UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

Dated: October 31, 2024

Commission File Number: 333-12138

CANADIAN NATURAL RESOURCES LIMITED

(Exact name of registrant as specified in its charter)

2100, 855 - 2ND Street S. W., Calgary, Alberta T2P 4J8

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ____ Form 40-F X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Exhibits 99.1, 99.2 and 99.3 to this report, filed on Form 6-K, shall be incorporated by reference as exhibits to the registrant's Registration Statements under the Securities Act of 1933 on Form F-10 (File Nos. 333-219366 and 333-219367).

| | | | | |

| Exhibit Number | Description |

| | |

| 99.1 | |

| | |

| Canadian Natural Resources Limited Announces 2024 Third Quarter Results |

| | |

| 99.2 | |

| | |

| 99.3 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | Canadian Natural Resources Limited (Registrant) | |

| | | | |

| | | | |

| Date: October 31, 2024 | By: | /s/ Stephanie A. Graham | |

| | | Stephanie A. Graham | |

| | | Corporate Secretary & Associate General Counsel, Canada | |

CANADIAN NATURAL RESOURCES LIMITED ANNOUNCES

2024 THIRD QUARTER RESULTS

CALGARY, ALBERTA – OCTOBER 31, 2024 – FOR IMMEDIATE RELEASE

Canadian Natural's President, Scott Stauth, commented on the Company's third quarter results, "Our unique and diverse asset base provides us with a competitive advantage, as we can allocate capital to the highest return projects without being reliant on any one commodity. Our consistent and top tier results are driven by safe and reliable operations. Our commitment to continuous improvement is supported by a strong team culture in all areas of our company that focus on improving our costs, driving execution of growth opportunities and increasing value to shareholders.

We achieved strong average production of approximately 1,363,000 BOE/d in Q3/24, consisting of 1,022,000 bbl/d of liquids and over 2.0 Bcf/d of natural gas. Our world class Oil Sand Mining and Upgrading assets delivered Q3/24 production of approximately 498,000 bbl/d of long life no decline Synthetic Crude Oil (”SCO”), including record monthly production of approximately 529,000 bbl/d of SCO in August 2024. These assets continue to drive strong operational performance and high utilization rates resulting in top tier quarterly operating costs of $20.67/bbl (US$15.16/bbl) driving significant free cash flow in Q3/24.

Subsequent to quarter end and subject to regulatory approvals, we announced that we have entered into an agreement to acquire Chevron Canada Limited's ("Chevron") 20% interest in the Athabasca Oil Sands Project (“AOSP”), which includes the Muskeg River and Jackpine mines, the Scotford Upgrader and the Quest Carbon Capture and Storage facility. This acquisition will bring Canadian Natural’s total working interest in AOSP to 90% and adds approximately 62,500 bbl/d of SCO production, contributing to Canadian Natural’s significant sustainable free cash flow generation. The Company also announced that we have entered into an agreement to acquire Chevron’s 70% operated working interest of light crude oil and liquids rich assets in the Duvernay play in Alberta. Production from these assets is targeted to average approximately 60,000 BOE/d in 2025, consisting of 179 MMcf/d of natural gas and 30,000 bbl/d of liquids. These Duvernay assets provide the opportunity for robust growth while contributing meaningful free cash flow. Both of these assets are a great fit for Canadian Natural and when combined with our strong operating culture will drive significant value for shareholders."

Canadian Natural's Chief Financial Officer, Mark Stainthorpe, added "In Q3/24, we delivered strong financial results, including adjusted net earnings of approximately $2.1 billion and adjusted funds flow of $3.9 billion, which drove significant returns to shareholders totaling $1.9 billion in the quarter. Year-to-date, up to and including October 30, 2024, we have distributed significant value to shareholders, totaling approximately $6.7 billion, inclusive of our sustainable and growing dividend and share repurchases.

Given our strong financial position and significant and sustainable free cash flow generation, as previously announced, the Board of Directors has agreed to increase the quarterly dividend by 7% to $0.5625 per share payable at the next regular quarterly dividend payment in January 2025. This will mark 2025 as the 25th consecutive year of dividend increases by Canadian Natural, with a compound annual growth rate (“CAGR”) of 21% over that time.

This increase in the quarterly dividend demonstrates the confidence that the Board of Directors has in the Company’s world class assets and its ability to generate significant and sustainable free cash flow. Our asset base is underpinned by top tier, long life low decline assets, a strong balance sheet and safe, effective and efficient operations all of which combine to provide us with unique competitive advantages in terms of capital efficiency, flexibility and sustainability, driving strong returns on capital."

HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Nine Months Ended |

| ($ millions, except per common share amounts) | Sep 30

2024 | Jun 30

2024 | Sep 30

2023 | Sep 30

2024 | Sep 30

2023 |

| Net earnings | $ | 2,266 | $ | 1,715 | $ | 2,344 | $ | 4,968 | $ | 5,606 |

Per common share (1) | – basic | $ | 1.07 | $ | 0.80 | $ | 1.08 | $ | 2.33 | $ | 2.56 |

| – diluted | $ | 1.06 | $ | 0.80 | $ | 1.06 | $ | 2.31 | $ | 2.53 |

Adjusted net earnings from operations (2) | $ | 2,071 | $ | 1,892 | $ | 2,850 | $ | 5,437 | $ | 5,987 |

Per common share (1) | – basic (3) | $ | 0.98 | $ | 0.89 | $ | 1.31 | $ | 2.55 | $ | 2.73 |

| – diluted (3) | $ | 0.97 | $ | 0.88 | $ | 1.30 | $ | 2.53 | $ | 2.71 |

| Cash flows from operating activities | $ | 3,002 | $ | 4,084 | $ | 3,498 | $ | 9,954 | $ | 7,538 |

Adjusted funds flow (2) | $ | 3,921 | $ | 3,614 | $ | 4,684 | $ | 10,673 | $ | 10,855 |

Per common share (1) | – basic (3) | $ | 1.85 | $ | 1.69 | $ | 2.15 | $ | 5.01 | $ | 4.96 |

| – diluted (3) | $ | 1.84 | $ | 1.68 | $ | 2.13 | $ | 4.97 | $ | 4.91 |

| Cash flows used in investing activities | $ | 1,274 | $ | 1,015 | $ | 1,199 | $ | 3,681 | $ | 3,912 |

Net capital expenditures (4) | $ | 1,349 | $ | 1,621 | $ | 1,108 | $ | 4,083 | $ | 3,934 |

| Abandonment expenditures | $ | 204 | $ | 129 | $ | 123 | $ | 495 | $ | 360 |

| | | | | |

| Daily production, before royalties | | | | | |

| Natural gas (MMcf/d) | 2,049 | 2,110 | 2,151 | 2,102 | 2,125 |

| Crude oil and NGLs (bbl/d) | 1,021,572 | 934,066 | 1,035,153 | 977,265 | 948,587 |

Equivalent production (BOE/d) (5) | 1,363,086 | 1,285,798 | 1,393,614 | 1,327,593 | 1,302,715 |

(1)Per common share and dividend amounts have been updated to reflect the two for one common share split. Further details are disclosed in the Advisory section of the Company's MD&A and in the financial statements for the three and nine months ended September 30, 2024 dated October 30, 2024.

(2)Non-GAAP Financial Measure. Refer to the "Non-GAAP and Other Financial Measures" section of the Company's MD&A for the three and nine months ended September 30, 2024 dated October 30, 2024.

(3)Non-GAAP Ratio. Refer to the "Non-GAAP and Other Financial Measures" section of the Company's MD&A for the three and nine months ended September 30, 2024 dated October 30, 2024.

(4)Non-GAAP Financial Measure. The composition of this measure was updated in the fourth quarter of 2023 and has been updated for all periods presented. Refer to the "Non-GAAP and Other Financial Measures" section of the Company's MD&A for the three and nine months ended September 30, 2024 dated October 30, 2024.

(5)A barrel of oil equivalent ("BOE") is derived by converting six thousand cubic feet ("Mcf") of natural gas to one barrel ("bbl") of crude oil (6 Mcf:1 bbl). This conversion may be misleading, particularly if used in isolation, or to compare the value ratio using current crude oil and natural gas prices since the 6 Mcf:1 bbl ratio is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

▪The strength of Canadian Natural's long life low decline asset base, supported by safe, effective and efficient operations, makes our business unique, robust and sustainable. In Q3/24, the Company generated strong financial results, including:

•Net earnings of approximately $2.3 billion and adjusted net earnings from operations of approximately $2.1 billion.

