Cazoo Group Ltd (NYSE: CZOO) (“Cazoo” or “the Company”), the UK

online used car platform which makes buying and selling a car as

simple as ordering any other product online, announces its

intention to transition to a marketplace business model, leveraging

the strength of the Cazoo brand and the market-leading ecommerce

platform it has built in online automotive retailing for the

benefit of the 13,000 car dealers operating in the UK’s highly

fragmented used car market.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240306316548/en/

(Photo: Business Wire)

On December 6, 2023 Cazoo completed a series of transactions to

restructure its capital structure and a new Board of Directors (the

“Board”) was appointed. Since their appointment, the members of the

Cazoo Board have reviewed the strategic options for the Company and

believe that a pivot to a pure-play marketplace business model is

the best direction for Cazoo and all its stakeholders. This will

leverage our key advantages: our brand, which is recognisable and

trusted nationwide, and our technology platform, which provides a

market leading customer experience, and which will build on the

demand from customers and UK dealers to transact online.

The adoption of a marketplace model leverages Cazoo’s

market-leading ecommerce platform and the more than £100 million

investment in the Cazoo brand. The brand is now one of the top five

most recognised UK automotive brands and has enabled Cazoo to sell

close to 160,000 retail cars entirely online since 2019. The Board

believes Cazoo will bring fresh opportunities for dealers in the

highly fragmented used car market, providing Britain’s car dealers

with an online platform to offer their vehicles to the one million

consumers on average who visit Cazoo’s website every month. Cazoo

will support interactions between consumers and car dealers across

a variety of business models, including enabling them to use the

Cazoo platform to complete their transactions fully online.

Cazoo will leverage its substantial customer and data resources,

including the 185,000 valuations it provides every month to

consumers looking to sell their car. Based on this and its other

proprietary pricing data, Cazoo is well-positioned to offer car

dealers valuable customer and market analytical insights to support

their sales and marketing activities and to help them source new

stock in the UK’s currently stock-constrained used car market.

To achieve this transition, beginning March 6, 2024, we will be

unwinding our inventory through retail and wholesale channels. We

will also make changes to our operations in line with a pure-play

marketplace model, such as exiting fulfilment operations and

reducing headcount to focus on our ecommerce technology platform,

proprietary data, brand, and our digital marketing and commercial

functions.

Paul Whitehead, Chief Executive Officer of Cazoo, said,

“Transitioning Cazoo to a pure-play automotive marketplace business

model leverages our key advantages: the nationally recognised and

trusted Cazoo brand and the Cazoo ecommerce technology platform. We

have built a data-driven business for buying and selling cars and

having sold close to 160,000 cars we have demonstrated that there

is robust demand for online transactions in the automotive market.

Our transition means we can now offer the UK’s 13,000 car dealers

the chance to put their forecourt stock in front of the one million

potential customers on average who visit the Cazoo website every

month. The UK used car market represents a significant opportunity

for Cazoo, with approximately seven million transactions annually,

worth an estimated £100 billion.

“We look forward to completing this transition and starting an

exciting new chapter for Cazoo, building upon our investment in

both the Cazoo brand and in our ecommerce technology platform.”

Management Change

Following the conclusion of the Board’s review of the business

and with a new strategic direction agreed and in place, Paul

Whitehead has made the decision that now is the right time to step

back as CEO.

Paul has been with Cazoo for more than five years, having joined

at its inception as Chief Operating Officer. Since his appointment

as CEO, Paul has successfully focused Cazoo on the business’s core

UK retail opportunity, delivered improved gross profit per unit

quarter on quarter, significantly reduced costs and extended the

company's cash runway. He oversaw completion of a restructure of

the company's debt before leading the Board’s recent strategic

review of Cazoo’s business model. Paul will step back as CEO at the

end of March but will remain with Cazoo until at least mid-May as a

strategic adviser to support its transition to the new business

model.

Cazoo has a highly experienced Board and Executive team who have

been through operational restructuring processes and will navigate

the business through this transitional period.

Tim Isaacs, Chairman of Cazoo, said, “I would like to

thank Paul for his immense contribution to Cazoo over five years

and where more recently he has guided the business through the

restructuring of the Group’s debt and successfully focusing on the

UK market.

“I am very pleased Paul has agreed to stay on as a strategic

adviser, as his knowledge and experience of digital marketplace

businesses will be invaluable.”

