false

0001140859

0001140859

2025-01-02

2025-01-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 2, 2025

Cencora,

Inc.

(Exact name of Registrant,

as specified in its charter)

| Delaware |

|

1-16671 |

|

23-3079390 |

| (State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| |

|

|

|

|

1

West First Ave.

Conshohocken,

PA |

|

|

|

19428-1800 |

| (Address of principal executive |

|

|

|

(Zip Code) |

| offices) |

|

|

|

|

| Registrant’s telephone number,

including area code: |

|

(610)

727-7000 |

Not Applicable

Former name or address, if changed since

last report

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which

registered |

| Common

Stock |

COR |

New

York Stock Exchange

(NYSE) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.01. Completion of Acquisition or Disposition of Assets

As previously disclosed in the Current Report

on Form 8-K filed by Cencora, Inc. (the “Company”) with the Securities and Exchange Commission on November 8, 2024, the

Company entered into a definitive agreement to acquire Retina Midco, Inc. (“Retina Consultants of America” or

“RCA”), a leading management services organization of retina specialists, from Webster Equity Partners. On January 2,

2025, the Company completed the acquisition and RCA became a subsidiary of the Company. The Company acquired an interest in RCA of approximately 85%, with certain RCA physicians and members of the management team retaining a minority equity interest in RCA. The

Company’s cash outlay at closing was $4.4 billion, which amount is subject to a customary post-closing purchase price

adjustment.

Item 7.01. Regulation FD Disclosure

On January 2, 2025, the Company issued a news

release announcing the completion of the acquisition of RCA, a copy of which is furnished with this Current Report as Exhibit 99.1 and

is incorporated herein by reference.

The information set forth in this Item 7.01, including

Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item

9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Cencora, Inc. |

| |

|

| Date: January 2, 2025 |

By: |

/s/ James F. Cleary |

| |

|

Name: |

James F. Cleary |

| |

|

Title: |

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Press Release

Cencora Completes Acquisition of Retina Consultants

of America

Acquisition Advances Specialty Leadership

Adjusted Diluted EPS Guidance Range Raised

to $15.15 to $15.45 for Fiscal 2025

CONSHOHOCKEN, PA, January 2, 2025 — Cencora, Inc. (NYSE:

COR) today announced the completion of its previously announced acquisition of Retina Consultants of America (“RCA”), a leading

management services organization (MSO) of retina specialists.

Cencora has acquired an interest in RCA of approximately 85%,

with certain RCA physicians and members of the management team retaining a minority equity interest in the company. After giving

effect to the equity rollover, a cash capitalization of RCA that Cencora has made, the payment of transaction fees and expenses and

the repayment of debt, Cencora’s cash outlay at closing was $4.4 billion, which amount is subject to a customary

post-closing purchase price adjustment. The acquisition allows Cencora to build on its leadership in specialty, expand its MSO

solutions and drive differentiated value for stakeholders, including physicians and patients.

Fiscal Year 2025 Expectations

The Company does not provide forward-looking guidance on a GAAP basis

as certain financial information, the probable significance of which cannot be determined, is not available or cannot be reasonably estimated.

Fiscal Year 2025 Expectations on an Adjusted (non-GAAP) Basis

Cencora has updated its fiscal year 2025 financial guidance

to reflect the expected contribution from the closing of the RCA acquisition and also continued momentum in the U.S. Healthcare

Solutions reportable segment. The Company now expects adjusted diluted earnings per share (EPS) to be in the range of $15.15 to

$15.45, raised from the previous range of $14.80 to $15.10.

Please refer to the Supplemental Information Regarding Non-GAAP Financial

Measures below.

About Cencora

Cencora is a leading global pharmaceutical solutions organization

centered on improving the lives of people and animals around the world. Cencora partners with pharmaceutical innovators across the value

chain to facilitate and optimize market access to therapies. Care providers depend on Cencora for the secure, reliable delivery of pharmaceuticals,

healthcare products, and solutions. Cencora’s 46,000+ worldwide team members contribute to positive health outcomes through the

power of Cencora’s purpose: Cencora is united in its responsibility to create healthier futures. Cencora is ranked #10 on the Fortune

500 and #18 on the Global Fortune 500 with more than $290 billion in annual revenue. Learn more at investor.cencora.com.

Cencora’s Cautionary Note Regarding Forward-Looking Statements

Certain of the statements contained in this press release are “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended (the “Securities Exchange Act”). Such forward-looking statements may include, without limitation,

statements about the transaction with RCA, the benefits of the transaction, future opportunities for Cencora and RCA and any

other statements regarding Cencora’s or RCA’s future operations, financial or operating results, anticipated business levels,

future earnings, planned activities, anticipated growth, market opportunities, strategies, and other expectations for future periods.

