- Reported Q3 2024 earnings per diluted share of $0.30 on a GAAP

basis and $0.31 earnings per diluted share on a non-GAAP basis

(“non-GAAP EPS”)

- Reiterated 2024 non-GAAP EPS guidance range of $1.61-$1.63 per

diluted share, which represents 8% growth over full-year 2023

non-GAAP EPS at the midpoint1

- Initiated 2025 non-GAAP guidance range of $1.74-$1.76 per

diluted share, which at the midpoint represents 8% growth from the

2024 midpoint and further maintains non-GAAP EPS growth target

through 2030 of the mid-to-high end of 6%-8% annually1

CenterPoint Energy, Inc. (NYSE: CNP) or “CenterPoint” today

reported income available to common shareholders of $193 million,

or $0.30 per diluted share on a GAAP basis for the third quarter of

2024, compared to $0.40 per diluted share in the comparable period

of 2023.

Non-GAAP EPS for the third quarter 2024 was $0.31 per diluted

share, $0.09 per diluted share lower than the comparable quarter of

2023. The primary driver of this unfavorable variance was

attributable to an increase in operating and maintenance expense of

$0.11 per share as a result of the increased and accelerated

activities under the first phase of the Greater Houston Resiliency

Initiative. The third quarter results were further driven by growth

and regulatory recovery, which contributed $0.09 per share of

favorability. The favorability from growth and regulatory recovery

were offset primarily by unfavorable usage of $0.02 per share

driven by outages during Hurricane Beryl and unfavorable weather

variances of $0.04 per share at Houston Electric when compared to

the third quarter of 2023.

“I’m confident in our team’s ability to continue to make

meaningful advances in furthering the resiliency and reliability of

our Houston electric grid. Our enhanced resiliency investment

journey is well underway, and we’ve made tremendous progress over

the last couple years in hardening our transmission system. We’ve

now turned our attention to increasing and accelerating investments

in automation and self-healing technologies at the distribution

system level which we believe will help us deliver on our goal for

Houston Electric to build the most resilient coastal grid in the

nation,” said Jason Wells, President & CEO of CenterPoint.

“I’m proud of our employees who helped us deliver on our

commitments of Phase I of the Greater Houston Resiliency Initiative

at an unprecedent pace. We know we have more work to do, and it’s

already started in Phase II of our program as we work to re-earn

the trust of our customers, communities, and stakeholders.”

continued Wells.

1

CenterPoint is unable to present a

quantitative reconciliation of forward-looking non-GAAP diluted

earnings per share without unreasonable effort because changes in

the value of ZENS (as defined herein) and related securities,

future impairments, and other unusual items are not estimable and

are difficult to predict due to various factors outside of

management’s control.

Earnings Outlook

In addition to presenting its financial results in accordance

with GAAP, including presentation of income (loss) available to

common shareholders and diluted earnings (loss) per share,

CenterPoint provides guidance based on non-GAAP income and non-GAAP

diluted earnings per share. Generally, a non-GAAP financial measure

is a numerical measure of a company’s historical or future

financial performance that excludes or includes amounts that are

not normally excluded or included in the most directly comparable

GAAP financial measure.

Management evaluates CenterPoint’s financial performance in part

based on non-GAAP income and non-GAAP earnings per share.

Management believes that presenting these non-GAAP financial

measures enhances an investor’s understanding of CenterPoint’s

overall financial performance by providing them with an additional

meaningful and relevant comparison of current and anticipated

future results across periods. The adjustments made in these

non-GAAP financial measures exclude items that management believes

do not most accurately reflect the company’s fundamental business

performance. These excluded items are reflected in the

reconciliation tables of this news release, where applicable.

CenterPoint’s non-GAAP income and non-GAAP diluted earnings per

share measures should be considered as a supplement to, and not as

a substitute for, or superior to, income available to common

shareholders and diluted earnings per share, which respectively are

the most directly comparable GAAP financial measures. These

non-GAAP financial measures also may be different than non-GAAP

financial measures used by other companies.

