- Net income of $101.9 million, or $0.63 per GAAP diluted share

for fourth quarter and $278.9 or $1.73 per GAAP diluted share for

the year

- Total net sales of $1.4 billion for fourth quarter, $5.7

billion for the fiscal year 2024

- Combined Adjusted EBITDA of $289.5 million for fourth quarter,

$1.08 billion for the year

- Received $68.6 million in cash dividends from Diamond Green

Diesel in fourth quarter, $179.8 million for fiscal year 2024

Darling Ingredients Inc. (NYSE: DAR) today reported net income

of $101.9 million, or $0.63 per diluted share for the fourth

quarter of 2024, compared to net income of $84.5 million, or $0.52

per diluted share, for the fourth quarter of 2023. The company

continued its focus on operational excellence, which resulted in

gross margin improvement in fourth quarter 2024, compared to third

quarter 2024, despite lower fat prices. The company also reported

total net sales of $1.4 billion for the fourth quarter of 2024,

compared with total net sales of $1.6 billion for the same period a

year ago, reflecting lower finished product pricing.

“Darling Ingredients delivered its strongest quarter of the

year, and delivered some notable milestones,” said Randall C.

Stuewe, Chairman and Chief Executive Officer. “We started up one of

the world’s largest sustainable aviation fuel (SAF) units in Port

Arthur, Texas, which is now debt free, and the joint venture

delivered meaningful dividends throughout the year. We integrated

several acquisitions around the world that position the company

well for future growth adapting to global market dynamics.”

For fiscal year ended Dec. 28, 2024, Darling Ingredients

reported net sales of $5.7 billion, compared to net sales of $6.8

billion for the same period in 2023. Net income for fiscal year

2024 was $278.9 million, or $1.73 per diluted share, as compared to

net income of $647.7 million, or $3.99 per diluted share, for

fiscal year 2023.

DGD sold 293.8 million gallons of renewable diesel for the

fourth quarter 2024 at an average of $0.40 per gallon EBITDA.

Darling Ingredients received $68.6 million in cash dividends from

DGD during the fourth quarter of 2024. For full year 2024, DGD sold

1.25 billion gallons at an average of $0.46 per gallon EBITDA.

Combined Adjusted EBITDA for the fourth quarter of 2024 was

$289.5 million, compared to $350.9 million for the same period in

2023. For fiscal year 2024, Combined Adjusted EBITDA totaled $1.08

billion, as compared to $1.61 billion for the same period in

2023.

As of Dec. 28, 2024, Darling Ingredients had $76.0 million in

cash and cash equivalents, and $1.16 billion available under its

committed revolving credit agreement. Total debt outstanding as of

Dec. 28, 2024, was $4.0 billion. The preliminary leverage ratio as

measured by the company’s bank covenant was 3.93X as of Dec. 28,

2024. Capital expenditures were $73.3 million for the fourth

quarter 2024, and $332.5 million for the year.

“Global raw material volumes remain robust and stronger fat

prices in the first quarter of 2025 should provide lift as pending

tariffs and the Clean Fuel Production Credit provide greater

certainty to the value of domestic feedstocks,” Stuewe said.

“Currently, we expect 2025 to be stronger than 2024, gaining

momentum throughout the year as DGD turnarounds are completed and

SAF sales command a larger percentage of our mix.”

Given fourth quarter 2024 run rates and only one period into the

new year, the company is providing guidance of $1.25 to $1.30

billion Combined Adjusted EBITDA and will provide updates as the

year progresses.

Darling Ingredients Inc. and

Subsidiaries

Consolidated Operating

Results

For the Three and Twelve

Months Ended December 28, 2024 and December 30, 2023

(in thousands, except per share

data)

Three Months Ended

Twelve Months Ended

(unaudited)

(unaudited)

$ Change

(unaudited)

$ Change

December 28,

December 30,

Favorable

December 28,

December 30,

Favorable

2024

2023

(Unfavorable)

2024

2023

(Unfavorable)

Net sales to third parties

$

1,194,900

$

1,226,490

$

(31,590

)

$

4,746,292

$

5,460,259

$

(713,967

)

Net sales to related party - Diamond Green

Diesel

222,793

387,593

(164,800

)

968,883

1,327,821

(358,938

)

Total net sales

1,417,693

1,614,083

(196,390

)

5,715,175

6,788,080

(1,072,905

)

Costs and expenses:

Cost of sales and operating expenses

(excludes depreciation and amortization, shown separately

below)

1,083,931

1,177,652

93,721

4,437,337

5,143,060

705,723

Gain on sale of assets

(4,056

)

(8,282

)

(4,226

)

(4,157

)

(7,421

)

(3,264

)

Selling, general and administrative

expenses

107,514

132,620

25,106

492,105

542,534

50,429

Restructuring and asset impairment

charges

5,794

13,133

7,339

5,794

18,553

12,759

Acquisition and integration costs

2,440

1,726

(714

)

7,842

13,884

6,042

Change in fair value of contingent

consideration

(4,491

)

5,167

9,658

(46,706

)

(7,891

)

38,815

Depreciation and amortization

128,158

137,929

9,771

503,825

502,015

(1,810

)

Total costs and expenses

1,319,290

1,459,945

140,655

5,396,040

6,204,734

808,694

Equity in net income of Diamond Green

Diesel

24,036

4,690

19,346

149,082

366,380

(217,298

)

