UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File Number: 001-34602

DAQO NEW ENERGY CORP.

Unit 29D, Huadu Mansion, 838 Zhangyang Road,

Shanghai, 200122

The People’s Republic of China

(+86-21) 5075-2918

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

DAQO NEW ENERGY CORP. |

| |

|

| |

By: |

/s/ Xiang Xu |

| |

Name: |

Xiang Xu |

| |

Title: |

Chairman of the Board of Directors and Chief Executive Officer |

| Date: October 30, 2024 |

|

Exhibit 99.1

Daqo New Energy Announces Unaudited Third Quarter

2024 Results

Shanghai, China—October 30, 2024—Daqo New Energy Corp.

(NYSE: DQ) ("Daqo New Energy," the "Company" or “we”), a leading manufacturer of high-purity polysilicon

for the global solar PV industry, today announced its unaudited financial results for the third quarter of 2024.

Third Quarter 2024 Financial and Operating Highlights

| · | Polysilicon production volume was 43,592 MT in Q3 2024, compared to 64,961

MT in Q2 2024 |

| · | Polysilicon sales volume was 42,101 MT in Q3 2024, compared to 43,082 MT

in Q2 2024 |

| · | Polysilicon average total production cost(1) was $6.61/kg

in Q3 2024 compared to $6.19/kg in Q2 2024 |

| · | Polysilicon average cash cost(1) was $5.34/kg in Q3 2024,

compared to $5.39/kg in Q2 2024 |

| · | Polysilicon average selling price (ASP) was $4.69/kg in Q3 2024, compared

to $5.12/kg in Q2 2024 |

| · | Revenue was $198.5 million in Q3 2024, compared to $219.9 million in Q2 2024 |

| · | Gross loss was $60.6 million in Q3 2024, compared to $159.2 million in Q2

2024. Gross margin was -30.5% in Q3 2024, compared to -72.4% in Q2 2024 |

| · | Net loss attributable to Daqo New Energy Corp. shareholders was $60.7 million

in Q3 2024, compared to $119.8 million in Q2 2024 |

| · | Loss per basic American Depositary Share (ADS) (3) was $0.92

in Q3 2024, compared to $1.81 in Q2 2024 |

| · | Adjusted net loss (non-GAAP) (2) attributable to Daqo New

Energy Corp. shareholders was $39.4 million in Q3 2024, compared to $98.8 million in Q2 2024 |

| · | Adjusted loss per basic ADS(3) (non-GAAP) (2) was

$0.59 in Q3 2024, compared to $1.50 in Q2 2024 |

| · | EBITDA (non-GAAP) (2) was -$34.3 million in Q3 2024, compared

to -$144.9 million in Q2 2024. EBITDA margin (non-GAAP) (2) was -17.3% in Q3 2024, compared to -65.9% in Q2 2024 |

| | |

Three months ended | |

| US$ millions except as indicated otherwise | |

September.

30, 2024 | | |

June. 30,

2024 | | |

September.

30, 2023 | |

| Revenues | |

| 198.5 | | |

| 219.9 | | |

| 484.8 | |

| Gross (loss)/profit | |

| (60.6 | ) | |

| (159.2 | ) | |

| 67.8 | |

| Gross margin | |

| (30.5 | )% | |

| (72.4 | )% | |

| 14.0 | % |

| (Loss)/income from operations | |

| (98.0 | ) | |

| (195.6 | ) | |

| 22.5 | |

| Net loss attributable to Daqo New Energy Corp. shareholders | |

| (60.7 | ) | |

| (119.8 | ) | |

| (6.3 | ) |

| Loss per basic ADS(3) ($ per ADS) | |

| (0.92 | ) | |

| (1.81 | ) | |

| (0.09 | ) |

| Adjusted net (loss)/income (non-GAAP)(2) attributable to Daqo New Energy Corp. shareholders | |

| (39.4 | ) | |

| (98.8 | ) | |

| 44.0 | |

| Adjusted (loss)/earnings per basic ADS(3) (non-GAAP)(2) ($ per ADS) | |

| (0.59 | ) | |

| (1.50 | ) | |

| 0.59 | |

| EBITDA (non-GAAP)(2) | |

| (34.3 | ) | |

| (144.9 | ) | |

| 70.2 | |

| EBITDA margin (non-GAAP)(2) | |

| (17.3 | )% | |

| (65.9 | )% | |

| 14.5 | % |

| Polysilicon sales volume (MT) | |

| 42,101 | | |

| 43,082 | | |

| 63,263 | |

| Polysilicon average total production cost ($/kg)(1) | |

| 6.61 | | |

| 6.19 | | |

| 6.52 | |

| Polysilicon average cash cost (excl. dep’n) ($/kg)(1) | |

| 5.34 | | |

| 5.39 | | |

| 5.67 | |

Notes:

| (1) | Production cost and cash cost only refer to production in our polysilicon facilities. Production cost is calculated by the inventoriable

costs relating to production of polysilicon divided by the production volume in the period indicated. Cash cost is calculated by the inventoriable

costs relating to production of polysilicon excluding depreciation cost and non-cash share-based compensation cost, divided by the production

volume in the period indicated. |

| (2) | Daqo New Energy provides EBITDA, EBITDA margins, adjusted net income attributable to Daqo New Energy Corp. shareholders and adjusted

earnings per basic ADS on a non-GAAP basis to provide supplemental information regarding its financial performance. For more information

on these non-GAAP financial measures, please see the section captioned "Use of Non-GAAP Financial Measures" and the tables captioned

"Reconciliation of non-GAAP financial measures to comparable US GAAP measures" set forth at the end of this press release. |

| (3) | ADS means American Depositary Share. One (1) ADS represents five (5) ordinary shares. |

Management Remarks

Mr. Xiang Xu, CEO of Daqo New Energy, commented,

“Entering the third quarter, China solar industry’s market conditions remained challenging, exacerbated by the overall over-supply

in the industry. Market selling prices continued to be below production costs for the majority of industry players throughout the entire

value-chain. Although this caused Daqo New Energy to sustain quarterly operating and net losses, our losses narrowed compared to the second

quarter and we continued to maintain a strong and healthy balance sheet with no financial debt. At the end of the third quarter, we had

a cash balance of $853 million, short-term investments of $245 million, bank note receivables of $83 million, and a fixed term bank deposit

balance of $1.2 billion. To capitalize on higher interest rates compared to those of bank savings, we purchased short-term investments

and fixed term bank deposits during the past two quarters. Overall, the company maintains strong liquidity with a balance of quick assets

of $2.4 billion. These mainly consists of bank deposits or bank financial products that can be quickly converted to cash when necessary.

During the third quarter, we started maintenance

of our facilities and adjusted our production utilization rate to 50% in light of weak market demand and to reduce our cash burn. The

total production volume at our two polysilicon facilities for the quarter was 43,592 MT. Through continued investments in R&D and

dedication to purity improvements at both facilities, our overall N-type product mix reached 75% during the quarter. Our Phase 5B, which

started initial production in May and is still ramping up, reached 70% N-type in its product mix, strengthening our confidence in

achieving 100% N-type by the end of next year. Despite lower utilization levels, we further reduced our cash cost to $5.34/kg, compared

to $5.39/kg in the second quarter. However, unit production cost trended up 7% sequentially to an average of $6.61/kg, as a result of

reduced production level which led to facility idle cost of approximately $0.55/kg.

“In light of the current market conditions,

we expect our Q4 2024 total polysilicon production volume to be approximately 31,000 MT to 34,000 MT. As a result, we anticipate our full

year 2024 production volume to be in the range of 200,000 MT to 210,000 MT.”

“During the third quarter, challenging market

conditions forced more industry players to reduce production utilization rates and begin maintenance. Based on industry statistics, polysilicon

supply in China decreased by 15% and 6% month-over-month in July and August, respectively, with the total polysilicon production

volume falling below 130,000MT in August, the lowest year-to-date. This reduction eased inventory pressure with prices bottoming in the

range of approximately RMB 35-40/kg. Despite relatively weak downstream wafer demand during the quarter, polysilicon prices stabilized

after reaching their lowest level and have stopped declining. This price level was below the cash costs of even the tier-one players,

and four consecutive months of cash losses have led all manufacturers to reassess their future strategy. In August and September,

due to downstream customers’ effort to take advantage of low prices amid production cuts, polysilicon prices rebounded to approximately

RMB 38-43/kg. However, industry polysilicon inventories remained significant at the end of the quarter. One month into the fourth quarter,

the polysilicon industry is still rebalancing supply and demand and needs further production cuts and stronger end market demand to sustain

a price recovery. The fourth quarter has historically seen strong new solar installations in China, and the aggressive stimulus packages

unveiled in September and October to support the domestic economy might encourage investments from state-owned enterprises.

In the medium to long-term, we believe the current low prices and market downturn will eventually result in a healthier market, as poor

profitability, losses, and cash burn will lead to many industry players exiting the business, ultimately eliminating overcapacity and

bringing the solar PV industry back to normal profitability and better margins.”

