Capital One Offers Refunds Over Sales Tactics

20 April 2012 - 9:19AM

Dow Jones News

Capital One Financial Corp. (COF) is setting aside $75 million

for customer refunds stemming from employees who violated company

policy when selling products to credit cardholders over the phone,

its top executive said Thursday.

Richard Fairbank, chairman and chief executive of Capital One,

said it is offering refunds to customers who bought certain

products "over the past couple of years." Some sales employees

"didn't adhere to our scripts and sales policy when cross selling

products to our credit-card customers," Fairbank told analysts

during an earnings conference call.

Fairbank didn't say how many customers would be offered refunds,

how the employees in question violated company policy or when the

violation occurred. A Capital One spokeswoman didn't immediately

return a call for comment Thursday night.

The policies and scripts are in "place to ensure that our sales

practices meet our standards and unfortunately this didn't happen

in some cases," Fairbank said. "It's very important that we make

sure that all of our customers have bought the products in the

context that we exactly intended when we were selling."

Capital One is the fifth-largest credit-card issuer in the U.S.

by spending, according to the Nilson Report, a payments-industry

newsletter.

Credit-card issuers have been hit with lawsuits in recent years

over the sale of add-on services including identity-theft

monitoring, payment protection, which is advertised as a way to

help consumers in the event of a job loss or other hardship event,

and other products. Such services typically carry monthly fees.

The state of Hawaii last week said it filed lawsuits against

seven credit-card lenders, alleging they enrolled customers in such

services without their permission or used misleading sales tactics

when pitching the products over the phone. The seven issuers are

Bank of America Corp. (BAC), Barclays PLC (BARC.LN) Capital One,

J.P. Morgan Chase & Co. (JPM), Citigroup Inc. (C), Discover

Financial Services (DFS) and HSBC Holdings PLC (HBC). Capital One

is acquiring HSBC's U.S. credit-card business.

Discover has disclosed a probe by the Federal Deposit Insurance

Corp. and Consumer Financial Protection Bureau over its marketing

of payment protection and other fee-based services. The regulators

are likely to take a joint enforcement action against the

credit-card issuer, the cost of which could exceed $100 million,

Discover said in January.

Capital One's shares were up 1.6% at $54.77 in after-hours

trading after reporting strong first-quarter earnings.

-By Andrew R. Johnson, Dow Jones Newswires; 212-416-3214;

andrew.r.johnson@dowjones.com

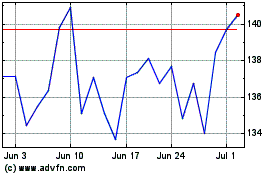

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jun 2024 to Jul 2024

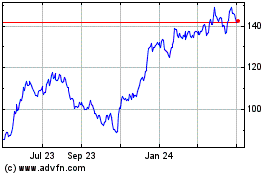

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jul 2023 to Jul 2024