to vote at such meeting, arranged in alphabetical order and showing the address of each stockholder and the number of shares registered in the name of each stockholder. Such list shall be open for any purpose germane to the meeting for a period of at least ten days prior to the meeting (i) on a reasonably accessible electronic network, provided that the information required to gain access to the list is provided with the notice of the meeting, or (ii) during ordinary business hours at the principal place of business of the Corporation.

Section 8. Voting.

(A) Except as otherwise provided in the Certificate of Incorporation or by law, each stockholder shall be entitled to one vote for each share of the capital stock of the Corporation registered in the name of such stockholder upon the books of the Corporation. Each stockholder entitled to vote at a meeting of stockholders may authorize another person or persons to act for him by proxy, but no such proxy shall be voted or acted upon after three years from its date, unless the proxy provides for a longer period. When directed by the presiding officer or upon the demand of any stockholder, the vote upon any matter before a meeting of stockholders shall be by ballot.

(B) Except as otherwise provided in this Section 8 of Article I, each director shall be elected by the vote of the majority of the votes cast with respect to that director’s election at any meeting for the election of directors at which a quorum is present. Notwithstanding the foregoing, if, as of the tenth day preceding the date the Corporation first mails its notice of meeting for such meeting to the stockholders of the Corporation, the number of nominees exceeds the number of directors to be elected (a “Contested Election”), the directors shall be elected by the vote of a plurality of the votes cast. For purposes of this Section 8, a majority of votes cast shall mean that the number of votes cast “for” a director’s election exceeds the number of votes cast “against” that director’s election (with “abstentions” and “broker nonvotes” not counted as a vote cast either “for” or “against” that director’s election).

(C) In order for any incumbent director to become a nominee of the Board of Directors for further service on the Board of Directors, such person must submit an irrevocable resignation, which shall become effective only if (i) that person shall not receive a majority of the votes cast in an election that is not a Contested Election, and (ii) the Board of Directors determines to accept the resignation in accordance with the policies and procedures adopted by the Board of Directors for such purpose. In the event an incumbent director fails to receive a majority of

the votes cast in an election that is not a Contested Election, the Governance and Nominations Committee, or such other committee designated by the Board of Directors pursuant to Section 7 of Article II of these Bylaws, shall make a recommendation to the Board of Directors as to whether to accept or reject the resignation of such incumbent director, or whether other action should be taken. The Board of Directors shall act on the resignation, taking into account the committee’s recommendation, and within ninety days following certification of the election results publicly disclose, by a press release and an appropriate filing with the Securities and Exchange Commission, its decision regarding the resignation, and, if the resignation is rejected, the rationale behind the decision.

(D) If the Board of Directors accepts a director’s resignation pursuant to this Section 8 of this Article I, or if a nominee for director is not elected and the nominee is not an incumbent director, then the Board of Directors may fill the resulting vacancy or may decrease the size of the Board of Directors pursuant to the provisions of these Bylaws.

(E) Shares of the capital stock of the Corporation belonging to the Corporation or to another corporation, if a majority of the shares entitled to vote in the election of directors of such other corporation is held, directly or indirectly, by the Corporation, shall neither be entitled to vote nor be counted for quorum purposes.

Section 9. Inspectors of Election. The Corporation may, and shall if required by law, in advance of any meeting of stockholders, appoint one or more inspectors of election, who may be employees of the Corporation, to act at the meeting or any adjournment thereof and to make a written report thereof. The Corporation may designate one or more persons as alternate inspectors to replace any inspector who fails to act. In the event that no inspector so appointed or designated is able to act at a meeting of stockholders, the chair of the meeting shall appoint one or more inspectors to act at the meeting. Each inspector, before entering upon the discharge of their duties, shall take and sign an oath to execute faithfully the duties of inspector with strict impartiality and according to the best of their ability. The inspector or inspectors so appointed or designated shall (i) ascertain the number of shares of capital stock of the Corporation outstanding and the voting power of each such share, (ii) determine the shares of capital stock of the Corporation represented at the meeting and the validity of proxies and ballots, (iii) count all votes and ballots, (iv) determine and retain for a reasonable period a record of the disposition of any challenges made to any determination by the inspectors, and (v) certify their determination of the number of shares of capital stock of the Corporation represented at the meeting and such inspectors’ count of all votes and ballots. Such certification and report shall specify such other information as may be required by law. In determining the validity and counting of proxies and ballots cast at any meeting of stockholders of the Corporation, the inspectors may consider such information as is permitted by applicable law. No person who is a candidate for an office at an election may serve as an inspector at such election.