•Cash flows from operating activities of approximately $3.0 billion.

•Adjusted funds flow of approximately $3.9 billion.

▪Canadian Natural continues to maintain a strong balance sheet and financial flexibility, with approximately $6.2 billion in liquidity(1) as at September 30, 2024.

▪Canadian Natural delivered quarterly average production in Q3/24 of 1,363,086 BOE/d, a decrease of 2% from Q3/23 levels of 1,393,614 BOE/d. Production in Q3/24 consisted of total liquids production of 1,021,572 bbl/d and natural gas production of 2,049 MMcf/d.

•The Company's world class Oil Sands Mining and Upgrading assets delivered strong production averaging 497,656 bbl/d of high value SCO in Q3/24, approximately 7,000 bbl/d higher than Q3/23 levels. These quarterly production volumes in Q3/24 included the impacts of planned turnaround activities at the non-operated Scotford Upgrader.

| | | | | | | | |

| Canadian Natural Resources Limited | 2 | Three and nine months ended September 30, 2024 |

◦Oil Sands Mining and Upgrading achieved a new monthly production record of approximately 529,000 bbl/d of SCO in August 2024. This was primarily due to high utilization at both Horizon and AOSP as well as the completion of the reliability enhancement project at Horizon during the planned turnaround in Q2/24.

◦Oil Sands Mining and Upgrading operating costs continue to be top tier, averaging $20.67/bbl (US$15.16/bbl) in Q3/24, a decrease of 7% from Q3/23 levels, primarily reflecting higher production volumes and lower energy costs.

◦Due to stronger than budgeted production volumes at the Scotford Upgrader concurrent with reduced duration of the planned turnaround, the annual net production impact to AOSP from these planned turnaround activities was reduced to approximately 5,400 bbl/d, a significant improvement compared to the budgeted annual net production impact of 11,000 bbl/d. The planned turnaround commenced on September 9, 2024 and was successfully completed subsequent to quarter end on October 18, 2024.

◦Additionally, a debottlenecking project was completed during the planned turnaround at the Scotford Upgrader which increases gross AOSP capacity by approximately 8,000 bbl/d. Upon closing the acquisition of Chevron's 20% interest in AOSP, the capacity net to Canadian Natural increases by approximately 7,200 bbl/d.

•Thermal in situ long life low decline production averaged 271,551 bbl/d in Q3/24, a decrease of 5% from Q3/23 levels, primarily due to the cyclical nature of production from Cyclic Steam Stimulation ("CSS") pads at Primrose and natural field declines, partially offset by Steam Assisted Gravity Drainage ("SAGD") pad additions at Kirby and Jackfish.

◦At Jackfish, the Company achieved record quarterly production of approximately 128,000 bbl/d in Q3/24, primarily due to strong results from pad additions and effective and efficient operations.

◦At Wolf Lake, the Company recently drilled a SAGD pad which is targeted to come on production in Q4/24 and as a result of strong execution targets to reach full production capacity in Q1/25, one quarter ahead of schedule.

▪During 2024, the Company has increased its contracted crude oil transportation capacity to 256,500 bbl/d, expanding its committed volumes to Canada’s West Coast and to the United States Gulf Coast ("USGC") to approximately 25% of liquids production compared to the mid-point of 2024 corporate annual guidance. The additional egress supports Canadian Natural’s long-term sales strategy by targeting expanded refining markets, driving stronger netbacks while also reducing exposure to egress constraints.

•Commencing December 1, 2024, the Company will increase its capacity on the Trans Mountain Expansion ("TMX") pipeline by 75,000 bbl/d to a total of 169,000 bbl/d.

•As previously disclosed, the Company increased its capacity on the Flanagan South pipeline in Q1/24 by 55,000 bbl/d to a total of 77,500 bbl/d, further expanding the Company's heavy oil diversification and market access to the USGC.

•The Company also has committed volumes of 10,000 bbl/d on the Keystone Base pipeline, with direct access to the USGC.

▪Subsequent to quarter end, Canadian Natural announced that it entered into an agreement to acquire Chevron's 20% interest in AOSP, which includes the Muskeg River and Jackpine mines, the Scotford Upgrader and the Quest Carbon Capture and Storage facility. Concurrently, the Company also entered into an agreement to acquire Chevron's 70% operated working interest in light crude oil and liquids rich assets in the Duvernay play in Alberta. Both of these acquisitions are targeted to contribute significant additional free cash flow to the Company.

•The AOSP acquisition brings Canadian Natural’s total working interest in AOSP to 90%, adding approximately 62,500 bbl/d of long life no decline SCO production to our portfolio.

•Production net to Canadian Natural from the Duvernay assets is targeted to average approximately 60,000 BOE/d in 2025.

•The effective date for these acquisitions is September 1, 2024 and is targeted to close in Q4/24.

RETURNS TO SHAREHOLDERS

▪Returns to shareholders in Q3/24 were strong, totaling approximately $1.9 billion, comprised of $1.12 billion of dividends and $0.74 billion through the repurchase and cancellation of approximately 15.6 million common shares at a weighted average price of $47.70 per share.

•Year to date in 2024, up to and including October 30, 2024, the Company has returned a total of approximately $6.7 billion directly to shareholders through $4.4 billion in dividends and $2.3 billion through the repurchase and cancellation of approximately 47.6 million common shares.

| | | | | | | | |

| Canadian Natural Resources Limited | 3 | Three and nine months ended September 30, 2024 |

▪Free cash flow is defined as adjusted funds flow, less capital and dividends. The Company will manage the allocation of free cash flow on a forward looking annual basis, while managing working capital and cash management as required. As previously disclosed on October 7, 2024 and subsequent to quarter end, the Board of Directors has adjusted the free cash flow allocation policy which will now be allocated as follows:

•60% of free cash flow to shareholder returns and 40% to the balance sheet until net debt reaches $15 billion.

•When net debt is between $12 billion and $15 billion, free cash flow allocation will be 75% to shareholder returns and 25% to the balance sheet.

•When net debt is at or below $12 billion, up from the current target of $10 billion, free cash flow allocation will be 100% to shareholder returns.

▪Post closing of the acquisitions previously disclosed on October 7, 2024, the Company will target to allocate 60% of free cash flow to shareholders. In a US$70/bbl WTI environment this change in free cash flow distribution to 60% allocation to shareholders targets to be approximately the equivalent absolute return to shareholders, including dividends, of what was targeted under the 100% of free cash flow allocation to shareholders existing prior to the acquisitions. Due to the additional free cash flow generation from the acquired assets, the Company’s balance sheet strengthens quickly. Over time, the acquisitions and the new free cash flow allocation policy will provide additional free cash flow returns to shareholders exceeding what would have been returned under the current 100% distribution of free cash flow to shareholders.

▪As previously disclosed on October 7, 2024 and subsequent to quarter end, the Board of Directors has agreed to increase the quarterly cash dividend by 7% to $0.5625 per common share, an increase from $0.525 per common share. The dividend will be payable on January 3, 2025 to shareholders of record at the close of business on December 13, 2024. This will mark 2025 as the 25th consecutive year of dividend increases by Canadian Natural, with a CAGR of 21% over that time.

(1) Non-GAAP Financial Measure. Refer to the "Non-GAAP and Other Financial Measures" section of this press release and the Company's MD&A for the three and nine months ended September 30, 2024 dated October 30, 2024.

| | | | | | | | |

| Canadian Natural Resources Limited | 4 | Three and nine months ended September 30, 2024 |

OPERATIONS REVIEW AND CAPITAL ALLOCATION

Canadian Natural has a balanced and diverse portfolio of assets, primarily Canadian-based, with international exposure in the UK section of the North Sea and Offshore Africa. Canadian Natural’s production is well balanced between light crude oil, medium crude oil, primary heavy crude oil, Pelican Lake heavy crude oil, bitumen (thermal oil) and SCO (herein collectively referred to as "crude oil") and natural gas and NGLs. This balance provides optionality for capital investments, maximizing value for the Company’s shareholders.