“This year is challenging for China’s

solar PV industry. At this point, we may have reached a cyclical bottom but have yet to see a clear turning point in the market. As the

price wars have undermined the healthy development of the industry, on October 14, the China Photovoltaic Industry Association (CPIA)

convened a special conference attended by senior executives from major manufacturers in the industry, calling to strengthen self-discipline

and reduce unbridled competition. While further details on promoting the sustainability of the industry still need to be discussed, we

believe this is a positive signal toward market consolidation with higher-cost and inefficient manufacturers gradually phasing out capacity

and exiting the business. On another positive note, on October 18, CPIA announced a “reference price” of RMB 0.68/W for

modules, setting a floor for winning bids. On the demand side, new solar PV installations in China in the first nine months of 2024 reached

160.88GW, growing 24.8% year-over-year.”

“Overall, in the long-run, solar PV is expected

to be one of the most competitive forms of power generation globally, and the continuous cost reductions in solar PV products and the

resulting reductions in solar energy generation costs are expected to create substantial additional demand for solar PV. We are optimistic

that we will capture the long-term benefits of the growing global solar PV market and maintain our competitive advantage by enhancing

our higher-efficiency N-type technology and optimizing our cost structure through digital transformation and AI adoption. As one of the

world’s lowest-cost producers with the highest quality N-type product, a strong balance sheet and no financial debt, we believe

we are well positioned to weather the current market downturn and emerge as one of the leaders in the industry to capture future growth.”

Outlook and guidance

The Company expects to produce approximately 31,000 MT to 34,000 MT

of polysilicon during the fourth quarter of 2024. The Company expects to produce approximately 200,000 MT to 210,000 MT of polysilicon

for the full year of 2024, inclusive of the impact of the Company’s annual facility maintenance.

This outlook reflects Daqo New Energy’s current and preliminary

view as of the date of this press release and may be subject to changes. The Company’s ability to achieve these projections is subject

to risks and uncertainties. See “Safe Harbor Statement” at the end of this press release.

Third Quarter 2024 Results

Revenues

Revenues were $198.5 million, compared to $219.9 million in the second

quarter of 2024 and $484.8 million in the third quarter of 2023. The decrease in revenues compared to the second quarter of 2024 was primarily

due to a decrease in the ASP as well as sales volume.

Gross (loss)/profit and margin

Gross loss was $60.6 million, compared to $159.2 million in the second

quarter of 2024 and gross profit of $67.8 million in the third quarter of 2023. Gross margin was -30.5%, compared to -72.4% in the second

quarter of 2024 and 14.0% in the third quarter of 2023. For the third quarter, the company recorded $80.9 million in inventory impairment

expenses, compared to $108 million in the second quarter. The increase in gross margin was primarily due to the inventories subject to

larger amount of inventory write-down in the second quarter were subsequently sold in the third quarter of 2024.

Selling, general and administrative expenses

Selling, general and administrative expenses were $37.7 million, compared

to $37.5 million in the second quarter of 2024 and $89.7 million in the third quarter of 2023. SG&A expenses during the third quarter

included $18.9 million in non-cash share-based compensation expense related to the Company’s share incentive plans, compared to

$19.6 million in the second quarter of 2024 and $46.3 million in the third quarter of 2023.

Research and development expenses

Research and development (R&D) expenses were $0.8 million, compared

to $1.8 million in the second quarter of 2024 and $2.8 million in the third quarter of 2023. Research and development expenses can vary

from period to period and reflect R&D activities that take place during the quarter.

(Loss)/income from operations and operating margin

As a result of the abovementioned, loss from operations was $98.0 million,

compared to $195.6 million in the second quarter of 2024 and income from operations of $22.5 million in the third quarter of 2023.

Operating margin was -49.4%, compared to -89.0% in the second quarter

of 2024 and 4.6% in the third quarter of 2023.

Net (loss)/income attributable to Daqo New Energy Corp. shareholders

and earnings per ADS

As a result of the abovementioned, net loss attributable to Daqo New

Energy Corp. shareholders was $60.7 million, compared to $119.8 million in the second quarter of 2024 and $6.3 million in the third quarter

of 2023.

Loss per basic American Depository Share (ADS) was $0.92, compared

to $1.81 in the second quarter of 2024, and $0.09 in the third quarter of 2023.

Adjusted (loss)/income (non-GAAP) attributable to Daqo New Energy

Corp. shareholders and adjusted (loss)/earnings per ADS(non-GAAP)

As a result of the aforementioned, adjusted net loss (non-GAAP) attributable

to Daqo New Energy Corp. shareholders, excluding non-cash share-based compensation costs, was $39.4 million, compared to $98.8 million

in the second quarter of 2024 and adjusted net income (non-GAAP) attributable to Daqo New Energy Corp. shareholders of $44.0 million in

the third quarter of 2023.