Section 10. Conduct of Meetings. The date and time of the opening and the closing of the polls for each matter upon which the stockholders will vote at a meeting shall be announced at the meeting by the chair of the meeting. The Board of Directors may adopt by resolution such rules and regulations for the conduct of the meeting of stockholders as it shall deem appropriate. Except to the extent inconsistent with such rules and regulations as adopted by the Board of Directors, the chair of any meeting of stockholders shall have the right and authority to convene and to adjourn the meeting, to prescribe such rules, regulations and procedures and to do all such acts as, in the judgment of such chair, are appropriate for the proper conduct of the meeting. Such rules, regulations or procedures, whether adopted by the Board of Directors or prescribed by the chair of the meeting, may include, without limitation, the following: (i) the establishment of an agenda or order of business for the meeting; (ii) rules and procedures for maintaining order at the meeting and the safety of those present; (iii) limitations on attendance at or participation in the meeting to stockholders of record of the Corporation, their duly authorized and constituted proxies or such other persons as the chair of the meeting shall determine; (iv) restrictions on entry to the meeting after the time fixed for the commencement thereof; and (v) limitations on the time allotted to questions or comments by participants. The chair at any meeting of stockholders, in addition to making any other determinations that may be appropriate to the conduct of the meeting, shall, if the facts warrant, determine and declare to the meeting that a matter or business was not properly brought before the meeting and if such chair should so determine, such chair shall so declare to the meeting and any such matter or business not properly brought before the meeting shall not be transacted or considered. Unless and to the extent determined by the Board of Directors or the chair of the meeting, meetings of stockholders shall not be required to be held in accordance with the rules of parliamentary procedure.

Section 11. [Reserved]

Section 12. Proxy Access.

(A) Inclusion of Nominee in Proxy Materials. Whenever the Board of Directors solicits proxies with respect to the election of directors at an annual meeting of stockholders, subject to the provisions of this Section 12, the Corporation shall include in its proxy materials for such annual meeting, in addition to any persons nominated for election by the Board of Directors or a committee appointed by the Board of Directors, the name, together with the Required Information (as defined below), of any person nominated for election (a “Stockholder Nominee”) to the Board of Directors by a stockholder, or by a group of no more than twenty (20) stockholders, that has satisfied (individually or, in the case of a group, collectively) all applicable conditions and has complied with all applicable procedures set forth in this Section 12 (an “Eligible Stockholder,” which shall include an eligible stockholder group), and that expressly elects at the time of providing the notice required by this Section 12 (the “Nomination Notice”) to have its nominee included in the Corporation’s proxy materials for such annual meeting pursuant to this Section 12.

(B) Required Information. For purposes of this Section 12, the “Required Information” that the Corporation will include in its proxy materials is (1) the information concerning the Stockholder Nominee and the Eligible Stockholder that is required to be disclosed in the Corporation’s proxy statement by the rules and regulations of the Securities and Exchange Commission promulgated under the Exchange Act; and (2) if the Eligible Stockholder so elects, a Supporting Statement (as defined below).