Operating income

122,439

158,828

(36,389

)

468,217

949,726

(481,509

)

Other expense:

Interest expense

(54,911

)

(68,453

)

13,542

(253,858

)

(259,223

)

5,365

Foreign currency gain/(loss)

(1,669

)

(206

)

(1,463

)

(1,154

)

8,133

(9,287

)

Other income, net

9,486

2,825

6,661

22,309

16,310

5,999

Total other expense

(47,094

)

(65,834

)

18,740

(232,703

)

(234,780

)

2,077

Equity in net income of other

unconsolidated subsidiaries

2,885

1,508

1,377

11,994

5,011

6,983

Income from operations before income

taxes

78,230

94,502

(16,272

)

247,508

719,957

(472,449

)

Income tax expense/(benefit)

(25,547

)

7,246

32,793

(38,337

)

59,568

97,905

Net income

103,777

87,256

16,521

285,845

660,389

(374,544

)

Net income attributable to noncontrolling

interests

(1,869

)

(2,740

)

871

(6,965

)

(12,663

)

5,698

Net income attributable to Darling

$

101,908

$

84,516

$

17,392

$

278,880

$

647,726

$

(368,846

)

Basic income per share:

$

0.64

$

0.53

$

0.11

$

1.75

$

4.05

$

(2.30

)

Diluted income per share:

$

0.63

$

0.52

$

0.11

$

1.73

$

3.99

$

(2.26

)

Number of diluted common shares:

161,071

161,935

161,418

162,387

Segment Financial

Tables (in thousands)

Feed Ingredients

Food Ingredients

Fuel Ingredients

Corporate

Total

Three Months Ended December 28, 2024

(unaudited)

Total net sales

$

924,157

$

361,686

$

131,850

$

—

$

1,417,693

Cost of sales and operating expenses

714,843

268,582

100,506

—

1,083,931

Gross margin

209,314

93,104

31,344

—

333,762

Gain on sale of assets

(1,210

)

(1,550

)

(1,296

)

—

(4,056

)

Selling, general and administrative

expenses

60,497

30,665

7,459

8,893

107,514

Restructuring and asset impairment

charges

3,671

2,123

—

—

5,794

Acquisition and integration costs

—

—

—

2,440

2,440

Change in fair value of contingent

consideration

(4,491

)

—

—

—

(4,491

)

Depreciation and amortization

90,648

26,119

9,189

2,202

128,158

Equity in net income of Diamond Green

Diesel

—

—

24,036

—

24,036

Segment operating income/(loss)

$

60,199

$

35,747

$

40,028

$

(13,535

)

$

122,439

Equity in net income of other

unconsolidated subsidiaries

2,885

—

—

—

2,885

Segment income/(loss)

63,084

35,747

40,028

(13,535

)

125,324

Segment Adjusted EBITDA

(Non-GAAP)

$

150,027

$

63,989

$

25,181

$

(8,893

)

$

230,304

DGD Adjusted EBITDA (Darling's Share)

(Non-GAAP)

—

—

59,159

—

59,159

Combined Adjusted EBITDA

(Non-GAAP)

$

150,027

$

63,989

$

84,340

$

(8,893

)

$

289,463

Reconciliation of Net Income/(loss) to

(Non-GAAP) Segment Adjusted EBITDA and (Non-GAAP) Combined Adjusted

EBITDA:

Net income attributable to Darling

$

63,084

$

35,747

$

40,028

$

(36,951

)

$

101,908

Net income attributable to noncontrolling

interests

1,869

1,869

Income tax benefit

(25,547

)

(25,547

)

Interest expense

54,911

54,911

Foreign currency loss

1,669

1,669

Other income, net

(9,486

)

(9,486

)

Segment income/(loss)

$

63,084

$

35,747

$

40,028

$

(13,535

)

$

125,324

Restructuring and asset impairment

charges

3,671

2,123

—

—

5,794

Acquisition and integration costs

—

—

—

2,440

2,440

Change in fair value of contingent

consideration

(4,491

)

—

—

—

(4,491

)

Depreciation and amortization

90,648

26,119

9,189

2,202

128,158

Equity in net income of Diamond Green

Diesel

—

—

(24,036

)

—

(24,036

)

Equity in net income of other

unconsolidated subsidiaries

(2,885

)

—

—

—

(2,885

)

Segment Adjusted EBITDA

(Non-GAAP)

$

150,027

$

63,989

$

25,181

$

(8,893

)

$

230,304

DGD Adjusted EBITDA (Darling's Share)

(Non-GAAP) *

59,159

59,159

Combined Adjusted EBITDA

(Non-GAAP)

$

150,027

$

63,989

$

84,340

$

(8,893

)

$

289,463

*See reconciliation of DGD Net Income to

(Non-GAAP) DGD Adjusted EBITDA below the DGD Consolidated

Statements of Income

Feed Ingredients

Food Ingredients

Fuel Ingredients

Corporate

Total

Three Months Ended December 30, 2023

(unaudited)

Total net sales

$

1,045,642

$

423,836

$

144,605

$

—

$

1,614,083

Cost of sales and operating expenses

755,062

311,163

111,427

—

1,177,652

Gross margin

290,580

112,673

33,178

—

436,431

Loss (gain) on sale of assets

1

(8,243

)

(40

)

—

(8,282

)