Adjusted loss per basic American Depository Share (ADS) was $0.59 compared

to $1.50 in the second quarter of 2024, and adjusted earnings per basic ADS of $0.59 in the third quarter of 2023.

EBITDA (non-GAAP)

EBITDA (non-GAAP) was -$34.3 million, compared to -$144.9 million in

the second quarter of 2024 and $70.2 million in the third quarter of 2023. EBITDA margin (non-GAAP) was -17.3%, compared to -65.9% in

the second quarter of 2024 and 14.5% in the third quarter of 2023.

Financial Condition

As of September 30, 2024, the Company had $853.4 million in cash,

cash equivalents and restricted cash, compared to $997.5 million as of June 30, 2024 and $3,280.8 million as of September 30,

2023. As of September 30, 2024, the notes receivables balance was $83 million, compared to $80.7 million as of June 30, 2024

and $275.8 million as of September 30, 2023. Notes receivables represent bank notes with maturity within six months.

Cash Flows

For the nine months ended September 30, 2024, net cash used in

operating activities was $376.5 million, compared to net cash provided by operating activities of $1,497.4 million in the same period

of 2023.

For the nine months ended September 30, 2024, net cash used in

investing activities was $1,747.7 million, compared to net cash used in investing activities of $954.3 million in the same period of 2023.

The net cash used in investing activities in the three quarters of 2024 was primarily related to the purchases of short-term investments

and fixed term deposits, which amounted to $1.4 billion.

For the nine months ended September 30, 2024, net cash used in

financing activities was $48.5 million, compared to net cash used in financing activities of $602.0 million in the same period of 2023.

The net cash used in financing activities in the three quarters of 2024 was primarily related to dividend payment and share repurchases

by a subsidiary of the Company.

Use of Non-GAAP Financial Measures

To supplement Daqo New Energy’s consolidated

financial results presented in accordance with United States Generally Accepted Accounting Principles (“US GAAP”), the Company

uses certain non-GAAP financial measures that are adjusted for certain items from the most directly comparable GAAP measures including

earnings before interest, taxes, depreciation and amortization ("EBITDA") and EBITDA margin; adjusted net income attributable

to Daqo New Energy Corp. shareholders and adjusted earnings per basic and diluted ADS. Our management believes that each of these non-GAAP

measures is useful to investors, enabling them to better assess changes in key element of the Company's results of operations across different

reporting periods on a consistent basis, independent of certain items as described below. Thus, our management believes that, used in

conjunction with US GAAP financial measures, these non-GAAP financial measures provide investors with meaningful supplemental information

to assess the Company's operating results in a manner that is focused on its ongoing, core operating performance. Our management uses

these non-GAAP measures internally to assess the business, its financial performance, current and historical results, as well as for strategic

decision-making and forecasting future results. Given our management's use of these non-GAAP measures, the Company believes these measures

are important to investors in understanding the Company's operating results as seen through the eyes of our management. These non-GAAP

measures are not prepared in accordance with US GAAP or intended to be considered in isolation or as a substitute for the financial information

prepared and presented in accordance with US GAAP; the non-GAAP measures should be reviewed together with the US GAAP measures, and may

be different from non-GAAP measures used by other companies.

The Company uses EBITDA, which represents earnings

before interest, taxes, depreciation and amortization, and EBITDA margin, which represents the proportion of EBITDA in revenues. Adjusted

net income attributable to Daqo New Energy Corp. shareholders and adjusted earnings per basic and diluted ADS exclude costs related to

share-based compensation. Share-based compensation is a non-cash expense that varies from period to period. As a result, our management

excludes this item from our internal operating forecasts and models. Our management believes that this adjustment for share-based compensation

provides investors with a basis to measure the Company's core performance, including compared with the performance of other companies,

without the period-to-period variability created by share-based compensation.

A reconciliation of non-GAAP financial measures to comparable US GAAP

measures is presented later in this document.

Conference Call

The Company has scheduled a conference call

to discuss the results at 8:00 AM U.S. Eastern Time on October 30, 2024 (8:00 PM Beijing / Hong Kong time on the same day).

The dial-in details for the earnings conference

call are as follows:

Participant dial in (U.S. toll free): +1-888-346-8982

Participant international dial in: +1-412-902-4272

China mainland toll free: 4001-201203

Hong Kong toll free: 800-905945

Hong Kong local toll: +852-301-84992

Please dial in 10 minutes before the call is scheduled

to begin and ask to join the Daqo New Energy Corp. call.