(C) Delivery of Nomination Notice. To be timely, a stockholder’s Nomination Notice must be delivered to, or mailed and received by, the Secretary of the Corporation at the principal executive offices of the Corporation no earlier than the 150th day, and not later than the close of business on the 120th day prior to the first anniversary of the release date of the Corporation’s proxy materials for its most recent annual meeting of stockholders; provided, however, that in the event that the annual meeting is called for a date that is more than thirty (30) days before or more than thirty (30) days after the first anniversary of the preceding year’s annual meeting, or if no annual meeting was held in the preceding year, to be timely, the Nomination Notice must be so delivered, or mailed and received, not later than the close of business on the later of the 120th day prior to the date of such annual meeting or the 10th day following the day on which public disclosure of the date of such annual meeting was made by the Corporation. In no event shall any adjournment or postponement of an annual meeting or any public announcement thereof commence a new time period (or extend any time period) for the giving of a Nomination Notice as described above.

(D) Permitted Number of Stockholder Nominees.

(1) The maximum aggregate number of Stockholder Nominees nominated by Eligible Stockholders that will be included in the Corporation’s proxy materials with respect to an annual meeting of stockholders (the “Permitted Number”) shall not exceed the greater of (a) two or (b) twenty percent (20%) of the number of directors in office as of the last day on which a Nomination Notice may be delivered pursuant to this Section 12, or if such amount is not a whole number, the closest whole number below twenty percent (20%); provided, however, that the Permitted Number shall be reduced by (i) any Stockholder Nominee whose name was submitted by an Eligible Stockholder for inclusion in the Corporation’s proxy materials pursuant to this Section 12 but either is subsequently withdrawn or that the Board of Directors decides to nominate for election and (ii) the number of incumbent directors who were Stockholder Nominees at any of the preceding three annual meetings (including any individual covered under clause (i) above) and whose election at the upcoming annual meeting is being recommended by the Board of Directors. In the event that one or more vacancies for any reason occurs on the Board of Directors after the deadline set forth in Section 12(C) above but before the date of the annual meeting and the Board of Directors resolves to reduce the size of the Board of Directors in connection therewith, the Permitted Number shall be calculated based on the number of directors in office as so reduced.

(2) Any Eligible Stockholder submitting more than one Stockholder Nominee for inclusion in the Corporation’s proxy materials pursuant to this Section 12 shall rank such Stockholder Nominees based on the order in which the Eligible Stockholder desires such Stockholder Nominees be selected for inclusion in the Corporation’s

proxy materials. In the event that the number of Stockholder Nominees submitted by Eligible Stockholders pursuant to this Section 12 exceeds Permitted Number provided for pursuant to subsection (D)(1) above, the highest ranking Stockholder Nominee who meets the requirements of this Section 12 of each Eligible Stockholder will be selected for inclusion in the Corporation’s proxy materials until the Permitted Number is reached, going in order by the number (largest to smallest) of shares of common stock of the Corporation each Eligible Stockholder disclosed as Owned (as defined below) in its respective Nomination Notice submitted to the Corporation pursuant to this Section 12. If the Permitted Number is not reached after the highest-ranking Stockholder Nominee who meets the requirements of this Section 12 of each Eligible Stockholder has been selected, this process will continue with the next highest ranked nominees as many times as necessary, following the same order each time, until the Permitted Number is reached.