Underpinning this asset base is the Company's long life low decline production, representing approximately 79% of total budgeted liquids production in 2024, the majority of which is zero decline high value SCO production from the Company's world class Oil Sands Mining and Upgrading assets. The remaining balance of the Company's long life low decline production comes from its top tier thermal in situ oil sands operations and Pelican Lake heavy crude oil assets. The combination of these long life low decline assets, low reserves replacement costs, and effective and efficient operations results in substantial and sustainable adjusted funds flow throughout the commodity price cycle.

In addition, Canadian Natural maintains a substantial inventory of low capital exposure projects within the Company's conventional asset base. These projects can be executed quickly and, in the right economic conditions, provide excellent returns and maximize value for our shareholders. Supporting these projects is the Company’s undeveloped landbase which enables large, repeatable drilling programs that can be optimized over time. Additionally, Canadian Natural maximizes long-term value by maintaining high ownership and operatorship of its assets, allowing the Company to control the nature, timing and extent of development. Low capital exposure projects can be stopped or started relatively quickly depending upon success, market conditions or corporate needs.

Canadian Natural’s balanced portfolio, built with both long life low decline assets and low capital exposure assets, enables effective capital allocation, production growth and value creation.

| | | | | | | | | | | | | | |

| Drilling Activity | Nine Months Ended |

| Sep 30, 2024 | Sep 30, 2023 |

| (number of wells) | Gross | Net | Gross | Net |

Crude oil (1) | 212 | | 207 | 186 | 179 |

| Natural gas | 77 | | 64 | 61 | 52 |

| Dry | 2 | | 2 | 2 | 2 |

| Subtotal | 291 | | 273 | 249 | 233 |

| Stratigraphic test / service wells | 460 | | 394 | 476 | 414 |

| Total | 751 | | 667 | 725 | 647 |

| Success rate (excluding stratigraphic test / service wells) | | 99% | | 99% |

(1)Includes bitumen wells.

▪Canadian Natural drilled a total of 273 net crude oil and natural gas producer wells in the first nine months of 2024, consistent with the Company's strategic decision to focus on longer cycle development opportunities in the first half of 2024. Canadian Natural has strategically allocated capital to its conventional heavy crude oil assets in the second half of 2024.

▪In Q1/24, the Company disclosed the reallocation of capital from certain dry natural gas development activity to multilateral heavy crude oil wells.

•Due to low natural gas prices in 2024, the Company has further reduced dry natural gas drilling activity. Canadian Natural now targets to drill a total of 74 net natural gas wells in 2024, 17 fewer wells than targeted in the original 2024 budget.

| | | | | | | | |

| Canadian Natural Resources Limited | 5 | Three and nine months ended September 30, 2024 |

North America Exploration and Production

| | | | | | | | | | | | | | | | | |

| Crude oil and NGLs – excluding Thermal In Situ Oil Sands | | |

| Three Months Ended | Nine Months Ended |

| Sep 30

2024 | Jun 30

2024 | Sep 30

2023 | Sep 30

2024 | Sep 30

2023 |

| Crude oil and NGLs production (bbl/d) | 228,221 | 231,592 | 232,496 | 232,416 | 231,047 |

| Net wells targeting crude oil | 59 | 33 | 42 | 130 | 131 |

| Net successful wells drilled | 58 | 33 | 42 | 129 | 129 |

| Success rate | 98% | 100% | 100% | 99% | 98% |

▪North America E&P liquids production, excluding thermal in situ, averaged 228,221 bbl/d in Q3/24, comparable to Q3/23 levels, reflecting primary heavy crude oil development activity offset by natural field declines. The Company has strategically allocated capital to its conventional heavy crude oil assets in the second half of 2024.

•Primary heavy crude oil production averaged 76,808 bbl/d in Q3/24, a 1% increase from Q3/23 levels due to strong drilling results from the Company's multilateral well program offset by natural field declines.

◦Operating costs(1) in the Company's primary heavy crude oil operations averaged $18.69/bbl (US$13.70/bbl) in Q3/24, a decrease of 5% from Q3/23 levels, primarily reflecting lower energy costs.

◦The Company operates the largest heavy crude oil landbase in Canada. We continue to maximize the value of this premium asset through our multilateral drilling program. As a result of optimized longer well designs and the technical expertise of our teams, the Company continued to deliver strong results in Q3/24.

–In the first nine months of 2024, the company drilled 76 net multilateral wells, maintaining top tier average initial peak rates of approximately 230 bbl/d per well, an increase of approximately 30% compared to budget average initial peak rates of 175 bbl/d per well.

•Pelican Lake production averaged 45,101 bbl/d in Q3/24, a decrease of 4% from Q3/23 levels, reflecting low natural field declines from this long life low decline asset.

◦Operating costs at Pelican Lake averaged $8.74/bbl (US$6.41/bbl) in Q3/24, an increase of 9% compared to Q3/23 levels, primarily due to higher maintenance activities in the quarter partially offset by lower energy costs.

•North America light crude oil and NGLs production averaged 106,312 bbl/d in Q3/24, a decrease of 3% from Q3/23 levels. The decrease was primarily the result of temporary processing facility outages and rail transportation restrictions offset by strong drilling results.

◦Operating costs in the Company's North America light crude oil and NGLs operations averaged $13.73/bbl (US$10.07/bbl) in Q3/24, a decrease of 11% from Q3/23 levels, primarily reflecting lower energy costs.

| | | | | | | | | | | | | | | | | |

| North America Natural Gas | | |

| Three Months Ended | Nine Months Ended |

| Sep 30

2024 | Jun 30

2024 | Sep 30

2023 | Sep 30

2024 | Sep 30

2023 |

| Natural gas production (MMcf/d) | 2,039 | 2,099 | 2,139 | 2,091 | 2,113 |

| Net wells targeting natural gas | 24 | 25 | 10 | 65 | 52 |

| Net successful wells drilled | 24 | 24 | 10 | 64 | 52 |

| Success rate | 100% | 96% | 100% | 98% | 100% |

▪Canadian Natural's North America natural gas production averaged 2,039 MMcf/d in Q3/24, a decrease of 5% compared to Q3/23, primarily reflecting previously announced deferrals of natural gas well onstream timing in response to natural gas pricing, the impacts of heat and wildfires conditions in Q3/24 and natural field declines. This decrease in production was partially offset by strong results from our Montney and Deep Basin wells.

•North America natural gas operating costs averaged $1.23/Mcf in Q3/24, comparable to Q3/23 levels.

(1)Calculated as production expense divided by respective sales volumes. Natural gas and NGLs production volumes approximate sales volumes.

| | | | | | | | |

| Canadian Natural Resources Limited | 6 | Three and nine months ended September 30, 2024 |

▪In Q1/24, the Company disclosed the reallocation of capital from certain dry natural gas development activity to multilateral heavy oil wells.

•Due to continued low natural gas prices in 2024, the Company is further reducing dry natural gas drilling capital. Canadian Natural now targets drilling a total of 74 net natural gas wells in 2024, 17 fewer wells than targeted in the original 2024 budget.

•Canadian Natural's 2024 corporate annual natural gas production guidance of 2,120 MMcf/d to 2,230 MMcf/d remains unchanged.

| | | | | | | | | | | | | | | | | |

| Thermal In Situ Oil Sands | | |

| Three Months Ended | Nine Months Ended |

| Sep 30

2024 | Jun 30

2024 | Sep 30

2023 | Sep 30

2024 | Sep 30

2023 |

| Bitumen production (bbl/d) | 271,551 | 268,044 | 287,085 | 269,258 | 256,466 |

| Net wells targeting bitumen | 25 | 30 | 2 | 78 | 50 |

| Net successful wells drilled | 25 | 30 | 2 | 78 | 50 |

| Success rate | 100% | 100% | 100% | 100% | 100% |

▪Thermal in situ long life low decline production averaged 271,551 bbl/d in Q3/24, a decrease of 5% from Q3/23 levels, primarily due to the cyclical nature of production from CSS pads at Primrose and natural field declines, partially offset by thermal SAGD pad additions at Kirby and Jackfish.

•Thermal in situ operating costs were strong, averaging $10.52/bbl (US$7.71/bbl) in Q3/24, a decrease of 8% from Q3/23 levels, primarily reflecting lower energy costs.

