Chatham Lodging Trust Declares Quarterly Common, Preferred Dividend

11 December 2024 - 1:00AM

Business Wire

Chatham Lodging Trust (NYSE: CLDT), a lodging real estate

investment trust (REIT) that invests in upscale, extended-stay

hotels and premium-branded, select-service hotels and owns 39

hotels, today announced that its board of trustees declared a

quarterly common share dividend of $0.07 per common share, as well

as a quarterly preferred share dividend of $0.41406 per preferred

share, payable on January 15, 2025, to shareholders of record as of

December 31, 2024.

About Chatham Lodging Trust

Chatham Lodging Trust is a self-advised, publicly traded real

estate investment trust (REIT) focused primarily on investing in

upscale, extended-stay hotels and premium-branded, select-service

hotels. The company owns 39 hotels totaling 5,883 rooms/suites in

17 states and the District of Columbia. Additional information

about Chatham may be found at chathamlodgingtrust.com.

Forward-Looking Statement Safe Harbor

Note: This press release contains forward-looking statements

within the meaning of federal securities regulations. These

forward-looking statements are identified by their use of terms and

phrases such as "anticipate," "believe," "could," "estimate,"

"expect," "intend," "may," "should," "plan," "predict," "project,"

"will," "continue" and other similar terms and phrases, including

references to assumption and forecasts of future results.

Forward-looking statements are not guarantees of future performance

and involve known and unknown risks, uncertainties and other

factors which may cause the actual results to differ materially

from those anticipated at the time the forward-looking statements

are made. These risks include, but are not limited to: national and

local economic and business conditions, including the effect on

travel of potential terrorist attacks, that will affect occupancy

rates at the company’s hotels and the demand for hotel products and

services; operating risks associated with the hotel business; risks

associated with the level of the company’s indebtedness and its

ability to meet covenants in its debt agreements; relationships

with property managers; the company’s ability to maintain its

properties in a Fourth-class manner, including meeting capital

expenditure requirements; the company’s ability to compete

effectively in areas such as access, location, quality of

accommodations and room rate structures; changes in travel

patterns, taxes and government regulations which influence or

determine wages, prices, construction procedures and costs; the

company’s ability to complete acquisitions and dispositions; and

the company’s ability to continue to satisfy complex rules in order

for the company to remain a REIT for federal income tax purposes

and other risks and uncertainties associated with the company’s

business described in the company's filings with the SEC. Although

the company believes the expectations reflected in such

forward-looking statements are based upon reasonable assumptions,

it can give no assurance that the expectations will be attained or

that any deviation will not be material. All information in this

release is as of the date hereof, and the company undertakes no

obligation to update any forward-looking statement to conform the

statement to actual results or changes in the company’s

expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241210118890/en/

Dennis Craven (Company) Chief Operating Officer (561)

227-1386

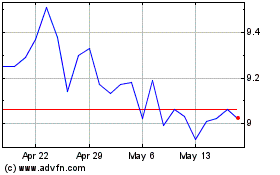

Chatham Lodging (NYSE:CLDT)

Historical Stock Chart

From Feb 2025 to Mar 2025

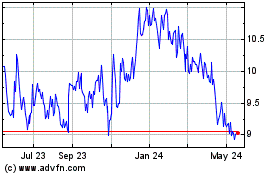

Chatham Lodging (NYSE:CLDT)

Historical Stock Chart

From Mar 2024 to Mar 2025