(E) Ownership. For purposes of this Section 12, an Eligible Stockholder shall be deemed to “Own” only those outstanding shares of common stock of the Corporation as to which the stockholder possesses both (1) the full voting and investment rights pertaining to the shares and (2) the full economic interest in (including the opportunity for profit and risk of loss on) such shares; provided that the number of shares calculated in accordance with clauses (1) and (2) shall not include any shares (a) sold by such stockholder or any of its affiliates in any transaction that has not been settled or closed, including any short sale, (b) borrowed by such stockholder or any of its affiliates for any purpose, or purchased by such stockholder or any of its affiliates subject to an agreement to resell, or (c) subject to any option, warrant, forward contract, swap, contract of sale, or other derivative or similar agreement entered into by such stockholder or any of its affiliates, whether any such instrument or agreement is to be settled with shares or with cash based on the notional amount or value of shares of common stock of the Corporation, in any such case which instrument or agreement has, or is intended to have, or if exercised would have, the purpose or effect of (1) reducing in any manner, to any extent or at any time in the future, such stockholder’s or its affiliates’ full right to vote or direct the voting of any such shares, and/or (2) hedging, offsetting or altering to any degree any gain or loss realized or realizable from maintaining the full economic ownership of such shares by such stockholder or affiliate. A stockholder shall “Own” shares held in the name of a nominee or other intermediary so long as the stockholder retains the right to instruct how the shares are voted with respect to the election of directors and possesses the full economic interest in the shares. A stockholder’s Ownership of shares shall be deemed to continue during any period in which (1) the person has loaned such shares, provided that the person has the power to recall such loaned shares on no more than five (5) business days’ notice and includes with the Nomination Notice an agreement that it (a) will promptly recall such loaned shares upon being notified by the Corporation that any of its Stockholder Nominees will be included in the Corporation’s proxy materials and (b) will continue to hold such recalled shares (including the right to vote such shares) through the date of the annual meeting of stockholders; or (2) the person has delegated any voting power by means of a proxy, power of attorney or other instrument or arrangement that is revocable at any time by the person. The terms “Owned,” “Owning” and other variations of the word “Own” shall have correlative meanings. Whether outstanding shares of common stock of the Corporation are “Owned” for purposes of this Section 12 shall be determined by the Board of Directors or any committee thereof, which determination shall be conclusive and binding on the Corporation and its stockholders. For purposes of this Section 12, the term “affiliate” or “affiliates” shall have the meaning ascribed thereto under the rules and regulations of the Securities and Exchange Commission promulgated under the Exchange Act.

(F) Eligible Stockholder. In order to make a nomination pursuant to this Section 12, an Eligible Stockholder or group of up to twenty (20) Eligible Stockholders must have Owned (as defined above) continuously for at least three (3) years at least the number of shares of common stock of the Corporation that shall constitute three percent (3%) or more of the voting power of the outstanding common stock of the Corporation (the “Required Shares”) as of (a) the date on which the Nomination Notice is delivered to, or mailed to and received by, the Secretary of the Corporation in accordance with this Section 12, (2) the record date for determining stockholders entitled to vote at the annual meeting, and (3) the date of the annual meeting. For this purpose, two or more funds or trusts that are (a) under common management and investment control, (b) under common management and funded primarily by the same employer, or (c) a “group of investment companies,” as such term is defined in Section 12(d)(1)(G)(ii) of the Investment Company Act of 1940, as amended (each, a “Qualifying Fund”), shall be treated as one stockholder or beneficial owner.

No person may be a member of more than one group of persons constituting an Eligible Stockholder under this Section 12. If a group of stockholders aggregates Ownership of shares in order to meet the requirements under this Section 12, (1) all shares held by each stockholder constituting their contribution to the foregoing three percent (3%) threshold must have been held by that stockholder continuously for at least three (3) years and through the date of the annual meeting, and evidence of such continuous Ownership shall be provided as specified in subsection 1.12(G) below, (2) each provision in this Section 12 that requires the Eligible Stockholder to provide any written statements, representations, undertakings, agreements or other instruments or to meet any other conditions shall be deemed to require each stockholder (including each individual fund) that is a member of such group to provide such statements, representations, undertakings, agreements or other instruments and to meet such other conditions (except that the members of such group may aggregate their stockholdings in order to meet the three percent (3%) Ownership requirement of the “Required Shares” definition) and (3) a breach of any obligation, agreement or representation under this Section 12 by any member of such group shall be deemed a breach by the Eligible Stockholder.

(G) Information to be Provided by Eligible Stockholder. Within the time period specified in this Section 12 for providing the Nomination Notice, an Eligible Stockholder making a nomination pursuant to this Section 12 must provide the following information in writing to the Secretary of the Corporation at the principal executive offices of the Corporation:

(1) one or more written statements from the Eligible Stockholder (and from each other record holder of the shares and intermediary through which the shares are or have been held during the requisite three (3)-year holding period) specifying the number of shares of common stock of the Corporation that the Eligible Stockholder Owns, and has continuously Owned for three (3) years preceding the date of the Nomination Notice, and the Eligible Stockholder’s agreement to provide, within five (5) business days after the later of the record date for the annual meeting and the date on which the record date is first publicly disclosed by the Corporation, written statements from the Eligible Stockholder, record holder and intermediaries verifying the Eligible Stockholder’s continuous Ownership of the Required Shares through the record date, provided that statements meeting the requirements of Schedule 14N will be deemed to fulfill this requirement;