Webcast link:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=ezkSfxNd

A replay of the call will be available 1 hour after the conclusion

of the conference call through November 6, 2024. The dial in details for the conference call replay are as follows:

U.S. toll free: +1-877-344-7529

International toll: +1-412-317-0088

Canada toll free: 855-669-9658

Replay access code: 9504502

To access the replay through an international

dial-in number, please select the link below.

https://services.choruscall.com/ccforms/replay.html

Participants will be asked to provide their name and company name upon

entering the call.

About Daqo New Energy Corp.

Daqo New Energy Corp. (NYSE: DQ) (“Daqo”

or the “Company”) is a leading manufacturer of high-purity polysilicon for the global solar PV industry. Founded in 2007,

the Company manufactures and sells high-purity polysilicon to photovoltaic product manufactures, who further process the polysilicon into

ingots, wafers, cells and modules for solar power solutions. The Company has a total polysilicon nameplate capacity of 305,000 metric

tons and is one of the world's lowest cost producers of high-purity polysilicon.

Safe Harbor Statement

This announcement contains forward-looking statements.

These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995.

These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates,” “guidance”

and similar statements. Among other things, the outlook for the fourth quarter and the full year of 2024 and quotations from management

in these announcements, as well as Daqo New Energy’s strategic and operational plans, contain forward-looking statements. The Company

may also make written or oral forward-looking statements in its reports filed or furnished to the U.S. Securities and Exchange Commission,

in its annual reports to shareholders, in press releases and other written materials and in oral statements made by its officers, directors

or employees to third parties. Statements that are not historical facts, including statements about the Company’s beliefs and expectations,

are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties, all of which are difficult or impossible

to predict accurately and many of which are beyond the Company’s control. A number of factors could cause actual results to differ

materially from those contained in any forward-looking statement, including but not limited to the following: the demand for photovoltaic

products and the development of photovoltaic technologies; global supply and demand for polysilicon; alternative technologies in cell

manufacturing; the Company’s ability to significantly expand its polysilicon production capacity and output; the reduction in or

elimination of government subsidies and economic incentives for solar energy applications; the Company’s ability to lower its production

costs; and changes in political and regulatory environment. Further information regarding these and other risks is included in the reports

or documents the Company has filed with, or furnished to, the U.S. Securities and Exchange Commission. All information provided in this

press release is as of the date hereof, and the Company undertakes no duty to update such information or any forward-looking statement,

except as required under applicable law.

Daqo New Energy Corp.

Unaudited Condensed Consolidated Statement

of Operations

(US dollars in thousands, except ADS and per ADS

data)