2023 and 2024 non-GAAP EPS; 2024 and 2025 non-GAAP EPS guidance

range

- 2023 and 2024 non-GAAP EPS and 2024 and 2025 non-GAAP EPS

guidance excludes:

- Earnings or losses from the change in value of CenterPoint’s

2.0% Zero-Premium Exchangeable Subordinated Notes due 2029 (“ZENS”)

and related securities; and

- Gain and impact, including related expenses, associated with

mergers and divestitures, such as the divestiture of Energy Systems

Group, LLC and our Louisiana and Mississippi natural gas local

distribution company (“LDC”) businesses.

In providing 2023 and 2024 non-GAAP EPS and 2024 and 2025

non-GAAP EPS guidance, CenterPoint does not consider the items

noted above and other potential impacts such as changes in

accounting standards, impairments, or other unusual items, which

could have a material impact on GAAP reported results for the

applicable guidance period. The 2024 and 2025 non-GAAP EPS guidance

ranges also consider assumptions for certain significant variables

that may impact earnings, such as customer growth and usage

including normal weather, throughput, recovery of capital invested,

effective tax rates, financing activities and related interest

rates, and regulatory and judicial proceedings. To the extent

actual results deviate from these assumptions, the 2024 and 2025

non-GAAP EPS guidance ranges may not be met, or the projected

annual non-GAAP EPS growth rate may change. CenterPoint is unable

to present a quantitative reconciliation of forward-looking

non-GAAP diluted earnings per share without unreasonable effort

because changes in the value of ZENS and related securities, future

impairments, and other unusual items are not estimable and are

difficult to predict due to various factors outside of management’s

control.

Reconciliation of consolidated income

(loss) available to common shareholders and diluted earnings (loss)

per share (GAAP) to non-GAAP income and non-GAAP diluted earnings

per share

Quarter Ended

September 30, 2024

Dollars in millions

Diluted EPS (1)

Consolidated income (loss) available to

common shareholders and diluted EPS

$

193

$

0.30

ZENS-related mark-to-market (gains)

losses:

Equity securities (net of taxes of $12)

(2)(3)

(42)

(0.07)

Indexed debt securities (net of taxes of

$11) (2)

42

0.07

Impacts associated with mergers and

divestitures (net of taxes of $1) (2)

5

0.01

Consolidated on a non-GAAP basis

(4)

$

198

$

0.31

1)

Quarterly diluted EPS on both a GAAP and

non-GAAP basis are based on the weighted average number of shares

of common stock outstanding during the quarter, and the sum of the

quarters may not equal year-to-date diluted EPS.

2)

Taxes are computed based on the impact

removing such item would have on tax expense.

3)

Comprised of common stock of AT&T

Inc., Charter Communications, Inc. and Warner Bros. Discovery,

Inc.

4)

The calculation on a per-share basis may

not add down due to rounding.

Reconciliation of consolidated income

(loss) available to common shareholders and diluted earnings (loss)

per share (GAAP) to non-GAAP income and non-GAAP diluted earnings

per share

Quarter Ended

September 30, 2023

Dollars in millions

Diluted EPS (1)

Consolidated income (loss) available to

common shareholders and diluted EPS

$

256

$

0.40

ZENS-related mark-to-market (gains)

losses:

Equity securities (net of taxes of $10)

(2)(3)

(39)

(0.06)

Indexed debt securities (net of taxes of

$10) (2)

37

0.06

Impacts associated with mergers and

divestitures (net of taxes of $0) (2)

2

-

Consolidated on a non-GAAP basis

(4)

$

256

$

0.40

1)

Quarterly diluted EPS on both a GAAP and

non-GAAP basis are based on the weighted average number of shares

of common stock outstanding during the quarter, and the sum of the

quarters may not equal year-to-date diluted EPS.

2)

Taxes are computed based on the impact

removing such item would have on tax expense. Taxes related to the

operating results of Energy Systems Group, as well as cash taxes

payable and other tax impacts related to the sale of Energy Systems

Group in the second quarter of 2023, are excluded from non-GAAP

EPS.