(2) the written consent of each Stockholder Nominee to being named in the proxy statement as a nominee and to serving as a director if elected, together with the information and representations that would be required to be set forth in a stockholder’s notice of a nomination pursuant to Section 4(A)(3)(a) and Section 4(A)(3)(c);

(3) a copy of the Schedule 14N that has been or is concurrently being filed by such Eligible Stockholder with the Securities and Exchange Commission as required by Rule 14a-18 under the Exchange Act, as such rule may be amended;

(4) the details of any relationship that existed within the past three (3) years and that would have been described pursuant to Item 6(e) of Schedule 14N (or any successor item) if it existed on the date of submission of Schedule 14N;

(5) a representation and undertaking (a) that the Eligible Stockholder (i) did not acquire, and is not holding, securities of the Corporation for the purpose or with the effect of influencing or changing control of the Corporation; (ii) has not nominated and will not nominate for election to the Board of Directors at the annual meeting any person other than the Stockholder Nominee(s) being nominated by it pursuant to this Section 12, (iii) has not engaged and will not engage in, and has not and will not be a “participant” in another person’s, “solicitation” within the meaning of Rule 14a-1(l) under the Exchange Act in support of the election of any individual as a director at the annual meeting other than its Stockholder Nominee(s) or a nominee of the Board of Directors, (iv) has not distributed and will not distribute to any stockholder any form of proxy for the annual meeting other than the form distributed by the Corporation, and (v) will Own the Required Shares through the date of the annual meeting of stockholders; (b) that the facts, statements and other information in all communications with the Corporation and its stockholders are and will be true and correct in all material respects and do not and will not omit to state a material fact necessary in order to make the statements made, in light of the circumstances under which they were made, not

misleading; and (c) as to whether or not the Eligible Stockholder intends to maintain qualifying Ownership of the Required Shares for at least one year following the annual meeting;

(6) in the case of a nomination by a group of stockholders that together is an Eligible Stockholder, the designation by all group members of one group member that is authorized to receive communications, notices and inquiries from the Corporation and to act on behalf of all such members with respect to the nomination and all matters related thereto, including any withdrawal of the nomination;

(7) an undertaking that the Eligible Stockholder agrees to (a) assume all liability stemming from any legal or regulatory violation arising out of the Eligible Stockholder’s communications with the stockholders of the Corporation or out of the information that the Eligible Stockholder provided to the Corporation, (b) indemnify and hold harmless the Corporation and each of its directors, officers and employees individually against any liability, loss or damages in connection with any threatened or pending action, suit or proceeding, whether legal, administrative or investigative, against the Corporation or any of its directors, officers or employees arising out of any nomination, solicitation or other activity by the Eligible Stockholder in connection with its efforts to elect the Stockholder Nominee(s) pursuant to this Section 12, (c) comply with all other laws, rules and regulations applicable to any actions taken pursuant to this Section 12, including the nomination and any solicitation in connection with the annual meeting of stockholders, and (d) with respect to any shares held or controlled by the Eligible Stockholder, to the extent that cumulative voting would otherwise be permitted, agrees not to cumulate votes in favor of the election of any Stockholder Nominee(s) nominated by such Eligible Stockholder; and

(8) in the case of a Qualifying Fund whose share Ownership is counted for purposes of qualifying as an Eligible Stockholder, documentation from the Qualifying Fund reasonably satisfactory to the Board of Directors that demonstrates that it meets the requirements of a Qualifying Fund set forth in Section 12(F) above

(H) Supporting Statement. The Eligible Stockholder may provide to the Secretary of the Corporation, at the time the information required by this Section 12 is provided, a written statement for inclusion in the Corporation’s proxy statement for the annual meeting of stockholders, not to exceed five hundred (500) words, in support of the Stockholder Nominee(s)’ candidacy (the “Supporting Statement”). Notwithstanding anything to the contrary contained in this Section 12, the Corporation may omit from its proxy materials any information or Supporting Statement (or portion thereof) that it, in good faith, believes would violate any applicable law, rule, regulation or listing standard. Nothing in this Section 12 shall limit the Corporation’s ability to solicit against and include in its proxy materials its own statements relating to any Eligible Stockholder or Stockholder Nominee.