▪Canadian Natural has decades of strong capital efficient growth opportunities on its long life low decline thermal in situ assets. As per our 2024 budget, we continue to develop these assets in a disciplined manner to deliver safe and reliable thermal in situ production including the following updates:

•At Jackfish, the Company achieved record quarterly production of approximately 128,000 bbl/d in Q3/24, primarily due to strong results from pad additions and effective and efficient operations. Additionally, the Company is currently drilling a SAGD pad at Jackfish with production from this pad targeted to come on in Q3/25.

•At Wolf Lake, the Company recently drilled a SAGD pad which is targeted to come on production in Q4/24 and as a result of strong execution will reach full production capacity in Q1/25, one quarter ahead of schedule.

•At Primrose, the Company targets to bring a CSS pad on production ahead of schedule in Q4/24, originally targeted for Q2/25. A second CSS pad has been drilled and is targeted to come on production ahead of schedule in Q1/25, originally budgeted for Q2/25.

▪Canadian Natural has been piloting solvent enhanced oil recovery technology on certain thermal in situ assets with an objective to increase bitumen production while reducing the Steam to Oil Ratio ("SOR") and optimizing solvent recovery. This technology has the potential for application throughout the Company's extensive thermal in situ asset base.

•At the Company's commercial scale solvent SAGD pad at Kirby North, we began solvent injection in June 2024 and all 8 wells are now injecting solvent. Early results have been positive with SOR reductions of approximately 30%, trending towards a targeted reduction of 40% to 50%. Solvent recoveries are in excess of 85% and are meeting expectations. As the project advances, the Company will continue to monitor SORs, solvent recovery and production trends.

•At Primrose, the Company is continuing to operate its solvent enhanced oil recovery pilot in the steam flood area to optimize solvent efficiency and to further evaluate this commercial development opportunity.

| | | | | | | | |

| Canadian Natural Resources Limited | 7 | Three and nine months ended September 30, 2024 |

North America Oil Sands Mining and Upgrading

| | | | | | | | | | | | | | | | | |

| Three Months Ended | Nine Months Ended |

| Sep 30

2024 | Jun 30

2024 | Sep 30

2023 | Sep 30

2024 | Sep 30

2023 |

Synthetic crude oil production (bbl/d) (1)(2) | 497,656 | 410,518 | 490,853 | 451,298 | 434,895 |

(1)SCO production before royalties and excludes production volumes consumed internally as diesel.

(2)Consists of heavy and light synthetic crude oil products.

▪The Company's world class Oil Sands Mining and Upgrading assets delivered strong production averaging 497,656 bbl/d of high value SCO in Q3/24, approximately 7,000 bbl/d higher than Q3/23 levels. These quarterly production volumes in Q3/24 included the impacts of planned turnaround activities at the non-operated Scotford Upgrader.

•Oil Sands Mining and Upgrading achieved a new monthly production record of approximately 529,000 bbl/d of SCO in August 2024. This was primarily due to high utilization at both Horizon and AOSP as well as the completion of the reliability enhancement project at Horizon during the planned turnaround in Q2/24.

•Oil Sands Mining and Upgrading operating costs continue to be top tier, averaging $20.67/bbl (US$15.16/bbl) in Q3/24, a decrease of 7% from Q3/23 levels, primarily reflecting higher production volumes and lower energy costs.

•Due to stronger than budgeted production volumes at the Scotford Upgrader concurrent with reduced duration of the planned turnaround, the annual net production impact to AOSP from these planned turnaround activities was reduced to approximately 5,400 bbl/d, a significant improvement compared to the budgeted annual net production impact of 11,000 bbl/d. The planned turnaround commenced on September 9, 2024 and was successfully completed subsequent to quarter end on October 18, 2024.

•Additionally, a debottlenecking project was completed during the planned turnaround at the Scotford Upgrader which increases gross AOSP capacity by approximately 8,000 bbl/d. Upon closing the acquisition of Chevron's 20% interest in AOSP, the capacity net to Canadian Natural increases to approximately 7,200 bbl/d.

▪At Horizon, the Company is progressing the NRUTT project which targets to add incremental production of approximately 6,300 bbl/d of SCO following mechanical completion in Q3/27.

International Exploration and Production

| | | | | | | | | | | | | | | | | |

| Three Months Ended | Nine Months Ended |

| Sep 30

2024 | Jun 30

2024 | Sep 30

2023 | Sep 30

2024 | Sep 30

2023 |

| Crude oil production (bbl/d) | 24,144 | 23,912 | 24,719 | 24,293 | | 26,180 | |

| Natural gas production (MMcf/d) | 10 | 11 | 12 | 11 | | 12 | |

| | | | | |

| | | | | |

| | | | | |

▪International E&P crude oil production volumes averaged 24,144 bbl/d in Q3/24, comparable to Q3/23 levels.

| | | | | | | | |

| Canadian Natural Resources Limited | 8 | Three and nine months ended September 30, 2024 |

MARKETING

| | | | | | | | | | | | | | | | | |

| Three Months Ended | Nine Months Ended |

| Sep 30

2024 | Jun 30

2024 | Sep 30

2023 | Sep 30

2024 | Sep 30

2023 |

| Benchmark Commodity Prices | | | | | |

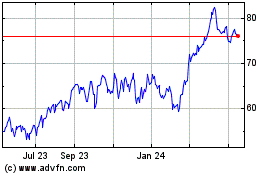

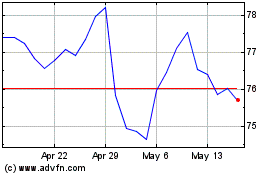

WTI benchmark price (US$/bbl) (1) | $ | 75.16 | $ | 80.55 | $ | 82.18 | $ | 77.55 | $ | 77.37 |

WCS heavy differential (discount) to WTI (US$/bbl) (1) | $ | (13.51) | $ | (13.54) | $ | (12.86) | $ | (15.46) | $ | (17.51) |

WCS heavy differential as a percentage of WTI (%) (1) | 18% | 17% | 16% | 20% | 23% |

| Condensate benchmark price (US$/bbl) | $ | 71.24 | $ | 77.11 | $ | 77.91 | $ | 73.71 | $ | 76.66 |

SCO price (US$/bbl) (1) | $ | 76.51 | $ | 83.33 | $ | 84.99 | $ | 76.42 | $ | 79.97 |

SCO premium (discount) to WTI (US$/bbl) (1) | $ | 1.35 | $ | 2.78 | $ | 2.81 | $ | (1.13) | $ | 2.60 |

| AECO benchmark price (C$/GJ) | $ | 0.77 | $ | 1.36 | $ | 2.26 | $ | 1.35 | $ | 2.86 |

| Realized Prices | | | | | |

Exploration & Production liquids realized price (C$/bbl) (2)(3)(4)(5) | $ | 79.15 | $ | 86.64 | $ | 87.83 | $ | 78.67 | $ | 73.45 |

SCO realized price (C$/bbl) (1)(3)(4)(5) | $ | 100.93 | $ | 108.81 | $ | 108.55 | $ | 99.19 | $ | 100.57 |

Natural gas realized price (C$/Mcf) (4) | $ | 1.25 | $ | 1.59 | $ | 2.81 | $ | 1.80 | $ | 3.20 |

(1)West Texas Intermediate ("WTI"); Western Canadian Select ("WCS"); Synthetic Crude Oil ("SCO").

(2)Exploration & Production crude oil and NGLs average realized price excludes SCO.

(3)Pricing is net of blending costs.

(4)Excludes risk management activities.

(5)Non-GAAP ratio. Refer to the "Non-GAAP and Other Financial Measures" section of the Company's MD&A for the three and nine months ended

September 30, 2024 dated October 30, 2024.

▪Canadian Natural has a balanced and diverse product mix of natural gas, NGLs, heavy crude oil, light crude oil, bitumen and SCO.

▪WTI prices averaged US$75.16/bbl in Q3/24, a decrease of US$7.02/bbl compared to Q3/23, primarily reflecting weaker global demand concerns.

▪SCO pricing averaged US$76.51/bbl in Q3/24, representing a US$1.35/bbl price premium to WTI, compared to a US$2.81/bbl price premium to WTI in Q3/23.