| | |

Three months ended | | |

Nine months ended | |

| | |

Sep 30, 2024 | | |

Jun 30, 2024 | | |

Sep 30, 2023 | | |

Sep 30, 2024 | | |

Sep 30, 2023 | |

| Revenues | |

$ | 198,496 | | |

$ | 219,914 | | |

$ | 484,839 | | |

$ | 833,721 | | |

$ | 1,831,397 | |

| Cost of revenues | |

| (259,090 | ) | |

| (379,074 | ) | |

| (417,025 | ) | |

| (981,390 | ) | |

| (997,943 | ) |

| Gross (loss)/profit | |

| (60,594 | ) | |

| (159,160 | ) | |

| 67,814 | | |

| (147,669 | ) | |

| 833,454 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| (37,727 | ) | |

| (37,526 | ) | |

| (89,697 | ) | |

| (113,686 | ) | |

| (174,238 | ) |

| Research and development expenses | |

| (813 | ) | |

| (1,836 | ) | |

| (2,758 | ) | |

| (4,187 | ) | |

| (6,866 | ) |

| Other operating income/(expense) | |

| 1,092 | | |

| 2,903 | | |

| 47,112 | | |

| 2,389 | | |

| 47,789 | |

| Total operating expenses | |

| (37,448 | ) | |

| (36,459 | ) | |

| (45,343 | ) | |

| (115,484 | ) | |

| (133,315 | ) |

| (Loss)/income from operations | |

| (98,042 | ) | |

| (195,619 | ) | |

| 22,471 | | |

| (263,153 | ) | |

| 700,139 | |

| Interest income, net | |

| 1,604 | | |

| 8,730 | | |

| 13,832 | | |

| 22,603 | | |

| 38,529 | |

| Foreign exchange gain/(loss) | |

| (752 | ) | |

| (1,406 | ) | |

| 3,143 | | |

| (2,427 | ) | |

| (16,571 | ) |

| Investment income/(loss) | |

| 8,253 | | |

| 7,149 | | |

| (165 | ) | |

| 15,402 | | |

| (143 | ) |

| (Loss)/income before income taxes | |

| (88,937 | ) | |

| (181,146 | ) | |

| 39,281 | | |

| (227,575 | ) | |

| 721,954 | |

| Income tax benefit/(expense) | |

| 12,007 | | |

| 23,283 | | |

| (21,438 | ) | |

| 20,934 | | |

| (147,236 | ) |

| Net (loss)/income | |

| (76,930 | ) | |

| (157,863 | ) | |

| 17,843 | | |

| (206,641 | ) | |

| 574,718 | |

| Net (loss)/income attributable to non-controlling interest | |

| (16,206 | ) | |

| (38,083 | ) | |

| 24,155 | | |

| (41,608 | ) | |

| 198,505 | |

| Net (loss)/income attributable to Daqo New Energy Corp. shareholders | |

| (60,724 | ) | |

| (119,780 | ) | |

| (6,312 | ) | |

| (165,033 | ) | |

| 376,213 | |

| (Loss)/earnings per ADS | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| (0.92 | ) | |

| (1.81 | ) | |

| (0.09 | ) | |

| (2.50 | ) | |

| 4.93 | |

| Diluted | |

| (0.92 | ) | |

| (1.81 | ) | |

| (0.09 | ) | |

| (2.50 | ) | |

| 4.89 | |

| Weighted average ADS outstanding | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 66,306,870 | | |

| 66,002,970 | | |

| 74,038,122 | | |

| 66,007,875 | | |

| 76,351,635 | |

| Diluted | |

| 66,306,870 | | |

| 66,002,970 | | |

| 74,152,055 | | |

| 66,007,875 | | |

| 76,665,986 | |

Daqo New Energy Corp.

Unaudited Condensed Consolidated Balance Sheets

(US dollars in thousands)

| | |

Sep 30, 2024 | | |

Jun 30, 2024 | | |

Sep 30, 2023 | |

| ASSETS: | |

| | | |

| | | |

| | |

| Current Assets: | |

| | | |

| | | |

| | |

| Cash, cash equivalents and restricted cash | |

| 853,401 | | |

| 997,481 | | |

| 3,280,816 | |

| Short-term investments | |

| 244,982 | | |

| 219,469 | | |

| 2,749 | |

| Accounts and notes receivable | |

| 84,507 | | |

| 80,719 | | |

| 275,843 | |

| Inventories | |

| 206,877 | | |

| 191,969 | | |

| 129,067 | |

| Fixed term deposit within one year | |

| 1,215,165 | | |

| 1,168,032 | | |

| - | |

| Other current assets | |

| 292,610 | | |

| 272,404 | | |

| 150,633 | |

| Total current assets | |

| 2,897,542 | | |

| 2,930,074 | | |

| 3,839,108 | |

| Property, plant and equipment, net | |

| 3,903,436 | | |

| 3,781,330 | | |

| 3,237,803 | |

| Prepaid land use right | |

| 159,853 | | |

| 155,197 | | |

| 147,774 | |

| Fixed term deposit over one year | |

| 28,536 | | |

| 27,366 | | |

| - | |

| Other non-current assets | |

| 59,338 | | |

| 46,534 | | |

| 70,956 | |

| TOTAL ASSETS | |

| 7,048,705 | | |

| 6,940,501 | | |

| 7,295,641 | |

| | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Accounts payable and notes payable | |

| 40,860 | | |

| 64,208 | | |

| 100,466 | |

| Advances from customers-short term portion | |

| 56,240 | | |

| 59,015 | | |

| 252,262 | |

| Payables for purchases of property, plant and equipment | |

| 454,364 | | |

| 436,286 | | |

| 292,488 | |

| Other current liabilities | |

| 77,597 | | |

| 82,086 | | |

| 165,102 | |

| Total current liabilities | |

| 629,061 | | |

| 641,595 | | |

| 810,318 | |

| Advance from customers – long term portion | |

| 76,734 | | |

| 102,861 | | |

| 104,206 | |

| Other non-current liabilities | |

| 18,489 | | |

| 18,012 | | |

| 33,526 | |

| TOTAL LIABILITIES | |

| 724,284 | | |

| 762,468 | | |

| 948,050 | |

| | |

| | | |

| | | |

| | |

| EQUITY: | |

| | | |

| | | |

| | |

| Total Daqo New Energy Corp.’s shareholders’ equity | |

| 4,705,832 | | |

| 4,593,003 | | |

| 4,733,218 | |

| Non-controlling interest | |

| 1,618,589 | | |

| 1,585,030 | | |

| 1,614,373 | |

| Total equity | |

| 6,324,421 | | |

| 6,178,033 | | |

| 6,347,591 | |

| TOTAL LIABILITIES & EQUITY | |

| 7,048,705 | | |

| 6,940,501 | | |

| 7,295,641 | |

Daqo New Energy Corp.

