petition filed by or against such person or any business of which such person was a general partner or executive officer, either at the time of the bankruptcy or within two years prior to that time; (ii) convicted of any criminal proceeding or subject to a pending criminal proceeding (excluding traffic violations and

other minor offenses); (iii) subject to any order, judgment, or decree, not subsequently reversed, suspended, or vacated, of any court of competent jurisdiction or Federal or State authority, permanently or temporarily enjoined, barred, suspended, or otherwise limited from involvement in any type of business,

securities, futures, commodities, or banking activities; (iv) found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been

reversed, suspended, or vacated; (v) subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, related to an alleged violation of securities or commodities law or regulation; any law or regulation respecting financial

institutions or insurance companies; or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or (vi) the subject of, or a party to, any sanction or order, not subsequently reversed, suspending, or vacated, of any self-regulatory organization, any registered entity of the

Commodity Exchange Act or any equivalent exchange, association, entity, or organization that has disciplinary authority over its members or persons associated with a member.

Compensation of Directors

For information concerning compensation of our Directors, please see “Compensation of Directors” on page 45 of this Proxy Statement.

RECOMMENDATION OF THE BOARD OF DIRECTORS

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF EACH OF THE NOMINEES FOR DIRECTOR

STRUCTURE AND PRACTICES OF THE BOARD OF DIRECTORS

Corporate Governance Guidelines and Compliance

The Board of Directors has adopted corporate governance guidelines that provide the framework for the governance of the Company. The corporate governance guidelines are available within the Corporate Governance section of the Company’s website at www.curtisswright.com or by sending a request in

writing to the Corporate Secretary, Curtiss-Wright Corporation, 13925 Ballantyne Corporate Place, Suite 400, Charlotte, North Carolina 28277.

The corporate governance guidelines address, among other things, standards for Director independence, meetings of the Board, executive sessions of the Board, committees of the Board, the compensation of Directors, duties of Directors to the Company and its stockholders, and the Board’s role in

management succession. The Board reviews these principles and other aspects of governance annually.

Meetings of the Board

The Board has regularly scheduled meetings each year and special meetings are held as necessary. In addition, management and the Directors communicate informally on a variety of topics, including suggestions for Board or committee agenda items, recent developments, and other matters of interest to

the Directors. Each Director has full access to management.

A meeting of the Company’s non-employee Directors in executive session without any employee Directors or members of management present is scheduled at every regularly scheduled Board meeting. During 2014, the non-employee Directors met nine times in executive session. In May 2014, John R.

Myers was appointed by the Board to serve as Lead Independent Director for such executive sessions for a period of one year expiring in May 2015, or until his successor is appointed. Previously, Dr. William W. Sihler served as Lead Independent Director for such executive sessions, whose term

8

had expired. The Lead Independent Director reviews the agenda items from the meeting with all non-employee Directors and leads discussions with the independent Board members and coordinates follow up discussions with management. For a further discussion on the position of Lead Independent Director,

please read the section titled “Board Leadership Structure” on page 11 of this Proxy Statement.

Directors are expected to attend all meetings of the Board and each committee on which they serve. In 2014, the Board held 15 meetings and committees of the Board held a total of 16 meetings. During 2014, no Director attended less than 75% of the aggregate number of meetings of the Board of Directors

or of the committee or committees on which he or she served, which were held during the period that he or she served.

The Company does not have a formal policy with respect to Director attendance at the annual meeting of stockholders. The Company believes that the potential expense involved with requiring all non-employee Directors to attend the annual meeting of stockholders outweighs the benefit of such attendance

because meeting agenda items are generally uncontested, nearly all shares voted are voted by proxy, and stockholder attendance at the meetings is traditionally very low. Accordingly, no non-employee Directors attended the Company’s 2014 annual meeting of stockholders. David C. Adams, the Company’s

Chairman and Chief Executive Officer, did attend the Company’s 2014 annual meeting of stockholders and will attend the Company’s 2015 annual meeting of stockholders where he will be available for questions.

Communication with the Board

Stockholders, employees, and other interested parties wishing to contact the Board directly may initiate in writing any communication with: (i) the Board, (ii) any committee of the Board, (iii) the non-employee Directors as a group, or (iv) any individual non-employee Director by sending the communication to

Dr. William W. Sihler, c/o Southeastern Consultants Group, Ltd., P.O. Box 5645, Charlottesville, Virginia, 22905. The name of any specific intended Board recipient should be noted in the communication. However, prior to forwarding any correspondence, Dr. Sihler will review such correspondence and, in his

discretion, not forward certain items if they are deemed to be of a commercial nature or sent in bad faith.

Director Independence

The corporate governance guidelines provide independence standards generally consistent with the New York Stock Exchange listing standards. These standards specify the criteria by which the independence of the Company’s Directors will be determined and require annually the Board to determine

affirmatively that each independent Director has no material relationship with the Company other than as a Director. The Board has adopted the standards set out in the corporate governance guidelines, which are posted within the Corporate Governance section of the Company’s website at

www.curtisswright.com, for its evaluation of the materiality of any Director relationship with the Company. To assist in the Board’s determination, each Director completed materials designed to identify any relationship that could affect the Director’s independence. On the basis of those materials and the standards

described above, the Board has determined that the following Directors are “independent” as required by the New York Stock Exchange listing standards and the Board’s corporate governance guidelines: Dean M. Flatt, S. Marce Fuller, Dr. Allen A. Kozinski, John R. Myers, John B. Nathman, Robert J. Rivet, Dr.

William W. Sihler, Albert E. Smith, and Stuart W. Thorn. Mr. Adams does not meet the corporate governance guidelines independence test and NYSE independence listing standards due to his current position as Chairman and Chief Executive Officer of the Company. There were no other transactions,

relationships, or arrangements not otherwise disclosed that were considered by the Board of Directors in determining whether any of the Directors are independent.

All members of the Audit Committee, the Executive Compensation Committee, the Finance Committee, and the Committee on Directors and Governance are independent Directors as defined in the New York Stock Exchange listing standards and in the standards in the Company’s corporate governance

guidelines.

9

Code of Conduct

The corporate governance guidelines contain a code of conduct that applies to every Director. The Company also maintains a code of conduct that applies to every employee, including the Company’s Chief Executive Officer, Chief Financial Officer, and Corporate Controller. The Company designed the

corporate governance guidelines and the code of conduct to ensure that its business is conducted in a consistently legal and ethical manner. The corporate governance guidelines include policies on, among other things, conflicts of interest, corporate opportunities, and insider trading. The Company’s code of

conduct applicable to its employees includes policies on, among other things, employment, conflicts of interest, financial reporting, the protection of confidential information, and insider trading and requires strict adherence to all laws and regulations applicable to the conduct of the Company’s business. The

Company will disclose any waivers of the codes of conduct pertaining to Directors or senior financial executives on its website at www.curtisswright.com in accordance with applicable law and the requirements of the NYSE corporate governance standards. To date, no waivers have been requested or granted.