Selling, general and administrative

expenses

77,281

30,195

6,714

18,430

132,620

Restructuring and asset impairment

charges

3,934

9,199

—

—

13,133

Acquisition and integration costs

—

—

—

1,726

1,726

Change in fair value of contingent

consideration

5,167

—

—

—

5,167

Depreciation and amortization

98,400

26,655

8,480

4,394

137,929

Equity in net income of Diamond Green

Diesel

—

—

4,690

—

4,690

Segment operating income/(loss)

$

105,797

$

54,867

$

22,714

$

(24,550

)

$

158,828

Equity in net income of other

unconsolidated subsidiaries

1,508

—

—

—

1,508

Segment income/(loss)

$

107,305

$

54,867

$

22,714

$

(24,550

)

$

160,336

Segment Adjusted EBITDA

(Non-GAAP)

$

213,298

$

90,721

$

26,504

$

(18,430

)

$

312,093

DGD Adjusted EBITDA (Darling's Share)

(Non-GAAP)

—

—

38,816

—

38,816

Combined Adjusted EBITDA

(Non-GAAP)

$

213,298

$

90,721

$

65,320

$

(18,430

)

$

350,909

Reconciliation of Net Income/(loss) to

(Non-GAAP) Segment Adjusted EBITDA and (Non-GAAP) Combined Adjusted

EBITDA:

Net income attributable to Darling

$

107,305

$

54,867

$

22,714

$

(100,370

)

$

84,516

Net income attributable to noncontrolling

interests

2,740

2,740

Income tax expense

7,246

7,246

Interest expense

68,453

68,453

Foreign currency loss

206

206

Other income, net

(2,825

)

(2,825

)

Segment income/(loss)

$

107,305

$

54,867

$

22,714

$

(24,550

)

$

160,336

Restructuring and asset impairment

charges

3,934

9,199

—

—

13,133

Acquisition and integration costs

—

—

—

1,726

1,726

Change in fair value of contingent

consideration

5,167

—

—

—

5,167

Depreciation and amortization

98,400

26,655

8,480

4,394

137,929

Equity in net income of Diamond Green

Diesel

—

—

(4,690

)

—

(4,690

)

Equity in net income of other

unconsolidated subsidiaries

(1,508

)

—

—

—

(1,508

)

Segment Adjusted EBITDA

(Non-GAAP)

$

213,298

$

90,721

$

26,504

$

(18,430

)

$

312,093

DGD Adjusted EBITDA (Darling's Share)

(Non-GAAP) *

38,816

38,816

Combined Adjusted EBITDA

(Non-GAAP)

$

213,298

$

90,721

$

65,320

$

(18,430

)

$

350,909

*See reconciliation of DGD Net Income to

(Non-GAAP) DGD Adjusted EBITDA below the DGD Consolidated

Statements of Income

Feed Ingredients

Food Ingredients

Fuel Ingredients

Corporate

Total

Twelve Months Ended December 28, 2024

(unaudited)

Total net sales

$

3,675,609

$

1,489,101

$

550,465

$

—

$

5,715,175

Cost of sales and operating expenses

2,886,125

1,115,348

435,864

—

4,437,337

Gross margin

789,484

373,753

114,601

—

1,277,838

Gain on sale of assets

(669

)

(1,758

)

(1,730

)

—

(4,157

)

Selling, general and administrative

expenses

279,095

119,604

32,370

61,036

492,105

Restructuring and asset impairment

charges

3,671

2,123

—

—

5,794

Acquisition and integration costs

—

—

—

7,842

7,842

Change in fair value of contingent

consideration

(46,706

)

—

—

—

(46,706

)

Depreciation and amortization

350,141

109,102

35,876

8,706

503,825

Equity in net income of Diamond Green

Diesel

—

—

149,082

—

149,082

Segment operating income/(loss)

$

203,952

$

144,682

$

197,167

$

(77,584

)

$

468,217

Equity in net income of other

unconsolidated subsidiaries

11,994

—

—

—

11,994

Segment income/(loss)

$

215,946

$

144,682

$

197,167

$

(77,584

)

$

480,211

Segment Adjusted EBITDA

(Non-GAAP)

$

511,058

$

255,907

$

83,961

$

(61,036

)

$

789,890

DGD Adjusted EBITDA (Darling's Share)

(Non-GAAP)

—

—

289,945

—

289,945

Combined Adjusted EBITDA

(Non-GAAP)

$

511,058

$

255,907

$

373,906

$

(61,036

)

$

1,079,835

Reconciliation of Net Income/(loss) to

(Non-GAAP) Segment Adjusted EBITDA and (Non-GAAP) Combined Adjusted

EBITDA:

Net income attributable to Darling

$

215,946

$

144,682

$

197,167

$

(278,915

)

$

278,880

Net income attributable to noncontrolling

interests

6,965

6,965

Income tax benefit

(38,337

)

(38,337

)

Interest expense

253,858

253,858

Foreign currency loss

1,154

1,154

Other income, net

(22,309

)

(22,309

)

Segment income/(loss)

$

215,946

$

144,682

$

197,167

$

(77,584

)

$

480,211

Restructuring and asset impairment

charges

3,671

2,123

—

—

5,794

Acquisition and integration costs

—

—

—

7,842

7,842

Change in fair value of contingent

consideration

(46,706

)

—

—

—

(46,706

)

Depreciation and amortization

350,141

109,102

35,876

8,706

503,825

Equity in net income of Diamond Green

Diesel

—

—

(149,082

)