▪The WCS differential to WTI averaged US$13.51/bbl, widening by US$0.65/bbl in Q3/24, compared to US$12.86/bbl in Q3/23, primarily reflecting lower heavy crude oil demand as a result of planned and unplanned outages at two US mid-west refineries.

▪The North West Redwater ("NWR") refinery primarily utilizes bitumen as feedstock, with production of ultra-low sulphur diesel and other refined products averaging 72,109 bbl/d in Q3/24.

▪During 2024, the Company has increased its contracted crude oil transportation capacity to 256,500 bbl/d, expanding its committed volumes to Canada’s West Coast and to the USGC to approximately 25% of liquids production compared to the mid-point of 2024 corporate annual guidance. The additional egress supports Canadian Natural’s long-term sales strategy by targeting expanded refining markets, driving stronger netbacks while also reducing exposure to egress constraints.

•Commencing December 1, 2024, the Company will increase its capacity on the TMX pipeline by 75,000 bbl/d to a total of 169,000 bbl/d.

•As previously disclosed, the Company increased its capacity on the Flanagan South pipeline in Q1/24 by 55,000 bbl/d to a total of 77,500 bbl/d, further expanding the Company's heavy oil diversification and market access to the USGC.

•The Company also has committed volumes of 10,000 bbl/d on the Keystone Base pipeline, with direct access to the USGC.

▪AECO natural gas prices averaged $0.77/GJ in Q3/24, significantly lower compared to Q3/23 primarily reflecting lower NYMEX benchmark pricing, combined with high storage inventories resulting from weaker demand and increased production levels in the Western Canadian Sedimentary Basin ("WCSB").

| | | | | | | | |

| Canadian Natural Resources Limited | 9 | Three and nine months ended September 30, 2024 |

•In 2024, the Company is targeting to use the equivalent of approximately 38% of its budgeted natural gas production in its operations, with approximately 25% targeted to be sold at AECO/Station 2 pricing, and approximately 37% targeted to be exported to other North American and international markets capturing higher natural gas prices, maximizing value from its diversified natural gas marketing portfolio.

SUSTAINABILITY HIGHLIGHTS

Canadian Natural's diverse portfolio is supported by a large amount of long life low decline assets which have low risk, high value reserves that require low maintenance capital. This allows us to remain flexible with our capital allocation and creates an ideal opportunity to pilot and apply technologies. Canadian Natural continues to invest in a range of technologies like solvents for enhanced recovery and Carbon Capture, Utilization and Storage ("CCUS") projects. Our culture of continuous improvement provides a significant advantage to delivering on our strategy of investing in technologies across our assets, which will enhance the Company’s long-term sustainability.

In June 2024, the Canadian Government amended the Competition Act, resulting in changes to the law around environmental communications. As we look to communicate the important work we are doing to protect the environment or helping to address climate change, there is uncertainty on how this new legislation will be interpreted and applied on a go forward basis. We regret that we are unable to provide an environment and climate update at this time. This legislation does not change our commitment to the environment and to ensuring safe, reliable operations, only the way in which we are publicly communicating these aspects of our business. As we receive additional guidance, we intend to resume environmental and climate-related disclosure.

While we wait for clarity on this legislation, we are proud to share Canadian Natural’s performance in governance, workplace and process safety, and our contributions to people, community and partnerships. Our 2023 Stewardship Report to Stakeholders, which can be found at www.cnrl.com, displays how Canadian Natural continues to focus on safe, reliable, effective and efficient operations while enhancing our world-class assets by innovating and leveraging technology, and driving continuous improvement across our teams. These efforts include building shared value with communities and Indigenous groups in our operating areas.

Highlights from the Company's 2023 report include:

▪50% reduction in total recordable injury frequency ("TRIF") and a 75% reduction in corporate lost time incident frequency ("LTI") from 2019 to 2023.

▪$502 million invested in research, technology development and deployment in 2023.

▪2.7 million tonnes of CO2e per year total carbon capture capacity.

▪$830 million in contracts secured with Indigenous businesses, a 21% increase from 2022.

▪Approximately $9 billion in payments to governments and local communities in 2023 through royalties, corporate taxes, property taxes and surface and mineral land leases.

| | | | | | | | |

| Canadian Natural Resources Limited | 10 | Three and nine months ended September 30, 2024 |

ADVISORY

Special Note Regarding Forward-Looking Statements

Certain statements relating to Canadian Natural Resources Limited (the "Company") in this document or documents incorporated herein by reference constitute forward-looking statements or information (collectively referred to herein as "forward-looking statements") within the meaning of applicable securities legislation. Forward-looking statements can be identified by the words "believe", "anticipate", "expect", "plan", "estimate", "target", "focus", "continue", "could", "intend", "may", "potential", "predict", "should", "will", "objective", "project", "forecast", "goal", "guidance", "outlook", "effort", "seeks", "schedule", "proposed", "aspiration" or expressions of a similar nature suggesting future outcome or statements regarding an outlook. Disclosure related to the Company's strategy or strategic focus, capital budget, expected future commodity pricing, forecast or anticipated production volumes, royalties, production expenses, capital expenditures, abandonment expenditures, income tax expenses, and other targets provided throughout this document and the Management's Discussion and Analysis ("MD&A") of the financial condition and results of operations of the Company, including the strength of the Company's balance sheet, the sources and adequacy of the Company's liquidity, and the flexibility of the Company's capital structure, constitute forward-looking statements. Disclosure regarding the agreement to acquire from Chevron Canada Limited or its affiliates (collectively, "Chevron"), of its 20% interest in the Athabasca Oil Sands Project ("AOSP"), its 70% operated working interest in the Duvernay asset play, as well as additional working interests in certain other non-producing oil sands leases, hereinafter referred to as the "agreement to acquire assets from Chevron", including the anticipated closing thereof, including the impact of such acquisitions on the Company's debt to book capitalization ratio, and plans relating to and expected results of existing and future developments, including, without limitation, those in relation to: the Company's assets at Horizon Oil Sands ("Horizon"), AOSP, the Primrose thermal oil projects ("Primrose"), the Pelican Lake water and polymer flood projects ("Pelican Lake"), the Kirby thermal oil sands project ("Kirby"), the Jackfish thermal oil sands project ("Jackfish") and the North West Redwater bitumen upgrader and refinery; construction by third parties of new, or expansion of existing, pipeline capacity or other means of transportation of bitumen, crude oil, natural gas, natural gas liquids ("NGLs") or synthetic crude oil ("SCO") that the Company may be reliant upon to transport its products to market; the abandonment and decommissioning of certain assets and the timing thereof; the development and deployment of technology and technological innovations; the financial capacity of the Company to complete its growth projects and responsibly and sustainably grow in the long-term; and the materiality of the impact of tax interpretations and litigation on the Company's results, also constitute forward-looking statements. These forward-looking statements are based on annual budgets and multi-year forecasts, and are reviewed and revised throughout the year as necessary in the context of targeted financial ratios, project returns, product pricing expectations and balance in project risk and time horizons. These statements are not guarantees of future performance and are subject to certain risks. The reader should not place undue reliance on these forward-looking statements as there can be no assurances that the plans, initiatives or expectations upon which they are based will occur. In addition, statements relating to "reserves" are deemed to be forward-looking statements as they involve the implied assessment based on certain estimates and assumptions that the reserves described can be profitably produced in the future. There are numerous uncertainties inherent in estimating quantities of proved and proved plus probable crude oil, natural gas and NGLs reserves and in projecting future rates of production and the timing of development expenditures. The total amount or timing of actual future production may vary significantly from reserves and production estimates.