Unaudited Condensed Consolidated Statements

of Cash Flows

(US dollars in thousands)

| | |

For the nine months ended September 30, | |

| | |

2024 | | |

2023 | |

| Operating Activities: | |

| | | |

| | |

| Net (loss)/income | |

$ | (206,641 | ) | |

$ | 574,718 | |

| Adjustments to reconcile net income to net cash provided by operating activities | |

| 395,599 | | |

| 235,283 | |

| Changes in operating assets and liabilities | |

| (565,447 | ) | |

| 687,435 | |

| Net cash (used in)/provided by operating activities | |

| (376,489 | ) | |

| 1,497,436 | |

| | |

| | | |

| | |

| Investing activities: | |

| | | |

| | |

| Purchases of property, plant and equipment | |

| (325,558 | ) | |

| (887,875 | ) |

| Purchases of land use right | |

| (10,089 | ) | |

| (77,220 | ) |

| Purchase and redemption of short-term investments and fixed-term deposits | |

| (1,412,100 | ) | |

| 10,805 | |

| Net cash used in investing activities | |

| (1,747,747 | ) | |

| (954,290 | ) |

| | |

| | | |

| | |

| Financing activities: | |

| | | |

| | |

| Net cash used in financing activities | |

| (48,498 | ) | |

| (602,006 | ) |

| | |

| | | |

| | |

| Effect of exchange rate changes | |

| (21,821 | ) | |

| (180,675 | ) |

| Net decrease in cash, cash equivalents and restricted cash | |

| (2,194,555 | ) | |

| (239,535 | ) |

| Cash, cash equivalents and restricted cash at the beginning of the period | |

| 3,047,956 | | |

| 3,520,351 | |

| Cash, cash equivalents and restricted cash at the end of the period | |

| 853,401 | | |

| 3,280,816 | |

Daqo New Energy Corp.

Reconciliation of non-GAAP financial measures

to comparable US GAAP measures

(US dollars in thousands)

| | |

Three months ended | | |

Nine months ended | |

| | |

Sep 30, 2024 | | |

Jun 30, 2024 | | |

Sep 30, 2023 | | |

Sep 30, 2024 | | |

Sep 30, 2023 | |

| Net (loss)/income | |

| (76,930 | ) | |

| (157,863 | ) | |

| 17,843 | | |

| (206,641 | ) | |

| 574,718 | |

| Income tax (benefit)/expense | |

| (12,007 | ) | |

| (23,283 | ) | |

| 21,438 | | |

| (20,934 | ) | |

| 147,236 | |

| Interest income, net | |

| (1,604 | ) | |

| (8,730 | ) | |

| (13,832 | ) | |

| (22,603 | ) | |

| (38,529 | ) |

| Depreciation & Amortization | |

| 56,218 | | |

| 44,958 | | |

| 44,765 | | |

| 147,845 | | |

| 106,999 | |

| EBITDA (non-GAAP) | |

| (34,323 | ) | |

| (144,918 | ) | |

| 70,214 | | |

| (102,333 | ) | |

| 790,424 | |

| EBITDA margin (non-GAAP) | |

| (17.3 | )% | |

| (65.9 | )% | |

| 14.5 | % | |

| (12.3 | )% | |

| 43.2 | % |

| | |

Three months ended | | |

Nine months ended | |

| | |

Sep 30, 2024 | | |

Jun 30, 2024 | | |

Sep 30, 2023 | | |

Sep 30, 2024 | | |

Sep 30, 2023 | |

| Net (loss)/income attributable to Daqo New

Energy Corp. shareholders | |

| (60,724 | ) | |

| (119,780 | ) | |

| (6,312 | ) | |

| (165,033 | ) | |

| 376,213 | |

| Share-based compensation | |

| 21,312 | | |

| 20,963 | | |

| 50,287 | | |

| 62,850 | | |

| 112,696 | |

| Adjusted net (loss)/income (non-GAAP) attributable to

Daqo New Energy Corp. shareholders | |

| (39,412 | ) | |

| (98,817 | ) | |

| 43,975 | | |

| (102,183 | ) | |

| 488,909 | |

| Adjusted (loss)/earnings per basic ADS (non-GAAP) | |

$ | (0.59 | ) | |

$ | (1.50 | ) | |

$ | 0.59 | | |

$ | (1.55 | ) | |

$ | 6.40 | |

| Adjusted (loss)/earnings per diluted ADS (non-GAAP) | |

$ | (0.59 | ) | |

$ | (1.50 | ) | |

$ | 0.59 | | |

$ | (1.55 | ) | |

$ | 6.38 | |

For additional information, please contact:

Daqo New Energy Corp.