—

(149,082

)

Equity in net income of other

unconsolidated subsidiaries

(11,994

)

—

—

—

(11,994

)

Segment Adjusted EBITDA

(Non-GAAP)

$

511,058

$

255,907

$

83,961

$

(61,036

)

$

789,890

DGD Adjusted EBITDA (Darling's Share)

(Non-GAAP) *

289,945

289,945

Combined Adjusted EBITDA

(Non-GAAP)

$

511,058

$

255,907

$

373,906

$

(61,036

)

$

1,079,835

*See reconciliation of DGD Net Income to

(Non-GAAP) DGD Adjusted EBITDA below the DGD Consolidated

Statements of Income

Feed Ingredients

Food Ingredients

Fuel Ingredients

Corporate

Total

Twelve Months Ended December 30,

2023

Total net sales

$

4,472,592

$

1,752,065

$

563,423

$

—

$

6,788,080

Cost of sales and operating expenses

3,385,859

1,310,581

446,620

—

5,143,060

Gross margin

1,086,733

441,484

116,803

—

1,645,020

Loss (gain) on sale of assets

814

(8,144

)

(91

)

—

(7,421

)

Selling, general and administrative

expenses

310,363

128,464

23,543

80,164

542,534

Restructuring and asset impairment

charges

4,026

14,527

—

—

18,553

Acquisition and integration costs

—

—

—

13,884

13,884

Change in fair value of contingent

consideration

(7,891

)

—

—

—

(7,891

)

Depreciation and amortization

360,249

94,991

34,466

12,309

502,015

Equity in net income of Diamond Green

Diesel

—

—

366,380

—

366,380

Segment operating income/(loss)

$

419,172

$

211,646

$

425,265

$

(106,357

)

$

949,726

Equity in net income of other

unconsolidated subsidiaries

5,011

—

—

—

5,011

Segment income/(loss)

$

424,183

$

211,646

$

425,265

$

(106,357

)

$

954,737

Segment Adjusted EBITDA

(Non-GAAP)

$

775,556

$

321,164

$

93,351

$

(80,164

)

$

1,109,907

DGD Adjusted EBITDA (Darling's Share)

(Non-GAAP)

501,987

501,987

Combined Adjusted EBITDA

(Non-GAAP)

$

775,556

$

321,164

$

595,338

$

(80,164

)

$

1,611,894

Reconciliation of Net Income/(loss) to

(Non-GAAP) Segment Adjusted EBITDA and (Non-GAAP) Combined Adjusted

EBITDA:

Net income attributable to Darling

$

424,183

$

211,646

$

425,265

$

(413,368

)

$

647,726

Net income attributable to noncontrolling

interests

12,663

12,663

Income tax expense

59,568

59,568

Interest expense

259,223

259,223

Foreign currency gain

(8,133

)

(8,133

)

Other income, net

(16,310

)

(16,310

)

Segment income/(loss)

$

424,183

$

211,646

$

425,265

$

(106,357

)

$

954,737

Restructuring and asset impairment

charges

4,026

14,527

—

—

18,553

Acquisition and integration costs

—

—

—

13,884

13,884

Change in fair value of contingent

consideration

(7,891

)

—

—

—

(7,891

)

Depreciation and amortization

360,249

94,991

34,466

12,309

502,015

Equity in net income of Diamond Green

Diesel

—

—

(366,380

)

—

(366,380

)

Equity in net income of other

unconsolidated subsidiaries

(5,011

)

—

—

—

(5,011

)

Segment Adjusted EBITDA

(Non-GAAP)

$

775,556

$

321,164

$

93,351

$

(80,164

)

$

1,109,907

DGD Adjusted EBITDA (Darling's Share)

(Non-GAAP) *

501,987

501,987

Combined Adjusted EBITDA

(Non-GAAP)

$

775,556

$

321,164

$

595,338

$

(80,164

)

$

1,611,894

*See reconciliation of DGD Net Income to

(Non-GAAP) DGD Adjusted EBITDA below the DGD Consolidated

Statements of Income

Darling Ingredients Inc. and

Subsidiaries

Balance Sheet

Disclosures

As of December 28, 2024 and

December 30, 2023

(in thousands)

(unaudited)

December 28,

December 30,

2024

2023

Cash and cash equivalents

$

75,973

$

126,502

Property, plant and equipment, net

2,713,669

2,935,185

Current portion of long-term debt

133,020

60,703

Long-term debt, net of current portion

3,908,978

4,366,370

Other Financial Data

As of December 28,

2024

(unaudited)

December 28,

2024

Revolver availability

$

1,159,611

Capital expenditures - YTD

$

332,465

Preliminary Leverage Ratio

3.93x

Diamond Green Diesel Joint

Venture

Consolidated Statements of

Income

For the Three and Twelve

Months Ended December 31, 2024 and December 31, 2023

(in thousands)

Three Months Ended

Twelve Months Ended

(unaudited)

(unaudited)

$ Change

(unaudited)

$ Change

December 31,

December 31,

Favorable

December 31,

December 31,

Favorable

2024

2023

(Unfavorable)

2024

2023

(Unfavorable)

Revenues:

Operating revenues

$

1,245,722

$

1,633,795

$

(388,073

)

$

5,065,592

$

6,990,622

$

(1,925,030

)

Expenses:

Total costs and expenses less lower of

cost or market inventory valuation adjustment and depreciation,

amortization and accretion expense

1,009,285

1,495,293

486,008

4,309,768

5,925,778

1,616,010

Lower of cost or market (LCM) inventory

valuation adjustment

118,120

60,871

(57,249

)

175,934

60,871

(115,063

)

Depreciation, amortization and accretion

expense

69,489

58,881

(10,608

)

264,992

230,921

(34,071

)

Total costs and expenses

1,196,894

1,615,045

418,151

4,750,694

6,217,570

1,466,876

Operating income

48,828

18,750

30,078

314,898

773,052

(458,154

)

Other income

7,778

3,454

4,324

22,114

10,317

11,797

Interest and debt expense, net

(8,301

)

(12,072

)

3,771

(38,673

)

(49,857

)

11,184

Income before income tax expense

48,305

10,132

38,173

298,339

733,512

(435,173

)

Income tax expense

233

752

519

175

752

577

Net income

$

48,072

$

9,380

$

38,692

$

298,164

$

732,760

$

(434,596

)

Reconciliation of DGD Net Income to

(Non-GAAP) DGD Adjusted EBITDA:

Net income

$

48,072

$

9,380

$

298,164

$

732,760

Income tax expense

233

752

175

752

Interest and debt expense, net

8,301

12,072

38,673

49,857

Other income

(7,778

)

(3,454

)

(22,114

)

(10,317

)

Operating income

48,828

18,750

314,898

773,052

Depreciation, amortization and accretion

expense

69,489

58,881

264,992

230,921

DGD Adjusted EBITDA (Non-GAAP)

118,317

77,631

579,890

1,003,973

Darling's Share 50%

50

%

50

%

50

%

50

%

DGD Adjusted EBITDA (Darling's Share)

(Non-GAAP)

$

59,159

$

38,816

$

289,945

$

501,987

Diamond Green Diesel Joint

Venture

Condensed Consolidated Balance

Sheets

December 31, 2024 and December

31, 2023

(in thousands)

December 31,

December 31,

2024

2023

(unaudited)

Assets:

Cash

$

353,446

$

236,794

Total other current assets

1,137,821

1,640,636

Property, plant and equipment, net

3,868,943

3,838,800

Other assets

100,307

89,697

Total assets

$

5,460,517

$

5,805,927

Liabilities and members' equity:

Revolver

$

—

$

250,000

Total other current portion of long term

debt

29,809

28,639

Total other current liabilities

319,688

417,918

Total long term debt

707,158

737,097

Total other long term liabilities

17,195

16,996

Total members' equity

4,386,667

4,355,277

Total liabilities and members'

equity

$

5,460,517

$

5,805,927

Reconciliation of Net Income

to (Non-GAAP) Adjusted EBITDA and (Non-GAAP) Pro forma

Adjusted EBITDA to Foreign

Currency

For the Three and Twelve

Months Ended December 28, 2024 and December 30, 2023

(in thousands)

Three Months Ended

Twelve Months Ended

Adjusted EBITDA

December 28,

December 30,

December 28,

December 30,

(U.S. dollars in thousands)

2024

2023

2024

2023

(unaudited)

(unaudited)

(unaudited)

Net income attributable to Darling

101,908

84,516

278,880

647,726

Depreciation and amortization

128,158

137,929

503,825

502,015

Interest expense

54,911

68,453

253,858

259,223

Income tax expense (benefit)

(25,547

)

7,246

(38,337

)

59,568

Restructuring and asset impairment

charges

5,794

13,133

5,794

18,553

Acquisition and integration costs

2,440

1,726

7,842

13,884

Change in fair value of contingent

consideration

(4,491

)

5,167

(46,706

)

(7,891

)

Foreign currency loss/(gain)

1,669

206

1,154

(8,133

)

Other income, net

(9,486

)

(2,825

)

(22,309

)

(16,310

)

Equity in net income of Diamond Green

Diesel

(24,036

)

(4,690

)

(149,082

)

(366,380

)

Equity in net income of other

unconsolidated subsidiaries

(2,885

)

(1,508

)

(11,994

)

(5,011

)

Net income attributable to noncontrolling

interests

1,869

2,740

6,965

12,663

Adjusted EBITDA (Non-GAAP)

$

230,304

$

312,093

$

789,890

$

1,109,907

Foreign currency exchange impact

1,410

(1

)

—

1,334

(2

)

—

Pro forma Adjusted EBITDA to Foreign

Currency (Non-GAAP)

$

231,714

$

312,093

$

791,224

$

1,109,907

DGD Adjusted EBITDA (Darling's share)

(Non-GAAP)*

$

59,159

$

38,816

$

289,945

$

501,987

Combined Adjusted EBITDA (Non-GAAP)

$

289,463

$

350,909

$

1,079,835

$

1,611,894

*See reconciliation of DGD Net Income to

(Non-GAAP) DGD Adjusted EBITDA below the DGD Consolidated

Statements of Income

(1) The average rates for the three months

ended December 28, 2024 were €1.00:$1.07, R$1.00:$0.17 and

C$1.00:$0.72 as compared to the average rates for the three months

ended December 30, 2023 of €1.00:$1.07, R$1.00:$0.20 and

C$1.00:$0.73, respectively.

(2) The average rates for the twelve

months ended December 28, 2024 were €1.00:$1.08, R$1.00:$0.19 and

C$1.00:$0.73 as compared to the average rates for the twelve months

ended December 30, 2023 of €1.00:$1.08, R$1.00:$0.20 and

C$1.00:$0.74, respectively.