The forward-looking statements are based on current expectations, estimates and projections about the Company and the industry in which the Company operates, which speak only as of the earlier of the date such statements were made or as of the date of the report or document in which they are contained, and are subject to known and unknown risks and uncertainties that could cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties include, among others: general economic and business conditions (including as a result of the actions of the Organization of the Petroleum Exporting Countries Plus ("OPEC+"), the impact of conflicts in the Middle East, the impact of the Russian invasion of Ukraine, increased inflation, and the risk of decreased economic activity resulting from a global recession) which may impact, among other things, demand and supply for and market prices of the Company's products, and the availability and cost of resources required by the Company's operations; volatility of and assumptions regarding crude oil, natural gas and NGLs prices; fluctuations in currency and interest rates; assumptions on which the Company's current targets are based; economic conditions in the countries and regions in which the Company conducts business; political uncertainty, including actions of or against terrorists, insurgent groups or other conflict including conflict between states; the ability of the Company to prevent and recover from a cyberattack, other cyber-related crime and other cyber-related incidents; industry capacity; ability of the Company to implement its business strategy, including exploration and development activities; the impact of competition; the Company's defense of lawsuits; availability and cost of seismic, drilling and other equipment; ability of the Company to complete capital programs; the Company's ability to secure adequate transportation for its products; unexpected disruptions or delays in the mining, extracting or upgrading of the Company's bitumen products; potential delays or changes in plans with respect to exploration or development projects or capital expenditures; ability of the Company to attract the necessary labour required to build, maintain, and operate its thermal and oil sands mining projects; operating hazards and other difficulties inherent in the exploration for and production and sale of crude oil and natural gas and in the mining, extracting or upgrading the Company's bitumen products; availability and cost of financing; the Company's success of exploration and development activities and its ability to replace and expand crude oil and natural gas reserves; the Company's ability to meet its targeted production levels; timing and success of integrating the business and operations of acquired companies and assets, including the agreement to acquire assets from Chevron; production levels; imprecision of reserves estimates and estimates of recoverable quantities of crude oil, natural gas and NGLs not currently classified as proved; actions by governmental authorities; government regulations and the expenditures required to comply with them (especially safety, competition, environmental laws and regulations and the impact of climate change initiatives on capital expenditures and production expenses); interpretations of applicable tax and competition laws and regulations; asset retirement obligations; the sufficiency of the Company's liquidity to support its growth strategy and to sustain its operations in the short, medium, and long-term; the strength of the Company's balance sheet; the flexibility of the Company's capital structure; the adequacy of the Company's provision for taxes; the impact of legal proceedings to which the Company is party; and other circumstances affecting revenues and expenses. The Company's operations have been, and in the future may be, affected by political developments and by national, federal, provincial, state and local laws and regulations such as restrictions on production, changes in taxes, royalties and other amounts payable to governments or governmental

| | | | | | | | |

| Canadian Natural Resources Limited | 11 | Three and nine months ended September 30, 2024 |

agencies, price or gathering rate controls and environmental protection regulations. Should one or more of these risks or uncertainties materialize, or should any of the Company's assumptions prove incorrect, actual results may vary in material respects from those projected in the forward-looking statements. The impact of any one factor on a particular forward-looking statement is not determinable with certainty as such factors are dependent upon other factors, and the Company's course of action would depend upon its assessment of the future considering all information then available.

Readers are cautioned that the foregoing list of factors is not exhaustive. Unpredictable or unknown factors not discussed in this document or the Company's MD&A could also have adverse effects on forward-looking statements. Although the Company believes that the expectations conveyed by the forward-looking statements are reasonable based on information available to it on the date such forward-looking statements are made, no assurances can be given as to future results, levels of activity and achievements. All subsequent forward-looking statements, whether written or oral, attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. Except as required by applicable law, the Company assumes no obligation to update forward-looking statements in this document or the Company's MD&A, whether as a result of new information, future events or other factors, or the foregoing factors affecting this information, should circumstances or the Company’s estimates or opinions change.

Special Note Regarding Common Share Split and Comparative Figures

At the Company's Annual and Special Meeting held on May 2, 2024, shareholders passed a Special Resolution approving a two for one common share split effective for shareholders of record as of market close on June 3, 2024. On June 10, 2024, shareholders of record received one additional share for every one common share held, with common shares trading on a split-adjusted basis beginning June 11, 2024. Common share, per common share, dividend, and stock option amounts for periods prior to the two for one common share split have been updated to reflect the common share split.

Special Note Regarding Amendments to the Competition Act (Canada)

On June 20, 2024, amendments to the Competition Act (Canada) came into force with the adoption of Bill C-59, An Act to Implement Certain Provisions of the Fall Economic Statement which impact environmental and climate disclosures by businesses. As a result of these amendments, certain public representations by a business regarding the benefits of the work it is doing to protect or restore the environment or mitigate the environmental and ecological causes or effects of climate change may violate the Competition Act's deceptive marketing practices provisions. These amendments include substantial financial penalties and, effective June 20, 2025, a private right of action which will permit private parties to seek an order from the Competition Tribunal under the deceptive marketing practices provisions. Uncertainty surrounding the interpretation and enforcement of this legislation may expose the Company to increased litigation and financial penalties, the outcome and impacts of which can be difficult to assess or quantify and may have a material adverse effect on the Company's business, reputation, financial condition, and results.

Special Note Regarding Currency, Financial Information and Production

This document should be read in conjunction with the Company's unaudited interim consolidated financial statements (the "financial statements") and MD&A for the three and nine months ended September 30, 2024, and the Company's audited consolidated financial statements for the year ended December 31, 2023. All dollar amounts are referenced in millions of Canadian dollars, except where noted otherwise. The Company’s financial statements and MD&A for the three and nine months ended September 30, 2024 have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB").

Production volumes and per unit statistics are presented throughout this document on a "before royalties" or "company gross" basis, and realized prices are net of blending and feedstock costs and exclude the effect of risk management activities. In addition, reference is made to crude oil and natural gas in common units called barrel of oil equivalent ("BOE"). A BOE is derived by converting six thousand cubic feet ("Mcf") of natural gas to one barrel ("bbl") of crude oil (6 Mcf:1 bbl). This conversion may be misleading, particularly if used in isolation, since the 6 Mcf:1 bbl ratio is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. In comparing the value ratio using current crude oil prices relative to natural gas prices, the 6 Mcf:1 bbl conversion ratio may be misleading as an indication of value. In addition, for the purposes of this document, crude oil is defined to include the following commodities: light and medium crude oil, primary heavy crude oil, Pelican Lake heavy crude oil, bitumen (thermal oil), and SCO. Production on an "after royalties" or "company net" basis is also presented for information purposes only. Further, results from operations for the three and nine months ended September 30, 2024 and all guidance amounts presented in this document excludes the impact of the agreement to acquire assets from Chevron.

Additional information relating to the Company, including its Annual Information Form for the year ended December 31, 2023, is available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Information on the Company's website does not form part of and is not incorporated by reference in the Company's MD&A.

Special Note Regarding Non-GAAP and Other Financial Measures

This document includes references to non-GAAP measures, which include non-GAAP and other financial measures as defined in National Instrument 52-112 – Non-GAAP and Other Financial Measures Disclosure. These financial measures are used by the Company to evaluate its financial performance, financial position or cash flow and include non-GAAP financial measures, non-GAAP ratios, total of segments measures, capital management measures, and supplementary financial measures. These financial measures are not defined by IFRS and therefore are referred to as non-GAAP and other financial measures. The non-GAAP and other financial measures used by the Company may not be comparable to similar measures presented by other companies, and should not be considered an alternative to or more meaningful than the most directly comparable financial measure presented in the Company's financial statements, as applicable, as an indication of the Company's performance. Descriptions of the Company’s non-GAAP and other financial measures included in this document, and reconciliations to the most directly comparable GAAP measure, as applicable, are provided below as well as in the "Non-GAAP and Other Financial Measures" section of the Company's MD&A for the three and nine months ended September 30, 2024, dated October 30, 2024.

| | | | | | | | |

| Canadian Natural Resources Limited | 12 | Three and nine months ended September 30, 2024 |

Capital Budget

Capital budget is a forward looking non-GAAP financial measure. The capital budget is based on net capital expenditures (Non-GAAP Financial Measure) and excludes net acquisition costs. Refer to the "Non-GAAP and Other Financial Measures" section of the Company's MD&A for more details on net capital expenditures.

Capital Efficiency

Capital efficiency is a supplementary financial measure that represents the capital spent to add new or incremental production divided by the current rate of the new or incremental production. It is expressed as a dollar amount per flowing volume of a product ($/bbl/d or $/BOE/d). The Company considers capital efficiency a key measure in evaluating its performance, as it demonstrates the efficiency of the Company's capital investments.

Free Cash Flow Policy in 2023 and 2024 (before the closing of the agreement to acquire Chevron's Alberta assets, targeted to close in Q4/24. Upon closing, the free cash flow policy will change as disclosed in the press release dated October 7, 2024.)