(I) Representations and Agreement of the Stockholder Nominee. Within the time period specified in this Section 12 for delivering the Nomination Notice, a Stockholder Nominee must deliver to the Secretary of the Corporation a written representation and agreement (in the form provided by the Secretary upon written request) adopting each of the representations set forth in Section 4(A)(3)(a) and Section 4(A)(3)(c) (including, without limitation, the requirement to provide a completed questionnaire, representation and agreement contained in Section 4(A)(3)(a)). At the request of the Corporation, the Stockholder Nominee must promptly, but in any event within five (5) business days of such request, submit all completed and signed questionnaires required of the Corporation’s directors and officers. The Corporation may request such additional information (1) as may be reasonably necessary to permit the Board of Directors or any committee thereof to determine if each Stockholder Nominee is independent under the listing standards of the principal U.S. exchange upon which the Corporation’s common stock is listed, any applicable rules of the Securities and Exchange Commission and any publicly disclosed standards used by the Board of Directors in determining and disclosing the independence of the Corporation’s directors (the “Applicable Independence Standards”) and otherwise to determine the eligibility of each Stockholder Nominee to serve as a director of the Corporation, or (2) that could be material to a reasonable stockholder’s understanding of the independence, or lack thereof, of each Stockholder Nominee.

(J) True, Correct and Complete Information. In the event that any information or communications provided by any Eligible Stockholder or Stockholder Nominee to the Corporation or its stockholders is not, when provided, or thereafter ceases to be, true, correct and complete in all material respects (including omitting a material fact necessary to make the statements made, in light of the circumstances under which they were made, not misleading), such Eligible Stockholder or Stockholder Nominee, as the case may be, shall promptly notify the

Secretary of the Corporation and provide the information that is required to make such information or communication true, correct, complete and not misleading; it being understood that providing any such notification shall not be deemed to cure any such defect or limit the Corporation’s right to omit a Stockholder Nominee from its proxy materials pursuant to this Section 12. In addition, any person providing any information to the Corporation pursuant to this Section 12 shall further update and supplement such information, if necessary, so that all such information shall be true and correct as of the record date for the annual meeting and as of the date that is ten (10) business days prior to the annual meeting or any adjournment or postponement thereof, and such update and supplement (or a written certification that no such updates or supplements are necessary and that the information previously provided remains true and correct as of the applicable date) shall be delivered to, or mailed and received by, the Secretary of the Corporation at the principal executive offices of the corporation not later than five (5) business days after the later of the record date for the annual meeting and the date on which the record date is first publicly disclosed by the Corporation (in the case of any update and supplement required to be made as of the record date), and not later than seven (7) business days prior to the date of the annual meeting or any adjournment or postponement thereof (in the case of any update and supplement required to be made as of ten (10) business days prior to the meeting).

(K) Limitation on Stockholder Nominees. Any Stockholder Nominee who is included in the Corporation’s proxy materials for a particular annual meeting of stockholders but withdraws from or becomes ineligible or unavailable for election at such annual meeting will be ineligible to be a Stockholder Nominee pursuant to this Section 12 for the next two (2) annual meetings of stockholders.