Words such as “aim,” “anticipate,” “believe,” “can,” “continue,” “could,”,

“estimate,” "expect," “intend,” “may,” “might,” “on track,” “opportunity,”

“plan,” “possible,” “potential,” “predict,” “project,” “seek,”

“should,” “strive,” “sustain,” “synergy,” “target,” “will,” “would”

and similar expressions are intended to identify forward-looking statements, but the absence of these words does not mean that a statement

is not forward-looking. Because forward-looking statements inherently involve risks and uncertainties, actual future results may differ

materially from those expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences

include, but are not limited to: inherent uncertainties involved in the estimates and judgments used in the preparation of financial

statements and the providing of estimates of financial measures, in accordance with GAAP and related standards, or on an adjusted basis;

Cencora’s or RCA’s failure to achieve expected or targeted future financial and operating performance and results; the possibility

that Cencora may be unable to achieve expected benefits, synergies and operating efficiencies in connection with the transaction

within the expected time frames or at all; business disruption being greater than expected following the transaction; the recruiting

and retention of key physicians and employees being more difficult following the transaction; the effect of any changes in customer

and supplier relationships and customer purchasing patterns; the impacts of competition; changes in the economic and financial conditions

of the business of Cencora or RCA; Cencora's de-leveraging plans and the ability of Cencora to maintain its investment grade rating;

and uncertainties and matters beyond the control of management and other factors described under “Risk Factors” in Cencora’s

Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other filings with the SEC. You can access Cencora’s filings with

the SEC through the SEC website at www.sec.gov or through Cencora’s website, and Cencora strongly encourages you to do so.

Except as required by applicable law, Cencora undertakes no obligation to update any statements herein for revisions or changes after

the date of this communication.

This press release is neither an offer to sell nor a solicitation of

an offer to buy any securities of Cencora. Any such offer will only be made pursuant to a prospectus filed with the SEC or pursuant to

one or more exemptions from the registration requirements of the Securities Act of 1933, as amended.

Supplemental Information Regarding Non-GAAP Financial Measure

To supplement the financial measures prepared in accordance

with U.S. generally accepted accounting principles (GAAP), Cencora uses the non-GAAP financial measure described below. The non-GAAP financial

measure should be viewed in addition to, and not in lieu of, financial measures calculated in accordance with GAAP. This supplemental

measure may vary from, and may not be comparable to, similarly titled measures by other companies.

The non-GAAP financial measure is presented because Cencora’s

management uses non-GAAP financial measures to evaluate Cencora’s operating performance, to perform financial planning, and to determine

incentive compensation. Therefore, Cencora believes that the presentation of the non-GAAP financial measure provides useful supplementary

information to, and facilitates additional analysis by, investors.

Cencora does not provide a reconciliation for this non-GAAP financial

measure on a forward-looking basis to the most comparable GAAP financial measure on a forward-looking basis because it is unable to provide

a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort

due to the uncertainty and potential variability of reconciling items, which are dependent on future events, are out of Cencora’s

control and/or cannot be reasonably predicted, and the probable significance of which cannot be determined.

This press release includes adjusted diluted earnings per share

(“EPS”), which represents diluted earnings per share determined in accordance with GAAP adjusted for specific items,

including the per share impact of: gains from antitrust litigation settlements; Turkey highly inflationary impact; LIFO expense

(credit); acquisition-related intangibles amortization; litigation and opioid expenses (credit); acquisition-related deal and

integration expenses; restructuring and other expenses; impairment of goodwill; the gain on the divestiture of non-core businesses;

the gain (loss) on the currency remeasurement related to 2020 Swiss tax reform; and the gain (loss) on the remeasurement of an

equity investment, in each case net of the tax effect calculated using the applicable effective tax rate for those items. In

addition, the per share impact of certain discrete tax items primarily attributable to an adjustment of a foreign valuation

allowance, and the per share impact of certain expenses related to 2020 Swiss tax reform are also excluded from adjusted diluted

earnings per share. Cencora’s management believes that this non-GAAP financial measure is useful to investors because it

eliminates the per share impact of items that are outside the control of Cencora or that are not considered to be indicative of

ongoing operating performance due to their inherent unusual, non-operating, unpredictable, non-recurring, or non-cash nature.

Contacts:

Investors:

Bennett S. Murphy

Bennett.Murphy@cencora.com

Media:

Lauren Esposito

215-460-6981

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

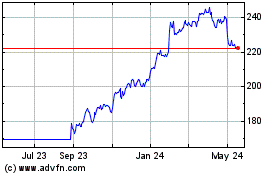

Cencora (NYSE:COR)

Historical Stock Chart

From Dec 2024 to Jan 2025

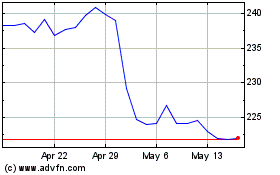

Cencora (NYSE:COR)

Historical Stock Chart

From Jan 2024 to Jan 2025