Free cash flow is a non-GAAP financial measure. The Company considers free cash flow a key measure in demonstrating the Company’s ability to generate cash flow to fund future growth through capital investment, pay returns to shareholders and to repay or maintain net debt levels, pursuant to the free cash flow allocation policy.

The Company’s free cash flow is used to determine the target amount of shareholder returns after dividends. The calculation in determining free cash flow varies depending on the Company’s net debt position, and as a result of achieving $10 billion in net debt at the end of 2023, the Company's free cash flow calculation has changed in 2024, when compared to 2023 as follows:

▪Allocation of Free Cash Flow in 2024

As net debt of $10 billion was achieved at the end of 2023, commencing in 2024, the Company will target to return 100% of free cash flow to shareholders. Free cash flow is calculated as adjusted funds flow less dividends on common shares, net capital expenditures and abandonment expenditures. The Company targets to manage the allocation of free cash flow on a forward looking annual basis, while managing working capital and cash management as required.

The Company's free cash flow for the three and nine months ended September 30, 2024 is shown below:

| | | | | | | | | | | |

| Three Months Ended | Nine Months Ended |

| ($ millions) | Sep 30

2024 | Jun 30

2024 | Sep 30

2024 |

Adjusted funds flow (1) | $ | 3,921 | | $ | 3,614 | | $ | 10,673 | |

| Less: Dividends on common shares | 1,118 | | | 1,125 | | 3,319 | |

Net capital expenditures (2) | | 1,349 | | | 1,621 | | | 4,083 | |

| Abandonment expenditures | | 204 | | | 129 | | 495 | |

| Free cash flow | $ | 1,250 | | $ | 739 | | $ | 2,776 | |

(1)Refer to the descriptions and reconciliations to the most directly comparable GAAP measure, which are provided in the "Non-GAAP and Other Financial Measures" section of the Company's MD&A for the three and nine months ended September 30, 2024, dated October 30, 2024.

(2)Non-GAAP Financial Measure. Refer to the "Non-GAAP and Other Financial Measures" section of the Company's MD&A for the three and nine months ended September 30, 2024, dated October 30, 2024.

▪Allocation of Free Cash Flow in 2023

When net debt was between $10 billion and $15 billion, as was the case in 2023, approximately 50% of free cash flow was allocated to shareholder returns and 50% was allocated to the balance sheet, less strategic growth/acquisition opportunities. In 2023, free cash flow of $6.9 billion was calculated as adjusted funds flow of $15.3 billion less dividends on common shares of $3.9 billion, base capital expenditures of $4.0 million and abandonment expenditures of $0.5 billion.

Long-term Debt, net

Long-term debt, net (also referred to as net debt) is a capital management measure that is calculated as current and long-term debt less cash and cash equivalents.

| | | | | | | | | | | | | | |

| ($ millions) | Sep 30

2024 | Jun 30

2024 | Dec 31

2023 | Sep 30

2023 |

| Long-term debt | $ | 10,029 | | $ | 10,149 | | $ | 10,799 | | $ | 11,644 | |

| Less: cash and cash equivalents | 721 | | 915 | | 877 | | 125 | |

| Long-term debt, net | $ | 9,308 | | $ | 9,234 | | $ | 9,922 | | $ | 11,519 | |

| | | | | | | | |

| Canadian Natural Resources Limited | 13 | Three and nine months ended September 30, 2024 |

CONFERENCE CALL

Canadian Natural Resources Limited (TSX-CNQ / NYSE-CNQ) will be issuing its 2024 Third Quarter Earnings Results on Thursday, October 31, 2024 before market open.

A conference call will be held at 9:00 a.m. MDT / 11:00 a.m. EDT on Thursday, October 31, 2024.

Dial-in to the live event:

North America 1-800-717-1738 / International 001-289-514-5100.

Listen to the audio webcast:

Access the audio webcast on the home page of our website, www.cnrl.com.

Conference call playback:

North America 1-888-660-6264 / International 001-289-819-1325 (Passcode: 46193#)

Canadian Natural is a senior crude oil and natural gas production company, with continuing operations in its core areas located in Western Canada, the U.K. portion of the North Sea and Offshore Africa.

| | |

CANADIAN NATURAL RESOURCES LIMITED T (403) 517-6700 F (403) 517-7350 E ir@cnrl.com 2100, 855 - 2 Street S.W. Calgary, Alberta, T2P 4J8 www.cnrl.com |

|

|

SCOTT G. STAUTH President MARK A. STAINTHORPE Chief Financial Officer LANCE J. CASSON Manager, Investor Relations Trading Symbol - CNQ Toronto Stock Exchange New York Stock Exchange |

| | | | | | | | |

| Canadian Natural Resources Limited | 14 | Three and nine months ended September 30, 2024 |

CANADIAN NATURAL RESOURCES LIMITED

| | |

MANAGEMENT'S DISCUSSION & ANALYSIS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024 |

| OCTOBER 30, 2024 |

MANAGEMENT'S DISCUSSION AND ANALYSIS

ADVISORY

Special Note Regarding Forward-Looking Statements

Certain statements relating to Canadian Natural Resources Limited (the "Company") in this document or documents incorporated herein by reference constitute forward-looking statements or information (collectively referred to herein as "forward-looking statements") within the meaning of applicable securities legislation. Forward-looking statements can be identified by the words "believe", "anticipate", "expect", "plan", "estimate", "target", "focus", "continue", "could", "intend", "may", "potential", "predict", "should", "will", "objective", "project", "forecast", "goal", "guidance", "outlook", "effort", "seeks", "schedule", "proposed", "aspiration" or expressions of a similar nature suggesting future outcome or statements regarding an outlook. Disclosure related to the Company's strategy or strategic focus, capital budget, expected future commodity pricing, forecast or anticipated production volumes, royalties, production expenses, capital expenditures, abandonment expenditures, income tax expenses, and other targets provided throughout this Management's Discussion and Analysis ("MD&A") of the financial condition and results of operations of the Company, including the strength of the Company's balance sheet, the sources and adequacy of the Company's liquidity, and the flexibility of the Company's capital structure, constitute forward-looking statements. Disclosure regarding the agreement to acquire from Chevron Canada Limited or its affiliates (collectively, "Chevron"), of its 20% interest in the Athabasca Oil Sands Project ("AOSP"), its 70% operated working interest in the Duvernay asset play, as well as additional working interests in certain other non-producing oil sands leases, hereinafter referred to as the "agreement to acquire assets from Chevron", including the anticipated closing thereof, including the impact of such acquisitions on the Company's debt to book capitalization ratio, and plans relating to and expected results of existing and future developments, including, without limitation, those in relation to: the Company's assets at Horizon Oil Sands ("Horizon"), AOSP, the Primrose thermal oil projects ("Primrose"), the Pelican Lake water and polymer flood projects ("Pelican Lake"), the Kirby thermal oil sands project ("Kirby"), the Jackfish thermal oil sands project ("Jackfish") and the North West Redwater bitumen upgrader and refinery; construction by third parties of new, or expansion of existing, pipeline capacity or other means of transportation of bitumen, crude oil, natural gas, natural gas liquids ("NGLs") or synthetic crude oil ("SCO") that the Company may be reliant upon to transport its products to market; the abandonment and decommissioning of certain assets and the timing thereof; the development and deployment of technology and technological innovations; the financial capacity of the Company to complete its growth projects and responsibly and sustainably grow in the long-term; and the materiality of the impact of tax interpretations and litigation on the Company's results, also constitute forward-looking statements. These forward-looking statements are based on annual budgets and multi-year forecasts, and are reviewed and revised throughout the year as necessary in the context of targeted financial ratios, project returns, product pricing expectations and balance in project risk and time horizons. These statements are not guarantees of future performance and are subject to certain risks. The reader should not place undue reliance on these forward-looking statements as there can be no assurances that the plans, initiatives or expectations upon which they are based will occur. In addition, statements relating to "reserves" are deemed to be forward-looking statements as they involve the implied assessment based on certain estimates and assumptions that the reserves described can be profitably produced in the future. There are numerous uncertainties inherent in estimating quantities of proved and proved plus probable crude oil, natural gas and NGLs reserves and in projecting future rates of production and the timing of development expenditures. The total amount or timing of actual future production may vary significantly from reserves and production estimates.