The Company’s code of conduct is available within the Corporate Governance section of the Company’s website at www.curtisswright.com or by sending a request in writing to the Corporate Secretary, Curtiss-Wright Corporation, 13925 Ballantyne Corporate Place, Suite 400, Charlotte, North Carolina 28277.

Board Committees

The Board of Directors has an Audit Committee, an Executive Compensation Committee, a Committee on Directors and Governance, and a Finance Committee. The Board has adopted a written charter for each of these committees. The full text of each charter is available within the Corporate Governance

section of the Company’s website at www.curtisswright.com or by sending a request in writing to the Corporate Secretary, Curtiss-Wright Corporation, 13925 Ballantyne Corporate Place, Suite 400, Charlotte, North Carolina 28277. The current membership of each committee is as follows:

|

|

|

|

|

|

|

|

|

Director |

|

Audit

Committee |

|

Executive

Compensation

Committee |

|

Committee

on Directors and

Governance |

|

Finance

Committee |

|

Dean M. Flatt |

|

|

|

X |

|

X |

|

|

|

S. Marce Fuller |

|

X |

|

X(1) |

|

|

|

|

|

Dr. Allen A. Kozinski |

|

|

|

|

|

X(1) |

|

X |

|

John R. Myers |

|

|

|

X |

|

X |

|

|

|

John B. Nathman |

|

|

|

|

|

X |

|

X |

|

Robert J. Rivet |

|

X(1) |

|

X |

|

|

|

|

|

Dr. William W. Sihler |

|

X |

|

|

|

|

|

X |

|

Albert E. Smith |

|

|

|

|

|

X |

|

X(1) |

|

Stuart W. Thorn |

|

X |

|

|

|

|

|

X |

Audit Committee. The Audit Committee presently consists of four directors. The Audit Committee met five times during 2014. The Audit Committee assists the Board in fulfilling its oversight responsibility relating to the integrity of the Company’s financial statements and the financial reporting process; the

systems of internal accounting and financial controls; the performance of the Company’s internal audit function; the annual independent audit of the Company’s financial statements; the performance, qualifications, and independence of its independent registered public accounting firm; risk assessment and

management; and the Company’s compliance and ethics programs.

Each member of the Audit Committee meets the independence requirements of the New York Stock Exchange, Rule 10A-3 under the Securities Exchange Act of 1934, and the Company’s corporate governance guidelines. In accordance with New York Stock Exchange requirements, the Board in its

business judgment has determined that each member of the Audit Committee is financially literate, knowledgeable, and qualified to review financial statements. The Board has also determined

10

that at least one member of the Audit Committee, Robert J. Rivet, is an “audit committee financial expert” as defined in the rules of the SEC.

Executive Compensation Committee. The Executive Compensation Committee presently consists of four directors. The Executive Compensation Committee met five times during 2014. Each member of the Executive Compensation Committee meets the independence requirements of the New York Stock

Exchange and the Company’s corporate governance guidelines.

The Executive Compensation Committee determines the compensation of the Chief Executive Officer and recommends to the full Board the compensation levels for the remaining executive officers of the Company. The Executive Compensation Committee also oversees the administration of the Company’s

executive compensation programs and reviews and evaluates compensation arrangements to assess whether they could encourage undue risk taking. In fulfilling its responsibilities, the Executive Compensation Committee may retain a consultant. For a discussion concerning the process and procedures for the

consideration and determination of executive compensation and the role of executive officers and compensation consultants in determining or recommending the amount or form of compensation, see “Compensation Discussion and Analysis” beginning on page 17 of this Proxy Statement.

Committee on Directors and Governance. The Committee on Directors and Governance presently consists of five directors. The Committee on Directors and Governance met three times during 2014. The Committee on Directors and Governance develops policy on the size and composition of the Board,

criteria for Director nomination, procedures for the nomination process, and compensation paid to Directors. The committee identifies and recommends candidates for election to the Board. Each member of the Committee on Directors and Governance meets the independence requirements of the New York

Stock Exchange and the Company’s corporate governance guidelines.

Finance Committee. The Finance Committee presently consists of five directors. The Finance Committee met three times during 2014. The Finance Committee, among other things, advises the Board regarding the capital structure of the Company, the Company’s dividend and stock repurchase policies, and

the investment managers and policies relating to the Company’s defined benefit plans. Each member of the Finance Committee meets the independence requirements of the New York Stock Exchange and the Company’s corporate governance guidelines.

Board Leadership Structure

The Company is focused on strong corporate governance practices and values independent Board oversight as an essential component of strong corporate performance to enhance stockholder value. The Company’s commitment to independent oversight is demonstrated by the independence of all directors,

except our Chairman. In addition, as discussed above, all of the members of the Board’s Audit Committee, Finance Committee, Executive Compensation Committee, and Committee on Directors and Governance are independent.

The Board believes that each business is unique, and that therefore, the appropriate board leadership structure will depend upon each company’s unique circumstances and needs at the time. Historically, the positions of Board Chairman and Chief Executive Officer of the Company were held by the same

individual. This pattern changed temporarily during 2013–2014 as former Chairman and Chief Executive Officer Martin R. Benante began a twenty-one month phased retirement. In 2013, Mr. Benante retired from the Chief Executive Officer position and David C. Adams, the then Company’s President and Chief

Operating Officer, was promoted to the positions of President and Chief Executive Officer and was also appointed as a member of the Board. Mr. Benante remained as Executive Chairman until January 1, 2015 at which time he retired from his position of Executive Chairman and Mr. Adams assumed the role as

Chairman and Chief Executive Officer. Mr. Benante will continue to serve as a member of the Board until his retirement from the Board effective just prior to the 2015 Annual Meeting. The Board believes that the temporary division of the Chief Executive Officer and Board Chairman positions during 2013–2014

contributed to the smooth transition of the Company’s top executive leadership position to Mr. Adams, enabling him to focus his time and energy on running the day-to-day operations of the Company at a time when he was relatively new to the role, while at the same time ensuring that Mr. Benante’s valuable

experience, wise judgment, and service would remain available to the Company during the transition period. Following completion of the

11

management transition at the end of 2014, the Board concluded that it was appropriate to return to having the positions of Chairman and Chief Executive Officer residing in one individual, Mr. Adams. Mr. Adams has been an employee of the Company for more than fourteen years, having served in increasing

levels of strategic, operational, and managerial responsibility. He possesses in-depth managerial and operational knowledge of the Company and its industries, as well as the issues, opportunities, and challenges it faces. Thus, he is best positioned to provide direction and highlight issues that ensure the Board of

Directors’ time and attention are focused on the most critical matters. In addition, the Board has determined that this leadership structure is optimal because it believes that having one leader serving as both Chairman and Chief Executive Officer fosters decisive leadership, accountability, effective decision-

making, and alignment on corporate strategy. Having one person serve as Chairman and Chief Executive Officer also enhances the Company’s ability to communicate its message and strategy clearly and consistently to its stockholders, employees, customers, and suppliers. In light of Mr. Adams’ experience and

knowledge of the Company’s business and industries, his ability to speak as both Chairman and Chief Executive Officer provides the Company with strong unified leadership.