Investor Relations

Email: ir@daqo.com

Christensen

In China

Mr. Rene Vanguestaine

Phone: +86 178-1749-0483

Email: rene.vanguestaine@christensencomms.com

In the U.S.

Ms. Linda Bergkamp

Phone: +1 480-614-3004

Email: lbergkamp@christensencomms.com

Exhibit 99.2

Daqo New Energy Promotes Xiaoyu Xu as Deputy

Chief Executive Officer

Shanghai, China—October 30, 2024—Daqo New Energy Corp.

(NYSE: DQ) ("Daqo New Energy," the "Company" or “we”), a leading manufacturer of high-purity polysilicon

for the global solar PV industry, today announced the appointment of Ms. Xiaoyu Xu as Deputy Chief Executive Officer of the Company,

effective October 30, 2024.

Ms. Xiaoyu Xu has served as the Company’s Investor Relations

Director and Board Secretary since May 2023 and as a Director since November 2023. She previously worked at J.P. Morgan in the

Corporate and Investment Bank department. Ms. Xu holds an MBA degree with a focus on finance, from the Wharton School of the University

of Pennsylvania, and a Bachelor of Science degree in business administration from the Haas School of Business at the University of California,

Berkeley. Ms. Xiaoyu Xu is the daughter of Mr. Xiang Xu, Chairman and CEO of Daqo New Energy.

"Ms. Xiaoyu Xu is a thoughtful, young leader who will bring

global perspectives, optimism and deep commitment to our mission. We believe there are significant opportunities for us to explore in

the renewable energy transition, both in China and globally. With her appointment, we will work to sharpen our corporate strategy and

drive our next phase of growth while living our mission and values,” said Mr. Xiang Xu.

“I am deeply honored to have the opportunity to work alongside

our exceptional team and will strive to fortify our position in the industry and boost our competitiveness,” said Xiaoyu. “I

am deeply inspired by our founding mission and I am fully dedicated to fostering sustainable development of the Company, driving innovative

advancement of green and clean energy on a global scale, and unlocking long-term values for our stakeholders.”

About Daqo New Energy Corp.

Daqo New Energy Corp. (NYSE: DQ) (“Daqo”

or the “Company”) is a leading manufacturer of high-purity polysilicon for the global solar PV industry. Founded in 2007,

the Company manufactures and sells high-purity polysilicon to photovoltaic product manufactures, who further process the polysilicon into

ingots, wafers, cells and modules for solar power solutions. The Company has a total polysilicon nameplate capacity of 305,000 metric

tons and is one of the world's lowest cost producers of high-purity polysilicon.

Safe Harbor Statement

This announcement contains forward-looking statements.

These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995.

These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates,” “guidance”

and similar statements. The Company may also make written or oral forward-looking statements in its reports filed or furnished to the

U.S. Securities and Exchange Commission, in its annual reports to shareholders, in press releases and other written materials and in oral

statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements

about the Company’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks

and uncertainties, all of which are difficult or impossible to predict accurately and many of which are beyond the Company’s control.

A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but

not limited to the following: the demand for photovoltaic products and the development of photovoltaic technologies; global supply and

demand for polysilicon; alternative technologies in cell manufacturing; the Company’s ability to significantly expand its polysilicon

production capacity and output; the reduction in or elimination of government subsidies and economic incentives for solar energy applications;

the Company’s ability to lower its production costs; and changes in political and regulatory environment. Further information regarding

these and other risks is included in the reports or documents the Company has filed with, or furnished to, the U.S. Securities and Exchange

Commission. All information provided in this press release is as of the date hereof, and the Company undertakes no duty to update such

information or any forward-looking statement, except as required under applicable law.

For more information,

please visit www.dqsolar.com.

For additional information, please contact:

Daqo New Energy Corp.

Investor Relations

Email: ir@daqo.com

Christensen

In China

Mr. Rene Vanguestaine

Phone: +86 178-1749-0483

Email: rene.vanguestaine@christensencomms.com

In the U.S.

Ms. Linda Bergkamp

Phone: +1 480-614-3004

Email: lbergkamp@christensencomms.com

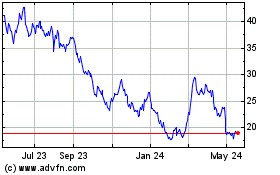

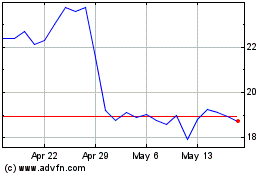

Daqo New Energy (NYSE:DQ)

Historical Stock Chart

From Dec 2024 to Dec 2024

Daqo New Energy (NYSE:DQ)

Historical Stock Chart

From Dec 2023 to Dec 2024