3)

Comprised of common stock of AT&T

Inc., Charter Communications, Inc. and Warner Bros. Discovery,

Inc.

4)

The calculation on a per-share basis may

not add down due to rounding.

Filing of Form 10-Q for CenterPoint Energy, Inc.

Today, CenterPoint Energy, Inc. filed with the Securities and

Exchange Commission (“SEC”) its Quarterly Report on Form 10-Q for

the quarter ended September 30, 2024. A copy of that report is

available on the company’s website, under the Investors section.

Investors and others should note that we may announce material

information using SEC filings, press releases, public conference

calls, webcasts, and the Investor Relations page of our website. In

the future, we will continue to use these channels to distribute

material information about the company and to communicate important

information about the company, key personnel, corporate

initiatives, regulatory updates, and other matters. Information

that we post on our website could be deemed material; therefore, we

encourage investors, the media, our customers, business partners

and others interested in our company to review the information we

post on our website.

Webcast of Earnings Conference Call

CenterPoint’s management will host an earnings conference call

on October 28, 2024, at 7:00 a.m. Central time / 8:00 a.m. Eastern

time. Interested parties may listen to a live audio broadcast of

the conference call on the company’s website under the Investors

section. A replay of the call can be accessed approximately two

hours after the completion of the call and will be archived on the

website for at least one year.

About CenterPoint Energy, Inc.

As the only investor-owned electric and gas utility based in

Texas, CenterPoint Energy, Inc. (NYSE: CNP) is an energy delivery

company with electric transmission and distribution, power

generation and natural gas distribution operations that serve more

than 7 million metered customers in Indiana, Louisiana, Minnesota,

Mississippi, Ohio, and Texas. As of September 30, 2024, the company

owned approximately $43 billion in assets. With approximately 9,000

employees, CenterPoint Energy and its predecessor companies have

been in business for more than 150 years. For more information,

visit CenterPointEnergy.com.

Forward-looking Statements

This news release includes, and the earnings conference call

will include, forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. All statements other than

statements of historical fact included in this news release and the

earnings conference call are forward-looking statements made in

good faith by CenterPoint and are intended to qualify for the safe

harbor from liability established by the Private Securities

Litigation Reform Act of 1995, including statements concerning

CenterPoint’s expectations, beliefs, plans, objectives, goals,

strategies, future operations, events, financial position, earnings

and guidance, growth, costs, prospects, capital investments or

performance or underlying assumptions and other statements that are

not historical facts. You should not place undue reliance on

forward-looking statements. When used in this news release, the

words "anticipate," "believe," "continue," "could," "estimate,"

"expect," "forecast," "goal," "intend," "may," "objective," "plan,"

"potential," "predict," "projection," "should," "target," "will" or

other similar words are intended to identify forward-looking

statements. The absence of these words, however, does not mean that

the statements are not forward-looking.