Mr. Adams fulfills his responsibilities in chairing the Board through close interaction with the Lead Independent Director. In May 2014, the Board appointed John R. Myers to serve in that capacity for a period of one year expiring in May 2015, or until his successor is appointed. Previously, Dr. William W. Sihler

served as Lead Independent Director for such executive sessions, whose term had expired. Prior to Dr. Sihler serving as Lead Independent Director, the Board appointed a Lead Independent Director for each non-employee Director executive session on a rotating basis, with the members of the Board alternating

in the position for each meeting. The Board has structured the role of its Lead Independent Director to strike an appropriate balance between well-focused and independent leadership on the Board. The Lead Independent Director serves as the focal point for independent Directors regarding resolving conflicts

with the Chief Executive Officer, or other independent Directors, and coordinating feedback to the Chief Executive Officer on behalf of independent Directors regarding business issues and Board management. The Lead Independent Director is expected to foster a cohesive Board that supports and cooperates

with the Chief Executive Officer’s ultimate goal of creating stockholder value. In this regard, the Lead Independent Director’s responsibilities include convening and presiding over executive sessions attended only by non-employee Directors, communicating to the Chief Executive Officer the substance of

discussions held during those sessions to the extent requested by the participants, serving as a liaison between the Chairman and the Board’s independent Directors on sensitive issues, consulting with the Chairman on meeting schedules and agendas, including the format and adequacy of information the

Directors receive and the effectiveness of the meeting process, overseeing the Board’s self-evaluation process, and presiding at meetings of the Board in the event of the Chairman’s unavailability.

The Board believes this governance structure and these practices ensure that strong and independent directors will continue to effectively oversee the Company’s management and key issues related to long-term business plans, long-range strategic issues, risks, and integrity.

Board Role in Risk Oversight

The Board of Directors oversees risk to help ensure a successful business at the Company. While the Chairman and Chief Executive Officer, Chief Operating Officer, Chief Financial Officer, and other members of the Company’s senior leadership team are responsible for the day-to-day management of risk,

the Board of Directors is responsible for appraising the Company’s major risks and ensuring that appropriate risk management and control procedures are in place.

The Company relies on a comprehensive risk management process to aggregate, monitor, measure, and manage risk. The risk management process is designed to enable the Board to establish a mutual understanding with management of the effectiveness of the Company’s risk management practices and

capabilities, to review the Company’s risk exposure, and to elevate certain key risks for discussion at the Board level. The Company’s risk management process is overseen by its Chief Risk Officer. The Chief Risk Officer regularly updates the Audit Committee on the Company’s risk management process. The

Chairperson of the Audit Committee then reports to the full Board on the risks associated with the Company’s operations.

12

While the Board has the ultimate oversight responsibility for risk management processes, various committees of the Board composed entirely of independent directors also have responsibility for aspects of risk management. The Audit Committee of the Board, acting pursuant to its written charter, serves as

the principal agent of the Board in fulfilling the Board’s oversight of risk assessment and management. The Audit Committee also performs a central oversight role with respect to financial reporting and compliance risks. The Executive Compensation Committee considers risks in connection with its design of

compensation programs for the Company’s employees, including the executive officers. The Finance Committee is responsible for assessing risks related to financing matters such as pension plans, capital structure, and equity and debt issuances. The Committee on Directors and Governance oversees risk

related to the Company’s overall governance, including Board and committee composition, Board size and structure, Director independence, ethical and business conduct, and the Company’s corporate governance profile and ratings.

The Board and its committees are kept informed by various reports on risk identification and mitigation provided to them on a regular basis, including reports made at the Board and Committee meetings by management. For example, the Company’s Chief Risk Officer and internal audit function maintain

oversight over the key areas of the Company’s financial processes and controls, and report periodically directly to the Audit Committee for the purpose of assessing and evaluating major strategic, operational, regulatory, information management, and external risks in the Company’s business. The Audit

Committee then reviews with management such risks and the steps management has taken to monitor, mitigate, and control such risks.

The Board believes that its leadership structure facilitates its oversight of risk by combining Board committees and majority independent Board composition with an experienced Chairman and Chief Executive Officer who has detailed knowledge of the Company’s business, history, and the complex challenges

it faces. The Chairman and Chief Executive Officer’s in-depth understanding of these matters and involvement in the day-to-day management of the Company positions him to promptly identify and raise key risks to the Board and focus the Board’s attention on areas of concern. The independent committee chairs

and other Directors also are experienced professionals or executives who can and do raise issues for Board consideration and review and are not hesitant to challenge management. The Board believes there is a well-functioning and effective balance between the non-management Directors and the Chairman

and Chief Executive Officer that enhances risk oversight.

Stockholder Recommendations and Nominations for Directors

Stockholder Recommendations. The Committee on Directors and Governance will consider stockholder recommendations for Director nominees. A stockholder desiring the committee to consider his or her Director recommendation should deliver a written submission to the Committee on Directors and

Governance in care of the Corporate Secretary, Curtiss-Wright Corporation, 13925 Ballantyne Corporate Place, Suite 400, Charlotte, North Carolina 28277. Such submission must include:

|

| |

(1) |

|

the name and address of such stockholder, |

|

| |

(2) |

|

the name of such nominee, |

|

| |

(3) |

|

the nominee’s written consent to serve if elected, |

|

| |

(4) |

|

documentation demonstrating that the nominating stockholder is indeed a stockholder of the Company, including the number of shares of stock owned, |

|

| |

(5) |

|

a representation (i) that the stockholder is a holder of record of the stock of the Company entitled to vote at such meeting and whether he or she intends to appear in person or by proxy at the meeting, and (ii) whether the stockholder intends or is part of a group that intends to deliver a proxy statement

to the Company’s stockholders respecting such nominee or otherwise solicit proxies respecting such nominee, |

|

| |

(6) |

|

a description of any derivative instruments the stockholder owns for which the Company’s shares are the underlying security or any other direct or indirect opportunity the stockholder has to profit from any increase or decrease in the value of the Company’s stock, |

|

| |

(7) |

|

a description of the extent to which the stockholder has entered into any transaction or series of transactions, including hedging, short selling, borrowing shares, or lending shares, with the effect or intent to mitigate loss to or manage or share risk or benefit of changes in the value |

13

|

| |

|

|

or price of share of stock of the Company for, or to increase or decrease the voting power or economic interest of, such stockholder with respect to any shares of stock of the Company, |

|

| |

(8) |

|

a description of any proxy, contract, arrangement, understanding, or relationship under which the stockholder has a right to vote any of shares of stock of the Company or influence the voting over any such shares, |

|

| |

(9) |

|

a description of any rights to dividends on the shares of stock of the Company the stockholder has that are separated or separable from the underlying shares of stock of the Company, |

|

| |

(10) |

|

a description of any performance-related fees (other than asset-based fee) the stockholder is entitled to based on any increase or decrease in the value of the shares of stock of the Company or related derivative instruments, |

|

| |

(11) |

|

to the extent known, the name and address of any other stockholder(s) supporting the nomination on the date of the stockholder’s submission of the nomination to the Committee on Directors and Governance, |

|

| |

(12) |

|

any information relating to the nominee and his or her affiliates that would be required to be disclosed in a proxy solicitation for the election of Directors of the Company pursuant to Regulation 14A under the Securities Exchange Act of 1934, and |

|

| |

(13) |

|

a description of all direct and indirect compensation, and other material monetary agreements, arrangements and understandings during the past three years, and any other material relationships between such nominating stockholder or beneficial owner, if any, on the one hand, and the nominee and his

or her respective affiliates or associates, or others acting in concert therewith, on the other hand.