About Darling Ingredients

A pioneer in circularity, Darling Ingredients Inc. (NYSE: DAR)

takes material from the animal agriculture and food industries, and

transforms them into valuable ingredients that nourish people, feed

animals and crops, and fuel the world with renewable energy. The

company operates over 260 facilities in more than 15 countries and

processes about 15% of the world’s animal agricultural by-products,

produces about 30% of the world’s collagen (both gelatin and

hydrolyzed collagen), and is one of the largest producers of

renewable energy. To learn more, visit darlingii.com. Follow us on

LinkedIn.

Darling Ingredients will host a conference call at 9 a.m.

Eastern Time (8 a.m. Central Time) on Feb. 6, 2025, to discuss

fourth quarter and fiscal year 2024 financial results, which will

be released earlier that day. At this time, the company will

provide additional details regarding its 2025 outlook. A

presentation accompanying supplemental financial data will also be

available at darlingii.com/investors.

To access the call as a listener, please register for the

audio-only webcast.

To join the call as a participant to ask a question, please

register in advance to receive a confirmation email with the

dial-in number and PIN for immediate access on Feb. 6, or call

833-470-1428 (United States) or 404-975-4839 (international) using

access code 054278.

A replay of the call will be available online via the webcast

registration link two hours after the call ends. A transcript will

be posted at darlingii.com/investors within 24 hours.

Use of Non-GAAP Financial

Measures:

Segment Adjusted EBITDA is

not a recognized accounting measurement under GAAP; it should not

be considered as an alternative to net income/(loss), as a measure

of operating results, or as an alternative to cash flow as a

measure of liquidity. It is presented here not as an alternative to

net income (loss), but rather as a measure of the segment’s

operating performance. Segment Adjusted EBITDA consists of net

income/(loss) plus depreciation and amortization, restructuring and

asset impairment charges, acquisition and integration costs, change

in fair value of contingent consideration, foreign currency

loss/(gain), net income/(loss) attributable to noncontrolling

interests, interest expense, income tax provision, other

income/(expense), equity in net (income)/loss of unconsolidated

subsidiaries and equity in net (income)/loss of Diamond Green

Diesel. Management believes that Segment Adjusted EBITDA is useful

in evaluating the segment’s operating performance because the

calculation of Segment Adjusted EBITDA generally eliminates

non-cash and certain other items for reasons unrelated to overall

operating performance and also believes this information is useful

to investors.

Adjusted EBITDA is not a

recognized accounting measurement under GAAP; it should not be

considered as an alternative to net income, as a measure of

operating results, or as an alternative to cash flow as a measure

of liquidity. It is presented here not as an alternative to net

income, but rather as a measure of the Company's operating

performance. Since EBITDA (generally, net income plus interest

expense, taxes, depreciation and amortization) is not calculated

identically by all companies, the presentation in this report may

not be comparable to EBITDA or Adjusted EBITDA presentations

disclosed by other companies. Adjusted EBITDA is calculated above

and represents for any relevant period, net income/(loss) plus

depreciation and amortization, restructuring and asset impairment

charges, acquisition and integration costs, change in fair value of

contingent consideration, foreign currency loss/(gain), net

income/(loss) attributable to non-controlling interests, interest

expense, income tax provision, other income/(expense) and equity in

net (income)/loss of unconsolidated subsidiaries. Management

believes that Adjusted EBITDA is useful in evaluating the Company's

operating performance compared to that of other companies in its

industry because the calculation of Adjusted EBITDA generally

eliminates the effects of financing, income taxes, non-cash and

certain other items that may vary for different companies for

reasons unrelated to overall operating performance and also

believes this information is useful to investors.

The Company’s management uses Adjusted EBITDA as a measure to

evaluate performance and for other discretionary purposes. In

addition to the foregoing, management also uses or will use

Adjusted EBITDA to measure compliance with certain financial

covenants under the Company’s Senior Secured Credit Facilities, 6%

Notes, 5.25% Notes and 3.625% Notes that were outstanding at

December 28, 2024. However, the amounts shown above for Adjusted

EBITDA differ from the amounts calculated under similarly titled

definitions in the Company’s Senior Secured Credit Facilities, 6%

Notes, 5.25% Notes and 3.625% Notes, as those definitions permit

further adjustments to reflect certain other nonrecurring costs,

non-cash charges and cash dividends from the DGD Joint Venture.

Additionally, the Company evaluates the impact of foreign exchange

on operating cash flow, which is defined as segment operating

income (loss) plus depreciation and amortization.

Pro forma Adjusted EBITDA to Foreign

Currency is not a recognized accounting measurement

under GAAP; it should not be considered as an alternative to net

income, as a measure of operating results, or as an alternative to

cash flow as a measure of liquidity. It is presented here not as an

alternative to net income, but rather as a measure of the Company's

operating performance. Management believes Pro forma Adjusted

EBITDA to Foreign Currency is useful in evaluating the Company’s

operating performance on a constant currency basis and also

believes this information is useful to investors.