Other updates

As previously disclosed, in connection with the Company’s

debt/equity exchange in December 2023 the Company committed that it

would remain listed on the New York Stock Exchange (the “NYSE”)

until at least March 20, 2024, but would have no obligation to

remain listed or registered with the Securities and Exchange

Commission (“SEC”) after that date. The Company’s board has been

evaluating the Company’s liquidity and cost structure, including

the costs of being a publicly reporting company, and whether the

benefits of being a publicly reporting and listed company outweigh

the costs. As part of its efforts to conserve cash, the Company has

notified the parties to its registration rights agreement that the

Company may delist from the NYSE and deregister its securities in

accordance with applicable SEC regulations.

The Board also continues to review strategic initiatives and

focus on satisfying Cazoo’s liquidity needs.

For more information, see our Form 6-K filed with the SEC on

March 6, 2024 and the exhibits attached thereto.

About Cazoo - www.cazoo.co.uk

Our mission is to transform the car buying and selling

experience across the UK by providing better selection, value,

transparency, convenience and peace of mind. Our aim is to make

buying or selling a car no different to ordering any other product

online, where consumers can simply and seamlessly buy, sell or

finance a car entirely online.

Forward-Looking Statements

This communication contains “forward-looking statements”. The

expectations, estimates, and projections of the business of Cazoo

may differ from its actual results and, consequently, you should

not rely on forward-looking statements as predictions of future

events. These forward-looking statements generally are identified

by the words “believe,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “may,” “will,” “would,”

“could,” “will be,” and similar expressions. Forward-looking

statements are predictions, projections and other statements about

future events that are based on current expectations and

assumptions and, as a result, are subject to risks and

uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this press

release, including but not limited to: (1) the Company’s ability to

achieve its proposed plan in the timeframe estimated; (2) the

Company’s ability to realize satisfactory prices from the sale of

its vehicles; (3) the Company’s ability to successfully transition

to a marketplace business model and achieve the benefits of this

new business model; (4) the Company’s ability to attract a

substantial number of dealers to utilize its website; (5) the

Company’s ability to raise additional capital before the beginning

of the second half of 2024 in order to satisfy its liquidity needs

on terms acceptable to it or at all; (6) the Company’s ability to

successfully engage in strategic alternatives including asset

sales, mergers, sales of the business or parts thereof or joint

ventures; (7) the risk that the Company’s board of directors may

take actions with which shareholders disagree; (8) the Company’s

ability to comply with the restrictive debt covenants, including

the liquidity covenant, contained in the indenture governing the

Company’s senior secured notes; (9) attracting, training and

retaining key personnel; (10) effectively promoting Cazoo’s brand

and increasing brand awareness; (11) acquiring and protecting

intellectual property; (12) reaching and maintaining profitability

in the future; (13) global inflation and cost increases for labor,

fuel, materials and services; (14) geopolitical and macroeconomic

conditions and their impact on prices for goods and services and on

consumer discretionary spending; (15) expanding Cazoo’s product

offerings and introducing additional products and services; (16)

enhancing future operating and financial results; (17) achieving

our long-term growth goals; (18) complying with laws and

regulations applicable to Cazoo’s business; (19) the volatility of

the trading price of our Class A ordinary shares; (20) the impact

on the trading market for the Company’s securities and decreased

liquidity if the Company delists and deregisters; (21) the risk

that Cazoo may cease to be a listed company or an SEC-reporting

company in the future, which would make it more difficult to buy

and sell securities of the Company; and (22) other risks and

uncertainties set forth in the sections entitled “Risk Factors” and

“Cautionary Note Regarding Forward-Looking Statements” in the

Annual Report on Form 20-F filed with the SEC by Cazoo Group Ltd on

March 30, 2023 and in subsequent filings with the SEC. The

foregoing list of factors is not exhaustive. You should carefully

consider the foregoing factors and the disclosure included in other

documents filed by Cazoo from time to time with the SEC. These

filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made.

Readers are cautioned not to put undue reliance on forward-looking

statements, and Cazoo assumes no obligation and does not intend to

update or revise these forward-looking statements, whether as a

result of new information, future events, or otherwise. Cazoo gives

no assurance that it will achieve its expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240306316548/en/

Investor Relations: Cazoo: Anna Gavrilova, Head of

Investor Relations, investors@cazoo.co.uk ICR: cazoo@icrinc.com

Media: Cazoo: Peter Bancroft, Interim Communications

Director, press@cazoo.co.uk Brunswick PR: Simone Selzer, +44 20

7404 5959

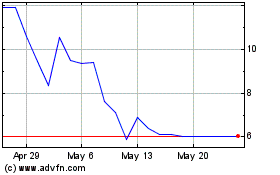

Cazoo (NYSE:CZOO)

Historical Stock Chart

From Feb 2025 to Mar 2025

Cazoo (NYSE:CZOO)

Historical Stock Chart

From Mar 2024 to Mar 2025