|

In addition, such submission must be accompanied by a written questionnaire with respect to the background and qualification of the nominee and the background of any other person or entity on whose behalf the nomination is being made. Further, the nominee must also provide a written representation and

agreement that such nominee (i) is not and will not become party to (x) any agreement, arrangement, or understanding as to how such prospective nominee will act or vote on any issue or question that has not been disclosed to the Company, or (y) any agreement, arrangement, or understanding as to how such

prospective nominee will act or vote on any issue or question that could limit or interfere with such nominee’s ability to comply with such nominee’s fiduciary duties, (ii) is not and will not become party to any agreement, arrangement, or understanding with respect to any direct or indirect compensation,

reimbursement, or indemnification in connection with service or action as a director, that has not been disclosed to the Company, and (iii) in such person’s individual capacity and on behalf of any beneficial owner on whose behalf the nomination is being made, would be in compliance with all applicable corporate

governance, conflict of interest, confidentiality, and stock ownership and trading policies and guidelines of the Company. The Committee may require additional information from the nominee to perform its evaluation.

In its assessment of each potential nominee, the Committee on Directors and Governance will review the nominee’s judgment, experience, independence, and understanding of the Company’s business; the range of talent and experience already represented on the Board; and such other factors that the

committee determines are pertinent in light of the current needs of the Company. The committee will also take into account the ability of a nominee to devote the time and effort necessary to fulfill his or her responsibilities as a Company Director.

The Committee on Directors and Governance does not have a formal written policy with regard to considering diversity in identifying nominees for directors, but when considering director candidates it seeks individuals with backgrounds and qualities that, when combined with those of the Company’s other

directors, provide a blend of skills, experience, and cultural knowledge that will further enhance the Board’s effectiveness. Diversity considerations for a director nominee may vary at any time according to the particular areas of expertise being sought as a complement to the existing Board composition. When the

need arises, the Company engages independent search firms to identify potential director nominees according to the criteria set forth by the Committee and assist the Committee in identifying and evaluating a diverse pool of qualified candidates.

14

The Committee on Directors and Governance annually evaluates the performance of the Board, each of the committees, and each of the members of the Board. It also reviews the size of the Board and whether it would be beneficial to add additional members and/or any new skills or expertise, taking into

account the overall operating efficiency of the Board and its committees. If the Board has a vacancy, or if the Committee determines that it would be beneficial to add an additional member, the Committee will take into account the factors identified above and all other factors which the Committee in its best

judgment deems relevant at such time.

Stockholder Nominations. A stockholder desiring to nominate a person as Director should deliver a written submission in accordance with the Company’s By-laws to the Corporate Secretary, Curtiss-Wright Corporation, 13925 Ballantyne Corporate Place, Suite 400, Charlotte, North Carolina 28277. Such

submission must include the items listed above under “Stockholder Recommendations and Nominations for Directors”. Stockholder submissions for Director nominees at the 2016 annual meeting of stockholders must be received by the Corporate Secretary of the Company no earlier than January 8, 2016 and no

later than February 7, 2016. Nominee recommendations that are made by stockholders in accordance with these procedures will receive the same consideration as recommendations initiated by the Committee on Directors and Governance.

The following report of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates this report

by reference therein.

Audit Committee Report

The Audit Committee of the Company’s Board of Directors consists of four non-employee directors, each of whom the Board has determined (i) meets the independence criteria specified by the SEC and the requirements of Sections 303A.07(a) and applicable sections of the New York Stock Exchange listing

standards and (ii) is financially literate in accordance with the requirements of Section 303A.07(b) of the New York Stock Exchange listing standards. The Audit Committee annually reviews and reassesses its written charter, as well as selects and retains the Company’s independent registered public accounting

firm.

Management is responsible for the financial reporting process, including its system of internal controls, and for the preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. Our independent accountants are responsible for

auditing those financial statements. The Audit Committee is responsible for monitoring and reviewing these processes. The Audit Committee does not have the duty or responsibility to conduct auditing or accounting reviews or procedures. None of the members of the Audit Committee may be employees of the

Company. Additionally, the Audit Committee members may not represent themselves to be accountants or auditors for the Company, or to serve as accountants or auditors by profession or experts in the fields of accounting or auditing for the Company. Therefore, the Audit Committee has relied, without

independent verification, on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles in the United States of America and on the representations of the independent accountants included in their

report on the Company’s financial statements.

The oversight performed by the Audit Committee does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting

standards and applicable laws and regulations. Furthermore, the discussions that the Audit Committee has with management and the independent accountants do not assure that the financial statements are presented in accordance with generally accepted accounting principles, that the audit of the financial

statements has been carried out in accordance with generally accepted auditing standards, or that our independent accountants are in fact “independent.”

As more fully described in its charter, the Audit Committee is responsible for overseeing the internal controls and financial reporting processes, as well as the independent audit of the financial statements by the independent registered public accounting firm, Deloitte & Touche LLP. As part of fulfilling its

responsibilities, the Audit Committee reviewed and discussed the audited consolidated

15

financial statements for fiscal year 2014 with management and discussed with management the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements. The Audit Committee also discussed with Deloitte &

Touche LLP the matters required to be discussed by the statement on Auditing Standards No. 16, as adopted by the Public Company Accounting Oversight Board (“PCAOB”). The Audit Committee has also discussed and considered the independence of Deloitte & Touche LLP with representatives of Deloitte &

Touche LLP, reviewing as necessary all relationships and services that might bear on the objectivity of Deloitte & Touche LLP, and received the written disclosures and the letter required under Rule 3526 of the PCAOB (Communications with Audit Committees Concerning Independence) from Deloitte & Touche

LLP. The Audit Committee provided to Deloitte & Touche LLP full access to the Audit Committee to meet privately and Deloitte & Touche LLP was encouraged to discuss any matters they desired with the Audit Committee and/or the full Board of Directors.

The opinion of Deloitte & Touche LLP is filed separately in the 2014 Annual Report on Form 10-K and should be read in conjunction with the reading of the financial statements.

Based upon the Audit Committee’s review and discussions referred to above, the Audit Committee has recommended to the Board of Directors that the audited consolidated financial statements and footnotes be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014,

for filing with the SEC.