Combined Adjusted EBITDA is

not a recognized accounting measurement under GAAP; it should not

be considered as an alternative to net income, as a measure of

operating results, or as an alternative to cash flow as a measure

of liquidity. It is presented here not as an alternative to net

income, but rather as a measure of the Company’s operating

performance. Combined Adjusted EBITDA consists of Adjusted EBITDA

plus DGD Adjusted EBITDA (Darling’s Share). When Combined Adjusted

EBITDA is presented by segment, Combined Adjusted EBITDA consists

of Segment Adjusted EBITDA plus DGD Adjusted EBITDA (Darling’s

Share). Management believes that Combined Adjusted EBITDA is useful

in evaluating the Company's operating performance compared to that

of other companies in its industry because the calculation of

Combined Adjusted EBITDA generally eliminates the effects of

financing, income taxes, non-cash and certain other items that may

vary for different companies for reasons unrelated to overall

operating performance and also believes this information is useful

to investors.

Information reconciling forward-looking Combined Adjusted EBITDA

to net income is unavailable to the Company without unreasonable

effort. The Company is not able to provide reconciliations of

Combined Adjusted EBITDA to net income because certain items

required for such reconciliations are outside of the Company’s

control and/or cannot be reasonably predicted, such as the impact

of volatile commodity prices on the Company’s operations, impact of

foreign currency exchange fluctuations, depreciation and

amortization and the provision for income taxes. Preparation of

such reconciliations for Darling Ingredients Inc. and the Company’s

joint venture, Diamond Green Diesel, would require a

forward-looking balance sheet, statement of operations and

statement of cash flows, prepared in accordance with GAAP for each

entity, and such forward-looking financial statements are

unavailable to the Company without unreasonable effort. The Company

provides guidance for its Combined Adjusted EBITDA outlook that it

believes will be achieved; however, it cannot accurately predict

all the components of the Combined Adjusted EBITDA calculation.

DGD Adjusted EBITDA is not

reflected in the Adjusted EBITDA or the Pro forma Adjusted EBITDA

to Foreign Currency. DGD Adjusted EBITDA is not a recognized

accounting measure under GAAP; it should not be considered as an

alternative to net income/(loss) or equity in net income/(loss) of

Diamond Green Diesel, as a measure of operating results, or as an

alternative to cash flow as a measure of liquidity and is not

intended to be a presentation in accordance with GAAP. The Company

calculates DGD Adjusted EBITDA by taking DGD’s net income/(loss)

plus income tax expense/(benefit), interest and debt expense, net,

and DGD’s depreciation, amortization and accretion expense less

other income. Management believes that DGD Adjusted EBITDA is

useful in evaluating the Company’s operating performance because

the calculation of DGD Adjusted EBITDA generally eliminates

non-cash and certain other items at DGD unrelated to overall

operating performance and also believes this information is useful

to investors. The Company calculates Darling’s Share of DGD

Adjusted EBITDA by taking DGD Adjusted EBITDA and then multiplying

by 50% to get Darling’s Share of DGD’s Adjusted EBITDA.

EBITDA per gallon is not a

recognized accounting measurement under GAAP; it should not be

considered as an alternative to net income or equity in income of

Diamond Green Diesel, as a measure of operating results, or as an

alternative to cash flow as a measure of liquidity and is not

intended to be a presentation in accordance with GAAP. EBITDA per

gallon is presented here not as an alternative to net income or

equity in income of Diamond Green Diesel, but rather as a measure

of Diamond Green Diesel's operating performance. Since EBITDA per

gallon (generally, net income plus interest expense, taxes,

depreciation and amortization divided by total gallons sold) is not

calculated identically by all companies, this presentation may not

be comparable to EBITDA per gallon presentations disclosed by other

companies. Management believes that EBITDA per gallon is useful in

evaluating Diamond Green Diesel's operating performance compared to

that of other companies in its industry because the calculation of

EBITDA per gallon generally eliminates the effects of financing,

income taxes and certain non-cash and other items presented on a

per gallon basis that may vary for different companies for reasons

unrelated to overall operating performance.

Cautionary Statements Regarding

Forward-Looking Information:

This media release includes “forward-looking” statements that

are subject to risks and uncertainties that could cause actual

results to differ materially from those expressed or implied in the

statements. Statements that are not statements of historical facts

are forward-looking statements and are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. Words such as “estimate,” “guidance,” “outlook,”

“project,” “planned,” “contemplate,” “potential,” “possible,”

“proposed,” “intend,” “believe,” “anticipate,” “expect,” “may,”

“will,” “would,” “should,” “could,” and similar expressions are

intended to identify forward-looking statements. All statements

other than statements of historical facts included in this release

are forward-looking statements. Forward-looking statements are

based on the Company's current expectations and assumptions

regarding its business, the economy and other future conditions.

The Company cautions readers that any such forward-looking

statements it makes are not guarantees of future performance and

that actual results may differ materially from anticipated results

or expectations expressed in its forward-looking statements as a

result of a variety of factors, including many that are beyond the

Company's control.