The forward-looking statements are based on current expectations, estimates and projections about the Company and the industry in which the Company operates, which speak only as of the earlier of the date such statements were made or as of the date of the report or document in which they are contained, and are subject to known and unknown risks and uncertainties that could cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties include, among others: general economic and business conditions (including as a result of the actions of the Organization of the Petroleum Exporting Countries Plus ("OPEC+"), the impact of conflicts in the Middle East, the impact of the Russian invasion of Ukraine, increased inflation, and the risk of decreased economic activity resulting from a global recession) which may impact, among other things, demand and supply for and market prices of the Company's products, and the availability and cost of resources required by the Company's operations; volatility of and assumptions regarding crude oil, natural gas and NGLs prices; fluctuations in currency and interest rates; assumptions on which the Company's current targets are based; economic conditions in the countries and regions in which the Company conducts business; political uncertainty, including actions of or against terrorists, insurgent groups or other conflict including conflict between states; the ability of the Company to prevent and recover from a cyberattack, other cyber-related crime and other cyber-related incidents; industry capacity; ability of the Company to implement its business strategy, including exploration and development activities; the impact of competition; the Company's defense of lawsuits; availability and cost of seismic, drilling and other equipment; ability of the Company to complete capital programs; the Company's ability to secure adequate transportation for its products; unexpected disruptions or delays in the mining, extracting or upgrading of the Company's bitumen products; potential delays or changes in plans with respect to exploration or development projects or capital expenditures; ability of the Company to attract the necessary labour required to build, maintain, and operate its thermal and oil sands mining projects; operating hazards and other difficulties inherent in the exploration for and production and sale of crude oil and natural gas and in the mining, extracting or upgrading the Company's bitumen products; availability and cost of financing; the Company's success of exploration and development activities and its ability to replace and expand crude oil and natural gas reserves; the Company's ability to meet its targeted production levels; timing and success of integrating the business and operations of acquired companies and assets, including the agreement to acquire assets from Chevron; production levels; imprecision of reserves estimates and estimates of recoverable quantities of crude oil, natural gas and NGLs not currently classified as proved; actions by governmental authorities; government regulations and the expenditures required to comply with them (especially safety, competition, environmental laws and regulations, and the impact of climate change initiatives on capital expenditures and production expenses); interpretations of applicable tax and competition laws and regulations; asset retirement obligations; the sufficiency of the Company's liquidity to support its growth strategy and to sustain its operations in the short-, medium-, and long-term; the strength of the Company's balance sheet; the flexibility of the Company's capital structure; the adequacy of the Company's provision for taxes; the impact of legal proceedings to which the Company is party; and other circumstances affecting revenues and expenses.

| | | | | | | | |

| Canadian Natural Resources Limited | 1 | Three and nine months ended September 30, 2024 |

The Company's operations have been, and in the future may be, affected by political developments and by national, federal, provincial, state and local laws and regulations such as restrictions on production, changes in taxes, royalties and other amounts payable to governments or governmental agencies, price or gathering rate controls and environmental protection regulations. Should one or more of these risks or uncertainties materialize, or should any of the Company's assumptions prove incorrect, actual results may vary in material respects from those projected in the forward-looking statements. The impact of any one factor on a particular forward-looking statement is not determinable with certainty as such factors are dependent upon other factors, and the Company's course of action would depend upon its assessment of the future considering all information then available.

Readers are cautioned that the foregoing list of factors is not exhaustive. Unpredictable or unknown factors not discussed in this MD&A could also have adverse effects on forward-looking statements. Although the Company believes that the expectations conveyed by the forward-looking statements are reasonable based on information available to it on the date such forward-looking statements are made, no assurances can be given as to future results, levels of activity and achievements. All subsequent forward-looking statements, whether written or oral, attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. Except as required by applicable law, the Company assumes no obligation to update forward-looking statements in this MD&A, whether as a result of new information, future events or other factors, or the foregoing factors affecting this information, should circumstances or the Company's estimates or opinions change.

Special Note Regarding Non-GAAP and Other Financial Measures

This MD&A includes references to non-GAAP measures, which include non-GAAP and other financial measures as defined in National Instrument 52-112 – Non-GAAP and Other Financial Measures Disclosure ("NI 52-112"). Non-GAAP measures are used by the Company to evaluate its financial performance, financial position or cash flow. Descriptions of the Company's non-GAAP and other financial measures included in this MD&A, and reconciliations to the most directly comparable GAAP measure, as applicable, are provided in the "Non-GAAP and Other Financial Measures" section of this MD&A.

Special Note Regarding Common Share Split and Comparative Figures

At the Company's Annual and Special Meeting held on May 2, 2024, shareholders passed a Special Resolution approving a two for one common share split effective for shareholders of record as of market close on June 3, 2024. On June 10, 2024, shareholders of record received one additional share for every one common share held, with common shares trading on a split-adjusted basis beginning June 11, 2024. Common share, per common share, dividend, and stock option amounts for periods prior to the two for one common share split have been updated to reflect the common share split.

Special Note Regarding Amendments to the Competition Act (Canada)

On June 20, 2024, amendments to the Competition Act (Canada) came into force with the adoption of Bill C-59, An Act to Implement Certain Provisions of the Fall Economic Statement which impact environmental and climate disclosures by businesses. As a result of these amendments, certain public representations by a business regarding the benefits of the work it is doing to protect or restore the environment or mitigate the environmental and ecological causes or effects of climate change may violate the Competition Act's deceptive marketing practices provisions. These amendments include substantial financial penalties and, effective June 20, 2025, a private right of action which will permit private parties to seek an order from the Competition Tribunal under the deceptive marketing practices provisions. Uncertainty surrounding the interpretation and enforcement of this legislation may expose the Company to increased litigation and financial penalties, the outcome and impacts of which can be difficult to assess or quantify and may have a material adverse effect on the Company's business, reputation, financial condition, and results.

Special Note Regarding Currency, Financial Information and Production

This MD&A should be read in conjunction with the Company's unaudited interim consolidated financial statements (the "financial statements") for the three and nine months ended September 30, 2024, and the Company's MD&A and audited consolidated financial statements for the year ended December 31, 2023. All dollar amounts are referenced in millions of Canadian dollars, except where noted otherwise. The Company's financial statements for the three and nine months ended September 30, 2024 and this MD&A have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB").

Production volumes and per unit statistics are presented throughout this MD&A on a "before royalties" or "company gross" basis, and realized prices are net of blending and feedstock costs and exclude the effect of risk management activities. In addition, reference is made to crude oil and natural gas in common units called barrel of oil equivalent ("BOE"). A BOE is derived by converting six thousand cubic feet ("Mcf") of natural gas to one barrel ("bbl") of crude oil (6 Mcf: 1 bbl). This conversion may be misleading, particularly if used in isolation, since the 6 Mcf: 1 bbl ratio is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. In comparing the value ratio using current crude oil prices relative to natural gas prices, the 6 Mcf: 1 bbl conversion ratio may be misleading as an indication of value. In addition, for the purposes of this MD&A, crude oil is defined to include the following commodities: light and medium crude oil, primary heavy crude oil, Pelican Lake heavy crude oil, bitumen (thermal oil), and SCO. Production on an "after royalties" or "company net" basis is also presented for information purposes only. Further, results from operations for the three and nine months ended September 30, 2024 and all guidance amounts presented in this MD&A exclude the impact of the agreement to acquire assets from Chevron.

The following discussion and analysis refers primarily to the Company's financial results for the three and nine months ended September 30, 2024 in relation to the comparable periods in 2023 and the second quarter of 2024. The accompanying tables form an integral part of this MD&A. Additional information relating to the Company, including its Annual Information Form for the year ended December 31, 2023, is available on SEDAR+ at www.sedarplus.ca, and on EDGAR at www.sec.gov. Information in such Annual Information Form and on the Company's website does not form part of and is not incorporated by reference in this MD&A. This MD&A is dated October 30, 2024.

| | | | | | | | |

| Canadian Natural Resources Limited | 2 | Three and nine months ended September 30, 2024 |

FINANCIAL HIGHLIGHTS(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Nine Months Ended |

| ($ millions, except per common share amounts) | | Sep 30

2024 | | Jun 30

2024 | | Sep 30

2023 | | | Sep 30

2024 | | Sep 30

2023 |