AUDIT COMMITTEE OF

THE BOARD OF DIRECTORS

Robert J. Rivet, Chairperson

S. Marce Fuller

Dr. William W. Sihler

Stuart W. Thorn

16

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (“CD&A”) details the Executive Compensation Committee’s (“Committee”) decisions regarding the compensation programs and practices as they relate to the Company’s Named Executive Officers (“NEOs”). In 2014, the Company’s NEOs included:

|

| |

• |

|

Martin R. Benante, Former Executive Chairman (retired), |

|

| |

• |

|

David C. Adams, Chairman and Chief Executive Officer, |

|

| |

• |

|

Glenn E. Tynan, Vice President and Chief Financial Officer, |

|

| |

• |

|

Thomas P. Quinly, Vice President and Chief Operating Officer, and |

|

| |

• |

|

Paul J. Ferdenzi, Vice President, General Counsel, and Corporate Secretary

|

On January 1, 2015, the Company transitioned to a new Chairman and Chief Executive Officer, Mr. Adams. As part of this planned transition, Mr. Benante retired as Executive Chairman and Chairman of the Board, effective January 1, 2015. Mr. Benante will continue to serve as a member of the Company’s

Board of Directors up until the Company’s 2015 Annual Meeting of stockholders on May 7, 2015, at which point Mr. Benante will retire from the board.

2014 Company Performance

Historically, Curtiss-Wright grew its portfolio of products and services through acquisitions supplemented by organic growth. In 2014, the Company concentrated on growing sales organically and increasing the margins of its existing lines of business by:

|

| |

• |

|

Leveraging the critical mass and powerful suite of capabilities it built over the past decade |

|

| |

• |

|

Driving operational excellence |

|

| |

• |

|

Improving its financial discipline |

|

| |

• |

|

Divesting low margin, non-strategic businesses

|

The intent of these strategies is to achieve top quartile performance among its peer groups. They are tied to a much more balanced capital deployment strategy—all part of the Company’s effort to improve the competitiveness of Curtiss-Wright over the long term and generate stronger returns for stockholders.

|

| |

• |

|

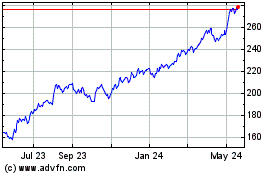

The Company’s performance reinforced its strategy. The Company’s financial performance in 2014 was strong, resulting in total shareholder return (TSR) at the 81st percentile, which is top quartile of our peer group. TSR is the change in Company share price plus dividends from the beginning of the

measurement period to the end. Highlights of the Company’s 2014 performance include: Operating income increased 19% and operating margin increased 140 basis points to 12.6%, based on improvements in the Company’s Commercial/Industrial and Energy segments. |

|

| |

• |

|

Net earnings from continuing operations increased 22% to $170 million, or $3.46 per diluted share. |

|

| |

• |

|

Working capital increased $196 million, or 24%. |

|

| |

• |

|

Organic sales increased $33 million, or 2%. |

|

| |

• |

|

Free cash flow, defined as cash flow from operations less capital expenditures, increased 60% to $265 million for 2014, equating to a much improved 156% cash conversion (based on net earnings from continuing operations). Cash conversion is calculated as free cash flow divided by earnings from

continuing operations.

|

17

The following chart illustrates how the Company compares against the peer group using TSR as of December 31, 2014:

2014 Incentive Payouts

Incentive awards earned by the NEOs for fiscal 2014 reflect the Company’s strong operating performance and the Company’s commitment to pay for performance.

|

| |

• |

|

2014 annual incentive awards were on average 160% of target for the NEO’s with incentives based on Company (80%) and individual (20%) performance. |

|

| |

• |

|

Cash-based performance units for the 2012-2014 performance period were earned on average at 128.2% of target. |

|

| |

• |

|

Performance share unit payout for the 2012-2014 performance period was 179% of target. |

|

| |

• |

|

Base salaries were increased only for Mr. Adams, Mr. Quinly, and Mr. Ferdenzi due to their promotions.

|

Pay and Performance Alignment

In 2014, the Committee requested that Farient Advisors, LLC, the Committee’s independent external compensation consultant, evaluate the relationship between the Company’s CEO pay and performance. Farient Advisors utilized the Company’s peer group and their alignment methodology to test whether

or not the Company’s Total Direct Performance-Adjusted Compensationä (PACä) for the CEO is (1) reasonable relative to the Company’s revenue size, peer group, and TSR performance and (2) sensitive to the Company’s TSR over time. PAC measures compensation outcomes after performance has occurred,

rather than target compensation, which represents “expected” compensation before performance has occurred. Farient Advisors compared the CEO’s PAC (including actual salary, actual short-term incentive awards, and performance-adjusted long-term incentive values) over rolling 3-year periods to TSR for the

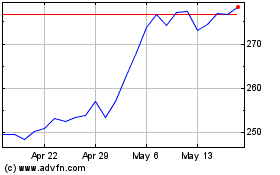

same rolling 3-year periods, and tested the results against those same variables for the peer group companies. The Company’s PAC was then compared to a range of values, as indicated by the upper and lower boundaries on the chart below. This range is known as the “Alignment Zone,” and it indicates the

reasonable range of pay outcomes for the performance delivered based on the Company’s size and the historical pay-for-performance experience of the peer group. All PAC values on the chart, current and historical, for both the Company as well as for the companies in the peer group, are adjusted to reflect the

Company’s size of approximately $2.2 billion in revenue as of December 31, 2014.

As shown in the chart below, Farient Advisors’ analysis indicates that the CEO’s compensation outcomes for the three-year periods ending 2012-2014 were reasonable relative to the Company’s peers and the performance delivered, underscoring the appropriateness of the executive compensation program.

18

Curtiss-Wright Corp CEO Total Direct PACTM

Pay for Performance Alignment for Three Year

Periods Ending in Year Shown

19

Compensation Practices and Policies

The Committee frequently reviews the Company’s executive compensation programs to ensure they support the Company’s compensation philosophy and objectives. The Committee continues to implement and maintain best practices for executive compensation. Listed below are some of the best practices

the Company follows and the practices that the Company does not include in its program:

|

|

|

|

|

|

|

Best Practices Followed |

|

Practices Curtiss-Wright Does Not Follow |

• |

|

Align pay and performance using measures of financial and operating performance and relative TSR |

|

• |

|

Employment agreements |

| |

|

|

|

• |

|

Executive compensation practices that encourage excessively risky business decisions |

• |

|

Balance short-term and long-term incentives using multiple performance measures |

|

• |

|

Short sales, hedging, or pledging of Curtiss-Wright stock |

|

|

|

|

• |

|

Reloaded, re-priced or backdated stock options |

• |

|

Caps on incentives |

|

• |

|

Tax gross-ups on change-in-control benefits for executives hired after January 2008 |

• |

|

Significant stock ownerships guidelines for NEOs and Board members including a 50% mandatory hold on net shares until ownership guidelines

are met for NEOs |

|

• |

|

Dividends on unvested or unearned performance shares |

|

|

|

|

• |

|

Excessive perquisites |

• |

|

A claw back policy on all incentive compensation |

|

• |

|

Excessive severance and/or change in control provisions |

• |

|

An independent external compensation consultant to review and advise on executive compensation |

|

|

|

|

Consideration of Say on Pay Results

At the 2014 Annual Meeting of stockholders, approximately 97% of shares voted were voted in favor of the Company’s executive pay programs (commonly known as Say on Pay). Stockholder input is important to the Committee; therefore, it regularly solicits input from the Company’s major stockholders on

the Company’s executive compensation programs. Since 2011, the Committee has made changes each year to respond to stockholder input and strengthen the link between executive pay and performance. The Committee believes that the 2014 voting results as well as the investor feedback indicate

stockholders’ approval of the NEO’s compensation levels, objectives, program design, and rationale.