Examples of forward-looking statements in this news release or

on the earnings conference call include statements about Houston

Electric’s Greater Houston Resiliency Initiative and longer-term

resiliency plans, capital investments (including with respect to

incremental capital opportunities, deployment of capital,

renewables projects, and financing of such projects), the timing of

and projections for upcoming rate cases for CenterPoint and its

subsidiaries, the timing and extent of CenterPoint's recovery,

including with regards to its restoration costs for the severe

weather events in May 2024 (“May 2024 Storm Events”) and Hurricane

Beryl, generation transition plans and projects, projects included

in CenterPoint's Natural Gas Innovation Plan and System Resiliency

Plan, and projects included under its 10-year capital plan, the

extent of anticipated benefits of new legislation, the pending sale

of our Louisiana and Mississippi natural gas LDC businesses, future

earnings and guidance, including long-term growth rate, customer

charges, operations and maintenance expense reductions, financing

plans (including with respect to the restoration costs for the May

2024 Storm Events and Hurricane Beryl and the timing of any future

equity issuances, securitization, credit metrics and parent level

debt), the timing and anticipated benefits of our generation

transition plan, including our exit from coal and our 10-year

capital plan, the Company’s 2.0% Zero-Premium Exchangeable

Subordinated Notes due 2029 (“ZENS”) and impacts of the maturity of

ZENS, CenterPoint’s continued focus on liquidity and credit

ratings, tax planning opportunities, future financial performance

and results of operations, including with respect to regulatory

actions and recoverability of capital investments, customer rate

affordability, value creation, opportunities and expectations,

expected customer growth, and sustainability strategy, including

our net zero and greenhouse gas emissions reduction goals. We have

based our forward-looking statements on our management’s beliefs

and assumptions based on information currently available to our

management at the time the statements are made. We caution you that

assumptions, beliefs, expectations, intentions, and projections

about future events may and often do vary materially from actual

results. Therefore, we cannot assure you that actual results will

not differ materially from those expressed or implied by our

forward-looking statements. Each forward-looking statement

contained in this news release or discussed on the earnings

conference call speaks only as of the date of this release or the

earnings conference call.

Some of the factors that could cause actual results to differ

from those expressed or implied by our forward-looking information

include, but are not limited to, risks and uncertainties relating

to: (1) CenterPoint’s business strategies and strategic

initiatives, restructurings, joint ventures and acquisitions or

dispositions of assets or businesses, including the announced sale

of our Louisiana and Mississippi natural gas LDC businesses, and

the completed sale of Energy Systems Group, LLC, which we cannot

assure you will have the anticipated benefits to us; (2)

industrial, commercial and residential growth in CenterPoint’s

service territories and changes in market demand; (3) CenterPoint’s

ability to fund and invest planned capital, and the timely recovery

of its investments; (4) financial market and general economic

conditions, including access to debt and equity capital, inflation,

interest rates, and their effect on sales, prices and costs; (5)

disruptions to the global supply chain and volatility in commodity

prices; (6) actions by credit rating agencies, including any

potential downgrades to credit ratings; (7) the timing and impact

of regulatory proceedings and actions and legal proceedings,

including those related to the May 2024 Storm Events and Hurricane

Beryl, Houston Electric’s mobile generation and the February 2021

winter storm event; (8) legislative and regulatory actions or

developments, including any actions resulting from the May 2024

Storm Events and Hurricane Beryl, as well as tax and developments

related to the environment such as global climate change, air

emissions, carbon, waste water discharges and the handling of coal

combustion residuals, among others, and CenterPoint’s net zero and

carbon emissions reduction goals; (9) the impact of pandemics; (10)

weather variations and CenterPoint’s ability to mitigate weather

impacts, including the approval and timing of securitization

issuances; (11) the impact of potential wildfires; (12) changes in

business plans; (13) CenterPoint’s ability to execute on its

initiatives, targets and goals, including its net zero and carbon

emissions reduction goals and operations and maintenance goals; and

(14) other factors discussed in CenterPoint’s Annual Report on Form

10-K for the fiscal year ended December 31, 2023 and CenterPoint’s

Quarterly Report on Form 10-Q for the quarters ended March 31,

2024, June 30, 2024, and September 30, 2024 including under “Risk

Factors,” “Cautionary Statements Regarding Forward-Looking

Information” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations — Certain Factors Affecting

Future Earnings” in such reports and in other filings with the

Securities and Exchange Commission (“SEC”) by CenterPoint, which

can be found at www.centerpointenergy.com on the Investor Relations

page or on the SEC website at www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241028586620/en/

Media: Communications

Media.Relations@CenterPointEnergy.com

Investors: Jackie Richert / Ben Vallejo 713.207.6500

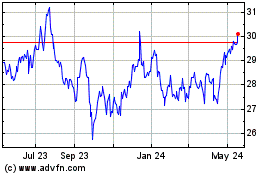

CenterPoint Energy (NYSE:CNP)

Historical Stock Chart

From Oct 2024 to Nov 2024

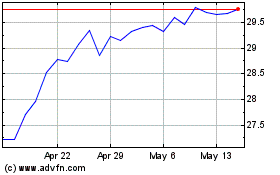

CenterPoint Energy (NYSE:CNP)

Historical Stock Chart

From Nov 2023 to Nov 2024