Important factors that could cause actual results to differ

materially from the Company’s expectations include: existing and

unknown future limitations on the ability of the Company's direct

and indirect subsidiaries to make their cash flow available to the

Company for payments on the Company's indebtedness or other

purposes; reduced demands or prices for biofuels, biogases or

renewable electricity; global demands for grain and oilseed

commodities, which have exhibited volatility, and can impact the

cost of feed for cattle, hogs and poultry, thus affecting available

rendering feedstock and selling prices for the Company’s products;

reductions in raw material volumes available to the Company due to

weak margins in the meat production industry as a result of higher

feed costs, reduced consumer demand, reduced volume due to

government regulations affecting animal production or other

factors, reduced volume from food service establishments, or

otherwise; reduced demand for animal feed; reduced finished product

prices, including a decline in fat, used cooking oil, protein or

collagen (including, without limitation, collagen peptides and

gelatin) finished product prices; changes to government policies

around the world relating to renewable fuels and greenhouse gas

(“GHG”) emissions that adversely affect prices, margins or markets

(including for the DGD Joint Venture), including programs like

renewable fuel standards, low carbon fuel standards (“LCFS”),

renewable fuel mandates and tax credits for biofuels, or loss or

diminishment of tax credits due to failure to satisfy any

eligibility requirements, including, without limitation, in

relation to the blender tax credit or the Clean Fuels Production

Credit (“CFPC”); climate related adverse results, including with

respect to the Company’s climate goals, targets or commitments;

possible product recall resulting from developments relating to the

discovery of unauthorized adulterations to food or food additives

or products which do not meet specifications, contract requirements

or regulatory standards; the occurrence of 2009 H1N1 flu (initially

known as “Swine Flu”), highly pathogenic strains of avian influenza

(collectively known as “Bird Flu”), severe acute respiratory

syndrome (“SARS”), bovine spongiform encephalopathy (or “BSE”),

porcine epidemic diarrhea (“PED”) or other diseases associated with

animal origin in the U.S. or elsewhere, such as the outbreak of

African Swine Fever in China and elsewhere; the occurrence of

pandemics, epidemics or disease outbreaks, such as the COVID-19

outbreak; unanticipated costs and/or reductions in raw material

volumes related to the Company’s compliance with the existing or

unforeseen new U.S. or foreign (including, without limitation,

China) regulations (including new or modified animal feed, Bird

Flu, SARS, PED, BSE or ASF or similar or unanticipated regulations)

affecting the industries in which the Company operates or its value

added products; risks associated with the DGD Joint Venture,

including possible unanticipated operating disruptions, a decline

in margins on the products produced by the DGD Joint Venture and

issues relating to the announced SAF upgrade project (including,

without limitation, operational, mechanical, product quality,

market based or other such issues); risks and uncertainties

relating to international sales and operations, including

imposition of tariffs, quotas, trade barriers and other trade

protections by foreign countries; tax changes, such as global

minimum tax measures, or issues related to administration, guidance

and/or regulations associated with biofuel policies, including

CFPC, and risks associated with the qualification and sale of such

credits; difficulties or a significant disruption (including,

without limitation, due to cyber-attack) in the Company’s

information systems, networks or the confidentiality, availability

or integrity of our data or failure to implement new systems and

software successfully; risks relating to possible third-party

claims of intellectual property infringement; increased

contributions to the Company’s pension and benefit plans, including

multiemployer and employer-sponsored defined benefit pension plans

as required by legislation, regulation or other applicable U.S. or

foreign law or resulting from a U.S. mass withdrawal event; bad

debt write-offs; loss of or failure to obtain necessary permits and

registrations; continued or escalated conflict in the Middle East,

North Korea, Ukraine or elsewhere, including the Russia-Ukraine war

and the Israeli-Palestinian conflict and other associated or

emerging conflicts in the Middle East; uncertainty regarding the

exit of the U.K. from the European Union; uncertainty regarding any

administration changes in the U.S. or elsewhere around the world,

including, without limitation, impacts to trade, tariffs and/or

policies impacting the Company (such as biofuel policies and

mandates); and/or unfavorable export or import markets. These

factors, coupled with volatile prices for natural gas and diesel

fuel, inflation rates, climate conditions, currency exchange

fluctuations, general performance of the U.S. and global economies,

disturbances in world financial, credit, commodities and stock

markets, and any decline in consumer confidence and discretionary

spending, including the inability of consumers and companies to

obtain credit due to lack of liquidity in the financial markets,

among others, could cause actual results to vary materially from

the forward-looking statements included in this report or

negatively impact the Company’s results of operations. Among other

things, future profitability may be affected by the Company’s

ability to grow its business, which faces competition from

companies that may have substantially greater resources than the

Company. The Company’s announced share repurchase program may be

suspended or discontinued at any time and purchases of shares under

the program are subject to market conditions and other factors,

which are likely to change from time to time. For more detailed

discussion of these factors and other risks and uncertainties

regarding the Company, its business and the industries in which it

operates, see the Company’s filings with the SEC, including the

Risk Factors discussion in Item 1A of Part I of the Company's

Annual Report on Form 10-K for the fiscal year ended December 30,

2023. The Company cautions readers that all forward-looking

statements speak only as of the date made, and the Company

undertakes no obligation to update any forward-looking statements,

whether as a result of changes in circumstances, new events or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206441697/en/

Darling Ingredients Contacts Investors: Suann

Guthrie Senior VP, Investor Relations, Sustainability &

Communications (469) 214-8202; suann.guthrie@darlingii.com

Media: Jillian Fleming Director, Global Communications

(972) 541-7115; jillian.fleming@darlingii.com

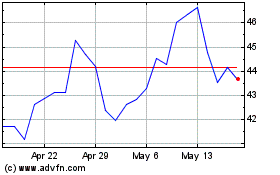

Darling Ingredients (NYSE:DAR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Darling Ingredients (NYSE:DAR)

Historical Stock Chart

From Feb 2024 to Feb 2025