Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

23 May 2024 - 6:15AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO SECTION 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-40754

Cazoo Group Ltd

(Exact Name of Registrant as Specified in Its Charter)

40 Churchway

London NW1 1LW

United Kingdom

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

INFORMATION CONTAINED IN THIS REPORT ON FORM

6-K

Cazoo Receives NYSE Delisting Notice

On May 21, 2024, the New York Stock Exchange

(the “NYSE”) notified Cazoo Group Ltd (“we,” “us,” “our,” “Cazoo,” or the

“Company”) that (i) the NYSE has determined to commence proceedings to delist the Company’s Class A ordinary

shares, par value $0.20 per share (the “Ordinary Shares”), from the NYSE and that (2) trading in the Ordinary Shares would

be suspended immediately. The NYSE reached its determination pursuant to NYSE Listed Company Manual Section 802.01D after

the Company disclosed that certain of the Company’s material subsidiaries have voluntarily filed for administration in the United

Kingdom and the Company’s board of directors has determined that it is in the best interests of the Company and its stakeholders

to commence a winding up of the Company. In reaching its delisting determination, the NYSE noted that the Company disclosed that the Company’s

board of directors does not presently expect that there will be any remaining proceeds for the Company’s shareholders as a result

of the winding up process.

The NYSE will apply to the Securities

and Exchange Commission (the “SEC”) to delist the Ordinary Shares upon completion of all applicable procedures.

The Company does not intend to appeal the determination and, therefore, it is expected that its Ordinary Shares will be delisted

from the NYSE.

As a result of the suspension and expected delisting,

Cazoo expects that its Ordinary Shares will commence trading in the OTC Pink Marketplace. The OTC Pink Marketplace is a significantly

more limited market than the NYSE, and quotation on the OTC Pink Marketplace likely results in a less liquid market for existing and potential

holders of the Ordinary Shares to trade the Ordinary Shares and could further depress the trading price of the Ordinary Shares. The Company

can provide no assurance that its Ordinary Shares will commence trading or continue to trade on this market, whether broker-dealers will

continue to provide public quotes of the Ordinary Shares on this market, or whether the trading volume of the Ordinary Shares will be

sufficient to provide for an efficient trading market.

Extraordinary General Meeting

As previously disclosed, the Company plans to

hold an Extraordinary General Meeting of Shareholders (the “EGM”) on June 6, 2024 to seek shareholder approval of the winding

up of the Company. If the shareholders approve the winding up, liquidators will be appointed, and they will liquidate any remaining assets

and satisfy, or make reasonable provisions for, the Company’s remaining obligations.

Forward-Looking Statements

This report contains “forward-looking

statements”. The expectations, estimates, and projections of the business of Cazoo may differ from its actual results and, consequently,

you should not rely on forward-looking statements as predictions of future events. These forward-looking statements generally are identified

by the words “plan,” “seek,” “intend,” “will,” “could,” and similar expressions.

Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations

and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially

from the forward-looking statements in this press release, including but not limited to: (1) our ability to complete the winding up in

a timely manner; (2) that our shareholders will not realize any value in the Company’s shares; (3) the holders of our Senior Secured

Notes will have significant influence over all shareholder votes, and they, as secured creditors, will have interests different from our

shareholders; (4) the risk that shareholders may not approve the Company’s winding up process (5) that our warrantholders will receive

nothing for their warrants; (6) the likelihood that our creditors will not receive a full recovery in connection with our winding up;

(7) the risk that our shareholders will not be able to buy or sell shares after we close our share transfer books in connection with the

Cayman Island winding-up process; (8) our directors and officers will continue to receive benefits from the Company during the winding

up; (9) the impact of business uncertainties in connection with the winding up; (10) the risk that we may have liabilities or obligations

about which we are not currently aware; (11) the risk that the cost of settling our liabilities and contingent obligations could be higher

than anticipated; (12) uncertainties associated with the listing of the shares on the OTC Pink market; and (13) other risks and uncertainties

set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements”

in the Form 6-K filed on March 6, 2024 and in subsequent filings with the SEC. The foregoing list of factors is not exhaustive. You should

carefully consider the foregoing factors and the disclosure included in other documents filed by Cazoo from time to time with the SEC.

These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially

from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are

cautioned not to put undue reliance on forward-looking statements, and Cazoo assumes no obligation and does not intend to update or revise

these forward-looking statements, whether as a result of new information, future events, or otherwise. Cazoo gives no assurance that it

will achieve its expectations.

Contacts

Investor Relations:

Cazoo: investors@cazoo.co.uk

Media:

Cazoo: press@cazoo.co.uk

Jess Reid – Teneo +44 (0) 7919 685287

Anthony Di Natale – Teneo +44 (0) 7880 715975

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

CAZOO GROUP LTD |

| |

|

|

| Date: May 22, 2024 |

By: |

/s/ Gareth Purnell |

| |

|

Gareth Purnell |

| |

|

Chief Financial Officer |

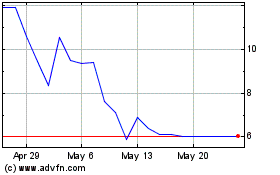

Cazoo (NYSE:CZOO)

Historical Stock Chart

From May 2024 to Jun 2024

Cazoo (NYSE:CZOO)

Historical Stock Chart

From Jun 2023 to Jun 2024