(L) Exceptions. Notwithstanding anything to the contrary set forth herein, the Corporation shall not be required to include, pursuant to this Section 12, any Stockholder Nominee in its proxy materials for any meeting of stockholders (1) if the Eligible Stockholder who has nominated such Stockholder Nominee has engaged in or is currently engaged in, or has been or is a “participant” in another person’s, “solicitation” within the meaning of Rule 14a-1(l) under the Exchange Act in support of the election of any individual as a director at the meeting other than its Stockholder Nominee(s) or a nominee of the Board of Directors, (2) if the Corporation receives notice pursuant to Section 4(A)(3) that any stockholder intends to nominate any nominee for election to the Board of Directors at such meeting, (3) who is not independent under the Applicable Independence Standards, as determined by the Board of Directors or any committee thereof, (4) whose nomination or election as a member of the Board Directors would cause the Corporation to be in violation of these Bylaws, the Certificate of Incorporation, the rules and listing standards of the principal exchanges upon which the Corporation’s shares of common stock are listed or traded, or any applicable law, rule or regulation, (5) who is or has been, within the past three (3) years, an officer or director of a competitor, as defined in Section 8 of the Clayton Antitrust Act of 1914, (6) who is a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses) or has been convicted in such a criminal proceeding within the past ten (10) years, (7) who is subject to any order of the type specified in Rule 506(d) of Regulation D promulgated under the Securities Act of 1933, as amended, (8) if such Stockholder Nominee or the applicable Eligible Stockholder shall have provided information to the Corporation in respect to such nomination that was untrue in any material respect or omitted to state a material fact necessary in order to make the statement made, in light of the circumstances under which it was made, not misleading, as determined by the Board of Directors, (9) if such Stockholder Nominee or the applicable Eligible Stockholder otherwise contravenes any of the agreements or representations made by such Stockholder Nominee or Eligible Stockholder or fails to comply with its obligations pursuant to this Section 12, or (10) if the applicable Eligible Stockholder ceases to be an Eligible Stockholder for any reason, including but not limited to not Owning the Required Shares through the date of the applicable annual meeting of stockholders.

(M) Disqualifications. Notwithstanding anything to the contrary set forth herein, if (1) a Stockholder Nominee is included in the Corporation’s proxy materials for the annual meeting but subsequently is determined not to satisfy the eligibility requirements of this Section 12 or any other provision of the Corporation’s Bylaws, Certificate of Incorporation, Principles of Corporate Governance or other applicable regulation at any time before the annual meeting, (2) a Stockholder Nominee and/or the applicable Eligible Stockholder shall have breached any of its obligations, agreements or representations, or fails to comply with its or their obligations pursuant to this Section 12, (3) a Stockholder Nominee dies, becomes disabled or otherwise becomes ineligible for inclusion in the Corporation’s proxy materials pursuant to this Section 12 or unavailable for election at the annual meeting, or (4) the

applicable Eligible Stockholder otherwise ceases to be an Eligible Stockholder for any reason, including but not limited to not Owning the Required Shares through the date of the applicable annual meeting of stockholders, in each case as determined by the Board of Directors, any committee thereof or the person presiding at the annual meeting, (x) the Corporation may omit or, to the extent feasible, remove the information concerning such Stockholder Nominee and the related Supporting Statement from its proxy materials and/or otherwise communicate to its stockholders that such Stockholder Nominee will not be eligible for election at the annual meeting, (y) the Corporation shall not be required to include in its proxy materials any successor or replacement nominee proposed by the applicable Eligible Stockholder or any other Eligible Stockholder and (z) the Board of Directors or the person presiding at the annual meeting shall declare such nomination to be invalid and such nomination shall be disregarded notwithstanding that proxies in respect of such vote may have been received by the Corporation. In addition, if the Eligible Stockholder (or a representative thereof) does not appear at the annual meeting to present any nomination pursuant to this Section 12, such nomination shall be declared invalid and disregarded as provided in clause (z) above.

(N) Filing Obligation. The Eligible Stockholder (including any person who Owns shares of common stock of the Corporation that constitute part of the Eligible Stockholder’s Ownership for purposes of satisfying Section 12(E) hereof) shall file with the Securities and Exchange Commission any solicitation or other communication with the Corporation’s stockholders relating to the meeting at which the Stockholder Nominee will be nominated, regardless of whether any such filing is required under Regulation 14A of the Exchange Act or whether any exemption from filing is available for such solicitation or other communication under Regulation 14A of the Exchange Act.