Overview of the 2014 Executive Compensation Program

Compensation Philosophy

The Company’s compensation philosophy and objectives will support and enable:

|

| |

• |

|

Curtiss-Wright’s vision of achieving top quartile performance |

|

| |

• |

|

Performance achieved through incentives

|

|

| |

- |

|

Target P50 pay (or total direct compensation—TDC) in aggregate with base pay aligned with market |

|

| |

- |

|

Realized pay aligned with performance—objective is P75 for P75 performance

|

|

| |

• |

|

Incentive Metrics and Targets dictated by Company needs that are:

|

|

| |

- |

|

Evaluated annually based on financial performance and outlook |

|

| |

- |

|

Modified in terms of weighting and mix as Curtiss-Wright advances towards top quartile |

|

| |

- |

|

Reviewed and assessed as business conditions change with exceptions possible when aligned with strategic purposes

|

20

|

| |

• |

|

Long Term Incentives including equity as a key component thereby providing shareholder alignment |

|

| |

• |

|

Compensation to be a tool for retention and management and leadership development

|

Compensation mix

To reinforce the Company’s pay for performance philosophy, more than two-thirds of targeted total direct compensation for each NEO is contingent upon performance and, therefore, fluctuates with the Company’s financial results and share price. The Committee targets total direct compensation opportunities

for the executive group on average to the 50th percentile (median) of the Company’s relevant market and peer data with actual upside and downside pay tied to corresponding performance.

2014 Target Compensation Mix and “Pay at Risk”

Performance-based compensation includes: annual incentives, performance share units, and cash-based performance units, which account for approximately 61% of the CEO’s total target compensation and 55% of the total compensation for the remaining NEO’s.

Competitive market data and peer group data

The Committee analyzed competitive market data from two sources:

1. Peer group; and

2. Survey data

The Committee utilizes both peer group and industry data weighted equally as the primary source for the CEO and CFO. The peer group data is most representative of competitors with similar product lines, markets/ industries and relative revenue size. Peer group performance therefore is a key relative

measure for the Company’s annual incentive plan and performance-based long-term incentive plan

21

metrics. In 2013, the Committee, with guidance from Farient Advisors and Management, modified the peer group for performance periods commencing January 1, 2014. The final peer group selected by the Committee consists of the following 23 companies:

|

|

|

|

|

|

|

• |

|

AAR Corp. |

|

• |

|

Hexcel Corp. |

• |

|

Actuant Corporation |

|

• |

|

IDEX Corporation |

• |

|

Applied Industrial Technologies, Inc. |

|

• |

|

Kaman Corporation |

• |

|

Barnes Group Inc. |

|

• |

|

Moog Inc. |

• |

|

BE Aerospace Inc. |

|

• |

|

Mueller Water Products, Inc. |

• |

|

CIRCOR International, Inc. |

|

• |

|

Orbital Sciences Corp. |

• |

|

Crane Co. |

|

• |

|

Rockwell Collins Inc. |

• |

|

Cubic Corporation |

|

• |

|

Spirit AeroSystems Holdings Inc. |

• |

|

EnPro Industries, Inc. |

|

• |

|

Teledyne Technologies Inc. |

• |

|

Esterline Technologies Corp. |

|

• |

|

Triumph Group, Inc. |

• |

|

Flowserve Corp. |

|

• |

|

Woodward, Inc. |

• |

|

GenCorp Inc. |

|

|

|

|

For the other NEOs, the Committee placed more focus on nationally recognized executive survey data from Towers Watson, Aon Hewitt, and Mercer. The Committee believes that due to the large sample size, the surveys provide more reliable, less volatile compensation data than the smaller peer group.

Roles in determining 2014 Executive Compensation

Summarized in the table below are roles and responsibilities for executive compensation:

|

|

|

|

|

Groups

Involved |

|

Roles and Responsibilities |

|

Executive

Compensation

Committee |

|

• |

|

Recommends to the full Board the compensation levels for the executive officers other than the Chief Executive Officer and determines the compensation of the Chief Executive Officer |

|

|

|

• |

|

Oversees the administration of the Company’s executive compensation programs |

|

|

|

• |

|

Reviews overall executive compensation philosophy and policies |

|

|

|

• |

|

Oversees cost and design of the Company’s retirement and recommends changes to the full Board |

|

|

|

• |

|

Oversees and directs the activities of the outside compensation consultant and ensures the independence of the consultant |

|

|

|

• |

|

Reviews and evaluates compensation arrangements to assess whether they could encourage undue risk taking |

|

Board Members |

|

• |

|

Determines the compensation of the executive officers other than the Chief Executive Officer |

|

|

• |

|

Oversees design and cost changes to the retirement plans |

|

Committee

Consultant– Farient

Advisors |

|

• |

|

Provides advice on executive and board director compensation matters |

|

|

|

• |

|

Provides information on competitive market trends in executive compensation |

|

|

|

• |

|

Provides proposals for compensation programs, program design, including measures, goal-setting and pay and performance alignment and other topics as the Committee deems appropriate |

|

|

|

• |

|

Is directly accountable to the Committee, which has sole authority to engage, dismiss, and approve the terms of engagement of the compensation consultant. During 2014, Farient Advisors did not provide any other services to the Company. |

|

|

|

|

|

22

|

|

|

|

|

Groups

Involved |

|

Roles and Responsibilities |

|

CEO |

|

• |

|

Evaluates performance of the executive officers other than his own |

|

|

• |

|

Makes recommendations to the Committee regarding base salary, annual incentive compensation targets, long-term cash incentive compensation targets, and long-term equity compensation for the executive officers other than himself |

|

Other Executives:

CFO, GC, Corp.

VP HR |

|

• |

|

Makes recommendations to the CEO and Committee regarding annual and long-term incentive plan design and performance metrics |

|

|

|

• |

|

Provides information and recommendations regarding board director pay with oversight by Farient Advisors |

During 2014, Farient Advisors did not provide any other services to the Company. It is the Committee’s and the Company’s belief that the services provided by Farient Advisors are independent and free from any conflict of interest.

2014 Compensation Components and Compensation Philosophy

The table below summarizes each of the Company’s 2014 compensation components and its role in the Company’s executive compensation program.

|

|

|

|

|

Compensation

Component |

|

Role in the Executive Compensation Program |

|

Base Salary |

|

• |

|

Provides fixed compensation based on responsibility level, position held, and market value |

|

Annual Incentive

Compensation |

|

• |

|

Motivates and rewards achieving annual financial and operational business objectives that are linked to the Company’s overall business strategy |

|

Long-Term

Incentive Program |

|

• |

|

Motivates NEOs to achieve longer term financial goals that drive total stockholder return through three components: |

|

|

|

|

|

1. Performance-based restricted stock units (TSR based) |

|

|

|

|

|

2. Cash-based performance units, and |

|

|

|

|

|

3. Time-based restricted stock units |

|

|

|

• |

|

Promotes stock ownership and aligns potential incentive payments with stockholder interests |

|

|

|

• |

|

Rewards for achieving longer-term (3 year) business objectives that are linked to the Company’s overall business strategy and total return to stockholders and encourages retention and motivates |

|

Employee Stock

Purchase Plan |

|

• |

|

Allows substantially all full- time employees with the ability to set aside money to purchase stock of the Company |

|

|

• |

|

Promotes stock ownership and aligns employees with stockholder interests |

|

Executive Deferred

Compensation Plan |

|

• |

|

Permits deferral of compensation in excess of 401(k) statutory limits for tax advantaged savings |

|

|

|

• |

|

Provides executives with a comparable savings opportunity as that of other employees |

|

Restoration

(Pension and

Savings) Plans |

|

• |

|

Provides competitive retirement benefit |

|

|

• |

|

Promotes long-term retention of key executives by providing an increasing value tied directly to length of service |

|

|

• |

|

Note: The Company’s traditional pension plan is closed to new entrants. It will cease to provide accruals to existing participants at the end of 2028 |

|

|

|

|

|

23

|

|

|

|

|

Compensation

Component |

|

Role in the Executive Compensation Program |

|

Limited Executive

Perquisites |

|

• |

|

Provides a competitive level; business-related benefit to the Company and assists with key aspects of employment: health and financial wellness |

|

Post-Employment

Agreements |

|

• |

|

Delivers temporary income following an NEO’s involuntary termination of employment. In the case of change in control, provides continuity of management |

|

Special Retention

Agreements |

|

• |

|

Provides stability and retention of key executives to support the Company’s succession planning at the top management level |

2014 Compensation Decisions and the Basis for Decisions

Base Salary

Base salary is intended to compensate the NEOs for performance of core job responsibilities and duties. Base salary drives other pay components in that it is used to determine target values for annual incentive compensation, long-term incentive compensation, retirement benefit calculations, severance

protection, and change-in-control benefits.

The Committee evaluates NEO salaries annually and makes recommendations to the Board that reflect the value of the position measured by competitive market data, the NEOs’ individual performance, and the individual’s longer-term intrinsic value to the Company.

For 2014, base salaries were in line with the 50th percentile and accordingly not increased (except for Messrs. Adams, Quinly and Ferdenzi due to promotions). Effective January 1, 2015, the Committee increased Mr. Adams’ salary to be closer to the 50th percentile of his peers.

Annual Incentive Compensation

For 2014, the NEOs participated in the 2005 Curtiss-Wright Modified Incentive Compensation Plan, as amended (“MICP”), approved by the Company stockholders in May 2011.

The Company believes that an important portion of the overall cash compensation for the NEOs should be contingent upon the successful achievement of certain annual corporate financial and individual goals and objectives that contribute to enhanced shareholder value over time. Accordingly, 80% of the

NEO’s annual incentive target is tied to financial performance, while the remaining 20% is tied to significant individual goals and objectives.

For the 2014 MICP, the Committee, in consultation with management and Farient Advisors, selected three financial measures and key individual performance-based objectives for all NEOs. As summarized in the table below, for the financial performance metric, thirty percent (30%) of the award was based

on the attainment of a corporate operating income (“OI”) goal; thirty percent (30%) on the attainment of an operating margin (“OM”) goal, twenty percent (20%) on the attainment of a working capital (“WC”) goal; and twenty percent (20%) on the performance against individual performance-based objectives.

24

Summarized below are the 2014 MICP goals, weightings, and the rationale for inclusion of each goal:

|

|

|

|

|

|

|

Goal |

|

Weighting |

|

Rationale |

|

OI |

|

30% |

|

• |

|

Requires management to increase profitability |

|

|

|

|

|

• |

|

Is understandable, measurable, and reflects management’s performance |

|

|

|

|

|

• |

|

Is a key driver of Company business strategy |

|

|

|

|

|

• |

|

Is correlated with the Company’s TSR |

|

OM |

|

30% |

|

• |

|

Requires management to achieve profitability goals through effective margins |

|

|

|

|

• |

|

Is understandable, measurable, and reflects management performance |

|

|

|

|

• |

|

Is a key driver of overall Company success and TSR |

|

WC |

|

20% |

|

• |

|

Requires management to reduce its working capital as a percentage of sales because every one percent decrease in WC equals $23MM in free cash flow |

|

Individual |

|

20% |

|

• |

|

Provides some portion of the annual incentive based on performance objectives for which each executive is directly responsible |

|

|

|

|

• |

|

Allows for differentiation of awards based on individual contributions |

|

|

|

|

• |

|

Supports leadership development and succession planning |

MICP Formula

Payout = (30% of Target x OI Performance Rating) + (30% of Target x OM

Rating) + (30% of Target x WC Rating)

+ (20% of Target x Individual Rating)

Any adjustments are reviewed by Farient Advisors and approved by the Committee as well as audited by the Company’s internal audit department. These adjustments ensure that management makes decisions based on the best interests of the Company and stockholders rather than the possible effects on

compensation.

Goal Setting Process

Annual MICP financial performance goals are developed through a rigorous goal setting process to test the validity of the Company’s performance objectives. In reviewing and setting performance targets, the Committee considers the Company’s five year strategic plan, annual budget, and the Company’s

compensation structure. Financial performance targets are established using historical and planned Company performance, historical peer performance, and analyst estimates of prospective performance. Individual goals are developed independently between the respective NEO and the CEO and then

presented, along with their rationale, to the Committee for consideration and approval. The CEO’s individual goals are established with the Committee’s input and approval while the Board approves all other NEOs individual goals. All goals are tied to strategic business needs for the coming year and are pushed

down through the organization to align all incentive pay participants with Company goals and objectives. The Committee believes that this approach provides consistency and continuity in the execution of the Company’s short term goals as well as a strategic tie to the accomplishment of the Company’s long-term

objectives.

The goals set by the Committee are designed to provide 50th percentile pay for 50th percentile performance. For pay above the 50th percentile there must be a corresponding level of performance.

25

2014 Annual Incentive Compensation (MICP) Payout

For 2014, the range of OI ($) performance was:

|

|

|

OI ($) Range of Performance |

|

Corporate |

|

Threshold |

|

|

$ |

|

213,600,000 |

|

|

Target |

|

|

$ |

|

267,000,000 |

|

|

Maximum |

|

|

$ |

|

293,600,000 |

|

For 2014, the target range of OM performance was:

|

|

|

OM (%) Range of Performance |

|

Corporate |

|

Threshold |

|

|

|

9.3 |

% |

|

|

Target |

|

|

|

10.1 |

% |

|

|

Maximum |

|

|

|

11.1 |

% |

|

For 2014, the target range of WC (% of Sales) performance was:

|

|

|

WC Range of Performance |

|

Corporate |

|

Threshold |

|

|

|

34.6 |

% |

|

|

Target |

|

|

|

32.0 |

% |

|

|

Maximum |

|

|

|

28.0 |

% |

|

No incentive is paid if performance falls below Threshold and payouts are capped at 200% even if performance exceeds the maximum target.