ARTICLE II

Board of Directors

Section 1. Number and Term of Office.

(A) The number of directors shall be fixed from time to time exclusively by the Board of Directors pursuant to a resolution adopted by a majority of the total number of authorized directors (whether or not there exist any vacancies in previously authorized directorships at the time any such resolution is presented to the Board for adoption). The directors shall be divided into three classes with the term of office of the first class (Class I) to expire at the 1998 annual meeting of stockholders; the term of office of the second class (Class II) to expire at the 1999 annual meeting; the term of office of the third class (Class III) to expire at the 2000 annual meeting; and thereafter for each such term to expire at each third succeeding annual meeting of stockholders after such election. The initial allocation of existing directors among the classes shall be made by determination of the Board of Directors. Subject to the rights of the holders of any series of Preferred Stock then outstanding, a vacancy resulting from the removal of a director by the stockholders as provided in subparagraph (C) below may be filled at a special meeting of the stockholders held for that purpose. All directors shall hold office until the expiration of the term of the class to which they were elected, and until their respective successors are elected, except in the case of the death, resignation, or removal of any director.

(B) Subject to the rights of the holders of any series of Preferred Stock then outstanding, newly created directorships resulting from any increase in the authorized number of directors or any vacancies in the Board of Directors resulting from death, resignation or other cause (other than removal from office by a vote of the stockholders) may be filled only by a majority vote of the directors then in office, though less than a quorum. Notwithstanding the last sentence of subparagraph (A) above, directors so chosen shall hold office for a term expiring at the next annual meeting of stockholders, and until their respective successors are elected, except in the case of the death, resignation, or removal of any director. No decrease in the number of directors constituting the Board of Directors shall shorten the term of any incumbent director.

(C) Subject to the rights of the holders of any series of Preferred Stock then outstanding, any directors, or the entire Board of Directors, may be removed from office at any time, with or without cause, but only by the affirmative vote of the holders of at least a majority of the voting power of all of the then outstanding shares of capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single

class. Vacancies in the Board of Directors resulting from such removal may be filled by a majority of the directors then in office, though less than a quorum, or by the stockholders as provided in subparagraph (A) above. Directors so chosen shall hold office for a term expiring at the next annual meeting of stockholders at which the term of office of the class to which they have been elected expires, and until their respective successors are elected, except in the case of the death, resignation or removal of any director.

(D) Any director who intends to retire, resign, or refuse to stand for re-election must indicate their intent to do so in a written notice to the Secretary of the Corporation, and the retirement, resignation, or refusal to stand for re-election shall become effective only as provided in the written notice, or as may subsequently be agreed between the director and the Corporation.

Section 2. Place of Meeting. The Board of Directors may hold its meetings in such place or places, if any, in the State of Delaware or outside the State of Delaware as the Board from time to time shall determine.

Section 3. Regular Meetings. Regular meetings of the Board of Directors shall be held as determined from time to time by the Board at the offices of the Corporation, or at such other place, if any, as the Board may determine. No notice shall be required for any regular meeting of the Board of Directors; but a copy of every resolution fixing or changing the time or place of regular meetings shall be mailed to every director at least five days before the first meeting held in pursuance thereof.

Section 4. Special Meetings. Special meetings of the Board of Directors shall be held whenever called by direction of the Chair of the Board of Directors, the President, or by a majority of the directors then in office. Notice of the day, hour and place, if any, of holding of each special meeting shall be given by mailing the same at least two days before the meeting or by causing the same to be transmitted by telegraph, cable, wireless, facsimile transmission, electronic mail or other means of electronic transmission at least one day before the meeting to each director. Unless otherwise indicated in the notice thereof, any and all business other than an amendment of these Bylaws may be transacted at any special meeting, and an amendment of these Bylaws may be acted upon if the notice of the meeting shall have stated that the amendment of these Bylaws is one of the purposes of the meeting. At any meeting at which every director shall be present, even though without any notice, any business may be transacted, including the amendment of these Bylaws.