Individual objectives are generally measurable and weighted based on their relative importance to the goals of the business unit and the overall success of the Company. Individual objectives can be quantitative or more subjective as long as they support operational success and reflect management’s

strategy. The Committee reviews each NEO’s individual performance and provides a rating between “one” and “five” for each stated objective. A “three” equates to 100% achievement; a “five” represents the maximum or 200% achievement; and a “two” represents 50% (threshold) achievement. A participant will

not receive an award for a rating of less than two. Each objective is multiplied by its weighting and then totaled for an overall rating. The overall rating is then multiplied against 20% of the NEO’s target award to derive a payout.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mr. Benante |

|

Mr. Adams |

|

Mr. Tynan |

|

Mr. Ferdenzi |

|

Mr. Quinly |

Goal |

|

Weight |

|

Rating |

|

Weight |

|

Rating |

|

Weight |

|

Rating |

|

Weight |

|

Rating |

|

Weight |

|

Rating |

|

Provide mentoring to new CEO |

|

|

|

100 |

% |

|

|

|

|

3.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase investor relations participation |

|

|

|

|

|

|

|

50 |

% |

|

|

|

|

4.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Drive talent management programs |

|

|

|

|

|

|

|

50 |

% |

|

|

|

|

4.0 |

|

|

|

|

|

|

|

|

|

|

|

|

34 |

% |

|

|

|

|

4.0 |

|

|

Capital allocation strategy transformation efficiencies |

|

|

|

|

|

|

|

|

|

|

|

40 |

% |

|

|

|

|

3.5 |

|

|

|

|

|

|

|

|

|

|

Finance and information technology transformation efficiencies |

|

|

|

|

|

|

|

|

|

|

|

60 |

% |

|

|

|

|

3.5 |

|

|

|

|

|

|

|

|

|

|

Reduction in outside counsel legal spend |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50 |

% |

|

|

|

|

3.9 |

|

|

|

|

|

|

Enhance contract terms and conditions of sale |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50 |

% |

|

|

|

|

3.7 |

|

|

|

|

|

|

Global risk management |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

% |

|

|

|

|

4.0 |

|

|

Staff professional development |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

% |

|

|

|

|

4.0 |

|

|

Total Score |

|

3.5 |

|

4.0 |

|

3.5 |

|

3.8 |

|

4.0 |

In order to assess the NEOs’ individual performance, the Committee is provided with detailed supporting documentation. In awarding a rating to each NEO, the Committee analyzes this supporting justification and also takes into account the Company’s overall performance and the assessment of the Chief

Executive Officer.

26

In assessing each NEO’s performance against his individual goals, the Committee considered the following:

|

|

|

|

|

Named Executive Officer |

|

Accomplishments |

|

Martin R. Benante |

|

• |

|

His effort to effectively transition his leadership role and responsibilities to Mr. Adams and to mentor Mr. Adams in his newly assigned role as Chief Executive Officer. |

|

David C. Adams |

|

• |

|

His effort to establish and maintain effective lines of communications with stockholders and the investment community. |

|

|

• |

|

His effort to develop future leadership within the Company. |

|

Glenn E. Tynan |

|

• |

|

His effort in developing and implementing an internal financial performance tracking system to support the Company’s strategy of operating margin improvement. |

|

|

|

• |

|

The Company’s improved financial performance as well as Mr. Tynan’s role in achieving the Company’s financial results such as by reducing costs through the creation of Centers of Excellence. |

|

Paul J. Ferdenzi |

|

• |

|

His effort in managing Company expenses by reducing legal department spend on outside counsel through rate reductions. |

|

|

• |

|

His effort in reducing the Company’s contractual liability with its customers by enhancing the Company’s standard terms and conditions of sale. |

|

Thomas P. Quinly |

|

• |

|

The content and quality of the management development programs that were designed as well as the number of employees trained through the programs. |

|

|

|

• |

|

His effort in developing and implementing strategic plans to manage risk. |

|

|

|

• |

|

His effort to develop future operational leadership within the Company. |

The following table details the 2014 MICP payout to each NEO based on actual financial results for the Company versus target and each NEO’s 2014 individual performance rating. With regards to the financial payout for the Company, the Company exceeded its targets on two of the three financial

measures, which resulted in the payouts in the table below.

27

In no event may MICP awards for participants be increased on a discretionary basis; however, the Committee does have the discretion to decrease the amount of any award paid to any participant under the MICP. For 2014, the Committee exercised no such downward discretion.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NEO |

|

Target % |

|

Goal |

|

Weight |

|

Actual

Result |

|

2014 MICP

Payout as %

of Target |

|

2014 MICP

Payout ($) |

|

Mr. Benante |

|

105% |

|

Individual Portion |

|

20% |

|

3.5 |

|

|

|

125 |

% |

|

|

|

$ |

|

254,625 |

|

|

|

|

|

|

OI Portion |

|

30% |

|

$298M |

|

|

|

195 |

% |

|

|

|

$ |

|

611,100 |

|

|

|

|

|

|

OM Portion |

|

30% |

|

12.6% |

|

|

|

200 |

% |

|

|

|

$ |

|

611,100 |

|

|

|

|

|

|

WC Portion |

|

20% |

|

32.7% |

|

|

|

83 |

% |

|

|

|

$ |

|

136,170 |

|

|

|

|

|

|

Total Payout |

|

100% |

|

|

|

|

|

|

$ |

|

1,646,915 |

|

|

Mr. Adams |

|

100% |

|

Individual Portion |

|

20% |

|

4.0 |

|

|

|

150 |

% |

|

|

|

$ |

|

244,616 |

|

|

|

|

|

|

OI Portion |

|

30% |

|

$298M |

|

|

|

195 |

% |

|

|

|

$ |

|

489,231 |

|

|

|

|

|

|

OM Portion |

|

30% |

|

12.6% |

|

|

|

200 |

% |

|

|

|

$ |

|

489,231 |

|

|

|

|

|

|

WC Portion |

|

20% |

|

32.7% |

|

|

|

83 |

% |

|

|

|

$ |

|

136,170 |

|

|

|

|

|

|

Total Payout |

|

100% |

|

|

|

|

|

|

$ |

|

1,359,247 |

|

|

Mr. Tynan |

|

75% |

|

Individual Portion |

|

20% |

|

3.5 |

|

|

|

125 |

% |

|

|

|

$ |

|

100,113 |

|

|

|

|

|

|

OI Portion |

|

30% |

|

$298M |

|

|

|

195 |

% |

|

|

|

$ |

|

240,271 |

|

|

|

|

|

|

OM Portion |

|

30% |

|

12.6% |

|

|

|

200 |

% |

|

|

|

$ |

|

240,271 |

|

|

|

|

|

|

WC Portion |

|

20% |

|

32.7% |

|

|

|

83 |

% |

|

|

|

$ |

|

66,875 |

|

|

|

|

|

|

Total Payout |

|

100% |

|

|

|

|

|

|

$ |

|

647,529 |

|

|